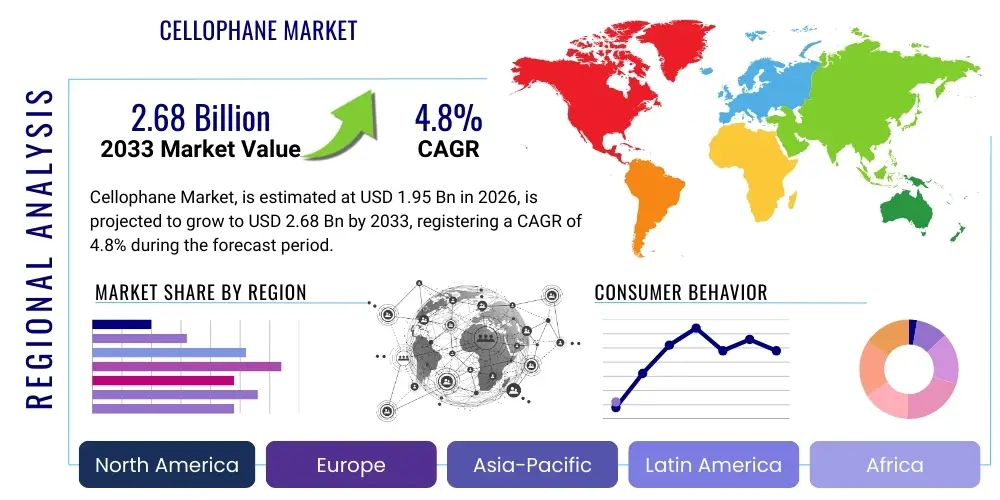

Cellophane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437818 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Cellophane Market Size

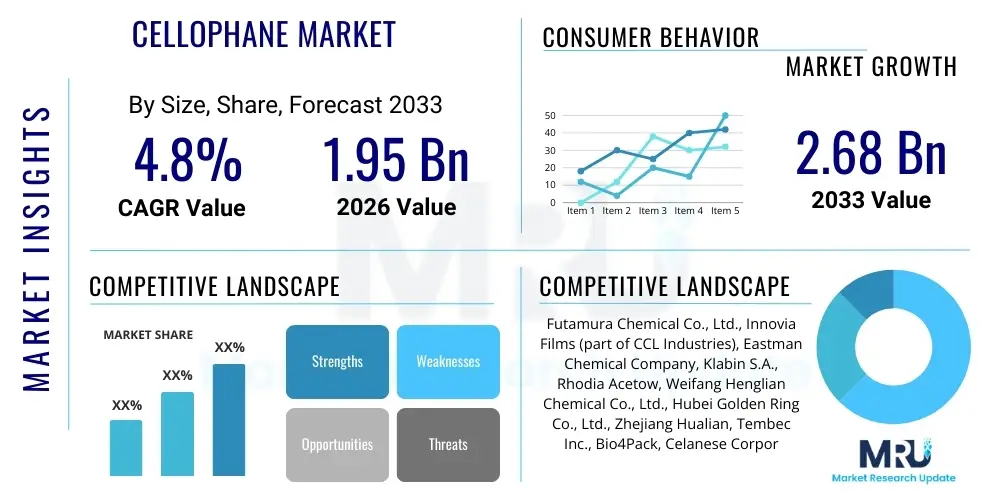

The Cellophane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.68 Billion by the end of the forecast period in 2033.

Cellophane Market introduction

The Cellophane Market encompasses the production, distribution, and consumption of thin, transparent sheets primarily manufactured from regenerated cellulose. Cellophane, chemically known as a cellulose film, is derived from wood pulp or other plant-based materials, making it a biodegradable and sustainable packaging solution. This inherent ecological advantage positions it favorably in an increasingly environmentally conscious global market. Historically renowned for its excellent gas barrier properties, transparency, and high resistance to oil and grease, cellophane has traditionally been a staple in the food packaging industry, particularly for confectionery, baked goods, and fresh produce where visual appeal and moisture regulation are critical.

Major applications of cellophane span several industries, most notably flexible packaging, pharmaceutical wrapping, adhesive tapes, and decorative applications, such as gift wrapping and ribbons. Its core benefits include high tensile strength, superior printability, and robust barrier properties against oxygen and aromas, though modern derivatives often require coatings (such as PVDC or nitrocellulose) to enhance moisture barrier performance for specific applications. The driving factors behind the market expansion include the rising demand for sustainable packaging alternatives that adhere to stringent environmental regulations, particularly in Europe and North America, and the consistent growth of the global processed food and confectionery sectors which rely on high-quality, attractive wrapping materials.

Furthermore, innovations in manufacturing processes, such as the development of compostable and water-soluble cellophane variants, are expanding its applicability beyond traditional uses. While synthetic polymers like polypropylene (PP) and polyethylene (PE) offer cost competitiveness, cellophane maintains a significant niche due to its renewability and excellent machinability, making it ideal for high-speed automatic packaging lines. The market's growth trajectory is strongly linked to technological advancements aimed at improving its functional characteristics while maintaining its crucial advantage of natural biodegradability.

Cellophane Market Executive Summary

The global Cellophane Market is characterized by a steady shift toward bio-based packaging materials, driven by pervasive environmental policies and consumer preference for sustainability. Current business trends indicate a focused investment in advanced coating technologies to enhance cellophane’s moisture resistance, thereby allowing it to compete effectively with plastic films in high-humidity applications. Key manufacturers are also streamlining supply chains and optimizing the viscose manufacturing process—the critical intermediary in cellophane production—to improve cost efficiencies and reduce the environmental footprint associated with raw material sourcing and chemical recovery. Mergers and acquisitions are relatively limited, but strategic collaborations emphasizing research and development of fully compostable packaging solutions are increasing, signaling a mature market optimizing for ecological impact.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, expanding food and beverage sectors, and increasing consumer awareness regarding sustainable packaging, particularly in populous economies like China and India. While Europe and North America exhibit slower volume growth, these regions lead in value-based innovation, pushing the demand for premium, high-barrier coated cellophane used in specialized pharmaceutical and luxury food wrapping. Restraints related to the high initial production cost compared to petrochemical-derived plastics persist, but regulatory mandates banning single-use plastics are systematically tilting the competitive balance in favor of biodegradable options like cellophane, particularly within the flexible packaging segment.

Segment trends highlight the dominance of the Food Packaging application segment, which utilizes cellophane for its aesthetic appeal and freshness preservation capabilities, especially for items with short shelf lives. However, the use of industrial-grade cellophane for pressure-sensitive tapes and medical device packaging is growing robustly, supported by stringent quality requirements in these fields. The coated cellophane segment, which includes nitrocellulose-coated (NC) and polymer-coated films, continues to command higher market share in value terms due to superior performance characteristics required for demanding barrier applications. This summarized market dynamic suggests a stable yet evolving market where innovation in sustainability and performance dictates future profitability and market positioning.

AI Impact Analysis on Cellophane Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cellophane Market frequently center on optimizing the complex, chemical-intensive manufacturing process, enhancing supply chain resilience, and improving quality control. Key concerns involve how AI can address the high energy usage and chemical recovery challenges inherent in the viscose production necessary for cellophane, and whether predictive maintenance can reduce operational downtime, which is costly due to the specialized nature of the machinery. Users also express interest in AI's role in consumer demand forecasting, particularly concerning fluctuating preferences for sustainable packaging and how this impacts raw material sourcing (wood pulp) and inventory management. The consensus expectation is that AI will primarily serve as an optimization tool, focusing on minimizing waste, ensuring product consistency, and accelerating the development of novel biodegradable coatings, rather than fundamentally altering the cellulosic chemical process itself.

- AI-driven optimization of the chemical recovery process in viscose production, leading to reduced chemical usage and lower environmental discharge.

- Implementation of predictive maintenance algorithms on high-speed cellophane manufacturing lines to minimize unplanned downtime and maximize operational efficiency.

- Enhanced demand forecasting models utilizing machine learning (ML) to accurately predict seasonal fluctuations in the confectionery and specialty food sectors, optimizing inventory levels of cellulose pulp and finished goods.

- AI integration into quality control systems (visual inspection) to detect microscopic defects in film consistency and coating application, ensuring compliance with strict barrier performance standards.

- Development and simulation of new biopolymer coatings using generative AI to rapidly test formulas for improved moisture barrier properties and accelerated compostability.

- Optimization of supply chain logistics, including route planning and material tracking, to manage the global distribution of specialized films efficiently.

DRO & Impact Forces Of Cellophane Market

The Cellophane Market is shaped by a powerful juxtaposition of environmental drivers and cost-related restraints. The primary driver is the global regulatory push, exemplified by plastic bans and Extended Producer Responsibility (EPR) schemes, which strongly favors renewable and biodegradable materials, directly benefiting cellophane. Coupled with this is the escalating consumer demand for visible sustainability cues in packaging, particularly in premium and organic food sectors. However, the significant restraint remains the higher cost of production compared to mass-produced synthetic polymers like BOPP and PET, driven by the energy-intensive chemical processing and the relative price volatility of high-grade wood pulp. These opposing forces—sustainability mandate vs. cost pressures—create an inherent tension in market adoption.

Opportunities for growth are concentrated in technological advancements that address the inherent weaknesses of cellophane, primarily its susceptibility to moisture vapor transmission. Development of high-performance, fully compostable barrier coatings represents a major opportunity to penetrate highly competitive markets such as snacks and beverages, which currently rely heavily on multi-layer plastics. Furthermore, expanding the application scope beyond traditional food packaging into specialized industrial uses, such as electrical insulation and medical sterilization wrap, offers diversified revenue streams. The market is also heavily influenced by impact forces related to raw material sustainability, including certifications like FSC, which ensures responsible forestry management, and fluctuations in oil prices, which indirectly affect the competitive pricing of plastic alternatives.

The key impact forces also include the technological maturity of competing bio-plastics, such as PLA and PHA. While cellophane boasts proven industrial scalability, the continuous improvement in clarity, cost, and functional performance of newer biopolymers could pose a medium-term threat. Overall, the market's trajectory is primarily determined by governmental regulations forcing the transition away from fossil-fuel-based packaging, transforming the high production cost of cellophane from a restraint into a justifiable expense for sustainability compliance. This regulatory landscape acts as the most significant external force accelerating market adoption, despite internal market pressures concerning cost and technical performance limitations.

Segmentation Analysis

The Cellophane Market segmentation provides a granular view of demand distribution across various product types, applications, and end-use industries, highlighting areas of high growth and technological focus. The market is primarily bifurcated based on the type of film—Coated and Uncoated—where coated films dominate in value due to their enhanced barrier properties essential for long-shelf-life products. Further segmentation by application reveals the overwhelming reliance of the food packaging sector on cellophane, though industrial and decorative uses offer stable niche opportunities. Understanding these segments is crucial for manufacturers to tailor product specifications (e.g., thickness, barrier type, printability) to specific regulatory environments and consumer needs in different geographical regions.

- By Product Type

- Coated Cellophane Films (e.g., NC Coated, PVDC Coated, Acrylic Coated)

- Uncoated Cellophane Films

- By Thickness

- Below 20 Microns

- 20 to 40 Microns

- Above 40 Microns

- By Application

- Food Packaging (Confectionery, Snacks, Dairy, Produce, Baked Goods)

- Tapes and Labels

- Pharmaceutical Packaging

- Decorative and Gift Wrapping

- Industrial Use (Capacitors, Electrical Insulation)

- By End-Use Industry

- Food & Beverage

- Pharmaceuticals & Healthcare

- Consumer Goods

- Electrical & Electronics

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Cellophane Market

The cellophane value chain is highly integrated and begins with the upstream sourcing of raw materials, primarily high-quality, bleached wood pulp (dissolving pulp) derived from sustainable forestry operations. This pulp undergoes rigorous chemical processing, involving steeping in sodium hydroxide and treatment with carbon disulfide, to produce viscose—the critical intermediary product. Upstream analysis focuses heavily on securing reliable and certified sources of wood pulp, managing chemical input costs, and ensuring compliance with stringent environmental regulations governing chemical handling and waste disposal during the viscose production stage, which is the most capital and energy-intensive step in the entire chain. Price stability of dissolving pulp is a major determinant of final product cost.

The midstream process involves the actual film casting, where the viscous solution is extruded through a narrow slit into an acid bath (sulfuric acid) to regenerate the cellulose film, followed by washing, drying, and, crucially, the application of various functional coatings (e.g., barrier coatings for moisture protection, antistatic agents) necessary for specific applications. Distribution channels are varied: Direct sales are common for large-volume industrial buyers and major food manufacturers who require highly customized films and technical support. Indirect channels, involving specialized packaging distributors, cater to smaller businesses and regional demands, offering localized inventory and quick turnaround times. The sophistication of the coating process and the subsequent quality control determines the film's suitability for high-speed automated packaging machinery.

Downstream analysis centers on the diverse end-user industries, with the food and beverage sector being the largest consumer. The effectiveness of the cellophane is ultimately judged by its performance on client packaging lines (machinability) and its ability to meet shelf-life requirements. The shift towards flexible packaging formats, driven by e-commerce and convenience food trends, places increasing demand on the film's strength and printability. Success in the downstream market requires close collaboration between cellophane manufacturers and packaging machine OEMs to ensure optimal film specification. The increasing regulatory pressure accelerates the move toward compostable films, fundamentally influencing procurement decisions by downstream consumer goods companies committed to reducing plastic usage.

Cellophane Market Potential Customers

The potential customers for the cellophane market are predominantly large-scale industrial buyers who prioritize sustainable, high-quality, and machine-compatible flexible packaging solutions. The core buyer base resides within the fast-moving consumer goods (FMCG) sector, specifically confectioners, bakeries, and organic food producers who leverage cellophane's aesthetic clarity, natural feel, and compostable attributes to enhance product presentation and meet environmental commitments. These buyers require materials that can maintain freshness and visual integrity while running reliably on highly automated, high-speed wrapping equipment, making film rigidity and static control critical purchasing factors.

Beyond food, significant potential lies in the pharmaceutical and healthcare industries, where specialized, sterile-grade cellophane is required for wrapping medical devices and unit-dose medications. These customers prioritize superior barrier properties against microbial contamination and gases, demanding stringent quality assurance and regulatory compliance. Furthermore, industrial end-users, including manufacturers of electrical capacitors and specialized adhesive tapes, represent niche but high-value customers who utilize cellophane for its unique thermal stability and non-conductive properties. These applications often require tailored thicknesses and specific physical properties not readily available in standard plastic films.

The procurement decision for potential customers is increasingly influenced by third-party certification bodies, such as certification for industrial or home composting (e.g., OK Compost). Large corporate buyers often mandate that their packaging suppliers demonstrate circularity and verifiable sustainability credentials, giving a distinct competitive advantage to cellophane producers with robust chain-of-custody certifications and advanced biodegradable coatings. This focus on traceability and verifiable environmental claims is expanding the customer base to include global retailers committed to zero-waste packaging goals, driving the transition away from multi-material laminate plastics toward mono-material, compostable films.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.68 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Futamura Chemical Co., Ltd., Innovia Films (part of CCL Industries), Eastman Chemical Company, Klabin S.A., Rhodia Acetow, Weifang Henglian Chemical Co., Ltd., Hubei Golden Ring Co., Ltd., Zhejiang Hualian, Tembec Inc., Bio4Pack, Celanese Corporation, Mitsubishi Chemical Corporation, Rotopaul GmbH, Sappi Limited, NatureWorks LLC, Novamont S.p.A., Fuzhou Fuming Cellulose Co., Ltd., Shijiazhuang Guangfa Cellulose Co., Ltd., PT. Indah Kiat Pulp & Paper Tbk, Wuhu Chunqiu Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cellophane Market Key Technology Landscape

The technological landscape of the cellophane market is characterized by incremental innovations focused primarily on enhancing performance attributes while preserving biodegradability. The core manufacturing technology, the viscose process, remains fundamentally chemical-intensive, but modernization efforts emphasize closed-loop systems for chemical recovery (e.g., carbon disulfide and sodium sulfate) to improve efficiency and reduce environmental discharge, aligning with Best Available Techniques (BAT) guidelines, particularly in European facilities. Key advancements involve extrusion and stretching technologies designed to improve the mechanical properties of the film, resulting in better consistency, higher tensile strength, and superior machinability on modern, high-speed wrapping equipment, addressing common industry complaints regarding film brittleness or inconsistent gauge.

The most critical technological development is in the field of barrier enhancement coatings. While traditional coatings like nitrocellulose (NC) and PVDC offered excellent performance, the current trend is shifting entirely towards bio-based and compostable coatings (e.g., starch derivatives, high-performance waxes, or fully biodegradable acrylics) that maintain the film’s end-of-life compostability certification. These novel barrier coatings are crucial for enabling cellophane to protect sensitive products, such as snacks and coffee, from moisture vapor and oxygen penetration over extended periods, a performance level previously reserved for non-renewable multi-layer plastics. Research efforts are heavily invested in finding an optimal balance between water vapor transmission rate (WVTR) and oxygen transmission rate (OTR) using sustainable chemistry.

Furthermore, technology is improving the digital integration of cellophane in the supply chain. Advanced printing technologies, including high-resolution flexographic and rotogravure printing, are optimized for the unique surface characteristics of cellulose film, allowing for vibrant, brand-specific graphics without compromising the film’s integrity or compostability. Manufacturers are also implementing advanced sensor technology and spectroscopy during production to monitor film gauge and coating thickness in real-time. This level of precision is vital for minimizing material usage, reducing waste, and ensuring that every roll of film meets the exact specifications required by specialized industrial applications, thereby reducing quality variation and bolstering market confidence in cellophane’s technical reliability.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market for cellophane, driven by explosive growth in the processed food and confectionery industries, particularly in India, China, and Southeast Asian nations. The region benefits from lower manufacturing costs, making cellophane a viable competitive alternative to plastics, especially in countries rapidly implementing municipal waste management systems. Increasing consumer disposable income and a growing preference for branded, hygienically packaged goods are primary demand drivers. Furthermore, regulatory movements in key regional economies mirroring Western plastic bans are significantly boosting the adoption of sustainable flexible packaging solutions.

- Europe: Europe is the market leader in value and innovation, driven by the strictest regulatory environment globally concerning plastic pollution and waste reduction. The EU’s ambitious targets for recycling and composting necessitate a move toward materials like cellophane, particularly in Germany, the UK, and France. European demand focuses heavily on premium, high-barrier, fully certified compostable cellophane used for luxury goods, organic produce, and niche pharmaceutical packaging. This region sets the global benchmark for sustainable production practices and chemical recovery standards in viscose manufacturing.

- North America: The North American market, led by the United States, shows stable growth, primarily concentrated in the specialty food, artisanal bakery, and gourmet confection sectors. While the market has traditionally been slower to adopt large-scale plastic alternatives than Europe, state-level regulations (especially in California and New York) and corporate sustainability pledges by major retailers are accelerating cellophane adoption. The demand here is specific, focusing on clear, high-quality uncoated cellophane for applications where breathability (e.g., fresh produce) or visual appeal is paramount, alongside tapes and industrial insulation applications.

- Latin America (LATAM): LATAM is an emerging market for cellophane, with growth linked to the modernization of the region’s food supply chain and rising environmental awareness in urban centers. Brazil and Mexico are key markets due to their substantial domestic food processing industries. Challenges include economic volatility and the predominance of lower-cost plastic alternatives, but the growing export market for packaged goods demands higher quality, sustainable materials that meet international importing standards, providing a key entry point for cellophane producers.

- Middle East and Africa (MEA): The MEA region remains a nascent market, primarily importing finished cellophane products rather than producing them locally. Demand is concentrated in the Gulf Cooperation Council (GCC) countries for high-end consumer goods packaging and specialty wrapping. Future growth is projected to align with infrastructure development and increased food manufacturing capacity, particularly as regional governments begin to address plastic waste concerns, offering long-term opportunities for sustainable material substitution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cellophane Market.- Futamura Chemical Co., Ltd.

- Innovia Films (part of CCL Industries)

- Eastman Chemical Company

- Klabin S.A.

- Rhodia Acetow

- Weifang Henglian Chemical Co., Ltd.

- Hubei Golden Ring Co., Ltd.

- Zhejiang Hualian

- Tembec Inc.

- Bio4Pack

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Rotopaul GmbH

- Sappi Limited

- NatureWorks LLC

- Novamont S.p.A.

- Fuzhou Fuming Cellulose Co., Ltd.

- Shijiazhuang Guangfa Cellulose Co., Ltd.

- PT. Indah Kiat Pulp & Paper Tbk

- Wuhu Chunqiu Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Cellophane market and generate a concise list of summarized FAQs reflecting key topics and concerns.Is Cellophane truly biodegradable and compostable compared to other bioplastics?

Yes, Cellophane, derived from regenerated cellulose (wood pulp), is inherently biodegradable. Uncoated cellophane is readily compostable. However, films coated for high barrier performance often require specialized, certified compostable coatings to ensure the entire structure breaks down without leaving plastic residue, differentiating it from many petroleum-based plastics.

What are the primary factors restraining the widespread adoption of cellophane packaging?

The primary restraining factor is the high production cost, which involves intensive chemical processing (viscose manufacturing) and specialized raw material sourcing (dissolving pulp). This makes cellophane significantly more expensive than mass-produced, fossil fuel-based films like BOPP, limiting its use in highly price-sensitive, low-margin packaging applications.

How does the Cellophane Market compete with synthetic films like BOPP and PET?

Cellophane competes primarily on sustainability and niche performance attributes, such as natural breathability for fresh produce, superior dead-fold capability, and high clarity. While synthetic films offer better moisture barriers and lower costs, cellophane gains competitive advantage through regulatory mandates and strong consumer demand for certified, renewable packaging solutions.

Which application segment generates the highest demand for cellophane globally?

The Food Packaging application segment consistently generates the highest demand for cellophane. This is dominated by the confectionery and baked goods sectors, which utilize cellophane for its attractive visual presentation, superior twist-wrap performance, and adequate barrier properties for products with short to medium shelf-lives.

What role do advanced coatings play in the future growth of the cellophane industry?

Advanced coatings are critical for future growth, enabling cellophane to enter highly demanding markets previously dominated by multi-layer plastics. By applying high-performance, yet fully compostable, bio-based coatings, manufacturers can significantly enhance the film's barrier against moisture vapor and oxygen, expanding its applicability to sensitive products like snacks, dried foods, and pharmaceuticals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Coloured Cellophane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Zwieback Market Size Report By Type (Paper Bags, Wax paper Bags, Cellophane Bags, Others), By Application (Food, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Cellophane Market Size Report By Type (Colourless Cellophane, Coloured Cellophane), By Application (Food Packaging, Tobacco Packaging, Pharmaceutical Packaging, Cosmetic Packaging, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Cellophane Market Statistics 2025 Analysis By Application (Food Packaging, Tobacco Packaging, Pharmaceutical Packaging, Cosmetic Packaging), By Type (Colourless Cellophane, Coloured Cellophane), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager