Dental Fitting Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442586 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Dental Fitting Market Size

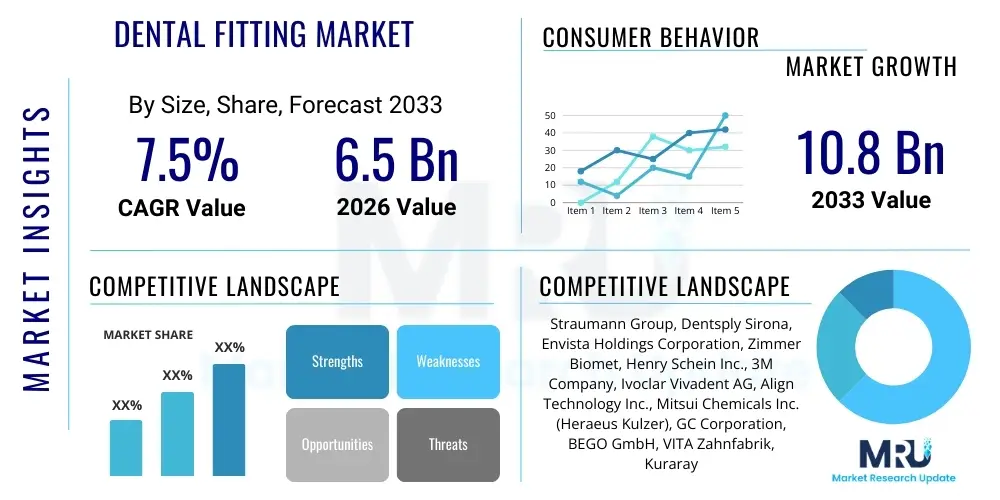

The Dental Fitting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global geriatric population, coupled with increasing disposable incomes in emerging economies which allow for greater expenditure on advanced restorative and cosmetic dental procedures. Furthermore, technological advancements, particularly in Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) systems and the widespread adoption of intraoral scanners, are dramatically improving the precision and turnaround time for dental fittings, thereby expanding market accessibility and patient compliance.

The dental fitting sector encompasses a wide array of restorative and prosthetic devices, including crowns, bridges, dentures, and specialized abutments used in implantology. Demand is structurally supported by the high prevalence of dental caries, periodontal diseases, and traumatic dental injuries globally. The shift from conventional, time-consuming fitting processes to modern digital workflows is a pivotal factor driving market valuation. These digital solutions not only enhance patient experience by reducing chair time but also minimize material waste and manufacturing errors, making high-quality dental care more economically viable for providers and ultimately accelerating market penetration.

Dental Fitting Market introduction

The Dental Fitting Market comprises the manufacturing, distribution, and utilization of restorative and prosthetic components designed to replace, repair, or enhance damaged or missing teeth and associated oral structures. Key products include fixed restorations (crowns, bridges, inlays, onlays), removable prosthetics (partial and full dentures), and implant abutments. Major applications span general dentistry, restorative dentistry, cosmetic dentistry, and orthodontics, addressing functional needs like mastication and speech, as well as critical aesthetic demands. The fundamental benefit of advanced dental fittings is the restoration of oral health, improvement in quality of life, and enhanced facial aesthetics, which contribute significantly to patient psychological well-being. A primary driving factor is the increasing global awareness regarding oral hygiene and the availability of sophisticated, durable materials such as zirconia, lithium disilicate, and titanium alloys.

The evolution of dental fittings is intrinsically linked to material science and digital technology. Modern fittings offer superior biocompatibility, longevity, and aesthetic integration compared to older amalgam or traditional metal components. The integration of 3D printing and milling technologies allows for highly customized, precise fittings, minimizing the need for multiple adjustments. The market is also heavily influenced by regulatory standards enforcing the safety and efficacy of these medical devices. Furthermore, the rising incidence of lifestyle-related oral health issues, such as tooth loss due to diabetes or tobacco use, contributes to a sustained demand base across all age groups, although the geriatric demographic remains the largest consumer segment.

Market dynamics are characterized by rapid innovation focused on material strength, color matching, and faster fabrication techniques. The competition among manufacturers centers on providing materials with enhanced mechanical properties and supporting laboratory partners with cutting-edge digital infrastructure. Investment in research and development is crucial, focusing on bio-active materials that promote tissue integration and fittings designed for minimally invasive surgical protocols. The shift towards preventive dentistry slightly moderates growth in certain areas but concurrently increases demand for high-quality, long-lasting restorations when intervention is necessary.

Dental Fitting Market Executive Summary

The Dental Fitting Market is characterized by robust business trends centered on digitization and premium material adoption. Key business trends involve the consolidation of dental laboratories, the expansion of global supply chains for advanced ceramic and polymer materials, and the increasing investment in subscription-based CAD/CAM software solutions. Leading manufacturers are establishing strategic partnerships with dental service organizations (DSOs) and large clinical chains to secure distribution and increase product visibility. Furthermore, there is a pronounced shift towards aesthetic dentistry, driving the demand for all-ceramic and zirconia restorations over traditional metal-backed fittings, which commands higher profit margins and necessitates continuous training for dental professionals in handling these advanced materials.

Regionally, North America and Europe currently dominate the market due to high healthcare expenditure, sophisticated dental insurance coverage, and early adoption of advanced technologies like digital scanners and in-house milling centers. However, the Asia Pacific region (APAC) is projected to exhibit the highest growth rate, driven by significant improvements in healthcare infrastructure, rapidly expanding dental tourism sectors in countries like India and Thailand, and a surging middle class demanding high-quality cosmetic procedures. Governmental initiatives in populous nations, aimed at improving public oral health, are also providing substantial structural support to market expansion in APAC, transforming it into a crucial revenue pocket for global market players.

In terms of segmentation, the Crowns and Bridges segment remains the largest revenue contributor due to the high frequency of restorative procedures globally. Material-wise, Zirconia is the fastest-growing segment, replacing traditional Porcelain-Fused-to-Metal (PFM) options owing to its superior strength, durability, and natural aesthetic qualities. The primary trend across all segments is customization, facilitated by additive manufacturing (3D printing). End-user analysis reveals that Dental Laboratories continue to be the primary consumer, acting as the critical link between manufacturers and clinics, but there is a growing trend of large dental clinics investing in specialized equipment to internalize the fitting fabrication process, thereby exerting pressure on traditional lab business models.

AI Impact Analysis on Dental Fitting Market

User queries regarding the impact of AI on the Dental Fitting Market frequently revolve around automation capabilities, precision enhancement, cost reduction in labs, and the future role of dental technicians. Key themes indicate strong expectations for AI-driven diagnostic accuracy, particularly in identifying early-stage bone degradation for implant planning, and optimizing the design phase of custom prosthetics. Users are concerned with data security, the need for standardized AI training datasets, and how AI might restructure the specialized skill requirements for dental professionals. There is high anticipation for AI to dramatically streamline CAD/CAM workflows, minimizing human error and accelerating patient-specific design iterations, ultimately leading to faster and more accurate fitting placement and potentially reducing overall treatment time and associated costs.

AI's initial impact is most visible in enhancing the efficiency of digital dentistry workflows. Machine learning algorithms are now employed to analyze vast datasets of anatomical structures, occlusion patterns, and material properties, allowing automated software to suggest optimal restoration designs that are tailored to individual patient biomechanics. This capability drastically cuts down the time required for experienced technicians to manually design complex fittings like multi-unit bridges or full arch restorations. Moreover, AI assists in treatment planning, particularly in implantology, by precisely determining the ideal implant position and angulation relative to surrounding bone density and nerve proximity, improving surgical predictability and long-term success rates of the dental fittings used.

The long-term influence of AI will reshape the manufacturing landscape, transitioning towards fully autonomous fabrication lines. AI systems are increasingly monitoring 3D printing and milling processes in real-time, adjusting parameters dynamically to ensure quality control and material integrity, minimizing defects, and optimizing material usage. This level of process control ensures consistency across large batches of customized fittings, which is essential for global scaling. Furthermore, AI-powered predictive maintenance tools are being integrated into laboratory equipment, reducing downtime and operational costs, which subsequently impacts the final price and accessibility of advanced dental fittings for end-users across various economic demographics.

- AI-enhanced diagnostic imaging for superior pre-fitting analysis.

- Automated CAD design optimization for crowns, bridges, and implant abutments.

- Predictive modeling of material performance and longevity under occlusal stress.

- Real-time quality control and defect detection in 3D printing and milling fabrication.

- Streamlining treatment planning, especially for complex restorative and implant cases.

- Virtual simulation and augmented reality guidance for precise fitting placement.

- Standardization of fitting parameters based on large-scale patient data analysis.

DRO & Impact Forces Of Dental Fitting Market

The Dental Fitting Market is driven by several powerful forces: the inexorable aging of the global population, which correlates directly with tooth loss and the need for prosthetic solutions; rising aesthetic consciousness fueling demand for high-end cosmetic restorations; and continuous technological breakthroughs in materials science (e.g., high-strength polymers, advanced ceramics) and digital manufacturing (e.g., intraoral scanners, high-speed milling, and specialized 3D printing). These drivers create significant momentum for market expansion, particularly in developing economies where healthcare access is rapidly improving. The availability of advanced, yet increasingly affordable, fabrication technology is democratizing access to complex restorative procedures.

However, the market faces significant restraints, primarily high procedure costs, especially in regions lacking comprehensive public dental insurance, which limits access for lower-income groups. Furthermore, the stringent regulatory approval processes required for novel biocompatible materials and specialized dental devices can slow down time-to-market for innovative products. Another key restraint is the shortage of highly skilled dental specialists (prosthodontists, implantologists) and trained dental lab technicians capable of efficiently operating the complex digital infrastructure, which creates bottlenecks in service delivery and localized market growth.

Opportunities abound, driven largely by the untapped potential of emerging markets, substantial growth in dental tourism attracting cross-border patients seeking cost-effective high-quality care, and the transition toward personalized medicine utilizing digital technology. Manufacturers can capitalize on the growing demand for clear aligners and temporary restorative materials. The market also sees impact forces related to environmental sustainability, pushing for biodegradable or recyclable materials and reducing waste in the lab process. Competitive intensity, driven by rapid technology transfer and intellectual property protection battles, significantly shapes pricing strategies and innovation cycles, forcing companies to maintain a leading edge through continual product development and strategic mergers and acquisitions.

Segmentation Analysis

The Dental Fitting Market is intricately segmented based on product type, material, end-user, and technology, reflecting the diverse range of clinical applications and manufacturing processes utilized globally. Product segmentation is crucial as it dictates the required materials and complexity of the fabrication process, ranging from single-unit restorations to full-mouth rehabilitations. Material segmentation highlights the shift from conventional metals to highly aesthetic and durable ceramics and polymers, driven by patient preference and improved performance characteristics. End-user segmentation distinguishes between centralized laboratories and decentralized clinical settings, which impacts purchasing patterns and volume requirements, while technology segmentation tracks the adoption of advanced digital workflows versus traditional manual techniques, indicating future capital investment directions.

- By Product Type:

- Crowns and Bridges

- Dentures (Full and Partial)

- Veneers

- Inlays and Onlays

- Abutments and Copings

- By Material:

- Ceramics (Zirconia, Lithium Disilicate, Feldspathic Porcelain)

- Polymers (Acrylic Resins, PEEK)

- Metals and Alloys (Titanium, Nickel-Chrome, Cobalt-Chrome)

- Composites

- By End User:

- Dental Laboratories (Commercial and Specialized)

- Dental Clinics and Hospitals

- Academic and Research Institutes

- By Technology:

- CAD/CAM Systems (Milling, 3D Printing)

- Casting and Pressing Techniques

- Traditional Manual Fabrication

Value Chain Analysis For Dental Fitting Market

The value chain for the Dental Fitting Market begins with the upstream segment, dominated by specialized raw material suppliers providing high-purity metals (titanium), advanced ceramic blocks (zirconia, lithium disilicate), and biocompatible polymers. This segment requires intensive R&D and strict quality control, as material integrity directly dictates the clinical success of the final fitting. Key players in the upstream sector often specialize in powder metallurgy or advanced chemical synthesis. Following this, the manufacturing segment involves companies specializing in sophisticated capital equipment, such as CAD/CAM milling machines, high-resolution 3D printers, sintering furnaces, and intraoral scanners, which are essential for processing the raw materials into customized intermediate or final products. Equipment manufacturers play a crucial role in enabling the digital workflow.

The central node of the value chain is the dental laboratory, which acts as the fabrication hub. Laboratories receive patient data (digital scans or physical impressions) from dental clinics and, utilizing advanced technology, design and manufacture the final dental fittings. The distribution channel involves both direct and indirect routes. Direct distribution occurs when large manufacturers sell high-cost capital equipment and bulk materials directly to large dental clinic chains or specialized labs. Indirect distribution, which is more common, relies on a network of specialized medical and dental distributors who manage logistics, inventory, and localized technical support for smaller independent clinics and labs, ensuring regional market penetration and accessibility of specialized products.

The downstream segment concludes with the interaction between the dental clinic (the primary service provider) and the end-user (the patient). Clinics purchase or use the fabricated fittings and provide the highly specialized service of placement, adjustment, and long-term maintenance. The efficiency and quality of the entire chain are critically dependent on seamless digital integration between the scanning technology in the clinic and the CAD/CAM software in the lab. Strategic outsourcing to foreign laboratories is increasingly common, representing a globalized aspect of the value chain, where cost-efficiencies in manufacturing are balanced against logistics and quality assurance requirements, thereby influencing the final consumer price and geographical market accessibility.

Dental Fitting Market Potential Customers

The primary end-users and buyers of dental fittings are highly specialized entities within the healthcare infrastructure, categorized primarily into Dental Laboratories, Dental Clinics (including private practices and large Dental Service Organizations or DSOs), and Hospitals/Academic Centers. Dental Laboratories represent the largest volume purchaser of fitting components, raw materials (blocks, discs), and capital equipment (milling machines, 3D printers). They act as B2B service providers, requiring reliable, high-throughput materials and components to efficiently serve their clinic clients. Their purchasing decisions are driven by material cost-effectiveness, consistency, and compatibility with leading digital systems. The trend towards large commercial laboratories consolidating smaller labs dictates purchasing power and material standardization across the industry.

Dental Clinics, particularly those operating as large DSOs or high-end private practices, represent the second major customer segment. While they traditionally purchase finished fittings from labs, the increasing adoption of in-house CAD/CAM capabilities (chairside systems) means they are now direct buyers of intraoral scanners, software licenses, and specialized material blocks for immediate chairside fabrication of simple restorations (like single-unit crowns). Their procurement focus is on systems that enhance patient convenience, reduce turnaround time, and offer aesthetic superiority, allowing them to market premium, rapid service offerings directly to consumers. Hospitals and academic centers purchase fittings primarily for complex maxillofacial reconstructions, trauma cases, and for conducting specialized materials research and professional training.

Ultimately, while the patient is the consumer of the final product and procedure, the professional entities listed above drive the purchasing decisions for specific fitting types and materials. Demographic factors such as age, disposable income, and insurance coverage heavily influence the demand for specific fitting types; for instance, the geriatric population drives demand for full dentures and complex implants, whereas younger demographics primarily seek cosmetic veneers and orthodontic components. Therefore, manufacturers must target their sales and marketing efforts toward empowering dental professionals and laboratories with superior technology and materials that meet the diverse clinical and aesthetic needs across all patient demographics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Straumann Group, Henry Schein, Zimmer Biomet (Dental), Ivoclar Vivadent, 3M, Envista Holdings Corporation, Align Technology, Mitsui Chemicals (Heraeus Kulzer), Planmeca Group, BEGO Group, Amann Girrbach, Shofu Inc., VOCO GmbH, Kuraray Noritake Dental Inc., VITA Zahnfabrik, Zirkonzahn GmbH, GC Corporation, Formlabs, SprintRay |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dental Fitting Market Key Technology Landscape

The technology landscape of the Dental Fitting Market is defined by the rapid convergence of digital imaging, computer-aided design, and advanced manufacturing techniques, collectively known as digital dentistry. The core technological shift involves replacing conventional physical impression-taking with highly accurate intraoral scanners (IOS), which capture 3D data of the patient's oral cavity. This digital data is then transferred seamlessly to CAD software, where artificial intelligence and machine learning algorithms assist technicians in designing precise, anatomically correct restorations. This shift minimizes patient discomfort, drastically reduces the potential for dimensional inaccuracies inherent in traditional materials like alginate or putty, and accelerates the diagnostic phase. Leading players are heavily investing in integrating AI into CAD workflows to automate complex design choices, such as margin placement and occlusal surface morphology, reducing dependence on highly specialized manual expertise.

The manufacturing phase is dominated by Computer-Aided Manufacturing (CAM) technologies, primarily encompassing high-speed milling (subtractive manufacturing) and specialized 3D printing (additive manufacturing). Milling remains the gold standard for high-strength, densely sintered materials like zirconia and certain ceramic blocks, ensuring homogenous material structure and clinical reliability. However, 3D printing technologies, specifically Digital Light Processing (DLP) and Stereolithography (SLA), are rapidly gaining traction for producing complex temporary restorations, surgical guides for implant placement, and frameworks for dentures and removable prosthetics. Additive manufacturing offers unparalleled geometric freedom and allows for mass customization at a much lower material waste rate, pushing the industry towards greater efficiency and environmentally conscious practices, which is a major technological focus moving forward.

Furthermore, material science technologies are progressing in tandem with digital fabrication. Innovations include the development of multi-layered, gradient-shaded ceramic blocks that mimic the natural translucency and color variation of real teeth, improving aesthetic outcomes dramatically. Specialized heat treatment and sintering technologies are required to maximize the strength and durability of these advanced ceramics. PEEK (Polyetheretherketone) and high-performance polymer fittings are also gaining importance, especially for patients with metal allergies or those requiring lightweight, impact-absorbing restorations. The interplay between these cutting-edge materials and precision fabrication tools constitutes the primary competitive advantage in the modern dental fitting technology market, driving the need for continuous software updates and hardware optimization among manufacturers and lab partners alike.

Regional Highlights

- North America: North America, particularly the United States, represents a dominant market share, driven by high per capita expenditure on dental care, widespread adoption of advanced digital dentistry solutions, and robust insurance coverage enabling patient access to high-value cosmetic and implant-supported restorations. The region boasts a highly consolidated market structure with numerous large DSOs and advanced dental laboratories that are early adopters of CAD/CAM and 3D printing technologies. Demand is further solidified by an aging population and a proactive approach toward aesthetic enhancement.

- Europe: Europe is a mature market characterized by sophisticated healthcare systems and strong regulatory frameworks (e.g., MDR compliance). Western European countries (Germany, France, UK) lead in material science innovation and clinical research, focusing on bio-compatible materials and minimally invasive fitting protocols. The growth here is stable, emphasizing quality and clinical longevity, with a strong internal market for dental tourism attracting intra-European patients seeking specialized implantology and complex prosthetic work.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by expanding healthcare infrastructure, rising disposable incomes, and increasing awareness of oral health in densely populated economies like China and India. The rapid growth in dental tourism, especially in Southeast Asia, significantly contributes to the demand for cost-effective, high-quality fittings. Governments are increasingly investing in public oral health initiatives, creating a massive, untapped patient pool transitioning from basic restorative care to advanced, modern fittings.

- Latin America (LATAM): The LATAM market is poised for significant growth, though currently challenged by fragmented healthcare systems and economic volatility. Urban centers show accelerating adoption of digital technology, particularly in private practices catering to the middle and upper classes. Mexico and Brazil are key markets, benefiting from investments in local manufacturing capabilities and serving as gateways for imported, high-technology dental equipment and materials.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, driven by oil wealth, government spending on world-class healthcare facilities, and a high expatriate population demanding premium services. Implantology and cosmetic dentistry are major focus areas. The African market remains nascent but offers long-term potential as infrastructure improves and dental education expands, focusing initially on essential restorative fittings and materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dental Fitting Market.- Dentsply Sirona

- Straumann Group

- Henry Schein, Inc.

- Zimmer Biomet (Dental)

- Ivoclar Vivadent AG

- 3M Company

- Envista Holdings Corporation

- Align Technology, Inc.

- Mitsui Chemicals, Inc. (Heraeus Kulzer)

- Planmeca Group

- BEGO Group

- Amann Girrbach AG

- Shofu Inc.

- VOCO GmbH

- Kuraray Noritake Dental Inc.

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- Zirkonzahn GmbH

- GC Corporation

- Formlabs, Inc.

- SprintRay Inc.

- 3Shape A/S

- Exocad GmbH (An Align Technology Company)

- Candulor AG

- Kerr Corporation (A Sybron Dental Specialties Company)

- COLTENE Holding AG

- A-dec Inc.

- Ultradent Products, Inc.

- Septodont Holding

- Sirona Dental Systems GmbH (Part of Dentsply Sirona)

- Vatech Co., Ltd.

- Biolase, Inc.

Frequently Asked Questions

Analyze common user questions about the Dental Fitting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional PFM fittings to Zirconia and all-ceramic restorations?

The shift is primarily driven by superior aesthetics, better biocompatibility, and increasing patient demand for metal-free dental solutions. Zirconia offers exceptional strength and durability, making it suitable for high-stress areas while providing translucent properties that closely mimic natural tooth structure, optimizing clinical outcomes and patient satisfaction.

How are CAD/CAM technologies influencing the efficiency and cost of dental fitting production?

CAD/CAM systems significantly enhance efficiency by automating the design and manufacturing process, drastically reducing manual labor time, and minimizing material waste. This precision technology lowers the incidence of errors requiring remakes, thereby reducing overall laboratory costs and improving turnaround time for patients.

Which geographical region is expected to show the fastest growth rate in the Dental Fitting Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This accelerated expansion is attributed to rapidly developing healthcare infrastructure, rising discretionary income fueling cosmetic procedure demand, and expanding dental tourism industries across key economies like India, China, and Southeast Asian nations.

What role does 3D printing play in modern dental fitting manufacturing?

3D printing (additive manufacturing) plays a critical role in rapid prototyping, creating highly accurate surgical guides for implant placement, and manufacturing specialized components like custom trays, temporary prosthetics, and increasingly, final polymer-based dentures. It enables complex geometries and true mass customization at reduced cost.

What are the main challenges restraining the growth of the Dental Fitting Market globally?

The market is primarily restrained by the high procedural cost of advanced restorative treatments, limited public insurance coverage in many regions, and a significant shortage of adequately trained dental professionals and lab technicians capable of utilizing sophisticated digital equipment efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dental Fitting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dental Fitting Market Size Report By Type (Crowns and Bridges, Denture, Other), By Application (Repair Broken Teeth, Implanted Teeth, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dental Fitting Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Crowns and Bridges, Denture, Other), By Application (Repair Broken Teeth, Implanted Teeth, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager