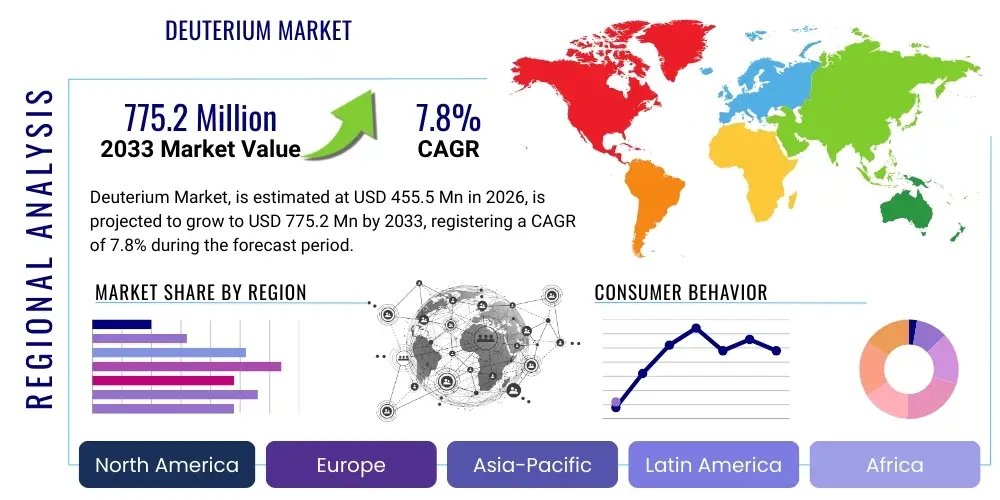

Deuterium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435978 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Deuterium Market Size

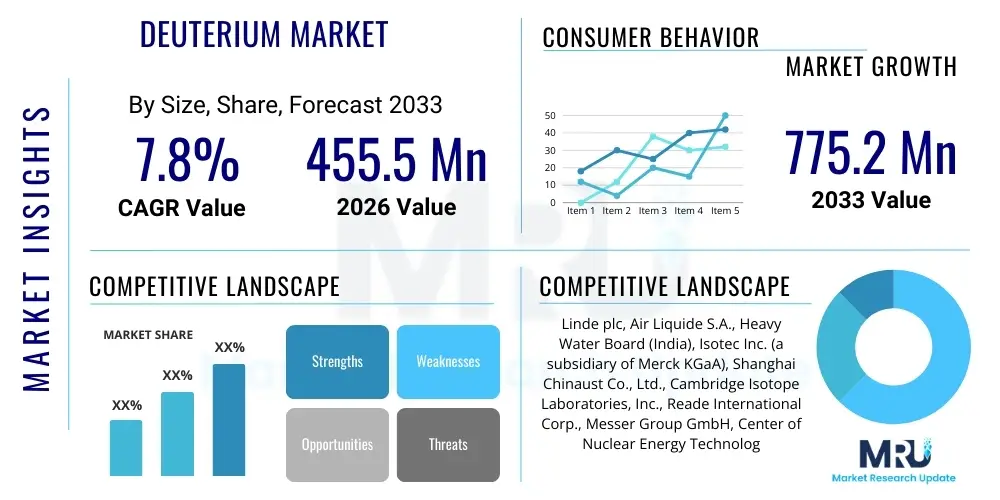

The Deuterium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 455.5 Million in 2026 and is projected to reach USD 775.2 Million by the end of the forecast period in 2033. This significant expansion is primarily driven by the escalating global demand for stable isotopes across critical sectors, including pharmaceuticals, high-tech electronics, and, most notably, the accelerating research and development initiatives in nuclear fusion energy. Deuterium’s role as a crucial component in heavy water moderators and coolants within pressurized heavy-water reactors (PHWRs) further solidifies its foundational market demand, while emerging medical imaging and analytical chemistry applications provide substantial avenues for future high-value market penetration. The increasing purity requirements across these varied end-use industries necessitate continuous investment in advanced separation and purification technologies, influencing the overall market valuation trajectory.

Deuterium Market introduction

The Deuterium Market revolves around the production, distribution, and application of the stable isotope of hydrogen, Deuterium (²H or D), which contains one proton and one neutron, doubling the atomic mass of standard hydrogen (¹H). Commonly utilized in the form of deuterium oxide (heavy water, D₂O) or deuterated compounds, this product is essential across several high-technology and scientific domains due to its distinctive nuclear and chemical properties, such as a slower reaction rate compared to protium, which is highly advantageous in kinetic studies and pharmaceutical development. Major applications span nuclear energy production, where heavy water is indispensable for neutron moderation in certain reactor designs; advanced research, including neutron scattering and magnetic resonance imaging (MRI); and the rapidly expanding field of deuterated drug development, where substituting hydrogen with deuterium can significantly improve drug metabolism, efficacy, and half-life by strengthening the corresponding carbon-deuterium bond.

The principal driving factors propelling this market include the global resurgence in nuclear power plant development, particularly PHWRs, which rely heavily on bulk supplies of D₂O for safe and efficient operation. Simultaneously, the pharmaceutical industry is increasingly embracing deuteration as a mechanism for life cycle management and enhancement of novel therapeutics, driving demand for high-purity, small-volume deuterated compounds. Furthermore, the immense global investment directed towards achieving commercially viable controlled nuclear fusion—specifically D-T (Deuterium-Tritium) fuel cycles—is anticipated to become a monumental long-term demand catalyst. The inherent benefits of using deuterium, such as increased stability in chemical reactions, better visibility in analytical techniques, and optimized neutron moderation capabilities, underscore its critical economic and scientific value, supporting sustained market growth.

Deuterium Market Executive Summary

The Deuterium Market is characterized by robust growth, primarily fueled by specialized applications in high-stakes industries, leading to an oligopolistic competitive landscape dominated by a few major industrial gas producers and governmental entities specializing in heavy water production. Current business trends indicate a definitive shift towards higher purity deuterium products, driven by the exacting specifications of the semiconductor and advanced display industries, alongside the rapidly maturing deuterated pharmaceuticals segment. Strategic partnerships and long-term supply agreements between producers and major end-users, especially nuclear operators and large pharmaceutical R&D firms, are key competitive strategies, focusing on ensuring supply chain stability and quality control. Technological advancements in isotopic separation methods, such as cryogenic distillation and laser separation techniques, are vital for reducing production costs and increasing purity levels, directly impacting market profitability.

Regionally, the market exhibits segmentation characterized by specific demand drivers. The Asia Pacific (APAC) region currently holds a dominant position and is projected to demonstrate the fastest growth rate, propelled by aggressive expansion in nuclear energy infrastructure, particularly in India and China, and burgeoning pharmaceutical and high-tech manufacturing bases. North America and Europe maintain significant market shares, heavily supported by substantial governmental funding for nuclear fusion research (e.g., ITER participation) and sophisticated, high-value demand from the established pharmaceutical and biotechnology sectors, which consume high-purity deuterated solvents and compounds. The Middle East and Africa (MEA) and Latin America represent nascent markets, with growth primarily tied to new nuclear power programs and growing research capabilities in academic institutions, requiring foundational supplies of D₂O and other deuterated materials.

Segment trends highlight the application segment dominance of Nuclear Power, largely due to the sheer volume of heavy water required for moderator and coolant functions in operating reactors. However, the Pharmaceutical and Life Sciences segment, though lower in volume, commands significantly higher pricing due to the complexity and purity requirements of deuterated drug substances, positioning it as the most lucrative segment in terms of revenue growth and profitability margin. The Purity segment analysis shows a clear upward trend in demand for 99.99% and above purity levels, reflecting the stringent quality standards mandated by specialized applications like optical fibers, microelectronics manufacturing, and advanced research instrumentation, signaling a premium market shift away from lower-grade industrial heavy water.

AI Impact Analysis on Deuterium Market

Analysis of common user questions regarding the influence of Artificial Intelligence on the Deuterium Market reveals key concerns centered on optimizing the extremely energy-intensive and complex isotopic separation processes, improving the efficiency of quality assurance in high-purity compounds, and accelerating the discovery phase for new deuterated drugs. Users frequently inquire about AI's potential to model complex cryogenic distillation columns, predicting optimal operating parameters in real-time to maximize yield and minimize energy consumption—a significant cost factor in deuterium production. Furthermore, there is substantial interest in how machine learning algorithms can rapidly screen potential deuterated drug candidates for metabolic stability and toxicity, streamlining R&D efforts and reducing time-to-market for high-value pharmaceutical products. The expectation is that AI will primarily serve as an optimization and discovery tool, enhancing operational efficiency for producers and accelerating innovation for end-users, rather than directly disrupting the underlying production technology.

AI’s influence is projected to significantly refine the operational backbone of deuterium production and application. In production, AI-driven process control systems can analyze vast amounts of sensor data from heavy water plants, identifying subtle deviations that affect separation efficiency, thereby ensuring consistent quality and minimizing waste. This predictive maintenance capability ensures maximal uptime for critical, specialized equipment. In application, particularly in controlled fusion research, AI models are essential for interpreting complex plasma physics data generated in tokomaks and stellarators, guiding engineers in achieving sustained fusion reactions involving deuterium and tritium fuels. This analytic capability dramatically reduces the experimental cycle time, accelerating the path toward commercial fusion energy, which represents the most substantial long-term market driver for bulk deuterium.

- AI-Enhanced Process Optimization: Utilization of predictive modeling and machine learning algorithms to optimize isotopic separation processes (e.g., cryogenic distillation, Girdler sulfide process), leading to improved yield, reduced energy costs, and enhanced production scalability.

- Accelerated Drug Discovery: Application of AI in cheminformatics and computational chemistry to rapidly identify and synthesize novel deuterated drug candidates with optimized pharmacokinetics, significantly cutting down R&D timelines in the pharmaceutical sector.

- Quality Control Automation: Deployment of computer vision and machine learning for automated inspection and quality assurance of high-purity deuterated solvents and specialized compounds used in sensitive electronic and optical applications.

- Fusion Reaction Modeling: Use of complex AI simulations to analyze plasma dynamics in fusion devices, optimizing confinement and heating techniques necessary for sustainable D-T fusion, thereby speeding up the deployment of commercial fusion reactors.

- Supply Chain Risk Mitigation: AI-driven predictive analytics to monitor global geopolitical stability and logistical bottlenecks, helping producers and consumers manage the supply chain volatility inherent in a globally consolidated market.

DRO & Impact Forces Of Deuterium Market

The Deuterium Market is shaped by powerful forces emanating from critical advancements in energy and healthcare sectors, balanced against inherent operational constraints and geopolitical risks. Drivers (D) are fundamentally rooted in the global shift towards carbon-free energy, exemplified by the increased deployment of Pressurized Heavy Water Reactors (PHWRs) and the massive international investment in nuclear fusion research (e.g., ITER, private fusion ventures), both requiring significant and sustained supplies of deuterium fuel and moderator. Furthermore, the rapid expansion of the deuterated pharmaceuticals pipeline, targeting indications ranging from oncology to neuroscience, provides a high-margin, consistent demand stream. These drivers establish a clear path for volumetric and value growth across the forecast period, underpinned by deuterium's unparalleled properties as a stable isotope.

Conversely, Restraints (R) present significant hurdles to market expansion and efficiency. The most pressing restraint is the extremely high capital expenditure and energy intensity associated with large-scale isotopic separation technologies, making market entry prohibitive and maintaining high operational costs for incumbents. Furthermore, the supply chain is highly consolidated, with production capacity often concentrated in state-controlled facilities in regions like India, Canada, and specific countries in Eastern Europe, leading to potential geopolitical vulnerabilities and restricted supply access. Regulatory complexities surrounding the handling, transport, and inventory of heavy water, often designated as a nuclear material, add layers of operational friction and cost, particularly affecting smaller end-users and research institutions.

Opportunities (O) are substantial and technology-driven, centered on revolutionary shifts in energy technology and manufacturing. The successful commercialization of nuclear fusion reactors represents the single largest long-term opportunity, potentially creating multi-billion dollar demand for bulk deuterium. Additionally, technological breakthroughs in non-traditional separation methods, such as advanced laser isotope separation (LIS) or improved chemical exchange processes, promise to drastically reduce production costs and diversify the supply base. The escalating adoption of high-purity deuterated solvents and precursor materials in the booming semiconductor and advanced materials sector—particularly for next-generation displays and optical devices—provides a high-growth niche market segment. Impact Forces, such as stringent environmental regulations favoring clean energy sources and continuous innovation in drug development, strongly influence both the demand for D₂O in nuclear applications and the profitability of the pharmaceutical segment, ensuring the market remains tightly coupled to major global scientific and energy policy initiatives.

Segmentation Analysis

The Deuterium Market segmentation provides a granular view of demand dynamics, separating the complex market based on Product Type (Purity), Application, and End-Use Industry. This structure allows for the analysis of varying price points, regulatory requirements, and competitive landscapes across different segments. The Purity segment is crucial as it determines the potential application, with ultra-high purity (>99.99%) material commanding significant price premiums necessary for sensitive scientific instruments and semiconductor fabrication, while standard reactor-grade heavy water (typically 99.75% to 99.95%) serves the bulk nuclear requirement. The Application and End-Use segments clearly delineate the primary revenue streams: high-volume, low-margin demand from the energy sector versus low-volume, high-margin revenue from the life sciences and research domains. Understanding these distinct segments is paramount for strategic planning related to production capacity allocation and sales channel development.

- By Product Type (Purity):

- Reactor Grade Heavy Water (99.75% - 99.95%)

- High Purity Deuterated Compounds (99.96% - 99.99%)

- Ultra-High Purity Deuterium Gas & Solvents (>99.99%)

- By Application:

- Nuclear Energy (Moderator and Coolant)

- Research & Development (Neutron Scattering, NMR, Analytical Chemistry)

- Pharmaceuticals & Life Sciences (Deuterated Drugs, Solvents)

- Optoelectronics & Semiconductors (Fiber Optics, Advanced Displays)

- Chemical and Industrial Processes

- By End-Use Industry:

- Energy Sector

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Electronics & Semiconductor Manufacturing

- Industrial Chemical Producers

Value Chain Analysis For Deuterium Market

The Deuterium Market value chain initiates with the Upstream Analysis, which involves the extraction of the natural isotope from source materials, primarily natural water, which contains approximately 150 parts per million (ppm) of deuterium. This stage is dominated by specialized, vertically integrated chemical and industrial gas companies, or large governmental nuclear enterprises, due to the requirement for highly complex and energy-intensive isotopic separation processes, predominantly the Girdler sulfide process or cryogenic distillation. The upstream cost structure is heavily weighted towards energy consumption and the massive capital investment in plant infrastructure. Control over proprietary separation technology is a critical success factor at this initial stage, creating significant barriers to entry for new competitors.

The middle segment of the value chain involves purification, storage, and specialized packaging, often requiring cryogenic handling for gaseous deuterium or stringent quality control for reactor-grade heavy water. The Distribution Channel for deuterium is bifurcated: bulk heavy water (D₂O) is typically supplied directly via long-term contracts (Direct sales) to governmental nuclear agencies or major energy utilities, requiring specialized transport protocols due to its regulatory status. Conversely, high-purity deuterated compounds and small-volume specialty chemicals required for pharmaceutical R&D, electronics, and analytical research are often distributed through specialized industrial gas distributors, chemical suppliers, and catalog houses (Indirect sales), which handle global logistics, purity certification, and just-in-time delivery to maintain product integrity and specialized packaging needs.

The Downstream Analysis centers on the end-use consumption, where value is generated by integrating deuterium into final products, such as next-generation drugs, efficient nuclear reactors, or highly sensitive analytical equipment. This stage is characterized by high demand elasticity based on technological breakthroughs, such as new drug approvals or governmental approval for new nuclear facilities. The profitability margins are maximized when ultra-high purity materials are synthesized into high-value downstream products, notably in the pharmaceutical sector. Effective supply chain management is crucial across the entire chain to mitigate the risks associated with the limited number of global production sites and the long lead times required for large-volume orders of heavy water.

Deuterium Market Potential Customers

The potential customers for deuterium products are highly specialized entities operating in regulated and high-technology domains, seeking stable, precise isotopic materials critical to their operational efficacy and product performance. The primary cohort consists of major state-owned and private Energy Sector operators who utilize heavy water as a moderator and coolant in their Pressurized Heavy Water Reactors (PHWRs). These entities require vast, recurring quantities of high-quality reactor-grade D₂O, often procured via governmental tenders or secured long-term national contracts to ensure strategic stockpiles.

A second crucial customer base lies within the Pharmaceutical & Biotechnology Companies, particularly those engaged in advanced drug discovery and development. These customers require milligram to kilogram quantities of ultra-high purity deuterated solvents for Nuclear Magnetic Resonance (NMR) spectroscopy and, critically, specific deuterated drug substances designed to optimize metabolic stability and enhance therapeutic profiles. These transactions are high-value, driven by stringent regulatory standards and the intellectual property associated with novel drug candidates. The third significant group includes Academic and Industrial Research Institutions, notably those involved in neutron scattering, plasma physics (fusion research), and materials science, who utilize deuterium gas and deuterated materials for highly specialized experimental setups requiring precise isotopic control and minimal contamination.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 455.5 Million |

| Market Forecast in 2033 | USD 775.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde plc, Air Liquide S.A., Heavy Water Board (India), Isotec Inc. (a subsidiary of Merck KGaA), Shanghai Chinaust Co., Ltd., Cambridge Isotope Laboratories, Inc., Reade International Corp., Messer Group GmbH, Center of Nuclear Energy Technology (CNET), CJSC “Mendeleev Plant”, Urenco Limited, Taiyo Nippon Sanso Corporation, Norsk Hydro, Atomic Energy of Canada Limited, ARC Specialties, LLC, Praxair Technology, Inc., Solvay S.A., Spectrum Chemical Mfg. Corp., TCI Chemicals (India) Pvt. Ltd., S.J. Smith Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Deuterium Market Key Technology Landscape

The production of deuterium relies on highly sophisticated isotopic separation techniques designed to isolate the heavier isotope from natural hydrogen sources. The prevailing commercial technology for large-scale heavy water production remains the Girdler Sulfide Process (GSP), which utilizes a chemical exchange reaction between hydrogen sulfide (H₂S) gas and water. While effective for bulk, reactor-grade production, the GSP requires massive infrastructure, operates at high temperatures and pressures, and utilizes highly corrosive and toxic materials, demanding stringent safety protocols and immense energy inputs. Ongoing research focuses on improving the thermal efficiency and yield of GSP to minimize operational costs, particularly important as energy prices fluctuate globally.

Alternative and emerging technologies are rapidly gaining relevance, particularly for the production of ultra-high purity deuterium required by the pharmaceutical and electronics sectors. Cryogenic Distillation is a leading alternative, especially for the separation of deuterium from protium in liquid hydrogen. This method offers significantly higher purity levels but requires extremely low operating temperatures (near absolute zero), resulting in very high capital costs for specialized cryogenic equipment. Furthermore, Advanced Laser Isotope Separation (LIS) techniques, although still nascent in commercial deployment for deuterium, represent a transformative opportunity. LIS promises lower energy consumption and smaller physical footprints compared to traditional methods, potentially lowering barriers to entry and enabling decentralized, modular production tailored for high-purity niche applications.

The pharmaceutical industry relies heavily on efficient chemical synthesis techniques to incorporate deuterium into target molecules, a process known as deuteration. This involves developing precise catalytic reactions that selectively replace hydrogen atoms with deuterium without altering the core structure of the drug candidate. Research in heterogeneous and homogeneous catalysis, coupled with process analytical technologies (PAT), is crucial for achieving the required isotopic enrichment and reducing the overall synthesis time and cost of deuterated drugs. The continuous push for process intensification and green chemistry methodologies across the production and application segments of the deuterium market dictates the technological landscape, prioritizing energy efficiency, purity yield, and safety compliance across all production scales.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of nuclear power expansion, particularly driven by India and China's commitment to energy security through PHWR technology, making it the largest consumer of reactor-grade heavy water. This region also serves as a major hub for high-tech electronics manufacturing (South Korea, Japan, Taiwan), driving specialized demand for high-purity deuterated materials in optical fibers and semiconductor lithography. India’s Heavy Water Board (HWB) is a major global producer, influencing international supply dynamics, while the region’s increasing investment in pharmaceutical R&D further diversifies its demand profile, positioning APAC as the fastest-growing market.

- North America: North America represents a mature, high-value market driven primarily by the biotechnology and research sectors. The U.S. remains a global leader in deuterated drug development and consumption of high-purity deuterated solvents for NMR and analytical testing. Crucially, the substantial governmental and private investment in advanced nuclear research, specifically in Controlled Fusion Energy (e.g., projects related to the National Ignition Facility and private fusion startups), establishes a high-potential future demand base for bulk deuterium gas and plasma fuels.

- Europe: Europe maintains a significant market share, bolstered by major international scientific collaborations, particularly its substantial involvement in the International Thermonuclear Experimental Reactor (ITER) project in France, which requires large, sustained supplies of deuterium. Furthermore, established pharmaceutical clusters in Germany, Switzerland, and the UK ensure continuous demand for high-purity deuterated compounds and solvents. Strict regulatory environments here mandate the highest quality standards, pushing technology providers to focus on advanced purification and certification processes.

- Latin America (LATAM): The LATAM market is currently smaller but exhibits steady growth, primarily concentrated in countries with existing or planned nuclear power programs, such as Argentina (operating CANDU reactors) and Brazil. Demand is largely focused on necessary D₂O replenishment and maintenance supplies for existing nuclear infrastructure, supplemented by growing academic research requirements for analytical chemistry applications.

- Middle East and Africa (MEA): MEA is a nascent market, with demand highly centralized around emerging nuclear energy aspirations, such as the UAE’s nuclear program, which might eventually require heavy water supplies, depending on reactor choice. Research demand remains moderate, tied mainly to specialized university research centers requiring imported deuterated solvents and reference materials for academic study.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Deuterium Market.- Linde plc

- Air Liquide S.A.

- Heavy Water Board (India)

- Isotec Inc. (a subsidiary of Merck KGaA)

- Shanghai Chinaust Co., Ltd.

- Cambridge Isotope Laboratories, Inc.

- Reade International Corp.

- Messer Group GmbH

- Center of Nuclear Energy Technology (CNET)

- CJSC “Mendeleev Plant”

- Urenco Limited

- Taiyo Nippon Sanso Corporation

- Norsk Hydro

- Atomic Energy of Canada Limited (AECL)

- ARC Specialties, LLC

- Praxair Technology, Inc.

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- TCI Chemicals (India) Pvt. Ltd.

- S.J. Smith Co.

Frequently Asked Questions

Analyze common user questions about the Deuterium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the bulk demand for Deuterium?

The primary application driving bulk demand is nuclear energy, specifically the use of deuterium oxide (heavy water, D₂O) as a neutron moderator and coolant in Pressurized Heavy Water Reactors (PHWRs), which require thousands of tons for initial fill and subsequent replenishment.

How do deuterated drugs offer advantages over conventional pharmaceuticals?

Deuterated drugs replace hydrogen atoms with deuterium at metabolically sensitive sites. This substitution strengthens the carbon-deuterium bond, slowing the rate of metabolic breakdown, thereby extending the drug’s half-life, improving bioavailability, and potentially reducing dosing frequency.

What major technological challenge affects deuterium production costs?

The major challenge is the extremely high capital expenditure (CAPEX) and operating expenditure (OPEX) associated with isotopic separation technologies, such as the Girdler sulfide process or cryogenic distillation, which are inherently energy-intensive due to the small difference in mass between protium and deuterium.

Which geographical region leads the global Deuterium Market in terms of growth?

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven primarily by significant expansion in nuclear power infrastructure, particularly in countries like China and India, and increasing demand from the sophisticated semiconductor and pharmaceutical manufacturing sectors.

What impact does nuclear fusion research have on the Deuterium Market?

Nuclear fusion research, such as the ITER project, creates a massive, long-term opportunity for deuterium demand. Deuterium is one half of the crucial D-T fuel cycle, and successful commercialization of fusion technology would necessitate consistent, large-scale supply of high-purity deuterium gas as a primary fuel source.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Deuterium Depleted Water (DDW) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Deuterium Oxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Deuterium Lamps Market Statistics 2025 Analysis By Application (HPLC, UV-VIS Sepctrophotometers, CE (Capilary Electrophoresis)), By Type (UV Glass, Synthetic Silica), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- UV Power Meter Market Statistics 2025 Analysis By Application (Black Light, UV LED, Ultraviolet Rays (UV-A), Mercury-Xenon Lamp, High Pressure Mercury-Xenon Lamp, Deuterium Lamp), By Type (UV Optical Power Meter, UV Laser Power Meter), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager