CFD Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433998 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

CFD Market Size

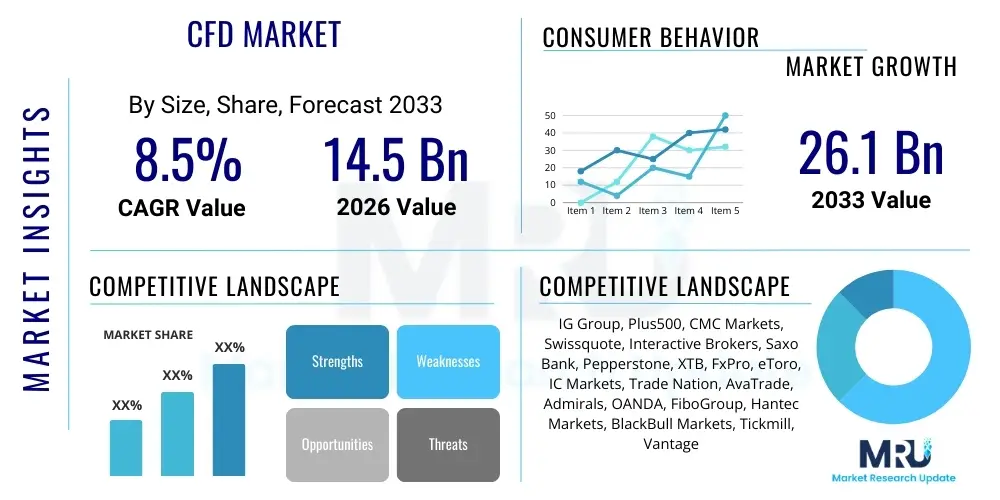

The CFD Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $26.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing globalization of financial markets, enhanced technological accessibility offered by online trading platforms, and the growing preference among retail investors for leveraged financial products that do not require ownership of the underlying asset. The inherent flexibility and cost-effectiveness of Contracts for Difference (CFDs), coupled with the availability of trading across diverse asset classes like indices, commodities, currencies, and equities, contribute significantly to this optimistic growth trajectory, particularly in high-growth regions of Asia Pacific and emerging markets.

The valuation reflects the sustained interest from both retail and institutional traders seeking sophisticated tools for speculation and hedging. Regulatory environments, while imposing tighter restrictions on leverage in certain developed regions, simultaneously enhance market stability and investor confidence, indirectly supporting sustainable growth. Furthermore, the rapid advancements in mobile trading applications and integration of advanced analytical tools, like machine learning for predictive modeling, are lowering the barrier to entry for new market participants, ensuring a consistent influx of trading volume across various geographical segments.

CFD Market introduction

The CFD Market encompasses the global trading of Contracts for Difference, which are derivative products allowing traders to speculate on the rising or falling prices of fast-moving global financial assets such as shares, indices, commodities, currencies, and treasuries. A CFD is essentially an agreement between two parties, typically a trader and a broker, to exchange the difference in the price of an asset from the time the contract is opened until it is closed. The product’s description centers on its leveraged nature, meaning traders can gain significant exposure to financial markets with a relatively small capital outlay, enhancing both potential returns and risks. CFDs have emerged as a dominant choice for speculative trading due to their flexibility, offering access to thousands of global markets through a single trading account and the ability to profit from both bullish and bearish market movements through short selling.

Major applications of CFDs include directional speculation, where traders attempt to profit from expected price movements, and hedging, where they use CFDs to offset potential losses in existing physical portfolios. For instance, a trader holding a large stock portfolio might use an index CFD to hedge against short-term market downturns without selling their underlying shares. Key benefits driving market adoption include low transaction costs—often incorporating spreads rather than fixed commissions—and high leverage ratios, although these ratios are increasingly regulated across major financial jurisdictions like the European Union (EU) and Australia. The global 24-hour nature of the Forex and index markets, accessible through CFD platforms, also significantly broadens the trading window for participants across different time zones.

Driving factors propelling the CFD market growth are multi-faceted, encompassing technological, economic, and demographic shifts. The primary driver is the ongoing digital transformation within the finance industry, which has democratized access to complex financial instruments via highly sophisticated, yet user-friendly, online trading platforms and mobile applications. Economic uncertainty and low-interest-rate environments globally encourage investors to seek alternative avenues for higher yield, making leveraged products attractive despite the associated risks. Furthermore, increasing financial literacy and the proliferation of educational trading resources have empowered a new generation of retail traders to engage actively with derivatives. The competitive landscape among brokers, leading to tighter spreads and better execution speeds, also continually enhances the market's appeal to high-frequency and algorithmic traders seeking optimal trading conditions.

CFD Market Executive Summary

The CFD Market is characterized by accelerating digitalization and intense regulatory scrutiny, shaping key business trends across all major global regions. Business trends are dominated by the fierce competition among brokers to offer superior technology, including proprietary trading platforms, advanced charting tools, and AI-driven analytics, which is essential for retaining market share in a highly commoditized service environment. There is a strong movement towards diversification of asset offerings, particularly integrating cryptocurrencies and themed equity baskets into the CFD portfolio to meet shifting investor demand. Furthermore, consolidation within the brokerage sector is notable, with larger, well-capitalized firms acquiring smaller regional players to expand their geographical reach and enhance regulatory standing, ensuring compliance with diverse international standards while seeking scale efficiencies to maintain competitive pricing structures.

Regional trends display significant divergence influenced primarily by regulatory frameworks. Europe, particularly following the implementation of ESMA’s product intervention measures, witnessed a temporary volume dip, but has since stabilized, with brokers focusing on higher-value clients and operating under strict guidelines that prioritize investor protection. The Asia Pacific (APAC) region, however, represents the highest growth potential, led by strong trading activity in Australia, Singapore, and emerging markets like Southeast Asia, where regulatory environments are often perceived as more flexible or are rapidly maturing, drawing substantial investment from international brokerage houses seeking new client acquisition opportunities. North America remains distinct, with CFDs generally prohibited for retail trading in the US, but the Canadian market shows steady, regulated growth, while the focus shifts to exchange-traded derivatives and functionally similar leveraged products in the excluded US jurisdiction.

Segment trends indicate a sustained dominance of Forex CFDs and Index CFDs due to their high liquidity and global accessibility, yet the fastest growth is observed in Commodity and Cryptocurrency CFDs. Commodity CFDs, particularly those linked to gold and oil, experience cyclical volume spikes driven by global geopolitical and economic instability, utilized both for speculation and inflation hedging. Cryptocurrency CFDs are gaining remarkable traction, especially among younger investors, offering exposure to volatile digital assets without the complexities of wallet management and direct ownership, though regulatory uncertainty remains a key factor influencing this segment’s long-term trajectory. In terms of end-users, while retail traders drive the majority of volume, the institutional segment, including hedge funds and proprietary trading desks using CFDs for short-term arbitrage and risk management, represents a high-value, albeit smaller, segment demanding superior execution and bespoke platform features.

AI Impact Analysis on CFD Market

Common user questions regarding AI's impact on the CFD market frequently revolve around the reliability and fairness of algorithmic trading systems, the potential for AI-driven risk management tools to prevent catastrophic losses, and the future role of the human broker. Users are deeply interested in how machine learning algorithms can provide superior predictive analytics, automatically identifying complex patterns in high-volume market data that are invisible to manual analysis. Key concerns center on transparency—whether the "black box" nature of AI trading strategies introduces unknown systemic risks—and the ethical implications of AI potentially exacerbating flash crashes or manipulating market liquidity. The general expectation is that AI will enhance execution speed, personalize trading experiences through adaptive interfaces, and fundamentally redefine post-trade analytics and compliance monitoring, pushing the industry toward a higher standard of operational efficiency and sophistication.

The integration of Artificial Intelligence and Machine Learning (ML) is rapidly transitioning from a competitive advantage to a necessary standard in the CFD market infrastructure. AI algorithms are being deployed extensively in execution management systems (EMS) to optimize trade routing, minimize slippage, and ensure Best Execution obligations are met, especially during periods of high volatility. For retail traders, AI-powered tools manifest as advanced pattern recognition indicators, sentiment analysis engines that aggregate news and social media data, and automated advisory bots that suggest optimal entry and exit points based on pre-set risk parameters. This technological shift is elevating the complexity of trading, requiring brokers to invest heavily in data infrastructure and talent capable of managing and iterating sophisticated models, which is essential for competitive edge and regulatory compliance across diverse jurisdictions.

Furthermore, AI plays a critical, behind-the-scenes role in reinforcing the stability and security of brokerage operations. In compliance and fraud detection, ML models are uniquely positioned to analyze millions of transactions in real-time to identify suspicious trading behaviors, instances of market abuse, or breaches of regulatory trading limits, thereby significantly bolstering Anti-Money Laundering (AML) and Know Your Customer (KYC) processes. On the risk management side, AI models are used for dynamic margin requirement calculations and real-time stress testing of portfolios, moving beyond traditional static risk metrics. This proactive approach allows brokers to manage their counterparty risk more effectively, reducing the probability of large client losses during extreme market events, which ultimately protects the broker's capital reserves and maintains systemic integrity across the entire CFD ecosystem.

- AI algorithms optimize pricing models and bid/ask spreads dynamically based on real-time liquidity and market depth, ensuring competitive offerings.

- Machine learning facilitates advanced predictive analytics for market forecasting, leveraging historical data, news sentiment, and macroeconomic indicators.

- Implementation of AI-driven conversational interfaces and chatbots to provide 24/7 customer support and personalized technical assistance to traders.

- AI enhances risk management systems by automating real-time monitoring of client exposure, dynamically adjusting leverage offerings, and executing automated stop-outs.

- Utilization of natural language processing (NLP) to analyze regulatory updates instantly and ensure brokerage operations remain compliant across multiple jurisdictions.

- Deployment of advanced behavioral biometrics and pattern recognition for superior fraud detection, account security, and prevention of manipulative trading practices.

DRO & Impact Forces Of CFD Market

The dynamics of the CFD market are dictated by a powerful interplay of Driving factors, Restraints, Opportunities, and broader Impact Forces. Key drivers include the pervasive trend of financial market digitalization, making trading globally accessible via mobile technology, coupled with the persistent investor demand for products offering high leverage and low entry barriers. The flexibility to trade long or short across a vast array of global assets, including the burgeoning segment of cryptocurrencies, continuously attracts new market participants seeking volatility exposure. However, these powerful drivers are often mitigated by significant restraints, primarily centered around escalating regulatory pressure, particularly in major Western markets like the EU and UK, which restrict leverage levels to protect retail investors, thereby dampening potential trading volumes and increasing compliance costs for brokers. The inherent high risk associated with leveraged products, often resulting in substantial losses for retail traders, also acts as a persistent barrier to widespread institutional adoption and regulatory endorsement.

Opportunities within the CFD space are abundant, particularly focusing on geographical expansion into underserved markets, notably Southeast Asia, Latin America, and select parts of Africa, where disposable incomes are rising and local derivatives markets are less mature. Technological innovation presents massive opportunities; specifically, the integration of distributed ledger technology (DLT) to enhance trade settlement speed and security, and the development of sophisticated API integration to cater to institutional traders and algorithmic funds seeking superior connectivity. Furthermore, specializing in niche asset classes, such as volatility indices, bespoke thematic indices, or specialized green energy commodities, allows brokers to differentiate their offerings in a saturated market, attracting sophisticated traders looking for unique market exposure or complex hedging tools.

Impact forces currently shaping the industry extend beyond direct market mechanics. The primary impact force is the evolving global financial regulatory consensus, which is gradually moving toward stricter consumer protection standards, profoundly affecting product design and marketing strategies. Macroeconomic instability, including high inflation and fluctuating interest rates, acts as a critical impact force, stimulating volatility which, while increasing trading opportunities, simultaneously heightens broker risk exposure and capital adequacy requirements. Finally, competition from other leveraged financial products, such as spread betting (predominantly in the UK/Ireland) and regulated futures/options markets, acts as a continuous competitive force, compelling CFD providers to maintain highly efficient, low-cost operational models and continuously invest in platform usability and speed to retain market dominance against alternative speculative avenues.

Segmentation Analysis

The CFD market is systematically segmented across several critical dimensions, including the type of underlying asset, the end-user profile, and the nature of the trading platform utilized, providing a granular view of market dynamics and commercial opportunities. Analyzing these segments is crucial for brokers and market participants to tailor their offerings, marketing efforts, and compliance frameworks according to the specific needs and regulatory requirements of distinct client groups and asset classes. The dominance of liquid markets like Forex and Indices traditionally dictates the largest volume share, but the rapid shifts in global investment sentiment are quickly elevating specialized segments, particularly in high-volatility products like Cryptocurrencies, which appeal to a risk-tolerant subset of the retail trading community. This structural segmentation allows for focused growth strategies and targeted technological development within specific high-potential sectors.

By asset class, the segmentation highlights where trading volumes are concentrated and where diversification is most required. Forex CFDs, representing the largest segment, benefit from deep liquidity and global accessibility, while Equity CFDs, though smaller, are vital for regional brokers providing localized access to domestic stocks, often used for hedging existing portfolio exposure. The categorization by end-user, differentiating between high-net-worth individuals, institutional investors, and mass-market retail traders, is essential for determining appropriate leverage limits, required capital disclosures, and the level of personalized service provision. For instance, institutional clients demand low latency and direct API connectivity, whereas retail clients prioritize user-friendly mobile applications and extensive educational resources, necessitating tailored platform offerings and support structures across the market.

The segmentation by platform type, distinguishing between proprietary systems developed in-house by brokers and third-party solutions like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), directly influences the technology budgets and competitive strategies of market participants. Brokers utilizing third-party platforms benefit from lower development costs and established user familiarity but face constraints in customization and unique feature development. Conversely, proprietary platforms allow for full control over the trading environment, enabling advanced tools like specialized indicators or unique order types, crucial for attracting high-volume traders. Understanding these segmentation nuances is key to strategic positioning and ensuring that the operational infrastructure aligns perfectly with the target demographic’s trading requirements and technological expectations in the highly competitive derivatives landscape.

- By Asset Class:

- Forex CFDs (Major, Minor, Exotic Currency Pairs)

- Index CFDs (Global Indices like S&P 500, FTSE 100, DAX 40)

- Equity/Share CFDs (Individual stocks, Thematic Baskets)

- Commodity CFDs (Hard Commodities: Gold, Oil; Soft Commodities: Agriculture)

- Cryptocurrency CFDs (Bitcoin, Ethereum, Altcoins)

- Treasury CFDs (Government Bonds, Interest Rates)

- By End User:

- Retail Investors (Mass Market, High-Net-Worth Individuals)

- Institutional Investors (Hedge Funds, Proprietary Trading Firms)

- By Trading Platform:

- Proprietary Platforms (Broker-developed, highly customized systems)

- Third-Party Platforms (MetaTrader 4, MetaTrader 5, cTrader)

- API Trading Solutions (For algorithmic and high-frequency traders)

- By Application:

- Speculation and Directional Trading

- Hedging and Risk Management

- Arbitrage Strategies

Value Chain Analysis For CFD Market

The value chain of the CFD market is highly streamlined, primarily involving technology development, liquidity provision, brokerage and execution services, and distribution channels, all underpinned by rigorous regulatory and compliance oversight. The upstream segment is dominated by technology vendors supplying robust trading platforms (such as MetaQuotes), data providers delivering real-time quotes and macroeconomic information (e.g., Reuters, Bloomberg), and prime brokers or Tier 1 banks that act as major liquidity providers, ensuring that brokers can fulfill large trades efficiently with minimal slippage. Reliable and fast access to accurate data feeds and low-latency execution engines are fundamental upstream components, dictating the quality and competitive edge of the downstream services offered to end-users. Brokers continuously seek to optimize these upstream relationships to secure the tightest pricing and deepest liquidity pools across all traded assets.

The core of the value chain rests within the brokerage operation itself, which involves risk management, client onboarding (KYC/AML), margin calculation, and the crucial execution mechanism, which can be either dealing desk (market maker) or non-dealing desk (STP/ECN). This stage integrates the upstream technology and liquidity with the downstream customer interface. Effective risk management, particularly the hedging of net client exposure and adherence to capital adequacy requirements, is paramount for the sustainability of the broker. Efficient customer support, comprehensive educational resources, and regulatory compliance management are integrated activities at this central stage, transforming raw market data and liquidity into a consumable, leveraged trading product suitable for both retail and institutional clientele.

The downstream analysis focuses on the distribution channel and the end-user experience. Distribution is predominantly direct-to-consumer via online platforms and mobile applications, minimizing the role of traditional intermediaries. Direct channels are supplemented by partnerships with Introducing Brokers (IBs) or Affiliates, who act as indirect sales channels, referring clients in exchange for commission, particularly effective in localized or emerging markets. The quality of the final distribution—the trading platform's usability, speed, security, and mobile integration—is the ultimate determinant of client retention and lifetime value. Furthermore, the provision of high-quality educational content and localized support through these distribution channels significantly enhances customer engagement and minimizes regulatory risks associated with uninformed trading, completing the value flow from data source to final trade execution.

CFD Market Potential Customers

The potential customer base for the CFD market is diverse, primarily segmented into two major categories: retail traders and institutional clients, each possessing distinct trading objectives, capital reserves, and technological requirements. Retail investors, comprising the largest volume of accounts, are typically individuals seeking short-term capital appreciation, portfolio hedging, or speculation on market movements without the high capital commitment required for direct ownership. Within the retail segment, there is a further distinction between mass-market traders who prioritize low deposit requirements and educational tools, and high-net-worth individuals who demand superior execution, personalized account management, and access to higher-tier asset classes and leverage, especially in regions where regulation permits greater flexibility.

Institutional customers represent the high-value segment, encompassing hedge funds, proprietary trading firms, and asset managers who utilize CFDs primarily for sophisticated short-term trading strategies, arbitrage opportunities, and efficient cross-market hedging against underlying exposures in physical securities or futures contracts. These clients demand specialized services, including bespoke liquidity feeds, guaranteed zero-latency connectivity via dedicated APIs, high levels of credit flexibility, and sophisticated post-trade reporting tools for detailed performance analysis and regulatory audit trails. The criteria for serving institutional clients are significantly more stringent than those for retail, often requiring direct relationships with prime brokers and specialized ECN infrastructure to ensure the depth and speed of execution necessary for high-frequency strategies.

A growing category of potential customers includes financial technology intermediaries and automated trading algorithm developers. FinTech firms often integrate CFD platforms via white-label solutions or APIs to offer specialized wealth management or auto-copy trading services to their own client bases, thereby acting as indirect distribution partners. Algorithmic developers, whether independent or working for prop desks, are customers focused purely on the technological infrastructure, valuing factors such as server collocation options, minimal network latency, and the stability of the trading environment above all else. Targeting these niche customer segments requires brokers to move beyond standard retail offerings and provide highly technical, customizable infrastructure solutions, highlighting the market’s evolution towards specialized technological service provision rather than just generalized brokerage services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $26.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IG Group, Plus500, CMC Markets, Swissquote, Interactive Brokers, Saxo Bank, Pepperstone, XTB, FxPro, eToro, IC Markets, Trade Nation, AvaTrade, Admirals, OANDA, FiboGroup, Hantec Markets, BlackBull Markets, Tickmill, Vantage |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CFD Market Key Technology Landscape

The technological infrastructure supporting the CFD market is highly sophisticated, focusing intensely on speed, security, and integration capabilities to facilitate high-frequency trading and maintain market integrity. Core technologies revolve around low-latency execution systems, often housed in geographically optimized data centers near major liquidity hubs like London (LD4) or New York (NY4), ensuring minimal delay between quote transmission and order execution. This reliance on high-speed infrastructure is crucial for competitive advantage, especially given the micro-second tolerances demanded by algorithmic traders. Proprietary trading platforms and advanced API solutions, built on robust programming languages and architecture, are essential for handling massive transactional volumes and managing real-time risk calculations under conditions of extreme market volatility, necessitating continuous investment in hardware and network optimization.

Beyond execution speed, the customer-facing technology landscape is dominated by the evolution of user interfaces and mobile trading capabilities. Modern CFD platforms must offer intuitive design, sophisticated charting tools (incorporating advanced technical indicators and drawing tools), and seamless integration of third-party tools such as economic calendars and news feeds. The migration toward mobile-first technology is critical, requiring brokers to develop powerful, feature-rich native applications for both iOS and Android that replicate the full functionality of desktop platforms, enabling clients to monitor positions, manage margins, and execute trades instantly from anywhere. Furthermore, the adoption of cloud computing services is optimizing scalability and redundancy, allowing brokers to rapidly scale operations during peak market periods while ensuring high uptime and disaster recovery capability, which are non-negotiable standards for financial institutions.

A final, yet pivotal, area of technological focus is the application of big data analytics and cyber security. Brokers leverage big data frameworks to analyze trading patterns, identify market manipulation attempts, and personalize marketing efforts based on granular client behavior. In parallel, the threat landscape necessitates state-of-the-art cybersecurity measures, including multi-factor authentication, advanced encryption standards, and continuous penetration testing, to protect client funds and sensitive personal data from sophisticated cyber attacks. Regulatory bodies increasingly mandate high security and data protection standards (like GDPR compliance), forcing brokers to utilize technologies such as blockchain for enhanced data integrity and AI-driven systems for proactive threat detection, thus transforming technology from a mere operational necessity into a core strategic driver for trust and regulatory adherence.

Regional Highlights

The global CFD market exhibits distinct regional characteristics, driven by varying regulatory regimes, levels of economic development, and investor sophistication. Europe remains a cornerstone of the market, historically representing a substantial portion of trading volume, particularly in the UK and Cyprus, which serve as major hubs for international brokers. Following the stringent product intervention measures introduced by the European Securities and Markets Authority (ESMA), which capped leverage for retail clients, the market saw a shift toward professional accounts and an increased focus on compliance. However, the region continues to thrive due to a mature financial ecosystem and a sophisticated user base, with innovation often centering around proprietary technology and regulatory sandbox testing for new products, securing its position as a high-quality, regulated trading environment.

Asia Pacific (APAC) is unequivocally identified as the primary engine of future growth, spurred by rising middle-class wealth, increasing access to high-speed internet, and a generally less restrictive regulatory environment compared to the West, although this is rapidly changing in key jurisdictions like Australia. Countries such as Singapore, Hong Kong, and increasingly Thailand and Indonesia, show exceptional growth potential due to high retail investor engagement and a strong demand for leveraged products. Brokers in this region prioritize localization—offering local currency support, culturally relevant marketing, and region-specific asset listings—to capture market share. This robust expansion is fueled by competitive platforms based in Australia (ASIC regulated) and other key financial centers offering high execution quality and attractive leverage options.

The Middle East and Africa (MEA) region presents significant emerging market opportunities, characterized by growing capital market activity and a population segment keenly interested in global financial exposure, often accessed through offshore brokers. The regulatory landscape is slowly formalizing in centers like Dubai (DIFC) and Abu Dhabi (ADGM), providing stability and attracting reputable international firms. North America, conversely, operates under unique constraints; the US market generally bans retail CFD trading, compelling firms targeting North American clients to focus on Canadian regulations or offer functional alternatives like proprietary synthetic derivatives. Latin America represents a nascent, high-potential region where economic instability often drives demand for flexible trading tools, although challenges related to payment infrastructure and regulatory ambiguity require careful strategic entry by market players.

- Asia Pacific (APAC): Highest CAGR forecast; driven by regulatory maturity in Australia and Singapore, and rapid retail adoption in emerging economies like India and Southeast Asia. Focus on cryptocurrency CFDs and localized equity derivatives.

- Europe: Mature, highly regulated market; strong focus on professional and high-net-worth clients following ESMA leverage caps. Concentration of technological innovation and prime brokerage services in major financial centers (London, Frankfurt).

- North America: Restricted market for retail CFDs in the US; growth concentrated in Canada and through offering similar derivatives products. Emphasis on institutional and API trading solutions.

- Middle East & Africa (MEA): High potential in financial hubs (UAE, South Africa); increasing demand driven by economic diversification and access to global assets. Regulatory frameworks are rapidly developing to attract foreign investment.

- Latin America: Emerging market with high volatility exposure; strong interest in Forex and Commodity CFDs; faces challenges related to infrastructure and inconsistent regulation, requiring specialized client onboarding strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CFD Market.- IG Group

- Plus500

- CMC Markets

- Swissquote

- Interactive Brokers

- Saxo Bank

- Pepperstone

- XTB

- FxPro

- eToro

- IC Markets

- Trade Nation

- AvaTrade

- Admirals

- OANDA

- FiboGroup

- Hantec Markets

- BlackBull Markets

- Tickmill

- Vantage

Frequently Asked Questions

What are the primary regulatory challenges facing the CFD brokerage industry globally?

The primary regulatory challenges involve complying with divergent international leverage restrictions, such as ESMA's caps in Europe and ASIC's limitations in Australia, which mandate lower risk exposure for retail clients. Furthermore, brokers face increasing scrutiny regarding financial transparency, fair pricing execution (Best Execution policies), and stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance requirements, necessitating significant investment in regulatory technology (RegTech) and robust internal controls to mitigate operational risk and maintain licensure.

How significant is the role of mobile trading in the future expansion of the CFD market?

Mobile trading is critically significant, serving as the dominant channel for retail investor engagement, especially in high-growth APAC and emerging markets where smartphones are often the primary access point to the internet. Future expansion relies on brokers providing highly optimized, secure, and feature-complete native mobile applications that facilitate rapid account management, instant trade execution, and sophisticated charting analysis, effectively democratizing access to complex financial derivatives 24/7.

Which asset class is driving the fastest volume growth in the CFD market?

While Forex and Indices maintain the largest overall volume, Cryptocurrency CFDs are experiencing the fastest percentage growth. This acceleration is driven by the extreme volatility and high potential returns associated with digital assets, attracting a new generation of speculative traders who seek leveraged exposure to tokens like Bitcoin and Ethereum without the complexities of decentralized wallet management or direct ownership risk.

What technological factors are essential for a CFD broker to maintain competitive advantage?

Competitive advantage is maintained through superior technological infrastructure centered on ultra-low latency execution systems, often achieved via dedicated fiber links and server collocation in key financial hubs. Furthermore, offering highly customizable proprietary trading platforms, incorporating advanced AI for risk management and personalized analytics, and ensuring robust API connectivity for algorithmic traders are essential technical differentiators in a market where speed and reliability are paramount client requirements.

How does institutional usage of CFDs differ from retail usage?

Institutional usage of CFDs primarily focuses on highly specialized short-term arbitrage, efficient cross-asset hedging of large portfolios, and utilizing high-frequency trading strategies requiring superior liquidity and credit lines. In contrast, retail usage is predominantly driven by directional speculation and long-term position taking based on technical or fundamental analysis, with retail traders typically constrained by lower leverage limits and prioritizing platform usability and educational resources over API-level execution speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- CFD Broker Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- FEA and CFD Simulation and Analysis Softwares Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (FEA, CFD), By Application (Automotive industry, Aerospace and defense industry, Electrical & electronics industry, Industrial machinery industry, Remote Control Hobby Car Industry, High End RC cars, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Computational Fluid Dynamics (CFD) Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On Premise CFD Software, Cloud-based CFD Software), By Application (Aerospace & Defense Industry, Automotive Industry, Electrical and Electronics Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager