Dental Fitting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434512 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Dental Fitting Market Size

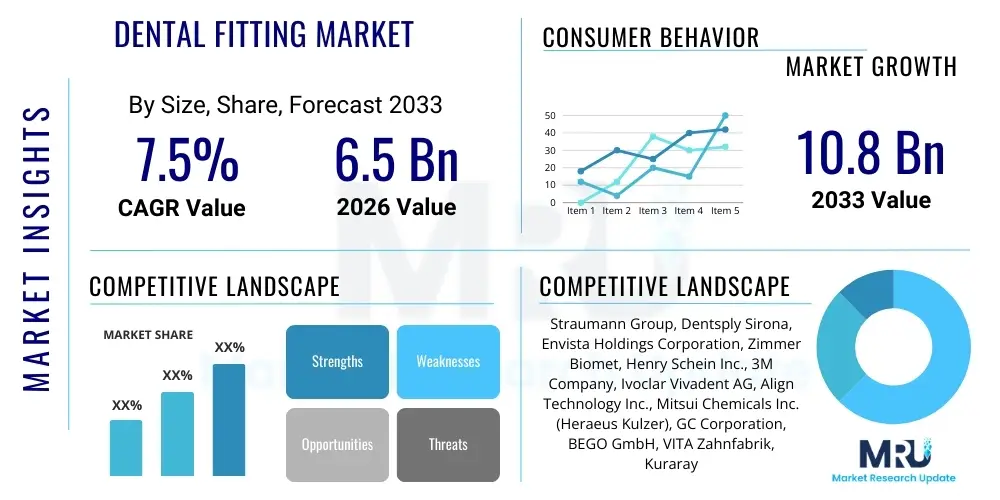

The Dental Fitting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.8 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by an accelerating demand for both restorative and cosmetic dental procedures globally, driven primarily by demographic shifts, heightened aesthetic consciousness, and significant advancements in material science and digital dentistry technologies.

Dental Fitting Market introduction

The Dental Fitting Market encompasses a wide range of restorative and prosthetic devices designed to replace, repair, or enhance natural teeth structures. Products within this market include sophisticated dental implants, crowns, bridges, dentures, veneers, and orthodontic appliances. These fittings are critical for restoring oral function, including mastication and speech, as well as addressing aesthetic concerns, thereby significantly improving the quality of life for patients globally. The core function of dental fittings is to provide durable, biocompatible, and anatomically precise solutions for missing or damaged dentition, addressing conditions arising from trauma, decay, periodontal disease, or congenital defects. The development of advanced materials, such as high-strength ceramics and biocompatible titanium alloys, has been pivotal in advancing the efficacy and longevity of these products, transitioning the market from traditional metal-based solutions towards more aesthetically pleasing and durable alternatives.

Major applications for dental fittings span general dentistry, prosthodontics, and cosmetic dentistry. In restorative dentistry, the primary use involves crowns and bridges used to cap severely damaged teeth or fill minor gaps, ensuring structural integrity and preventing further deterioration. Dental implants represent a rapidly growing segment, offering permanent solutions for tooth loss by surgically fusing artificial roots into the jawbone, providing a stable foundation for prosthetic teeth. Benefits associated with modern dental fittings include enhanced durability, natural appearance (especially with CAD/CAM-designed ceramic restorations), reduced patient discomfort, and improved long-term oral health outcomes. Furthermore, the increasing prevalence of dental tourism, where patients seek high-quality care at competitive prices across borders, contributes significantly to market expansion.

Key driving factors fueling the expansion of the Dental Fitting Market include the global aging population, which inherently requires more complex restorative dental work, and rising disposable incomes in emerging economies, enabling greater access to private dental care. Increased public and professional awareness regarding oral hygiene and the importance of timely restorative treatments also stimulate demand. Technological innovations, particularly the widespread adoption of digital workflows involving intraoral scanners and 3D printing for rapid prototyping and manufacturing of customized fittings, are revolutionizing the production process, making high-precision devices more accessible and affordable, thus serving as a strong market catalyst.

Dental Fitting Market Executive Summary

The Dental Fitting Market exhibits robust growth, characterized by fundamental shifts towards digitalization, material innovation, and patient-specific customization. Current business trends heavily favor companies investing in integrated digital dentistry solutions, encompassing everything from diagnostic software and imaging technology to advanced manufacturing capabilities like milling and 3D printing. This integration enhances efficiency, reduces chair time, and dramatically improves the fit and aesthetics of the final restoration, placing competitive pressure on traditional manufacturing labs to adopt new technologies. Furthermore, mergers and acquisitions remain a crucial strategic tool for market leaders, allowing them to consolidate technology patents, expand geographic footprints, and achieve economies of scale, particularly in the premium implant and high-end ceramics segments.

Regional trends indicate that North America and Europe currently dominate the market due to established healthcare infrastructure, high consumer awareness, and significant reimbursement coverage for complex procedures. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth in APAC is attributed to rapidly expanding middle classes in countries like China and India, increasing healthcare expenditure, and substantial investment by governments in modernizing dental care facilities. Latin America and the Middle East also represent burgeoning opportunities as healthcare infrastructure improves and dental aesthetic trends gain widespread acceptance among younger populations, diversifying the global demand landscape.

Segment trends highlight the sustained dominance of dental implants, driven by their superior long-term clinical outcomes compared to conventional dentures and bridges. Within materials, ceramics, particularly zirconia, are gaining market share rapidly over traditional metal-based alloys due to their excellent biocompatibility, strength, and superior aesthetic properties, fulfilling the growing patient desire for natural-looking restorations. End-user trends show that specialized dental clinics and private practices remain the largest consumers of high-value dental fittings, though the establishment of larger corporate dental chains and hospital-based dentistry units is increasingly centralizing purchasing power, influencing distribution strategies and pricing dynamics across the industry.

AI Impact Analysis on Dental Fitting Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dental Fitting Market predominantly focus on themes related to diagnostic accuracy, automation of prosthetic design, the potential for reduced manufacturing costs, and the resulting changes in the dental professional's role. Common user questions explore whether AI can autonomously design a perfectly fitting crown, how AI-driven analysis might improve implant placement precision, and the timeline for widespread adoption of AI tools in general practice. Users are generally optimistic about AI’s potential to enhance efficiency and clinical predictability but express concerns regarding data privacy, regulatory approvals, and the ethical implications of automating critical design and planning phases. The consensus expectation is that AI will function primarily as a powerful assistive tool, optimizing human decision-making rather than replacing specialized dental technicians or prosthodontists entirely, focusing on tasks such as anatomical landmark recognition, predictive failure analysis, and personalized treatment sequencing.

AI is fundamentally transforming the workflow associated with dental fitting creation, starting from initial diagnostics. Machine learning algorithms are being trained on vast datasets of intraoral scans, CBCT images, and dental records to assist clinicians in identifying subtle pathologies, assessing bone density for implant success, and accurately determining optimal crown preparation margins. This enhanced diagnostic capability allows for more personalized treatment planning, minimizing procedural risks and ensuring the selected dental fitting is optimally suited for the patient’s unique anatomical and physiological requirements. Furthermore, AI contributes significantly to the educational and research domains, providing automated analysis of clinical trial data and assisting in the refinement of novel dental materials and fitting designs.

In the manufacturing phase, AI algorithms are seamlessly integrated with Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) systems. These intelligent tools can generate initial prosthetic designs based on scanned data and opposing arch morphology, automatically suggesting optimal contours, thickness, and occlusion points that would take a human designer hours to finalize manually. This automation speeds up the design cycle, reduces the incidence of human error, and facilitates rapid iteration and customization. Consequently, AI-enhanced CAD software allows dental labs to produce highly complex fittings, such as multi-unit bridges or full-arch restorations, with exceptional precision and consistency, directly impacting the quality and cost-effectiveness of dental care delivery globally.

- AI enhances diagnostic accuracy through automated analysis of dental imaging (CBCT, panoramic X-rays).

- Optimizes implant placement planning by analyzing bone quality and anatomical structures with high precision.

- Accelerates prosthetic design (crowns, bridges) via intelligent CAD software, minimizing human input time.

- Facilitates personalized treatment planning by modeling patient-specific biomechanics and occlusal forces.

- Improves manufacturing efficiency and material waste reduction when integrated with 3D printing and milling units.

- Aids in predictive maintenance and lifespan assessment of existing dental fittings.

DRO & Impact Forces Of Dental Fitting Market

The dynamics of the Dental Fitting Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), constantly being shaped by potent Impact Forces. Key drivers primarily include the relentless demographic shift towards an older global population, which correlates directly with increased incidence of edentulism and periodontal disease, necessitating restorative interventions. Simultaneously, rising aesthetic expectations, particularly among younger demographics in developed and emerging economies, fuel demand for cosmetic fittings like veneers and aesthetic crowns. Technological innovation, specifically the leap in digital dentistry (CAD/CAM, 3D printing, and intraoral scanning), serves as a foundational driver, making procedures faster, more accurate, and yielding superior, highly customized results that attract greater patient willingness to invest in dental care.

However, significant restraints temper market growth. The high initial cost of premium dental fittings, especially complex implant procedures and associated surgical components, often limits access for low- and middle-income groups in markets lacking comprehensive dental insurance or robust public healthcare schemes. Furthermore, strict and evolving regulatory requirements across major economies (FDA, MDR in Europe) increase the complexity and cost associated with bringing new biomaterials and device designs to market, potentially slowing the pace of innovation adoption by smaller manufacturers. Another restraint involves the shortage of specialized prosthodontists and skilled dental technicians capable of utilizing the latest digital and material technologies effectively, particularly in rapidly growing but underserved geographical areas.

Opportunities for exponential growth are concentrated in emerging economies, where expanding healthcare infrastructure and rising dental health awareness create vast untapped markets. Personalized dentistry, enabled by AI and advanced manufacturing techniques, represents a major technological opportunity, allowing manufacturers to move beyond standardized products to truly patient-specific fittings that offer better clinical outcomes. Impact forces strongly influencing the market trajectory include changing reimbursement policies, which dictate patient affordability and procedure adoption rates, and rapid globalization, which intensifies competition and drives standardization efforts. The ongoing pressure from material science breakthroughs to develop stronger, lighter, and more biocompatible materials (e.g., advanced polymers and next-generation ceramics) continues to redefine product capabilities and patient expectations.

Segmentation Analysis

The Dental Fitting Market is rigorously segmented across multiple dimensions, including product type, material composition, and end-user distribution, providing a granular view of market dynamics and potential investment avenues. Analyzing these segments is crucial for understanding specific growth pockets, competitive landscapes, and technological differentiation strategies employed by key industry players. The division by product type (implants, crowns, bridges, etc.) reflects clinical need and procedural complexity, with high-value segments like implants exhibiting sustained robust growth. Segmentation by material highlights the critical shift from conventional alloys towards high-performance aesthetic materials like zirconia, lithium disilicate, and advanced polymeric composites, driven by clinical demands for aesthetics and biocompatibility. The inherent heterogeneity of the market necessitates tailored marketing and distribution approaches based on the specific requirements of each segment.

Segmentation by end-user, primarily divided into hospitals, dental clinics, and academic/research institutes, reveals that specialized dental clinics continue to represent the largest segment due to the high volume of routine and specialized restorative procedures they perform. However, hospitals, particularly those integrated with large medical complexes, are increasingly adopting high-end CAD/CAM systems and surgical facilities, becoming significant procurement centers for complex fittings. Geographic segmentation remains vital, differentiating between mature, technology-saturated markets (North America, Western Europe) and high-growth, penetration-focused regions (Asia Pacific, Latin America), where expansion strategies must prioritize affordability and scalable solutions.

The interaction between these segments defines market trends. For instance, the demand for highly aesthetic zirconia crowns (material segment) is directly linked to the rapid adoption of digital impression taking and in-office milling machines (technology landscape) within specialized private practices (end-user segment). Understanding these cross-segment linkages allows manufacturers to anticipate shifts in demand and invest strategically in areas that offer the highest synergistic growth potential, focusing on delivering integrated solutions that streamline the entire restorative dentistry workflow from patient diagnosis to final placement.

- Product Type:

- Dental Implants (Root Form, Plate Form)

- Crowns and Bridges (Single Unit, Multi-unit)

- Dentures (Complete, Partial)

- Veneers (Porcelain, Composite)

- Inlays and Onlays

- Material:

- Ceramics (Zirconia, Lithium Disilicate, Porcelain)

- Metals and Alloys (Titanium, Gold Alloys, Nickel-Chromium)

- Polymers and Composites

- End-User:

- Dental Clinics and Private Practices

- Hospitals

- Academic and Research Institutes

Value Chain Analysis For Dental Fitting Market

The value chain for the Dental Fitting Market begins with the upstream supply of raw materials, which is crucial for defining the quality and performance of the final product. Key upstream elements include the procurement of specialized biocompatible metals such as medical-grade titanium and cobalt-chromium alloys, high-purity ceramic powders (zirconia, alumina), and advanced composite resins. Suppliers in this segment focus heavily on quality certification, material traceability, and adherence to international biocompatibility standards. The cost and reliability of this upstream supply directly influence the manufacturing costs and the ultimate price point of high-end fittings like implants and all-ceramic crowns, making strategic sourcing and long-term supplier relationships essential for manufacturers.

The midstream phase involves the core activities of manufacturing, design, and fabrication, which are increasingly dominated by digital technologies. This stage includes sophisticated processes such as investment casting for metal frameworks, pressing and sintering for ceramics, and, critically, CAD/CAM milling and additive manufacturing (3D printing). Dental laboratories, which form a major component of this midstream, are rapidly modernizing their operations, adopting intraoral scanners and advanced design software to manage digital workflows. Manufacturing effectiveness at this stage is measured by precision, throughput, and the ability to produce highly customized fittings rapidly, driving significant investment in robotics and automation to reduce labor intensity and improve dimensional accuracy.

The downstream distribution channel involves moving the finalized dental fittings from the manufacturing lab or company warehouse to the end-users (dental clinics and hospitals). Distribution is characterized by a mix of direct and indirect channels. Large multinational manufacturers often utilize a direct sales force for high-value items like premium implant systems, offering comprehensive educational support and surgical kits directly to specialized clinics and surgeons. Conversely, smaller labs or generalized products often rely on indirect channels, utilizing regional distributors, dealers, and specialized dental supply houses. These intermediaries are vital for inventory management, localized logistics, and penetrating smaller or geographically dispersed practices, ensuring timely delivery of custom-fabricated components necessary for patient care.

Dental Fitting Market Potential Customers

The primary potential customers and end-users of the Dental Fitting Market are specialized dental practitioners and institutional healthcare providers, whose procurement decisions are guided by clinical need, quality assurance, patient volume, and economic considerations. Specialized dental clinics, including prosthodontists, periodontists, and general dentistry practices focused on restorative and cosmetic procedures, constitute the largest and most influential customer segment. These customers require a steady supply of high-quality components for procedures ranging from routine fillings and simple crowns to complex full-arch implant restorations. Their purchasing criteria heavily emphasize product reliability, ease of use (clinical workflow integration), robust long-term clinical data, and comprehensive technical support from manufacturers, particularly regarding digital solutions like scanners and CAD/CAM software.

Hospitals and academic medical centers represent another critical segment, often purchasing in bulk for their oral and maxillofacial surgery departments, dental residency programs, and larger patient bases, which often include complex trauma or oncology cases requiring specialized fittings. These institutional buyers tend to prioritize established brands, standardized procurement processes, and cost-effectiveness achieved through volume purchasing agreements. Furthermore, academic institutions serve as vital customers for advanced and experimental materials, driving early adoption of cutting-edge technologies and materials that are still undergoing clinical validation or refinement, thereby influencing future market trends and shaping the opinions of upcoming dental professionals.

The emergence of Dental Service Organizations (DSOs) and large corporate dental chains represents a significant shift in the customer landscape. These consolidated entities centralize purchasing decisions for numerous affiliated clinics, gaining substantial negotiating leverage over manufacturers. DSOs prioritize efficient supply chain management, standardization of materials and protocols across all locations, and pricing models that support high-volume, cost-effective care delivery. Manufacturers must adapt their sales strategies to cater to the distinct needs of DSOs, focusing on offering scaled pricing, integrated digital platform solutions, and consistent logistical support to manage geographically dispersed inventories of fittings and components effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Straumann Group, Dentsply Sirona, Envista Holdings Corporation, Zimmer Biomet, Henry Schein Inc., 3M Company, Ivoclar Vivadent AG, Align Technology Inc., Mitsui Chemicals Inc. (Heraeus Kulzer), GC Corporation, BEGO GmbH, VITA Zahnfabrik, Kuraray Noritake Dental Inc., Shofu Inc., VOCO GmbH, COLTENE Group, Septodont, Kavo Kerr, BioHorizons, Keystone Dental. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Fitting Market Key Technology Landscape

The technological landscape of the Dental Fitting Market is characterized by rapid digitization and the convergence of advanced manufacturing techniques with material science. The dominant technological pillar is Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM), which has fundamentally streamlined the fabrication of highly precise crowns, bridges, and implant abutments. CAD systems allow clinicians or lab technicians to digitally design restorations based on data acquired from intraoral scanners, eliminating the inaccuracies and time constraints associated with traditional physical impressions. CAM systems, including in-office milling machines and sophisticated dental lab equipment, then execute these designs using high-performance materials like zirconia or lithium disilicate, enabling same-day restorations and dramatically improving patient convenience and clinical workflow efficiency across the industry. This shift towards digital integration is non-negotiable for competitive differentiation.

Complementing CAD/CAM is the rapidly evolving field of Additive Manufacturing, or 3D Printing, which is increasingly utilized for producing temporary restorations, surgical guides for implantology, models, and specialized dental components using photopolymer resins and selective laser melting for metals. 3D printing offers unparalleled geometric complexity and customization capabilities, enabling the creation of intricate lattice structures and highly personalized fittings that would be challenging or impossible to produce using subtractive milling techniques. This technology significantly reduces material waste and enables laboratories to manage high-volume, high-variability production runs more cost-effectively, positioning it as a cornerstone technology for the next generation of dental prosthetic fabrication and significantly lowering the barrier to entry for complex customized devices.

Furthermore, intraoral scanning technology has become a crucial enabler for digital dentistry, replacing messy, traditional impression materials and providing high-resolution, color-accurate 3D models of the oral cavity instantly. These scanners drastically improve the patient experience, reduce turnaround times, and feed precise data directly into the CAD/CAM workflow, ensuring optimal fit and minimal chairside adjustments for the final fitting. Innovations also extend to the materials domain, with research focusing on developing intelligent, bioactive materials that promote osseointegration and reduce the risk of secondary infections, such as specialized surface treatments for titanium implants and high-strength polymer nanocomposites designed for durability and flexibility in denture bases and temporary restorations, continually pushing the boundaries of what dental fittings can achieve clinically.

Regional Highlights

- North America: This region maintains market leadership primarily driven by high per capita healthcare spending, advanced infrastructure, robust dental insurance coverage, and early adoption of premium digital dentistry technologies, including CAD/CAM and cone-beam computed tomography (CBCT). The United States, in particular, showcases a high consumer acceptance rate for expensive cosmetic procedures and complex implantology, sustaining demand for high-value fittings made of zirconia and titanium. Competition is fierce, focusing on product differentiation, clinical education, and providing integrated digital solutions to large Dental Service Organizations (DSOs).

- Europe: Western European countries represent a mature market characterized by sophisticated public and private dental care systems, stringent regulatory requirements (Medical Device Regulation - MDR), and a high demand for aesthetically superior restorations. Germany, France, and the UK are key markets, showing a strong inclination towards premium materials and advanced implant systems. Growth is steady, fueled by an aging population and government initiatives aimed at improving prosthetic care access, focusing on material innovation and durable clinical solutions.

- Asia Pacific (APAC): APAC is the fastest-growing region, presenting substantial untapped potential. Growth is catalyzed by rising health awareness, increasing disposable incomes, and significant government investment in modernizing healthcare infrastructure in large developing economies like China, India, and South Korea. While premium fittings are adopted in major metropolitan areas, the overall market emphasizes affordability and accessibility. Manufacturers often tailor product lines to meet the diverse economic strata, driving high demand for conventional dentures and cost-effective crown and bridge solutions alongside rapid technological adoption in major urban centers.

- Latin America (LATAM): This region demonstrates promising growth, supported by the expansion of medical and dental tourism, particularly in countries like Brazil and Mexico. The market is highly price-sensitive, balancing demand for high-quality, aesthetic fittings with economic constraints. Local manufacturing capabilities are developing, but imports of sophisticated implant and CAD/CAM components remain necessary. Market expansion relies on improving access to financing options for complex procedures and increasing professional training in advanced restorative techniques.

- Middle East and Africa (MEA): Growth in the MEA region is sporadic but significant in wealthier Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where high healthcare spending supports the immediate adoption of cutting-edge technologies and premium fittings, often catering to cosmetic dentistry demands. In contrast, African markets remain underdeveloped, primarily focusing on essential and affordable conventional fittings, with long-term growth dependent on improved economic stability and consistent investment in public health infrastructure and specialized dental training.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Fitting Market.- Straumann Group

- Dentsply Sirona

- Envista Holdings Corporation

- Zimmer Biomet

- Henry Schein Inc.

- 3M Company

- Ivoclar Vivadent AG

- Align Technology Inc.

- Mitsui Chemicals Inc. (Heraeus Kulzer)

- GC Corporation

- BEGO GmbH

- VITA Zahnfabrik

- Kuraray Noritake Dental Inc.

- Shofu Inc.

- VOCO GmbH

- COLTENE Group

- Septodont

- Kavo Kerr (Part of Envista)

- BioHorizons

- Keystone Dental

Frequently Asked Questions

Analyze common user questions about the Dental Fitting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the market demand for advanced dental fittings?

Market demand is primarily driven by the global aging population, which necessitates more restorative care, coupled with rapidly increasing aesthetic awareness, higher disposable incomes in developing economies, and significant technological advancements in digital dentistry (CAD/CAM, 3D printing) that enable superior, personalized restorations and streamline clinical workflows.

How is the adoption of ceramics and zirconia impacting the dental fitting material segment?

Zirconia and other high-strength ceramics are rapidly gaining market share by replacing traditional metal alloys. This shift is driven by their superior biocompatibility, exceptional strength, and excellent aesthetic match to natural dentition, aligning with patient preferences for metal-free, durable, and natural-looking dental restorations, particularly for crowns and implant abutments.

Which regional market is anticipated to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by vast populations, expanding middle classes, improving access to private dental care, increased governmental investment in healthcare infrastructure, and the growing urbanization leading to greater demand for aesthetic and restorative procedures.

What role does Artificial Intelligence (AI) play in the manufacturing process of dental fittings?

AI integrates with CAD/CAM systems to optimize prosthetic design automatically, analyze patient anatomy for precision planning, and enhance manufacturing efficiency. AI algorithms improve the accuracy of milling and 3D printing operations, reduce material waste, and significantly shorten the turnaround time required to fabricate complex, customized dental restorations.

What are the main restraints hindering the broader adoption of premium dental fittings?

The primary restraints include the high initial cost of complex premium procedures, such as dental implant surgery, limited dental insurance or public reimbursement coverage across many global markets, and the scarcity of specialized dental professionals adequately trained in utilizing the latest digital and materials technologies for advanced restorative work.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dental Fitting Market Size Report By Type (Crowns and Bridges, Denture, Other), By Application (Repair Broken Teeth, Implanted Teeth, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Fitting Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Crowns and Bridges, Denture, Other), By Application (Repair Broken Teeth, Implanted Teeth, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager