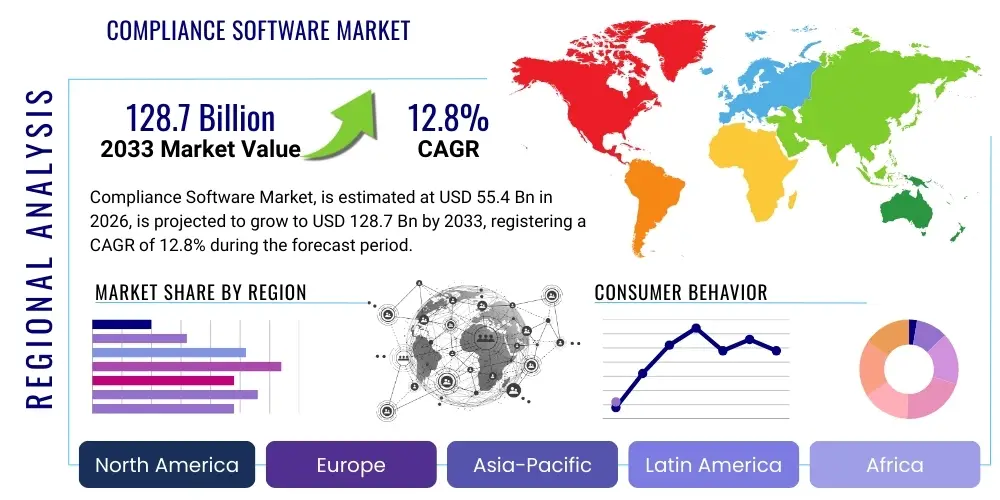

Compliance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435697 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Compliance Software Market Size

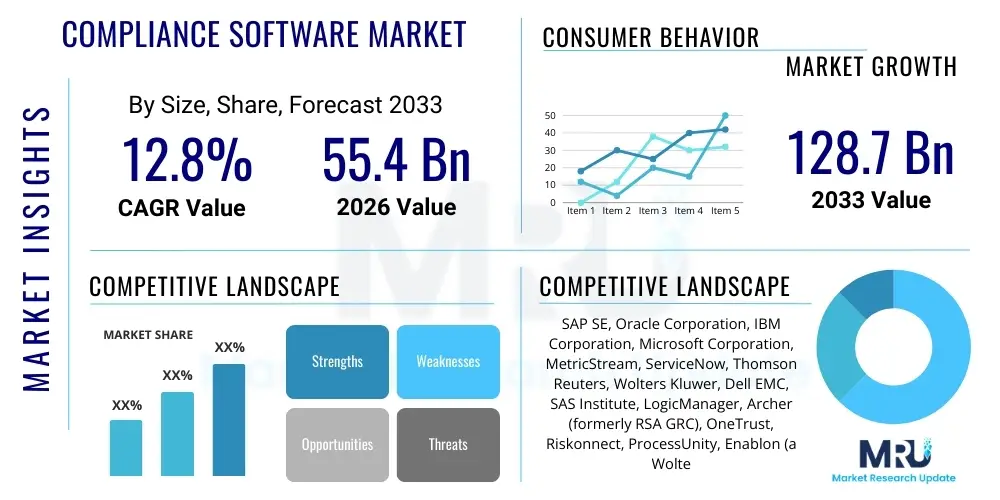

The Compliance Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. This robust expansion is fueled primarily by the exponential growth in global data regulation and the increasing complexity of cross-jurisdictional compliance mandates. Organizations across highly regulated sectors, such as banking, finance, and healthcare, are prioritizing automated governance, risk, and compliance (GRC) solutions to mitigate severe financial penalties and reputational damage associated with non-compliance.

The market is estimated at $55.4 Billion USD in 2026 and is projected to reach $128.7 Billion USD by the end of the forecast period in 2033. This significant upward trajectory reflects the mandatory shift from manual compliance processes to sophisticated, integrated software platforms capable of real-time monitoring, automated reporting, and proactive risk assessment. Investments in RegTech (Regulatory Technology) solutions are becoming essential operational expenditures rather than discretionary IT spending, particularly as cloud-based deployment models accelerate adoption among small and medium enterprises (SMEs).

The consistent regulatory flux, coupled with the rising threat landscape involving cyber security and data privacy breaches, fundamentally underpins this market expansion. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) into compliance software is enhancing the efficiency and predictive capabilities of GRC platforms, thereby increasing their value proposition and driving greater enterprise uptake globally, solidifying the market's high growth potential through the next decade.

Compliance Software Market introduction

The Compliance Software Market encompasses applications and services designed to help organizations meet regulatory requirements, industry standards, and internal corporate policies efficiently and reliably. This technology sector is critical for establishing robust Governance, Risk, and Compliance (GRC) frameworks. The core offerings include solutions for policy management, audit trail documentation, regulatory change management, and risk assessments across diverse operational domains. Major applications span heavily regulated industries such as Banking, Financial Services, and Insurance (BFSI), Healthcare, Manufacturing, and IT & Telecom, where adherence to laws like GDPR, HIPAA, Sarbanes-Oxley (SOX), and specific financial regulations is non-negotiable.

The immediate benefits derived from adopting comprehensive compliance software platforms are manifold, centered predominantly on risk reduction and operational efficiency. These systems automate the often labor-intensive process of monitoring internal controls, performing gap analysis against new regulations, and generating audit-ready reports, thus significantly minimizing the probability of human error and inadvertent regulatory breaches. Furthermore, by centralizing compliance functions, organizations achieve greater visibility into their risk posture, leading to more informed strategic decisions and enhanced stakeholder trust. The shift toward cloud-native compliance solutions is lowering the barrier to entry, making sophisticated GRC tools accessible even to smaller organizations navigating increasingly complex global mandates.

Key driving factors propelling the market forward include the unprecedented proliferation of global data privacy laws, the intensification of cross-border trade requiring adherence to multiple jurisdictional standards, and the rising cost of non-compliance, which can involve massive fines and criminal penalties. Additionally, the digital transformation sweeping through all industries necessitates dynamic compliance solutions that can monitor complex, cloud-based IT infrastructures and highly distributed workforce environments. The demand is further amplified by corporate governance trends that emphasize transparency and accountability, pushing compliance from a reactive function to a proactive, integrated business process essential for sustained organizational health and competitiveness.

Compliance Software Market Executive Summary

The Compliance Software Market is currently defined by significant digital and regulatory convergence, driving rapid adoption across key vertical markets. Business trends highlight a strong shift toward integrated GRC suites, moving away from disparate, point solutions. Organizations are prioritizing platforms that offer AI-driven automation for continuous control monitoring and predictive risk modeling, positioning Regulatory Technology (RegTech) as the highest growth area within the broader fintech and enterprise software ecosystem. Furthermore, the Software-as-a-Service (SaaS) deployment model dominates market uptake due to its scalability, lower upfront costs, and ease of deployment, particularly catering to the expansive needs of mid-sized and distributed global enterprises seeking agility in compliance management.

Regionally, North America maintains its leadership position, primarily due to the maturity of its regulatory environment, early adoption of GRC technologies, and the high concentration of major market vendors and stringent regulations such as CCPA and sector-specific financial mandates. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by aggressive digital transformation initiatives, increasing awareness of data sovereignty, and the implementation of new, comprehensive regulatory frameworks across developing economies like India and Southeast Asian nations. Europe's growth remains solid, propelled consistently by the enduring mandates of GDPR and various European Union directives focusing on corporate sustainability reporting and digital operational resilience.

In terms of segmentation trends, the BFSI sector remains the primary revenue generator due to the intense scrutiny and high penalty environment it operates within. Within components, the services segment, encompassing consulting, integration, and managed services, is experiencing significant growth, reflecting the need for specialized expertise in customizing and maintaining complex compliance frameworks. Furthermore, large enterprises, while constituting the largest current revenue share, are facing increasingly multifaceted global compliance challenges, whereas the SME segment represents the most lucrative opportunity for future market penetration, largely driven by affordable, subscription-based cloud offerings designed to democratize access to advanced compliance tools.

AI Impact Analysis on Compliance Software Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Compliance Software Market frequently revolve around automation efficacy, data security, and the ethics of algorithmic governance. Users are highly interested in how AI can move compliance beyond simple reactive checks to predictive intelligence—specifically, questions about the feasibility of automating the detection of regulatory deviations before they occur, the ability of ML algorithms to process vast, unstructured regulatory documents in real-time, and concerns regarding data privacy when deploying sophisticated AI models. A major underlying theme is the reliability and explainability (XAI) of AI in audit trails, ensuring that automated decisions can withstand legal and regulatory scrutiny. Users seek confirmation that AI integration will not introduce new forms of bias or regulatory blind spots, but rather deliver tangible improvements in speed and accuracy.

The integration of AI and Machine Learning (ML) is fundamentally transforming compliance software by enhancing its core functionalities, shifting the market paradigm from passive reporting to active, intelligent risk management. AI algorithms are instrumental in automating the arduous process of regulatory mapping, allowing systems to instantly ingest and analyze regulatory updates from hundreds of global jurisdictions and automatically map necessary changes to internal controls and policies. This drastically reduces the time and manpower required for regulatory change management, one of the most significant pain points for large multinational corporations. Moreover, AI excels in continuous transaction monitoring, identifying subtle patterns indicative of fraud, money laundering, or insider trading that traditional rules-based systems often miss.

AI's most profound impact is seen in predictive compliance and behavioral analysis. ML models analyze historical compliance data, internal communications, and employee behavior metrics to identify high-risk areas and predict potential non-compliance events before they materialize. This capability allows compliance teams to allocate limited resources more effectively, focusing preventative efforts on the areas of greatest organizational exposure. While these advanced capabilities require significant investment in data infrastructure and model validation, the resulting reduction in potential fines, coupled with optimized operational efficiency, solidifies AI as the critical technological differentiator and primary growth accelerator for the compliance software industry over the forecast period.

- Automated Regulatory Mapping: AI instantly analyzes and processes new regulations, automatically identifying impacts on internal policies.

- Predictive Risk Analytics: Machine Learning models identify high-risk patterns and forecast potential future compliance breaches.

- Enhanced Continuous Monitoring: AI-driven systems provide real-time scrutiny of transactional data and internal controls.

- Intelligent Document Classification: Automated extraction of critical information from vast volumes of unstructured legal and compliance documents.

- Reduced False Positives: ML algorithms refine alert systems, reducing noise and allowing compliance officers to focus on genuine threats.

- Explainable AI (XAI) for Audits: Ensuring that algorithmic decisions and risk assessments are transparent, traceable, and defensible during regulatory examinations.

DRO & Impact Forces Of Compliance Software Market

The Compliance Software Market is subject to powerful and interconnected driving, restraining, and opportunity forces. Key drivers include the overwhelming global regulatory burden, characterized by stringent data protection laws (like GDPR and CCPA) and complex financial mandates (like Basel III and MiFID II). These external pressures create mandatory demand for automated compliance solutions. Conversely, major restraints involve the high initial cost of deploying large, integrated GRC platforms, the complexity of integrating new software with diverse legacy IT infrastructures, and the persistent shortage of qualified compliance and RegTech experts capable of managing these sophisticated systems. Opportunities are centered on the rapid uptake of SaaS models among SMEs, the emergence of highly specialized RegTech solutions utilizing blockchain for verifiable audit trails, and expanding market potential in previously underserved regions like Latin America and parts of Africa undergoing rapid regulatory maturation.

The core drivers are sustained by two primary factors: the rising volume of digital data necessitating automated oversight, and the escalating financial and reputational cost associated with non-compliance, which acts as a powerful deterrent and spending accelerator. Organizations are driven by necessity to invest in systems that guarantee regulatory adherence. However, the success of market expansion is moderated by the internal resistance caused by vendor lock-in associated with older, customized GRC systems and the continuous need for training and operational adjustment required to maximize the value of advanced platforms. Furthermore, data security concerns regarding multi-tenant cloud environments represent a persistent restraint, requiring vendors to demonstrate impeccable security protocols to gain client trust, particularly in the highly sensitive BFSI and healthcare sectors.

The impact forces within this market are predominantly high and positive. Regulatory pressure acts as a nearly inelastic demand force, meaning that spending on compliance software cannot be easily postponed, even during economic downturns, because regulatory fines often far outweigh the software investment costs. The continuous evolution of technology, particularly AI and distributed ledger technology (DLT), acts as a disruptive, transformative force, constantly introducing more efficient and proactive compliance methods. These impact forces ensure that the market remains dynamic, characterized by continuous innovation and mandatory enterprise expenditure, ultimately leading to sustained high CAGR throughout the forecast period, while fostering a competitive environment focused on integrated, scalable, and highly accurate solutions.

Segmentation Analysis

The Compliance Software Market is segmented comprehensively across several critical dimensions, including Component, Deployment Mode, Organization Size, and Industry Vertical. Understanding these segmentations is vital for assessing market opportunities and vendor strategic focus. The component segmentation, dividing the market into software and services, highlights the crucial role of professional services in implementation, integration, and ongoing regulatory consulting, often commanding a higher growth rate than the software licenses themselves due to the complexity inherent in customizing GRC frameworks. The organization size delineation shows a significant pivot toward accommodating Small and Medium Enterprises (SMEs) through accessible cloud-based solutions, reflecting the broadening regulatory scope impacting businesses of all scales.

Deployment mode analysis confirms the undeniable dominance of the cloud (SaaS) model, which is favored for its flexibility, reduced infrastructure requirements, and scalability, essential attributes when facing dynamic global regulations. While large organizations maintain a necessary portion of on-premise deployment for highly sensitive data or specific jurisdictional requirements, the trend is overwhelmingly cloud-centric. Furthermore, the industry vertical segmentation illuminates the disparate compliance burdens across sectors; the BFSI sector requires extreme focus on financial crimes and market conduct, whereas Healthcare is dominated by patient data privacy (HIPAA, HITECH), and IT & Telecom grapples with network security and data sovereignty issues, requiring highly specialized software configurations tailored to idiosyncratic industry mandates.

Strategic growth within these segments is heavily concentrated on integrated GRC solutions that bridge functional silos—combining risk management, internal audit, and compliance oversight into a unified platform. Vendors are increasingly focusing on vertical-specific compliance clouds, offering pre-configured regulatory content packages designed to speed up deployment and time-to-compliance for sectors like pharmaceutical or energy. This targeted approach leverages technological advances like AI-powered regulatory monitoring to deliver greater precision and relevance, maximizing the return on investment for end-users facing intense competition and relentless regulatory oversight, thereby defining the future competitive landscape.

- Component:

- Software (Platform and Modules)

- Services (Professional Services, Managed Services)

- Deployment Mode:

- On-Premise

- Cloud (SaaS)

- Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT and Telecom

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

Value Chain Analysis For Compliance Software Market

The value chain for the Compliance Software Market begins with the upstream suppliers, primarily comprising specialized software developers, foundational technology providers (e.g., cloud infrastructure services, AI/ML algorithm developers, and database management system providers), and regulatory content providers who supply the constant flow of updated legal and regulatory data essential for the software's functionality. The quality and timeliness of this upstream data are paramount, as the accuracy of the compliance software directly depends on the integrity of the regulatory intelligence feed. Development activities involve extensive R&D to integrate advanced predictive analytics, user-friendly interfaces, and robust security architecture capable of handling highly sensitive organizational data under stringent privacy requirements.

Midstream activities involve the core functions of software development, customization, testing, and system integration. This stage is dominated by the major GRC platform vendors who aggregate the upstream components and translate regulatory intelligence into actionable software rules and workflows. Distribution channels are twofold: direct sales involving large-scale, complex enterprise licensing and bespoke implementation services, particularly for multinational corporations with highly customized compliance needs; and indirect sales through channel partners, Value-Added Resellers (VARs), and system integrators who facilitate localized deployment, ongoing maintenance, and offer complementary managed services, especially targeting the expansive SME segment via standardized SaaS agreements.

The downstream segment centers on the end-users—organizations across various verticals—and the crucial role played by post-sales services. System integrators and specialized compliance consultants are vital in ensuring successful adoption, providing expertise in mapping complex organizational controls to the new software modules, and delivering continuous support for regulatory updates. The value realization for the customer is achieved through operational efficiency gains, minimized risk exposure, and guaranteed audit readiness. The efficiency of the distribution channel, particularly the rapid scaling facilitated by global cloud infrastructure, directly impacts market penetration and the total cost of ownership for the end-user, thereby maximizing the overall market value delivered across the chain.

Compliance Software Market Potential Customers

The primary purchasers and beneficiaries of Compliance Software solutions are organizations operating within highly regulated industry verticals where the consequences of non-adherence are severe, often involving substantial financial penalties and legal repercussions. The largest segment of potential customers is the Banking, Financial Services, and Insurance (BFSI) sector, encompassing commercial banks, investment firms, insurance carriers, and payment processors. These institutions require sophisticated software for managing Anti-Money Laundering (AML), Know Your Customer (KYC), market manipulation monitoring, and global financial reporting standards, driving continuous expenditure on advanced RegTech platforms that integrate seamlessly with core banking systems.

Another major cohort of potential customers resides in the Healthcare and Life Sciences sector, including hospitals, pharmaceutical companies, biotechnology firms, and medical device manufacturers. Their buying decisions are governed by strict patient privacy regulations (e.g., HIPAA in the US, regional equivalents globally) and specific mandates related to clinical trials, drug manufacturing processes, and supply chain integrity. These organizations seek compliance software that can manage electronic health records security, track training compliance for regulatory submissions, and maintain verifiable audit trails across decentralized operations, making robust GRC tools essential operational necessities rather than optional IT upgrades.

Beyond these highly traditional compliance-intensive sectors, the IT and Telecommunications sector represents an increasingly critical customer base, particularly driven by global data sovereignty laws, complex intellectual property (IP) management needs, and contractual adherence requirements for governmental clients. Furthermore, any organization that manages significant volumes of consumer data, such as large e-commerce retailers, global manufacturers with complex international supply chains, and government agencies, constitutes a vast potential customer pool. The increasing availability of scalable, affordable SaaS solutions is rapidly expanding the addressable market to include millions of SMEs worldwide who must comply with baseline data protection and tax regulations but previously lacked the capital for large-scale GRC implementation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.4 Billion USD |

| Market Forecast in 2033 | $128.7 Billion USD |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, MetricStream, ServiceNow, Thomson Reuters, Wolters Kluwer, Dell EMC, SAS Institute, LogicManager, Archer (formerly RSA GRC), OneTrust, Riskonnect, ProcessUnity, Enablon (a Wolters Kluwer business), Galvanize (now part of Diligent), Curaspan Health Group, Resolver, Protiviti. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Compliance Software Market Key Technology Landscape

The technological landscape of the Compliance Software Market is rapidly evolving, driven by the need for greater efficiency, precision, and proactive risk detection. The foundational technology remains integrated Governance, Risk, and Compliance (GRC) platforms, which have matured into sophisticated, modular ecosystems capable of handling diverse regulatory requirements simultaneously. Cloud computing is the dominant delivery mechanism, facilitating the global scalability and continuous updating necessary for modern compliance, often utilizing hyper-scaler infrastructure like AWS, Azure, and Google Cloud to ensure data residency and security requirements are met across various jurisdictions. This transition to cloud-native architecture accelerates deployment and reduces the maintenance overhead for end-users, fundamentally reshaping the consumption of GRC tools.

The most transformative technologies currently influencing the market are Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are integrated into modules for regulatory monitoring, predictive risk modeling, and continuous control testing. AI algorithms can scan global legal databases, interpret regulatory language, and auto-map new mandates to existing control libraries, a process known as regulatory intelligence. Furthermore, ML is used extensively in transactional surveillance and behavioral analysis within the BFSI sector to combat financial crime more effectively by identifying anomalous patterns that signal money laundering or fraud with high precision, dramatically improving the efficacy of existing compliance frameworks.

Emerging technologies like Blockchain and Distributed Ledger Technology (DLT) are also gaining traction, particularly in creating immutable, verifiable audit trails and enhancing supply chain transparency compliance. DLT offers a cryptographic method for proving data integrity and ownership, which is highly beneficial for demonstrating compliance adherence during external audits without relying solely on centralized ledger systems. Additionally, the increasing reliance on APIs (Application Programming Interfaces) is standardizing connectivity between disparate enterprise systems—such as ERP, HR systems, and dedicated compliance platforms—enabling holistic data flow essential for enterprise-wide risk aggregation and accurate regulatory reporting, thereby enhancing the overall integrated technological maturity of the compliance ecosystem.

Regional Highlights

The global Compliance Software Market exhibits distinct growth trajectories and maturity levels across major geographic regions, primarily influenced by the stringency of local regulatory environments, technological adoption rates, and economic stability. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to the presence of highly complex and segmented regulatory frameworks (e.g., SOX, HIPAA, CCPA, and vast financial sector regulations), the high concentration of major GRC software vendors, and a culture of proactive technological investment to avoid punitive fines. U.S. financial institutions and major technology companies are the largest consumers, driving demand for cutting-edge AI-powered solutions.

Europe represents the second-largest market, characterized by regulatory harmonization efforts, most notably the General Data Protection Regulation (GDPR), which mandated significant investments in data privacy and security compliance software across all sectors. European growth is consistently bolstered by directives aimed at financial stability (e.g., MiFID II) and corporate sustainability reporting. While the European market is mature, the fragmentation of national implementation rules and a generally more cautious approach to technology adoption compared to North America create localized challenges, though demand for robust, privacy-centric GRC solutions remains high and mandatory across the European Union and the UK.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market during the forecast period. This accelerated growth is fueled by massive digital transformation efforts, rapid economic expansion, and the introduction of increasingly sophisticated data protection and financial market regulations in countries like China, India, Singapore, and Australia. Organizations in APAC are rapidly shifting to cloud-based GRC models to handle cross-border trade complexities and address localized data residency mandates. The growing middle class and expanding financial inclusion programs further mandate high regulatory oversight, positioning APAC as the critical future revenue driver for global compliance software providers.

- North America: Market leader due to strict financial and data privacy regulations (SOX, HIPAA, CCPA). Characterized by high technological maturity and early adoption of AI-driven GRC platforms.

- Europe: Strong growth driven by continuous enforcement of GDPR and new sustainability and operational resilience regulations (DORA). High demand for solutions managing localized jurisdictional compliance within the EU framework.

- Asia Pacific (APAC): Expected highest CAGR, driven by rapid digital transformation, increasing regulatory enforcement (especially data sovereignty laws), and expansion of cloud-based compliance solutions in key economies like India and Southeast Asia.

- Latin America (LATAM): Emerging market potential, stimulated by increasing foreign investment and the implementation of new regional data protection laws, driving foundational GRC adoption.

- Middle East & Africa (MEA): Growth concentrated in the Gulf Cooperation Council (GCC) nations, primarily driven by financial sector modernization and cybersecurity mandates, relying heavily on foreign vendor solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Compliance Software Market, evaluating their product portfolios, recent strategic developments, regional presence, and competitive positioning within the dynamic regulatory technology landscape.- SAP SE

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Thomson Reuters

- Wolters Kluwer

- ServiceNow

- MetricStream

- Archer (formerly RSA GRC)

- SAS Institute

- LogicManager

- OneTrust

- Riskonnect

- ProcessUnity

- Diligent (incorporating Galvanize)

- Resolver

- Protiviti

- Dell EMC

- NAVEX Global

- RegEd

Frequently Asked Questions

Analyze common user questions about the Compliance Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Compliance Software Market?

The primary driver is the accelerating complexity and global scope of regulatory mandates (such as data privacy laws, financial reporting standards, and environmental, social, and governance (ESG) rules), coupled with the prohibitively high financial and reputational penalties associated with non-compliance. This makes compliance software a mandatory investment for risk mitigation.

How is AI specifically enhancing the functionality of compliance software?

AI integrates predictive analytics and machine learning to automate continuous control monitoring, conduct real-time transactional surveillance (for AML/KYC), and perform regulatory mapping by instantly analyzing new legal text. This shifts the function from reactive auditing to proactive, predictive risk management, significantly improving accuracy and efficiency.

Which deployment model dominates the Compliance Software Market, and why?

The Cloud (Software-as-a-Service or SaaS) deployment model dominates. SaaS offers superior scalability, lower total cost of ownership (TCO), and the critical ability to instantly update regulatory content across all clients simultaneously, which is essential for managing rapidly changing global mandates.

Which industry vertical is the largest consumer of compliance software?

The Banking, Financial Services, and Insurance (BFSI) sector remains the largest consumer. BFSI operates under the most stringent and detailed regulatory scrutiny concerning market conduct, anti-money laundering (AML), capital adequacy, and consumer protection, necessitating continuous, heavy investment in GRC platforms.

What major challenge do SMEs face in adopting compliance software, and how is the market addressing it?

SMEs traditionally faced barriers due to the high upfront cost and complex implementation of legacy GRC systems. The market is addressing this by offering streamlined, scalable, subscription-based SaaS solutions and specialized industry-specific modules that minimize customization needs and reduce the dependence on in-house technical GRC experts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sales Tax and VAT Compliance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- PCI Compliance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Healthcare Compliance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Compliance Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Audit management, Compliance Management, Risk management, Policy management, Incident management, Others), By Application (Small and Medium Enterprises, Large Enterprises), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Tax Compliance Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Direct Tax Compliance Software, Indirect Tax Compliance Software), By Application (Small Business and Individuals, Midsize Enterprise, Large Enterprise), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager