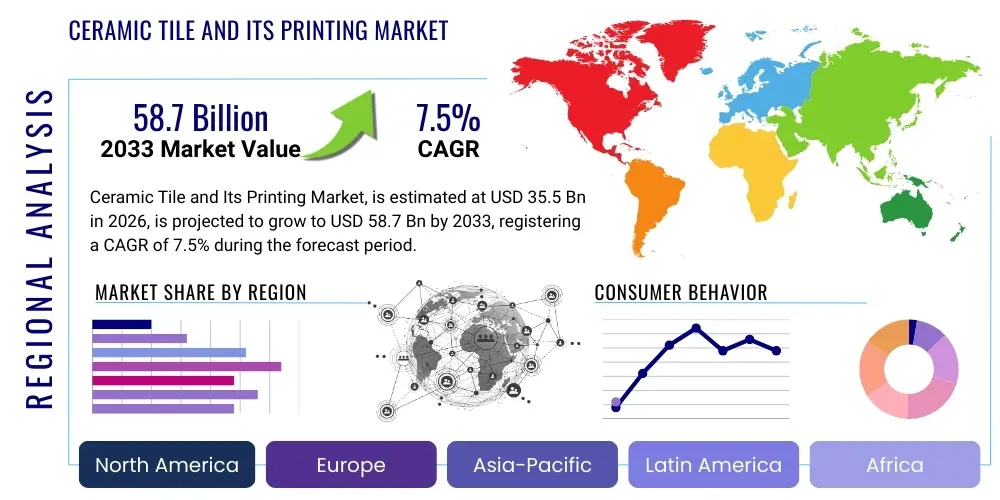

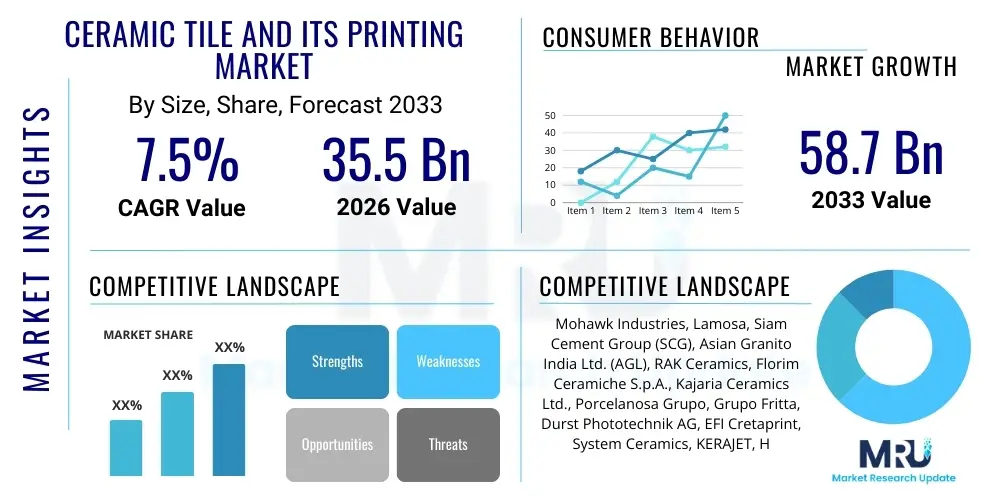

Ceramic Tile and Its Printing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441167 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Ceramic Tile and Its Printing Market Size

The Ceramic Tile and Its Printing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 42.9 Billion by the end of the forecast period in 2033.

Ceramic Tile and Its Printing Market introduction

The Ceramic Tile and Its Printing Market encompasses the production and decoration of ceramic tiles, primarily utilizing advanced printing technologies such as digital inkjet printing, screen printing, and rotogravure printing. Digital printing has revolutionized this sector by enabling high-resolution, complex designs, and realistic textures, mimicking natural materials like wood and stone with unparalleled accuracy and efficiency. This market is intrinsically linked to the global construction and interior design industries, serving as a foundational element in residential, commercial, and industrial infrastructure projects. The product offerings range from simple monochromatic tiles to highly sophisticated decorative panels, catering to diverse aesthetic and functional requirements across different geographies and socioeconomic segments.

Ceramic tiles, known for their durability, low maintenance, hygiene, and resistance to fire and moisture, form the backbone of this industry. The integration of high-definition printing capabilities allows manufacturers to significantly reduce production costs associated with intricate patterning, minimize waste, and offer greater customization flexibility compared to traditional methods. Major applications include floor and wall coverings in bathrooms, kitchens, external facades, shopping centers, and hospitals. The shift toward larger format tiles and personalized design elements, facilitated by precise printing technology, further expands the market's application scope and value proposition for architects and interior decorators seeking unique, performance-oriented surface solutions. The increasing urban population and subsequent rise in renovation activities globally also underpin sustained demand for these aesthetically versatile materials.

Key driving factors accelerating market expansion include rapid urbanization in developing economies, leading to extensive new construction activities, and the growing preference for aesthetically pleasing, digitally printed tiles that offer superior design repeatability and vibrant color palettes. Furthermore, technological advancements in ink chemistry, specifically the development of functional inks like anti-slip and antibacterial variations, enhance the utility and safety profile of ceramic surfaces, making them suitable for specialized environments such as healthcare facilities and high-traffic public spaces. The increasing awareness among consumers regarding the environmental sustainability of ceramic production processes, particularly when coupled with efficient digital manufacturing, also contributes positively to market growth, positioning tiles as a durable and ecologically sound flooring and cladding option.

Ceramic Tile and Its Printing Market Executive Summary

The global Ceramic Tile and Its Printing Market is defined by a dynamic interplay of technological adoption, shifting consumer preferences towards high-end aesthetics, and robust infrastructural development, particularly across the Asia Pacific region. Business trends are dominated by the rapid conversion from conventional printing techniques to advanced digital inkjet printing systems, which allow for shorter production runs, quicker design changes, and significant reduction in material and labor costs. Manufacturers are intensely focused on integrating automation and smart factory concepts, leveraging industrial IoT to optimize production lines and enhance quality control, thereby maintaining competitive pricing while offering premium, customized products. Strategic partnerships between tile manufacturers and digital printing solution providers (ink and equipment suppliers) are crucial for accelerating innovation and market penetration across specialized segments.

Regional trends indicate that Asia Pacific, driven primarily by India and China, remains the largest consumer and producer base due to massive investments in residential housing, commercial complexes, and public infrastructure projects. European markets, while mature, are characterized by a strong demand for innovative, large-format, and aesthetically refined tiles that adhere to stringent environmental and quality standards. North America shows steady growth, fueled by strong renovation and remodeling activities, alongside a preference for durable, digitally rendered textures like wood and natural stone alternatives. Emerging markets in Latin America and the Middle East & Africa (MEA) are also exhibiting high growth potential, supported by infrastructural spending and a burgeoning middle class seeking modern, high-quality finishing materials for new homes and offices. These regional variances necessitate tailored market strategies concerning product mix, pricing, and distribution channels.

Segment trends highlight the dominance of porcelain tiles due to their superior strength, low porosity, and versatility, making them highly suitable for both interior and exterior applications. Within the printing segment, Digital Inkjet Printing holds the largest market share and is expected to exhibit the fastest growth, largely replacing older technologies like rotary screen printing due to its precision and flexibility in handling complex graphical demands. The commercial segment, encompassing retail, hospitality, and institutional construction, represents a high-value application area, frequently demanding customized, high-performance printed tiles. Conversely, the residential segment drives volume, focusing on cost-effective, durable, and visually appealing printed ceramic solutions that meet modern interior design standards. The ongoing trend toward incorporating recycled materials and low-VOC inks underscores the increasing relevance of sustainability across all operational segments.

AI Impact Analysis on Ceramic Tile and Its Printing Market

User queries concerning the integration of Artificial Intelligence (AI) in the Ceramic Tile and Its Printing Market frequently revolve around optimizing design workflows, predicting material defects, and enhancing supply chain efficiency. Key themes include the use of AI for generating novel tile designs based on current interior trends and customer preferences (predictive aesthetics), employing machine vision and deep learning for real-time quality inspection during high-speed printing, and utilizing predictive analytics to manage complex inventory and maintenance schedules for high-capital printing equipment. Users anticipate that AI will significantly reduce material waste, accelerate time-to-market for new collections, and lead to unprecedented levels of design personalization, addressing both sustainability concerns and the demand for bespoke architectural finishes. The central expectation is that AI will move the industry beyond incremental improvements to transformative operational and creative capabilities.

- AI-powered generative design algorithms accelerate the creation of complex, high-resolution tile patterns and textures.

- Machine Vision systems, driven by AI, detect minor printing defects, color inconsistencies, and structural flaws in real-time on the production line.

- Predictive maintenance analytics optimize the scheduling for inkjet printer heads and kiln operations, minimizing costly downtime.

- AI-driven supply chain optimization enhances raw material procurement (clays, glazes, inks) and finished goods logistics.

- Demand forecasting models utilize AI to predict regional and seasonal preferences, guiding inventory levels and production volumes.

- Customization platforms powered by AI enable consumers and designers to visualize and order highly personalized printed tile configurations instantly.

- Robotics and AI collaborate in tile handling, sorting, and packaging, improving efficiency and reducing labor dependency in harsh factory environments.

- AI monitors energy consumption in kilns and dryers, recommending operational adjustments to enhance sustainability and lower utility costs.

- Enhanced color management systems use AI to ensure perfect color fidelity across different production batches and printing machines.

- Intelligent formulation of digital inks and glazes, where AI predicts performance characteristics based on material composition.

- AI facilitates automated texturing processes, ensuring the printed design perfectly matches the tactile surface relief of the tile.

- Chatbots and virtual assistants improve customer interaction regarding product specifications and personalized design inquiries.

- Automated compliance checks, using AI to verify adherence to regional building codes and quality standards regarding tile specifications.

- Integration of AI systems with Enterprise Resource Planning (ERP) tools for holistic operational oversight and strategic decision-making.

DRO & Impact Forces Of Ceramic Tile and Its Printing Market

The dynamics of the Ceramic Tile and Its Printing Market are fundamentally shaped by the continuous pursuit of aesthetic excellence and manufacturing efficiency, countered by inherent challenges related to raw material volatility and capital intensity. The primary driving force is the global surge in construction activity, particularly in emerging economies, combined with the technological imperative to shift towards digital printing which offers superior design quality and operational flexibility over traditional methods. However, the market faces significant restraints, chiefly high initial capital investment required for state-of-the-art digital printing machinery and the fluctuating prices of essential raw materials like kaolin, feldspar, and specialized ceramic inks. These forces collectively dictate the entry barriers and competitive landscape, compelling established players to continuously innovate their production processes and material sourcing strategies to maintain profitability and market share.

Opportunities for growth are abundant, rooted in the potential for advanced functional tile development and geographical expansion into untapped or rapidly growing construction hubs. The increasing demand for anti-microbial, self-cleaning, and energy-efficient tiles (e.g., ventilated facade systems) necessitates highly precise printing capabilities that can incorporate functional coatings, opening new, high-margin niche segments. Geographically, market penetration opportunities lie in regions undergoing massive infrastructure overhauls, such as parts of Southeast Asia, Africa, and Latin America, where demand for durable and aesthetically modern building materials is skyrocketing. Furthermore, the accelerating trend of remodeling and renovation in developed countries provides a consistent revenue stream, as consumers frequently opt for printed tiles to refresh older spaces, seeking durable, yet contemporary finishes that digital printing readily provides.

The impact forces influencing the market trajectory are multifaceted. Technological obsolescence risk is high, driven by rapid innovations in printing hardware and ink formulation, forcing companies to constantly reinvest to stay relevant. Regulatory impact forces, particularly those related to environmental protection, are also critical; stricter regulations concerning VOC emissions from glazes and wastewater discharge compel manufacturers to adopt cleaner, digitally-focused production methods, favoring suppliers who offer eco-friendly ink solutions. Economic impact forces, such as interest rate changes affecting the housing market and global trade tariffs impacting the cross-border movement of finished tiles and raw materials, significantly influence investment decisions and overall market stability. Collectively, these impact forces necessitate a robust, adaptable manufacturing strategy centered on sustainable practices and continuous technological upgrades to secure long-term market leadership.

Segmentation Analysis

The Ceramic Tile and Its Printing Market is broadly segmented based on the type of tile manufactured, the printing technology employed for decoration, and the application area (end-use). This segmentation is crucial for understanding the market's underlying dynamics, as different segments exhibit varying growth rates and adoption levels of digital printing technologies. The core segments reflect a transition from traditional ceramic manufacturing processes to high-tech, digitally-enabled production lines, driven by the consumer's growing desire for aesthetic diversity and product customization. Analyzing these segments helps stakeholders tailor their product development, marketing efforts, and investment strategies to maximize returns in high-potential areas, such as large-format porcelain tile printing for commercial applications.

The Tile Type segmentation distinguishes between ceramic (non-porcelain), porcelain, and glazed tiles, reflecting differences in raw material composition, firing temperature, durability, and resulting price points. Porcelain tiles, known for their superior performance characteristics—low water absorption, high strength, and frost resistance—command a premium and are increasingly favored in high-traffic commercial and outdoor environments, driving substantial investment in advanced printing capabilities specifically designed for their dense structure. Conversely, traditional ceramic tiles remain dominant in volume-driven residential segments where cost sensitivity is higher, utilizing established printing methods while also gradually adopting digital solutions for improved visual appeal.

The Technology segmentation is perhaps the most defining characteristic of the modern market, highlighting the shift from analog printing (like rotary screen printing and traditional photolithography) to sophisticated Digital Inkjet Printing (DIP). DIP provides crucial advantages in terms of pattern complexity, color depth, registration accuracy, and rapid design changes, directly addressing the architectural community's demand for high-fidelity, unique surface aesthetics. While screen printing still holds ground in specific segments, particularly for applying functional coatings or simple color layers, the digital sector is the engine of market value growth, necessitating ongoing R&D in high-performance ceramic inks and sophisticated print head technology to achieve ever-higher resolutions and production speeds.

- By Technology:

- Digital Inkjet Printing (DIP)

- Screen Printing

- Rotogravure Printing

- Other Printing Methods (e.g., Pad Printing)

- By Tile Type:

- Porcelain Tiles

- Ceramic Tiles (Non-Porcelain)

- Glazed Tiles

- Unglazed Tiles

- By Application (End-Use):

- Residential (Floors, Walls, Countertops)

- Commercial (Offices, Retail, Hospitality)

- Industrial (Warehouses, Factories)

- Outdoor/External Cladding

- By Size:

- Small Format (Up to 30x30 cm)

- Medium Format (30x30 cm to 60x60 cm)

- Large Format (60x60 cm and above)

- By Functionality:

- Standard Decorative Tiles

- Functional Tiles (Anti-slip, Anti-microbial, Self-cleaning)

Value Chain Analysis For Ceramic Tile and Its Printing Market

The value chain for the Ceramic Tile and Its Printing Market begins with the upstream procurement of raw materials and technological components, a stage characterized by high dependence on geological reserves and specialized chemical suppliers. Upstream analysis involves the sourcing of primary raw materials like specific clays (kaolin, ball clay), feldspar, silica sand, and crucial chemical additives necessary for formulating the tile body and the glazes. Most critically for the printing segment, the upstream phase involves the specialized production of ceramic pigments, sophisticated inorganic inks (often nano-pigment based), and high-performance digital printing equipment (inkjet heads, software). Reliability and quality control at this stage are paramount, as the consistency of raw materials directly impacts the final tile's physical properties and the print quality achieved by digital machinery.

The midstream phase encompasses the core manufacturing processes: body preparation, forming, glazing, firing, and crucially, the printing and decoration stage. This is where value is added through technological intensity, particularly via advanced digital inkjet printers that apply precise patterns and textures. Downstream analysis focuses on the distribution, logistics, and end-user application of the finished printed tiles. The efficiency of the distribution channel is vital, given the heavy, fragile nature of the product, requiring specialized handling and storage to prevent breakages. Effective downstream operations rely heavily on strong relationships with architects, interior designers, distributors, and major retail chains, who influence procurement decisions and final installation practices.

Distribution channels in this market are multilayered, combining both direct and indirect routes to market. Direct distribution typically involves large manufacturers supplying directly to major commercial project developers, large institutional buyers, or flagship retail stores, allowing for greater control over pricing and branding. Indirect distribution, which accounts for the majority of residential market sales, utilizes independent wholesalers, specialized tile distributors, and retail home improvement chains. The complexity of digital printing introduces a highly technical requirement at the point of sale; therefore, strong partnerships with specialized installers and project managers who understand the nuances of laying large-format, digitally printed tiles are increasingly important for ensuring product performance and customer satisfaction.

Ceramic Tile and Its Printing Market Potential Customers

Potential customers for the Ceramic Tile and Its Printing Market are diverse, spanning both large-scale commercial entities and individual homeowners, segmented broadly into the construction, renovation, and interior design industries. Key end-users/buyers include residential housing developers responsible for mass construction projects, commercial real estate firms building offices, retail spaces, and hospitality establishments (hotels and resorts), and governmental agencies undertaking public infrastructure projects such as transportation hubs and healthcare facilities. These bulk buyers prioritize durability, standardization, adherence to safety codes (e.g., anti-slip requirements), and the ability to source large quantities of uniform, aesthetically appealing tiles quickly and efficiently, making high-volume, digitally printed solutions highly attractive.

A second major customer group consists of individual consumers undertaking home renovation or custom home construction projects. These customers, often advised by architects and interior designers, place a premium on aesthetic quality, design uniqueness, and the ability to customize finishes. The flexibility offered by digital printing technology—allowing for highly realistic wood, marble, or textile effects, or personalized artistic patterns—caters directly to this demand for bespoke and trend-forward interior surfaces. The rise of DIY culture, particularly in North America and Europe, also makes accessible, easy-to-install tile formats with aesthetically rich printed designs a significant consumer focus, increasing reliance on retail channels and online marketplaces for selection and purchase.

Furthermore, specialized industrial buyers, such as those in the food processing or pharmaceutical sectors, represent crucial customers for functional printed tiles. These sectors require surfaces that not only meet high durability standards but also incorporate features like specialized anti-microbial coatings or chemical resistance, which are applied using precision printing technologies. The growing segment of external cladding and ventilated façade systems in modern architecture also designates high-end construction firms as critical customers, demanding large-format, frost-resistant, and UV-stable printed porcelain tiles for external use. These various buyer profiles necessitate a complex marketing and sales approach that addresses both volume-driven pricing sensitivity and performance-driven technical requirements across different market verticals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 42.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SACMI, System Ceramics, Durst Group, EFI Cretaprint, KeraJet, Smaltoceram, Esmalglass Itaca Group, Ferro Corporation, Torrecid, Fincibec Group, Gruppo Concorde, Mohawk Industries, RAK Ceramics, Asian Granito India Ltd. (AGIL), Kajaria Ceramics, Porcelanosa Grupo, H.C. Starck Ceramics, Colorker, LB Officine Meccaniche, and Guoxin Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Tile and Its Printing Market Key Technology Landscape

The technological landscape of the Ceramic Tile and Its Printing Market is overwhelmingly dominated by high-resolution Digital Inkjet Printing (DIP), representing a paradigm shift from conventional methods. DIP utilizes highly specialized ceramic inks, which are formulations of inorganic pigments suspended in specific liquid carriers, deposited onto the unfired or glazed tile body using advanced piezo-electric print heads. This technology allows for the precise, non-contact application of color and texture-enhancing materials, delivering photo-realistic imagery, complex geometric patterns, and highly defined veining (crucial for mimicking natural marble and wood) that are unattainable with older rotary screen methods. Continuous investment in faster print speeds, wider print widths, and increased nozzle density are the primary R&D focus areas to improve production efficiency and fidelity.

Beyond the core printing hardware, significant technological advancements are occurring in supporting technologies, particularly in ceramic ink chemistry and digital glazing systems. The development of specialized functional inks, such as those embedding anti-microbial agents or opaque white inks that improve color vibrancy on darker substrates, enhances the value proposition of printed tiles. Digital glazing technology, known as 'digital structure' or 'digital material deposition,' uses inkjet principles not just for color but for applying transparent or matte glazes, creating tactile relief and three-dimensional surface effects that perfectly align with the underlying printed design. This synergy between digital color and digital structure is critical for creating premium, high-definition architectural surfaces.

Furthermore, the integration of automation and Industry 4.0 principles is rapidly shaping the production environment. Advanced software solutions are necessary for managing the complex workflow, from processing design files (often large raster or vector graphics) to precisely controlling the print heads and coordinating the movement of the tiles through the drying and firing stages. Laser etching and texturing techniques are also emerging, which, when combined with digital printing, allow manufacturers to achieve extremely precise surface modifications that enhance the tile's anti-slip properties or tactile realism. The convergence of these hardware, software, and chemical innovations defines the competitive edge in modern ceramic tile manufacturing, demanding significant upfront investment in state-of-the-art facilities.

Regional Highlights

- Asia Pacific (APAC): The Engine of Volume and Growth

APAC stands as the undisputed global leader in both production and consumption of ceramic tiles and related printing technologies. This dominance is primarily fueled by rapid urbanization, massive government and private sector investments in infrastructure, and the continuous expansion of the residential sector, particularly in populous countries like China, India, and Vietnam. Manufacturers in this region are characterized by high volume output and increasing adoption of digital printing to enhance product quality and export competitiveness. India, in particular, is witnessing a monumental shift toward premium digitally printed vitrified and porcelain tiles, driven by rising consumer income and preference for durable, aesthetically superior flooring options. The region's competitiveness is defined by a strong focus on cost efficiency coupled with the necessity to meet increasingly sophisticated design requirements for a growing middle class, forcing rapid technological upgrades across major manufacturing hubs.

The sheer scale of manufacturing in China continues to influence global pricing and technological diffusion. However, environmental regulations are becoming stricter, encouraging Chinese manufacturers to invest in cleaner, highly automated, digital production lines to comply with new standards while maintaining output capacity. Other high-growth nations, such as Indonesia and Thailand, are also expanding their domestic production capabilities, driven by localized construction booms. The high demand for printed tiles in APAC spans all applications, from affordable housing projects requiring functional printed ceramics to high-end commercial spaces demanding large-format, digitally textured porcelain slabs. Regional technological adoption is often quick, driven by the desire to differentiate products in a highly saturated market environment.

The prevalence of integrated digital printing systems, supported by local suppliers for raw materials and maintenance, ensures high throughput. Key trends include the transition to larger format tiles and the export of high-quality, digitally produced porcelain tiles to Western markets. The emphasis is on balancing low production costs with quality, relying heavily on local machinery and ink suppliers who compete directly with established European technology providers.

- Europe: Focus on Premiumization and Sustainability

Europe, home to traditional ceramic powerhouses like Italy and Spain, remains a crucial market segment, characterized by a mature consumer base that values design innovation, high quality, and sustainability. While production volume is generally lower than in APAC, the value generated per square meter is significantly higher due to a focus on premium, design-led products and highly specialized printed tiles (e.g., historical replica designs, intricate geometric patterns). European manufacturers were pioneers in adopting digital inkjet technology and continue to lead innovation in digital glazing and texturing systems.

The market growth in Europe is driven by renovation projects and the strong aesthetic influence of Italian and Spanish design houses. There is a strong regulatory push towards sustainable manufacturing, including stringent controls on emissions and energy consumption, further encouraging the adoption of efficient digital printing techniques which reduce waste. Consumers here demand transparent sourcing and environmentally friendly products, favoring manufacturers who utilize low-VOC glazes and implement closed-loop water systems in their printing processes. The high adoption rate of large format slabs, particularly for counter-tops and external façades, necessitates highly precise digital printing capabilities.

Germany, France, and the UK are major consumption centers, demanding tiles that meet high technical specifications for commercial use and residential luxury projects. Innovation focuses on creating extremely realistic natural material mimics (stone, wood) and developing functional surfaces, such as highly durable, easy-to-clean hospital tiles, all facilitated by high-end digital printing and firing technology. The stability of the European market makes it a lucrative testing ground for new, high-value printing applications.

- North America (NA): Renovation and High-Definition Aesthetics

The North American market is primarily driven by robust residential renovation and remodeling activities, alongside steady growth in commercial construction. Consumers in the US and Canada exhibit a strong preference for durable, low-maintenance flooring and wall coverings, making digitally printed porcelain and ceramic tiles highly popular substitutes for natural wood and stone, often at a lower cost. The market is characterized by a significant import volume, but domestic production is highly focused on modern, digitally-driven high-end products.

The adoption of large-format tiles is accelerating in this region, driven by architectural trends favoring seamless, expansive surfaces. Digital printing technology is critical here, enabling the production of high-definition, complex graphics needed for premium design integration. Key market drivers include the housing recovery and the increasing trend toward open-plan living spaces requiring versatile and resilient printed flooring solutions. Retail channels, including major home improvement centers, play a pivotal role in the distribution and consumer acceptance of digitally printed tiles.

Manufacturers serving NA emphasize quick turnaround times and flexible design capabilities, responding to fast-changing interior design trends. The market benefits significantly from cross-border trade with Mexico and Canada, but the demand for customized, American-made large-format tiles printed with local aesthetic preferences is a growing factor. Quality and longevity are primary purchasing criteria, further solidifying the position of digitally printed porcelain over traditional ceramics in high-traffic areas.

- Latin America (LATAM): Infrastructure Development and Local Manufacturing

The LATAM market is experiencing varied growth, heavily influenced by country-specific economic stability and infrastructure investment cycles. Brazil and Mexico are leading regional manufacturers, focusing on both domestic demand and exports. The demand for ceramic tiles is intrinsically linked to government housing programs and ongoing commercial construction projects, creating a steady, high-volume requirement for durable, printed flooring materials.

Digital printing adoption is increasing steadily as regional manufacturers seek to modernize their production lines to compete with imports from Asia and Europe and offer more aesthetically diverse products to local consumers. Cost efficiency remains a crucial consideration, leading to a strong demand for reliable, yet affordable, digital printing equipment and locally sourced raw materials. Residential construction drives the bulk of the volume, often favoring mid-format printed ceramic tiles that offer good value and local aesthetic relevance.

The market is slowly moving towards higher-value porcelain tiles, especially in major urban centers, where commercial development demands higher durability and sophisticated aesthetics achieved through digital decoration. Challenges include economic volatility and logistical complexities, which sometimes impede the widespread adoption of the latest, high-capital printing technologies.

- Middle East & Africa (MEA): Rapid Industrialization and Luxury Projects

The MEA market is highly dynamic, driven by massive planned construction and real estate projects, particularly in the Gulf Cooperation Council (GCC) countries. These regions, fueled by oil wealth and diversification efforts (e.g., Saudi Vision 2030, UAE development plans), generate enormous demand for large volumes of high-quality, often luxury, printed ceramic and porcelain tiles for residential towers, mega-malls, and public infrastructure.

Manufacturers in the region, such as RAK Ceramics, have heavily invested in advanced, digitally optimized production facilities to cater to both local requirements and export markets. The aesthetic preference leans toward grandeur, often utilizing digital printing to replicate rare and exotic marbles and stones on large format slabs. High performance is critical due to extreme climate conditions (intense heat and high UV exposure), necessitating specialized glazes and UV-resistant inks applied via digital technology.

African countries, led by nations like Nigeria and South Africa, represent rapidly emerging markets where urbanization is driving foundational demand for affordable, functional, printed ceramic tiles for mass housing projects. While the production technology adoption lags behind the GCC, investment is accelerating to serve the local need for durable, locally relevant building materials, creating significant future opportunities for digital printing technology providers focused on volume and efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Tile and Its Printing Market.- SACMI

- System Ceramics (Coesia Group)

- Durst Group

- EFI Cretaprint

- KeraJet

- Smaltoceram S.A.

- Esmalglass Itaca Group

- Ferro Corporation

- Torrecid S.A.

- Fincibec Group

- Gruppo Concorde

- Mohawk Industries Inc.

- RAK Ceramics PSC

- Asian Granito India Ltd. (AGIL)

- Kajaria Ceramics Ltd.

- Porcelanosa Grupo

- H.C. Starck Ceramics GmbH

- Colorker S.A.

- LB Officine Meccaniche SpA

- Guoxin Industrial (China)

- Tecnargilla

- Xaar PLC

- FUJIFILM Dimatix, Inc.

- HP Inc. (Industrial Printing Solutions)

- Kerajet S.A.

Frequently Asked Questions

Analyze common user questions about the Ceramic Tile and Its Printing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of digital printing in the ceramic tile market?

The primary driver is the unparalleled flexibility and quality offered by digital inkjet technology, enabling the reproduction of high-definition, complex designs like natural wood and stone textures with minimal waste. This flexibility allows manufacturers to meet evolving architectural demands for custom, large-format, and aesthetically superior tiles efficiently.

How does digital printing compare to traditional screen printing for ceramic tiles?

Digital printing (DIP) offers superior color registration, limitless pattern variation, and the ability to change designs instantly without mechanical adjustments, leading to lower setup costs and high production flexibility. Traditional screen printing is generally less precise and limited in the complexity of designs it can reproduce effectively.

Which geographical region holds the largest market share for ceramic tile manufacturing and printing?

The Asia Pacific (APAC) region, led by China and India, holds the largest market share globally due to extensive urbanization, vast infrastructure projects, and a high volume of residential construction. This region also demonstrates accelerated adoption of modern digital printing technologies to enhance export quality.

What are the primary restraints affecting the Ceramic Tile and Its Printing Market?

Key restraints include the extremely high initial capital investment required for purchasing advanced digital printing machinery (printers and associated kiln technology), as well as significant volatility in the prices of critical raw materials such such as specialized ceramic inks and pigments, alongside fluctuating energy costs for firing processes.

What is the role of AI in optimizing ceramic tile printing operations?

AI is increasingly utilized for optimizing the market by powering generative design tools that suggest new patterns, implementing machine vision systems for real-time quality control and defect detection during high-speed printing, and enhancing predictive maintenance protocols for complex, high-precision inkjet equipment, ensuring optimal throughput and reducing downtime dramatically.

What are the key advantages of using porcelain over traditional ceramic tiles in commercial applications?

Porcelain tiles offer significantly lower water absorption, superior mechanical strength, and higher resistance to abrasion and frost compared to traditional ceramic tiles. These characteristics make digitally printed porcelain ideal for high-traffic commercial settings and exterior cladding where durability and longevity under varied environmental conditions are non-negotiable requirements, justifying their higher cost.

How is the focus on sustainability impacting ink development for tile printing?

Sustainability drives innovation in ink development toward formulations with lower volatile organic compounds (VOCs) and heavy metal content. Manufacturers are focusing on highly efficient ink consumption, developing water-based or eco-solvent ceramic inks, and integrating production processes that minimize wastewater and energy usage, aligning with global green building standards.

What technological advancement is crucial for achieving 3D texture in printed tiles?

The development and integration of Digital Glazing Technology (often called digital material deposition or digital structure) is crucial. This technology uses specialized inkjet systems to apply transparent, structured, or matte glazes selectively, creating tactile relief and three-dimensional effects that perfectly align with the underlying printed color pattern, dramatically increasing the realism of the surface finish.

Which application segment shows the highest growth potential for high-end printed tiles?

The Commercial application segment, particularly encompassing high-end hospitality (hotels), retail luxury stores, and large corporate offices, shows the highest growth potential. These environments require large format, custom-designed, highly durable, and aesthetically unique printed tiles, often utilizing porcelain slabs with complex digital textures, driving high market value.

What challenges do manufacturers face when implementing large-format tile printing?

Challenges include the increased risk of tile warping or breakage during firing and handling, the need for specialized printing equipment with wider print beds and highly stable material transport systems, and complex logistics required for transporting and installing large, heavy, digitally printed slabs, which demands high precision throughout the entire value chain.

How is the shift toward functional tiles affecting the printing market?

The shift toward functional tiles (e.g., anti-microbial, self-cleaning, photovoltaic) necessitates advanced digital printing capabilities to precisely deposit specialized functional coatings or nano-materials onto the tile surface. This expansion into high-value functional coatings is opening up niche segments, particularly in healthcare and industrial applications, where performance is paramount.

Describe the role of key technology suppliers in the ceramic tile printing ecosystem.

Key technology suppliers, such as SACMI, System Ceramics, and Durst Group, are vital as they provide the essential high-capital equipment (digital printers, kilns, handling systems) and crucial consumables (specialized inkjet heads and inorganic pigments/inks). Their continuous innovation in speed, precision, and efficiency directly determines the production capacity and quality achievable by tile manufacturers globally.

What influence do interior designers and architects have on market trends?

Interior designers and architects are significant market influencers as they specify materials for large commercial and high-end residential projects. Their demand for increasingly bespoke patterns, realistic material mimics, and large, seamless formats directly drives manufacturers' investment decisions in advanced digital printing and finishing technologies to satisfy contemporary aesthetic standards.

How does the volatility of energy prices impact the ceramic tile manufacturing sector?

Ceramic tile manufacturing is highly energy-intensive, primarily due to the high temperatures required in the firing process (kilns). Volatility in natural gas or electricity prices directly increases operational costs, potentially squeezing profit margins and encouraging manufacturers to adopt more energy-efficient digital drying and firing technologies to mitigate financial risk and maintain competitive pricing.

What is the expected Compound Annual Growth Rate (CAGR) for this market?

The Ceramic Tile and Its Printing Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 7.8% between the years 2026 and 2033, driven by sustained global construction activity and accelerated technological adoption, particularly digital printing advancements in major emerging economies and renovation markets worldwide.

Which specific type of ink is most commonly used in digital ceramic tile printing?

Digital ceramic tile printing predominantly uses specialized inorganic ceramic inks. These inks contain finely ground, thermally stable inorganic pigments suspended in an organic vehicle (carrier fluid). These pigments must withstand the extremely high temperatures of the firing process (up to 1250°C) without degradation, ensuring permanent color and high durability of the finished product.

How does automation enhance quality control in printed tile production?

Automation, often integrated with AI and machine vision, enhances quality control by performing high-speed, non-subjective inspection of every single tile. Automated systems detect minute color deviations, pattern mismatches, and structural defects with greater accuracy and consistency than human inspectors, minimizing waste and ensuring uniform output quality essential for large-scale projects and high-end sales.

What role does the renovation sector play in market demand?

The renovation and remodeling sector, especially in mature economies like North America and Europe, provides a constant and resilient source of demand. Homeowners and commercial property managers frequently choose digitally printed tiles for upgrades due to their durability, ease of maintenance, and the ability to achieve modern, high-end aesthetics replicating expensive natural materials at a more accessible price point.

What are the primary logistical challenges faced by the downstream value chain?

Downstream logistics face challenges related to the weight and fragility of the finished ceramic tiles, especially the large-format slabs. This necessitates specialized packaging, careful handling, and complex, coordinated transport to minimize breakage, increase costs, and requires specialized equipment and training throughout the distribution network to maintain product integrity.

How do tariffs and trade policies influence the global market dynamics?

Tariffs and complex trade policies significantly influence global market dynamics by affecting the cost of imported raw materials (clays, inks) and finished tiles, particularly impacting regions relying heavily on imports. Trade barriers can shift manufacturing focus to domestic production within major consuming regions like the US or Europe, thereby accelerating localized investment in advanced digital printing facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ceramic Tile and Its Printing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ceramic Tile and its Printing Market Statistics 2025 Analysis By Application (Household Usage, Commercial Usage), By Type (Porcelain tile, Porcelain stoneware tiles, Fine stoneware tiles, Stoneware tiles, Earthenware tiles), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager