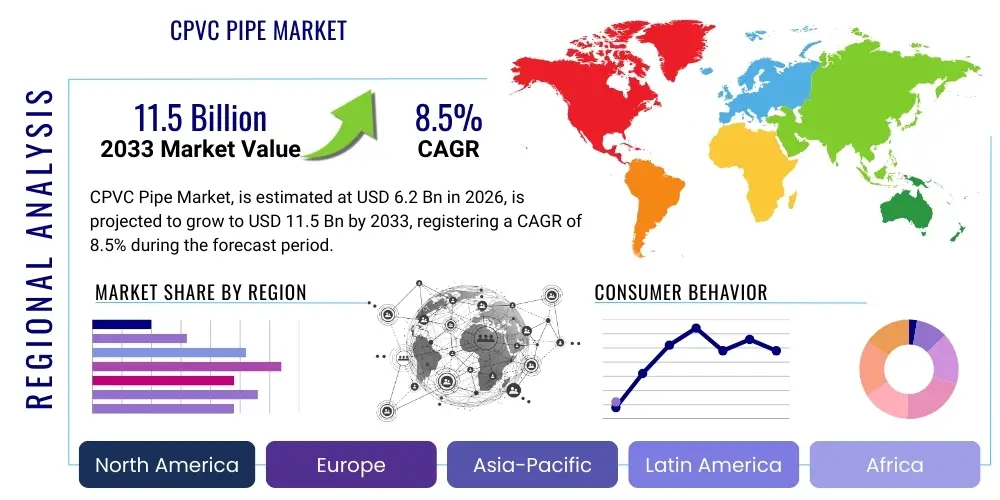

CPVC Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431533 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

CPVC Pipe Market Size

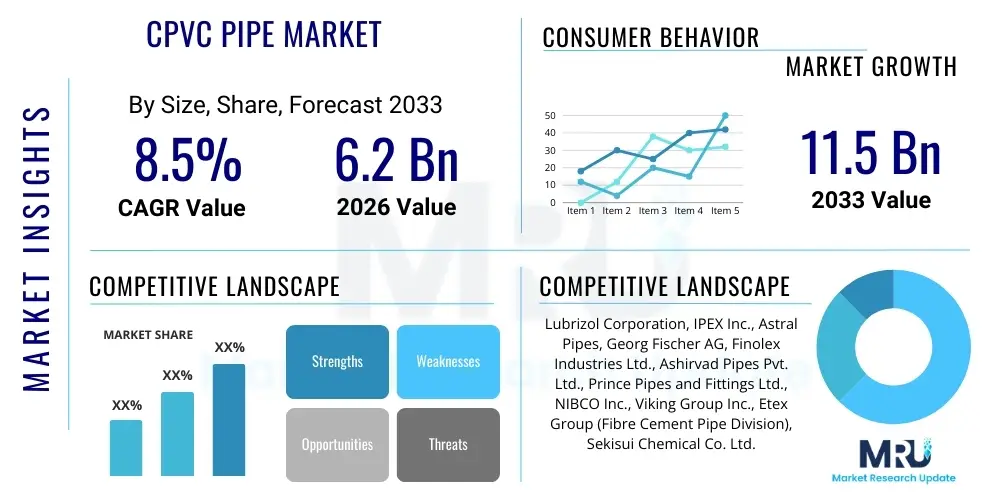

The CPVC Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.5 Billion by the end of the forecast period in 2033.

CPVC Pipe Market introduction

The Chlorinated Polyvinyl Chloride (CPVC) pipe market encompasses the manufacturing, distribution, and utilization of pipes and fittings made from CPVC resin. This specialized thermoplastic is created by subjecting standard PVC to a chlorination reaction, significantly increasing its chlorine content. This enhanced chemical structure provides superior resistance to high temperatures, pressure, and corrosive chemicals compared to standard PVC, making CPVC pipes ideal for demanding applications, particularly those involving hot water or aggressive fluids.

CPVC piping systems are widely adopted across various sectors due to their outstanding thermal performance and mechanical strength. Key applications include residential and commercial plumbing for hot and cold potable water distribution, industrial fluid handling, and fire sprinkler systems where fire resistance is paramount. The inherent benefits, such as non-corrosive properties, ease of installation, longevity, and reduced maintenance costs, position CPVC as a preferred alternative to traditional metallic piping materials like copper and galvanized steel, particularly in regions experiencing rapid urbanization and infrastructure modernization.

The primary driving factors fueling market expansion are the robust growth in global construction activities, especially in emerging economies, and the increasing regulatory mandates promoting lead-free and non-metallic piping solutions for water conveyance. Furthermore, the rising awareness regarding the long-term cost-effectiveness and durability of CPVC systems compared to metallic options contributes significantly to its market penetration. Continuous innovation in CPVC compound technology aimed at improving pressure ratings and chemical resistance further solidifies its position in high-specification industrial segments.

CPVC Pipe Market Executive Summary

The CPVC Pipe Market is characterized by sustained expansion driven primarily by global infrastructural development and increasing adoption rates in the residential and commercial building sectors. Key business trends indicate a shift towards sustainable manufacturing processes and the development of high-performance CPVC compounds capable of withstanding extreme conditions, thus opening new avenues in specialized industrial fluid transport. Manufacturers are focusing on backward integration to secure raw material supplies (PVC resin and chlorine) and enhance cost competitiveness, while strategic partnerships and mergers remain common strategies for expanding geographical reach and penetrating niche markets.

Regionally, the Asia Pacific (APAC) dominates the market, exhibiting the highest growth rate due to massive investments in housing, rapid industrialization, and favorable government initiatives supporting sanitation and clean water supply projects, notably in India and China. North America and Europe maintain significant market shares, characterized by established regulatory frameworks and a strong focus on replacing aging metallic infrastructure with durable, corrosion-resistant CPVC systems. Latin America and the Middle East & Africa are emerging as high-potential regions, buoyed by oil and gas industry demands and rising urbanization requiring advanced plumbing solutions.

Segmentation analysis highlights the dominance of the residential segment by volume, given its widespread use in internal plumbing and hot water systems. However, the industrial segment is anticipated to exhibit the fastest growth, propelled by the demand for CPVC in chemical processing plants, wastewater treatment, and power generation facilities where resistance to aggressive chemicals and high temperatures is critical. CPVC pipes used for hot and cold-water distribution remain the leading application segment, reflecting the material’s primary competitive advantage over conventional PVC and PPR.

AI Impact Analysis on CPVC Pipe Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the CPVC Pipe Market often center on themes of operational efficiency, predictive maintenance, and supply chain optimization rather than direct product transformation. Users are concerned with how AI can mitigate raw material price volatility, enhance quality control during extrusion and molding, and optimize complex distribution networks globally. Key expectations revolve around using machine learning algorithms to forecast demand accurately based on macroeconomic construction indices, thereby reducing inventory costs and minimizing material waste. Furthermore, interest exists in leveraging AI for analyzing sensor data in industrial piping systems to predict failures or leaks, shifting maintenance strategies from reactive to proactive, which significantly enhances the reliability of CPVC installations, especially in critical infrastructure applications.

AI is beginning to integrate into the CPVC manufacturing process through sophisticated digital twins and simulation tools. These applications allow manufacturers to model various polymerization and chlorination conditions, optimizing energy consumption and ensuring consistent product quality (e.g., precise wall thickness and dimensional stability). Advanced machine vision systems powered by AI are deployed on production lines to detect even minute defects in pipe surfaces or couplings instantly, far exceeding human inspection capabilities. This focus on enhanced manufacturing precision and reduced defect rates directly translates into higher trust and reliability for end-users, especially in high-pressure and high-temperature environments.

The implementation of AI-driven logistics solutions is revolutionizing the distribution of CPVC products. Algorithms analyze real-time freight costs, geopolitical risks, and regional demand spikes to suggest optimal shipping routes and inventory staging locations. This optimization is particularly crucial for a high-volume, relatively low-margin product like CPVC pipe. Although AI does not change the chemical composition of the pipe itself, its influence on manufacturing quality, supply chain resilience, and system maintenance efficiency makes it a critical enabling technology for sustained market growth and competitive differentiation.

- AI optimizes raw material procurement forecasting, mitigating volatility risks in chlorine and PVC supply chains.

- Machine learning algorithms enhance quality control through real-time defect detection during pipe extrusion.

- Predictive maintenance schedules are generated by AI analyzing sensor data from installed CPVC piping networks in industrial settings.

- AI-powered simulation tools optimize manufacturing processes, reducing energy consumption and waste generation.

- Demand forecasting models, integrated with construction permits data, improve inventory management and logistical efficiency for distributors.

DRO & Impact Forces Of CPVC Pipe Market

The CPVC Pipe Market’s trajectory is shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the global surge in residential and commercial construction, particularly in developing nations, coupled with regulatory shifts favoring non-metallic and durable plumbing solutions for potable water. The superior characteristics of CPVC, such as high heat distortion temperature, resistance to corrosion, and relative ease of installation compared to traditional metals, strongly contribute to its market acceptance. However, the market faces significant restraints, primarily stemming from the volatile pricing of raw materials, particularly PVC resin and chlorine, which directly affects manufacturing costs and profitability. Additionally, intense competition from alternative advanced polymers, such as PEX and PPR, challenges CPVC’s market share in specific geographical and application segments.

Opportunities for growth are abundant, notably in expanding applications within industrial fluid management for highly corrosive chemicals, and penetration into sectors requiring high fire resistance, such as certain commercial building mandates. The ongoing trend of replacing aging galvanized steel and copper infrastructure, especially in mature economies, presents a substantial backlog of potential replacement projects. Furthermore, strategic geographic expansion into underserved markets in Africa and Latin America, combined with continuous product innovation to improve pressure ratings and UV resistance, offers compelling avenues for long-term growth and market diversification.

The primary Impact Forces influencing the market are governmental regulations pertaining to construction safety and water quality standards, which often mandate the use of certified materials like CPVC. Economic cycles, especially those impacting the global housing market and infrastructure spending, exert a direct, high-magnitude influence on demand volume. Technological shifts, including the development of next-generation coupling mechanisms (e.g., solvent cement alternatives) and optimized compounding techniques, provide medium-term competitive pressure, forcing continuous improvement among established players.

- Drivers:

- Rapid growth in residential and commercial construction globally.

- Superior heat and corrosion resistance compared to metallic and standard PVC pipes.

- Increasing governmental mandates for safe and lead-free potable water distribution systems.

- Longer lifespan and reduced maintenance costs of CPVC systems.

- Restraints:

- Fluctuations and high volatility in raw material prices (PVC resin, chlorine).

- Competition from alternative polymer piping materials (PEX, PPR).

- Environmental concerns related to the disposal and end-of-life cycle management of plastic products.

- Opportunities:

- Large-scale infrastructure replacement projects in mature markets.

- Expansion of application scope in specialized industrial sectors like chemical processing.

- Development of CPVC compounds optimized for extreme environments (e.g., high-pressure industrial lines).

- Impact Forces:

- Economic impact of global construction spending and interest rate changes (High).

- Regulatory shifts regarding fire safety and non-metallic material standards (Medium to High).

- Technological advancements in polymer compounding and pipe joining methods (Medium).

Segmentation Analysis

The CPVC Pipe Market is segmented based on product type, application, and end-user, providing a granular view of demand dynamics across different vertical markets. Product segmentation typically includes CPVC pipes and CPVC fittings, with fittings playing a crucial role in ensuring system integrity and compatibility, particularly under thermal stress. The dominant application category is hot and cold water distribution, which leverages CPVC’s inherent ability to withstand elevated temperatures and prevent bacterial growth, a critical requirement for potable water systems. Analyzing these segments helps stakeholders understand where growth is concentrated and where competitive advantages can be best exploited through specialized product offerings.

From an end-user perspective, the market is broadly divided into residential, commercial, and industrial sectors. The residential sector historically drives high volume due to mass-market requirements for household plumbing and heating, while the commercial sector includes large-scale projects like hotels, hospitals, and educational institutions, demanding higher specifications and longer warranties. The industrial sector, though smaller in volume, generates high value, as it requires highly chemical-resistant pipes for process lines in chemical plants, pharmaceutical manufacturing, and power generation facilities, where product failure carries enormous financial and safety risks.

The geographic segmentation remains vital, with regional economic conditions and local building codes dictating material preference and market size. Segmentation analysis confirms that while material innovation often originates in mature markets like North America and Europe, the highest growth rates are currently observed in APAC, driven by sheer volume and rapid infrastructure development. Understanding the specific needs of each segment, such as chemical compatibility requirements in the industrial sector versus thermal expansion management in residential plumbing, is essential for targeted market penetration and maximizing profitability.

- By Product Type:

- CPVC Pipes

- CPVC Fittings (Elbows, Tees, Couplings, Valves, etc.)

- By Application:

- Hot and Cold Water Distribution

- Fire Sprinkler Systems

- Industrial Fluid Handling (Chemical Processing, Water Treatment)

- HVAC/Ducting

- By End-User:

- Residential

- Commercial (Hospitals, Hotels, Offices)

- Industrial (Chemical, Power, Oil & Gas, Manufacturing)

Value Chain Analysis For CPVC Pipe Market

The CPVC Pipe Market value chain begins with the upstream procurement of critical raw materials, primarily PVC resin, chlorine, and various proprietary additives and stabilizers. The successful chlorination of PVC resin to create CPVC compound is a specialized chemical process, typically performed by a limited number of global chemical giants who hold significant control over the intellectual property and supply. Stability in the upstream segment relies heavily on global petrochemical pricing and effective supply contracts, as fluctuations directly impact the cost structure of pipe manufacturers. Ensuring high-quality CPVC compound consistency is paramount, as it determines the final product's performance characteristics, such as pressure rating and maximum operating temperature.

The core manufacturing process involves extrusion (for pipes) and injection molding (for fittings). Midstream players focus on optimizing these processes for efficiency, minimizing scrap, and maintaining strict quality standards compliant with global specifications like ASTM and NSF. Distribution channels represent a critical downstream component. CPVC products are typically routed through a multi-tiered system: direct sales to large industrial projects or original equipment manufacturers (OEMs), and indirect sales through extensive networks of wholesale distributors, specialized plumbing supply houses, and local retailers serving residential and commercial contractors. The effectiveness of the distribution channel is key to market penetration, requiring robust inventory management and strong relationships with plumbing professionals.

Direct sales channels are crucial for highly technical, large-volume industrial projects where engineering consultation and technical support are required from the manufacturer. Conversely, indirect channels rely on the distributor’s ability to provide immediate stock availability and localized support for the high volume of smaller residential and commercial installations. The solvent cement used for joining CPVC pipes is often integrated into the distribution strategy, ensuring system compatibility and proper installation. Downstream value creation is enhanced by providing comprehensive training and technical documentation to plumbers and installers, ensuring correct application and maximizing the longevity of the CPVC piping system, thereby strengthening end-user confidence.

CPVC Pipe Market Potential Customers

The primary customers and end-users of CPVC pipe systems span three distinct but interconnected sectors: residential builders and contractors, commercial infrastructure developers, and specialized industrial facility operators. In the residential segment, potential customers are typically home builders and remodeling contractors who value CPVC for its reliable performance in delivering hot and cold potable water, its non-corrosive nature, and its cost-effectiveness compared to traditional copper. These buyers require materials that meet local building codes and offer quick, reliable installation methods, often favoring standardized sizes and easily available fittings.

Commercial end-users, including hospital administrators, hotel developers, and managers of large office complexes, prioritize system longevity, minimal disruption during installation, and compliance with stringent fire safety regulations, particularly regarding the use of CPVC in fire sprinkler systems. This segment often purchases through large procurement channels, focusing on lifecycle cost analysis and requiring extensive documentation regarding pressure testing and chemical resistance. Reliability and reputation of the manufacturer are paramount due to the high costs associated with system failure in a commercial environment.

The industrial sector represents the most technically demanding customer base, comprising chemical processing companies, semiconductor manufacturers, and power generation utilities. These buyers are looking for CPVC systems capable of handling corrosive chemicals, high pressures, and extreme temperatures that would quickly degrade metallic piping. Purchasing decisions are driven by chemical compatibility charts, long-term durability guarantees, and bespoke engineering support, positioning these buyers as high-value, albeit fewer in number, potential customers who often engage directly with manufacturers or specialized industrial distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lubrizol Corporation, IPEX Inc., Astral Pipes, Georg Fischer AG, Finolex Industries Ltd., Ashirvad Pipes Pvt. Ltd., Prince Pipes and Fittings Ltd., NIBCO Inc., Viking Group Inc., Etex Group (Fibre Cement Pipe Division), Sekisui Chemical Co. Ltd., Advanced Drainage Systems Inc., Trelleborg AB, Polypipe Group PLC, Supreme Industries Ltd., Ori-Plast Ltd., Kalpataru Piping Solutions, Kisan Mouldings Ltd., JM Eagle Inc., Weld-On Adhesives Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CPVC Pipe Market Key Technology Landscape

The technology landscape for the CPVC Pipe Market primarily revolves around optimizing the base polymer chemistry, enhancing extrusion and molding precision, and improving pipe joining techniques. Key technological advancements center on developing next-generation CPVC compounds that exhibit higher pressure resistance, broader chemical compatibility, and superior resistance to degradation from UV exposure or chlorine concentration found in some municipal water supplies. Compound manufacturers are utilizing advanced polymer science to fine-tune the molecular structure post-chlorination, increasing the glass transition temperature (Tg) and improving overall mechanical durability, allowing CPVC pipes to operate safely at higher temperatures and pressures, thus extending their addressable market.

Manufacturing technologies are continuously evolving, focusing on high-speed, high-precision extrusion lines equipped with sophisticated monitoring systems. These technologies utilize complex die designs to ensure uniform wall thickness and concentricity, which are critical for maintaining the structural integrity and pressure rating of the pipe. Furthermore, injection molding techniques for fittings are becoming more advanced, allowing for the rapid production of complex geometries with tighter dimensional tolerances. These improvements in dimensional stability minimize leakage points and reduce installation complexity for end-users, directly impacting system reliability and overall project completion time.

A crucial technological area involves joining methods. While solvent cement remains the predominant technique for CPVC pipe installation, ongoing innovation focuses on developing low-VOC (Volatile Organic Compound) solvent cements to meet increasingly strict environmental and occupational health regulations. Furthermore, mechanical joining systems, such as specialized grooved couplings and flanged connections, are gaining traction, particularly in industrial applications or large commercial installations where disassembly and maintenance access are frequently required. These alternative joining methods offer robustness and eliminate the curing time associated with traditional solvent welding, providing significant logistical advantages on large construction sites.

Regional Highlights

Regional analysis underscores the heterogeneous nature of CPVC pipe demand, heavily influenced by local economic growth, climate conditions, and specific plumbing traditions. Asia Pacific (APAC) stands as the undisputed engine of growth, propelled by massive government investment in urban infrastructure, rapid expansion of residential housing, and increasing adoption of modern plumbing practices in countries like India, China, and Southeast Asia. The sheer scale of construction activity in these nations, coupled with the shift away from less durable materials, guarantees a high volume consumption. Manufacturers are strategically establishing production facilities within APAC to capitalize on lower operational costs and fulfill escalating local demand swiftly, often bypassing import duties and streamlining the supply chain.

North America and Europe represent mature, high-value markets characterized primarily by replacement demand and strict quality standards. In North America, CPVC is highly valued in both residential plumbing (due to its high-temperature rating for hot water) and fire suppression systems, where it competes effectively with traditional metallic options. European demand is driven by stringent environmental regulations and the need for energy-efficient building solutions, though competition from PEX and multilayer pipe systems remains strong in the underfloor heating segment. These regions demand high certification levels (e.g., NSF, ASTM, DIN), fostering a focus on premium, specification-grade CPVC products.

Latin America and the Middle East & Africa (MEA) are emerging regions offering significant future potential. Latin American growth is fueled by infrastructure modernization and water management projects, seeking durable solutions for water transport in areas with varied municipal water quality. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits robust demand driven by large-scale commercial and mega-project construction, including desalination plants and high-rise residential complexes. The harsh climate in MEA necessitates materials with high durability and resistance to thermal cycling, favoring the performance characteristics inherent in CPVC systems, provided they are formulated to handle high levels of UV exposure during installation.

- Asia Pacific (APAC): Dominates market growth due to massive urbanization, high volume residential construction, and critical infrastructural projects in emerging economies like India and China. Focus on affordable, durable plumbing solutions.

- North America: Strong market for replacement of aging copper and galvanized steel systems. High penetration in hot water distribution and certified fire sprinkler systems; stringent product standards (NSF certified).

- Europe: Growth driven by stringent regulations on water quality and efficient heating systems. Emphasis on durable, low-maintenance materials, though facing intense competition from PEX and multilayer systems.

- Middle East & Africa (MEA): Emerging market characterized by large-scale commercial real estate and infrastructure development. High demand in industrial cooling and water transport systems requiring resistance to extreme heat and corrosive water sources.

- Latin America: Sustained growth driven by improving sanitation infrastructure and residential building expansion, replacing older, non-standardized piping materials with certified CPVC solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CPVC Pipe Market.- Lubrizol Corporation

- IPEX Inc.

- Astral Pipes

- Georg Fischer AG

- Finolex Industries Ltd.

- Ashirvad Pipes Pvt. Ltd.

- Prince Pipes and Fittings Ltd.

- NIBCO Inc.

- Viking Group Inc.

- Etex Group

- Sekisui Chemical Co. Ltd.

- Advanced Drainage Systems Inc.

- Trelleborg AB

- Polypipe Group PLC

- Supreme Industries Ltd.

- Ori-Plast Ltd.

- Kalpataru Piping Solutions

- Kisan Mouldings Ltd.

- JM Eagle Inc.

- Weld-On Adhesives Inc.

- Reliance Industries Limited (through feedstock supply)

- Pipelife International GmbH

- WL Plastics

- Akatherm International B.V.

- Uponor Corporation

Frequently Asked Questions

Analyze common user questions about the CPVC Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is CPVC and how does it differ from standard PVC pipes?

CPVC stands for Chlorinated Polyvinyl Chloride, a thermoplastic created by adding an extra chlorine molecule to PVC resin. The primary difference lies in thermal performance; CPVC has a higher chlorine content, which significantly increases its glass transition temperature (Tg). This allows CPVC pipes to safely handle much higher operating temperatures (up to 200°F or 93°C) and pressures compared to standard PVC, making CPVC suitable for hot water distribution and fire sprinkler systems, applications where standard PVC would fail.

Is CPVC piping safe for potable drinking water and what certifications are required?

Yes, CPVC piping is widely considered safe for potable drinking water and is used globally for residential and commercial plumbing. To ensure safety and quality, CPVC products must be certified by third-party organizations such as NSF International (specifically NSF/ANSI Standard 14 and 61) in North America, and adhere to standards like ASTM (American Society for Testing and Materials) or equivalent European/Asian specifications. These certifications verify that the material does not leach harmful substances into the water and meets strict performance criteria for durability.

What are the key advantages of using CPVC over traditional copper or galvanized steel piping?

The key advantages of CPVC piping include superior resistance to corrosion and scaling, a significant benefit compared to metallic pipes which can degrade over time, affecting water quality and flow. CPVC systems are also lighter, easier, and quicker to install using solvent cement, reducing labor costs. Furthermore, CPVC does not transmit heat readily, reducing energy loss in hot water lines, and it is inherently flame-retardant, making it highly effective for fire suppression systems.

How does the volatility of raw material prices impact the CPVC pipe market?

The CPVC pipe market is highly sensitive to the cost fluctuations of its primary raw materials: PVC resin and chlorine. As the base material costs rise, manufacturing margins are compressed, leading to higher final product prices for end-users. This volatility creates procurement challenges for manufacturers and can affect competitiveness against alternative piping materials whose raw material inputs may be more stable. Market analysts constantly track petrochemical indices and chlorine production capacity to forecast pricing trends in the CPVC sector.

Which end-user segment is experiencing the fastest adoption rate for CPVC pipes globally?

While the residential segment remains the largest consumer by volume, the Industrial segment is currently experiencing the fastest adoption rate growth in value terms. This acceleration is driven by the increasing need for high-performance fluid handling solutions in specialized environments such as chemical processing, pharmaceutical manufacturing, and complex water treatment facilities. The industrial sector requires customized CPVC compounds capable of reliably managing aggressive chemicals and extreme operating conditions, thereby driving high-value demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- CPVC Pipe & Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- CPVC Pipe and Fitting Market Size Report By Type (CPVC Pipe, CPVC Fitting), By Application (Chemical Processing, Waste Water Treatment, Hot and Cold Water Distribution, Fire Sprinkle Systems, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- CPVC Pipe Market Statistics 2025 Analysis By Application (Hot and Cold Water Distribution, Waste Water Treatment, Chemical Processing, Fire Sprinkle Systems), By Type (Schedule 40 CPVC Pipe, Schedule 80 CPVC Pipe), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- CPVC Pipe and Fittings Market Statistics 2025 Analysis By Application (Hot and Cold Water Distribution, Waste Water Treatment, Chemical Processing, Fire Sprinkle Systems), By Type (CPVC Pipe, CPVC Fitting), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager