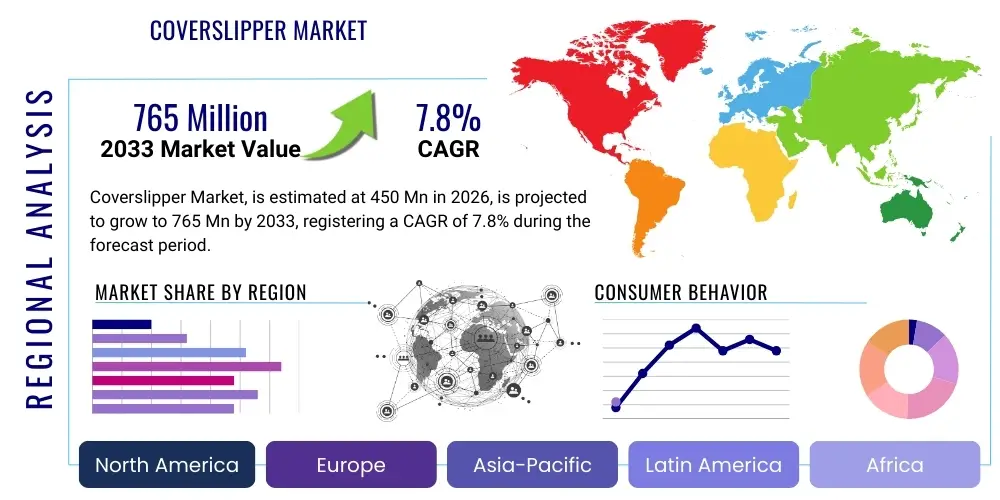

Coverslipper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440368 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Coverslipper Market Size

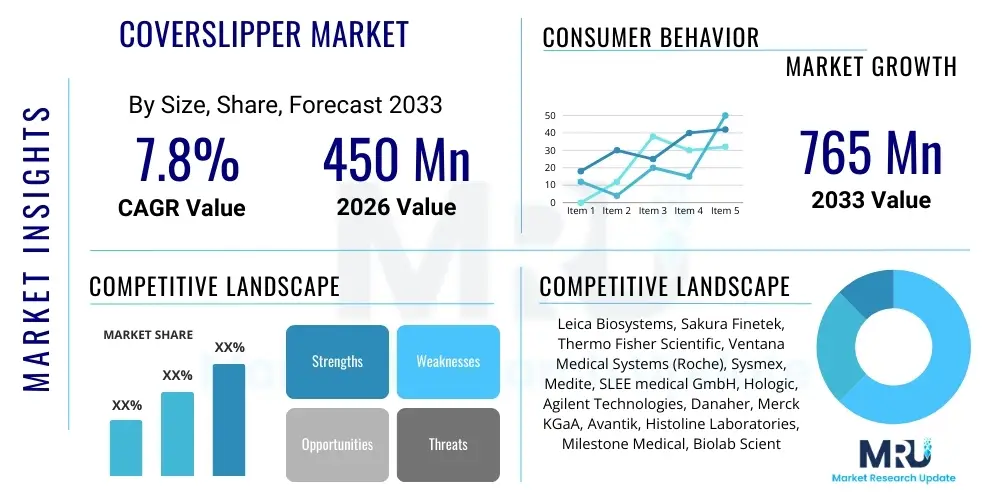

The Coverslipper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 765 Million by the end of the forecast period in 2033. This growth trajectory is underpinned by increasing demand for automated pathology solutions, rising prevalence of chronic diseases necessitating diagnostic testing, and continuous technological advancements aimed at enhancing laboratory efficiency and diagnostic accuracy. The market's expansion reflects a global shift towards streamlined and standardized histological processing in clinical and research settings, driven by the imperative to improve patient outcomes and reduce operational costs associated with manual procedures.

Coverslipper Market introduction

The Coverslipper Market encompasses the global landscape of devices designed to automate the crucial final step in microscopic slide preparation: the application of a coverslip. Coverslippers are indispensable instruments in histopathology and cytology laboratories, providing a standardized, bubble-free, and precise sealing of prepared tissue or cell samples on glass slides, thereby preserving the specimen for microscopic examination and long-term storage. These devices range from manual and semi-automatic systems to highly sophisticated, fully automatic machines that can process hundreds of slides per hour, often integrated with slide stainers to create a seamless workflow. The primary product description highlights their function in ensuring optical clarity, sample integrity, and consistency across diagnostic workflows. Major applications span clinical diagnostics, where they are vital for routine histological and cytological examinations of biopsies and smears, to advanced research settings in academic institutions and pharmaceutical companies for drug discovery, toxicology studies, and disease mechanism investigations. The benefits derived from the adoption of coverslippers are manifold, including significant improvements in laboratory efficiency, standardization of slide quality, reduction in human error, enhanced occupational safety by minimizing exposure to hazardous reagents, and ultimately, a faster turnaround time for diagnostic results. Key driving factors propelling this market include the escalating global burden of chronic diseases such as cancer, demanding accurate and rapid diagnostic services, the persistent shortage of skilled laboratory personnel, and a growing emphasis on laboratory automation to cope with increasing sample volumes and reduce operational costs. Furthermore, continuous technological advancements, particularly in integrating digital imaging and robotic capabilities, are consistently expanding the utility and precision of these devices, making them central to modern pathology practices.

Coverslipper Market Executive Summary

The Coverslipper Market is currently experiencing a robust growth phase, characterized by several pivotal business, regional, and segment trends. From a business perspective, the market is witnessing increased consolidation through mergers and acquisitions, as leading manufacturers seek to expand their product portfolios and geographical reach, offering more comprehensive pathology solutions. Strategic partnerships between technology providers and diagnostic laboratories are also becoming more common, aiming to integrate advanced automation with digital pathology platforms. There is a strong emphasis on research and development, particularly in creating smarter, faster, and more integrated systems that can handle diverse slide types and staining protocols. Furthermore, companies are investing in expanding their distribution networks, especially in emerging economies, to capitalize on their burgeoning healthcare infrastructure. Regionally, North America and Europe continue to dominate the market due to well-established healthcare systems, high adoption rates of advanced diagnostics, and significant R&D investments. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, driven by increasing healthcare expenditure, improving access to diagnostic services, and a rising prevalence of chronic diseases requiring pathological examination. Latin America and the Middle East & Africa also present substantial growth opportunities as their healthcare sectors modernize and embrace automation. Segment-wise, the fully automatic coverslippers segment is experiencing the highest growth, largely attributed to the increasing demand for high-throughput solutions in large diagnostic laboratories and hospitals. The integration of coverslipping functions with automated stainers is a significant trend, offering laboratories a streamlined, single-platform solution. Moreover, the end-user segment of diagnostic laboratories, particularly independent reference laboratories, continues to be the largest consumer of coverslippers, reflecting their critical role in the diagnostic pathway. The market is also seeing a shift towards modular and customizable systems that can adapt to varying laboratory sizes and specific workflow requirements, catering to both high-volume and specialized pathology settings.

AI Impact Analysis on Coverslipper Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to profoundly transform the Coverslipper Market, extending beyond mere automation to intelligent workflow optimization and quality assurance. Common user questions related to AI's impact often revolve around how these technologies can enhance diagnostic accuracy, reduce the need for manual intervention, ensure consistent slide quality, and integrate seamlessly with existing digital pathology ecosystems. Users are keenly interested in predictive maintenance capabilities to minimize downtime, automated error detection to prevent re-processing, and the potential for AI to support complex decision-making processes in pathology. The overriding expectation is that AI will make coverslipping processes not just faster and more efficient, but also significantly more reliable and intelligent, ultimately contributing to more accurate and timely patient diagnoses. The discourse frequently touches upon the role of AI in bridging the gap between physical slide preparation and the digital pathology workflow, fostering a more connected and data-rich laboratory environment where every step, including coverslipping, is optimized through data-driven insights. This shift represents a move towards 'smart pathology labs' where AI acts as a foundational layer for operational excellence.

- AI-powered image analysis integration for pre- and post-coverslipping quality control, ensuring optimal clarity and absence of defects.

- Automated slide quality assessment using computer vision, identifying imperfections like bubbles, dust, or incorrect coverslip placement, reducing manual inspection.

- Predictive maintenance algorithms for coverslipper hardware, anticipating potential failures and scheduling preventive service to minimize operational downtime.

- Enhanced workflow optimization in pathology laboratories through AI-driven scheduling and resource allocation for coverslipping tasks, improving throughput.

- Seamless integration with digital pathology platforms for comprehensive slide management, metadata tagging, and automated archival, connecting the physical and digital domains.

- Data generation and analysis capabilities to monitor coverslipping performance trends, identify bottlenecks, and facilitate continuous process improvement.

- Support for remote diagnostics and telepathology by ensuring high-quality, perfectly prepared slides for digital scanning and virtual analysis.

- Reduced human error by automating complex decision points and minimizing subjective quality assessments, leading to more standardized results.

DRO & Impact Forces Of Coverslipper Market

The Coverslipper Market is shaped by a dynamic interplay of Drivers, Restraints, Opportunities, and a range of Impact Forces that collectively determine its growth trajectory and competitive landscape. The primary drivers fueling market expansion include the increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and infectious diseases, which necessitate a growing volume of diagnostic histopathological and cytopathological examinations globally. This rising disease burden directly translates into a greater demand for efficient and standardized slide preparation methods. Furthermore, the persistent and worsening shortage of skilled histotechnologists and laboratory technicians globally compels diagnostic laboratories to adopt automated solutions to maintain throughput and reduce reliance on manual labor, positioning coverslippers as essential tools. Technological advancements, particularly in integrating robotics, digital imaging, and software controls, are continually enhancing the precision, speed, and reliability of these devices, making them more attractive investments for modern laboratories. Restraints, however, temper this growth. The high initial capital investment required for advanced, fully automatic coverslipping systems can be prohibitive for smaller laboratories or those in developing regions with constrained budgets. The complexity of integrating new automated systems with existing laboratory information systems (LIS) and laboratory management systems (LMS) often presents significant challenges, demanding substantial IT infrastructure and skilled personnel for seamless implementation. Moreover, stringent regulatory frameworks and lengthy approval processes for medical devices can delay market entry for innovative products, while the ongoing need for specialized training and routine maintenance for these sophisticated instruments adds to operational costs. Opportunities for market players are abundant, particularly in emerging markets across Asia Pacific, Latin America, and the Middle East & Africa, where healthcare infrastructure development and increasing healthcare spending are creating new avenues for market penetration. The trend towards personalized medicine and companion diagnostics also creates demand for highly precise and standardized sample preparation, aligning perfectly with the capabilities of advanced coverslippers. Furthermore, the development of compact, cost-effective, and user-friendly systems can unlock market potential in smaller diagnostic centers and research facilities. Impact forces, encompassing competitive intensity, technological disruption, economic fluctuations, and evolving regulatory landscapes, constantly influence market dynamics. Intense competition among key players drives continuous innovation and pricing strategies. The rapid pace of technological advancements, particularly in areas like AI and digital pathology, presents both opportunities for integration and the risk of obsolescence for less adaptive systems. Economic factors, such as healthcare expenditure budgets and reimbursement policies, directly affect purchasing decisions of end-users. Finally, global health crises and geopolitical shifts can disrupt supply chains and alter diagnostic priorities, underscoring the market's sensitivity to broader external conditions.

Segmentation Analysis

The Coverslipper Market is meticulously segmented across various dimensions, providing a granular understanding of its structure, demand patterns, and growth opportunities. This segmentation helps to identify specific market niches, target customer groups, and develop tailored product strategies that cater to the diverse needs of pathology and research laboratories worldwide. The primary segmentation criteria include product type, level of automation, end-user applications, and throughput capacities, each revealing unique market dynamics and competitive landscapes. Analyzing these segments is crucial for stakeholders to accurately gauge market potential, allocate resources effectively, and formulate robust business development plans that address the specific requirements of different laboratory environments, from high-volume clinical diagnostic centers to specialized research facilities. The overarching trend within these segments indicates a strong drive towards greater automation and integration, reflecting the industry's continuous pursuit of enhanced efficiency, standardization, and diagnostic accuracy, while also acknowledging the persistent role of semi-automatic and manual systems in specific settings.

- By Product Type:

- Manual Coverslippers: Entry-level devices requiring significant human intervention for slide loading, reagent dispensing, and coverslip application, typically used in low-volume labs or for specific research needs.

- Semi-Automatic Coverslippers: Offer partial automation, often automating reagent dispensing and coverslip placement while still requiring manual slide loading and unloading, bridging the gap between manual and fully automatic systems.

- Fully Automatic Coverslippers: High-throughput systems capable of completely automating the coverslipping process from slide loading to unloading, often integrated with automated stainers, ideal for high-volume diagnostic laboratories.

- Automated Stainer-Coverslipper Integrated Systems: Combined platforms that perform both staining and coverslipping sequentially without manual intervention, streamlining workflow and minimizing contamination.

- By End-User:

- Hospitals:

- Private Hospitals: Often adopt advanced, fully automatic systems due to larger budgets and high diagnostic volumes.

- Public Hospitals: Balancing budget constraints with increasing patient loads, they adopt a mix of semi-automatic and fully automatic systems.

- Diagnostic Laboratories:

- Independent Reference Laboratories: High-volume processing centers that are early adopters of fully automated, high-throughput coverslippers and integrated systems.

- Hospital-Attached Laboratories: Serve specific hospital needs, often integrating coverslippers with their existing pathology lab infrastructure.

- Research & Academic Institutions:

- Universities: Utilize coverslippers for educational purposes and basic research, often preferring versatile manual or semi-automatic systems.

- Research Centers: Engage in specialized studies, requiring high precision and flexibility, often using a range of coverslippers depending on research focus.

- Pharmaceutical & Biotechnology Companies: Employ coverslippers in drug discovery, toxicology studies, and preclinical research for consistent slide preparation.

- Hospitals:

- By Application:

- Histopathology: The most significant application, involving the preparation of tissue biopsies and surgical specimens for microscopic analysis to diagnose diseases.

- Tissue Biopsy Processing: Essential for preserving tissue sections after staining.

- Surgical Pathology: Critical for rapid and accurate diagnosis during surgical procedures.

- Cytology: Preparing cell samples (e.g., Pap smears, fluid analyses) for microscopic examination.

- Liquid-Based Cytology: Requires precise coverslipping of thin-layer preparations.

- Conventional Cytology: Traditional smear preparations needing consistent coverslipping.

- Immunohistochemistry (IHC): Specialized staining techniques requiring careful coverslipping to preserve antigen-antibody reactions.

- IHC Staining: Ensuring optimal preservation of stained cells.

- Special Stains: Coverslipping for specific diagnostic markers.

- Special Applications: Includes specific neurological, forensic, and veterinary pathology applications.

- Neuropathology: Preparation of brain and nerve tissue.

- Forensic Pathology: Crime scene and medico-legal investigations.

- Histopathology: The most significant application, involving the preparation of tissue biopsies and surgical specimens for microscopic analysis to diagnose diseases.

- By Throughput:

- Low-Throughput Systems: Designed for smaller laboratories or specialized applications with limited slide processing volumes.

- Medium-Throughput Systems: Suitable for mid-sized laboratories requiring moderate slide processing capabilities per hour.

- High-Throughput Systems: Essential for large diagnostic centers and reference laboratories handling high volumes of slides, often capable of processing hundreds of slides hourly.

Value Chain Analysis For Coverslipper Market

The value chain for the Coverslipper Market is a complex ecosystem spanning multiple stages, from raw material sourcing to end-user delivery and post-sales support, each segment contributing to the overall product value and market efficiency. The upstream segment involves the procurement of essential raw materials and components, including precision mechanical parts, optical components, electronic circuits, software modules, and specialized reagents like mounting media and coverslips. Key upstream players include manufacturers of sophisticated motors, sensors, microcontrollers, and precision-machined plastics and metals, along with suppliers of high-quality glass coverslips and specialized resins for mounting media. The quality and reliability of these upstream inputs are paramount for the performance and longevity of the coverslipper devices. Downstream activities focus on the distribution, sales, and post-purchase services of coverslippers to end-users. Distribution channels are varied and typically involve a mix of direct sales forces from major manufacturers, particularly for large institutional clients, and a network of specialized distributors and resellers who cater to a broader range of laboratories, often providing localized support and faster delivery. Indirect channels, such as online marketplaces for laboratory equipment, are gaining traction, especially for smaller or refurbished units, though direct sales and specialized distributors remain dominant due to the need for installation, training, and maintenance. The after-sales support segment, including technical service, maintenance contracts, spare parts availability, and customer training, is a critical component of the value chain, ensuring customer satisfaction and device longevity. Manufacturers often invest heavily in building robust service networks to differentiate themselves in a competitive market. Furthermore, the value chain is increasingly influenced by partnerships between coverslipper manufacturers and providers of other pathology equipment, such as automated stainers and digital pathology scanners, aiming to offer integrated, end-to-end solutions that enhance workflow efficiency and provide a holistic diagnostic ecosystem. This integration minimizes interoperability issues and provides a seamless experience for laboratories, further solidifying the value proposition. Overall, optimization across the entire value chain, from high-quality component sourcing to efficient distribution and robust post-sales support, is essential for sustained market growth and competitive advantage in the coverslipper industry.

Coverslipper Market Potential Customers

The potential customers for coverslippers are primarily entities within the healthcare and life sciences sectors that require precise and consistent preparation of microscopic slides for diagnostic, research, or quality control purposes. These end-users, or buyers of the product, encompass a broad spectrum of laboratories with varying needs regarding throughput, automation level, and specialized applications. The largest segment of potential customers includes hospitals, both private and public, which house pathology departments that process a vast number of biopsies and cytology samples daily. Their demand for coverslippers is driven by the need for rapid turnaround times, high accuracy in diagnostics, and improved efficiency to manage escalating patient loads. Diagnostic laboratories, especially large independent reference laboratories, represent another significant customer base. These commercial entities often handle extremely high volumes of samples from multiple healthcare providers and thus prioritize fully automatic, high-throughput coverslipping systems that can integrate seamlessly with their laboratory information management systems (LIMS) to ensure standardization and traceability. Research and academic institutions, including university pathology departments, biomedical research centers, and government-funded research organizations, also constitute a vital customer segment. These facilities utilize coverslippers for a wide array of experimental studies, disease mechanism investigations, and educational purposes, often requiring versatile systems that can accommodate different slide types and experimental protocols. Furthermore, pharmaceutical and biotechnology companies are key potential customers, employing coverslippers in their drug discovery pipelines, preclinical toxicology studies, and biomarker development efforts. For these companies, consistent and high-quality slide preparation is crucial for accurate data generation and regulatory compliance. Beyond these primary segments, other niche customers include forensic laboratories, veterinary pathology clinics, and certain industrial quality control laboratories that require microscopic analysis of prepared samples. The specific needs of these diverse customer groups, such as budget constraints, sample volume, existing infrastructure, and the level of technical expertise available, dictate their preference for manual, semi-automatic, or fully automatic coverslipping solutions, influencing market segmentation and product development strategies by manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 765 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leica Biosystems, Sakura Finetek, Thermo Fisher Scientific, Ventana Medical Systems (Roche), Sysmex, Medite, SLEE medical GmbH, Hologic, Agilent Technologies, Danaher, Merck KGaA, Avantik, Histoline Laboratories, Milestone Medical, Biolab Scientific, Diapath S.p.A., General Data Company, Qualtek, Bio-Optica Milano, Cardinal Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coverslipper Market Key Technology Landscape

The Coverslipper Market is characterized by a rapidly evolving technological landscape, with innovations continuously driving improvements in efficiency, precision, and integration within pathology workflows. At the core of modern coverslipping technology lies sophisticated robotic automation, enabling precise handling of delicate slides, accurate dispensing of mounting media, and consistent application of coverslips without manual intervention. This robotic precision minimizes human error, reduces repetitive strain injuries for laboratory personnel, and ensures standardized slide quality across high volumes. Advanced optical sensing systems are routinely incorporated to detect slide edges, verify coverslip presence, and even perform rudimentary quality checks for bubbles or debris, thereby enhancing reliability. Digital imaging capabilities are becoming increasingly vital, allowing for pre- and post-coverslipping image capture, which aids in quality control and provides a digital record of each slide. Integrated software solutions play a critical role, providing intuitive user interfaces, managing customizable protocols for different slide types and mounting media, and enabling seamless connectivity with Laboratory Information Systems (LIS) or Laboratory Management Systems (LIMS). This connectivity facilitates automated data logging, tracking, and remote monitoring, crucial for efficient laboratory operations and compliance. Barcode scanning technology is universally adopted for automated slide identification and traceability, ensuring accurate patient sample management from staining to archival. Furthermore, the growing convergence with digital pathology platforms necessitates coverslippers that can prepare slides optimized for high-resolution scanning, ensuring flatness and optical clarity. Emerging technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are beginning to influence the coverslipper landscape, particularly for advanced quality control, predictive maintenance, and optimizing workflow parameters in real-time. These intelligent systems analyze patterns in slide preparation to anticipate and correct potential issues, further enhancing consistency and reducing re-processing rates. The development of environmentally friendly mounting media and solvent-free coverslipping processes also represents a significant technological shift, driven by sustainability concerns and health safety regulations. Overall, the key technology landscape is defined by automation, precision engineering, digital integration, and increasingly, intelligent algorithms, all aimed at creating more efficient, reliable, and integrated solutions for modern pathology laboratories.

Regional Highlights

- North America: This region consistently holds a dominant share in the Coverslipper Market, driven by its highly developed healthcare infrastructure, substantial healthcare expenditure, and a strong emphasis on advanced diagnostics. The presence of leading market players, early adoption of laboratory automation, high prevalence of chronic diseases necessitating extensive pathological testing, and significant investments in research and development activities contribute to its leading position. The demand is particularly high from large hospital networks and independent diagnostic reference laboratories that prioritize high-throughput and integrated solutions to manage vast sample volumes.

- Europe: Europe represents another major market for coverslippers, characterized by an aging population, a rising incidence of cancer, and a well-established network of public and private healthcare facilities. Strict regulatory standards for medical devices and laboratory practices often drive the adoption of high-quality, reliable automated systems. Countries like Germany, France, and the UK are at the forefront of adopting advanced pathology solutions, supported by significant government funding for healthcare and strong academic research institutions that contribute to technological innovation.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, primarily due to the rapid expansion of healthcare infrastructure, increasing disposable incomes, and a burgeoning awareness of advanced diagnostic techniques. Countries such as China, India, Japan, and South Korea are witnessing substantial investments in modernizing pathology laboratories and expanding access to diagnostic services. The vast population base, coupled with a rising burden of chronic diseases, creates immense opportunities for market penetration. Government initiatives to improve healthcare accessibility and quality further fuel the adoption of automated coverslipping solutions.

- Latin America: This region is an emerging market with significant growth potential, albeit from a smaller base. Factors contributing to growth include improving healthcare access, increasing governmental and private sector investments in healthcare infrastructure, and a growing demand for advanced diagnostic services in countries like Brazil, Mexico, and Argentina. The market here is characterized by a gradual shift from manual to semi-automatic and fully automatic systems as laboratories seek to enhance efficiency and standardize their processes.

- Middle East and Africa (MEA): The MEA region presents developing opportunities, with significant investments in healthcare infrastructure development, particularly in GCC countries, driving the adoption of modern laboratory equipment. Increasing awareness about early disease diagnosis and the expansion of diagnostic facilities are key growth drivers. While the market is still in its nascent stages compared to developed regions, the focus on diversifying economies and improving healthcare services is expected to steadily boost the demand for coverslippers in the coming years.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coverslipper Market.- Leica Biosystems

- Sakura Finetek

- Thermo Fisher Scientific

- Ventana Medical Systems (Roche Diagnostics)

- Sysmex Corporation

- Medite GmbH

- SLEE medical GmbH

- Hologic, Inc.

- Agilent Technologies

- Danaher Corporation

- Merck KGaA

- Avantik (Previously part of Boekel Scientific)

- Histoline Laboratories

- Milestone Medical

- Biolab Scientific

- Diapath S.p.A.

- General Data Company, Inc.

- Qualtek

- Bio-Optica Milano S.p.A.

- Cardinal Health

Frequently Asked Questions

Analyze common user questions about the Coverslipper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a coverslipper and why is it essential in pathology?

A coverslipper is a laboratory instrument used to automatically apply a thin glass or plastic coverslip onto a prepared microscope slide, sealing the specimen. It is essential in pathology for preserving tissue and cell samples, preventing damage, ensuring optical clarity for microscopic examination, and standardizing slide preparation, which is critical for accurate diagnosis and long-term archival.

What are the main types of coverslippers available in the market?

The Coverslipper Market primarily offers three main types: manual, semi-automatic, and fully automatic coverslippers. Manual systems require complete human intervention, semi-automatic systems automate some steps like reagent dispensing, while fully automatic systems handle the entire process from slide loading to unloading, often integrated with stainers for high-throughput laboratories.

How does automation in coverslipping benefit pathology laboratories?

Automation in coverslipping significantly benefits pathology laboratories by increasing efficiency and throughput, reducing manual labor and the risk of human error, improving slide quality consistency, minimizing technician exposure to hazardous chemicals, and providing a faster turnaround time for diagnostic results. It leads to standardized, high-quality slides critical for reliable diagnosis.

What is the role of digital pathology in the evolution of coverslipper technology?

Digital pathology drives the evolution of coverslipper technology by demanding perfectly prepared, optically clear, and bubble-free slides optimized for high-resolution scanning. Coverslippers are integrating features like advanced imaging and software connectivity to ensure slides are ideal for digital conversion, enabling remote diagnosis, AI-powered analysis, and seamless data management within digital pathology workflows.

What are the key factors driving the growth of the Coverslipper Market?

Key factors driving market growth include the increasing global prevalence of chronic diseases, particularly cancer, necessitating more diagnostic tests; the rising demand for laboratory automation to improve efficiency and reduce human error; a persistent shortage of skilled histotechnologists; and continuous technological advancements in automation, imaging, and software integration within pathology solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automatic Coverslipper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Coverslipper Market Size Report By Type (Glass Coverslipper , Film Coverslipper), By Application (Small Sized Hospital, Medium Sized Hospital, Large Sized Hospital, Mega Sized Hospital, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager