Desalination Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434680 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Desalination Market Size

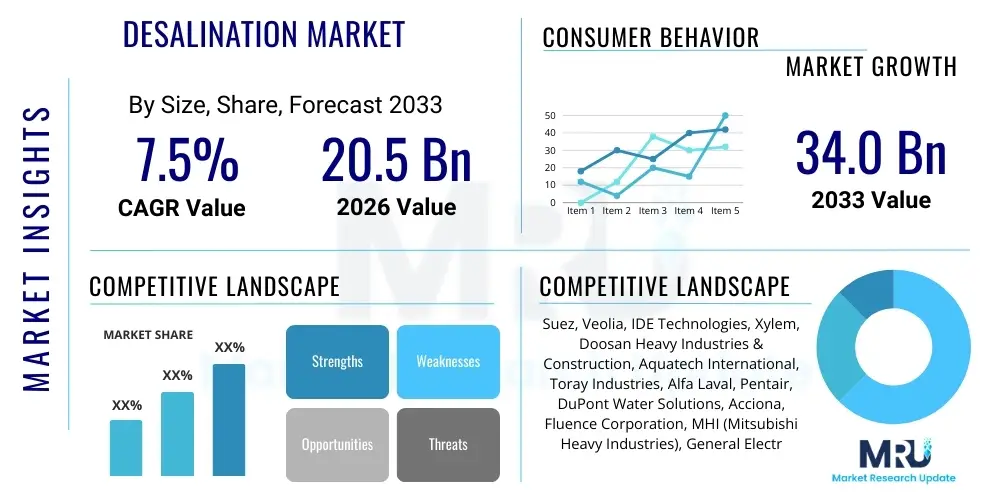

The Desalination Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 34.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing global water scarcity, rapid industrialization, and significant advancements in membrane technology and energy recovery systems, which collectively reduce the operational cost and environmental footprint of desalination facilities.

Desalination Market introduction

The Desalination Market encompasses the technologies and infrastructure designed to remove salt and other dissolved solids from water, making it suitable for human consumption, industrial processes, and agricultural use. The primary product is potable or process-grade water derived from non-conventional sources like seawater, brackish water, or highly contaminated wastewater. Desalination technologies are broadly categorized into membrane processes, notably Reverse Osmosis (RO), and thermal processes, such as Multi-Stage Flash (MSF) and Multi-Effect Distillation (MED). RO currently dominates the market due to its comparatively lower energy consumption and modular design, making it highly adaptable for various scales of deployment, from large municipal plants to compact industrial solutions.

Major applications of desalinated water span municipal consumption, providing reliable sources of drinking water in arid and densely populated coastal regions, and industrial sectors, including power generation, oil and gas, and chemical manufacturing, where high-purity water is essential for critical processes. The core benefits of desalination lie in securing water independence, mitigating the impact of drought and climate change on water availability, and enabling sustainable economic development in water-stressed areas. Furthermore, the technology aids in environmental protection by treating industrial effluents and reducing the strain on freshwater ecosystems, thereby promoting circular water management practices across diverse geographic landscapes.

The primary driving factors propelling market expansion include escalating global population growth, which intensifies demand for municipal water supplies, coupled with pervasive industrial expansion in regions characterized by limited natural freshwater reserves. Regulatory mandates promoting water reuse and stringent discharge standards also necessitate advanced desalination and purification techniques. Crucially, the continuous decline in the levelized cost of water (LCOW) from desalination plants, driven by innovation in high-flux, anti-fouling membranes, and breakthroughs in highly efficient energy recovery devices (ERDs), fundamentally enhances the economic viability and competitive position of desalinated water compared to traditional sources.

Desalination Market Executive Summary

The Desalination Market is experiencing a pivotal transformation marked by high capital investment in large-scale infrastructure projects, especially across the Middle East and Asia Pacific regions. Current business trends indicate a strong shift toward hybrid desalination systems, which combine thermal and membrane technologies to optimize performance and reduce energy variability, alongside a significant uptake in Public-Private Partnership (PPP) models to finance and operate complex water projects. The market is also witnessing rapid consolidation among technology providers aiming to offer integrated, end-to-end water management solutions, focusing heavily on automation and digitalization to enhance operational efficiencies and predictive maintenance capabilities.

Regionally, the Middle East and Africa (MEA) remains the cornerstone of the desalination market, driven by acute water scarcity, substantial governmental backing, and readily available capital for mega-projects. However, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market, propelled by swift urbanization, increasing industrial water demand (particularly in manufacturing and power generation), and the necessity to treat highly polluted inland brackish water sources. North America and Europe are focusing predominantly on industrial water reuse applications, decentralized municipal solutions, and leveraging advanced technologies like brine minimization and zero liquid discharge (ZLD) to comply with stringent environmental regulations.

Segmentation trends highlight the dominance of the Reverse Osmosis (RO) segment due to its versatility and decreasing energy requirements. Within applications, the municipal sector holds the largest market share, but the industrial segment, specifically the power and chemical industries, demonstrates the highest growth potential, demanding specialized high-purity water systems. Furthermore, the focus is increasingly shifting toward sustainable desalination practices, incorporating renewable energy sources (solar, wind) directly into plant operations, which further addresses the market's historical dependency on fossil fuels and aligns with global sustainability mandates and climate mitigation goals.

AI Impact Analysis on Desalination Market

Common user questions regarding AI's impact on the Desalination Market frequently revolve around optimizing energy consumption, predicting membrane fouling, and automating complex plant operations. Users are keen to understand how AI can transition desalination from a resource-intensive process to a smart, predictive, and resilient utility. Key themes include the economic feasibility of implementing machine learning algorithms for real-time control, the potential for AI-driven predictive maintenance to reduce costly downtime, and the role of digital twins in simulating operational improvements and training personnel. The overwhelming expectation is that AI will be the primary catalyst for achieving greater operational efficiency and significantly lowering the Levelized Cost of Water (LCOW), thereby improving the overall financial viability and scalability of desalination solutions globally.

AI's application in desalination centers on data analytics derived from sensor networks monitoring critical parameters such as temperature, pressure, salinity, and flow rates. These algorithms process vast datasets to identify subtle precursors to equipment failure or membrane degradation well before human operators might notice them, facilitating proactive interventions. This predictive capability is crucial in high-capital infrastructure projects like desalination plants, where unexpected shutdowns can incur massive financial penalties. Furthermore, AI systems are being deployed to dynamically adjust pump speeds and pressure settings in response to fluctuating input water quality and energy prices, ensuring the plant operates at peak energy efficiency across various environmental conditions.

The future integration of AI extends to optimizing brine management and resource recovery. Machine learning models can analyze the complex chemical composition of brine discharge and recommend optimal strategies for mineral extraction (e.g., lithium, magnesium), transforming a waste product into a valuable resource stream. This shift supports the circular economy model and addresses environmental concerns associated with high-salinity discharge. AI is thus viewed not just as an operational tool but as an integral component of sustainable desalination technology, enabling greater resource utilization and minimal environmental impact through sophisticated process control and decision support systems.

- AI-driven optimization of energy consumption (up to 15% reduction) through predictive control of pump and flow dynamics.

- Implementation of Digital Twins for real-time performance monitoring, scenario testing, and operator training.

- Predictive maintenance using machine learning to forecast membrane fouling and equipment failure, maximizing uptime.

- Automated chemical dosing adjustments based on real-time feed water quality analysis, minimizing chemical usage.

- Optimization of brine discharge strategies and mineral recovery processes to enhance sustainability and economic returns.

DRO & Impact Forces Of Desalination Market

The Desalination Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The core driver is the intensifying global water stress stemming from climate change effects—including prolonged droughts and shifting precipitation patterns—coupled with persistent population growth and consequential urbanization, which collectively strain existing conventional freshwater supplies. Significant technological improvements, particularly in high-rejection, low-pressure membranes and highly efficient energy recovery devices, continue to reduce the operational expenditure (OPEX) of desalination facilities, making desalinated water increasingly competitive with, and in some regions superior to, imported or long-distance water conveyance systems, thereby accelerating project development worldwide.

However, the market faces significant restraints, primarily centered around the high capital cost (CAPEX) required for plant construction and the substantial energy consumption, which historically has contributed to high Levelized Cost of Water (LCOW). Environmental concerns related to brine discharge, specifically its high salinity and potential temperature differences, pose regulatory hurdles and necessitate expensive pretreatment and discharge infrastructure, slowing project approvals in ecologically sensitive coastal zones. Furthermore, the public perception of desalination, sometimes viewed as an expensive and non-sustainable solution, particularly in regions with established freshwater infrastructure, occasionally delays market penetration and acceptance.

The primary opportunities lie in the rapidly expanding industrial water reuse segment, where the treatment of complex industrial effluents using advanced membrane technology offers substantial recurring revenue streams. The development and commercialization of next-generation, low-energy desalination technologies, such as forward osmosis (FO) and membrane distillation (MD), alongside the integration of renewable energy sources (solar, wind) to power desalination plants, offer pathways to mitigate energy constraints and environmental impact. These forces create an environment where technological leadership and strategic partnerships, especially in financing and project execution, are critical determinants of market success and long-term viability.

Segmentation Analysis

The Desalination Market segmentation provides a structured view of the industry, allowing for targeted analysis based on technology, application, source water, and component. The technological landscape is dominated by membrane separation methods, which offer scalability and energy efficiency advantages over traditional thermal distillation processes. The application segment reflects the foundational role of desalination in providing basic utility services (municipal) while also catering to the highly specialized water quality needs of complex industrial operations. Analyzing these segments is essential for stakeholders to identify investment hot spots, align product development with evolving water needs, and understand the competitive dynamics driving market share across different end-use sectors globally.

The source water classification highlights the shift from predominantly seawater desalination to an increasing focus on brackish water and wastewater reuse. Brackish water, characterized by lower salt concentration than seawater, requires less energy for treatment, making it highly attractive for inland regions. Similarly, the growing adoption of wastewater treatment using advanced desalination techniques, often incorporated in municipal and industrial reuse loops, underscores the industry's commitment to water circularity and resilience. This diversity in source water treatment necessitates varied technological solutions and customized pretreatment protocols, driving continuous innovation within the component manufacturing ecosystem.

- Technology:

- Reverse Osmosis (RO)

- Multi-Stage Flash (MSF)

- Multi-Effect Distillation (MED)

- Electrodialysis (ED) and Electrodialysis Reversal (EDR)

- Application:

- Municipal

- Industrial (Power, Oil & Gas, Mining, Chemicals)

- Agriculture

- Source Water:

- Seawater

- Brackish Water

- Wastewater

- Components:

- Pumps and Booster Systems

- Membranes and Filters

- Chemicals and Pretreatment Systems

- Energy Recovery Devices (ERDs)

- Automation and Control Systems

Value Chain Analysis For Desalination Market

The Desalination Market value chain begins with upstream activities focused on raw material sourcing, specializing in the development and manufacturing of high-performance components critical for separation and process efficiency. This phase involves R&D for advanced membrane materials (e.g., thin-film composites, graphene oxide), specialized chemical suppliers for pretreatment, and complex engineering firms designing high-pressure pumps and efficient Energy Recovery Devices (ERDs). Success in the upstream segment is heavily reliant on proprietary technology, robust intellectual property, and adherence to stringent quality controls, as the performance and lifespan of the entire desalination plant are fundamentally determined by the quality of these core components.

Midstream activities encompass the engineering, procurement, and construction (EPC) phase, where specialized international engineering firms design and integrate the various components into a fully functional plant, often requiring highly customized solutions based on feed water characteristics and specific capacity requirements. This segment demands extensive project management expertise, risk mitigation capabilities, and adherence to localized environmental and construction standards. Following construction, the downstream segment focuses on the operation and maintenance (O&M) of the plant, which is increasingly becoming a critical revenue stream. Long-term O&M contracts, often utilizing digitalization and remote monitoring, ensure operational longevity, maximize water production capacity, and minimize downtime, linking plant profitability directly to service quality and efficiency.

Distribution channels in the desalination market are predominantly direct for large, municipal, and industrial mega-projects, where component manufacturers and EPC contractors engage directly with government utilities or large industrial corporations. However, indirect channels, involving specialized local distributors and integrators, are crucial for smaller, decentralized brackish water treatment systems or packaged units intended for remote industrial sites. The trend is toward integrated solution providers who manage the entire lifecycle, from design (direct) to localized parts replacement and servicing (often indirect through certified local service partners), ensuring a robust supply chain for both capital deployment and long-term operational needs.

Desalination Market Potential Customers

Potential customers for desalination solutions are predominantly large-scale entities with critical and sustained water demands that cannot be reliably met by conventional sources. The largest end-users are municipal water utilities and government bodies, particularly those serving densely populated coastal cities or regions suffering from chronic water shortages and vulnerability to drought conditions. These clients prioritize high volume capacity, long-term reliability (30-50 years), adherence to strict water quality standards (WHO or equivalent), and guaranteed operational efficiency to manage public utility costs, often procuring services through long-term water purchase agreements (WPAs).

The second major customer group is the industrial sector, characterized by highly specific and often localized water requirements. Within this segment, power generation plants (thermal and nuclear) require massive quantities of demineralized water for boiler feed and cooling, while the oil and gas industry utilizes high-purity water for drilling, refining, and enhanced oil recovery (EOR). Furthermore, the burgeoning chemicals and pharmaceutical manufacturing sectors require ultra-pure water (UPW) that often mandates post-desalination polishing treatments. These industrial customers focus heavily on minimizing process downtime, achieving precise water quality specifications, and integrating desalination facilities directly into their existing energy and waste management systems for optimal synergy and cost control.

A rapidly emerging customer segment involves the agricultural sector, particularly in arid regions utilizing advanced irrigation techniques (drip and micro-irrigation). While traditionally sensitive to the higher cost of desalinated water, large-scale agribusiness and governmental agricultural development projects are increasingly exploring brackish water desalination solutions to sustain high-value crops and manage increasing land salinization. This segment demands energy-efficient, robust, and often modular solutions that can be deployed across vast rural areas, prioritizing ease of operation and maintenance over highly centralized complexity, opening new avenues for decentralized deployment models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 34.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suez, Veolia, IDE Technologies, Xylem, Doosan Heavy Industries & Construction, Aquatech International, Toray Industries, Alfa Laval, Pentair, DuPont Water Solutions, Acciona, Fluence Corporation, MHI (Mitsubishi Heavy Industries), General Electric (GE), Saudi Basic Industries Corporation (SABIC), Abengoa, Osmoflo, Consolidated Contractors Company (CCC), Hyflux Ltd (Restructured), Septech Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Desalination Market Key Technology Landscape

The core of the desalination technology landscape is characterized by the ongoing dominance of Reverse Osmosis (RO), which utilizes semi-permeable membranes and high-pressure pumps to separate salts from water. Recent technological advancements in RO focus heavily on membrane material science, specifically developing fouling-resistant membranes with higher flux rates that operate effectively at lower pressures, thereby significantly reducing energy requirements. Low-pressure RO, often coupled with highly efficient Energy Recovery Devices (ERDs) such as isobaric chambers, has cemented RO's position as the most cost-effective solution for both seawater and brackish water treatment globally, driving widespread adoption across diverse geographical and climatic zones.

Thermal desalination processes, including Multi-Stage Flash (MSF) and Multi-Effect Distillation (MED), remain vital, particularly in the Middle East where they can be effectively co-located with power plants (co-generation) to utilize waste heat, offering high-purity distillate water. While generally more energy-intensive than modern RO, thermal methods are less sensitive to poor feed water quality and are inherently resistant to membrane fouling, making them a robust choice for highly turbid or contaminated seawater sources. The trend, however, is moving towards hybrid systems that combine the thermal efficiency of MED or MSF with the high volumetric output of RO, optimizing overall performance and allowing operators to switch between technologies based on energy cost fluctuations and feed water conditions.

Emerging and specialized technologies are also gaining traction, addressing niche market requirements and advancing sustainability goals. Electrodialysis (ED) and Electrodialysis Reversal (EDR) are increasingly utilized for brackish water treatment and are highly effective for low salinity water, offering lower energy consumption than RO in these specific applications. Furthermore, innovative techniques like Forward Osmosis (FO), which uses osmotic pressure gradients instead of hydraulic pressure, and Membrane Distillation (MD), which leverages temperature differences, are being intensively researched and piloted for challenging applications such as treating highly concentrated industrial streams and achieving Zero Liquid Discharge (ZLD), positioning the market for radical shifts in efficiency and environmental compliance in the long term.

Regional Highlights

Regional dynamics are critical in defining the Desalination Market trajectory, driven by varying levels of water stress, energy costs, and governmental investment priorities. The Middle East and Africa (MEA) region remains the global epicenter, hosting the largest capacity of desalination plants worldwide. Countries like Saudi Arabia, the UAE, and Israel rely on desalination for over 70% of their potable water needs, fueled by substantial sovereign wealth investments and strategic imperatives to ensure water security. The focus here is on mega-projects (giga-scale plants) and the successful integration of thermal and membrane technologies, often utilizing co-generation from large energy complexes. The region continues to pioneer advancements in large-scale brine management and energy efficiency.

Asia Pacific (APAC) represents the fastest-growing market, primarily driven by rapid urbanization and industrial expansion across China, India, and Australia. China’s extensive industrial sector requires vast amounts of high-purity water, boosting demand for industrial-grade RO and advanced wastewater reuse solutions. Australia, prone to severe drought cycles, invests heavily in large coastal desalination plants as critical droughtproofing infrastructure. This region is characterized by diverse feed water types—from seawater to highly contaminated inland brackish water—necessitating a broad technological portfolio and rapid deployment of modular, decentralized systems to meet diverse localized demands efficiently.

North America and Europe, while possessing advanced water infrastructure, show substantial growth in specific high-value segments. North America focuses significantly on industrial wastewater treatment, including hydraulic fracturing flowback water and municipal wastewater reuse, driving demand for high-recovery membrane systems and ZLD solutions. European markets, particularly Spain, Italy, and the Mediterranean coast, utilize desalination to augment tourism-driven municipal supplies and agricultural needs. The European growth is highly influenced by stringent environmental regulations, encouraging the adoption of energy-efficient solutions powered by renewable energy and robust standards for minimal brine discharge impact, focusing on environmental sustainability alongside performance.

- Middle East & Africa (MEA): Dominant market share; driven by critical water scarcity and massive government-backed infrastructure projects (Saudi Arabia, UAE); high adoption of hybrid thermal/RO technologies.

- Asia Pacific (APAC): Highest CAGR; propelled by rapid industrialization (China, India) and municipal demand; increasing focus on brackish water and wastewater reuse for inland development.

- North America: Focus on industrial process water, wastewater reuse, and addressing localized droughts (California, Texas); strong emphasis on advanced filtration and ZLD technologies.

- Europe: Growth driven by tourism, agriculture (Mediterranean), and strict environmental compliance; pioneering integration of renewable energy sources and advanced brine management techniques.

- Latin America: Emerging market driven by mining operations (Chile, Peru) requiring large volumes of process water and addressing urban water deficits in coastal capitals; increasing reliance on containerized and modular RO units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Desalination Market.- Suez

- Veolia

- IDE Technologies

- Xylem

- Doosan Heavy Industries & Construction

- Aquatech International

- Toray Industries

- Alfa Laval

- Pentair

- DuPont Water Solutions

- Acciona

- Fluence Corporation

- MHI (Mitsubishi Heavy Industries)

- General Electric (GE)

- Saudi Basic Industries Corporation (SABIC)

- Abengoa

- Osmoflo

- Consolidated Contractors Company (CCC)

- Hyflux Ltd (Restructured)

- Koch Separation Solutions (KSS)

Frequently Asked Questions

Analyze common user questions about the Desalination market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Desalination Market?

The primary driver is the accelerating global water scarcity, exacerbated by climate change and population growth, which necessitates reliable, non-conventional water sources. Simultaneously, technological advancements, particularly in Reverse Osmosis (RO) membranes and Energy Recovery Devices (ERDs), have significantly lowered the energy consumption and Levelized Cost of Water (LCOW), making desalination economically viable for municipal and industrial applications worldwide.

Which desalination technology currently dominates the market share?

Reverse Osmosis (RO) technology dominates the Desalination Market due to its superior energy efficiency, scalability, and suitability for treating both seawater and brackish water. Its market leadership is further reinforced by continuous innovation in membrane chemistry, leading to higher water rejection rates and resistance to fouling compared to traditional thermal distillation methods like MSF or MED.

What are the main environmental challenges associated with desalination plants?

The main environmental challenge is the disposal of highly concentrated brine effluent. Discharge must be carefully managed to prevent negative impacts on marine ecosystems near coastal outfalls. Modern plants mitigate this through advanced dispersal systems, or increasingly, through specialized technologies aimed at minimizing brine volume (brine reduction) or achieving Zero Liquid Discharge (ZLD) by extracting valuable minerals.

How is Artificial Intelligence (AI) influencing the operational costs of desalination?

AI influences operational costs by enabling predictive maintenance, reducing costly unexpected downtime, and optimizing energy consumption. Machine learning algorithms analyze real-time data to adjust pump pressures and chemical dosing dynamically, ensuring the plant operates at peak efficiency, which is critical since energy accounts for 40-60% of the operational expenditure (OPEX) in RO plants.

Which geographical region exhibits the highest market potential for future desalination projects?

While the Middle East holds the largest installed capacity, the Asia Pacific (APAC) region is projected to exhibit the highest market potential and fastest growth rate (CAGR). This expansion is fueled by massive industrial demand in China and India, widespread urbanization, and the necessity to treat highly complex brackish and contaminated wastewater sources, requiring diverse technological deployments and significant capital investment.

What is the difference between thermal and membrane desalination processes?

Thermal processes (like MSF and MED) use heat to evaporate water and then condense the vapor, leaving salts behind, often requiring high temperatures and large amounts of energy, making them suitable for coupling with power plants. Membrane processes (like RO) use pressure to force water through semi-permeable membranes, separating the dissolved salts. Membrane processes generally require less energy and are more modular, dominating new global installations.

How critical are Energy Recovery Devices (ERDs) to the desalination market?

ERDs are absolutely critical, especially in Reverse Osmosis (RO) plants. They capture the hydraulic energy remaining in the high-pressure brine stream and transfer it back to the feed water, significantly reducing the required input energy. High-efficiency ERDs, which can recover up to 98% of the wasted energy, are fundamental to achieving low Levelized Cost of Water (LCOW) and maintaining the economic competitiveness of modern desalination projects.

What role do Public-Private Partnerships (PPPs) play in financing desalination projects?

PPPs play a crucial role, particularly in large municipal and regional projects. They enable governments to leverage private sector capital, technical expertise, and operational efficiency, thereby accelerating project development and reducing public financial risk. Models such as Build-Own-Operate-Transfer (BOOT) or Build-Own-Operate (BOO) are common, transferring construction and operational responsibilities to experienced private consortiums for long durations.

What are the technological challenges associated with treating brackish water versus seawater?

Brackish water generally requires less energy input for RO due to lower salinity compared to seawater. However, inland brackish sources often present greater challenges related to chemical scaling, biological fouling, and the presence of complex organic contaminants. This necessitates robust, specialized pretreatment systems and sometimes the use of Electrodialysis (ED) instead of RO, tailored specifically to the lower salt concentration and unique contaminant profile.

How does the demand from the industrial sector differ from municipal demand in the desalination market?

Municipal demand is high-volume and focuses on potable water quality and long-term supply reliability. Industrial demand, conversely, often requires smaller volumes but significantly higher purity (ultra-pure water) for critical processes like boiler feed or semiconductor manufacturing. Industrial customers prioritize modularity, precise water quality control, and seamless integration with existing processing systems, often driving demand for advanced post-treatment technologies and water reuse solutions.

What innovations are addressing the issue of brine minimization?

Innovations addressing brine minimization include high-recovery RO systems, specialized membrane technologies, and advanced thermal processes like mechanical vapor compression (MVC) and crystallization. These technologies concentrate the reject brine further, reducing the volume requiring disposal and sometimes facilitating the economic extraction of high-value salts and minerals, moving closer toward a Zero Liquid Discharge (ZLD) operational model.

Why is the integration of renewable energy important for the future of the desalination market?

Integrating renewable energy (solar photovoltaic and wind) is crucial because it directly addresses the market's biggest restraint: high energy consumption and reliance on fossil fuels. Renewable-powered desalination plants significantly reduce the carbon footprint, stabilize long-term operating costs against volatile fuel prices, and align water infrastructure projects with global sustainability and climate change mitigation goals, unlocking new market opportunities in remote locations.

What is the role of digitalization in optimizing desalination plant performance?

Digitalization involves implementing IoT sensors, cloud computing, and advanced analytics to monitor plant health, optimize processes, and manage the supply chain. This real-time visibility enables remote control, facilitates rapid troubleshooting, and allows for data-driven decisions regarding maintenance schedules and energy input, ensuring consistent performance and regulatory compliance with minimal human intervention.

How do global regulatory standards influence the adoption of desalination technologies?

Global regulatory standards, particularly concerning drinking water quality (e.g., WHO guidelines) and environmental discharge limits (e.g., EU directives on wastewater), force technology providers to continuously innovate. Stringent standards drive the demand for technologies that guarantee high-purity output and environmentally safe brine management practices, favoring advanced membrane and pretreatment systems that can consistently meet compliance requirements under varying conditions.

What opportunities exist in the market for small, modular desalination units?

Small, modular units cater to decentralized applications, including remote industrial camps, small coastal communities, and emergency response settings. These units offer rapid deployment, flexibility, and lower initial capital outlay compared to mega-plants. They are particularly attractive for mining, oil & gas operations, and disaster relief, where the water source changes frequently and mobility is required.

Which sector uses the highest volume of desalinated water globally?

The municipal sector, supplying potable water to residential areas and urban centers, uses the highest volume of desalinated water globally. This is driven by massive consumption needs in arid coastal metropolitan areas, predominantly across the Middle East, North Africa, and increasingly in parts of Asia and North America experiencing persistent drought conditions and population surges.

What technological breakthroughs are expected to reshape the desalination market in the next decade?

Key technological breakthroughs expected include the commercialization of highly selective 2D material membranes (like graphene or carbon nanotubes) offering ultra-high flux and efficiency, significant advancements in Forward Osmosis (FO) for low-energy separation, and widespread deployment of solar-thermal desalination systems capable of achieving ZLD in conjunction with low-temperature distillation techniques.

Why is pretreatment a critical stage in the desalination process?

Pretreatment is critical because it removes suspended solids, microorganisms, and larger organic matter from the feed water before it reaches the core separation membranes or thermal units. Effective pretreatment prevents fouling, scaling, and degradation of expensive membranes, thereby ensuring stable plant operation, maximizing water recovery rates, and extending the operational lifespan of the entire system, ultimately minimizing LCOW.

How does the desalination market respond to volatile energy prices?

The market responds to volatile energy prices by intensifying R&D efforts on energy efficiency, primarily adopting more efficient Energy Recovery Devices (ERDs) and favoring Reverse Osmosis (RO) over thermal methods where feasible. Furthermore, projects increasingly incorporate captive renewable energy sources or utilize hybrid power purchase agreements to hedge against price volatility and secure long-term operational sustainability.

What defines a 'hybrid' desalination plant?

A hybrid desalination plant combines two or more distinct desalination processes, typically coupling a membrane process (RO) with a thermal process (MSF or MED). This setup allows operators to utilize waste heat from a co-located power plant for the thermal component while leveraging the high throughput and energy efficiency of the RO component, offering operational flexibility, resilience against feed water changes, and enhanced overall output reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Desalination Plants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Water Desalination and Purification Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Water Desalination Equipment Market Size Report By Type (Reverse Osmosis, Multi-Stage Flash (MSF) Distillation, Multi-Effect Distillation (MED), Others), By Application (Municipal, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Vertical Axis Wind Turbine Market Size Report By Type (Darrieus, Savonius), By Application (Residential, Commercial and Industrial, Fishery and Recreational Boats, Hybrid Systems, Pastures, Farms and Remote Villages, Potable Systems for Leisure, Pumping, Desalination and Purification, Remote Monitoring, Research and Education), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Water Desalination Equipment Market Size Report By Type (Portable Emergency Seawater Desalination Watermakers, Marine Fresh Seawater Desalination Watermakers, Land-based Seawater Desalination Plants, Offshore Seawater Desalination Watermakers (Oil & Gas), NATO Cerified Military SWRO Seawater Desalination Watermakers), By Application (Drinking water, Agricultural water, Industrial water, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager