CPU Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434520 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

CPU Market Size

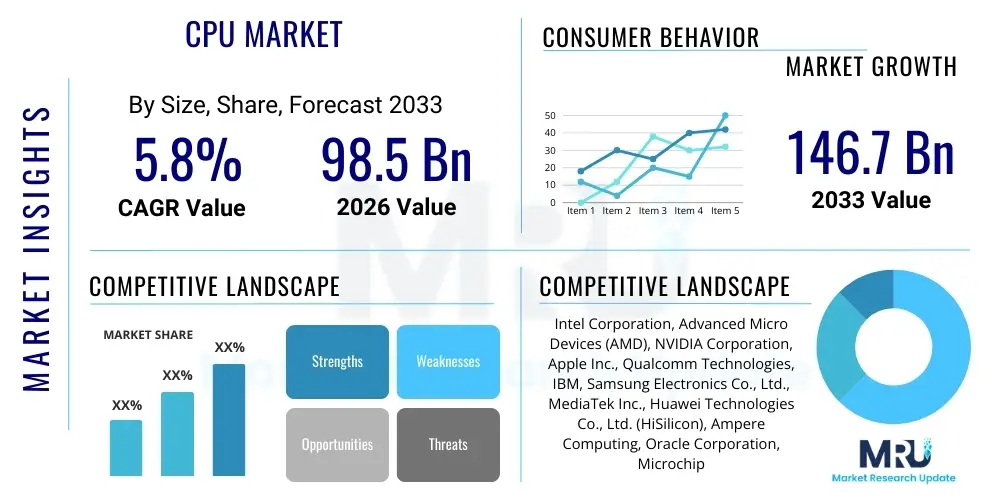

The CPU Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $98.5 Billion in 2026 and is projected to reach $146.7 Billion by the end of the forecast period in 2033.

CPU Market introduction

The Central Processing Unit (CPU) Market encompasses the design, manufacture, and sale of microprocessors, the fundamental component responsible for executing instructions and managing the primary operations of computing devices. Modern CPUs are complex systems integrating billions of transistors, utilizing advanced lithography techniques (such as 3nm and 2nm nodes) to achieve superior performance per watt. Product offerings span a wide spectrum, ranging from low-power System-on-Chips (SoCs) for mobile and embedded applications to high-core count, multi-socket processors designed for demanding data center workloads and high-performance computing (HPC) environments. The performance metrics driving market differentiation include clock speed, core count, cache size, Instruction Set Architecture (ISA) efficiency, and integrated capabilities like advanced graphics or dedicated AI accelerators.

Major applications for CPUs include consumer electronics (PCs, laptops, smartphones), enterprise servers, networking equipment, industrial automation systems, and increasingly, automotive computing platforms crucial for autonomous driving and infotainment systems. The primary benefit derived from advanced CPUs is enhanced computational efficiency, enabling faster data processing, improved multitasking, and reduced energy consumption for complex tasks. This efficiency directly supports the ongoing digital transformation across industries, making reliable and powerful CPUs essential infrastructure.

Key driving factors accelerating market growth include the exponential expansion of cloud computing infrastructure, necessitating continuous upgrades to server CPUs capable of handling massive virtualized workloads. Furthermore, the global proliferation of 5G networks and the resultant growth in edge computing devices demand highly efficient, low-latency processors. The transition toward hybrid work models continues to bolster demand for high-performance desktop and mobile CPUs, while intense competition and rapid architectural innovation (e.g., heterogeneous core design and chiplet technology) push manufacturers toward higher density and specialized functionalities.

CPU Market Executive Summary

The global CPU market is characterized by intense architectural innovation, primarily driven by the transition from monolithic designs to advanced chiplet and multi-die architectures, allowing for superior scalability, thermal management, and yield efficiency. Business trends highlight a significant shift towards custom silicon development, particularly by hyperscale cloud providers and major consumer electronics manufacturers, challenging the traditional dominance of pure-play CPU vendors like Intel and AMD. Strategic investments are heavily skewed towards improving energy efficiency (performance per watt), critical for massive data centers aiming to reduce operational expenditures and environmental impact, while the escalating geopolitical tensions regarding semiconductor manufacturing capacity have introduced volatility and heightened supply chain security as a core strategic consideration for regional markets.

Regional trends indicate Asia Pacific (APAC) maintaining its dominance, fueled by robust manufacturing bases, rapid digitalization initiatives, and the massive consumer markets of China and India, alongside the established high-tech economies of Japan, South Korea, and Taiwan. North America remains the primary hub for high-end server and data center CPU demand, reflecting the concentration of major cloud service providers and advanced research facilities. Europe focuses heavily on embedded systems, industrial automation, and stringent energy efficiency standards, leading to higher adoption rates of specialized, power-optimized CPU solutions tailored for IoT and Industry 4.0 applications.

Segment trends reveal the server segment experiencing the highest growth trajectory, primarily due to the continuous demand for AI training and large language model (LLM) inference capabilities, driving adoption of CPUs with integrated accelerators or extremely high core counts. The mobile CPU segment is increasingly adopting advanced ARM architectures and sophisticated heterogeneous computing designs, integrating specialized processing units (NPUs, ISPs) alongside traditional CPU cores to manage complex tasks efficiently. The long-term architectural battle between x86, optimized for legacy software and high-throughput server workloads, and ARM, dominant in power-constrained environments and increasingly competitive in the data center, defines the current technological trajectory.

AI Impact Analysis on CPU Market

Common user questions regarding AI’s impact on the CPU market frequently revolve around whether CPUs will become obsolete compared to GPUs or specialized accelerators (NPUs), how integrated AI capabilities affect CPU pricing and design, and the role of general-purpose CPUs in the era of pervasive AI deployment. Users are concerned about the necessary specifications for edge AI inference and the efficiency of CPUs when running light AI workloads versus dedicated hardware. The key themes summarized from this user inquiry analysis underscore a general expectation that CPUs must evolve to integrate significant AI acceleration features, shifting their role from pure computation to acting as sophisticated orchestrators of heterogeneous processing elements within a system, rather than being entirely replaced by specialized chips.

The integration of AI capabilities directly into the CPU die, primarily through Neural Processing Units (NPUs) or dedicated AI acceleration blocks, is redefining processor design. This shift is crucial for handling local, low-latency inference tasks common in client devices (laptops, smartphones) and edge infrastructure. This integration allows for substantial power savings and improved security compared to offloading tasks to external accelerators, fundamentally expanding the scope and performance envelope of modern CPUs in AI-driven environments. Furthermore, CPUs serve a critical role in pre-processing data, managing memory access, and coordinating the workload distribution across diverse accelerators (GPUs, FPGAs) within large-scale data center environments.

The market impact is characterized by an increased demand for server CPUs optimized for throughput and memory bandwidth, enabling efficient handling of massive datasets necessary for AI model serving and general-purpose infrastructure tasks supporting AI platforms. While dedicated accelerators dominate large-scale training, the vast majority of AI inference tasks in enterprise and consumer settings are handled by CPUs, often utilizing optimized instruction sets (like AVX-512) and efficient vector processing capabilities. This symbiotic relationship ensures that the CPU remains the essential backbone of almost all AI deployments, driving investment in software optimization and specialized instruction set architectures to maximize AI workload efficiency on general-purpose cores.

- Increased integration of dedicated Neural Processing Units (NPUs) directly onto client and server CPU silicon.

- Shift towards heterogeneous core architectures (e.g., performance and efficiency cores) optimized for managing bursts of AI-related computational load alongside background tasks.

- Surging demand for server CPUs featuring higher core counts and enhanced memory bandwidth (e.g., DDR5, HBM) to support vast AI training and LLM serving environments.

- Development of specialized instruction sets and microcode updates to enhance vector processing efficiency for AI inference tasks on existing CPU cores.

- Requirement for advanced CPU features (e.g., virtualization, security enclaves) to manage and secure proprietary AI models deployed at the edge and in cloud infrastructure.

DRO & Impact Forces Of CPU Market

The dynamics of the CPU market are shaped by powerful opposing forces, summarized by the need for superior performance against the constraints of power consumption and manufacturing costs. Key drivers include the relentless expansion of data centers, the rollout of 5G infrastructure enabling edge computing, and pervasive digitalization across industrial and consumer sectors, all demanding sustained increases in computational throughput and efficiency. Restraints primarily involve the immense capital expenditure and technical complexity associated with scaling down lithography nodes (3nm and beyond), leading to significantly higher chip costs, coupled with ongoing geopolitical instability affecting global semiconductor supply chains, notably concentrated manufacturing capacity in East Asia.

Opportunities for growth are concentrated in emerging fields such as the proliferation of the open-source RISC-V instruction set architecture, offering customization and competitive entry points for niche markets (e.g., embedded and IoT), and the explosive demand for high-performance automotive computing platforms necessary for autonomous vehicle capabilities. Impact forces compelling change include Moore's Law deceleration, forcing reliance on architectural innovation (e.g., 3D stacking, chiplets) over simple transistor shrinking, and the competitive disruption posed by vertically integrated silicon developers (like Apple, Google, Amazon) who are optimizing custom silicon specifically for their proprietary software stacks, placing immense pressure on traditional vendors.

The market structure is heavily influenced by the dual constraints of physics and economics. The physical limits of lithography drive R&D intensity, making generational leaps more expensive and less frequent. Economically, the market experiences high barriers to entry due to the necessity of proprietary manufacturing (foundry access) and deep IP portfolios. The net result is a highly competitive oligopoly where success is determined by the ability to balance peak performance delivery with stringent power budgets, especially crucial in server and mobile applications, ensuring continuous architectural agility is mandatory for market share maintenance.

Segmentation Analysis

The CPU market segmentation provides a granular view of diverse demand patterns influenced by application, required performance envelope, and underlying architecture. The market is primarily categorized by Application (Data Center, Client Computing, Automotive, Industrial/Embedded), Architecture (x86, ARM, RISC-V), and core design specifications (Core Count, Heterogeneous vs. Homogeneous). This detailed segregation is critical for manufacturers to tailor product development, optimizing features like integrated security, power management, and specialized instruction sets to meet specific end-user requirements, particularly noting the divergence in needs between massive cloud infrastructures and power-sensitive edge devices.

The Data Center application segment demands maximum core density and high throughput, favoring advanced x86 and high-end ARM server CPUs, whereas the Client Computing segment (Desktop/Mobile) balances performance with power efficiency and graphics capabilities. The shift towards ARM architecture is most pronounced in mobile and embedded systems due to its superior power efficiency, but its presence is rapidly expanding into data center and client platforms. Core Count segmentation reflects the performance tiering, with 10+ core CPUs dominating high-end gaming and server markets, while lower core counts remain prevalent in entry-level consumer and IoT devices, ensuring that specific market needs dictate the optimal processor design choice.

- By Application:

- Data Center/Server

- Client Computing (Desktop and Mobile)

- Automotive

- Industrial and Embedded Systems (IoT)

- Networking and Communications

- By Architecture:

- x86 (Intel and AMD compatible)

- ARM (Advanced RISC Machines)

- RISC-V

- By Core Count:

- 2-4 Cores

- 6-8 Cores

- 10-16 Cores

- 16+ Cores (including multi-chip modules)

- By Process Node:

- 7nm and Above

- 5nm

- 3nm and Below

Value Chain Analysis For CPU Market

The CPU market value chain is extensive and highly capital intensive, commencing with intensive upstream activities focused on semiconductor R&D, Instruction Set Architecture licensing, and Electronic Design Automation (EDA) tool development. Key upstream players include IP providers like ARM Holdings and RISC-V foundational groups, alongside EDA software giants, who provide the necessary intellectual property and tools for chip design. Fabrication is the most capital-heavy stage, dominated by advanced foundry operations (e.g., TSMC, Samsung Foundry, Intel Foundry Services) responsible for wafer production, lithography, and packaging. The quality and cost of upstream services dictate the final product capability and price point.

Midstream activities involve the Integrated Device Manufacturers (IDMs) and fabless companies that design and market the finished CPUs. These entities focus on system architecture integration, software ecosystem optimization, and marketing strategy. The packaging and testing phase, often involving outsourced assembly and test (OSAT) providers, ensures chip quality and prepares the CPU for integration into larger systems. Efficient supply chain management at this stage is crucial for timely product delivery and minimizing inventory costs, particularly given the global nature of component sourcing.

Downstream distribution channels are bifurcated between direct sales to large Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) (e.g., Dell, HP, Lenovo) who integrate the CPUs into final products, and indirect sales through a vast network of authorized distributors and value-added resellers (VARs) serving smaller system builders, retail customers, and specialized industrial clients. The increasing dominance of cloud providers buying directly from manufacturers or designing their own silicon represents a significant direct channel shift, bypassing traditional distribution layers, thus compressing margins in the intermediate segments and driving a demand for customized, large-volume solutions.

CPU Market Potential Customers

The potential customer base for the CPU market is diverse, spanning virtually every sector that relies on digital computation and data processing, but can be primarily categorized into four major buyer groups: hyperscale cloud service providers (CSPs), major global Original Equipment Manufacturers (OEMs), specialized industrial and automotive companies, and general enterprise and consumer markets. Hyperscale CSPs, such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, represent the highest volume buyers of server CPUs, prioritizing metrics like core density, high memory bandwidth, and power efficiency for their massive data centers. Their purchasing power often drives market specification trends and enables them to commission custom silicon designs.

OEMs, including laptop, desktop, and mobile phone manufacturers (e.g., Apple, Samsung, Dell), purchase CPUs in large volumes for integration into consumer-facing products, requiring a balance of performance, thermal management, and cost-effectiveness tailored for specific product lines (premium vs. budget). The automotive industry, driven by the rapid development of electric vehicles and autonomous driving capabilities, represents a rapidly emerging high-value customer segment demanding specialized, highly reliable, and safety-certified CPUs capable of handling massive sensor data processing and complex control algorithms.

Finally, the industrial and embedded market, encompassing sectors like robotics, medical devices, networking infrastructure, and IoT deployments, requires CPUs optimized for reliability, extended operating temperatures, long product lifecycles, and low power consumption. This segment is increasingly adopting specialized architectures like RISC-V for tailored, efficient solutions. General enterprise customers purchase systems through integrators and VARs, seeking robust CPUs for general-purpose servers, workstations, and office computing infrastructure, focusing heavily on security features and total cost of ownership (TCO).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $98.5 Billion |

| Market Forecast in 2033 | $146.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation, Apple Inc., Qualcomm Technologies, IBM, Samsung Electronics Co., Ltd., MediaTek Inc., Huawei Technologies Co., Ltd. (HiSilicon), Ampere Computing, Oracle Corporation, Microchip Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Broadcom Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CPU Market Key Technology Landscape

The CPU market technology landscape is defined by relentless pursuit of transistor density and architectural efficiency, leveraging cutting-edge lithography nodes such as 3nm and 2nm, which enable higher integration and reduced power consumption, particularly in high-volume mobile and client processors. A fundamental shift is the transition from traditional monolithic die construction to advanced packaging techniques, notably chiplet and 3D stacking technologies, exemplified by AMD's implementation of chiplets and Intel's Foveros technology. These technologies allow manufacturers to mix and match different functional dies (e.g., I/O, compute, cache) fabricated on potentially different process nodes, maximizing yield, reducing cost, and allowing for heterogeneous integration of specialized accelerators (GPUs, NPUs) within a single package.

Another crucial technological development is the widespread adoption of heterogeneous computing, utilizing a blend of high-performance (P-cores) and high-efficiency (E-cores) cores within the same processor package, managed by sophisticated hardware schedulers. This approach, pioneered in mobile and now standard in desktop and laptop CPUs, significantly improves power management and multitasking performance, optimizing workload assignment based on priority and power budget. Furthermore, memory technology advancements, particularly the shift to DDR5 and the integration of High Bandwidth Memory (HBM) in server and accelerator applications, are essential, as CPU performance is increasingly bottlenecked by data movement speeds rather than raw computational speed, demanding massive increases in memory bandwidth to feed modern multi-core designs.

The ongoing development of new Instruction Set Architectures (ISAs) also fundamentally shapes the market, primarily the growth of RISC-V. While x86 and ARM dominate, RISC-V offers an open, customizable alternative particularly attractive for embedded systems, specialized accelerators, and sovereignty-focused regional initiatives, allowing developers to extend the ISA without proprietary licensing constraints. Security hardening technologies, including hardware-backed memory encryption, secure enclaves, and trusted execution environments, are becoming standard features across all CPU segments, addressing growing enterprise and consumer concerns regarding data integrity and protection against physical and network-based attacks, further complexifying the silicon design process.

Regional Highlights

- Asia Pacific (APAC): APAC holds the largest market share, driven by its expansive semiconductor manufacturing ecosystem (Taiwan, South Korea, China), massive consumer electronics markets, and significant investments in digitalization and 5G deployment across emerging economies. China's focused drive for semiconductor self-sufficiency and the rapid expansion of cloud infrastructure throughout Southeast Asia are key accelerators.

- North America: North America is characterized by the highest adoption rate of high-performance server CPUs, primarily due to the concentration of global hyperscale cloud service providers (CSPs) and leading technology research institutions. Demand is heavily skewed towards high-margin, leading-edge processors optimized for AI/ML workloads and HPC environments, maintaining its position as the innovation leader and largest spender on advanced architectures.

- Europe: The European market demonstrates robust growth, particularly in the industrial and automotive CPU segments, aligned with the region's strong focus on Industry 4.0 and advanced vehicle technology standards. Regulatory focus on energy efficiency (e.g., EU Green Deal) drives demand for highly optimized, power-efficient CPUs suitable for edge computing and low-power IoT applications.

- Latin America (LATAM): LATAM is an emerging market with steady growth, fueled by increasing internet penetration, mobile device proliferation, and nascent but rapidly expanding local data center infrastructure build-out, requiring cost-effective and reliable mobile and entry-level server CPUs.

- Middle East and Africa (MEA): Growth in MEA is largely dependent on large-scale government digitalization projects and the development of regional smart city initiatives, creating demand for networking infrastructure and dedicated data center CPUs, often procured via international technology partnerships and significant public sector investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CPU Market.- Intel Corporation

- Advanced Micro Devices (AMD)

- NVIDIA Corporation

- Apple Inc.

- Qualcomm Technologies

- IBM

- Samsung Electronics Co., Ltd.

- MediaTek Inc.

- Huawei Technologies Co., Ltd. (HiSilicon)

- Ampere Computing

- Oracle Corporation

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Broadcom Inc.

- Amazon Web Services (AWS - Graviton)

- Google LLC (Tensor)

- SiFive, Inc.

Frequently Asked Questions

Analyze common user questions about the CPU market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current architectural shift in CPU design?

The primary factor is the deceleration of traditional Moore's Law scaling, forcing manufacturers to rely on architectural innovation like chiplet technology and heterogeneous core designs (mixing performance and efficiency cores) to achieve generational gains in performance and power efficiency, particularly critical for server and mobile markets.

How is the rivalry between x86 and ARM architectures affecting the data center market?

The rivalry is intensifying as ARM-based CPUs, particularly those from companies like Ampere and custom designs from hyperscalers (e.g., AWS Graviton), offer superior performance per watt compared to traditional x86 counterparts in specific scale-out cloud workloads, creating significant long-term competitive pressure on x86 dominance in the data center.

What role does the RISC-V instruction set architecture play in the global CPU market?

RISC-V serves as a key disruptive force offering an open-source, royalty-free alternative to proprietary ISAs (x86 and ARM). Its flexibility makes it highly attractive for specialized embedded systems, custom accelerators, industrial IoT, and national initiatives seeking greater control over their semiconductor supply chain and design.

What are the greatest supply chain risks currently facing the CPU industry?

The greatest risks stem from the high concentration of advanced semiconductor manufacturing (lithography nodes 5nm and below) within a few specific geographical regions, primarily in East Asia. Geopolitical tensions and the resultant trade restrictions or supply disruptions pose major threats to the global availability and cost structure of high-end CPUs.

Are integrated AI accelerators (NPUs) replacing the need for general-purpose CPUs in client devices?

No, integrated NPUs are designed to handle specific, repetitive, low-power AI inference tasks (like image processing or speech recognition) very efficiently. The general-purpose CPU remains essential as the central orchestrator, managing the operating system, memory allocation, and handling the majority of non-AI related computational tasks, working synergistically with the NPU.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- CPU and GPU Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- CPU Cooler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Interposer Market Size Report By Type (2D Interposer, 5D Interposer, 3D Interposer), By Application (CIS, CPU or GPU, MEMS 3D Capping Interposer, RF Devices, Logic SoC, ASIC or FPGA, High Power LED), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- FinFET CPU Market Statistics 2025 Analysis By Application (Smartphones, Computers and Tablets, Wearables, High-End Networks, Automotive), By Type (22nm, 20nm, 16nm, 14nm, 10nm, 7nm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- CPU Heatsink Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Air Cooling, Water Cooling, Thermoelectric Cooling), By Application (Gaming PC Use, Commercial PC Use, Other PC Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager