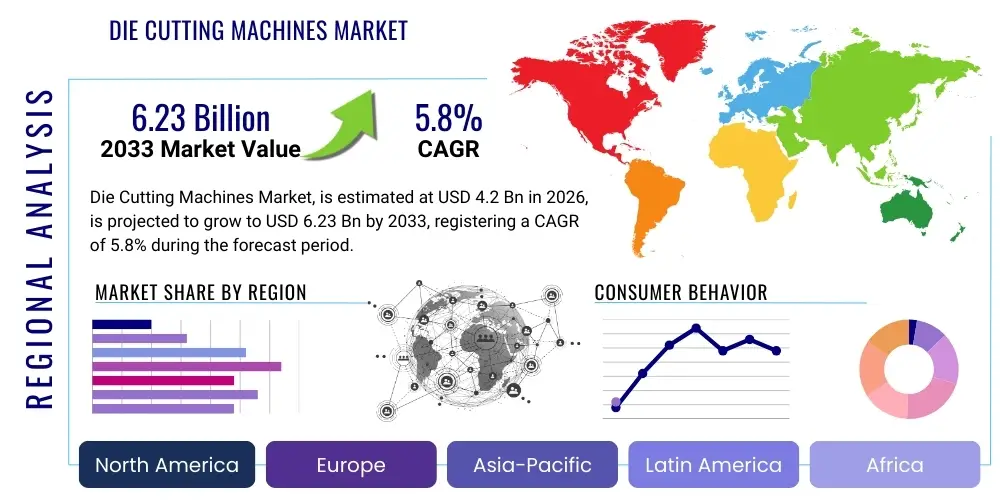

Die Cutting Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437291 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Die Cutting Machines Market Size

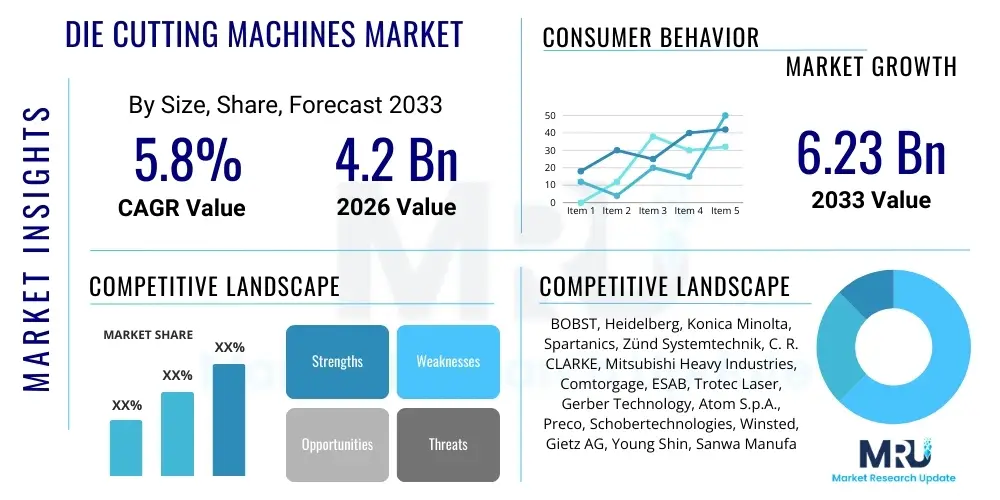

The Die Cutting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $6.23 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the surging demand for high-volume, customized packaging solutions across various end-use industries, including food and beverage, pharmaceuticals, and consumer electronics. The increasing globalization of supply chains necessitates faster, more accurate production methods for components and packaging materials, positioning advanced die cutting technologies as crucial enablers of modern manufacturing efficiency.

The transition from traditional mechanical processes to automated and digitally controlled die cutting systems, such as rotary and laser cutters, significantly contributes to market expansion. These advanced machines offer superior precision, reduced material waste, and the flexibility to handle complex geometries and diverse substrates, including corrugated board, plastics, and advanced composites. Furthermore, the growing trend toward personalization and short-run production, particularly in the e-commerce sector, mandates the adoption of quick-changeover and highly versatile die cutting equipment, thereby boosting investment in modern machinery that supports lean manufacturing principles and just-in-time production schedules.

Regional economic development, particularly in Asia Pacific (APAC), which serves as a global manufacturing hub, plays a pivotal role in shaping the market landscape. High levels of capital expenditure in setting up new production facilities equipped with state-of-the-art automation systems are observed across emerging economies. This sustained investment, coupled with stringent quality control standards in sensitive sectors like medical devices and automotive components, ensures continuous demand for high-quality, reliable die cutting solutions. The emphasis on minimizing operational downtime and maximizing throughput is a core strategic objective driving the procurement decisions for these sophisticated machine tools, underpinning the forecasted market expansion through 2033.

Die Cutting Machines Market introduction

The Die Cutting Machines Market encompasses a range of precision equipment designed to cut specific shapes, creases, and perforations into materials like paper, cardboard, textiles, plastics, foam, and specialized composites. These machines operate by pressing a sharp-edged die onto the material, delivering consistent, high-accuracy results crucial for mass production. Market growth is inherently linked to the dynamism of the packaging, automotive, electronics, and textile sectors, all of which rely heavily on precise component fabrication and packaging construction. Modern die cutting technology has evolved significantly, moving beyond basic manual operation to embrace sophisticated automation, integrating computer numerical control (CNC), robotics, and non-contact methods such as laser cutting, which enhance both speed and design complexity capabilities.

Die cutting machines serve critical functions across diverse industrial applications, providing standardized components, intricate seals, gaskets, labels, and consumer product packaging. Key applications range from creating complex multilayer circuits in the electronics industry to shaping insulating materials and interior components in the automotive sector. The primary benefits derived from using these machines include unparalleled accuracy, high repeatability necessary for certified quality management systems, substantial increases in production volume compared to manual methods, and optimized material utilization, leading to cost savings. The versatility of these systems allows manufacturers to swiftly switch between different materials and product designs, providing essential adaptability in fast-paced manufacturing environments where product lifecycles are often short and demand fluctuations are common.

Driving factors for this market include the global expansion of the e-commerce sector, which necessitates specialized, protective, and visually appealing packaging, often requiring intricate die-cut designs. Furthermore, stringent regulatory requirements in sectors like pharmaceuticals and food packaging demand precise labeling and tamper-evident designs achievable only through advanced die cutting. Technological advancements in areas such as digital printing and finishing workflows are compelling manufacturers to adopt integrated die cutting solutions that seamlessly connect design, print, and finishing stages. The need for efficiency and reduction in lead times, coupled with the increasing use of sustainable and recyclable packaging materials that require careful handling and precise cutting, collectively accelerates the adoption of modern, high-performance die cutting equipment across the globe.

Die Cutting Machines Market Executive Summary

The Die Cutting Machines Market is experiencing a robust period of expansion, fundamentally shaped by three critical forces: increasing automation, digitalization of workflows, and a strong push toward sustainable manufacturing practices. Business trends indicate a definitive shift toward fully automatic and semi-automatic rotary die cutting systems, valued for their high speed and suitability for continuous production lines, particularly within high-volume packaging and label manufacturing. Key stakeholders are focusing on integrating smart technologies, such as IoT sensors and cloud-based monitoring systems, into their machinery to facilitate predictive maintenance, remote diagnostics, and real-time performance optimization. This move ensures maximized uptime and reduced operational costs, providing a substantial competitive advantage to companies adopting these digital tools. Furthermore, customized manufacturing and the demand for short-run flexibility are fueling the growth of high-precision digital cutting and laser die cutting technologies, which eliminate the need for physical dies, significantly reducing setup time and material wastage.

Regional trends reveal the Asia Pacific (APAC) region as the primary growth engine, largely due to explosive growth in manufacturing output, burgeoning consumer markets, and substantial investments in new industrial infrastructure, especially in China, India, and Southeast Asian nations. North America and Europe, characterized by established industrial bases, demonstrate high demand for premium, high-automation, and specialized die cutting solutions tailored for sophisticated applications in aerospace, medical technology, and electric vehicle component manufacturing. These mature markets prioritize machinery that adheres to stringent environmental and worker safety standards, often driving demand for enclosed and highly efficient digital cutting platforms. The Latin America and Middle East & Africa (LAMEA) regions are also showing increasing market potential, driven by rising local production of consumer goods and the necessary upgrade of existing, outdated manufacturing equipment to meet global quality standards.

Segment trends confirm the dominance of the packaging application segment, which utilizes the vast majority of die cutting machinery output for corrugated, folding carton, and flexible packaging. Within product types, the Automatic Die Cutting Machine segment is projected to maintain the fastest growth rate, reflecting the industry’s overall commitment to minimizing human intervention and maximizing production speed. The Laser Die Cutting technology segment, while currently smaller than traditional mechanical methods, is anticipated to record the highest CAGR, primarily due to its versatility in handling intricate designs and sensitive materials without mechanical stress. These machines are increasingly critical in the electronics and medical device manufacturing industries where micro-precision and non-contact cutting are prerequisites for product integrity. The convergence of these technological, regional, and end-user trends dictates that future market success will depend heavily on vendors’ ability to deliver integrated, sustainable, and highly automated cutting solutions.

AI Impact Analysis on Die Cutting Machines Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming the traditional die cutting process, specifically focusing on predictive maintenance, quality control, and operational efficiency gains. Key themes emerging from these user questions revolve around the feasibility of autonomous operation, the ability of AI to optimize material layout (nesting) to minimize scrap, and whether integrated ML systems can adapt cutting parameters in real-time based on material variations or machine wear. There is significant user interest in leveraging AI for fault detection in the cutting dies themselves, extending the lifespan of expensive tooling. The primary expectation is that AI will move die cutting from a routine mechanical operation to a smart, self-optimizing process, ultimately driving down costs associated with downtime and material waste while ensuring consistent output quality across massive production runs. Users are seeking validated evidence of AI systems providing measurable improvements in throughput and precision compared to conventional automated systems.

The application of AI in die cutting machines addresses major operational bottlenecks. For example, predictive maintenance algorithms analyze vibration data, temperature readings, and cycle times to forecast component failure long before it occurs, drastically reducing unplanned machine stoppages. This capability is paramount in high-volume industries like packaging, where even minor delays can result in significant financial losses. Furthermore, integrating computer vision systems powered by AI allows for instantaneous, highly accurate inspection of every cut piece, detecting microscopic flaws or dimensional inaccuracies that human operators might miss, thereby guaranteeing zero-defect output. AI also contributes substantially to sustainability efforts by using sophisticated optimization algorithms to calculate the most efficient cutting path and arrangement (nesting), minimizing material usage and waste generation, a critical concern for manufacturers facing rising material costs and environmental scrutiny.

Advanced AI models are also being developed to manage job sequencing and machine load balancing across a fleet of die cutting equipment. By analyzing incoming orders, material availability, and machine specifications, AI can dynamically assign jobs to optimize throughput and energy consumption, effectively turning a collection of machines into a cohesive, highly efficient production unit. This level of process optimization, moving beyond simple scheduling to deep, data-driven resource allocation, represents a paradigm shift in how die cutting operations are managed. The successful implementation of AI promises to elevate the entire domain of precision cutting from a purely mechanical process to a high-technology manufacturing discipline focused on maximizing yield and ensuring complete quality assurance, thereby redefining industry standards for speed, accuracy, and reliability in converting various substrates into finished products.

- AI-powered predictive maintenance reduces machine downtime by anticipating component failures.

- Machine Learning algorithms optimize material nesting and layout, significantly minimizing scrap material and waste.

- Integrated computer vision systems enable real-time, automated quality inspection for 100% defect detection.

- AI facilitates autonomous parameter adjustment (speed, pressure, depth) based on material inconsistency or die wear.

- Smart systems enhance job scheduling and load balancing across multiple die cutting units for optimized fleet efficiency.

DRO & Impact Forces Of Die Cutting Machines Market

The Die Cutting Machines Market is primarily driven by the exponential growth of the global packaging industry, fueled by e-commerce expansion and urbanization, which increases the demand for custom cartons, labels, and protective inserts. A crucial driver is the necessity for high-precision manufacturing, especially in automotive electronics, medical device fabrication, and flexible display technologies, sectors where tolerances are minimal and consistency is non-negotiable. Opportunities are substantial in developing advanced laser and digital cutting systems that can seamlessly integrate into digital print workflows, offering faster turnaround times for personalized and short-run jobs, addressing a significant market gap left by traditional tooling-dependent machinery. However, the market faces restraints, chiefly high initial capital investment required for automated and laser systems, making adoption challenging for small and medium-sized enterprises (SMEs), alongside the increasing price volatility of raw materials like steel and specialty alloys used in die manufacturing, which impacts overall production costs and machine pricing stability.

Impact forces on the market are multifaceted, combining economic, technological, and regulatory pressures. Technological advancements force rapid innovation, particularly in the integration of robotics for automated material handling (loading and unloading), which minimizes labor costs and improves safety standards, thereby setting new benchmarks for productivity. Economically, the market is highly sensitive to global manufacturing GDP and trade policies, as die cutting machines are fundamental capital goods. Regulatory forces, particularly those centered on sustainability and environmental protection, push manufacturers towards adopting processes that minimize material waste and energy consumption, favoring digital and automated solutions over older, less efficient mechanical setups. This regulatory pressure is a key factor driving the demand for high-efficiency machinery certified under various international standards for environmental management and energy performance.

Specific drivers include the increasing use of non-metallic materials, such as technical textiles, carbon fiber composites, and specialty films, which require specialized cutting precision often best delivered by advanced rotary or laser systems rather than flatbed methods. Restraints also encompass the need for highly skilled labor to program, operate, and maintain sophisticated CNC and laser die cutting equipment, posing a workforce development challenge in certain regions. The significant opportunity lies in expanding service contracts and aftermarket support, providing value-added services like predictive maintenance, software upgrades, and specialized training, which can stabilize revenue streams for manufacturers beyond initial machine sales. These interwoven forces of accelerating technological sophistication, stringent industry demands for precision, and global economic sensitivity collectively define the dynamic environment in which the die cutting market operates, compelling constant innovation and strategic adaptation from all market participants to maintain relevance and competitive advantage.

Segmentation Analysis

The Die Cutting Machines Market is broadly segmented based on Product Type, Technology, Application, and End-Use Industry, reflecting the diverse operational requirements and technological maturity across different sectors. The primary goal of segmentation analysis is to provide a granular view of market dynamics, identifying specific high-growth areas and tailoring strategic approaches to distinct user needs. Product types differentiate machines based on their level of automation (manual, semi-automatic, automatic), while technology segments highlight the mechanism of operation, distinguishing between traditional mechanical methods (flatbed, rotary) and non-contact methods (laser, digital plotters). This structure helps in understanding where investment capital is flowing—for instance, the heavy investment into automatic rotary systems for high-speed continuous packaging lines versus the targeted adoption of laser systems for intricate, specialized component cutting.

The application segmentation is crucial as it directly links machine type to specific industry output, allowing vendors to align their offerings with prevailing industry trends such as the shift towards sustainable packaging materials that require gentler cutting techniques. End-use industries, including packaging, automotive, electronics, and textiles, exhibit unique buying behaviors; automotive manufacturers prioritize machines capable of handling durable, specialized composites, whereas the electronics sector requires ultra-high precision for flexible circuit boards and insulation materials. Analyzing these segments confirms that the market is moving away from labor-intensive manual systems toward highly integrated, data-driven automated platforms. This transition is not uniform; however, in regions with lower labor costs, semi-automatic flatbed systems still maintain a significant market share for general packaging and display board applications.

Detailed segmentation analysis also reveals a notable trend towards customization and modularity, particularly within the mid-to-high-end technology segments. Manufacturers are increasingly demanding machines that can be easily reconfigured to handle seasonal fluctuations in demand or sudden shifts in material specifications. This preference drives the development of modular die cutting lines where different processes (e.g., cutting, creasing, stripping, blanking) can be integrated or separated as needed. Understanding the nuances within these segments, such as the adoption rates of different automation levels within the packaging sector versus the textile industry, is paramount for forecasting localized demand patterns and allocating research and development resources effectively to maintain a competitive edge and address the sophisticated and evolving needs of a global manufacturing base.

- By Product Type:

- Manual

- Semi-Automatic

- Automatic

- By Technology:

- Flatbed Die Cutting

- Rotary Die Cutting

- Laser Die Cutting

- Digital Plotter/Knife Cutting

- By Application:

- Packaging (Folding Carton, Corrugated Board)

- Labels and Stickers

- Automotive Components (Gaskets, Insulators)

- Electronics (Flexible Circuits, Films)

- Textiles and Apparel

- Others (Medical, Signage)

- By End-Use Industry:

- Industrial Manufacturing

- Commercial Printing and Packaging

- Personal Craft and Hobbies

Value Chain Analysis For Die Cutting Machines Market

The value chain for the Die Cutting Machines Market begins upstream with raw material suppliers and specialized component manufacturers. This phase is critical, involving the sourcing of high-grade steel and specialty alloys for die production, along with precision mechanical components such as motors, gearing systems, and advanced electronic controls (PLCs, sensors, servo drives) necessary for automated machinery. Manufacturers of the die cutting equipment rely heavily on the quality and consistency of these upstream suppliers. A strong, reliable supply chain for precision parts is vital, as machine performance—accuracy, speed, and longevity—is directly determined by the quality of these core components. Disruptions in the global supply of electronic components or specialized metals can significantly impact production lead times and the final cost of die cutting machinery, necessitating robust inventory management and diverse sourcing strategies among major machine builders.

The core manufacturing stage involves the assembly, integration, and testing of the complete die cutting unit. This phase is increasingly focused on sophisticated software development, especially for CNC, laser, and digital cutting systems, where proprietary algorithms manage cutting optimization and material handling. Distribution channels are typically a combination of direct sales for large, customized industrial machinery (allowing for close consultation and installation support) and indirect channels utilizing regional distributors and system integrators. Distributors often play a crucial role in providing local maintenance, spare parts inventory, and application-specific consulting, particularly in regions where the original equipment manufacturer (OEM) does not have a large physical presence. The choice between direct and indirect distribution is often dictated by the complexity and scale of the machinery being sold, with high-end, bespoke automation solutions usually relying on the direct model.

The downstream segment of the value chain focuses on sales, installation, training, and, most importantly, ongoing maintenance and aftermarket support. End-users (e.g., packaging converters, automotive suppliers) seek comprehensive service contracts that guarantee minimal downtime and rapid access to specialized technicians and spare parts. This aftermarket service, which includes die tooling replacement and machine modernization, represents a significant and stable revenue stream for machine manufacturers. The efficiency and responsiveness of the downstream services directly influence customer loyalty and repeat business. Furthermore, the feedback loop from end-users regarding machine performance and application requirements is crucial for driving R&D and future product development, thereby ensuring that new die cutting technologies remain aligned with evolving industrial demands for greater speed, precision, and material versatility, closing the loop back to the upstream innovation cycle.

Die Cutting Machines Market Potential Customers

Potential customers for Die Cutting Machines span a wide array of manufacturing and converting sectors, primarily categorized by the material they process and the volume of output required. The largest and most influential customer base resides within the packaging industry, specifically packaging converters who utilize die cutting machines to produce folding cartons, corrugated boxes, and specialized protective inserts for consumer goods, food and beverage, and pharmaceutical products. These customers prioritize high-speed rotary and large-format flatbed die cutters capable of processing thousands of sheets per hour with minimal setup time, driven by the relentless consumer demand for standardized and personalized packaging solutions necessary for e-commerce fulfillment and retail display. Their purchasing decisions are heavily influenced by machine throughput, reliability, and the ability to handle recyclable and lightweight substrate materials effectively, often requiring complex creasing and stripping capabilities.

Another significant group of buyers includes manufacturers in the automotive and aerospace industries. These end-users utilize specialized die cutting machines, often flatbed or high-precision laser cutters, for the production of non-metallic components such as gaskets, seals, insulation layers, sound dampening materials, and interior trim components. In these sectors, the primary requirements are extreme dimensional accuracy, material compatibility (e.g., technical textiles, rubber, foam composites), and stringent quality traceability, making non-contact or highly precise digital cutting technologies particularly attractive. The electronics manufacturing sector represents a rapidly growing customer segment, relying on sophisticated, often smaller-scale, high-precision laser and rotary die cutters to create flexible circuit boards (FPC), specialized adhesives, screen protectors, and insulating films for consumer electronics and medical devices, where micron-level accuracy is essential for product functionality and integrity.

Beyond large-scale industrial customers, a notable segment comprises commercial printers and specialized label manufacturers who require versatile digital and rotary die cutting systems for short-run labels, stickers, and promotional materials. These customers value flexibility, quick changeover capabilities, and the ability to integrate die cutting processes inline with digital printing equipment to provide a complete print-to-finish solution. Finally, the personal craft and hobby market represents a significant volume segment for smaller, affordable, digital die cutting machines. While the unit price is low, the collective volume drives consistent demand for entry-level technology. However, the core focus of the industrial market remains centered on high-capital expenditure machinery catering to the packaging, automotive, and electronics industries, which demand industrial-grade precision, durability, and integration capabilities necessary for continuous, large-volume production environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $6.23 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BOBST, Heidelberg, Konica Minolta, Spartanics, Zünd Systemtechnik, C. R. CLARKE, Mitsubishi Heavy Industries, Comtorgage, ESAB, Trotec Laser, Gerber Technology, Atom S.p.A., Preco, Schobertechnologies, Winsted, Gietz AG, Young Shin, Sanwa Manufacturing, Cartes S.r.l., Kama GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Die Cutting Machines Market Key Technology Landscape

The technological landscape of the Die Cutting Machines Market is rapidly shifting towards digitalization, automation, and non-contact cutting methods to meet escalating demands for speed, versatility, and precision. Rotary die cutting technology remains the industry standard for high-volume, continuous applications, particularly in label and flexible packaging manufacturing, due to its ability to process materials at extremely high speeds. However, modern rotary systems incorporate quick-change magnetic cylinders and servo-driven control systems, optimizing setup times and ensuring extremely accurate registration even at high velocities. Flatbed die cutting, traditionally used for larger format materials like corrugated board and folding cartons, is evolving through enhanced stripping and blanking mechanisms, often integrating robotic arms for automated stacking and waste removal, minimizing manual intervention and improving overall line efficiency. This blend of mechanical robustness with digital control forms the backbone of the high-speed industrial segment.

A transformative trend is the increasing dominance of non-contact technologies, specifically Laser Die Cutting and Digital Plotter/Knife Cutting. Laser systems offer unparalleled precision and the ability to process intricate designs without the need for physical dies, significantly reducing tooling costs and time-to-market for complex or customized products. These systems are critical in high-value, low-volume sectors such as flexible electronics and medical component manufacturing, where material stress must be minimized. Digital knife cutting systems, utilizing oscillating or static blades guided by high-precision CNC mechanisms, provide exceptional flexibility for handling thick materials, foams, and technical textiles. They are highly favored for prototyping and short-run production due to their versatility and ability to change cutting geometries instantly via software commands, fully eliminating physical die dependence and catering directly to the needs of the modern, agile manufacturing workflow.

Furthermore, the integration of Industry 4.0 concepts is pervasive, encompassing IoT integration and advanced software solutions. Modern die cutting machines are equipped with extensive sensor networks that collect operational data on speed, pressure, vibration, and energy consumption. This data is leveraged for sophisticated monitoring, enabling predictive maintenance schedules and real-time performance optimization through cloud-based analytics platforms. Workflow digitalization is paramount; machines now seamlessly interface with upstream CAD/CAM software and downstream enterprise resource planning (ERP) systems, streamlining the entire production chain from design conceptualization to final product delivery. The continued convergence of high-precision mechanics, smart automation, and powerful data analytics defines the current key technology landscape, emphasizing efficiency, flexibility, and a commitment to data-driven operational intelligence in the cutting process.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: APAC, led by manufacturing powerhouses like China, India, and Japan, holds the largest market share and is projected to exhibit the fastest growth during the forecast period. This dominance stems from the region's status as the global epicenter for consumer goods, electronics, and automotive manufacturing. High foreign direct investment (FDI) in setting up sophisticated packaging and converting plants, coupled with rapidly expanding local consumer markets driving demand for packaged goods, fuels the continuous procurement of automated die cutting machinery. The fierce competition and increasing focus on exports mandate investment in high-speed, high-precision equipment to meet international quality and volume standards.

- North America Focus on High Automation and Specialized Applications: The North American market is characterized by a strong emphasis on automation and the adoption of advanced, high-tech die cutting solutions, particularly laser and digital systems. Demand is significantly driven by the electronics, medical device, and aerospace industries, which require extremely high precision for specialized materials. Due to high labor costs, the region prioritizes fully automated, end-to-end solutions that integrate material feeding and robotic waste removal. Sustainability mandates also push converters towards machinery capable of handling biodegradable and complex multi-layer packaging substrates efficiently.

- Europe’s Emphasis on Quality and Sustainability: Europe represents a mature market demanding premium die cutting solutions known for quality, reliability, and adherence to strict environmental regulations. Western European countries exhibit high adoption rates of advanced flatbed and rotary cutters used in the sophisticated folding carton and luxury packaging sectors. The focus here is on energy efficiency, minimal noise output, and integration into highly organized production lines. Eastern Europe, while growing, serves as a significant manufacturing base for general packaging, showing steady demand for robust semi-automatic and automatic systems.

- Latin America (LATAM) and MEA Emerging Opportunities: The LATAM and Middle East & Africa (MEA) regions present substantial untapped potential. Market growth in these areas is driven by increasing industrialization, urbanization, and a growing middle class, which translates to higher local consumption of packaged goods. Investments are concentrated on upgrading outdated machinery and establishing new production capacities. Demand often targets mid-range, flexible, and robust semi-automatic equipment that offers a balance between capital outlay and improved productivity, particularly in basic packaging and labeling sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Die Cutting Machines Market.- BOBST

- Heidelberg

- Konica Minolta

- Spartanics

- Zünd Systemtechnik AG

- C. R. CLARKE & CO. (UK) Ltd

- Mitsubishi Heavy Industries

- Comtorgage Corporation

- ESAB Corporation

- Trotec Laser GmbH

- Gerber Technology LLC

- Atom S.p.A.

- Preco, Inc.

- Schobertechnologies GmbH

- Winsted Corporation

- Gietz AG

- Young Shin Development Co., Ltd.

- Sanwa Manufacturing Co., Ltd.

- Cartes S.r.l.

- Kama GmbH

Frequently Asked Questions

Analyze common user questions about the Die Cutting Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of automatic die cutting machines?

The primary driver is the necessity for high-volume production with maximized efficiency and minimal labor intervention, particularly in the rapidly growing global packaging and label industries. Automatic machines offer superior throughput, reduced material waste, and exceptional repeatability compared to semi-automatic or manual systems.

How is sustainability impacting the selection of die cutting technology?

Sustainability mandates are pushing manufacturers toward digital and laser cutting technologies, which minimize physical tooling waste and offer precise material layout optimization (nesting) to reduce material scrap. Furthermore, machines must be capable of handling new, often delicate, sustainable and recyclable packaging substrates without compromising cutting quality.

Which die cutting technology is best suited for complex, short-run jobs?

Digital Plotter/Knife Cutting and Laser Die Cutting technologies are best suited for complex, short-run, or customized jobs. These systems eliminate the time and cost associated with manufacturing physical dies, allowing for instantaneous design changes via software and quick turnaround for bespoke orders common in e-commerce and prototyping.

What role does AI play in optimizing die cutting operations?

AI integrates into die cutting by providing predictive maintenance through sensor data analysis, optimizing material usage via advanced nesting algorithms, and enabling real-time quality control using computer vision systems. This leads to reduced downtime, lower operational costs, and guaranteed output quality, transforming traditional machinery into smart assets.

Which application segment holds the largest share of the Die Cutting Machines Market?

The Packaging application segment holds the largest market share. This includes the production of folding cartons, corrugated boxes, and complex protective packaging necessary for the consumer goods, food and beverage, and pharmaceutical sectors globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Flatbed Die Cutting Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Die Cutting Machines Market Statistics 2025 Analysis By Application (Packaging Industry, Automobile Industry, Mobile Phone Industry), By Type (Rotary Die Cutting Machines, Platen Die Cutting Machines), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager