Collagen Casings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435743 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Collagen Casings Market Size

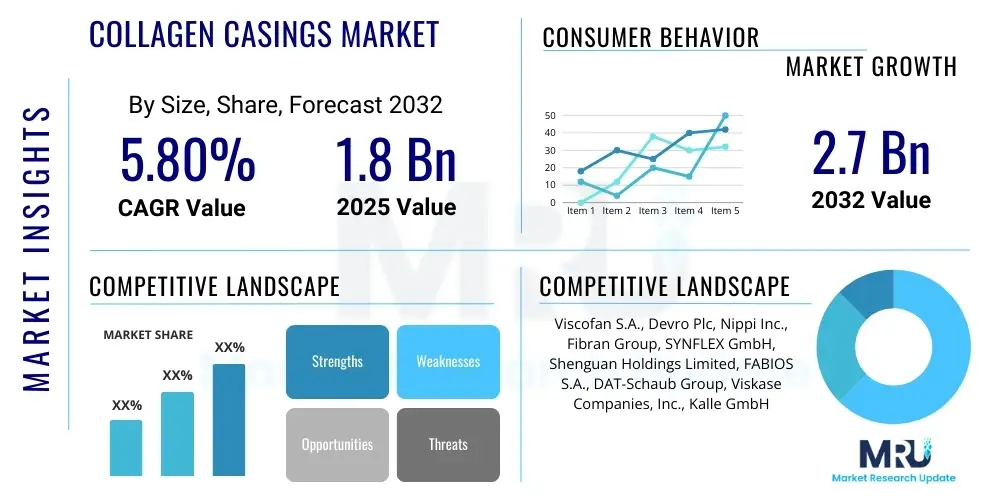

The Collagen Casings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1,500 Million in 2026 and is projected to reach USD 2,400 Million by the end of the forecast period in 2033.

Collagen Casings Market introduction

The Collagen Casings Market encompasses the production and distribution of edible and non-edible casings derived primarily from bovine or porcine hide collagen. These casings are extensively utilized in the processed meat industry, particularly for sausages, frankfurters, and other deli products, offering an alternative to natural guts and synthetic plastic casings. Collagen casings are manufactured through a highly standardized extrusion process, resulting in uniform diameter, strength, and consistency, which significantly enhances high-speed automated sausage production lines. Their major appeal lies in their edibility, consistency, high efficiency, and the fact that they offer superior bite texture compared to certain synthetic alternatives.

The primary applications of collagen casings span across fresh sausages, dried sausages, cooked sausages, and processed meats like pepperoni and salami. These casings provide several crucial benefits, including improved productivity due to consistent size and shape, reduced operational waste, and excellent smoke permeability which enhances the flavor profile of the final product. Furthermore, the inherent edibility of most standard collagen casings eliminates the need for peeling before consumption, increasing consumer convenience. The market growth is fundamentally driven by the rising global demand for processed meat products, increasing automation in food manufacturing, and continuous technological improvements in casing extrusion that enhance strength and reduce cost.

Driving factors for this market include the expansion of organized retail chains globally, which fuels standardized production requirements, and the consumer preference shift towards convenient, ready-to-eat protein sources. While concerns over meat consumption sustainability exist, the consistent performance and cost-effectiveness of collagen casings in high-volume production environments secure their position as a preferred choice over labor-intensive natural casings. Innovations focusing on thinner walls, better smoke adhesion, and specialized casings for non-meat applications, such as vegan sausages, also contribute significantly to the market's sustained growth trajectory.

Collagen Casings Market Executive Summary

The global Collagen Casings Market is characterized by robust expansion, primarily fueled by the accelerating industrialization of the global processed meat sector and the rising demand for efficient, standardized production inputs. Current business trends indicate a strong move toward advanced manufacturing techniques, allowing key players to produce thinner, yet stronger, collagen casings optimized for automated co-extrusion and high-speed stuffing lines. Furthermore, sustainability and sourcing transparency are emerging as critical competitive differentiators, pushing manufacturers to ensure responsible procurement of raw collagen materials and minimize processing waste. Strategic mergers and acquisitions are common as large players seek to consolidate market share and penetrate niche geographic regions, especially in emerging economies where per capita meat consumption is rising.

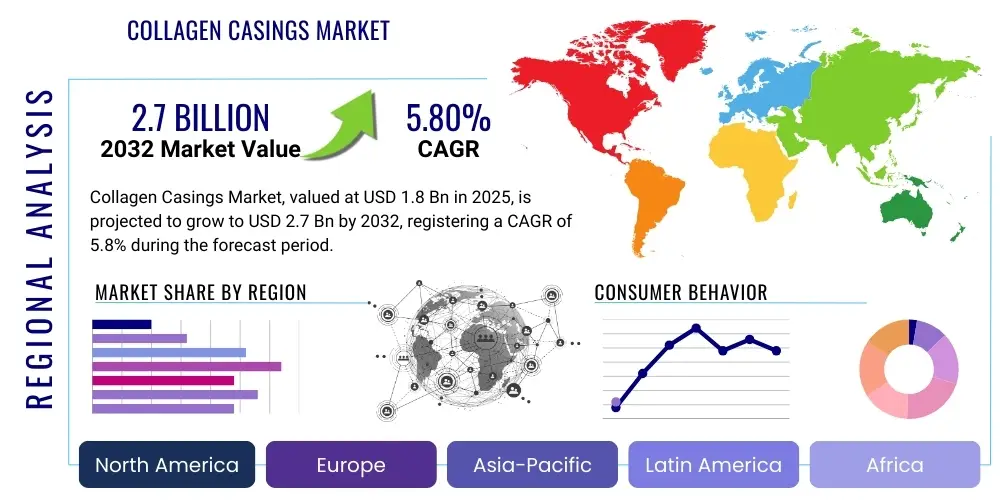

Regionally, Europe and North America remain the dominant markets due to their mature processed meat industries and high level of automation, though the Asia Pacific (APAC) region is demonstrating the highest growth velocity. This rapid growth in APAC is attributed to changing dietary habits, increasing urbanization, and the substantial expansion of quick-service restaurants and modern retail formats in countries like China and India. European regional trends focus heavily on premiumization and specialized casings for traditional, high-value artisanal products, while North America emphasizes volume production and cost efficiency. The Middle East and Africa (MEA) and Latin America are poised for growth, driven by investments in modern slaughterhouses and meat processing facilities aiming to meet increasing local demand.

Segmentation trends highlight the dominance of Edible Casings, given their wide application across hot dogs and fresh sausages, which represent the largest volume segment globally. However, the Non-Edible segment, often used for large diameter salamis or molded products, is also experiencing steady growth, particularly in high-end cured meat segments requiring precise shaping and enhanced shelf stability. By source, bovine collagen remains the primary feedstock, although porcine-based casings are essential in markets where religious or cultural restrictions do not apply. The segment analysis confirms that product standardization, diameter variability, and tailored casing permeability remain crucial factors dictating purchasing decisions among major food processors.

AI Impact Analysis on Collagen Casings Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can revolutionize the historically traditional processes within the collagen casings industry, focusing specifically on raw material optimization, quality control, and supply chain efficiency. Key themes center around whether AI can predict and minimize variability in raw hide collagen quality, thereby ensuring superior end-product consistency and reducing processing costs. Concerns often revolve around the high initial investment required for implementing sophisticated AI-driven sensor technology on extrusion lines and the need for specialized personnel to manage complex data analytics in traditional manufacturing environments. Expectations are high regarding AI’s potential to significantly accelerate R&D cycles for developing novel casing properties, such as enhanced smoke absorption or tailored elasticity for specialized stuffing applications. The consensus among market inquiries suggests AI implementation is moving from conceptual discussions to pilot projects focused on predictive maintenance and automated quality checks.

- AI-driven predictive maintenance optimizes extrusion machinery uptime, minimizing unexpected shutdowns.

- Machine learning algorithms enhance raw material sorting and grading, ensuring optimal collagen quality input.

- Real-time visual inspection systems using AI detect subtle casing flaws (e.g., thickness variations, weak spots) at high speeds, improving quality assurance.

- Demand forecasting models powered by AI improve inventory management of specialized casings, reducing spoilage and overstocking.

- Optimized formulation creation using ML reduces trial-and-error in developing new casing blends with specific mechanical properties.

- Enhanced supply chain visibility and risk assessment through AI-enabled tracking of bovine/porcine hide sources.

DRO & Impact Forces Of Collagen Casings Market

The dynamics of the Collagen Casings Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape investment decisions and operational strategies. The primary driver is the accelerating shift towards automated and high-speed processing in the global meat industry, where the consistent diameter and mechanical strength of collagen casings offer a distinct efficiency advantage over natural alternatives. This high compatibility with automation, coupled with the rising consumer demand for standardized convenience meat products, establishes a strong foundation for continuous market growth. However, this growth is simultaneously constrained by the volatility in raw material prices, as collagen is derived from bovine or porcine hides, making the market vulnerable to livestock disease outbreaks and changes in global meat production cycles. Furthermore, the persistent environmental and health scrutiny faced by the processed meat industry, particularly in developed Western markets, acts as a moderate restraint on overall category expansion, pushing manufacturers toward more sustainable sourcing practices.

Significant opportunities exist in emerging economies, notably in Asia Pacific and Latin America, where rapid urbanization and increasing disposable incomes are fueling a demand surge for branded and packaged meat products. These regions currently underutilize collagen casings, presenting a vast expansion potential for established players. Moreover, diversification into non-meat applications, such as specialized casings for vegan or plant-based sausage alternatives, represents a niche but high-growth opportunity, aligning the industry with broader dietary trends focused on reducing meat consumption. Innovation in biodegradable and environmentally friendly packaging solutions also presents a chance to overcome existing regulatory challenges and enhance corporate social responsibility profiles, appealing to environmentally conscious consumers and regulators.

The overarching impact forces include intense competitive rivalry among the few established global manufacturers who possess the necessary technological expertise and scale to operate efficiently. Regulatory impact forces, particularly those related to food safety, traceability, and permissible additives, continuously shape production standards and market access. Economic fluctuations, especially in global commodity markets, influence the profitability of raw material sourcing. The increasing consolidation among major meat processors (the key customers) acts as a powerful buyer impact force, demanding rigorous quality standards, competitive pricing, and long-term supply agreements. Successfully navigating these forces requires manufacturers to invest heavily in resilient supply chains, continuous product innovation, and rigorous compliance infrastructure.

Segmentation Analysis

The Collagen Casings Market is segmented based on critical factors including the type of casing, the source of collagen, the diameter of the casing, and the primary application in the food industry. This granular segmentation allows market participants to tailor their production and marketing strategies to specific customer needs, ranging from high-volume hot dog producers requiring thin edible casings to specialized deli manufacturers needing strong, non-edible casings for cured products. The dominant segment remains edible casings due to their efficiency and acceptance in mass-market products like frankfurters and breakfast sausages. However, the diverse end-user applications necessitate a complex product portfolio covering various mechanical properties, smoke permeability levels, and shelf-life characteristics.

Understanding the market by source is essential, as the choice between bovine and porcine collagen often depends on regional availability, cost structure, and adherence to local cultural or religious dietary laws. Bovine collagen, being more readily available and often less subject to cultural restriction in certain large markets, typically holds a larger share. Furthermore, segmentation by diameter reflects the operational requirements of food processors; large diameter casings are generally reserved for salamis and bologna, while small diameters are standard for retail sausages. The continuous refinement of manufacturing processes allows for highly precise categorization and targeting within these segments, supporting robust growth across various niches.

The segmentation structure is crucial for accurate market analysis, revealing that high-growth opportunities often lie within specialized segments, such as small diameter edible collagen casings designed specifically for high-moisture processed poultry products, or tailored non-edible transfer casings utilized in industrial food preparation. Manufacturers must continuously optimize their production lines to efficiently switch between these segments while maintaining strict quality control. This complexity underscores the strategic importance of technological advancement in extrusion and blending techniques to cater effectively to the diverse demands generated by each defined market segment.

- By Type:

- Edible Casings

- Non-Edible Casings

- By Source:

- Bovine Collagen

- Porcine Collagen

- Others (e.g., Poultry/Fish)

- By Application:

- Fresh Sausages

- Cooked Sausages (e.g., Hot Dogs, Frankfurters)

- Dried/Cured Sausages (e.g., Salami, Pepperoni)

- Smoked Sausages

- Other Applications (e.g., molded meats)

- By Diameter:

- Small Diameter (Below 30 mm)

- Large Diameter (30 mm and above)

Value Chain Analysis For Collagen Casings Market

The value chain for the Collagen Casings Market begins with the upstream procurement and processing of raw materials, primarily bovine and porcine hides. This initial stage is critical, as the quality and consistency of the hide processing—involving cleaning, liming, splitting, and preparation of the collagen slurry—directly dictates the mechanical properties and final quality of the extruded casing. Key challenges at the upstream level involve maintaining a secure and reliable supply of high-grade raw hides, which often requires robust relationships with large slaughterhouses and stringent quality checks to manage biological variability. Efficiency in the upstream segment is paramount for cost management and ensuring a stable input for the subsequent complex manufacturing processes.

The manufacturing stage involves the complex, capital-intensive process of collagen extrusion, drying, shirring (pleating), and packaging. This midstream segment is dominated by highly specialized global players who possess proprietary technology related to collagen fibrillation and casing formation. Distribution channels are varied, incorporating both direct sales models, where large manufacturers supply major meat processors directly under long-term contracts, and indirect channels, utilizing specialized food ingredient distributors, particularly for smaller processors and niche markets. The choice between direct and indirect distribution often depends on the geographic reach, the size of the customer, and the technical support requirements associated with the casing type.

The downstream analysis focuses on the end-users, primarily industrial meat processors, butchers, and food service companies. For high-volume producers, seamless integration of the casings into automated stuffing and processing lines is the key requirement, emphasizing the importance of consistent shirring and casing strength. Indirect distribution is common in fragmented markets, where specialized distributors provide inventory management and technical advisory services, especially regarding casing preparation (e.g., soaking requirements) and usage on various machinery types. The value chain concludes with the consumer purchasing the final processed meat product, where the collagen casing contributes to the overall texture, appearance, and edibility, thus closing the feedback loop on product performance and acceptability.

Collagen Casings Market Potential Customers

The primary customers for collagen casings are large-scale industrial meat processors and manufacturers specializing in high-volume sausage production. These customers prioritize operational efficiency, material consistency, and cost-effectiveness, making collagen casings the preferred choice over natural casings which are inherently variable and labor-intensive to handle. Global food conglomerates producing brands of hot dogs, frankfurters, and standardized breakfast sausages represent the largest volume consumers, demanding vast quantities of small-diameter edible casings suitable for continuous automated stuffing lines. Their purchasing decisions are highly centralized, focusing on multi-year supply contracts, rigorous quality audits, and competitive pricing structures.

A secondary, yet significant, customer segment includes smaller regional meat processors, artisan butcher shops, and specialized cured meat producers (e.g., salami and pepperoni manufacturers). While these entities may purchase lower volumes, they often require specialized, higher-margin collagen casings, such as those with specific smoke permeabilities or large diameters for dry-cured applications. For these customers, the purchasing criteria emphasize product customization, technical support regarding curing processes, and reliable local distribution. The increasing trend of store-brand private label meat production by major retailers also creates a significant potential customer base that often dictates casing specifications to their co-packers.

Furthermore, emerging potential customers include manufacturers of plant-based and vegan sausage alternatives. As the demand for meat substitutes rises globally, these companies seek casings that mimic the appearance and bite of traditional meat products while often requiring specific processing characteristics suitable for non-animal protein mixes. This represents a burgeoning, high-growth niche market that requires innovative, custom-formulated collagen or collagen-like casings. Finally, the food service sector, including institutional kitchens and catering companies that prepare large quantities of processed meats, also serves as an indirect but influential buyer through their purchasing demands placed upon meat suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,400 Million |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Viskase Companies, Inc., Devro plc, Nitta Casings Inc., Shenguan Holdings (Group) Limited, Fibran S.A., Fabios S.A., Kalle GmbH, Atlantis-Pak, Sichuan Shengda Group, DAT-Schaub, Innovia Films (for related packaging), Weschenfelder, Al-Ameen, Oversea Casing Company, Natural Casing Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Collagen Casings Market Key Technology Landscape

The technological landscape of the Collagen Casings Market is highly sophisticated, centering on advanced extrusion and shirrability processes designed for high-speed industrial application. A core technology involves the precise control of the collagen slurry’s pH, temperature, and concentration before and during extrusion to ensure optimal fiber alignment (fibrillation) and final casing strength. Continuous improvement in extrusion dies allows manufacturers to produce extremely thin-walled casings that maintain high tensile strength and puncture resistance, a critical factor for automated handling. Furthermore, co-extrusion technology, while not strictly focused on pure collagen casings, is indirectly competitive as it allows processors to form a casing substitute simultaneously with stuffing, pushing collagen manufacturers to improve the efficiency and cost of pre-formed products.

Shirring technology represents another crucial area of innovation. Shirring involves pleating the casing into sticks, enabling thousands of feet of casing to be loaded onto a stuffing machine quickly. Modern automated shirring processes utilize advanced machinery and specialized lubricants to achieve highly compact sticks, minimizing downtime and maximizing throughput on high-speed stuffers. Innovations focus on creating sticks that can handle rougher mechanical treatment without tearing or unraveling, thereby improving overall line efficiency for meat processors. Chemical surface treatment technologies are also key, particularly those related to smoke absorption and peelability. Specialized protein or polymer coatings are applied post-extrusion to enhance color development during smoking or to ensure easy removal for non-edible casings.

The future technology focus is increasingly moving towards developing casings with customizable permeability characteristics and incorporating functional ingredients. Researchers are investigating ways to integrate antimicrobial agents directly into the casing matrix to extend the shelf life of the enclosed product, reducing the reliance on chemical preservatives. Additionally, there is a strong emphasis on achieving greater utilization of diverse collagen sources, including fish or poultry waste streams, through advanced enzymatic hydrolysis and purification techniques. This not only addresses raw material sourcing constraints but also aligns with circular economy objectives, ensuring the technological evolution supports both performance and sustainability mandates within the complex regulatory environment.

Regional Highlights

-

North America: Market Maturity and Automation Dominance

North America is a cornerstone market for collagen casings, characterized by a highly consolidated processed meat industry and substantial investment in high-speed, automated production lines. The United States, in particular, drives the demand for small-diameter edible casings due to the immense consumption of hot dogs, breakfast sausages, and frankfurters. The market here demands uncompromising consistency and compatibility with continuous processing equipment. While growth rates are stabilizing compared to emerging markets, innovation focuses on ultra-thin casings and efficiency gains. Regulatory standards concerning bovine spongiform encephalopathy (BSE) related materials and traceability mandate strict adherence among all suppliers operating in the region.

Canada also contributes significantly, maintaining robust demand driven by strong domestic meat processing and exports. The emphasis in North America is placed heavily on supply chain reliability and the ability of manufacturers to deliver large volumes quickly and consistently. The segment of dried/cured sausages (salami, pepperoni) also provides substantial demand for specialized non-edible collagen films and casings used for shaping and stability during the curing process. Competition is fierce, prompting key players to focus on strategic partnerships with major food conglomerates to secure long-term contracts.

-

Europe: Quality, Tradition, and Regulatory Complexity

Europe represents a large and diverse market, spanning high-volume operations in Western Europe (Germany, UK) and traditional, premium production in Southern and Eastern Europe. Countries like Germany and Poland are leading producers and consumers of cooked and fresh sausages, necessitating large volumes of high-quality collagen casings. Demand is bifurcated: mass-market products require cost-effective, high-speed casings, while traditional sausages demand specialized collagen products that mimic the appearance and bite of natural casings, supporting local Protected Designation of Origin (PDO) products.

Regulatory frameworks, especially those governed by the European Union regarding food safety, additive use, and raw material traceability (TSE regulations), impose stringent requirements on casing manufacturers. The European market is also a leader in promoting sustainable and animal-welfare-focused sourcing, pushing suppliers toward transparent and ethically compliant supply chains. Western Europe is seeing accelerated uptake of collagen in deli meats, replacing natural or cellulose casings where automation is critical, making it a pivotal region for continuous technological refinement and market segmentation strategies.

-

Asia Pacific (APAC): Highest Growth Trajectory and Urbanization Impact

The Asia Pacific region is forecast to exhibit the fastest growth in the collagen casings market during the forecast period. This acceleration is driven by rapid urbanization, Westernization of diets, and substantial growth in modern retail infrastructure. Countries such as China, India, Japan, and Australia are witnessing a surge in the demand for packaged, processed meat products, shifting away from traditional wet market sourcing.

China is a key consumption and production hub, with increasing industrialization of its immense food sector driving the transition from traditional natural casings to standardized collagen alternatives. India’s smaller, yet rapidly expanding, organized processed food sector presents considerable long-term potential. Market players in APAC must adapt to diverse local product types, climate challenges (affecting casing storage and product shelf life), and specific cultural preferences regarding protein source (e.g., higher acceptance of porcine collagen in specific regions like Vietnam and China). Investment in localized manufacturing and distribution networks is critical for securing market share in this fragmented yet explosive region.

-

Latin America: Industrialization and Expanding Meat Exports

The Latin American market, particularly Brazil and Argentina, is crucial due to their status as major global meat producers and exporters. The industrialization of the meat sector to meet high international export standards fuels significant demand for standardized collagen casings. Brazil is a powerhouse in processed poultry and pork, where collagen casings are essential for efficiency.

While domestic consumption of processed meats is growing steadily, the primary driver remains the optimization of export-oriented production facilities. Challenges in this region include economic instability and fragmented logistics infrastructure, which can impact supply chain reliability. Opportunities lie in integrating advanced shirrability technologies and expanding product offerings beyond basic cooked sausages into cured and smoked products catering to local tastes.

-

Middle East and Africa (MEA): Halal Compliance and Infrastructure Development

The MEA region is predominantly driven by increasing per capita income, population growth, and investments in modern food processing infrastructure, particularly in the GCC countries and South Africa. A critical factor in this region is the mandatory requirement for Halal certification, meaning bovine collagen casings sourced and processed strictly according to Islamic dietary laws are highly preferred.

Demand is growing for both fresh and cooked sausages consumed primarily in urban centers and the tourism sector. Market entry strategies often revolve around establishing reliable supply chains compliant with stringent religious and food safety standards. Infrastructure development in regions like South Africa and the UAE, coupled with rising consumer awareness of branded food products, paves the way for sustained, albeit moderate, growth in the adoption of collagen casings over highly specialized or traditional local casings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Collagen Casings Market.- Viskase Companies, Inc.

- Devro plc

- Nitta Casings Inc.

- Shenguan Holdings (Group) Limited

- Fibran S.A.

- Fabios S.A.

- Kalle GmbH

- Atlantis-Pak

- Sichuan Shengda Group

- DAT-Schaub (Part of Danish Crown)

- Weschenfelder

- Innovia Films (Related player in packaging)

- Al-Ameen Casings

- Oversea Casing Company

- Natural Casing Company (Diversified supplier)

- Hengtai Group

- Pekos S.A.

- Edible Casings Co. Ltd.

- Viscofan S.A. (Primarily Cellulose/Plastic, but competitive force)

- Chongqing Tengzhou Casing Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Collagen Casings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of collagen casings over natural casings?

Collagen casings offer superior manufacturing consistency (uniform diameter and strength), enabling high-speed, automated production lines. They are generally more cost-effective, reduce raw material waste, and eliminate the need for specialized sourcing and preparation required for natural casings. Most are edible and offer excellent smoke permeability.

What is the projected Compound Annual Growth Rate (CAGR) for the Collagen Casings Market?

The Collagen Casings Market is projected to grow at a CAGR of 6.9% between 2026 and 2033, driven largely by the industrialization of meat processing, especially in the Asia Pacific region, and continuous technological advancements.

Which type of collagen casing holds the largest market share by type?

Edible collagen casings hold the largest market share by type. They are predominantly used in high-volume products such as frankfurters, hot dogs, and fresh sausages where the edibility and ease of processing are critical factors for mass-market acceptance.

How does raw material price volatility affect the collagen casings industry?

Raw material price volatility significantly impacts the industry because collagen is derived from bovine and porcine hides, making supply dependent on global livestock production and disease outbreaks. Manufacturers often mitigate this risk through long-term supply agreements and optimizing processing efficiency to absorb cost fluctuations.

Which region is expected to demonstrate the fastest growth in the collagen casings market?

The Asia Pacific (APAC) region is expected to demonstrate the fastest growth due to rapid urbanization, increasing disposable income, shifting dietary preferences toward processed meats, and substantial investment in modern food processing infrastructure across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager