Cutting Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433312 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Cutting Tools Market Size

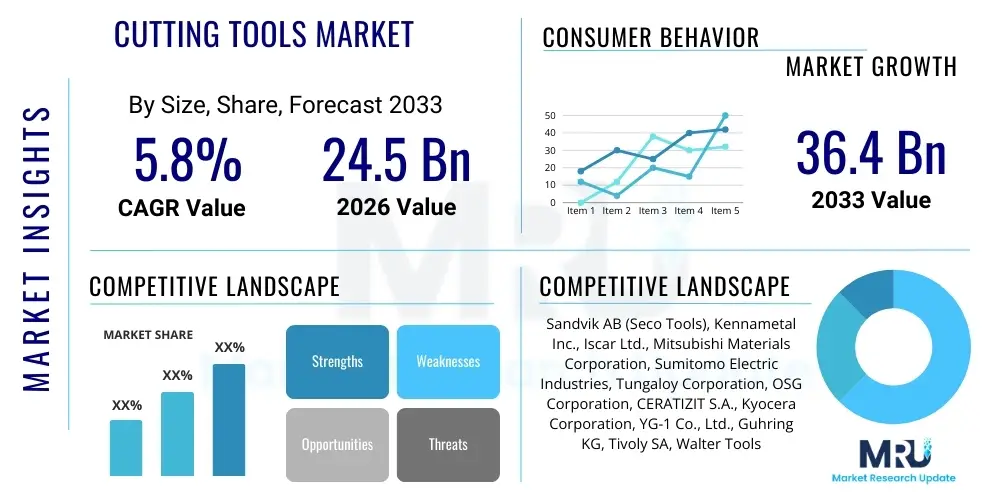

The Cutting Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $36.4 Billion by the end of the forecast period in 2033.

Cutting Tools Market introduction

The Cutting Tools Market encompasses a vast array of high-precision instruments essential for machining processes across virtually all manufacturing sectors. These tools, which include drills, mills, reamers, taps, and inserts, are critical for shaping, sizing, and finishing components to exacting specifications. Market growth is fundamentally driven by the expanding global demand for complex, high-tolerance components, particularly within the automotive, aerospace, medical device, and energy sectors, where material complexity (such as high-strength steels, titanium alloys, and composites) necessitates specialized tooling materials and sophisticated coating technologies like Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD). The continuous innovation in material science and tool geometries is a key enabler for productivity gains in modern manufacturing environments, allowing for faster processing speeds and extended tool life.

Major applications of cutting tools span high-volume production lines, specialized job shops, and integrated manufacturing systems. In the automotive industry, these tools are indispensable for powertrain components, chassis parts, and increasingly for battery enclosures in electric vehicles (EVs). The aerospace sector demands tools capable of handling superalloys with exceptional thermal stability and precision, vital for jet engine components and structural airframe parts. The inherent benefits of utilizing advanced cutting tools include improved surface finish quality, significant reduction in cycle times, enhanced machining accuracy, and crucial cost savings stemming from reduced downtime and optimized material removal rates. The performance of a cutting tool directly influences the overall efficiency and profitability of a manufacturing operation.

Driving factors propelling this market include the global trend toward industrial automation and the implementation of Industry 4.0 principles, which mandate higher performance and data integration capabilities from tooling. Furthermore, the increasing complexity of raw materials used in next-generation products, such as lightweighting initiatives in transportation, fuels continuous research and development into novel tool substrates (like specialized carbides and ceramics) and intelligent tooling systems equipped with embedded sensors for real-time monitoring. This focus on maximizing operational efficiency and adapting to new material challenges is the core catalyst for market expansion.

Cutting Tools Market Executive Summary

The Cutting Tools Market Executive Summary highlights a pronounced shift toward digitization and high-performance material applications. Current business trends indicate robust investment in hybrid manufacturing solutions that integrate subtractive processes with additive capabilities, fundamentally altering tool design requirements and usage patterns. The push for automated machining centers and unattended operation necessitates the adoption of highly reliable, long-life tools and sophisticated tool management software, reducing reliance on manual intervention and optimizing inventory control. Geographically, the Asia Pacific (APAC) region continues its dominance, fueled by massive industrial expansion in China, India, and Southeast Asia, driven by local and export-oriented manufacturing, particularly in consumer electronics and automotive parts. This regional growth is coupled with strategic investments in high-tech manufacturing centers in North America and Europe, focusing on advanced aerospace and medical device production.

Segment trends reveal a rapid adoption of Indexable Inserts due to their versatility and cost-efficiency in heavy-duty and roughing applications, allowing manufacturers to quickly swap out worn cutting edges without replacing the entire tool body. Concurrently, the demand for Solid Carbide tools is accelerating in high-precision and miniature machining applications, benefiting from superior rigidity and wear resistance crucial for intricate component features. Material innovation within these segments, focusing on advanced coatings such as aluminum chromium nitride (AlCrN) and diamond-like carbon (DLC), ensures tools can withstand extreme temperatures and pressures generated when machining difficult-to-cut materials like nickel-based superalloys and hardened steels.

The overall market trajectory is defined by consolidation among major players seeking to acquire specialized technology firms and expand their regional service capabilities, ensuring they can provide comprehensive tooling solutions alongside technical expertise. This consolidation, coupled with the rising imperative for sustainability in manufacturing, drives demand for reconditioning and recycling programs for expensive tools like carbide inserts. Successful market participation requires companies to excel not only in material science but also in delivering digital services, predictive analytics, and integrated tool management systems that align with the smart factory ecosystem, ensuring maximum tool performance and operational transparency across the customer base.

AI Impact Analysis on Cutting Tools Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cutting Tools Market primarily center on three core areas: predictive maintenance, optimization of tool selection and path generation, and closed-loop quality control in autonomous machining environments. Users are keenly interested in how AI algorithms can leverage data from spindle loads, vibration sensors, and acoustic emissions to accurately predict tool wear and impending failure, thereby maximizing tool utilization and minimizing costly unplanned downtime. A significant concern revolves around the integration complexity—specifically, how to effectively merge proprietary tool data with machine tool control systems (CNC) and Manufacturing Execution Systems (MES) using cloud-based or edge computing solutions. Expectations are high that AI will lead to truly self-optimizing machining processes, moving beyond simple programmed parameters to dynamic, real-time adjustments of feed rates and speeds based on instantaneous machining conditions and material behavior, fundamentally transforming tooling life management and process stability.

AI’s influence extends profoundly into the design and performance validation phases of cutting tools. Generative design tools, powered by AI, are enabling manufacturers to iterate tool geometries faster, optimizing chip evacuation, thermal management, and vibration damping far beyond conventional simulation methods. This capability allows tool makers to rapidly respond to unique material challenges presented by industries like aerospace, where complex geometries and difficult materials are standard. Furthermore, AI assists in optimizing supply chain logistics and inventory management for end-users by forecasting demand for specific tool types based on production schedules and historical wear rates across disparate machine fleets, providing a robust solution to maintain lean inventories while ensuring tool availability.

In the context of generative manufacturing environments, AI facilitates the creation of digital twins for cutting tools, allowing operators and engineers to simulate the performance of a new tool or coating under various stress scenarios before it even reaches the physical production floor. This simulation capability dramatically reduces prototype costs and speeds up time-to-market for specialized tools. Ultimately, AI transforms the cutting tool from a passive consumable into an integral, intelligent component of the digital manufacturing ecosystem, providing actionable data that informs not only the immediate machining process but also future capital investment and tooling procurement strategies across the entire enterprise.

- AI enhances predictive maintenance by analyzing sensor data (vibration, temperature) to anticipate tool failure, maximizing utilization time.

- Generative Design algorithms optimize cutting tool geometries for enhanced chip evacuation and reduced thermal stress during machining.

- Machine Learning models refine cutting parameters (speed, feed rate) in real-time, achieving dynamic process optimization and extended tool life.

- AI integrates tool data with CNC and MES systems, enabling fully automated, closed-loop manufacturing processes (Smart Manufacturing).

- Advanced image recognition and AI inspection ensure stringent quality control of manufactured parts and used cutting edges, minimizing defects.

DRO & Impact Forces Of Cutting Tools Market

The Cutting Tools Market is shaped by significant Drivers, Restraints, Opportunities, and complex Impact Forces. Key drivers include the exponential growth in the global automotive industry, particularly the rapid transition toward Electric Vehicles (EVs), which requires specialized tooling for new materials like aluminum, composite battery housings, and intricate motor components, moving away from traditional internal combustion engine (ICE) tooling. Simultaneously, the persistent demand for lightweighting across aerospace and automotive sectors necessitates tooling capable of efficiently processing difficult-to-cut materials such as titanium alloys (Ti-6Al-4V) and nickel-based superalloys (Inconel), driving innovation in High-Performance Cutting (HPC) technologies. The ongoing global trend of industrial automation and the proliferation of advanced five-axis and multi-tasking CNC machines also fuels demand for specialized, high-rigidity tools designed for complex machining operations, emphasizing precision and minimizing operational variance across the supply chain.

Restraints in the market primarily involve the high volatility and increasing cost of raw materials, particularly tungsten carbide, which forms the foundation of most high-performance cutting tools. Fluctuations in geopolitical stability and supply chain disruptions can severely impact procurement costs and lead times, pressuring manufacturers to seek alternative materials or intensify recycling initiatives. Additionally, the shortage of highly skilled machinists and programmers capable of leveraging the full potential of advanced CNC machines and sophisticated tooling remains a structural restraint, slowing the adoption rate of some ultra-high-end tool systems that require specialized knowledge for optimal setup and operation. Economic downturns or regional trade disputes can temporarily suppress capital expenditure in manufacturing sectors, impacting tool consumption.

Opportunities are abundant, centered around the integration of Additive Manufacturing (AM) capabilities into the tooling production process, allowing for the creation of customized tools with intricate internal cooling channels that significantly enhance performance and thermal stability. The burgeoning medical device manufacturing sector, requiring micron-level precision for implants and surgical instruments, represents a high-value niche market demanding specialized micro-tooling solutions. Furthermore, the development of intelligent tooling—tools embedded with RFID tags or sensors for monitoring performance and identity—offers a compelling opportunity for market players to transition from being simple tool suppliers to providers of integrated manufacturing data services, aligning perfectly with the demands of Industry 4.0 environments. The combined impact forces result in a market where technical expertise, material innovation, and digital integration are the non-negotiable prerequisites for sustained competitive advantage.

Segmentation Analysis

The Cutting Tools Market is meticulously segmented based on product type, material composition, end-use application, and distribution channel, reflecting the diverse and highly specialized requirements of modern manufacturing. Segmentation analysis is critical for understanding market dynamics, as different segments exhibit varying growth rates influenced by technological advancements, regulatory environments, and regional industrial output. The primary product segmentation distinguishes between Indexable Tools, favored for large-scale, versatile, and heavy material removal tasks due to their replaceable inserts, and Solid Tools, preferred for high-precision finishing, small-part machining, and superior rigidity in intricate applications. The evolution of composite materials and high-strength alloys continues to drive investment specifically within the high-performance material and specialized application segments, creating lucrative niche markets.

Material composition segmentation highlights the dominance of cemented carbide, followed by High-Speed Steel (HSS), ceramics, and superhard materials like Polycrystalline Diamond (PCD) and Cubic Boron Nitride (CBN). Cemented carbide tools, often enhanced with advanced coatings (TiN, AlTiN, CVD Diamond), remain the industry standard, balancing cost, toughness, and wear resistance. However, the rapidly growing demand from the aerospace and medical sectors for machining superalloys is accelerating the utilization of specialized ceramics and CBN, which offer superior performance at elevated temperatures and hardness levels. Understanding this material shift is crucial for manufacturers developing next-generation tooling portfolios, ensuring compatibility with evolving manufacturing specifications.

Application segmentation reveals the automotive and general engineering sectors as the largest consumers, though aerospace and defense consistently drive demand for the highest performance and most expensive tools. The medical sector, demanding stringent traceability and micro-machining capabilities for implants and instruments, is becoming a key focus area for specialized tool makers. Regional analysis further refines these segment insights, showing that adoption rates of advanced tooling vary significantly, heavily influenced by local manufacturing maturity, labor costs, and governmental support for digitalization initiatives. The ongoing technological push towards higher throughput and precision across all these sectors underpins the stable long-term growth of the market.

- By Product Type:

- Indexable Inserts (Turning, Milling, Drilling, Boring)

- Solid Tools (Drills, End Mills, Reamers, Taps)

- Rotary Tools

- Hole Making Tools

- Boring Tools

- Others (Threading, Grooving, Parting)

- By Material:

- Cemented Carbide

- High-Speed Steel (HSS)

- Ceramics

- Superhard Materials (PCD, CBN)

- Cermets

- By Application/End-Use Industry:

- Automotive (ICE and EV components)

- Aerospace & Defense

- General Engineering

- Energy (Oil & Gas, Wind Turbine components)

- Medical Devices

- Die & Mold

- By Coating Type:

- PVD (Physical Vapor Deposition)

- CVD (Chemical Vapor Deposition)

- Uncoated

- DLC (Diamond-Like Carbon)

Value Chain Analysis For Cutting Tools Market

The Value Chain for the Cutting Tools Market is characterized by highly specialized stages, beginning with upstream procurement of critical raw materials, principally Tungsten, Cobalt, and specialized powder metal alloys. The upstream segment is challenged by resource concentration and geopolitical risks associated with these strategic materials, necessitating robust sourcing and recycling strategies. Manufacturers engage in complex powder metallurgy and sintering processes to create the carbide blanks and substrates, requiring significant capital investment in high-precision equipment and specialized metallurgical expertise to control grain size and material purity, which directly influences the final tool performance. This foundational stage dictates the quality, cost, and availability of the core tool structure, making supply chain resilience a paramount operational concern for major tool producers globally.

The midstream component involves the core manufacturing process, including pressing, sintering, grinding, and, crucially, the application of advanced coatings (CVD/PVD). This phase is highly capital-intensive and technologically advanced, with market leaders investing heavily in proprietary grinding machines and coating technologies to achieve micron-level tolerances and superior wear resistance. Tool geometry design, often aided by computational fluid dynamics and advanced simulation software, is a critical value-add during this stage, differentiating premium tool providers. Standardization is prevalent in high-volume, general-purpose tools, while custom engineering dominates in niche sectors like aerospace or medical, where unique material compositions require bespoke tooling solutions and rapid prototyping capabilities.

Downstream activities focus on distribution, technical support, and end-user engagement. Distribution channels are typically a mix of direct sales to large Original Equipment Manufacturers (OEMs) for high-volume, standardized contracts, and an extensive network of specialized industrial distributors or third-party integrators who provide localized inventory, technical consultation, and regrinding/reconditioning services to small and medium enterprises (SMEs). The trend is moving towards integrating digital services, where tool manufacturers offer sophisticated tool management software (TMS), vending solutions, and performance monitoring as part of the overall offering. Technical support, including application engineering and process optimization advice, is a key differentiating factor, transforming the distributor relationship from transactional to strategic, ultimately enhancing overall customer productivity and loyalty in a highly competitive B2B market environment.

Cutting Tools Market Potential Customers

The primary customers (End-Users/Buyers) of cutting tools are diverse manufacturing entities that require precise material removal to create finished components. The largest segment remains the Automotive industry, encompassing both traditional internal combustion engine (ICE) component suppliers and the rapidly expanding Electric Vehicle (EV) supply chain, including battery enclosure manufacturers, motor housing suppliers, and structural component producers focused on lightweight materials like aluminum and composites. These customers require high volumes of reliable, standardized tools for long production runs, alongside specialized tools for complex machining of new EV components, driving demand for both indexable and solid carbide solutions optimized for high-speed machining environments.

The Aerospace and Defense sector represents a vital, high-value customer base, characterized by stringent quality control and the need to machine exotic materials (e.g., Inconel, Titanium alloys) that are extremely difficult to cut. Customers in this segment prioritize tool reliability, precision, and application-specific engineering support over absolute cost, driving demand for specialized superhard materials (CBN, PCD) and highly customized geometries capable of withstanding extreme thermal loads and minimizing material hardening during machining. These buyers often maintain direct relationships with tool manufacturers for technical consultancy and proprietary tool development programs, seeking strategic partnerships rather than simple transactional purchases.

Other significant potential customers include the General Engineering and Machine Shops segment, which comprises numerous small and medium enterprises (SMEs) requiring a versatile range of tools for job-shop environments, typically sourced through local industrial distributors. Furthermore, the Medical Device sector is a rapidly growing customer segment, demanding micro-machining capabilities for implants, surgical instruments, and prosthetic components, emphasizing materials like stainless steel, titanium, and specialized polymers. The Energy sector, including oil & gas drilling equipment and wind turbine component manufacturers (requiring large-diameter tooling for gearbox and hub machining), also constitutes a significant buyer base, particularly for robust tools designed for heavy-duty, demanding applications in specialized materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $36.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB (Seco Tools), Kennametal Inc., Iscar Ltd., Mitsubishi Materials Corporation, Sumitomo Electric Industries, Tungaloy Corporation, OSG Corporation, CERATIZIT S.A., Kyocera Corporation, YG-1 Co., Ltd., Guhring KG, Tivoly SA, Walter Tools (Sandvik), Mapal Dr. Kress KG, LMT Tools, Emuge-Franken, HARVI, Nachi-Fujikoshi Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cutting Tools Market Key Technology Landscape

The technology landscape of the Cutting Tools Market is undergoing rapid transformation, largely driven by the demands of digital manufacturing and the processing of novel materials. A primary technological focus is on enhancing tool longevity and performance through advanced coating science. Multi-layer and nanocomposite coatings, utilizing techniques like High-Power Impulse Magnetron Sputtering (HiPIMS) for PVD applications, are becoming standard, offering superior hardness, reduced friction, and thermal stability compared to traditional mono-layer coatings. These advanced surface treatments are crucial for maintaining edge integrity when machining high-temperature alloys and hardened steels at aggressive speeds and feeds, extending the period between tool changes and supporting lights-out manufacturing operations.

Another pivotal technological development is the integration of embedded intelligence within the tools themselves, often referred to as 'Smart Tooling'. This involves incorporating micro-sensors, RFID chips, or data matrix codes that facilitate real-time performance monitoring, tool identification, and traceability throughout the entire lifecycle. These sensors can transmit data related to temperature, vibration, and cutting forces back to the machine control and cloud systems. This data, when analyzed by AI, enables adaptive control systems to dynamically adjust machining parameters, leading to optimal material removal rates, and providing crucial inputs for proactive maintenance scheduling. This shift towards data-driven tooling management is critical for operational excellence in Industry 4.0 facilities, moving beyond traditional, time-based maintenance models.

Furthermore, Additive Manufacturing (AM) is increasingly impacting tool production, particularly in creating specialized tool bodies (shanks and holders) with complex internal geometries impossible to achieve through conventional methods. Laser Powder Bed Fusion (LPBF) allows for the incorporation of intricate conformal cooling channels directly into the tool holder, enabling highly efficient dissipation of heat from the cutting zone. This significantly reduces thermal shock on the cutting edge, improving tool life and overall process stability, especially when deep-hole drilling or machining heat-sensitive materials. While the inserts themselves are still predominantly manufactured using sintering, the customization of the tool body using AM represents a significant technological leap toward optimized and application-specific cutting solutions, driving greater customization in the high-end market segment.

Regional Highlights

- Asia Pacific (APAC): Dominance and High Growth Rate: APAC represents the largest and fastest-growing regional market, primarily driven by massive manufacturing output in China, India, South Korea, and Japan. China remains the global production hub for automotive, electronics, and general engineering components, demanding both high-volume standardized tools and increasingly sophisticated high-performance tooling for domestic R&D initiatives and premium export markets. The region benefits from lower manufacturing labor costs, fueling large capital investments in automated machining centers which require high-reliability tooling.

- North America: Technological Adoption and Aerospace Focus: North America demonstrates robust demand, largely centered on the high-value aerospace & defense sector, complex medical device manufacturing, and the revitalization of the automotive sector, heavily investing in EV production capabilities. The focus here is less on volume and more on technological sophistication, driving rapid adoption of intelligent tooling, specialized coatings (PCD/CBN), and digital tool management systems to maximize efficiency and maintain competitive advantage against lower-cost regions.

- Europe: Precision Engineering and Industry 4.0 Leadership: Europe, spearheaded by Germany, Italy, and Scandinavia, is defined by its strength in high-end automotive production (luxury vehicles), precision engineering, and machine tool manufacturing. This region is a leader in adopting Industry 4.0 standards, demanding cutting tool providers offer integrated digital solutions, sustainable manufacturing practices (tool recycling), and specialized solutions for complex, multi-axis machining applications in demanding materials.

- Latin America (LATAM): Gradual Industrialization: The LATAM market, led by Brazil and Mexico, exhibits steady growth tied to localized automotive production and basic industrialization. Demand is typically cost-sensitive, favoring HSS and standard carbide tools, though modernization in specific export-oriented sectors (e.g., aerospace parts in Mexico) is slowly increasing the need for high-performance tooling and associated technical support.

- Middle East and Africa (MEA): Energy Sector Influence: Growth in MEA is primarily linked to investments in the Oil & Gas sector, which requires specialized, large-format drilling and heavy machining tools for infrastructure and pipeline components. Economic diversification efforts are slowly boosting general engineering, though the market size remains smaller compared to other regions, dependent largely on volatile commodity prices impacting capital spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cutting Tools Market.- Sandvik AB (Seco Tools)

- Kennametal Inc.

- Iscar Ltd.

- Mitsubishi Materials Corporation

- Sumitomo Electric Industries

- Tungaloy Corporation

- OSG Corporation

- CERATIZIT S.A.

- Kyocera Corporation

- YG-1 Co., Ltd.

- Guhring KG

- Tivoly SA

- Walter Tools (Sandvik Group)

- Mapal Dr. Kress KG

- LMT Tools

- Emuge-Franken

- HARVI

- Nachi-Fujikoshi Corp.

- Shibaura Machine Co., Ltd. (formerly Toshiba Machine)

- J. Schwanog GmbH

Frequently Asked Questions

Analyze common user questions about the Cutting Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Cutting Tools Market?

The market growth is fundamentally driven by the global transition towards electric vehicle (EV) manufacturing, necessitating new aluminum and composite machining tools, alongside the stringent demand for precision components in the expanding aerospace and medical device sectors. The adoption of advanced manufacturing techniques (Industry 4.0) and the increasing need to machine high-strength, lightweight materials also fuel demand.

How does the transition to electric vehicles (EVs) impact cutting tool demand?

The EV transition reduces demand for tooling used in traditional internal combustion engines (ICE) but significantly increases demand for specialized tools used to machine large aluminum battery enclosures, electric motor housings, and lightweight chassis components. This shifts focus toward high-speed machining (HSM) and robust tools optimized for non-ferrous and composite materials.

Which material segment dominates the market and why is it important?

The Cemented Carbide segment dominates the market due to its superior balance of hardness, toughness, and wear resistance, making it suitable for a wide range of general and high-performance applications. Ongoing advancements in carbide coatings (PVD/CVD) further solidify its dominance, enabling higher productivity and longer tool life across diverse end-use industries.

What role does Artificial Intelligence (AI) play in modern cutting tool usage?

AI plays a critical role in enabling predictive maintenance by analyzing sensor data to forecast tool wear, optimizing tool path and cutting parameters in real-time, and accelerating the design of new, high-performance tool geometries using generative design methodologies, enhancing overall machining efficiency.

Which region offers the highest growth potential for cutting tool manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential, attributed to sustained large-scale industrial expansion, governmental support for manufacturing bases in countries like China and India, and the rising consumer demand for locally produced goods across the automotive and electronics supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Gear Cutting Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Speed Steel (HSS) Metal Cutting Tools Market Size Report By Type (HSS Milling Tools, HSS Drilling Tools, HSS Tapping Tools, HSS Reaming & Counterboring Tools, HSS Gear Cutting Tools, HSS Broaching Tools), By Application (Automobile Industry, Aircraft Industry, Oil & Gas Industry, Machinery Industry, Shipping Building Industry, Rail Transport Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Solid Carbide Cutting Tools Market Statistics 2025 Analysis By Application (Machinery Industry, Automotive Industry, Aerospace Industry, Energy Industry, Others), By Type (Aluminium Carbide, Calcium Carbide, Silicon Carbide, Tungsten Carbide, Iron Carbide), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cutting Tools Market Statistics 2025 Analysis By Application (Machinery Industry, Automotive Industry, Aerospace Industry, Energy Industry), By Type (Cemented Carbide, High Speed Steel, Ceramics, Diamond), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Metal Cutting Tools Market Statistics 2025 Analysis By Application (Machinery Industry, Automotive Industry, Aerospace Industry, Energy Industry), By Type (Cemented carbide, High speed steel, Ceramics, Diamond, Milling, Turning, Drilling, Grinding), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager