Commercial Vehicle Urea Tank Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440387 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Commercial Vehicle Urea Tank Market Size

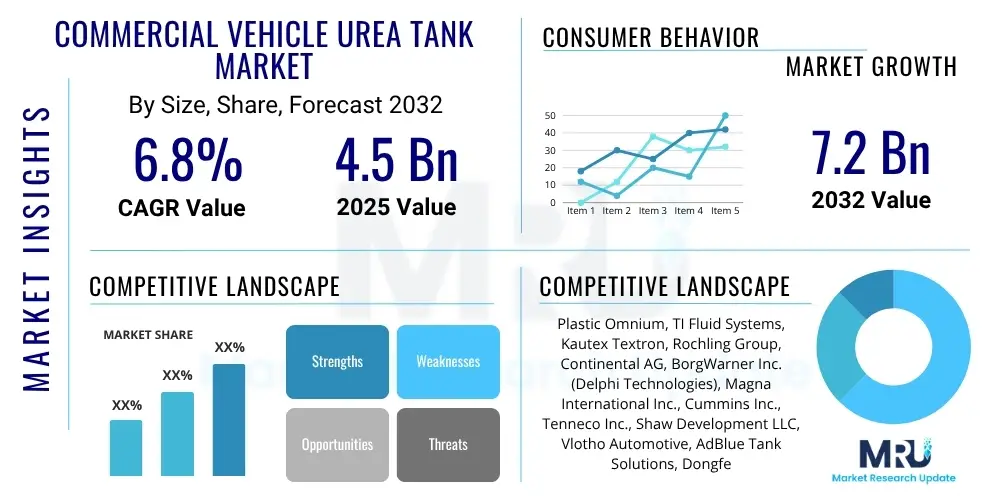

The Commercial Vehicle Urea Tank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.83 billion by the end of the forecast period in 2033.

Commercial Vehicle Urea Tank Market introduction

The Commercial Vehicle Urea Tank Market encompasses the manufacturing, distribution, and sales of specialized storage units designed to hold Diesel Exhaust Fluid (DEF), also known as AdBlue, for heavy-duty and medium-duty commercial vehicles. These tanks are an integral component of Selective Catalytic Reduction (SCR) systems, which are essential for meeting stringent global emission regulations, particularly Euro V, Euro VI, EPA 2010, and Bharat Stage (BS) VI standards. The primary function of a urea tank is to safely store and supply DEF to the SCR system, where it is injected into the exhaust stream to convert harmful nitrogen oxides (NOx) into harmless nitrogen and water vapor, significantly reducing environmental pollution. Product designs vary, incorporating features like heating elements to prevent DEF from freezing in cold climates, integrated sensors for level monitoring, and robust construction materials to withstand harsh operating conditions.

Major applications for these urea tanks span across a broad spectrum of commercial vehicles, including long-haul trucks, city buses, construction equipment, agricultural machinery, and various vocational vehicles. The increasing adoption of SCR technology across different regions, driven by regulatory mandates, fuels the demand for these tanks. The benefits associated with commercial vehicle urea tanks and SCR systems are multifaceted, including substantial reductions in NOx emissions, improved fuel efficiency in certain engine designs, and compliance with environmental laws, which in turn avoids penalties and enhances corporate social responsibility. These benefits are crucial for fleet operators facing growing pressure to reduce their carbon footprint and adhere to strict air quality standards, thereby providing a strong impetus for market expansion.

The market is significantly driven by several key factors. Foremost among these are the escalating global emission standards, which compel vehicle manufacturers to integrate SCR systems into new commercial vehicle designs. Furthermore, the expansion of the logistics and transportation sector, particularly in emerging economies, coupled with increased freight movement and passenger transport, contributes to a larger fleet size requiring DEF solutions. Technological advancements in tank materials, sensor integration, and heating mechanisms are also enhancing product durability and efficiency, making them more attractive to original equipment manufacturers (OEMs) and end-users. Additionally, the growing awareness regarding air pollution and public health concerns further encourages the adoption of cleaner vehicle technologies, reinforcing the market’s growth trajectory.

Commercial Vehicle Urea Tank Market Executive Summary

The Commercial Vehicle Urea Tank Market is experiencing robust growth driven by stringent global emission regulations and the expanding commercial vehicle sector. Business trends indicate a strong push towards lightweighting, material innovation (such as high-density polyethylene, HDPE), and the integration of smart sensor technology for enhanced monitoring and predictive maintenance. Manufacturers are focusing on modular designs that can be easily integrated into diverse vehicle architectures, and there is an increasing emphasis on cost-effective production methods to meet the high volume demands of OEMs. The competitive landscape is characterized by both established automotive component suppliers and specialized tank manufacturers, all vying for market share through product differentiation and strategic partnerships.

Regionally, the market exhibits varied dynamics. Europe and North America, with their long-standing and strict emission standards, represent mature but steady growth markets, characterized by high adoption rates of SCR technology. The Asia Pacific region, particularly countries like China and India, is emerging as a significant growth engine due to rapid industrialization, urbanization, and the recent implementation of stringent emission norms (e.g., Bharat Stage VI in India, China VI). Latin America and the Middle East & Africa are also showing promising growth, albeit from a lower base, as these regions gradually adopt more advanced emission control technologies for their expanding commercial fleets. This global regulatory harmonization trend is creating a broader, more unified market for urea tank solutions.

Segment trends highlight the dominance of plastic-based urea tanks (HDPE) over metal variants due to their superior corrosion resistance, lighter weight, and manufacturing flexibility. In terms of capacity, tanks ranging from 20-50 liters are particularly popular for medium-duty trucks and buses, while larger capacities (50-100 liters and above) cater to heavy-duty trucks and long-haul applications. The aftermarket segment is also gaining traction as vehicles age and require replacements or upgrades. Furthermore, ongoing research and development efforts are concentrated on improving tank insulation, designing more efficient heating elements for cold weather operation, and enhancing overall system reliability to ensure optimal performance of the SCR system throughout the vehicle's lifespan.

AI Impact Analysis on Commercial Vehicle Urea Tank Market

The integration of Artificial Intelligence (AI) is set to revolutionize various aspects of the Commercial Vehicle Urea Tank Market, fundamentally altering design, manufacturing, and operational efficiencies. Users frequently inquire about how AI can optimize DEF consumption, predict maintenance needs for urea tanks and SCR systems, and enhance overall fleet management. There is significant interest in AI’s potential to provide real-time data analysis for DEF levels, quality, and temperature, enabling predictive refills and preventing operational disruptions due to DEF shortages or quality issues. Concerns also revolve around the complexity of integrating AI, data security, and the return on investment for such advanced systems. Users expect AI to drive smarter, more efficient, and more reliable emission control solutions, ultimately reducing total cost of ownership for commercial fleets.

- AI-driven predictive maintenance for urea tanks and SCR components, minimizing downtime.

- Optimization of DEF consumption through AI algorithms analyzing driving patterns, routes, and load conditions.

- Real-time monitoring and anomaly detection for DEF levels, quality, and system health.

- Enhanced supply chain management for DEF and urea tank components through AI-powered forecasting.

- Intelligent routing systems that consider DEF refill points and availability.

- AI-assisted design and simulation of urea tanks for improved thermal management and durability.

- Personalized recommendations for DEF usage and system care based on vehicle-specific data.

DRO & Impact Forces Of Commercial Vehicle Urea Tank Market

The Commercial Vehicle Urea Tank Market is propelled by several key drivers, primarily the escalating stringency of global emission regulations. Governments worldwide are implementing and tightening standards such as Euro VI, EPA 2010, and BS VI, compelling commercial vehicle manufacturers to adopt Selective Catalytic Reduction (SCR) technology, which inherently requires urea tanks for Diesel Exhaust Fluid (DEF). This regulatory push is a fundamental and non-negotiable driver. Additionally, the continuous expansion of the logistics and transportation sectors, particularly in burgeoning economies, leads to a larger fleet of commercial vehicles, thereby increasing the overall demand for these essential components. The growing awareness and emphasis on environmental sustainability by both corporations and consumers further contribute to the market’s growth, as fleet operators seek to improve their environmental credentials and comply with green initiatives. Technological advancements in material science, such as the development of more durable and lightweight polymers for tank construction, also serve as a driver by enhancing product appeal and performance.

Despite the strong growth drivers, the market faces certain restraints. The primary restraint is the fluctuating price of raw materials, particularly high-density polyethylene (HDPE), which directly impacts manufacturing costs and, subsequently, the final product price. The initial high cost of implementing SCR systems, including the urea tank, can be a deterrent for some fleet operators, especially smaller businesses in price-sensitive markets. Furthermore, the operational challenge of ensuring a consistent and widespread DEF refueling infrastructure, especially in remote areas or developing regions, presents a logistical hurdle that can hinder the wider adoption of SCR-equipped vehicles. Lastly, the need for regular maintenance and the potential for crystallization issues within the DEF system, if not properly managed, can add to operational complexities and costs, acting as a deterrent for some end-users.

Opportunities within this market are abundant and promising. The ongoing electrification trend in the commercial vehicle sector, while seemingly a long-term threat, also presents an immediate opportunity for hybrid commercial vehicles that still utilize internal combustion engines and thus require urea tanks. The development of advanced tank designs that are more compact, modular, and intelligent (e.g., with integrated sensors for predictive maintenance and remote monitoring) opens new avenues for innovation and market differentiation. Furthermore, the expansion of the aftermarket segment, driven by the replacement needs of an aging fleet equipped with SCR systems, offers significant revenue potential. Emerging markets, with their rapid infrastructure development and increasing demand for commercial transport, represent untapped growth territories. Companies that invest in robust distribution networks and localized manufacturing capabilities in these regions are well-positioned to capitalize on these opportunities.

The impact forces within the Commercial Vehicle Urea Tank Market are largely shaped by technological advancements, regulatory pressures, and economic shifts. Regulatory forces are paramount, dictating the baseline demand and performance requirements for urea tanks. Economic forces, including global GDP growth, fuel prices, and supply chain stability, directly influence the purchase decisions of fleet operators and the overall health of the commercial vehicle industry. Technological forces drive innovation in materials, manufacturing processes, and smart features, improving product efficiency, durability, and cost-effectiveness. Environmental impact forces, stemming from public and governmental concerns over air quality, continually push for cleaner vehicle technologies. Lastly, competitive forces among manufacturers lead to continuous improvement in product design, pricing strategies, and service offerings, ensuring a dynamic and evolving market landscape.

Segmentation Analysis

The Commercial Vehicle Urea Tank Market is meticulously segmented across various parameters to provide a granular understanding of its dynamics, catering to diverse vehicle types, material preferences, and capacity requirements. This segmentation helps in identifying specific growth pockets and tailoring product development strategies. The primary segmentation dimensions include material type, capacity, vehicle type, and sales channel, each influencing market share and competitive positioning. Understanding these segments is crucial for stakeholders to effectively target their offerings and address the nuanced demands of the global commercial vehicle industry.

- By Material Type:

- High-Density Polyethylene (HDPE) Urea Tanks

- Metal Urea Tanks (Stainless Steel, Aluminum)

- By Capacity:

- Below 20 Liters

- 20-50 Liters

- 50-100 Liters

- Above 100 Liters

- By Vehicle Type:

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

- Off-Highway Vehicles (Construction, Agricultural)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Commercial Vehicle Urea Tank Market

The value chain for the Commercial Vehicle Urea Tank Market begins with upstream activities, encompassing raw material procurement and component manufacturing. This stage involves suppliers of high-density polyethylene (HDPE) resins, stainless steel, aluminum, and various electronic components such as sensors, heating elements, and level indicators. These raw material and component suppliers play a critical role in determining the quality, cost, and availability of essential inputs for tank production. Strong supplier relationships and effective supply chain management are crucial here to ensure consistent quality and mitigate price volatility. The innovation in material science at this stage, such as the development of more durable and lightweight plastics, directly impacts the performance and cost-effectiveness of the final urea tank product, driving efficiency and sustainability throughout the subsequent stages of the value chain.

Midstream activities involve the core manufacturing and assembly processes undertaken by urea tank producers. This includes blow molding or injection molding for plastic tanks, welding and fabrication for metal tanks, and the integration of heating systems, sensors, and other electronic modules. Quality control, precision engineering, and adherence to automotive standards are paramount at this stage. Manufacturers often invest heavily in automation and advanced production techniques to achieve economies of scale and maintain competitive pricing. Many urea tank manufacturers are specialized component suppliers to the automotive industry, and some major commercial vehicle OEMs also have in-house production capabilities or strategic partnerships with dedicated tank manufacturers. This phase also includes sophisticated testing protocols to ensure tanks meet stringent safety, durability, and performance requirements under various operating conditions, including temperature extremes and vibration.

Downstream activities focus on the distribution and end-user engagement. The primary distribution channel is direct sales to Original Equipment Manufacturers (OEMs) of commercial vehicles, where urea tanks are integrated into new vehicle assembly lines. This OEM channel requires robust logistical capabilities, just-in-time delivery, and close collaboration with vehicle manufacturers on design and specifications. The aftermarket channel, comprising independent garages, authorized service centers, and spare parts distributors, forms the second major distribution route. Here, replacement tanks are supplied for existing vehicles due to wear and tear, damage, or upgrades. This channel relies on effective warehousing, broad distribution networks, and strong relationships with local distributors and repair shops. Both direct and indirect channels are critical, with the OEM market driving initial demand and the aftermarket ensuring sustained revenue streams and product longevity. After-sales service, technical support, and warranty provisions are also vital components of the downstream value chain, enhancing customer satisfaction and brand loyalty.

Commercial Vehicle Urea Tank Market Potential Customers

The primary potential customers for the Commercial Vehicle Urea Tank Market are predominantly situated within the global automotive and transportation industry, specifically those entities involved in the manufacturing, sales, and operation of commercial vehicles. This broad category includes major Original Equipment Manufacturers (OEMs) of heavy-duty trucks, medium-duty trucks, buses, coaches, and various types of off-highway machinery such as construction vehicles, agricultural tractors, and mining equipment. These OEMs are the largest direct buyers as they integrate urea tanks into their new vehicle designs as a standard component of their Selective Catalytic Reduction (SCR) systems to comply with current and future emission regulations. Their purchasing decisions are driven by factors such as component quality, reliability, cost-effectiveness, and the supplier's ability to meet stringent production schedules and technical specifications.

Beyond the OEM segment, a significant portion of potential customers lies within the aftermarket. This includes large fleet operators, independent commercial vehicle repair workshops, authorized service centers, and spare parts distributors. Fleet operators, ranging from global logistics companies to regional trucking firms and municipal bus services, require replacement urea tanks for their aging vehicles due to damage, wear, or the need for system upgrades. Their purchasing decisions are often influenced by the total cost of ownership, including the price of the replacement part, ease of installation, and expected lifespan. Repair workshops and service centers act as intermediaries, purchasing tanks from distributors and installing them for their end-user clients, emphasizing product availability, technical support, and competitive pricing. The aftermarket segment, therefore, provides a consistent and growing demand as the global fleet of SCR-equipped commercial vehicles expands and ages, ensuring a sustained revenue stream for tank manufacturers and distributors.

Additionally, specialized vehicle manufacturers, such as those producing refuse trucks, emergency vehicles, or custom-built vocational vehicles, also represent a segment of potential customers. These manufacturers often have unique requirements for tank dimensions, mounting solutions, and material specifications due to the specialized nature of their vehicle designs and operational environments. Their demand, while perhaps lower in volume compared to large-scale truck OEMs, often commands higher margins for customized solutions. Emerging markets, characterized by rapid industrialization and infrastructure development, are also a critical area for customer acquisition. As these regions adopt stricter emission standards and expand their commercial vehicle fleets, the demand for urea tanks will surge. Furthermore, government bodies and public transport authorities, through their procurement of public service vehicles, also act as indirect but influential customers, setting standards and driving the adoption of emission-compliant technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.83 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Röchling Group, Plastic Omnium, Magna International Inc., Kautex Textron GmbH & Co. KG (a division of Textron Inc.), TI Fluid Systems, YAPP Automotive Systems Co., Ltd., ElringKlinger AG, Mann+Hummel, MAHLE GmbH, SMP Automotive Technology Systems GmbH, Fuji Technica Inc., Shaw Development, Systems & Components, Eberspächer Group, Dürr AG, Webasto Group, Hella GmbH & Co. KGaA, Continental AG, Denso Corporation, Bosch Rexroth AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Vehicle Urea Tank Market Key Technology Landscape

The Commercial Vehicle Urea Tank Market is continuously evolving with significant technological advancements aimed at enhancing efficiency, durability, and compliance with increasingly stringent environmental regulations. A core technology shaping this landscape is the widespread adoption of High-Density Polyethylene (HDPE) for tank construction. HDPE offers superior corrosion resistance compared to metal tanks, significantly lighter weight, and greater design flexibility, allowing for more complex geometries to fit challenging vehicle layouts. Manufacturing processes such as blow molding and rotational molding are critical, enabling the production of seamless, robust tanks that can withstand harsh operating conditions, including vibrations, temperature fluctuations, and chemical exposure from Diesel Exhaust Fluid (DEF). Innovations in multi-layer co-extrusion techniques further enhance the material properties, providing improved barrier performance against DEF permeation and enhanced impact resistance, contributing to longer product lifespans and greater reliability for commercial fleet operators.

Beyond basic tank construction, the integration of smart technologies is a key area of focus. Advanced sensor technologies are becoming standard, including sophisticated DEF level sensors that provide accurate real-time data to the vehicle's engine control unit (ECU). These sensors often incorporate ultrasonic or capacitive technologies for improved precision and reliability, preventing false readings and ensuring optimal DEF dosing. Temperature sensors are also crucial, especially in regions with cold climates, to monitor DEF temperature and activate integrated heating elements. These heating elements, often electric or exhaust-gas-heated, prevent DEF from freezing at temperatures below -11°C (12°F), ensuring the SCR system remains operational even in extreme cold. The efficiency and energy consumption of these heating systems are continuously being optimized to minimize their impact on vehicle fuel economy, representing a significant technological challenge and area of innovation for manufacturers.

Furthermore, the technology landscape includes continuous efforts in optimizing tank designs for better thermal management and integration with other vehicle systems. This involves designing tanks that can dissipate heat efficiently in hot climates and retain heat in cold environments, ensuring DEF remains within its optimal operating temperature range. Modular tank designs are gaining traction, offering greater adaptability for different commercial vehicle platforms and simplifying assembly processes for OEMs. Research is also underway in developing materials with integrated self-cleaning properties or advanced coatings to prevent DEF crystallization and build-up within the tank and associated components. Connectivity features, allowing for remote monitoring of DEF levels and tank diagnostics, are emerging as an important aspect, particularly in the context of fleet management systems. These advancements collectively aim to enhance the overall performance, reduce maintenance, and ensure the long-term reliability of commercial vehicle urea tanks, thereby supporting global efforts to reduce harmful emissions from heavy-duty transport.

Regional Highlights

- North America: A mature market driven by EPA 2010 and subsequent regulations; strong demand from heavy-duty trucking and expanding logistics. Focus on robust, cold-weather resistant tanks.

- Europe: Leading the adoption of SCR technology due to stringent Euro VI standards; significant market share with a focus on efficiency, lightweight design, and compact integration for diverse vehicle types.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapidly implementing emission norms (e.g., China VI, BS VI in India) and burgeoning commercial vehicle production. High potential for market expansion.

- Latin America: Emerging market with increasing adoption of modern emission standards; growing commercial vehicle fleet and infrastructure development contribute to steady demand.

- Middle East & Africa (MEA): Gradually adopting cleaner vehicle technologies; moderate growth influenced by diverse regulatory landscapes and expanding construction and transport sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Vehicle Urea Tank Market.- Röchling Group

- Plastic Omnium

- Magna International Inc.

- Kautex Texttextron GmbH & Co. KG (a division of Textron Inc.)

- TI Fluid Systems

- YAPP Automotive Systems Co., Ltd.

- ElringKlinger AG

- Mann+Hummel

- MAHLE GmbH

- SMP Automotive Technology Systems GmbH

- Fuji Technica Inc.

- Shaw Development

- Systems & Components

- Eberspächer Group

- Dürr AG

- Webasto Group

- Hella GmbH & Co. KGaA

- Continental AG

- Denso Corporation

- Bosch Rexroth AG

Frequently Asked Questions

What is a commercial vehicle urea tank and why is it important?

A commercial vehicle urea tank stores Diesel Exhaust Fluid (DEF/AdBlue), which is injected into the exhaust system as part of a Selective Catalytic Reduction (SCR) system. It's crucial for converting harmful nitrogen oxides (NOx) into harmless nitrogen and water, enabling commercial vehicles to meet stringent global emission standards and reduce environmental pollution.

Which material type dominates the commercial vehicle urea tank market?

High-Density Polyethylene (HDPE) urea tanks dominate the market. HDPE offers superior corrosion resistance, is lighter than metal, and provides greater design flexibility, which are critical advantages for automotive applications in various operating conditions.

How do emission regulations influence the demand for urea tanks?

Emission regulations, such as Euro VI, EPA 2010, and BS VI, are the primary drivers of demand. These stringent standards mandate the use of SCR technology in new commercial vehicles, directly requiring the integration of urea tanks to comply with legal NOx reduction targets.

What are the key technological advancements in urea tanks?

Key advancements include lightweight and durable HDPE materials, integrated smart sensors for precise DEF level and quality monitoring, efficient heating elements for cold weather operation, and modular designs for improved vehicle integration. These enhance performance and reliability.

What challenges does the commercial vehicle urea tank market face?

The market faces challenges such as volatile raw material prices, the initial higher cost of SCR system implementation for fleet operators, ensuring a widespread DEF refueling infrastructure, and mitigating potential DEF crystallization issues which can impact system performance and maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Commercial Vehicle Urea Tank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Commercial Vehicle Urea Tank Market Size Report By Type (19 liters, 38 liters, 57 liters, 114 liters, Other size), By Application (HD Off Road, HD On Road), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager