Depaneling Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431771 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Depaneling Machine Market Size

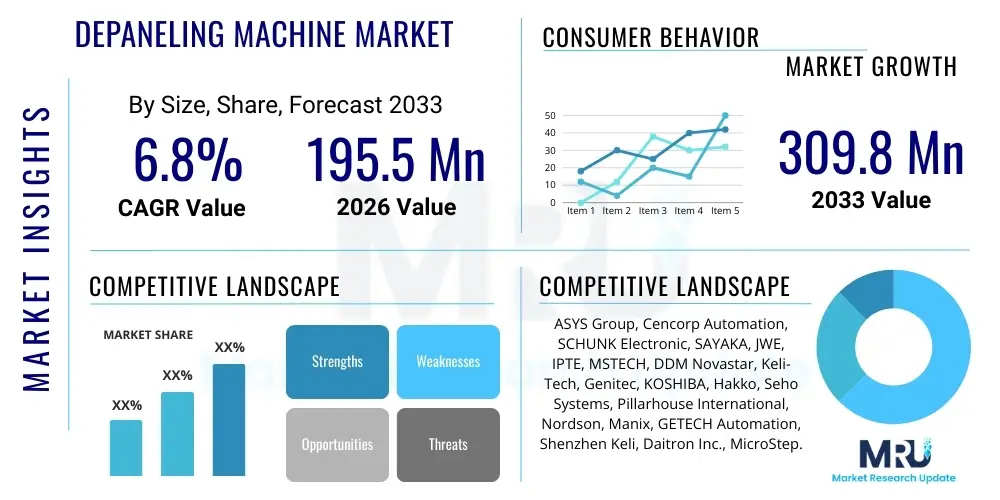

The Depaneling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 195.5 Million in 2026 and is projected to reach USD 309.8 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating miniaturization of electronic components, the growing adoption of complex rigid-flex PCBs, and the critical demand for high-precision, low-stress separation techniques across major electronics manufacturing hubs globally. The transition towards fully automated production lines further reinforces the need for advanced depaneling solutions, particularly laser and router-based systems, which offer superior throughput and minimal mechanical stress compared to conventional methods.

Depaneling Machine Market introduction

The Depaneling Machine Market encompasses specialized equipment designed for separating individual printed circuit boards (PCBs) or assemblies from a larger fabrication panel after the manufacturing and assembly processes are complete. This crucial post-assembly process, known as depaneling or singulation, must be performed with high accuracy and minimal mechanical or thermal stress to avoid damage to sensitive components and board integrity. Depaneling machines utilize various techniques, including mechanical routing, laser cutting, V-scoring, punching, and sawing, chosen based on the board material, thickness, component density, and required throughput. These machines are integral to modern surface mount technology (SMT) lines.

Major applications of depaneling technology span diverse high-growth sectors, including consumer electronics (smartphones, wearables), automotive electronics (ADAS, infotainment systems), medical devices (diagnostic equipment, implants), aerospace and defense, and industrial control systems. The primary benefits of utilizing automated depaneling machines include significantly enhanced production throughput, improved yield rates due to reduced component damage, minimized operational costs associated with manual handling, and superior repeatability and precision. The demand for increasingly smaller, lighter, and more complex electronic devices inherently drives the need for precise, stress-free depaneling methods capable of handling densely populated boards.

Key driving factors accelerating market expansion include the global surge in demand for 5G infrastructure deployment and associated network hardware, the relentless growth of the Internet of Things (IoT), and the rapid electrification and digitalization of the automotive sector. Furthermore, stringent quality requirements in critical applications such as medical and aerospace mandate the use of high-precision depaneling solutions like laser systems, which offer unparalleled accuracy and eliminate dust generation. The continuous innovation in PCB substrate materials and mounting technologies necessitates corresponding advancements in depaneling equipment capabilities, pushing manufacturers toward more flexible and high-speed automated systems.

Depaneling Machine Market Executive Summary

The Depaneling Machine Market is characterized by robust growth driven by the pervasive trend of miniaturization and the necessity for highly reliable electronic assemblies. Business trends indicate a strong shift towards flexible automation solutions, with manufacturers prioritizing modular designs that can adapt to high-mix, low-volume production environments typical in advanced electronics manufacturing. Capital expenditure is increasingly allocated to laser depaneling systems, recognizing their advantages in processing fragile substrates and eliminating mechanical stress, particularly relevant for high-density interconnect (HDI) and flexible PCBs. Key market players are intensely focused on integrating advanced software features, including machine vision systems and AI-powered optimization tools, to enhance cutting path accuracy and reduce programming time, positioning superior technological capability as a primary competitive differentiator.

Regionally, the Asia Pacific (APAC) continues to dominate the market, largely due to the concentration of global electronics manufacturing bases in countries like China, South Korea, Taiwan, and Vietnam. This region exhibits the highest demand volume for all types of depaneling machinery, fueled by aggressive expansion in consumer electronics and electric vehicle manufacturing. North America and Europe, while representing mature markets, show high adoption rates for sophisticated, high-end laser and router systems, driven by stringent quality standards in medical, aerospace, and defense applications. Emerging markets in Southeast Asia and Latin America are showing accelerated growth, prompted by lower manufacturing costs and the establishment of new assembly plants, favoring the adoption of semi-automatic and cost-effective router systems initially.

Segment trends highlight the dominance of router-based depaneling systems in terms of installed base, offering a balance between cost-effectiveness, throughput, and operational flexibility for standard rigid boards. However, the fastest growth is observed in the laser depaneling segment, driven by the increasing complexity of flexible and rigid-flex PCBs where non-contact processing is essential for maintaining substrate integrity. Segmentation by automation reveals a definitive trajectory towards fully automatic inline systems, crucial for achieving Industry 4.0 production efficiencies and minimizing human intervention. Application-wise, the Consumer Electronics segment remains the largest consumer, but the Automotive Electronics segment is experiencing disproportionately high growth due to the integration of complex sensor packages and control units requiring high-reliability PCB separation.

AI Impact Analysis on Depaneling Machine Market

Analysis of common user questions regarding AI's impact on depaneling machines frequently centers on topics such as optimizing cutting paths for complex geometries, minimizing waste material, predicting tool wear and maintenance schedules, and enabling real-time quality control checks. Users are concerned with how AI can transition current automated systems from fixed-program operation to intelligent, adaptive processing capable of handling dynamic production requirements and material variations without manual reprogramming. Key expectations include leveraging machine learning algorithms to reduce initial setup time for new PCB designs and to integrate predictive maintenance features, thereby maximizing uptime. Concerns often revolve around the data infrastructure required to train these sophisticated models and the interoperability of AI systems with existing manufacturing execution systems (MES).

The integration of Artificial Intelligence and advanced machine learning into depaneling technology is transforming the operational paradigm from mere automation to intelligent process optimization. AI is fundamentally utilized to enhance machine vision capabilities, enabling ultra-precise alignment and registration corrections in real-time, which is critical for minimizing positional errors, particularly during high-speed laser cutting. Furthermore, neural networks are being deployed to analyze sensor data related to vibration, temperature, and cutting force, allowing the machine to dynamically adjust cutting parameters—such as feed rate and spindle speed—to maintain optimal quality and extend tool life. This real-time adaptive control minimizes micro-cracking and component stress, leading to a substantial improvement in overall yield, particularly for advanced substrate materials.

Beyond process control, AI plays a pivotal role in manufacturing intelligence by facilitating predictive maintenance and optimizing scheduling across multiple machines. By analyzing historical performance data and recognizing patterns indicative of imminent component failure or degradation (e.g., router bit dullness, laser power drift), AI algorithms can proactively alert operators, scheduling maintenance precisely when needed rather than relying on time-based intervals. This transition to condition-based maintenance significantly reduces unexpected downtime. Moreover, in multi-product environments, AI algorithms can efficiently optimize the sequence of jobs, grouping similar depaneling requirements to minimize changeover time and maximize throughput, thereby enhancing overall factory floor utilization and supporting the agility required for Industry 4.0 implementations.

- AI-driven image processing enhances component recognition and fiducial alignment accuracy, ensuring precise non-contact cutting.

- Machine learning algorithms optimize cutting paths and tool trajectories for complex PCB geometries, minimizing operational time.

- Predictive maintenance schedules are generated by analyzing vibration and force sensor data, drastically reducing unexpected machine downtime.

- Real-time process feedback loop adjustments (e.g., laser power, router speed) are implemented by AI to compensate for material variations and maintain consistent cut quality.

- Automated defect detection using deep learning ensures immediate identification of stress fractures or burrs post-depaneling.

- Optimization of job scheduling and batch grouping using AI maximizes machine throughput in high-mix manufacturing environments.

DRO & Impact Forces Of Depaneling Machine Market

The Depaneling Machine Market is governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its trajectory. Key drivers include the exponential growth in demand for highly integrated electronic devices, the continuous innovation in complex, multi-layered PCBs (especially rigid-flex designs), and the necessity for stress-free separation methods to protect sensitive surface-mounted components. The global movement towards fully automated, lights-out manufacturing facilities further accelerates the adoption of high-throughput automated depaneling systems. Conversely, market restraints largely center on the high initial capital investment required for advanced laser and high-precision router systems, particularly challenging for smaller and medium-sized enterprises. Technical complexities associated with programming and maintaining highly sophisticated vision-guided systems also present a barrier to entry, alongside the specialized skill set required for operating non-conventional cutting technologies like ultra-short pulse lasers. These forces necessitate continuous innovation in cost-effective, yet high-precision, solutions.

Significant opportunities are emerging from the rapid expansion of niche applications such as micro-LED display manufacturing, advanced semiconductor packaging (e.g., wafer level packaging), and the integration of specialized sensors in medical diagnostics. These applications demand extremely fine features and minimal thermal or mechanical impact, providing a fertile ground for high-specification laser depaneling technologies. Furthermore, the push for sustainable manufacturing practices opens opportunities for equipment manufacturers to develop technologies that minimize material waste and improve energy efficiency, aligning with global environmental regulations. The growing regionalization of electronics supply chains outside traditional Asian hubs, driven by geopolitical considerations, creates new localized demand pools for advanced depaneling machinery in North America and Europe, requiring localized service and support infrastructure.

The collective impact forces favor technological advancements focused on precision and flexibility. The overwhelming market requirement for increased component density and smaller board footprints means that older, high-stress methods like punching and scoring are rapidly being replaced by non-contact (laser) and low-stress mechanical (router) methods. This technological evolution exerts powerful upward pressure on pricing and complexity, increasing the market share of sophisticated systems. The high entry barrier associated with complex machinery is being partially mitigated by the emergence of service models (Equipment-as-a-Service) and standardized, user-friendly software interfaces. Overall, the impact forces suggest sustained growth, heavily skewed towards automated, high-precision, and technologically advanced solutions capable of addressing the future needs of miniaturized electronics.

Segmentation Analysis

The Depaneling Machine Market is comprehensively segmented based on Type, Automation Level, and Application, providing a granular view of market dynamics and adoption patterns across diverse industrial ecosystems. The segmentation by Type—encompassing Router, Laser, Punching, and others—reflects the evolution of cutting technology driven by the demand for higher precision and reduced stress on delicate PCBs. Router-based systems, characterized by mechanical cutting tools, remain the most widely adopted due to their versatility and suitability for standard rigid boards, while laser systems are rapidly gaining momentum due to their non-contact nature, making them ideal for flexible circuits and high-density, sensitive components.

Segmentation by Automation Level—Automatic, Semi-Automatic, and Manual—is indicative of the level of capital expenditure and required throughput in manufacturing facilities. The shift towards fully automatic, inline systems is a definitive trend, crucial for high-volume operations seeking minimal labor intervention and maximum process repeatability, aligning with smart factory initiatives. Conversely, semi-automatic systems serve as cost-effective entry points for lower volume or high-mix production environments, particularly prevalent in prototyping and specialized assembly houses. Finally, the Application segmentation demonstrates market consumption patterns across key end-use industries, with Consumer Electronics, Automotive, and Medical Devices being the primary drivers of technological innovation and volume growth due to their strict quality and reliability demands.

- By Type:

- Router Depaneling Machines (Mechanical routing offers versatility and high accuracy for rigid PCBs.)

- Laser Depaneling Machines (Non-contact cutting, suitable for flexible PCBs and fragile components, fastest-growing segment.)

- Punching Depaneling Machines (High throughput for specific geometries, high mechanical stress, declining usage.)

- V-Scoring Depaneling Machines (Cost-effective for linear separation, requires pre-scoring during fabrication.)

- Sawing Depaneling Machines (Used for thick boards and specific materials, moderate stress.)

- By Automation Level:

- Automatic Depaneling Machines (Inline integration, high throughput, minimal labor, focus on vision systems.)

- Semi-Automatic Depaneling Machines (Requires operator loading/unloading, common in mid-volume production.)

- Manual Depaneling Tools (Low volume, prototyping, specialized repair work.)

- By Application:

- Consumer Electronics (Smartphones, Tablets, Wearables - highest volume driver.)

- Automotive Electronics (ADAS, Control Units, EV components - high growth, high reliability required.)

- Aerospace and Defense (Strict quality mandates, favoring laser and high-precision router systems.)

- Medical Devices (Implants, Diagnostic Equipment - non-contact processing is critical.)

- Industrial Electronics (Automation systems, Power supplies.)

Value Chain Analysis For Depaneling Machine Market

The value chain for the Depaneling Machine Market initiates with upstream activities encompassing the sourcing of precision components, specialized materials, and advanced software required for machine construction. This includes high-speed spindles, precise linear motion systems, optical components (for laser systems), and sophisticated machine vision hardware and proprietary control software. Key suppliers include specialized manufacturers of motion control systems (servomotors, linear guides) and laser sources (CO2, UV, fiber lasers). The competitive advantage at this stage hinges on securing high-quality, reliable components that minimize downtime and ensure the sub-micron level precision demanded by advanced PCB manufacturing. Integration and partnership with technology providers for AI and machine learning software are becoming increasingly vital components of the upstream supply structure.

The manufacturing stage involves the assembly, integration, rigorous testing, and calibration of the final depaneling systems. Leading market players often maintain specialized facilities to handle the precision engineering required for these machines. Distribution channels play a critical role, involving a mix of direct sales teams for major global electronics manufacturers (offering customization and complex integration services) and indirect channels through regional distributors or systems integrators. These indirect channels are particularly effective for reaching Small and Medium-sized Enterprises (SMEs) and localized assembly houses, providing regional support, training, and maintenance services. The effectiveness of the distribution network, particularly the quality of post-sales service and technical support, significantly influences customer purchasing decisions and long-term relationships.

Downstream analysis focuses on the end-users—the PCB assembly houses, contract manufacturers (EMS providers), and original equipment manufacturers (OEMs) across various sectors. The final segment of the value chain is post-sales service, which includes installation, preventative maintenance, spare parts supply, and software updates. Given the high cost and criticality of depaneling machines in the production line, comprehensive service contracts and rapid response capabilities are crucial for maximizing customer lifetime value. Furthermore, recycling and refurbishment services for older equipment are emerging as important sustainability considerations within the downstream chain, driven by circular economy initiatives. Effective communication between manufacturing, distribution, and service arms ensures high customer satisfaction and market penetration.

Depaneling Machine Market Potential Customers

The primary customers for depaneling machine technology are entities involved in the high-volume, precision manufacturing and assembly of electronic printed circuit boards. This diverse customer base includes large multinational Electronics Manufacturing Service (EMS) providers, such as Foxconn, Flextronics, and Jabil, which require fully automated, high-throughput inline systems to manage global production for tier-one OEMs. These contract manufacturers often utilize a mix of router and laser systems based on the specific board material and complexity of the product being assembled. They prioritize scalability, speed, and seamless integration with existing factory automation infrastructure (MES).

Original Equipment Manufacturers (OEMs) specializing in advanced applications also constitute a significant customer segment. This includes major automotive suppliers focusing on ADAS modules and battery management systems, premium medical device manufacturers producing complex diagnostic tools, and aerospace contractors. These specialized OEMs typically demand the highest level of precision and reliability, making them prime candidates for advanced UV laser depaneling systems capable of handling sensitive materials and minimizing thermal stress. Their focus is often on quality control and minimizing component damage rather than raw volume.

A third major customer group comprises smaller, specialized PCB fabrication houses and prototyping centers. These entities often engage in high-mix, low-volume production and are more likely to invest in semi-automatic or versatile router-based systems that offer flexibility and a lower initial investment barrier. Educational institutions and R&D centers also utilize these machines for research into new substrate materials and assembly techniques. The buying decision across all segments is fundamentally driven by the need to balance throughput requirements, component sensitivity (measured by mechanical stress tolerance), and the total cost of ownership (TCO), including tool life and service costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Million |

| Market Forecast in 2033 | USD 309.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASYS Group, Cencorp Automation, SCHUNK Electronic, SAYAKA, JWE, IPTE, MSTECH, DDM Novastar, Keli-Tech, Genitec, KOSHIBA, Hakko, Seho Systems, Pillarhouse International, Nordson, Manix, GETECH Automation, Shenzhen Keli, Daitron Inc., MicroStep. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Depaneling Machine Market Key Technology Landscape

The technological landscape of the Depaneling Machine Market is characterized by the convergence of high-precision mechanical engineering, advanced optics, and sophisticated machine vision systems, increasingly augmented by artificial intelligence. The evolution is centered on minimizing mechanical and thermal stress while maximizing throughput and process flexibility. Router-based systems have advanced through the implementation of high-speed, precision spindles (up to 60,000 RPM) coupled with advanced dust extraction systems and non-contact height sensing to ensure consistent depth control and reduced burr formation. The integration of dual-table systems and automated jig changing mechanisms maximizes continuous operation and drastically reduces non-productive time, making these routers suitable for high-volume rigid board processing.

The most significant technological shift involves laser depaneling, which utilizes non-contact ablation for board separation. Ultra-Violet (UV) lasers (355nm wavelength) are dominant in this space, offering high energy absorption by common PCB materials (FR4, polyimide) and minimal Heat Affected Zone (HAZ), making them ideal for highly sensitive flexible PCBs and ceramic substrates. Recent advancements include femtosecond and picosecond pulse lasers, offering even cleaner cuts and virtually eliminating thermal damage, crucial for next-generation micro-LED and HDI applications. These laser systems rely heavily on sophisticated Galvo scanners for precise beam steering and pattern recognition algorithms (vision systems) to accurately register the panel before cutting, often compensating for material distortion in real-time.

Furthermore, technology development is focused on enhancing interoperability and ease of use. Software advancements include off-line programming capabilities, which allow manufacturers to generate and simulate complex cutting paths without disrupting live production, alongside standardized protocols (like SEMI standards) for seamless integration into the factory MES. Machine vision systems are moving beyond basic fiducial alignment to full 3D component mapping, ensuring tool clearance and preventing damage to unusually high or sensitive components. The rise of cobots (collaborative robots) is also influencing the landscape, providing flexible, automated loading and unloading solutions for semi-automatic depaneling machines, bridging the gap between manual operation and full inline automation effectively.

Regional Highlights

The global Depaneling Machine Market demonstrates distinct regional dynamics heavily influenced by the location of major electronics manufacturing clusters and the specific technological demands of localized end-use sectors.

- Asia Pacific (APAC): APAC is the unequivocally dominant market, accounting for the largest share in both volume and value. This dominance is attributed to the presence of global EMS giants and major OEM manufacturing bases in countries such as China, Taiwan, South Korea, Japan, and Vietnam. The sheer volume of consumer electronics, telecommunications equipment, and affordable electric vehicle components produced here drives massive demand for high-throughput, automatic depaneling systems, particularly both advanced routers and cost-effective laser solutions. Growth rates remain robust due to continuous capacity expansion and technological upgrades aimed at Industry 4.0 standards.

- North America: This region is characterized by high demand for quality, precision, and high-reliability equipment, driven primarily by the aerospace and defense, advanced medical devices, and high-performance computing sectors. North American manufacturers typically invest in the most advanced, high-specification equipment, such as UV and ultra-short pulse laser systems, often prioritizing minimal component stress and traceability features over initial capital cost. The presence of significant R&D activities also fuels the demand for prototyping and specialized depaneling solutions.

- Europe: European market growth is propelled by the robust automotive electronics sector, strict regulatory environment, and strong focus on industrial automation and advanced machinery manufacturing (Germany, Italy). European users demand precision and longevity, leading to strong uptake of integrated, fully automatic systems that comply with stringent industrial safety and environmental standards. While overall volume is lower than APAC, the market value per unit often remains high due to specialization and quality requirements.

- Latin America (LATAM): This region is an emerging market, driven primarily by localized assembly plants serving regional consumer electronics and automotive segments (especially Brazil and Mexico). The market currently favors cost-effective and versatile semi-automatic router systems, but increasing foreign direct investment in manufacturing is expected to drive higher adoption of automated solutions throughout the forecast period.

- Middle East and Africa (MEA): MEA remains the smallest market but is exhibiting nascent growth driven by investments in telecommunications infrastructure, defense electronics, and localized smart technology manufacturing initiatives (e.g., Saudi Arabia, UAE). Demand is concentrated around basic to mid-range router and V-scoring machines, with high-end laser systems adoption limited to specialized aerospace and government projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Depaneling Machine Market.- ASYS Group (Germany)

- Cencorp Automation (Finland)

- SCHUNK Electronic GmbH (Germany)

- SAYAKA Co., Ltd. (Japan)

- JWE - Jingbo Electronic Equipment Co., Ltd. (China)

- IPTE NV (Belgium)

- MSTECH (South Korea)

- DDM Novastar (USA)

- Keli-Tech Automation Equipment Co., Ltd. (China)

- Genitec Co., Ltd. (Taiwan)

- KOSHIBA Holdings Co., Ltd. (Japan)

- Hakko Corporation (Japan)

- Seho Systems GmbH (Germany)

- Pillarhouse International Ltd (UK)

- Nordson Corporation (USA)

- Manix (USA)

- GETECH Automation (Malaysia)

- Shenzhen Keli Technology Co., Ltd. (China)

- Daitron Inc. (Japan)

- MicroStep (Slovakia)

Frequently Asked Questions

Analyze common user questions about the Depaneling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between laser and router depaneling systems?

Router depaneling utilizes a mechanical milling bit (cutter) to physically separate PCBs, which is highly effective for standard rigid boards but imparts mechanical stress. Laser depaneling uses a non-contact, focused beam (typically UV or CO2) to ablate the material, eliminating mechanical stress and making it superior for fragile components, flexible PCBs, and complex geometries. Laser systems generally offer higher precision but require greater capital investment.

Which application segment drives the highest demand volume for depaneling machines?

The Consumer Electronics application segment, encompassing the manufacturing of smartphones, wearables, and other high-volume consumer gadgets, generates the highest overall demand volume for depaneling machines globally. This segment drives high adoption of fully automatic, high-speed systems to meet mass production throughput requirements.

How is Industry 4.0 influencing the design and functionality of new depaneling machines?

Industry 4.0 mandates the integration of advanced sensors, machine vision systems, and AI-driven control software to enable real-time monitoring, predictive maintenance, and autonomous optimization of cutting parameters. New machines feature enhanced connectivity (IoT capabilities) for seamless data exchange with Manufacturing Execution Systems (MES) and centralized factory platforms.

What are the key technical challenges in depaneling rigid-flex PCBs?

Rigid-flex PCBs pose challenges due to the stark material difference between the rigid FR4 sections and the flexible polyimide portions. Depaneling must avoid damaging the delicate flex components and maintain precise registration. This complexity favors the use of UV laser systems, which provide precise, stress-free cutting on heterogeneous materials, minimizing micro-cracking and material deformation.

Why is the Asia Pacific region the leading market for depaneling equipment?

The Asia Pacific region leads the market due to the massive concentration of global electronics contract manufacturing (EMS) and original equipment manufacturing (OEM) facilities. High production volumes, coupled with continuous investment in capacity expansion and technology upgrades across key economies like China, South Korea, and Taiwan, sustain its dominant market position.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Depaneling Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- PCB Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (In-line Type, Off-line Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Laser Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (In-line Type, Off-line Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Automatic Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (Laser, Mechanical), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Off-line Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (Laser, Mechanical), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager