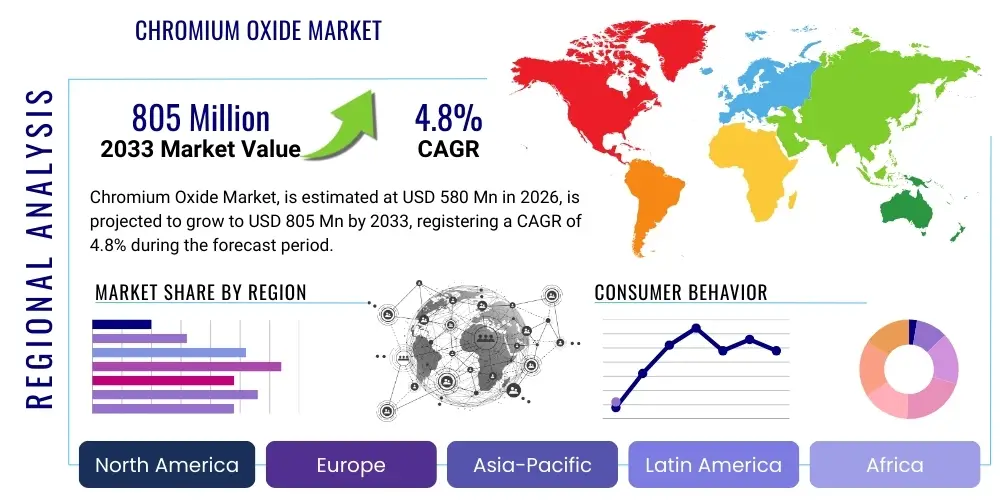

Chromium Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435986 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Chromium Oxide Market Size

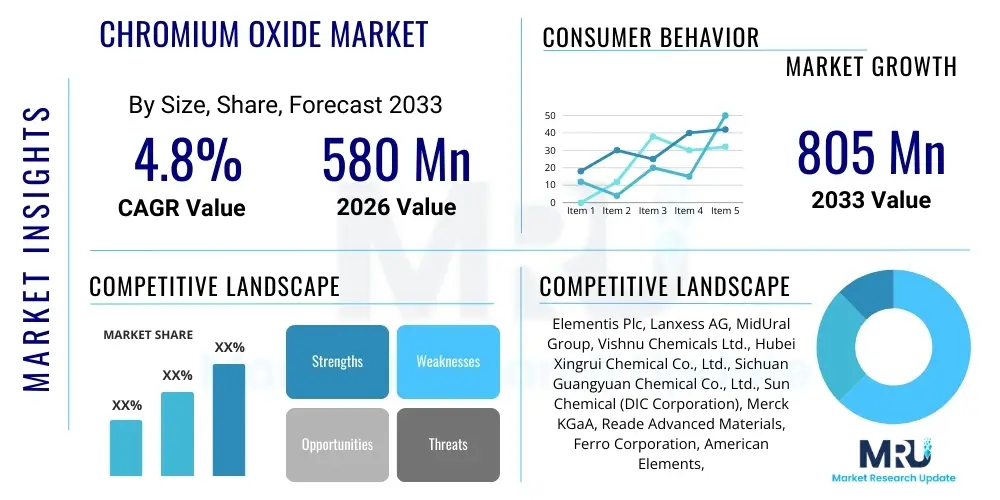

The Chromium Oxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033.

Chromium Oxide Market introduction

Chromium oxide (Cr2O3) is a highly stable and versatile inorganic compound, recognized primarily for its deep green coloration, extreme hardness, and exceptional resistance to heat and chemical corrosion. It is synthesized mainly from chromite ore and is valued across diverse industrial sectors. Its inherent properties, such as a high melting point (around 2,435 °C) and excellent infra-red reflectivity, position it as a critical material in high-performance applications. The technical grade of chromium oxide is extensively utilized in the metallurgical industry, serving as a raw material for producing pure chromium metal and various specialty alloys. This application segment is vital, driven by the increasing global demand for high-strength, corrosion-resistant metals used in aerospace and automotive manufacturing.

Beyond metallurgy, chromium oxide is the principal component of the viridian family of pigments, offering superior color stability, lightfastness, and weather resistance, making it indispensable for paints, coatings, and specialized protective finishes. Its application in the refractory sector is equally significant, where it is used to manufacture bricks and linings for high-temperature furnaces and kilns, especially those handling glass, steel, and cement, due to its minimal reactivity with molten materials. The overall market growth is fundamentally propelled by the rapid urbanization and industrialization across developing economies, particularly in Asia Pacific, which fuels demand in construction, infrastructure, and manufacturing sectors requiring durable coatings and refractory solutions.

Key benefits driving market adoption include its exceptional chemical inertness, which extends the lifespan of products ranging from exterior paints to industrial ceramics, and its role as an essential precursor in chrome plating processes, providing superior corrosion protection and aesthetic finishes. However, the market operates under the shadow of stringent environmental regulations concerning hexavalent chromium (Cr(VI)), forcing manufacturers to invest heavily in sustainable and cleaner production technologies to ensure the final product is safe and compliant with global health standards. The convergence of robust industrial demand and continuous process innovation defines the competitive landscape of the global chromium oxide market.

Chromium Oxide Market Executive Summary

The Chromium Oxide market is currently characterized by moderate growth, primarily fueled by infrastructural development and the expanding scope of high-performance coatings and refractory applications, particularly in the Asia Pacific region. Business trends indicate a strong focus on high-purity grades required for specialized applications, such as thermal spray coatings and advanced ceramics, where material quality directly influences end-product performance and longevity. Key market players are strategically investing in efficient, environmentally compliant production methods to mitigate risks associated with raw material price volatility and stricter global environmental standards regarding chromium usage. Furthermore, consolidation and strategic partnerships aimed at securing long-term chromite ore supply chains are emerging as significant competitive strategies to ensure stable operational output.

Regionally, Asia Pacific maintains its dominant position, underpinned by massive industrial output in China and India across steel, cement, and manufacturing sectors. North America and Europe, while experiencing slower overall growth, demonstrate higher demand for premium, value-added chromium oxide products, focusing on the defense, aerospace, and high-specification chemical catalyst sectors. The shifting manufacturing landscape towards sustainable practices is influencing regional dynamics, with European manufacturers often leading in the implementation of circular economy principles for chrome chemicals. This regional divergence in regulatory standards and application focus dictates varied investment priorities across the globe, impacting supply chain robustness.

Segmentation analysis reveals that the pigment grade segment, driven by the massive construction and automotive refinishing markets, remains the largest by volume. However, the metallurgical grade segment is poised for the fastest growth, benefiting from the rising global demand for specialty steels and high-temperature alloys used in renewable energy infrastructure and advanced transport systems. Trends within the segments highlight a notable shift towards chromium oxide nanoparticles for catalytic applications and electronic materials, offering enhanced surface area and reactivity. This transition towards high-tech applications necessitates stricter quality control and purification technologies, distinguishing leading manufacturers from standard commodity producers.

AI Impact Analysis on Chromium Oxide Market

User inquiries regarding AI's role in the Chromium Oxide market commonly center on how machine learning can optimize the energy-intensive calcination process, improve raw material conversion efficiency, and ensure stringent quality control to prevent the formation of regulated byproducts like hexavalent chromium. Key themes reflect an expectation that AI will deliver predictive maintenance in large-scale processing plants, manage complex global supply chain logistics involving chromite ore and finished products, and accelerate the development of novel, cleaner synthesis routes. Stakeholders are particularly concerned with using AI for real-time monitoring of impurity levels and adjusting reaction parameters instantaneously, thereby minimizing waste and maximizing product yield and purity, crucial for the high-end refractory and electronic applications.

The application of Artificial Intelligence and advanced analytics is transforming operational efficiency within chromium oxide manufacturing facilities. AI-driven process optimization algorithms can analyze vast datasets—including temperature, pressure, feed rates, and chemical composition—to predict optimal reaction conditions for the high-temperature reduction and calcination stages. This predictive capability significantly reduces energy consumption and shortens batch cycle times, leading to lower operating costs and a reduced carbon footprint, addressing both economic and environmental pressures faced by producers. Furthermore, AI systems are instrumental in improving safety protocols by identifying potential equipment failures before they occur, ensuring continuous and stable production throughput.

In the domain of market strategy and logistics, AI tools are enhancing demand forecasting accuracy by analyzing macroeconomic indicators, regional construction trends, and customer buying patterns, allowing manufacturers to optimize inventory levels and production schedules precisely. This leads to more responsive supply chain management, particularly critical given the reliance on globally sourced chromite ore. The integration of image processing and machine vision techniques, powered by AI, into quality control enables rapid and highly accurate assessment of pigment particle size distribution and color consistency, ensuring the final product meets the increasingly narrow specifications demanded by specialized coating and ceramic industries.

- AI optimizes calcination parameters, reducing energy consumption by 10-15%.

- Machine learning algorithms enhance raw material utilization efficiency, minimizing chromite ore waste.

- Predictive maintenance minimizes unscheduled downtime in manufacturing plants.

- AI-driven sensors enable real-time detection and mitigation of hexavalent chromium formation.

- Advanced analytics improves demand forecasting accuracy for high-purity grades.

- Vision systems powered by AI ensure consistent particle size and color quality control.

- Optimization models enhance global logistics and inventory management for chrome chemicals.

DRO & Impact Forces Of Chromium Oxide Market

The dynamics of the Chromium Oxide market are shaped by a potent combination of robust industrial drivers, significant regulatory restraints, and lucrative opportunities emerging from technological advancements and niche applications. Key drivers include the escalating global demand for high-performance refractory materials essential for the steel and glass industries, underpinned by continuous infrastructure spending in rapidly industrializing nations. Simultaneously, the restraints are predominantly environmental, centered on the stringent global regulations targeting hexavalent chromium compounds, which necessitate costly process upgrades and limit market entry. Opportunities lie in developing high-ppurity, nano-scale chromium oxide for emerging fields such as solid oxide fuel cells and specialized catalysts, offering pathways to premium pricing and market differentiation.

Impact forces acting on the market manifest through varying degrees of raw material price elasticity and regulatory enforcement intensity. Economic volatility affects the price of chromite ore, the primary input, which consequently impacts the profitability and stability of the entire supply chain. High capital expenditure is required for compliant manufacturing, creating significant barriers to entry for smaller players and consolidating market power among major producers who can afford advanced closed-loop systems and detoxification processes. Furthermore, the substitution threat from alternative pigments and refractory materials, while moderate, continuously pushes manufacturers to improve the cost-performance ratio of chromium oxide products.

The market faces a crucial balance between capitalizing on industrial growth and adhering to sustainability mandates. The global push for durable, long-life coatings in the automotive and aerospace sectors drives volume, while the necessity of eco-friendly production methods demands constant innovation in synthesis and waste management. The combined effect of these forces suggests a future market characterized by slow but steady volume growth in traditional sectors, complemented by higher-value, rapid growth in specialized, high-purity niches where environmental compliance is non-negotiable and technological sophistication is paramount.

Segmentation Analysis

The Chromium Oxide market is primarily segmented based on the grade of the product, which dictates its purity and intended industrial application, and by the major end-use industries it serves. Understanding these segmentations is crucial as price points and growth rates vary significantly between commodity-grade products used in refractories and highly purified products required for chemical synthesis or advanced thermal spray applications. The segmentation by grade—metallurgical, refractory, and pigment—reflects the dominant revenue streams, with pigment grade typically capturing the largest volume share due to its wide usage in construction materials, ceramics, and paints.

The application segmentation provides insight into the underlying demand drivers. The metallurgy sector utilizes Chromium Oxide predominantly for the production of chromium metal, which is essential for stainless steel and specialty alloys, linking its growth directly to global steel production and aerospace manufacturing cycles. Conversely, the refractories segment, the second largest by value, relies heavily on the compound’s thermal stability, benefiting from expansions in the glass and cement industries. The strategic focus for market growth involves targeting high-growth applications such as aerospace coatings, where thermal barrier properties are critical, and electronic materials, demanding ultra-high purity (>99.9%).

Geographic segmentation highlights Asia Pacific as the undeniable volume leader due to its colossal manufacturing and infrastructure sectors. However, North America and Europe lead in consumption of the high-purity and nano-grade products, emphasizing a value-driven market strategy in developed regions. Analysis across these dimensions confirms that future market resilience will depend on manufacturers’ ability to diversify product offerings beyond commodity grades into technologically demanding, high-value niches that promise greater margin stability and insulation from cyclical raw material volatility.

- Grade

- Metallurgical Grade

- Refractory Grade

- Pigment Grade

- Chemical/Catalytic Grade

- Application

- Metallurgy (Production of Chromium Metal and Alloys)

- Refractories (Bricks, Monolithics, Cements)

- Coatings and Paints (Green Pigments, Protective Coatings)

- Ceramics and Glass

- Abrasives

- Chemical Synthesis and Catalysis

- Other Applications (e.g., Thermal Spray, Defense)

- Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, South Africa)

Value Chain Analysis For Chromium Oxide Market

The value chain for the Chromium Oxide market begins with the upstream segment, dominated by the mining and processing of chromite ore, primarily concentrated in geopolitical hotspots such as South Africa, Kazakhstan, and India. This phase is capital-intensive and highly susceptible to international commodity price fluctuations and extraction sustainability standards. The primary step involves chromite beneficiation to achieve a suitable grade for subsequent chemical processing. Security of raw material supply is a critical competitive factor in the upstream segment, leading major chemical processors to vertically integrate or establish long-term sourcing contracts to ensure stability against supply disruptions and geopolitical risks.

The midstream phase involves the chemical transformation of chromite into chromium oxide, typically via the highly energy-intensive reduction process involving sulfur or carbon, often preceded by an oxidation step to form sodium dichromate. This manufacturing stage requires substantial technical expertise, sophisticated high-temperature equipment, and strict environmental compliance protocols to manage chromium residue effectively, especially minimizing the creation of toxic Cr(VI). The midstream value is added through purification, particle size control (crucial for pigment and abrasive grades), and customization for specific end-user requirements, distinguishing high-purity manufacturers who achieve grades up to 99.9% from bulk producers.

The downstream segment encompasses distribution and end-user application. Distribution channels involve both direct sales to large consumers (such as major refractory producers or steel mills) and indirect sales through specialized chemical distributors catering to diverse small and medium enterprises (SMEs) in the ceramics, paint, and plating industries. The final value realization occurs when chromium oxide is incorporated into products, such as thermal barrier coatings in aerospace, durable green pigments in architectural finishes, or specialized chrome metal for superalloys. The efficiency of the downstream relies heavily on tailored logistics, ensuring prompt and safe delivery, particularly for international orders, thus linking market responsiveness directly to competitive advantage.

Chromium Oxide Market Potential Customers

Potential customers for Chromium Oxide span a wide industrial spectrum, necessitating tailored sales and marketing strategies based on technical requirements and purchasing volumes. The largest institutional buyers are firms specializing in refractory production, including manufacturers of high-performance bricks, castables, and gunning mixes used in high-temperature environments across the glass, cement, and metal smelting industries. These customers prioritize thermal stability, consistency, and resistance to chemical attack, often requiring refractory grades optimized for specific furnace chemistries and operating temperatures to maximize lining lifespan and minimize maintenance downtime in harsh operational settings.

Another major segment comprises manufacturers in the coatings, paints, and plastics sector. These customers utilize pigment grade chromium oxide for its unmatched color fastness, opacity, and weather resistance, essential for applications such as exterior architectural coatings, camouflage paints for military use, and coloring concrete and roofing materials. The demand here is highly sensitive to color consistency and particle morphology, requiring specialized micronized grades that disperse efficiently in various binder systems to achieve uniform and aesthetically pleasing finishes, linking demand to global construction and automotive sectors.

Furthermore, the metallurgical industry, particularly stainless steel producers and specialty alloy manufacturers, represents a significant customer base, procuring metallurgical-grade chromium oxide as a critical input for achieving precise chrome content in their alloys. High-purity grades are also increasingly sought by advanced technology sectors, including aerospace defense contractors for thermal barrier coatings, electronic component manufacturers for specialized thin films, and chemical companies using it as a catalyst support or a raw material for producing complex chrome chemicals. Selling to these high-tech customers demands stringent quality assurance documentation and adherence to rigorous industry standards such as ISO 9001 and various material specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elementis Plc, Lanxess AG, MidUral Group, Vishnu Chemicals Ltd., Hubei Xingrui Chemical Co., Ltd., Sichuan Guangyuan Chemical Co., Ltd., Sun Chemical (DIC Corporation), Merck KGaA, Reade Advanced Materials, Ferro Corporation, American Elements, Shepherd Chemical Company, Noah Technologies Corporation, Aktyubinsk Chromium Chemicals Plant, Chrome Star Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromium Oxide Market Key Technology Landscape

The technological landscape of the Chromium Oxide market is primarily focused on process refinement aimed at increasing purity, reducing energy intensity, and ensuring compliance with tightening environmental standards, particularly regarding the elimination of hexavalent chromium (Cr(VI)) contamination. Traditional production methods involve high-temperature roasting and reduction, which are energy-intensive and often result in complex waste streams. Current advancements are centered on developing hydrometallurgical routes and alternative reduction processes that operate at lower temperatures and offer better control over reaction chemistry, thereby yielding ultra-high purity Cr2O3 suitable for electronics and specialized alloy production without the inherent risk of Cr(VI) formation.

Another critical area of technological innovation is the development and commercialization of nano-sized chromium oxide particles. Nanotechnology facilitates the production of Cr2O3 with enhanced surface area and tailored morphology, significantly improving performance in catalytic applications, magnetic media, and advanced composite materials. Manufacturers are employing advanced precipitation and sol-gel techniques coupled with sophisticated drying technologies to achieve uniform particle size distribution, which is essential for ensuring consistent color in high-end pigments and optimizing catalytic activity. This shift towards nano-grade materials unlocks new revenue opportunities in high-value, low-volume segments, demanding substantial investment in specialized milling and classification equipment.

Furthermore, technology is being deployed to enhance resource efficiency and sustainability. This includes closed-loop recycling systems that recover chromium from industrial waste streams and advanced wastewater treatment technologies to detoxify residual chrome compounds. The integration of continuous monitoring systems and process control automation, often driven by spectroscopic analysis and AI, represents a significant technological leap. These systems allow for real-time adjustments to maintain optimal operational parameters, crucial for maximizing yield and minimizing environmental impact, positioning technological leadership as a key determinant of market competitiveness and operational sustainability.

Regional Highlights

The global Chromium Oxide market exhibits pronounced regional variations in consumption patterns, regulatory environments, and manufacturing scale. Asia Pacific (APAC) dominates the market both in terms of production capacity and consumption volume, driven overwhelmingly by China and India. This dominance is attributable to the region's massive manufacturing base, particularly in steel production (requiring metallurgical and refractory grades) and the booming construction and automotive sectors (driving demand for pigment and coating grades). The relative ease of regulatory compliance compared to Western markets has historically supported high-volume, cost-competitive production, although environmental enforcement is steadily increasing, demanding technological upgrades from regional players.

Europe represents a mature market characterized by high regulatory scrutiny, particularly under the REACH framework, which heavily influences the use and handling of all chrome chemicals. Consequently, the European market focuses intensely on high-quality, specialty, and environmentally compliant Chromium Oxide. Demand in Europe is primarily driven by high-specification applications, including advanced aerospace coatings, premium automotive finishes, and the high-end ceramics industry. Manufacturers in this region often lead in developing sustainable, low-waste production technologies, commanding premium prices for certified eco-friendly products, despite slower overall industrial growth rates compared to APAC.

North America is a significant consumer, particularly for refractory and specialized chemical grades. The demand structure is robust, supported by strong industrial sectors such as aerospace and defense, which require ultra-high purity Cr2O3 for specialized thermal spray applications and high-performance alloys. The market in the U.S. and Canada is highly fragmented yet sophisticated, with an emphasis on reliable supply chains and domestically produced specialty chemicals. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares, but MEA, particularly South Africa, plays a crucial role as a major source of chromite ore, influencing global raw material prices and supply security, while Latin America's market growth is tied to fluctuations in regional construction and infrastructure spending.

- Asia Pacific (APAC): Market volume leader; driven by China’s refractory and steel production and India’s infrastructure expansion. Focus on high-volume, cost-effective grades.

- Europe: Value-driven market; strict REACH regulations enforce high environmental standards. Strong demand for specialty, high-purity pigments and compliant chemical grades.

- North America: Significant consumer of high-grade materials; strong demand from aerospace, defense, and specialized chemical catalysis sectors. Emphasis on supply chain resilience.

- Middle East & Africa (MEA): Critical upstream region (chromite mining). Consumption growth linked to regional construction projects and oil & gas infrastructure.

- Latin America: Moderate growth trajectory, dependent on fluctuating local construction and manufacturing activities, especially in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromium Oxide Market.- Elementis Plc

- Lanxess AG

- MidUral Group

- Vishnu Chemicals Ltd.

- Hubei Xingrui Chemical Co., Ltd.

- Sichuan Guangyuan Chemical Co., Ltd.

- Sun Chemical (DIC Corporation)

- Merck KGaA

- Reade Advanced Materials

- Ferro Corporation

- American Elements

- Shepherd Chemical Company

- Noah Technologies Corporation

- Aktyubinsk Chromium Chemicals Plant

- Chrome Star Chemical

- Aarti Industries Ltd.

- Cromital SpA

- Manganese Products (India) Pvt. Ltd.

- Hunter Chemical LLC

- BASF SE (Specialty Chemicals Division)

Frequently Asked Questions

Analyze common user questions about the Chromium Oxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Chromium Oxide in the refractory segment?

The demand is primarily driven by the exceptional thermal stability, high melting point, and chemical inertness of Chromium Oxide, making it critical for lining high-temperature furnaces used in the steel, cement, and glass manufacturing industries globally, especially in infrastructure-heavy regions like APAC.

How do environmental regulations impact the production and cost structure of Chromium Oxide?

Stringent regulations, notably those targeting the toxic hexavalent chromium (Cr(VI)), necessitate significant investments in advanced filtration, waste treatment, and process redesign (like closed-loop systems). These compliance costs raise the operational expenditure, thereby impacting the final market price of compliant chromium oxide products.

Which geographical region holds the largest market share for Chromium Oxide?

Asia Pacific (APAC), led by industrial output in China and India, holds the largest market share due to extensive consumption in manufacturing, infrastructure, refractory, and domestic paints and coatings sectors, offering substantial volume demand across all product grades.

What is the key technological trend emerging in the Chromium Oxide market?

The key technological trend is the development of ultra-high purity and nano-grade chromium oxide through cleaner synthesis routes, such as hydrometallurgy, aimed at enabling advanced applications in electronics, thermal barrier coatings, and high-efficiency catalysts, while simultaneously minimizing the environmental footprint.

What is the main application of metallurgical grade Chromium Oxide?

Metallurgical grade Chromium Oxide serves as a crucial raw material for the production of metallic chromium, which is indispensable for manufacturing specialty alloys, particularly stainless steel and superalloys used extensively in the automotive, aerospace, and defense industries requiring high corrosion and heat resistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chromium Oxide Green Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chromium Oxide Market Size Report By Type (Chromium oxide green, Chromium hydroxide, Chromic acid), By Application (Pigments, Refractories, Abrasives, Catalysts, Others, By End-use Industry, Paints & coatings, Construction, Electronics, Aerospace, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chromium Oxide Green Market Statistics 2025 Analysis By Application (Coating, Ceramics, Rubber, Metallurgy), By Type (Pigment Grade, Metallurgical Grade, Refractory Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Chromium Oxide Green Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pigment Grade, Metallurgical Grade, Refractory Grade, Others), By Application (Coating, Ceramics, Rubber, Metallurgy, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager