Coworking Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432339 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Coworking Market Size

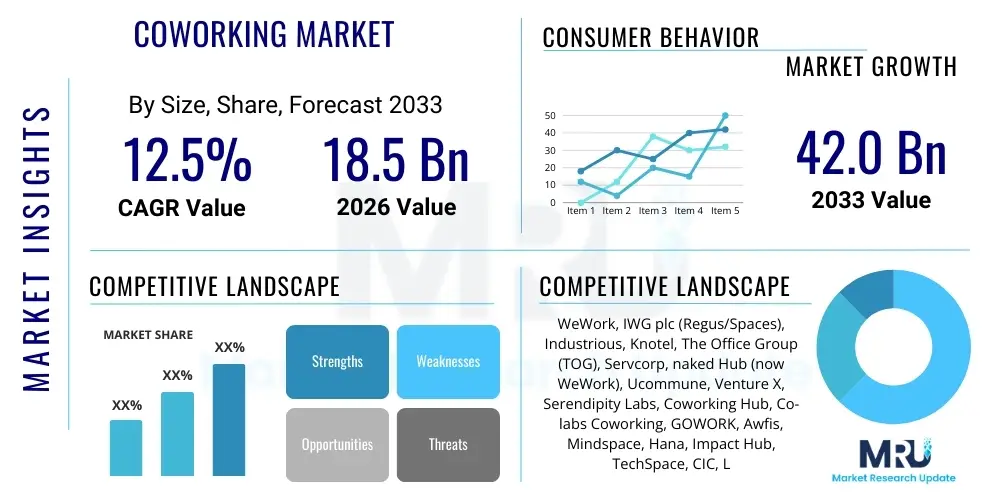

The Coworking Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $42.0 Billion by the end of the forecast period in 2033.

Coworking Market introduction

The Coworking Market encompasses the provision of shared office spaces and flexible workspace solutions to individuals, freelancers, startups, small and medium-sized enterprises (SMEs), and increasingly, large corporations. This market is defined by flexible lease terms, community-focused environments, and integrated amenities such as high-speed internet, meeting rooms, and administrative support. The product offering typically ranges from open, hot-desking areas to dedicated private offices and tailored managed solutions, catering to diverse professional needs and operational scales. The fundamental value proposition of coworking spaces lies in reducing capital expenditure on fixed real estate while fostering collaboration and professional networking.

Major applications for coworking services span technology, consulting, creative industries, and professional services, acting as a crucial infrastructure layer supporting the gig economy and hybrid work models. The primary benefits include operational flexibility, cost efficiency, scalability, and access to a vibrant, curated professional community that enhances employee engagement and innovation. The shift away from traditional, long-term leases towards an agile real estate strategy is a major driver, particularly for businesses navigating fluctuating market conditions and seeking immediate, customizable workspace solutions across multiple geographies. Furthermore, the enhanced focus on employee experience and work-life balance post-2020 has significantly boosted demand for localized, high-quality flexible workspaces.

Key driving factors fueling sustained market growth include rapid urbanization and the corresponding high cost of commercial real estate, necessitating cost-effective alternatives for businesses. Secondly, the widespread adoption of remote and hybrid work policies by major global organizations has created a structural need for decentralized hub-and-spoke office models, often serviced by coworking operators. Lastly, the maturation of technology platforms simplifying booking, management, and community interaction within these spaces contributes to operational efficiency and customer satisfaction, solidifying the coworking model as a permanent fixture in the global commercial real estate ecosystem.

Coworking Market Executive Summary

The global Coworking Market exhibits robust momentum, primarily driven by seismic shifts in corporate real estate strategies emphasizing flexibility and decentralization. Current business trends indicate a significant bifurcation in demand: while freelancers and startups remain core customers, the primary growth impetus now stems from large enterprises utilizing coworking spaces for satellite offices, project teams, and core-and-flex strategies. This institutional adoption is demanding higher standards of security, privacy, and technology integration within flexible workspaces, pushing operators towards offering more premium, managed office solutions alongside traditional open plans. Geographically, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid entrepreneurial activity and governmental support for digital infrastructure, although North America and Europe continue to hold the largest market shares due to established ecosystems and the early adoption of hybrid work models. Operators are strategically focusing on suburban and secondary city locations to cater to the distributed workforce, moving beyond historically saturated central business districts (CBDs).

Segment trends reveal that the Private Office segment is registering the most significant growth in terms of revenue, reflecting the enhanced corporate requirement for dedicated, secure spaces coupled with the convenience of coworking amenities. The Managed Office space application, where operators provide fully customized and branded spaces under a flexible term for a single large client, is becoming a dominant model for enterprise engagement. Technology integration, particularly focusing on frictionless access control, environmental monitoring (IoT), and seamless meeting room management, is critical for competitive differentiation. Moreover, the market is undergoing consolidation, with major global players acquiring smaller, specialized regional providers to rapidly expand their geographic footprint and service breadth. This competitive environment is forcing mid-tier operators to specialize, often targeting specific industry verticals or niche community demographics to maintain relevance.

Investment trends highlight substantial capital flowing into 'Space-as-a-Service' models, attracting both traditional real estate asset owners and technology venture capital. Investors are increasingly viewing coworking operators not merely as tenants but as crucial technology and service providers enabling future-of-work solutions. Regulatory environments in developed markets are slowly adapting to flexible workspace leases, improving the financial transparency and long-term viability of coworking investments. Overall, the market trajectory is highly positive, shifting from a niche disruptor to an essential component of modern business infrastructure, driven by the enduring corporate need for operational agility and the continuing evolution of employee expectations regarding where and how work is performed.

AI Impact Analysis on Coworking Market

User queries regarding AI's influence on the Coworking Market primarily revolve around operational efficiency, personalized service delivery, and the potential displacement of administrative roles. Common concerns focus on how AI can automate community management tasks, optimize space utilization in real-time, and enhance security without compromising the human element that defines coworking culture. Users frequently ask about AI-driven predictive maintenance for building systems, smart meeting room booking optimization based on historical usage patterns, and the creation of highly personalized member journeys, from initial onboarding to networking recommendations. The underlying expectation is that AI will be a cost reduction tool for operators and an experience enhancement tool for members, creating 'smarter' buildings and fostering more meaningful professional connections through advanced data analytics.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational paradigm of coworking spaces, moving them closer to being technology platforms rather than just physical locations. AI algorithms are crucial for yield management, dynamically pricing hot desks and meeting rooms based on real-time demand, local competitive data, and seasonal fluctuations, maximizing occupancy and revenue per square foot. Furthermore, AI-powered chatbots and virtual assistants are streamlining member services, handling routine requests for IT support, booking changes, and amenity information instantly, freeing up community managers to focus on high-value engagement activities. This integration is essential for maintaining high service levels while scaling operations efficiently across multiple locations globally, establishing a new baseline for operational excellence in the sector.

Beyond internal operations, AI also impacts the tenant experience by facilitating intelligent networking and community building. ML models analyze member profiles, industry affiliations, and behavioral data (e.g., resources utilized, events attended) to recommend relevant connections, collaborators, or potential business partners within the ecosystem. This ability to proactively foster beneficial relationships moves coworking beyond shared infrastructure toward becoming a curated business accelerator. Simultaneously, AI enhances physical security through advanced facial recognition for access control, anomaly detection in surveillance footage, and predictive maintenance scheduling for HVAC and electrical systems, ensuring a seamless, safe, and sustainable physical environment for all members.

- Yield Management Optimization: AI algorithms dynamically adjust pricing for desks and rooms based on real-time occupancy data and demand forecasts, maximizing revenue yield.

- Predictive Space Utilization: ML models analyze historical check-in data to predict peak hours and resource bottlenecks, allowing operators to proactively allocate staff and resources.

- Automated Member Support: AI chatbots handle initial inquiries, technical support requests, and facility issues, providing instant 24/7 responsiveness and reducing operational overhead.

- Intelligent Community Matching: Algorithms analyze member skills, goals, and needs to suggest relevant professional connections and collaborative opportunities, enhancing the networking value proposition.

- Smart Building Management: Integration with IoT sensors and AI facilitates automated climate control, lighting optimization, and predictive maintenance, lowering utility costs and improving environmental sustainability.

- Enhanced Security and Access: Facial recognition and smart access control systems powered by AI streamline entry/exit and monitor suspicious activity in real-time, improving overall site security.

DRO & Impact Forces Of Coworking Market

The Coworking Market is strongly influenced by a combination of powerful drivers, significant restraints, and emerging opportunities, collectively shaping its strategic direction. Primary drivers include the global pivot towards hybrid work models, reducing reliance on expensive, fixed real estate portfolios, and the corresponding corporate desire for flexibility and scalability in workforce management. Restraints often center around high capital expenditure required for prime real estate acquisition or conversion, the inherent dependence on reliable, high-speed technological infrastructure, and the challenge of maintaining brand consistency and service quality across widely distributed locations. Opportunities lie in penetrating secondary and tertiary markets, developing highly specialized vertical-focused spaces (e.g., biotech labs, media production suites), and leveraging data analytics to offer 'Space-as-a-Service' models that deeply integrate technology with physical space management. These dynamic forces result in market volatility but also promote constant innovation in service delivery and technological deployment, fundamentally changing the interaction between landlords, tenants, and space users.

Detailed Analysis of Drivers

The primary driver for the expansion of the Coworking Market is the institutional recognition that flexible workspace solutions offer a superior alternative to traditional leases in an environment characterized by rapid business change. Corporate occupiers are actively seeking to shift from fixed costs to variable, usage-based expenditures, a move heavily facilitated by flexible operators. This transition is not merely about cost reduction; it is a strategic response to talent management, as employees increasingly demand the choice and convenience offered by decentralized work locations closer to home. The integration of coworking options into corporate real estate portfolios is now viewed as an essential talent retention and attraction strategy, positioning flexibility as a core business infrastructure requirement rather than a peripheral amenity.

Furthermore, globalization and the resulting necessity for multinational corporations to establish rapid operational footprints in new territories without undertaking lengthy, expensive traditional lease negotiations substantially drives demand. Coworking spaces provide immediate, fully equipped, and compliant entry points into new markets, drastically accelerating time-to-market for international expansion efforts. This efficiency is coupled with the community aspect, which is a powerful driver for small businesses and startups seeking crucial networking opportunities, mentorship, and a professional environment that fuels productivity and combat the isolation often associated with fully remote work. The collective weight of corporate demand for flexibility, employee demand for choice, and startup needs for community establishes a strong, resilient market foundation.

- Shift to Hybrid Work Models: Corporate adoption of distributed work structures necessitates flexible satellite offices and meeting hubs.

- Real Estate Cost Reduction: Coworking minimizes capital expenditure on office fit-outs and converts fixed rental costs into variable operational costs.

- Scalability and Flexibility: Businesses can rapidly scale up or down office requirements without lengthy contractual burdens, crucial for startups and fluctuating project teams.

- Community and Networking Value: The curated professional environment attracts freelancers and SMEs seeking collaboration and business development opportunities.

- Urbanization and Property Costs: High commercial property values in major metropolitan areas make shared, optimized spaces the only viable economic solution for many businesses.

Detailed Analysis of Restraints

One of the most significant restraints facing the Coworking Market is the high capital intensity associated with acquiring or leasing prime commercial properties and executing necessary high-quality fit-outs. Coworking operators often bear substantial upfront costs related to technology installation, aesthetic design, and furnishing, which require significant external financing. This creates financial vulnerability, especially during economic downturns or periods of unexpectedly low occupancy, exemplified by challenges faced during global health crises where lease obligations remained fixed while revenue sharply declined. This high operating leverage exposes operators to market fluctuations and requires sophisticated financial management and robust balance sheets to sustain growth.

Moreover, the risk of brand dilution and inconsistency in service quality across vast, decentralized networks poses a continuous management challenge. As operators expand rapidly, maintaining the curated, high-touch community experience that defines the value proposition becomes difficult, potentially leading to member dissatisfaction. Security and data privacy concerns also represent a major restraint; shared spaces inherently raise complexities related to network security, physical access control, and ensuring confidentiality for large enterprise clients handling sensitive information. Convincing major corporations that shared infrastructure meets their rigorous compliance and security standards requires ongoing investment and certification, limiting the immediate adoption rate among highly regulated industries.

- High Capital Investment: Significant upfront costs for real estate acquisition, construction, and high-spec fit-outs pose a financial burden.

- Dependency on Occupancy Rates: Profitability is heavily reliant on maintaining high utilization, making operators vulnerable to economic shocks and competition.

- Security and Privacy Concerns: Shared infrastructure raises security issues, potentially deterring large corporate clients with strict data confidentiality requirements.

- Regulatory Complexity: Navigating varied local zoning laws, lease regulations, and liability standards across multiple global jurisdictions can impede rapid expansion.

- Market Saturation in CBDs: Intense competition in prime central business districts leads to price wars and diminishing profit margins in established areas.

Detailed Analysis of Opportunities

The greatest opportunities for market expansion lie in the strategic penetration of underserved geographic areas, specifically secondary and tertiary cities, and suburban centers where the working population lives. The rise of the ‘15-minute city’ concept means there is increasing demand for professional, localized workspaces that drastically cut down commute times. Operators can capitalize on this by forming strategic partnerships with local property developers and residential landlords to integrate small-format, convenient coworking hubs into mixed-use developments, providing flexible access to professionals who previously commuted daily to distant CBDs.

A second major opportunity involves specialization and vertical market targeting. Rather than offering generic services, operators are increasingly focusing on niche segments such as life sciences, creative arts, fintech, or manufacturing. These specialized spaces require unique infrastructure (e.g., labs, sound stages, high-power computing), allowing operators to command premium pricing and create highly sticky, high-value communities. Furthermore, the massive amount of utilization data generated by smart coworking environments presents an unparalleled opportunity for data monetization, where operators can leverage insights into workforce trends, space usage efficiency, and employee behavior to advise corporate clients on their broader real estate strategies, effectively positioning themselves as strategic real estate consultants.

- Suburban and Secondary Market Expansion: Tapping into demand in residential zones to cater to decentralized workforces.

- Vertical Specialization: Creating niche spaces (e.g., Bio-labs, Art Studios, Fintech Hubs) that offer specialized infrastructure and command premium rates.

- Managed Office Solutions (Enterprise Focus): Providing bespoke, fully managed, and branded spaces to single large corporations under flexible contracts.

- Integration with Smart City Infrastructure: Leveraging IoT and AI to develop highly efficient, sustainable, and data-driven workspace environments.

- Partnerships with Traditional Real Estate: Collaborating with conventional landlords to manage the flexible component of their properties, expanding operator reach without heavy capital outlay.

Impact Forces Analysis

The overall impact of these forces is driving rapid maturation in the Coworking Market. The convergence of high corporate demand (Drivers) and the need for capital optimization (Opportunities) is offsetting the risks associated with high upfront costs and security concerns (Restraints). Technology acts as the primary enabling force, mitigating the impact of high operational costs through efficiency gains (AI analysis), while the demand for flexibility pushes operators toward stronger financial models like asset-light management agreements rather than capital-intensive leases. The market is shifting from a purely transactional business to a service-heavy, relationship-driven sector where technological competency and consistent service quality are the key determinants of long-term success. Geopolitical stability and global economic growth remain pivotal exogenous forces; any widespread economic contraction could significantly dampen corporate spending on non-essential flexible space, emphasizing the need for robust, long-term enterprise contracts to buffer against market volatility.

Segmentation Analysis

The Coworking Market segmentation provides a crucial framework for understanding the diverse consumer base and the varied solutions offered by the industry. The market is primarily segmented by Type (Open Workspace, Private Offices, Hybrid), End-User (Freelancers, SMEs, Large Enterprises), and Application (Conventional Coworking Spaces, Managed Office Spaces, Virtual Offices). Analyzing these segments reveals shifting demand dynamics, particularly the move towards more dedicated and secure options like private offices and managed solutions, driven by the increased participation of large corporate clients. This granular analysis is essential for operators to tailor their offerings, optimize pricing strategies, and allocate resources effectively to capture the highest growth potential across different customer demographics and service preferences.

- By Type:

- Open Workspace (Hot Desks, Dedicated Desks)

- Private Offices (Serviced Offices)

- Hybrid/Flex Space (A mix of open and private areas tailored for team needs)

- By End-User:

- Freelancers and Individual Professionals

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises (Corporations)

- By Application:

- Conventional Coworking Spaces (Multi-tenant, community-focused)

- Managed Office Spaces (Bespoke, single-client, flexible solutions)

- Virtual Offices and On-Demand Services

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Coworking Market

The Coworking Market value chain begins with upstream activities centered on real estate sourcing and development. This includes securing suitable locations, either through long-term leases, acquisitions, or asset-light management agreements, followed by complex architectural design and high-quality fit-out involving construction firms, furniture suppliers, and advanced IT infrastructure providers. Effective upstream management focuses on maximizing space efficiency, minimizing capital expenditure, and ensuring that the physical assets are future-proofed with smart building technology. Strategic partnerships with landlords and developers are crucial at this stage to optimize capital deployment and ensure favorable lease terms, forming the foundation of the operator's physical network.

Midstream activities involve core operations management, including facilities maintenance, technology deployment, and, most importantly, community management. This is the stage where the operator adds primary value through service delivery. Downstream activities focus on sales, marketing, and customer relationship management (CRM). This involves direct sales efforts targeting large enterprises, managing digital marketing campaigns to attract individual members, and administering the booking and billing processes. Distribution channels in this market are predominantly direct—via the operator's proprietary sales teams and online platforms. However, indirect channels, such as brokerage firms specializing in flexible space and third-party aggregation platforms (e.g., LiquidSpace, Coworker), play an increasing role in matching supply with large-scale corporate demand, providing an essential layer of market discovery and comparison for enterprise clients seeking global coverage.

Coworking Market Potential Customers

Potential customers, or end-users, of the Coworking Market are segmented into distinct groups based on their size, operational needs, and financial flexibility. Freelancers and individual professionals represent the traditional core customer base, valuing affordability, networking opportunities, and a structured work environment alternative to working from home. Small and Medium-sized Enterprises (SMEs) constitute a critical and rapidly growing segment; they require dedicated office space for growing teams but lack the capital or desire for long-term lease commitments, relying on coworking for quick scalability and access to premium amenities.

The most lucrative segment, however, is Large Enterprises (Corporations). These global companies utilize coworking spaces for various strategic purposes: establishing satellite offices in decentralized locations, housing specialized project teams requiring high flexibility, and implementing 'core-and-flex' strategies where a smaller core traditional office is supplemented by flexible memberships across a broad network. The rising demand from this enterprise segment is driving operators to invest heavily in security, dedicated IT infrastructure, and robust reporting capabilities, seeking flexible solutions that mirror the high standards of a traditional corporate headquarters. Consulting firms, technology developers, and professional services are particularly significant buyers of managed and dedicated private office solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $42.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WeWork, IWG plc (Regus/Spaces), Industrious, Knotel, The Office Group (TOG), Servcorp, naked Hub (now WeWork), Ucommune, Venture X, Serendipity Labs, Coworking Hub, Co-labs Coworking, GOWORK, Awfis, Mindspace, Hana, Impact Hub, TechSpace, CIC, LiquidSpace, Rise Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coworking Market Key Technology Landscape

The technological evolution within the Coworking Market is centered on creating frictionless, highly efficient, and personalized user experiences while providing operators with robust management and analytical tools. The foundation of this landscape is the proliferation of IoT (Internet of Things) devices, which enable 'smart space' functionality. These technologies include smart lighting and climate control sensors that optimize energy consumption based on real-time occupancy, digital access control systems (mobile key cards, facial recognition), and integrated AV equipment in meeting rooms. The primary objective is to automate routine operational tasks and reduce human intervention, leading to significant cost savings and improved environmental sustainability metrics for the physical space.

Central to the modern coworking technology stack is the Member Management Software (MMS) or proprietary platform, which acts as the digital backbone connecting all physical and service layers. This platform manages bookings, billing, access control, and facilitates community interaction via a unified mobile application. Advanced platforms now integrate sophisticated data analytics and Machine Learning (ML) capabilities to track utilization metrics across the entire portfolio, providing actionable insights into peak demand periods, amenity usage, and member churn prediction. This allows operators to shift from reactive facility management to proactive, data-driven revenue and capacity planning, significantly boosting operational scalability and profitability.

Furthermore, the increased emphasis on hybrid and virtual offerings necessitates robust Cloud Computing infrastructure and high-speed, secure network connectivity (5G ready infrastructure and dedicated enterprise-grade VPN services). Virtual office services require sophisticated VoIP and communication platforms seamlessly integrated with physical meeting rooms, enabling global connectivity and remote collaboration. For enterprise clients, the technology landscape must also include certified security layers and compliance tools (like GDPR readiness and SOC 2 compliance) to assure them that their sensitive business operations can be securely conducted within a shared environment, solidifying the transition of coworking spaces into essential components of the modern corporate IT and real estate infrastructure.

Regional Highlights

The global Coworking Market exhibits significant regional variations in maturity, growth trajectory, and customer demands. North America, particularly the United States, holds the largest market share, characterized by mature operational models, high enterprise adoption rates, and intense competition among established global players. The regional focus is heavily tilted towards high-end, premium managed solutions catering to tech firms and large corporations adopting hub-and-spoke strategies. The market in North America benefits from a highly developed venture capital ecosystem and a culture that rapidly adopts flexible work arrangements, necessitating constant innovation in service delivery and technology integration to maintain competitive differentiation.

Europe represents a highly fragmented yet rapidly consolidating market, where regulatory differences and diverse national cultures influence market development. Western Europe (UK, Germany, France) is highly mature, focusing on integrating sustainability (Green Buildings) and high-quality design into their offerings. Eastern European nations are witnessing accelerated growth driven by lower operating costs and burgeoning tech hubs. The core demand across Europe stems from SMEs and a strong culture of individual entrepreneurship, although enterprise penetration is steadily increasing. Operators must navigate complex labor laws and distinct regional preferences for office design and community style.

Asia Pacific (APAC) is projected to be the fastest-growing region globally, fueled by robust economic development, rapid urbanization, and a massive demographic of young, mobile professionals. Key growth markets include India, China, and Southeast Asian nations like Singapore and Indonesia. Unlike Western markets, APAC often sees higher governmental involvement in promoting tech and startup ecosystems, sometimes leading to strategic partnerships with coworking operators. Demand here is characterized by extremely high density usage, reliance on mobile-first technology solutions, and a strong preference for community-focused spaces. Challenges in APAC include navigating diverse bureaucratic requirements and securing prime real estate in extremely dense and expensive urban centers.

Latin America and the Middle East & Africa (MEA) are emerging markets for coworking, showing substantial potential but facing structural challenges. In MEA, growth is concentrated in key financial hubs like Dubai, Abu Dhabi, and Riyadh, where government diversification initiatives are fueling startup activity. Demand is highly premium-focused, catering to multinational corporations and high-net-worth individuals. Latin America sees strong localized growth, often driven by economic instability pushing businesses toward flexible, short-term commitments. Both regions require operators to adapt to volatile economic conditions and varied levels of digital infrastructure penetration, focusing expansion on metropolitan centers where connectivity and talent concentration are highest.

- North America: Market leader focused on enterprise solutions and premium managed offices; driven by tech sector demand for highly flexible, secure workspaces and hub-and-spoke models.

- Europe: Mature but fragmented market emphasizing specialization, sustainability (ESG compliance), and high-quality design; strong adoption across SMEs and professional services in Western regions.

- Asia Pacific (APAC): Fastest growing region; characterized by high urbanization rates, mobile-first operations, and rapid expansion in major hubs like India and China, heavily influenced by entrepreneurial government policies.

- Latin America: Emerging market driven by cost sensitivity and economic volatility; demand concentrated in major cities (Sao Paulo, Mexico City) where operational flexibility is highly valued.

- Middle East and Africa (MEA): Growth tied to diversification strategies in oil-rich economies (UAE, Saudi Arabia); demand is generally high-end, serving expatriate professionals and expanding global corporations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coworking Market.- IWG plc (Regus, Spaces)

- WeWork

- Industrious

- The Office Group (TOG)

- Servcorp

- Knotel

- Ucommune

- Awfis

- Mindspace

- Venture X

- Serendipity Labs

- GOWORK

- Impact Hub

- Hana (CBRE)

- TechSpace

- Hub Australia

- Workbar

- Capital Factory

- Convene

- LiquidSpace

Frequently Asked Questions

Analyze common user questions about the Coworking market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Coworking Market CAGR between 2026 and 2033?

The Coworking Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, indicating robust growth driven by the shift towards flexible workspace models.

How is AI primarily impacting coworking space operations?

AI is primarily used to enhance operational efficiency and member experience by enabling dynamic pricing (yield management), optimizing space utilization through predictive analytics, and automating routine administrative and support tasks via smart building systems and chatbots.

Which end-user segment is driving the most significant revenue growth?

While SMEs and freelancers remain core customers, Large Enterprises are driving the most significant revenue growth, specifically through demand for dedicated Private Offices and Managed Office Solutions that offer security and scalability on flexible terms.

What are the main restraints hindering market growth?

Major restraints include the high upfront capital expenditure required for premium real estate fit-outs, the inherent financial vulnerability linked to maintaining high occupancy rates across diverse portfolios, and addressing complex security and data privacy concerns for enterprise clients.

Which geographical region is forecast to experience the fastest growth?

The Asia Pacific (APAC) region is forecasted to experience the fastest growth due to rapid urbanization, increasing governmental support for startup ecosystems, and a large population of young professionals rapidly adopting flexible working arrangements across major economic hubs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Coworking Space Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Coworking Space Management Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud-Based, On-Premise), By Application (Large Enterprises, SMEs), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager