Ceramic Tile and Its Printing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435211 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ceramic Tile and Its Printing Market Size

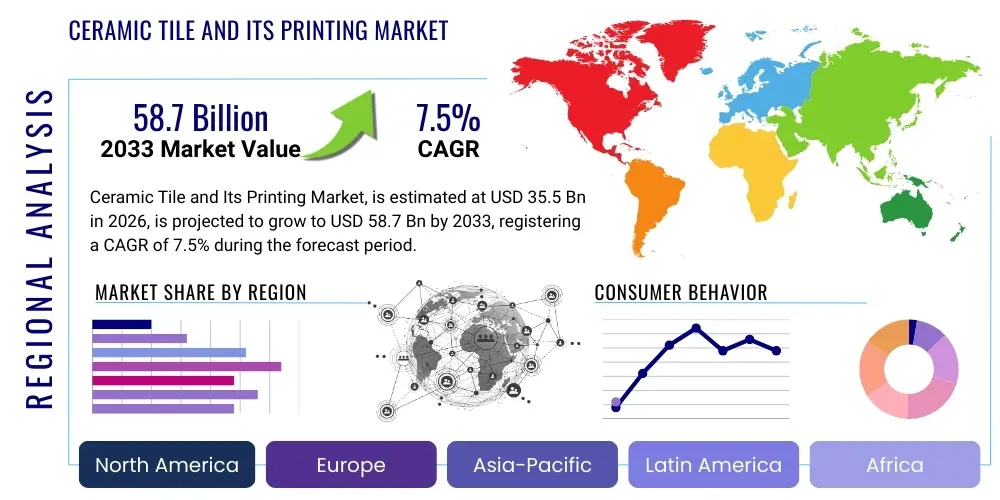

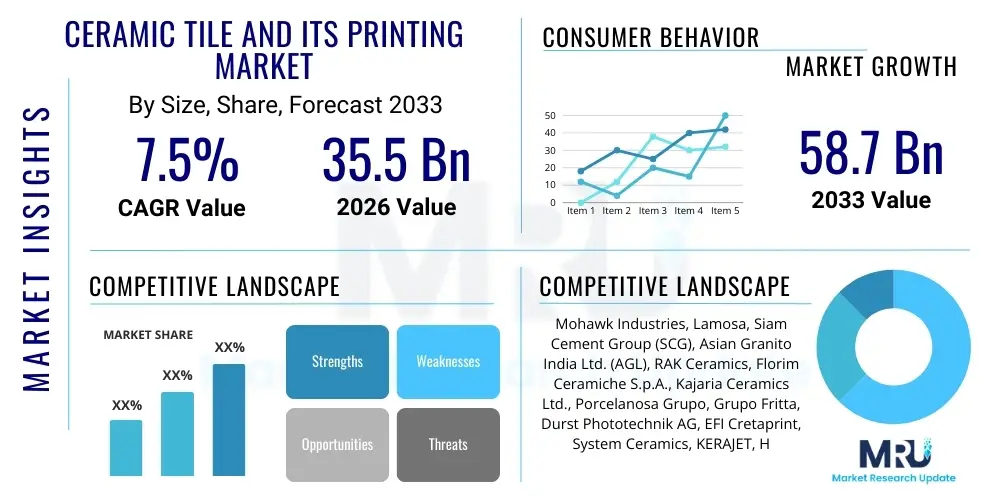

The Ceramic Tile and Its Printing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 58.7 Billion by the end of the forecast period in 2033.

Ceramic Tile and Its Printing Market introduction

The Ceramic Tile and Its Printing Market encompasses the manufacturing, finishing, and decorative processing of ceramic tiles, primarily driven by the integration of advanced digital inkjet printing technologies. This market segment has undergone a profound transformation, moving away from conventional screen printing methods toward high-definition digital decoration, which allows for unparalleled aesthetic realism, design flexibility, and efficient mass customization. Ceramic tiles, fundamental materials in the global construction sector, are utilized extensively in residential, commercial, and industrial flooring, wall cladding, and specialized architectural applications due to their durability, ease of maintenance, and aesthetic versatility. The widespread adoption of digital printing enables manufacturers to replicate natural materials like marble, wood, and stone with photorealistic accuracy, meeting the evolving sophisticated demands of interior designers and architects globally. The core products include glazed porcelain tiles, ceramic wall tiles, large format slabs, and specific technical tiles, all benefiting from precise digital decoration processes.

The principal applications for ceramic tiles span various sectors, including new construction projects, renovation activities, and infrastructure development. The residential sector remains a primary consumer, driven by increasing housing demands in emerging economies and the trend toward luxury finishes. Commercial applications, encompassing hotels, hospitals, retail spaces, and corporate offices, demand high-performance, durable tiles that can be rapidly produced with complex, branded designs—a capability significantly enhanced by digital printing systems. Furthermore, the inherent benefits of ceramic tiles, such as water resistance, fire resistance, and longevity, ensure their continued preference over alternative flooring materials. The technological shift toward digital printing not only improves the final product's quality but also drastically reduces waste and setup times associated with traditional printing techniques, thereby promoting operational efficiency and sustainability within the manufacturing ecosystem.

The market growth is fundamentally driven by accelerating urbanization and increased disposable incomes, particularly across Asia Pacific nations, which fuel large-scale construction activities. The driving factors also include stringent consumer preferences for visually appealing and customized interior finishes, readily achievable through digital ceramic printing. Moreover, advancements in printing inks, including functional and special effect inks (such as matte, glossy, metallic, and reactive inks), expand the creative possibilities and perceived value of ceramic products. Regulatory support for sustainable manufacturing practices further encourages the adoption of digital methods that minimize water and energy consumption. The demand for large format tiles and slabs, often only feasible with precise digital control, also contributes significantly to the market's upward trajectory, cementing the role of digital decoration as an indispensable technology in modern tile manufacturing.

Ceramic Tile and Its Printing Market Executive Summary

The Ceramic Tile and Its Printing Market is experiencing robust expansion, characterized by a fundamental shift towards automation and sustainability, defining current business trends. Manufacturers are increasingly investing in single-pass digital inkjet printers capable of ultra-high resolution and speed, addressing the rising global demand for personalized and aesthetically superior floor and wall coverings. A key business trend involves the consolidation of the supply chain, where ink and equipment providers are forging closer partnerships with tile manufacturers to develop integrated solutions, optimizing color management and ink performance on varied substrates. Furthermore, the market is witnessing accelerated integration of Industry 4.0 principles, leveraging data analytics and interconnected machinery to enhance production predictability, minimize defects, and manage complex inventory of diverse designs effectively. The push for green manufacturing, driven by stricter environmental standards and consumer awareness, means that companies prioritizing dry pressing techniques and eco-friendly ceramic inks are gaining a competitive advantage in mature markets.

Regional dynamics indicate a pronounced shift in manufacturing focus and consumption patterns. The Asia Pacific (APAC) region currently dominates the market both in terms of production capacity and consumption volume, primarily fueled by massive infrastructure investments and rapid urbanization in China, India, and Southeast Asian nations. While APAC leads in sheer volume, Western Europe and North America demonstrate high demand for premium, high-value, digitally printed tiles, focusing on large-format slabs and technical porcelain. These regions exhibit strong trends towards replacement and renovation markets, demanding specialized effects and high-durability products. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are characterized by rapid capacity expansion and technology adoption, positioning them as high-growth potential regions where modernization of existing manufacturing facilities is a priority for local players aiming to compete with international imports.

Segmentation trends highlight the increasing prominence of porcelain tiles over traditional ceramic tiles due to superior technical specifications, particularly abrasion resistance and water absorption rates, making them suitable for a wider range of indoor and outdoor applications. Within the printing segment, the adoption of specialized effects inks, such as protective anti-slip coatings applied digitally or metallic glazes, is rapidly growing, allowing manufacturers to differentiate their products beyond basic color and pattern reproduction. In terms of application, the residential segment maintains the largest market share, but the fastest growth rate is observed in the commercial segment, driven by large-scale, standardized projects requiring quick turnaround times for complex, customized floor plans. The ongoing refinement of digital printing heads and proprietary ink formulations ensures that this technology remains the primary enabler for future product innovation in the global tile industry.

AI Impact Analysis on Ceramic Tile and Its Printing Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Ceramic Tile and Its Printing Market predominantly center on three major themes: design innovation, manufacturing efficiency, and predictive quality control. Users are keen to understand how AI algorithms can revolutionize the tile design process by generating novel patterns, textures, and color palettes that transcend human creative limitations, often asking about 'AI-driven aesthetic optimization' and 'trend prediction.' A significant area of concern and interest focuses on operational improvements, specifically how AI can optimize the complex parameters of the firing and glazing stages to minimize energy consumption and material waste, termed 'smart kiln management.' Furthermore, there is strong demand for knowledge concerning AI’s role in automated visual inspection systems (AVIS), which use machine learning to detect subtle defects in digitally printed surfaces, ensuring consistent quality and lowering failure rates in high-volume production lines.

The implementation of AI algorithms is fundamentally reshaping the design phase, offering manufacturers a significant competitive edge by drastically reducing the time required for product development. AI can analyze vast datasets of consumer preferences, social media trends, and architectural demands to predict successful designs, thus guiding product portfolio management and ensuring higher market acceptance rates. Beyond mere prediction, Generative Adversarial Networks (GANs) are being deployed to create hyper-realistic replicas of natural stone and wood, offering designers unlimited variations without the physical constraints of traditional design studios. This capability allows for 'mass personalization at scale,' moving beyond simple customization to creating unique designs tailored to specific regional or project requirements, thereby minimizing design lead times and increasing the speed of market entry for new collections.

In the manufacturing sphere, AI integration extends deeply into process control and maintenance. Machine learning models analyze real-time data from kilns, dryers, and printing machines—such as temperature variations, humidity levels, and ink viscosity—to dynamically adjust operational settings, ensuring optimal product outcomes and significant energy savings. Predictive maintenance (PdM) powered by AI is transforming equipment upkeep, moving from time-based or reactive fixes to condition-based interventions, maximizing machine uptime, and minimizing costly unscheduled production stops. This enhanced level of operational intelligence not only boosts throughput and capacity utilization but also contributes to greater overall factory efficiency (OFE), making manufacturing facilities more responsive and resilient in fluctuating market conditions.

- AI enhances aesthetic realism through generative design algorithms for unique patterns.

- Predictive Maintenance (PdM) optimizes uptime of digital printing and firing equipment.

- Machine learning improves color consistency and print registration accuracy across large batches.

- AI-powered Automated Visual Inspection Systems (AVIS) ensure real-time defect detection and quality grading.

- Supply chain optimization using AI minimizes raw material inventory and logistics costs.

- Smart kiln management reduces energy consumption by dynamically adjusting firing curves.

DRO & Impact Forces Of Ceramic Tile and Its Printing Market

The Ceramic Tile and Its Printing Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by significant impact forces shaping its evolution. Key drivers include aggressive urbanization rates globally, particularly in developing economies, which necessitates large-scale residential and commercial construction, generating sustained demand for durable and aesthetically pleasing surface materials. The increasing demand for home renovation and remodeling activities in mature markets, coupled with rising disposable incomes, further fuels the preference for premium, digitally decorated ceramic products that offer superior design flexibility. Technological advancement in digital printing equipment, offering higher speeds, better resolution, and specialized functional inks, acts as a primary market accelerator, enabling cost-effective production of customized tile collections, thus rapidly shortening product innovation cycles. These drivers collectively exert a positive and reinforcing impact force on market expansion and technological adoption.

However, the market faces notable restraints that moderate its growth trajectory. The most significant restraint is the high initial capital expenditure required for installing advanced digital inkjet printing lines, including specialized equipment, expensive print heads, and proprietary ceramic inks. This barrier to entry particularly affects smaller manufacturers in competitive regions. Furthermore, the market is highly susceptible to fluctuations in raw material prices (clays, feldspar, energy) and geopolitical instability affecting international trade logistics. Another persistent challenge involves environmental regulations, particularly regarding the disposal of industrial waste and the high energy consumption associated with the firing process. While digital printing reduces certain waste streams, the industry as a whole must navigate stringent mandates related to carbon emissions, pushing manufacturers towards costly sustainable technologies, which temporarily acts as a limiting factor on profitability.

Opportunities for sustained market expansion lie primarily in two areas: product diversification and geographical penetration. The advent of 3D printing technology for ceramic applications presents a future opportunity for creating complex, textural surfaces and entirely novel tile geometries that traditional molds cannot achieve. The development of 'smart tiles' integrated with IoT sensors, offering functionalities such as temperature monitoring or energy harvesting, represents a niche, high-value opportunity in the technical tile segment. Geographically, untapped potential exists in secondary and tertiary cities within emerging economies, which are now beginning their construction boom cycles, offering vast scope for new facility establishment and market penetration. Successfully navigating the high capital constraints and leveraging technological advancements to achieve cost-competitive sustainable production are critical factors defining the success of players in this dynamic market.

Segmentation Analysis

The Ceramic Tile and Its Printing Market is comprehensively segmented based on product type, application, raw material, and the printing technology employed, providing granular insights into market dynamics and growth pockets. Product type segmentation primarily distinguishes between porcelain tiles, ceramic tiles, and vitrified tiles, reflecting differences in water absorption rates, durability, and manufacturing processes. Porcelain tiles, offering superior performance characteristics suitable for heavy traffic and external applications, typically command a higher price point and exhibit faster growth rates driven by commercial construction. The fundamental segmentation by printing technology focuses on digital inkjet printing versus traditional methods, where digital continues its rapid displacement of older techniques dueening to superior efficiency and design capabilities. Understanding these segments is crucial for manufacturers tailoring production capacity and technology investments to specific market demands.

Raw material segmentation highlights the dependence on essential inputs like clay, feldspar, silica, and specific additives. Variations in raw material availability and quality directly impact the final tile characteristics and manufacturing costs, necessitating sophisticated sourcing and purification processes. Application segmentation differentiates between residential, commercial, and industrial usage. While the residential sector holds the largest volume share, the commercial sector, encompassing large-scale projects like shopping malls and public transport hubs, often dictates demand for specialized technical features, complex digital designs, and stringent quality control, serving as a catalyst for innovation in printing technology. The detailed analysis of these segments reveals shifting consumer preferences toward large format tiles and bespoke, digitally-enhanced surface aesthetics across all end-use sectors.

Furthermore, segmentation by end-user location (indoor vs. outdoor) impacts the requirements for slip resistance, freeze-thaw durability, and UV stability, all of which are increasingly being managed through digitally applied functional coatings and specialized ceramic inks. The evolution of printing systems, including the integration of multiple print bars for different types of inks (e.g., glazes, opaque whites, and corrosive colors), is refining segment capabilities. Market players focus on technological differentiation within segments, aiming to capture the high-margin market of digitally decorated large format slabs, which minimizes grout lines and maximizes the visual impact of high-definition printing across expansive surfaces.

- By Product Type:

- Porcelain Tiles

- Ceramic Tiles (Non-Porcelain)

- Vitrified Tiles

- Other Specialized Tiles (e.g., Mosaic, Terrazzo)

- By Application:

- Residential (Flooring, Walls)

- Commercial (Hotels, Retail, Offices)

- Industrial (Factories, Warehouses)

- By Printing Technology:

- Digital Inkjet Printing (Single Pass, Multi Pass)

- Traditional Printing (Screen Printing, Rotary Printing)

- By Raw Material:

- Feldspar

- Clay (Ball Clay, Kaolin)

- Silica Sand

- Additives and Pigments

Value Chain Analysis For Ceramic Tile and Its Printing Market

The value chain of the Ceramic Tile and Its Printing Market is complex, involving distinct upstream, midstream, and downstream activities that contribute sequentially to the final product's value. The upstream segment focuses on the extraction, processing, and supply of essential raw materials, including various types of clay, feldspar, kaolin, and silica sand. Reliability of supply and consistency in material quality are paramount, as these inputs directly determine the technical properties and aesthetic quality of the finished ceramic body. Critical upstream partners also include specialized suppliers of digital printing technologies, such as manufacturers of high-performance print heads, proprietary ceramic inks, and advanced digital glazes. Innovations in ink formulation, particularly the development of environmentally friendly, high-opacity, and effect-producing inks, are major value drivers at this stage, heavily influencing midstream manufacturing capabilities.

The midstream phase constitutes the core manufacturing processes, involving body preparation (milling and pressing), drying, firing (kiln processes), and critically, the digital decoration step. This stage represents the highest value addition, utilizing complex, high-speed digital printers to apply decorative patterns, glazes, and protective coatings directly onto the tile body. Efficiency and precision in midstream operations, driven by automation and quality control systems, directly determine cost-competitiveness. Manufacturing players focus on optimizing firing cycles for energy efficiency and minimizing waste through advanced process control. Direct and indirect distribution channels characterize the downstream segment. Direct channels include sales to large architectural firms, major contractors, and big-box retailers, which often require specific volumes and customization. Indirect channels involve wholesalers, distributors, specialized tile showrooms, and e-commerce platforms, facilitating market access to individual consumers and small-to-medium contractors.

The downstream distribution network plays a crucial role in market penetration and customer engagement. Given the weight and fragility of the final product, logistics and warehousing constitute a significant portion of the final product cost. Manufacturers strategically utilize both direct sales forces for large commercial projects and extensive networks of indirect distributors to cover diverse geographical markets. The trend towards e-commerce, although challenging due to logistical complexities, is growing, driven by the need for quick access to vast product catalogs and virtual design tools. Effective coordination between the manufacturer and the distribution channel ensures that the digitally printed designs, which form the primary differentiation factor, are correctly marketed and supplied to end-users, maximizing perceived value and market reach. Successful participants in this value chain prioritize vertical integration or robust strategic alliances across these segments to ensure material security and technological superiority.

Ceramic Tile and Its Printing Market Potential Customers

The primary potential customers and end-users of the Ceramic Tile and Its Printing Market are segmented across the entire spectrum of the built environment, driven by the necessity for durable, low-maintenance, and visually appealing surface coverings. Residential property developers and individual homeowners represent the largest volume segment. New housing projects, particularly in rapidly urbanizing regions, require vast quantities of floor and wall tiles. Homeowners engaging in remodeling projects are increasingly opting for digitally printed ceramic tiles because they offer the aesthetic richness of expensive natural materials (like marble or exotic wood) at a significantly lower cost and without the associated maintenance challenges. Their purchasing decisions are highly influenced by design trends, perceived product lifespan, and environmental certifications, making them sensitive to digitally enabled aesthetic quality and sustainability credentials.

The commercial sector serves as a crucial high-value customer base, encompassing large institutional buyers such as hotel chains, healthcare facilities, shopping centers, and educational institutions. These entities demand tiles with high technical specifications, including superior durability, chemical resistance, and specific safety features (e.g., enhanced slip resistance). Commercial projects often require vast, consistent batches of customized designs, making digital printing indispensable for delivering branded or architect-specific aesthetics efficiently and to exacting quality standards. Architects, interior designers, and large contractors often act as key decision-makers and influencers in this segment, prioritizing suppliers who can demonstrate technological proficiency, rapid prototyping capabilities, and consistent supply of large format, bespoke slabs.

A specialized segment of potential customers includes industrial and infrastructure developers. Industrial facilities, such as food processing plants, laboratories, and heavy manufacturing units, require highly technical tiles that can withstand extreme mechanical stress, chemical exposure, and high temperatures. While aesthetic printing might be secondary, digital printing technology is increasingly used here for applying functional coatings, such as anti-microbial treatments or highly visible safety line markings, directly onto the tile surface. Additionally, public sector infrastructure projects, including airports, subway systems, and government buildings, represent stable customers requiring high volumes of robust, digitally registered tiles that comply with strict regulatory mandates regarding public safety and longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 58.7 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mohawk Industries, Lamosa, Siam Cement Group (SCG), Asian Granito India Ltd. (AGL), RAK Ceramics, Florim Ceramiche S.p.A., Kajaria Ceramics Ltd., Porcelanosa Grupo, Grupo Fritta, Durst Phototechnik AG, EFI Cretaprint, System Ceramics, KERAJET, H.P. GAUER GMBH, Tecnoferrari, FUJI FILM Dimatix, DIP-Tech, Marazzi Group S.r.l., Dongpeng Ceramic, Guangdong Mona Lisa Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Tile and Its Printing Market Key Technology Landscape

The technological landscape of the Ceramic Tile and Its Printing Market is overwhelmingly dominated by High-Definition Digital Inkjet Printing (HD-DIP), which has superseded conventional rotary screen and flatbed printing methods. HD-DIP utilizes piezoelectric drop-on-demand print heads, capable of ejecting ceramic inks with micro-level precision, thereby achieving photorealistic image quality and perfect registration across large tile surfaces. The most critical technological advancements are centered on single-pass printing systems, which maximize throughput speed and reduce cycle times, essential for high-volume manufacturing environments prevalent in APAC. Continuous technological research is focused on optimizing print head durability and minimizing nozzle clogging, common operational challenges that directly impact production efficiency and maintenance costs. Furthermore, the integration of advanced software for color management and RIP (Raster Image Processor) software is crucial for ensuring brand color consistency and managing complex design files across various machine types.

A parallel and equally important technological development involves the evolution of ceramic inks and functional glazes. Modern ceramic inks are nano-pigmented, allowing for deeper color saturation and sharper detail, while specialized functional inks are enabling new product differentiation. These include reactive inks that create controlled textural effects upon firing, metallic inks for aesthetic accents, and specialized anti-slip inks applied digitally to meet safety standards for wet areas. The capability to digitally apply specific materials, such as ceramic fritters and granulated glass, using specialized dispensing heads alongside standard color inks, allows manufacturers to create intricate three-dimensional surface textures, significantly enhancing the tactile quality of the finished tile. This shift from purely two-dimensional decoration to integrated 3D texturing is a major technological differentiator in the premium segment.

Beyond the core printing process, efficiency technologies are paramount. This includes advancements in dry grinding and pressing techniques, which reduce the need for water in raw material preparation, improving environmental performance and energy savings during the drying phase. Automated defect detection systems, increasingly integrating machine vision and AI algorithms, operate in-line post-printing and pre-firing, ensuring instantaneous quality assessment and feedback to the printing unit, minimizing waste before energy-intensive firing. The overall trend is toward complete process integration and monitoring, leveraging Industrial Internet of Things (IIoT) frameworks to connect all stages, from raw material handling to final sorting and packaging, ensuring maximum efficiency and data-driven operational decision-making across the entire manufacturing pipeline.

Regional Highlights

The global Ceramic Tile and Its Printing Market exhibits distinct regional consumption and production patterns, strongly influenced by construction activity, regulatory environments, and prevailing design trends. The Asia Pacific (APAC) region stands out as the undisputed leader in both production volume and market consumption. Countries such as China, India, and Vietnam are the epicenters of global tile manufacturing, benefiting from abundant raw material availability, lower labor costs, and exponential growth in urban infrastructure development. Rapid urbanization and massive government investments in housing and commercial real estate projects drive the demand for cost-effective, high-volume ceramic products, positioning APAC as the highest growth region. The continuous upgrade of printing technology in APAC factories is focused on increasing efficiency and output capacity to meet this scale of demand, resulting in regional dominance that influences global price competitiveness.

Europe, characterized by mature construction markets and stringent environmental standards, represents the leading region for high-value, aesthetically superior, and digitally enhanced porcelain tiles and slabs. Western European manufacturers, particularly in Italy and Spain, prioritize innovation, focusing on large-format tiles, customized architectural solutions, and sustainability certifications (such as EU Ecolabel). Demand in this region is primarily driven by renovation projects, the requirement for high-end residential finishes, and strict adherence to technical performance standards. The regional market growth, while slower than APAC in volume, is robust in value, driven by premiumization and the consistent adoption of the very latest digital printing and surface finishing technologies, setting global trends for design and quality.

North America and Latin America demonstrate contrasting dynamics. North America is a significant importer, where demand is dominated by residential remodeling and robust commercial construction activity, favoring imported high-quality, digitally printed products from Europe and Asia. The emphasis here is on quick installation, aesthetic variety, and compliance with anti-slip and durability standards. Latin America, specifically countries like Brazil and Mexico, hosts substantial domestic production capabilities, which are increasingly integrating digital printing to modernize facilities and reduce reliance on older, less efficient methods. The Middle East and Africa (MEA) region is experiencing strong growth propelled by ambitious mega-projects and housing initiatives, particularly in the GCC countries. MEA markets demand robust, climatically suitable tiles, and digital printing is essential for replicating the intricate geometric and cultural patterns popular in local architecture, positioning these regions as critical adopters of advanced digital decoration systems.

- Asia Pacific (APAC): Dominates global production and consumption; fueled by rapid urbanization and infrastructure investment (China, India). Focus on high volume and speed digital printing.

- Europe: Leading region for premium, high-value porcelain slabs and aesthetic innovation (Italy, Spain). Strong emphasis on design quality and sustainability.

- North America: Significant consumption market driven by remodeling and commercial construction. High demand for imported, large format, digitally designed tiles.

- Latin America: Emerging manufacturing hub (Brazil, Mexico) rapidly adopting digital technology to modernize local production capabilities.

- Middle East & Africa (MEA): High growth potential driven by large-scale real estate developments and increasing adoption of aesthetically complex, digitally produced patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Tile and Its Printing Market.- Mohawk Industries

- Lamosa

- Siam Cement Group (SCG)

- Asian Granito India Ltd. (AGL)

- RAK Ceramics

- Florim Ceramiche S.p.A.

- Kajaria Ceramics Ltd.

- Porcelanosa Grupo

- Grupo Fritta (Ink Supplier)

- Durst Phototechnik AG (Technology Provider)

- EFI Cretaprint (Technology Provider)

- System Ceramics (Technology Provider)

- KERAJET (Technology Provider)

- H.P. GAUER GMBH (Ink Supplier)

- Tecnoferrari

- FUJI FILM Dimatix (Printhead Supplier)

- DIP-Tech (Glass & Tile Printing)

- Marazzi Group S.r.l.

- Dongpeng Ceramic

- Guangdong Mona Lisa Industrial

Frequently Asked Questions

Analyze common user questions about the Ceramic Tile and Its Printing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Ceramic Tile Printing Market?

The primary driver is the accelerating global adoption of high-definition digital inkjet technology, which enables manufacturers to produce customized, photorealistic tiles (replicating natural materials like wood and marble) with high speed, flexibility, and minimal waste, meeting growing demand for aesthetic personalization in construction and renovation sectors.

How does digital printing technology enhance the sustainability of ceramic tile manufacturing?

Digital printing enhances sustainability by significantly reducing water usage and setup waste compared to traditional methods. Furthermore, it allows for on-demand production and customization, minimizing inventory levels and reducing the energy footprint associated with producing surplus stock. Many specialized ceramic inks are also formulated to be more environmentally benign.

Which region holds the largest market share for ceramic tile production and consumption?

The Asia Pacific (APAC) region, driven predominantly by China and India, holds the largest market share in terms of both ceramic tile production capacity and consumption volume, largely due to rapid urbanization and extensive infrastructure development projects across the area.

What are the main technical challenges faced by digital ceramic printing?

Key technical challenges include the high initial capital investment required for printing equipment, managing the operational cost and frequent maintenance of sophisticated print heads, and ensuring the stability and performance of specialized ceramic inks that must withstand the high temperatures of the firing process.

How is Artificial Intelligence (AI) being utilized in the ceramic tile market?

AI is primarily utilized in two areas: optimizing manufacturing processes through predictive maintenance and smart kiln management to reduce energy consumption, and enhancing product design through generative AI models that create new, market-informed aesthetic patterns and textures for digital printing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ceramic Tile and Its Printing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ceramic Tile and its Printing Market Statistics 2025 Analysis By Application (Household Usage, Commercial Usage), By Type (Porcelain tile, Porcelain stoneware tiles, Fine stoneware tiles, Stoneware tiles, Earthenware tiles), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager