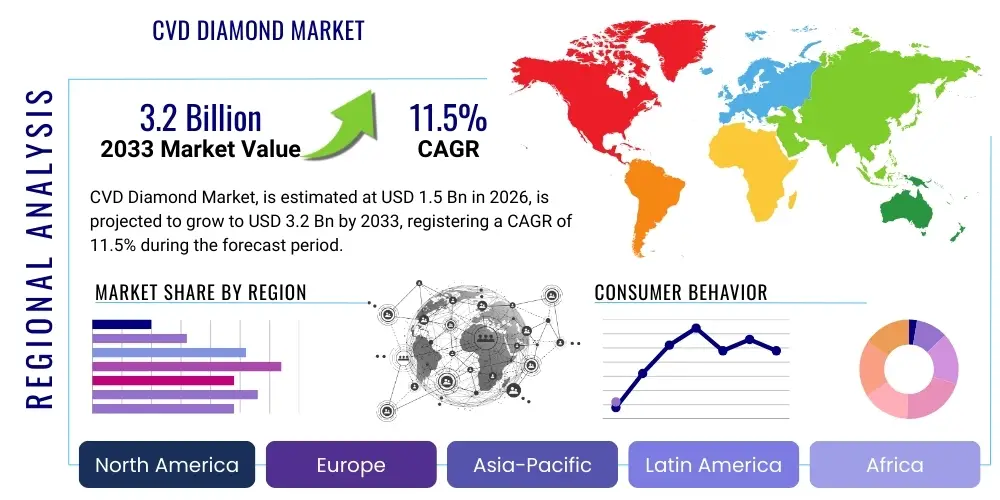

CVD Diamond Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437027 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

CVD Diamond Market Size

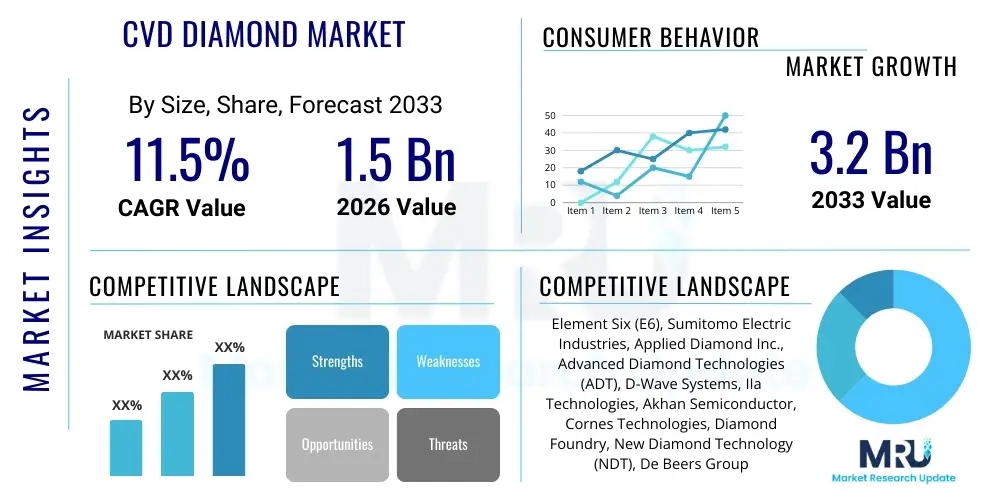

The CVD Diamond Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. This robust growth trajectory is primarily fueled by the increasing demand for advanced materials in high-technology sectors, including thermal management in power electronics, precision optics, and quantum computing applications. The unique material properties of Chemical Vapor Deposition (CVD) diamonds, such as extreme hardness, superior thermal conductivity, and chemical inertness, position them as critical enablers for next-generation devices, particularly where traditional materials fail to meet stringent performance requirements.

The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033. This valuation reflects the rapid scaling of production capabilities and the diversification of applications beyond traditional industrial uses like cutting and grinding tools. Investments in large-area deposition equipment and techniques aimed at reducing production costs are key factors underpinning this accelerated market expansion. Furthermore, the rising adoption of synthetic diamonds as a sustainable and ethically sourced alternative to natural diamonds in both industrial and gemstone markets contributes significantly to the anticipated revenue growth.

Geographically, Asia Pacific is expected to maintain market dominance, driven by substantial investments in semiconductor fabrication and electronics manufacturing hubs located in countries like China, South Korea, and Taiwan. However, significant R&D initiatives in North America and Europe, focusing on defect control and achieving ultra-high purity levels required for quantum technology, will ensure these regions also contribute substantially to market revenue throughout the forecast period. The strategic shift towards replacing traditional silicon carbide and gallium nitride substrates with diamond in high-power applications represents a major revenue stream.

CVD Diamond Market introduction

The CVD Diamond Market encompasses the global production, distribution, and utilization of diamonds synthesized using the Chemical Vapor Deposition technique. This method involves introducing carbon-containing gases (such as methane) into a vacuum chamber, where they are decomposed by microwave plasma or hot filament systems, allowing carbon atoms to deposit and form crystalline diamond films or bulk crystals on a substrate. This process allows for precise control over the material's properties, including purity, crystallographic orientation, and isotopic composition, making it highly versatile for both industrial and specialized technological applications. The resultant CVD diamonds exhibit exceptional characteristics, including the highest thermal conductivity of any known material, outstanding electrical insulation, high optical transparency across a wide spectrum, and extreme mechanical hardness.

Major applications of CVD diamonds span diverse high-growth industries. In electronics, they are crucial for advanced thermal management (heat spreaders) in high-power density components, improving the reliability and efficiency of 5G infrastructure, electric vehicle (EV) power inverters, and high-performance computing (HPC) systems. In optics, their wide band gap and transmission properties make them ideal for infrared windows, laser optics, and deep-UV detectors, particularly in harsh environments. Furthermore, the market benefits from significant adoption in advanced tooling (cutting, drilling, and polishing), medical devices (radiotherapy dosemeters), and specialized jewelry, where ethical sourcing and material consistency are paramount considerations. The ability to produce large, flawless, single-crystal diamonds opens pathways for next-generation quantum technologies and high-energy physics research.

The market growth is fundamentally driven by the relentless miniaturization and increasing power density of electronic devices, which necessitates superior thermal dissipation solutions that only CVD diamonds can efficiently provide. Key benefits include extended device lifespan, reduced operational energy costs, and enhanced performance ceilings unattainable with conventional materials. Other driving factors include technological advancements in deposition rates and scalability, decreasing the cost-per-carat for specific industrial grades, and regulatory pressures favoring sustainable material sourcing. The transition from legacy materials to diamond in cutting-edge defense, space, and medical technologies underscores the material’s critical role in future technological infrastructure.

CVD Diamond Market Executive Summary

The CVD Diamond Market is experiencing a paradigm shift from a niche industrial material utilized primarily in abrasives to a strategic enabling technology for sectors undergoing rapid technological transformation, such as 5G, electric mobility, and quantum computing. Business trends indicate significant capital expenditure in increasing reactor size and efficiency, alongside substantial mergers and acquisitions aimed at consolidating intellectual property related to large-area, single-crystal growth. Companies are strategically pivoting their focus toward producing electronic-grade (ultra-high purity) diamonds rather than solely industrial or gem-quality stones, reflecting the escalating financial returns and demand from semiconductor and photonics end-users. Supply chain robustness is being enhanced through vertical integration, ensuring control over precursors and post-processing technologies, thereby mitigating volatility risks inherent in specialized chemical supply chains.

Regional trends highlight the Asia Pacific region as the dominant manufacturing and application hub, largely driven by the concentration of semiconductor and consumer electronics industries. However, Europe and North America retain a strong competitive edge in high-value, research-intensive segments, particularly in defense, quantum applications, and specialized medical instrumentation. European governments and private entities are heavily investing in diamond-based sensor technology and quantum research infrastructure. Meanwhile, the Middle East and Africa (MEA) are emerging as potentially viable production locations due to access to necessary energy resources and investment in advanced manufacturing capabilities, though adoption remains primarily concentrated in energy exploration and specialized industrial tooling sectors. The regulatory landscape around material trade and origin verification is becoming increasingly stringent, favoring certified CVD synthetic products.

Segmentation trends reveal that the electronic grade segment, encompassing diamond materials used for heat spreaders and semiconductor substrates, is projected to register the fastest CAGR, surpassing the traditional mechanical and abrasive grade segments. This surge is directly correlated with the global transition towards high-frequency and high-power electronic systems, demanding materials capable of handling extreme operating conditions. Furthermore, the single-crystal diamond sub-segment is gaining significant traction over the polycrystalline diamond film segment, particularly in advanced research and quantum applications, where anisotropic properties and zero-defect requirements are essential. The optics and laser applications segment, driven by military and high-power industrial laser systems, represents a stable, high-margin niche within the overall market structure, maintaining steady demand for large, flawless optical windows.

AI Impact Analysis on CVD Diamond Market

User queries regarding AI's influence on the CVD Diamond Market frequently revolve around optimizing complex manufacturing parameters, ensuring consistent material quality, and accelerating the discovery of novel diamond applications. Users are concerned about how AI can handle the multi-dimensional complexity of the CVD growth process, which involves regulating precise gas flows, plasma temperature, pressure, and duration to achieve desired material properties (e.g., nitrogen vacancy defect centers for quantum). Key themes emerging from these inquiries include the expectation that AI and Machine Learning (ML) will drastically reduce synthesis time, minimize trial-and-error costs associated with R&D, and improve yield rates for electronic-grade, low-defect single crystals. Furthermore, users seek clarity on AI's role in automated quality control, predicting structural imperfections, and modeling thermal performance characteristics under diverse operational stress conditions.

The application of Artificial Intelligence is revolutionizing the research and manufacturing phases of the CVD diamond value chain, moving the industry towards highly repeatable and predictable outcomes. AI algorithms, particularly deep learning models, are now being deployed to analyze real-time data streaming from sophisticated CVD reactor sensors, correlating subtle changes in plasma spectroscopy and chamber conditions with the final physical and electronic properties of the grown diamond. This capability allows manufacturers to dynamically adjust growth parameters mid-synthesis, correcting for deviations and significantly increasing the yield of ultra-high purity materials critical for advanced semiconductor and quantum applications. This level of optimization minimizes material waste and operational downtime, addressing a long-standing challenge of inconsistent quality in high-cost diamond synthesis.

Beyond process control, AI is essential in accelerating the discovery of new functionalities for CVD diamonds. ML models are used to simulate the behavior of diamond films integrated into new electronic device architectures, such as predicting the efficacy of diamond heat spreaders in novel transistor designs or modeling the interaction of light with diamond-based quantum registers. This predictive capability dramatically reduces the reliance on costly physical prototyping and shortens the development cycle for new diamond products, providing a significant competitive advantage to firms embracing digitalization. The incorporation of AI-driven robotics in post-processing steps, such as laser cutting, polishing, and quality inspection, further ensures geometric precision and speeds up time-to-market for finished components.

- AI optimizes CVD reactor parameters (pressure, temperature, gas composition) to maximize single-crystal growth rate and purity.

- Machine Learning (ML) enables real-time, predictive quality control, identifying structural defects (e.g., non-diamond carbon incorporation, twinning) instantly during synthesis.

- AI-driven simulation accelerates materials research, predicting the performance of diamond films in new electronic and optical devices, reducing R&D cycles.

- Automation using AI-powered robotics enhances precision and speed in post-processing activities like cutting, polishing, and laser inscription.

- Predictive maintenance analytics deployed on CVD reactor hardware minimize unscheduled downtime and optimize equipment lifespan, boosting overall manufacturing efficiency.

- AI algorithms assist in characterizing and optimizing nitrogen-vacancy (NV) center formation, crucial for next-generation quantum sensing and computing applications.

DRO & Impact Forces Of CVD Diamond Market

The dynamics of the CVD Diamond Market are heavily influenced by a balanced interplay of accelerating technological drivers and substantial economic and technical restraints, mitigated by significant opportunities arising from emerging high-tech applications. The primary market driver is the inescapable need for superior thermal management solutions driven by the increasing power density and operating frequencies in high-performance electronics, particularly in 5G base stations, data centers, and electric vehicle power trains. This technical requirement creates a non-negotiable demand for diamond's unique thermal properties. Conversely, a major restraint is the exceptionally high capital expenditure required to establish and operate industrial-scale CVD synthesis facilities, coupled with the long cycle times and complex, proprietary intellectual property (IP) surrounding growth techniques for large, electronic-grade single crystals, posing significant barriers to entry for new market participants. Opportunities abound in the burgeoning fields of quantum technology (NV center creation), biosensing, and high-security defense optics, where the high material cost is justified by the mission-critical performance enhancement provided.

The market is experiencing impact forces exerted primarily through supply-side technological advancements and demand-side industrial shifts. Technological impact forces include breakthroughs in plasma generation and substrate preparation that drastically improve deposition rates and reduce the structural defect density in resulting materials, thereby lowering the cost basis for electronic and optical grade materials. Market impact forces on the demand side are driven by government initiatives promoting advanced manufacturing and strategic material stockpiling, recognizing CVD diamonds as essential for future defense and communications infrastructure. Furthermore, increasing consumer acceptance and verification of synthetic diamonds in the jewelry sector provide a parallel economic structure that helps fund R&D for industrial applications.

The synthesis of large, defect-free single crystals remains a significant technical bottleneck, constraining the supply of materials necessary for quantum and high-power semiconductor applications, which acts as an ongoing restraint. However, the opportunity presented by the potential replacement of conventional materials (like sapphire and SiC) in niche, high-temperature, high-radiation environments provides a massive long-term growth prospect. Companies focused on achieving homogeneity across large-area substrates and developing cost-effective doping techniques for semiconductor fabrication (e.g., boron doping for p-type conductivity) are best positioned to capitalize on these opportunities, successfully navigating the complex challenges of scaling production while maintaining stringent material specifications.

Segmentation Analysis

The CVD Diamond Market segmentation provides a granular view of diverse product types, applications, and end-user industries, revealing differential growth rates and distinct market dynamics across various segments. Segmentation by Type predominantly distinguishes between Polycrystalline Diamond (PCD) films and Single-Crystal Diamond (SCD) materials, reflecting fundamental differences in their microstructure and application suitability. PCD is widely used for industrial tooling due to its toughness and cost-effectiveness, whereas SCD, offering superior thermal and electronic properties, dominates high-end applications like quantum sensors and advanced optics. The growth forecast heavily favors the SCD segment due to its intrinsic value proposition in next-generation electronic components and research instruments requiring flawless material structure.

Application-wise, the market is primarily categorized into Mechanical & Tooling, Thermal Management (Heat Spreaders), Optical, and Semiconductor/Electronics, with Thermal Management emerging as the highest-growth segment. The relentless increase in heat flux in modern computing chips, IGBTs (Insulated Gate Bipolar Transistors) for EVs, and high-frequency amplifiers makes diamond heat sinks indispensable. End-user segmentation further clarifies demand structure, ranging from general Industrial Sectors (drilling, mining) to highly specialized sectors like Aerospace & Defense, Healthcare (surgical instruments, radiation detectors), and Telecommunications (high-speed data transmission equipment). Each end-user segment has unique requirements concerning diamond size, purity, and defect concentration, necessitating specialized CVD synthesis protocols and post-processing techniques.

The interplay between these segments is crucial; for instance, advancements in electronic-grade SCD directly feed into the Semiconductor and Quantum Computing end-user markets, commanding premium pricing. Meanwhile, continuous innovation in polycrystalline diamond coatings and thick films supports the stable, high-volume demand from the traditional cutting and grinding tooling market, ensuring consistent revenue generation for basic industrial grades. Regional market dominance is often correlated with the prevalence of specific segment demand; for example, Asia Pacific's focus on consumer electronics drives high demand for thin-film PCD and heat spreader SCDs, while North America and Europe emphasize quantum and defense applications, driving demand for the most specialized SCD materials.

- By Type:

- Polycrystalline Diamond (PCD)

- Single-Crystal Diamond (SCD)

- Microcrystalline Diamond

- By Grade:

- Electronic Grade (Ultra-high Purity)

- Optical Grade

- Mechanical/Industrial Grade

- Gem Grade

- By Application:

- Thermal Management & Heat Spreaders

- Advanced Tooling (Cutting, Drilling, Wear Parts)

- Optical Windows & Lenses

- Semiconductor Devices (Substrates, Detectors)

- Quantum Sensing and Computing

- Medical Devices & Instrumentation

- By End-User Industry:

- Electronics & Telecommunications

- Aerospace & Defense

- Automotive (Electric Vehicles)

- Healthcare & Medical

- Mining & Construction

- Research & Academia

- Jewelry (Non-Industrial)

Value Chain Analysis For CVD Diamond Market

The value chain for the CVD Diamond Market is complex, beginning with highly specialized upstream activities involving precursor gas preparation and reactor manufacturing, moving through the core synthesis process, and culminating in highly tailored downstream finishing and end-user integration. Upstream analysis focuses on the sourcing and purification of precursor gases, primarily methane and hydrogen, alongside specialized reactor design and fabrication, which are proprietary and crucial for controlling the synthesis environment. Key upstream suppliers include specialty gas manufacturers and highly technical equipment providers who supply the high-power microwave plasma systems and specialized high-purity substrates (often silicon or iridium) upon which the diamond is grown. Control over the purity of these inputs is paramount, as minute contaminants can severely degrade the resulting diamond's electronic and optical performance, particularly for electronic-grade single crystals.

The midstream phase involves the core CVD synthesis, where highly skilled labor and proprietary operational protocols determine the diamond’s quality, size, and crystal structure. This synthesis phase is characterized by intense intellectual property protection and high entry barriers. Following synthesis, the downstream process is equally critical, encompassing highly precise post-processing techniques such as laser cutting, lapping, polishing, and surface functionalization. These steps transform the rough diamond material into application-specific components, such as micro-lenses, thermal spreaders cut to precise geometries, or substrates mounted onto device packages. The efficiency and precision of these downstream processes determine the final component's viability and cost-effectiveness for end-users like chip manufacturers or laser system integrators.

Distribution channels in the CVD Diamond Market are segmented into direct and indirect routes based on the product grade and complexity. Direct distribution channels are prevalent for high-value, customized electronic and quantum-grade diamonds, where manufacturers engage directly with large-scale industrial buyers (e.g., semiconductor foundries, defense contractors). This direct engagement ensures technical consultation and adherence to stringent specification requirements. Indirect distribution involves specialized distributors and material wholesalers, commonly used for high-volume, standardized products such as industrial tooling inserts or gem-quality stones. E-commerce platforms are increasingly utilized for smaller volume, standardized industrial products, while highly specialized components often require a complex network of technical sales representatives and certified integrators to ensure proper integration into sophisticated end-user systems.

CVD Diamond Market Potential Customers

Potential customers and end-users of CVD diamond products span the spectrum from major global electronics manufacturers to highly specialized government research laboratories and defense agencies, all seeking materials that offer performance characteristics beyond conventional limits. The primary purchasing drivers for these end-users are material hardness for enhanced wear resistance in industrial tooling, superior thermal conductivity for critical heat dissipation in high-power devices, and unique optical properties for high-energy laser systems. End-users in the semiconductor and telecommunications sectors, particularly manufacturers of 5G power amplifiers (PAs) and RF front-end modules, are major consumers of CVD diamond heat spreaders (electronic-grade SCD) to prevent thermal runaway and ensure device longevity in challenging operational environments.

The aerospace and defense industry represents a high-value, specialized customer base, utilizing CVD diamonds for infrared and radar-transparent windows, radomes, and high-power laser optics, capitalizing on the material's durability and wide-spectrum transparency in extreme conditions. Within the healthcare sector, potential buyers include medical equipment manufacturers requiring precise radiation detectors (dosimeters) and specialized surgical instruments that benefit from diamond's bio-compatibility and extreme hardness. Furthermore, the emerging quantum technology sector, comprising academic institutions, national labs, and early-stage quantum computing firms, is a crucial customer for highly specialized SCDs containing optimized nitrogen-vacancy (NV) centers, essential for quantum sensing and memory applications.

The traditional industrial sector, encompassing mining, construction, and oil and gas exploration, remains a foundational customer segment. These industries require robust polycrystalline diamond (PCD) cutting tools and wear parts capable of surviving abrasive environments and high operational temperatures, demanding consistency and longevity rather than ultra-high purity. Lastly, the high-end jewelry market represents a significant consumer of gem-quality CVD diamonds, driven by consumer preference for ethical sourcing and visual brilliance, which indirectly supports R&D investment in the industrial diamond sector by providing economies of scale in the synthesis process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six (E6), Sumitomo Electric Industries, Applied Diamond Inc., Advanced Diamond Technologies (ADT), D-Wave Systems, IIa Technologies, Akhan Semiconductor, Cornes Technologies, Diamond Foundry, New Diamond Technology (NDT), De Beers Group (Lightbox), Sandvik Hyperion, Shanghai Bochi Diamond, Beijing Worldia Diamond Tools Co., Ltd., Henan Huanghe Whirlwind Co., Ltd., WD Lab Grown Diamonds, ScioSense, Mitsui Grinding Technology, Seki Technotron, TAIWAN DIAMOND INDUSTRIAL CO., LTD. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CVD Diamond Market Key Technology Landscape

The technology landscape for the CVD Diamond Market is primarily defined by two core synthesis methodologies: Microwave Plasma Chemical Vapor Deposition (MPCVD) and Hot Filament Chemical Vapor Deposition (HFCVD). MPCVD is the dominant technology, particularly favored for producing high-quality, large-area, single-crystal diamonds (SCD) necessary for electronic and optical applications. The technology utilizes microwave energy to generate high-density plasma, which effectively dissociates carbon precursors and promotes high growth rates with minimal structural defects. Recent advancements in MPCVD focus on increasing the reactor chamber size and power density, enabling the simultaneous growth of larger-diameter wafers, thereby addressing scalability challenges crucial for mass market adoption in semiconductor manufacturing and thermal management.

HFCVD, while generally less efficient for ultra-high purity SCD, remains valuable for deposition of polycrystalline diamond films and coatings over complex geometries, often used in tooling and wear-resistant applications due to its lower operational cost and relative simplicity. Further critical technological developments involve substrate engineering, particularly the use of iridium/silicon carbide interlayers to minimize lattice mismatch stress, which is essential for growing high-quality, large-area single crystals on non-diamond substrates. Additionally, precise doping techniques, such as the controlled incorporation of boron or nitrogen during growth, are vital for tuning the electrical conductivity (p-type semiconductor) or creating specific quantum defects (Nitrogen Vacancy or NV centers), enabling novel applications in power electronics and quantum sensing.

Post-synthesis technologies are equally vital for commercial viability. These include advanced laser processing systems for precise cutting and micro-machining, as well as highly sophisticated chemo-mechanical polishing (CMP) methods required to achieve atomic-level surface smoothness. This ultra-smooth finish is non-negotiable for optical windows and critical for reducing resistance when used as a heat spreader interface in high-power chips. Furthermore, process monitoring technologies, including in-situ plasma diagnostics and spectroscopic analysis, coupled with AI-driven feedback loops, represent the leading edge of manufacturing innovation, aiming to automate quality control and ensure maximum yield of defect-free, electronic-grade material, thereby cementing the technological maturity of the CVD synthesis process.

Regional Highlights

Regional dynamics within the CVD Diamond Market are heavily influenced by the concentration of advanced manufacturing capabilities, R&D funding, and specific end-user industry demands, creating distinct centers of excellence globally. Asia Pacific (APAC) holds the largest market share, predominantly driven by China, South Korea, and Taiwan, which are global leaders in semiconductor fabrication, consumer electronics, and automotive manufacturing (especially EVs). The vast demand for thermal management solutions for smartphones, 5G infrastructure equipment, and EV power electronics fuels the high adoption rate of CVD diamond heat spreaders and thin films across the region. Furthermore, APAC's strong domestic industrial tooling sector ensures continuous demand for high-volume polycrystalline diamond products.

North America is characterized by high investment in high-value, specialized segments, particularly aerospace, defense, and the rapidly growing quantum computing sector. Driven by significant government and private funding in countries like the United States and Canada, the region focuses heavily on synthesizing ultra-high purity, isotopically controlled single-crystal diamonds for use in high-power defense lasers, advanced sensors, and quantum entanglement experiments. Although manufacturing volumes may be lower than APAC, the average selling price and strategic importance of the materials produced here are exceptionally high. The region also hosts several pioneering companies dedicated to commercializing diamond-based semiconductor technology (Akhan, Element Six subsidiaries).

Europe represents a sophisticated market focusing on precision engineering, scientific instrumentation, and advanced medical technology. Countries such as Germany, the UK, and Switzerland are key consumers, utilizing CVD diamonds in high-end industrial tooling, advanced optics, and sophisticated medical imaging and radiotherapy devices. European Union initiatives promoting green technology and localized supply chains are also boosting investment in domestic CVD diamond manufacturing capabilities. The Middle East and Africa (MEA) market, though smaller, exhibits specific demand in the oil and gas industry for durable drilling tools and specialized electronics capable of withstanding harsh downhole environments. Investment from state-owned enterprises in diversifying economies also shows promise for future manufacturing growth in specialized material sciences.

- Asia Pacific (APAC): Dominant region driven by semiconductor, 5G, and EV thermal management demand; major manufacturing hub for both industrial and electronic grades; focuses on scale and high-volume output. Key countries: China, Japan, South Korea.

- North America: High-value market segment focused on research-intensive applications (quantum computing, defense optics); emphasis on ultra-high purity single-crystal synthesis; leading in technological innovation and IP development. Key countries: United States, Canada.

- Europe: Strong demand from precision engineering, automotive R&D, and medical technology sectors; emphasis on environmental standards and high-quality industrial components; significant governmental research funding into diamond applications. Key countries: Germany, UK, Switzerland.

- Latin America: Developing market primarily driven by mining and construction industries, focused on basic industrial tooling; lower penetration of advanced electronic grades; potential growth tied to infrastructure development.

- Middle East and Africa (MEA): Niche demand concentrated in oil and gas exploration (PCD drill bits) and defense sectors; emerging potential for manufacturing due to energy availability and sovereign wealth fund investments in diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CVD Diamond Market, encompassing companies across the entire value chain from synthesis to specialized application integration.- Element Six (E6)

- Sumitomo Electric Industries

- Applied Diamond Inc.

- Advanced Diamond Technologies (ADT)

- D-Wave Systems

- IIa Technologies

- Akhan Semiconductor

- Cornes Technologies

- Diamond Foundry

- New Diamond Technology (NDT)

- De Beers Group (Lightbox)

- Sandvik Hyperion

- Shanghai Bochi Diamond

- Beijing Worldia Diamond Tools Co., Ltd.

- Henan Huanghe Whirlwind Co., Ltd.

- WD Lab Grown Diamonds

- ScioSense

- Mitsui Grinding Technology

- Seki Technotron

- TAIWAN DIAMOND INDUSTRIAL CO., LTD.

Frequently Asked Questions

Analyze common user questions about the CVD Diamond market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between CVD and HPHT diamonds?

CVD (Chemical Vapor Deposition) diamonds are grown using a low-pressure gas phase technique, resulting in materials optimized for high-technology applications such as optics and electronics, often characterized by high purity and controlled isotopic composition. HPHT (High-Pressure/High-Temperature) diamonds are grown by mimicking natural conditions, typically used for industrial abrasives or gem-quality stones, utilizing metal solvents and higher pressures.

In which applications does CVD diamond technology provide the most significant competitive advantage?

CVD diamond offers a critical advantage in high-power thermal management (heat spreaders) for devices like IGBTs and RF components, due to its unmatched thermal conductivity, which is five times higher than copper. It is also essential in advanced quantum sensing and computing because of its ability to host stable, addressable nitrogen-vacancy (NV) centers, unavailable in conventional materials.

What is the main obstacle preventing widespread, low-cost adoption of electronic-grade CVD diamond?

The primary obstacle is the high complexity and corresponding capital investment required to synthesize large-area, defect-free single-crystal diamonds (SCDs). Achieving uniform, ultra-high purity across large wafers at high deposition rates remains a technical challenge, maintaining high production costs, despite falling costs for industrial and gem grades.

How is the CVD Diamond Market addressing sustainability and ethical sourcing concerns?

CVD diamonds inherently address ethical sourcing concerns as they are grown in controlled laboratory environments, offering a fully traceable and conflict-free alternative to mined stones. Manufacturers utilize high-tech verification and certification processes (e.g., origin tracking) to ensure transparency and consumer confidence, positioning the material as a sustainable choice for both industrial and jewelry markets.

Which key technological advancements are currently driving market growth in the CVD sector?

Key advancements include increasing the size and power of MPCVD reactors for large-scale wafer production, optimizing growth protocols to achieve higher crystalline purity for quantum applications, and integrating AI/ML models to refine and automate synthesis parameters, drastically improving yield rates and reducing material imperfections across all grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- CVD Diamond Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- CVD Diamond Heat Spreaders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chemical Mechanical Polishing (CMP) Diamond Pad Conditioner Market Size Report By Type (Conventional CMP Diamond Pad Conditioner, CVD Diamond CMP Pad Conditioner), By Application (300 mm, 200 mm, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- CVD Diamond Market Size Report By Type (Rough, Polished), By Application (Machine & Cutting Tools, Thermal Applications, Electrochemical Applications, Gem Segment, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- CMP Pad Regulator Market Statistics 2025 Analysis By Application (300 mm, 200 mm), By Type (Conventional Pad Conditioners, CVD Diamond Pad Conditioners), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager