Cubic Boron Nitride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431831 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cubic Boron Nitride Market Size

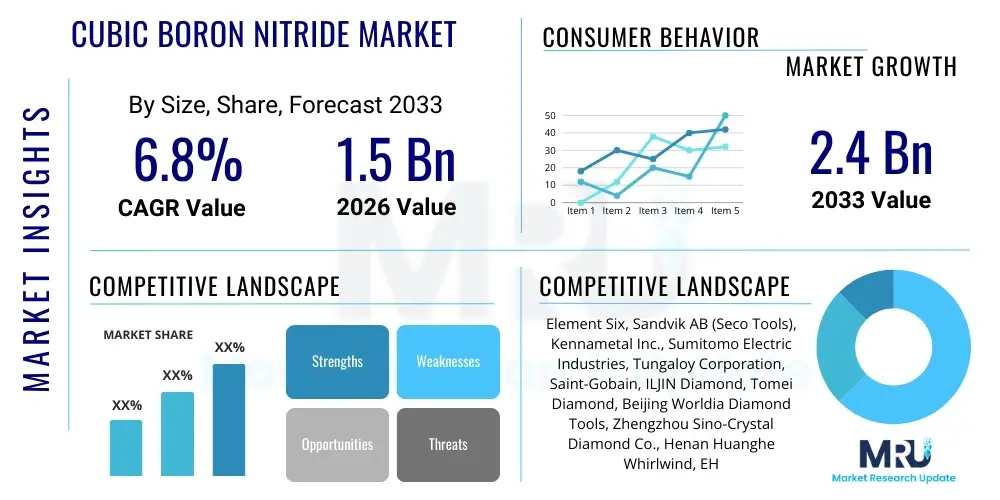

The Cubic Boron Nitride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Cubic Boron Nitride Market introduction

The Cubic Boron Nitride (CBN) Market encompasses the production, distribution, and consumption of synthetic materials known for their extreme hardness, second only to diamond. CBN is a superabrasive material utilized primarily in demanding industrial applications where high thermal stability, chemical inertness, and superior wear resistance are paramount. This unique combination of properties makes CBN indispensable in the machining of hard ferrous materials, including hardened steel, nickel-based superalloys, and chilled cast iron, materials that traditional abrasives cannot efficiently process. The fundamental market drivers include the accelerating demand from the automotive and aerospace industries for lightweight, high-performance components that necessitate precision machining and grinding processes.

The core product offering in this market includes CBN grit, CBN inserts, and CBN grinding wheels, categorized based on crystal structure, purity, and bonding agents. Major applications span precision engineering, tool manufacturing, and the production of complex components used in gas turbines and automotive powertrains. CBN's inherent advantages, such as its ability to operate at higher cutting speeds and temperatures without degradation compared to conventional abrasives, significantly enhance manufacturing productivity and improve the surface finish quality of machined parts. The material's chemical stability prevents detrimental reactions with iron and other common alloying elements, which is a major limitation for diamond-based tools in ferrous metal applications.

Key market benefits driving adoption include enhanced tool life, reduced cycle times in manufacturing, and superior dimensional accuracy in finished products. The market is further propelled by technological advancements in high-pressure, high-temperature (HPHT) synthesis methods, allowing manufacturers to produce higher purity and more consistent CBN crystals tailored for specific industrial needs. Furthermore, the global shift towards precision manufacturing and the increasing complexity of materials used in modern engineering sectors ensure sustained growth for CBN products throughout the forecast period, positioning it as a crucial enabler of advanced manufacturing processes worldwide.

Cubic Boron Nitride Market Executive Summary

The Cubic Boron Nitride (CBN) market is characterized by robust growth, primarily fueled by the accelerating adoption of advanced materials in the automotive and aerospace sectors. Business trends indicate a strong focus on strategic mergers and acquisitions among leading producers to consolidate market share and leverage proprietary HPHT synthesis technologies, aiming for cost efficiency and enhanced product performance consistency. The transition toward electric vehicles (EVs), while reducing demand for certain engine component machining, is simultaneously boosting the requirement for CBN tools in the high-precision processing of EV motor parts, battery casings, and structural components made from extremely hard, specialty materials, maintaining a net positive outlook for the market.

Regionally, Asia Pacific, particularly China and India, dominates both manufacturing and consumption, driven by massive investments in infrastructure development, rapid industrialization, and the establishment of sophisticated automotive and electronics supply chains. North America and Europe remain mature markets, focusing heavily on specialized, high-value CBN products for aerospace maintenance, repair, and overhaul (MRO), as well as advanced tool and die applications where high-quality surface finish and tight tolerances are non-negotiable. This regional disparity necessitates customized market entry strategies, focusing on volume and efficiency in APAC, versus technological superiority and niche applications in the West.

Segment trends reveal that the metalworking segment, particularly grinding and cutting applications, remains the largest consumer by application, though the segment related to advanced electronics and semiconductor manufacturing is exhibiting the highest growth rate due to the unique thermal management properties of certain CBN derivatives. In terms of product type, CBN polycrystalline compacts (PCD) and high-density sintered inserts are gaining significant traction over traditional bonded abrasives, reflecting the industry's need for tools capable of enduring intermittent cutting operations and higher thermal stresses associated with dry machining techniques and minimal quantity lubrication (MQL) strategies.

AI Impact Analysis on Cubic Boron Nitride Market

User queries regarding the impact of Artificial Intelligence (AI) on the CBN market frequently center on how AI can optimize the costly and energy-intensive HPHT synthesis process, predict CBN tool wear patterns in real-time manufacturing environments, and enhance the development of novel CBN composite materials. Users are highly interested in predictive maintenance models enabled by machine learning (ML) to maximize tool life and minimize unexpected production stoppages in high-value machining operations. Furthermore, there is considerable expectation that AI-driven data analysis will lead to faster identification of optimal CBN grade compositions for specific exotic alloys, significantly reducing R&D cycles and lowering the barrier to entry for complex material processing, ultimately driving demand for highly specialized CBN products.

- AI optimizes HPHT synthesis parameters, leading to improved crystal uniformity and reduced production costs.

- Machine learning models predict CBN tool wear and tear in grinding and cutting processes, enabling predictive maintenance strategies.

- AI algorithms accelerate the discovery and formulation of new CBN composites and specialized bonding agents for niche applications.

- Data analytics enhance quality control and defect detection during CBN component manufacturing, ensuring higher product reliability.

- Smart manufacturing systems integrate CBN tool data for real-time process optimization and enhanced material removal rates.

- Automation facilitated by AI streamlines the handling and utilization of CBN inserts in high-precision, automated CNC machining centers.

DRO & Impact Forces Of Cubic Boron Nitride Market

The Cubic Boron Nitride market is predominantly driven by the increasing complexity of engineering materials, particularly the use of hardened steels and exotic alloys in demanding industries like automotive and aerospace, where conventional abrasive tools are inadequate. The rising global demand for precision components requiring exceptionally tight tolerances and superior surface finishes further fuels the adoption of CBN abrasives. However, the market faces significant restraints, primarily the extraordinarily high initial cost of CBN tools compared to cheaper alternatives like tungsten carbide or aluminum oxide, and the substantial investment required in HPHT synthesis facilities, which limits the number of global producers capable of consistent, high-quality output. Opportunities arise from the rapidly expanding electric vehicle sector, requiring specialized machining of components like battery substrates and motor shafts, as well as the increasing adoption of dry machining techniques that leverage CBN's high thermal stability.

The impact forces influencing the market trajectory are multifaceted. Technological advancements act as a strong positive force; continuous innovation in bonding technology and crystal structure refinement allows CBN tools to tackle even harder materials with greater efficiency and longevity. Conversely, the environmental impact and energy consumption associated with the HPHT process present a restraining force, pushing the industry towards developing more energy-efficient synthesis methods. The threat of substitutes, while low in ultra-hard machining applications, remains a factor in general metalworking, where enhanced ceramics or advanced coatings might offer competitive performance improvements at a lower cost. Furthermore, geopolitical stability affects the supply chain of raw materials, such as high-purity boron and nitrogen precursors, essential for CBN synthesis.

Market dynamics are intensely influenced by the interplay between material science and end-user demands. As regulatory pressures mandate lighter, more fuel-efficient components in transportation, the use of difficult-to-machine, lightweight alloys increases, thereby amplifying the need for CBN tools capable of high material removal rates without compromising structural integrity or surface quality. This fundamental requirement ensures that despite the high cost, the total economic benefit derived from extended tool life and increased throughput justifies the investment in high-performance CBN tooling, solidifying its irreplaceable role in modern, high-volume, precision manufacturing environments across major global industrial hubs.

Segmentation Analysis

The Cubic Boron Nitride market is comprehensively segmented based on product type, application, end-use industry, and geographic region, allowing for detailed analysis of market dynamics and targeted strategic planning. Product segmentation typically includes categories such as CBN micro-powder (used for lapping and polishing), CBN sintered products (inserts and wheels), and CBN coating materials. The performance characteristics of CBN materials are heavily dependent on their synthesis method and the subsequent bonding agent used—metallic, resin, or ceramic—each tailored for specific machining environments and workpiece materials, necessitating granular reporting within these classifications for accurate market sizing.

Application segmentation focuses primarily on the usage patterns within grinding, cutting, and honing processes, with grinding applications typically representing the dominant share due to the widespread use of CBN wheels in tool sharpening and precision surface finishing of hardened metals. End-use segmentation is crucial, identifying key sectors such as automotive (engine components, transmission parts), aerospace (turbine blades, landing gear), machine tools (precision bearings, guide rails), and electronics (semiconductor substrates, specialized polishing). The differential growth rates among these end-user segments, particularly the rapid growth in aerospace and electronics, are pivotal determinants of overall market expansion trends.

Understanding these segments is essential for stakeholders to optimize their production mixes and sales channels. For instance, producers focusing on high-volume automotive markets prioritize cost-effective CBN inserts and standard grinding wheels, while those targeting the aerospace sector must adhere to stringent quality standards and specialize in custom, high-durability CBN tools for superalloy processing. Regional segmentation reflects the maturity of industrial bases and manufacturing capacity, with APAC leading in production volume and North America leading in value-added, high-performance CBN application usage.

- By Product Type:

- CBN Inserts and Tools (Polycrystalline CBN - PCBN)

- CBN Grinding Wheels (Vitrified, Resin, Metal Bonded)

- CBN Micron Powder and Slurry

- CBN Composites and Films

- By Application:

- Grinding and Honing (Internal, Cylindrical, Surface Grinding)

- Cutting and Turning (Hard Turning, Milling, Drilling)

- Lapping and Polishing

- By End-Use Industry:

- Automotive Industry (Engine blocks, crankshafts, gears)

- Aerospace & Defense (Turbine parts, landing gear components)

- Machine Tools and Equipment Manufacturing

- Bearing and Gear Manufacturing

- Electronics and Semiconductor Manufacturing

- Medical Devices and Precision Instruments

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA) (GCC Countries, South Africa)

Value Chain Analysis For Cubic Boron Nitride Market

The Cubic Boron Nitride value chain begins with upstream activities focused on the procurement and refinement of critical raw materials, primarily high-purity boron nitride precursors, which are synthesized under high pressure and high temperature (HPHT) conditions to form the CBN crystal structure. This synthesis phase is highly specialized, capital-intensive, and constitutes a critical bottleneck in the value chain, as only a limited number of global players possess the required technological expertise and infrastructure. Key upstream challenges involve managing the consistency of crystal growth and ensuring the quality of the precursor materials, which directly influence the superabrasive properties of the final product.

Midstream activities involve processing the synthesized CBN grit into various usable forms, including bonding the material with metallic, resin, or ceramic matrices to create grinding wheels, lapping compounds, or pressing them into polycrystalline cubic boron nitride (PCBN) compacts for cutting inserts. The choice of bonding agent is paramount, dictating the tool’s suitability for wet or dry machining and its resistance to thermal shock and chemical degradation. Distribution channels for CBN products are segmented into direct sales, particularly for large industrial accounts in the automotive and aerospace sectors requiring customized solutions, and indirect sales through specialized industrial distributors and tool suppliers who serve smaller job shops and general engineering firms.

Downstream analysis focuses on the end-user applications where CBN tools are deployed, primarily in hard turning, milling, and high-precision grinding operations. Direct channels are favored for highly technical products where application engineering support is necessary, ensuring customers maximize the tool's performance in complex operations like hard part machining of gears and bearings. Indirect channels benefit from the distributor's regional reach and inventory management capabilities, offering off-the-shelf CBN products efficiently. The value capture is highest in the midstream and downstream segments, where technological integration and specialized application support differentiate manufacturers and distributors, enabling premium pricing due to the immense productivity gains CBN provides to end-users.

Cubic Boron Nitride Market Potential Customers

Potential customers for Cubic Boron Nitride (CBN) products are predominantly large-scale industrial manufacturers and specialized precision engineering firms operating within sectors that require the machining of exceptionally hard or abrasive materials where conventional tooling fails to meet performance or cost-efficiency metrics. The automotive industry represents the single largest end-user segment, with manufacturers relying heavily on CBN inserts for hard turning of critical powertrain components such as hardened steel gears, camshafts, and transmission parts to ensure durability and dimensional accuracy. The stringent quality standards and high volume of production in automotive manufacturing necessitate the use of CBN tools to achieve necessary cycle times and reduce tool change frequency.

The aerospace and defense industry forms another significant customer base, characterized by its need to machine thermally resistant superalloys, including Nickel-based and Titanium alloys, often used in turbine components and structural airframe parts. These materials are notoriously difficult to machine, making CBN tools, particularly advanced PCBN inserts, essential for achieving the required surface integrity and structural precision demanded by safety-critical applications. The high value associated with these components means that the upfront cost of CBN tooling is easily justified by the reduction in scrap rates and improvement in component performance and longevity.

Furthermore, the general machine tool industry, including bearing manufacturers and tool and die makers, consistently requires high-performance abrasives for sharpening high-speed steel (HSS) and carbide tools, and for the precision grinding of rollers and races used in industrial bearings. In emerging sectors, the electronics industry, specifically in the preparation of semiconductor substrates and advanced thermal management components, is rapidly increasing its consumption of CBN micro-powders and films, driven by the materials' superior thermal conductivity, positioning these firms as high-growth potential customers for specialized CBN products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six, Sandvik AB (Seco Tools), Kennametal Inc., Sumitomo Electric Industries, Tungaloy Corporation, Saint-Gobain, ILJIN Diamond, Tomei Diamond, Beijing Worldia Diamond Tools, Zhengzhou Sino-Crystal Diamond Co., Henan Huanghe Whirlwind, EHWA Diamond, 3M Company, Asahi Diamond Industrial Co., Ltd., CERATIZIT Group, Hyperion Materials & Technologies, Showa Denko K.K., Kyocera Corporation, Mitsubishi Materials Corporation, NanoDiamond Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cubic Boron Nitride Market Key Technology Landscape

The core technology underpinning the Cubic Boron Nitride market is the High-Pressure, High-Temperature (HPHT) synthesis method, which mimics the natural conditions required to transform hexagonal boron nitride (HBN) into its cubic, superhard phase. Continuous advancements in HPHT technology focus on increasing the volume capacity of synthesis presses (such as belt-type, cubic, and toroidal presses), enhancing temperature and pressure uniformity within the reaction cell, and developing novel solvent-catalyst systems. These technological improvements aim to produce CBN crystals with superior thermal stability, optimized crystal morphology, and higher purity, crucial factors determining the final abrasive performance, especially in demanding applications like hard turning of exotic aerospace materials.

Beyond the synthesis of the raw material, the bonding and compaction technologies are equally critical. Polycrystalline Cubic Boron Nitride (PCBN) inserts are manufactured by sintering CBN particles with a ceramic or metallic binder under extreme pressure and temperature, resulting in highly dense, tough cutting tools. Recent technological shifts involve developing advanced ceramic bonding systems for grinding wheels, offering enhanced porosity control and chemical resistance, which are vital for reducing thermal damage to workpieces during high-speed grinding. Furthermore, physical vapor deposition (PVD) and chemical vapor deposition (CVD) techniques are increasingly used to apply thin, high-performance CBN coatings onto lower-cost substrates, expanding the material's application range into areas where solid CBN tools might be cost-prohibitive.

The integration of digital technologies, including Artificial Intelligence and IoT, into the manufacturing landscape is rapidly influencing the application of CBN tools. Smart tooling, embedded with sensors, provides real-time data on temperature, vibration, and force during machining. This data allows for dynamic adjustment of machining parameters to prevent premature tool failure and maximize material removal rates. This trend towards intelligent manufacturing necessitates CBN tool manufacturers to focus not only on material science but also on digital integration, ensuring their products function optimally within sophisticated CNC environments and contribute proactively to overall manufacturing efficiency and process control.

Regional Highlights

The global Cubic Boron Nitride market exhibits significant regional variation in terms of production capacity, consumption drivers, and technological sophistication. The Asia Pacific (APAC) region currently dominates the market both in volume and value and is projected to experience the highest growth rate during the forecast period. This dominance is attributed to the substantial presence of robust manufacturing bases, particularly in China, Japan, South Korea, and India, which are major global hubs for automotive component production, electronics, and general machinery manufacturing. China, in particular, benefits from massive governmental investments in infrastructure and indigenous high-pressure material synthesis technology, leading to high production output and increased domestic consumption of CBN products.

North America and Europe represent mature markets characterized by stringent quality requirements and a high concentration of specialized, high-value end-users, especially in the aerospace and defense sectors, as well as advanced medical device manufacturing. These regions drive demand for premium, customized CBN solutions, such as micro-grain PCBN inserts and advanced ceramic-bonded grinding wheels, focusing heavily on precision grinding and machining of superalloys and hardened steels. While the overall volume growth may be slower than APAC, the value generated per unit of CBN consumption in these Western markets remains exceptionally high due to the complexity and precision required in their respective industrial applications.

The Latin America and Middle East & Africa (MEA) regions, while smaller, offer significant emerging opportunities. MEA's market growth is primarily linked to the expansion of industrial diversification initiatives and increasing investment in local manufacturing, particularly in the oil and gas sector which utilizes CBN for specialized drilling and processing equipment components. Latin America, particularly Brazil and Mexico, benefits from a growing automotive manufacturing base, attracting major international CBN suppliers who aim to capture the developing need for high-performance machining solutions in these expanding industrial clusters, although supply chain reliability remains a structural challenge in certain sub-regions.

- Asia Pacific (APAC): Leads global consumption and production, driven by massive automotive, electronics, and general industrial growth; focus on volume production and competitive pricing; high potential for capacity expansion.

- North America: Strong market for high-value, specialized CBN tools used in aerospace, defense, and high-precision tooling; emphasis on technological superiority and customized solutions; significant R&D spending on new material applications.

- Europe: High demand from established automotive (especially Germany and Italy) and high-quality machine tool industries; preference for advanced vitrified and ceramic bonded CBN grinding wheels for superior finish and tolerance.

- Latin America: Growing industrial base, particularly in the automotive and mining sectors; increasing imports of high-performance CBN tooling to modernize manufacturing capabilities.

- Middle East & Africa (MEA): Emerging market driven by oil & gas equipment manufacturing and localized industrialization efforts; focused primarily on maintenance and high-durability applications in harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cubic Boron Nitride Market.- Element Six

- Sandvik AB (Seco Tools)

- Kennametal Inc.

- Sumitomo Electric Industries

- Tungaloy Corporation

- Saint-Gobain

- ILJIN Diamond

- Tomei Diamond

- Beijing Worldia Diamond Tools

- Zhengzhou Sino-Crystal Diamond Co.

- Henan Huanghe Whirlwind

- EHWA Diamond

- 3M Company

- Asahi Diamond Industrial Co., Ltd.

- CERATIZIT Group

- Hyperion Materials & Technologies

- Showa Denko K.K.

- Kyocera Corporation

- Mitsubishi Materials Corporation

- NanoDiamond Products

- Nippon Steel & Sumitomo Metal Corporation

- Bosch Rexroth AG

- Puma-Chem Corp.

- SF-Diamond

- Zhongnan Diamond Co., Ltd.

- Diamond Innovations

- CISRI (China Iron and Steel Research Institute)

- Syntech Group

- New Asia Superhard Materials

- Zhecheng Hongxiang Superhard Material

Frequently Asked Questions

Analyze common user questions about the Cubic Boron Nitride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Cubic Boron Nitride (CBN) and why is it preferred over diamond in some applications?

CBN is a superabrasive material, second in hardness only to diamond. It is preferred over diamond for machining ferrous materials (iron, steel, and nickel alloys) because, unlike diamond, CBN is chemically inert and thermally stable, preventing premature wear and reaction at the high temperatures generated during the machining of these hard metals.

Which end-use industry drives the highest demand for CBN tools globally?

The automotive industry is the largest consumer of CBN, using it extensively for the hard turning and grinding of critical powertrain components such as engine parts, gears, and transmission systems, where high precision and durability in hardened steels are essential.

What are the primary technological challenges in the synthesis of high-quality Cubic Boron Nitride?

The main challenges involve the high capital investment and energy consumption of the High-Pressure, High-Temperature (HPHT) process, maintaining pressure and temperature uniformity for consistent crystal growth, and developing robust bonding agents for optimal tool performance under varying stress conditions.

How is the rise of Electric Vehicles (EVs) affecting the CBN market?

While EVs reduce demand for traditional internal combustion engine component machining, they generate new demand for CBN in processing ultra-hard materials required for specialized motor shafts, high-strength structural battery components, and complex gearbox systems, resulting in a net positive shift toward specialized CBN grades.

What distinguishes polycrystalline CBN (PCBN) inserts from conventional CBN grinding wheels?

PCBN inserts are sintered compacts used primarily for cutting and turning applications in high-volume, continuous machining operations, offering superior toughness and thermal stability. CBN grinding wheels, conversely, utilize bonded CBN particles and are specialized for high-precision abrasive processes like surface, cylindrical, and internal grinding.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cubic Boron Nitride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Superabrasives Market Statistics 2025 Analysis By Application (Automotive, Aerospace and Defense, Building and Construction, Oil and Gas), By Type (Diamond Material, Cubic Boron Nitride Material, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cubic Boron Nitride Abrasive Market Statistics 2025 Analysis By Application (Automotive, Machinery, Metal Fabrication, Electronics, Other), By Type (CBN Monocrystalline, CBN Micro Mist), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Superabrasive Market Statistics 2025 Analysis By Application (Automotive, Machinery, Metal Fabrication, Aerospace), By Type (Diamond, Cubic Boron Nitride (CBN), Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Hexagonal BN Market Statistics 2025 Analysis By Application (Hexagonal Boron Nitride Composite Ceramics, Preparation of Cubic Boron Nitride (CBN), Paint, Coatings and Lubricants Industry, Cosmetics Industry, Industrial Packaging), By Type (Premium Grade (PG), Customized Grade (CG), Standard Grade (SG)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager