DIP Cords Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433040 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

DIP Cords Market Size

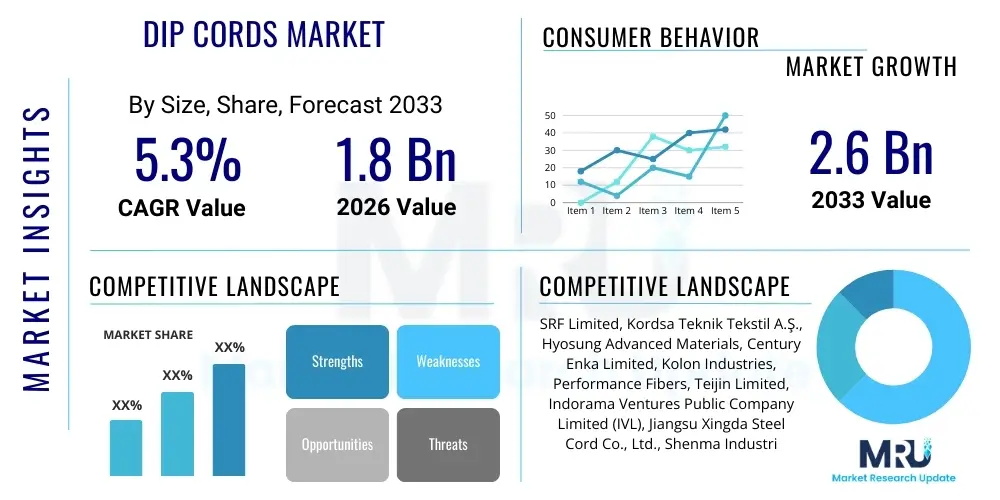

The DIP Cords Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

DIP Cords Market introduction

The DIP Cords Market encompasses the production and distribution of high-tenacity textile reinforcement materials, primarily used in the manufacturing of radial tires, conveyor belts, and various mechanical rubber goods (MRG). DIP cords, short for dipped cords, are manufactured by twisting high-strength filaments—such as polyester, nylon, rayon, and aramid—and subsequently treating them with a specialized adhesive dipping solution. This dipping process is crucial as it enhances the adhesion between the textile cord and the surrounding rubber matrix, ensuring durability, stability, and high performance under demanding operational conditions, particularly in automotive and heavy industrial applications.

The core application driving market growth is the tire industry, where DIP cords provide the critical structural integrity necessary for modern radial tires, improving fatigue resistance, dimensional stability, and load-bearing capabilities. Beyond tires, these cords are vital components in high-performance V-belts, hoses, and industrial transmission belts, facilitating efficient power transmission and reducing maintenance requirements across diverse industrial sectors. The inherent benefits of DIP cords—including superior heat resistance, excellent tensile strength, and reduced creep deformation—make them indispensable for safety-critical and high-stress applications.

Market expansion is fundamentally driven by the escalating global demand for vehicles, especially in emerging economies, alongside significant infrastructural investments requiring robust conveyor systems and heavy-duty industrial machinery. Furthermore, technological advancements focused on developing eco-friendly dipping chemistries and optimizing cord materials for electric vehicles (EVs) are opening new avenues for innovation. The focus on lightweighting vehicles to improve fuel efficiency and battery range also necessitates continuous improvements in cord strength-to-weight ratios, positioning advanced DIP cord technologies as critical enablers for future mobility solutions.

DIP Cords Market Executive Summary

The global DIP Cords Market demonstrates robust growth, underpinned by foundational demand from the automotive sector, which remains the primary consumer. Key business trends include aggressive capacity expansion, particularly in Asia Pacific, driven by the shift of tire manufacturing bases to regions offering lower operational costs and proximity to rapidly expanding end-user markets. Strategic mergers, acquisitions, and joint ventures are prominent as manufacturers seek to secure raw material supplies, integrate dipping technology expertise, and expand their geographical footprint to serve global Tier 1 tire manufacturers efficiently. Sustainability is emerging as a critical competitive differentiator, compelling companies to invest in solvent-free dipping technologies and transition toward bio-based or recycled polymeric inputs, aligning with stricter environmental regulations and corporate social responsibility goals.

Regionally, Asia Pacific (APAC) dominates the market share and is projected to exhibit the highest growth rate throughout the forecast period, primarily due to the massive scale of tire production in countries like China, India, and ASEAN nations, coupled with rapid urbanization and infrastructural development. North America and Europe, while mature, emphasize high-performance and specialty cords, driven by stringent safety standards and the premiumization of tire offerings, particularly for specialty vehicles and high-end automotive segments. These established markets are characterized by advanced technological adoption and a strong focus on supply chain resilience and local manufacturing capabilities, often demanding customized cord specifications for niche applications.

Segment trends reveal a continued dominance of Polyester (PET) DIP cords due to their cost-effectiveness, excellent dimensional stability, and high tensile properties, making them the staple choice for passenger car tires. However, the Nylon segment, particularly Nylon 66, sees increasing application in high-speed and truck tires where superior fatigue resistance and heat aging performance are paramount. Furthermore, there is growing traction in the adoption of specialized cords, such as Hybrid and Aramid DIP cords, which offer superior strength and thermal stability critical for heavy-duty off-the-road (OTR) tires and demanding industrial applications, reflecting a market moving towards material diversification based on specific performance needs.

AI Impact Analysis on DIP Cords Market

User inquiries regarding AI's influence on the DIP Cords market typically center on three core themes: optimizing manufacturing efficiency, improving quality control, and forecasting raw material volatility. Users are keen to understand how machine learning models can enhance complex dipping processes—which require precise control over temperature, tension, and chemical concentration—to minimize defects and material waste. Concerns are raised about the feasibility of integrating AI into legacy manufacturing infrastructure and the necessary data science expertise required. Expectations include AI-driven predictive maintenance for high-cost machinery, real-time quality assurance using vision systems, and advanced demand forecasting that can stabilize the highly sensitive procurement of textile and chemical raw materials, ultimately seeking tangible reductions in operational expenditure and improvements in product consistency.

- AI-powered Predictive Maintenance: Minimizing downtime of complex dipping and twisting machinery through real-time sensor data analysis.

- Optimized Dipping Process Control: Machine learning algorithms adjusting chemical bath concentration and curing parameters to ensure optimal adhesion and reduce batch-to-batch variability.

- Visual Quality Inspection: Deployment of AI vision systems for high-speed, non-destructive defect detection in the cord structure and dipping layer.

- Supply Chain and Inventory Forecasting: Utilizing AI to predict future demand and raw material price fluctuations (e.g., PET resin, RFL chemicals) to optimize procurement strategies.

- Enhanced Material Design Simulation: Applying generative AI to simulate new polymer-adhesive combinations, accelerating the development of specialized high-performance DIP cords for niche applications like electric vehicle tires.

DRO & Impact Forces Of DIP Cords Market

The DIP Cords Market is primarily propelled by the fundamental growth of the automotive industry, particularly the increasing global vehicle parc and the continuous need for replacement tires, coupled with significant expansion in emerging economies where infrastructure projects necessitate robust industrial rubber products. Conversely, the market faces constraints dominated by the volatility of raw material prices, particularly petrochemical-derived polymers like Polyester and Nylon, and the rising cost and complexity of adhering to stringent environmental regulations regarding the RFL (resorcinol-formaldehyde-latex) dipping system, which presents disposal and health challenges. However, the ongoing development of formaldehyde-free dipping agents and high-performance specialty materials offers substantial opportunities for market participants to differentiate their products and capture high-value segments.

Market growth drivers include the technological shift towards radial tires globally, requiring higher-quality DIP cords, and the rapid adoption of electric vehicles (EVs). EVs necessitate specialized, stronger, and more durable cords to handle the higher torque, increased battery weight, and specialized low-rolling-resistance requirements of EV tires. This structural demand guarantees sustained growth for premium and advanced cord types. Furthermore, industrial applications, such as large-scale conveyor belts used in mining and logistics, continue to demand greater load-bearing capabilities, necessitating innovative and customized textile reinforcements.

Restraints are notably complex, including the capital-intensive nature of establishing new dipping and weaving facilities, leading to high barriers to entry. Additionally, the mature technological status of standard PET cords means pricing pressure remains intense in high-volume segments. The regulatory pressure to eliminate harmful chemicals, particularly formaldehyde, forces substantial R&D expenditure on finding effective, large-scale, and cost-efficient alternatives to traditional dipping systems. Opportunity lies in leveraging these challenges by investing heavily in sustainable dipping technologies and developing proprietary hybrid cords (e.g., combinations of PET and PEN) designed specifically for next-generation vehicle platforms and advanced industrial rubber components, enabling premium pricing and establishing early mover advantage in specialized segments.

Segmentation Analysis

The DIP Cords Market is intricately segmented based on material type, application, and end-use industry, reflecting the diverse performance requirements across various sectors. The analysis reveals that material differentiation is key, with polyester dominating volume due to its favorable cost-to-performance ratio for standard passenger tires, while nylon and specialty fibers cater to high-stress, high-performance, and heavy-duty segments. Application segmentation highlights the tire industry's overwhelming market share, yet other sectors like mechanical rubber goods (MRG) and specialized industrial conveyor systems offer stable, high-margin opportunities requiring customized material specifications and dipping formulations. Geographic segmentation remains crucial, linking production capacity directly to the demand centers of the automotive and manufacturing industries.

- By Material Type:

- Polyester (PET) DIP Cords

- Nylon (Nylon 6, Nylon 66) DIP Cords

- Rayon DIP Cords

- Aramid/High-Modulus Specialty Cords

- Hybrid Cords

- By Tire Type:

- Radial Tires

- Bias Tires

- By Application:

- Tire Reinforcement (Passenger Car, Truck & Bus, Off-the-Road)

- Mechanical Rubber Goods (MRG)

- Conveyor Belts

- V-Belts and Transmission Belts

- Hoses and Diaphragms

- By End-Use Industry:

- Automotive

- Industrial & Manufacturing

- Construction & Mining

- Aerospace & Defense

Value Chain Analysis For DIP Cords Market

The value chain for DIP cords is vertically integrated and highly specialized, beginning with the upstream supply of raw materials, predominantly petrochemical intermediates required to produce high-tenacity yarn (e.g., PET chips, Caprolactam). This phase involves major chemical and textile companies. The midstream involves the core manufacturing processes: polymerization, spinning/extrusion into filament yarns, twisting the filaments into cords, and the critical dipping process using RFL or alternative adhesive systems. Manufacturing nodes often require substantial capital investment in specialized machinery to maintain precise tension and dipping accuracy, where quality control is paramount as defects at this stage severely impact the final product's performance.

Downstream analysis highlights the direct reliance on major global tire manufacturers (Tier 1 suppliers like Bridgestone, Michelin, Goodyear) and large industrial rubber goods producers. Distribution channels are predominantly direct, characterized by long-term supply contracts and strong technical relationships between the cord manufacturer and the end-user, often involving detailed customization of cord specifications, including dip pick-up rate and tenacity, to meet specific tire designs. Indirect distribution is minimal but may involve specialized distributors serving smaller MRG manufacturers or replacement market suppliers.

The profitability and efficiency of the entire chain are heavily influenced by the cost and stability of upstream polymer supply and the ability of cord manufacturers to manage complex environmental compliance related to dipping chemicals. Success in the market hinges not only on production efficiency but also on continuous R&D collaboration with tire makers to develop next-generation reinforcement materials optimized for evolving automotive standards, such as those driven by electric vehicle technology and stringent regulatory requirements for tire performance and longevity. This tight linkage underscores the strategic importance of long-term partnerships within the industry.

DIP Cords Market Potential Customers

The primary consumers and potential customers of DIP cords are global tire manufacturing conglomerates, which account for the largest volume consumption due to the essential role of these cords in tire carcass and belt structure reinforcement across all vehicle types (passenger, truck, OTR). Within this segment, the focus is on securing long-term contracts with major original equipment manufacturers (OEM) and replacement market suppliers, who require reliable, high-volume supply chains capable of delivering precise material specifications. A secondary, yet high-value, customer base includes specialized industrial rubber manufacturers.

These industrial customers utilize DIP cords for producing high-performance mechanical rubber goods (MRG), specifically heavy-duty conveyor belts utilized in mining, bulk material handling, and logistics, as well as complex V-belts and hoses essential for automotive engines and industrial machinery. These customers often require specialty cords (e.g., Aramid or high-modulus PET) designed to withstand extreme temperatures, abrasion, and cyclic fatigue, leading to lower volume but significantly higher margin contracts. Furthermore, smaller, specialized manufacturers focusing on niche applications, such as aircraft landing gear components or high-pressure hydraulic hoses, also represent a targeted customer segment seeking bespoke cord solutions with exacting quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 5.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SRF Limited, Kordsa Teknik Tekstil A.Ş., Hyosung Advanced Materials, Century Enka Limited, Kolon Industries, Performance Fibers, Teijin Limited, Indorama Ventures Public Company Limited (IVL), Jiangsu Xingda Steel Cord Co., Ltd., Shenma Industrial Co., Ltd., Cordenka GmbH, Madura Industrial Textiles (Maduratex), Trelleborg AB, Bekaert, Toyobo Co., Ltd., Rhodia (Solvay Group), PHP Fibers GmbH, S&T Motiv Co., Ltd., Hebei Iron and Steel Group, Toray Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DIP Cords Market Key Technology Landscape

The technological landscape of the DIP Cords market is characterized by continual refinement in both material science and processing techniques aimed at maximizing strength, minimizing weight, and enhancing environmental compliance. Core technology centers on the polymerization and spinning processes used to create high-tenacity yarns, where innovations focus on increasing the molecular orientation and reducing internal flaws in fibers like PET and Nylon 66. Advanced twisting machinery ensures uniformity and structural integrity of the cord construction, which is paramount for preventing fatigue failure in tires. Crucially, the dipping process leverages sophisticated chemical engineering to develop new adhesive formulations that achieve superior bond strength without relying on traditional, environmentally sensitive chemistries.

A significant technological shift involves the development and commercialization of formaldehyde-free (FF) dipping systems, which replace the conventional RFL dipping agent components. These newer technologies utilize alternative cross-linking agents and adhesion promoters to maintain high performance while reducing VOC emissions and eliminating hazardous substances, satisfying rigorous European and North American environmental regulations. Furthermore, manufacturers are employing advanced online monitoring and sensor technologies, often integrating AI and IoT tools, to achieve real-time control over parameters such as cord tension, dip penetration rate, and curing oven temperature, ensuring extremely consistent quality across large production batches, thereby reducing scrap rates and optimizing throughput.

The introduction of hybrid cord structures represents another key technological advancement, combining the desirable properties of different materials (e.g., Aramid for stiffness and Polyester for cost-efficiency) within a single cord to optimize performance for specific tire locations (e.g., cap ply vs. body ply). This allows tire designers to achieve superior balance between rolling resistance, durability, and comfort. Future R&D is heavily focused on materials compatible with next-generation rubber compounds, including synthetic rubber formulations used in specialized EV tires, requiring cords that can handle higher operating temperatures and significantly prolonged usage cycles associated with electric mobility.

Regional Highlights

The regional dynamics of the DIP Cords Market are heavily influenced by the geographic concentration of automotive and tire manufacturing hubs, infrastructural development levels, and regional regulatory frameworks concerning environmental standards and product safety.

- Asia Pacific (APAC): Dominates the global market, driven by high-volume manufacturing of tires in China, India, and Southeast Asia. The region benefits from lower operating costs and caters to rapidly expanding domestic automotive markets and significant global export volumes. Investment in new capacity expansion is concentrated here, aiming to meet the escalating demand from both passenger car and heavy commercial vehicle sectors.

- Europe: Characterized by stringent quality and environmental regulations, leading to a strong focus on premium, high-performance cords and rapid adoption of formaldehyde-free dipping technologies. The European market emphasizes innovation for niche applications, including specialty tires and high-end industrial conveyor systems, often demanding Aramid or specialized Polyester cords for enhanced efficiency and durability.

- North America: A mature market focused on replacing outdated cord structures with technologically advanced materials. Demand is driven by large vehicle platforms (trucks and SUVs) and the increasing complexity of regulatory standards for tire labeling and performance. Manufacturing remains focused on efficiency, automation, and supply chain security to serve major domestic tire plants.

- Latin America (LATAM): Exhibits steady growth linked to improving economic conditions and increased vehicle assembly. The region represents a vital market for both domestic consumption and export, though investment in manufacturing technology often lags APAC and Europe, focusing primarily on standard polyester and nylon cord production.

- Middle East and Africa (MEA): Emerging market characterized by infrastructural projects (mining, construction) driving demand for OTR tires and heavy-duty industrial belts. Market growth is nascent but promising, reliant on imported cords or recent capacity additions focused on regional self-sufficiency, often prioritizing durability under harsh climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DIP Cords Market.- SRF Limited

- Kordsa Teknik Tekstil A.Ş.

- Hyosung Advanced Materials

- Century Enka Limited

- Kolon Industries

- Performance Fibers

- Teijin Limited

- Indorama Ventures Public Company Limited (IVL)

- Jiangsu Xingda Steel Cord Co., Ltd.

- Shenma Industrial Co., Ltd.

- Cordenka GmbH

- Madura Industrial Textiles (Maduratex)

- Trelleborg AB

- Bekaert

- Toyobo Co., Ltd.

- Rhodia (Solvay Group)

- PHP Fibers GmbH

- S&T Motiv Co., Ltd.

- Hebei Iron and Steel Group

- Toray Industries

Frequently Asked Questions

Analyze common user questions about the DIP Cords market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of DIP Cords in the automotive industry?

DIP Cords serve as essential reinforcement materials, primarily in tire manufacturing, providing the necessary tensile strength, structural integrity, and dimensional stability to the rubber components, enhancing durability and performance, especially in radial tires.

How is the growth of Electric Vehicles (EVs) impacting the demand for DIP Cords?

EV growth is driving demand for specialized, high-modulus, and high-strength DIP cords. Due to the increased weight and torque of EVs, their tires require stronger cords to ensure safety, reduce rolling resistance, and optimize battery range, creating a premium segment opportunity.

Which material type currently dominates the DIP Cords Market?

Polyester (PET) DIP cords currently hold the largest market share globally. This dominance is attributed to their favorable balance of cost-effectiveness, dimensional stability, and sufficient strength for standard passenger car tires, making them the industry staple.

What are the key environmental challenges facing DIP Cord manufacturers?

The primary environmental challenge is the use of Resorcinol-Formaldehyde-Latex (RFL) in the dipping process, which contains hazardous substances. Manufacturers are actively investing in formaldehyde-free (FF) and alternative dipping technologies to comply with increasingly strict global environmental and health regulations.

Which geographical region is projected to experience the fastest market growth?

Asia Pacific (APAC) is projected to exhibit the highest growth rate, driven by significant investments in automotive and tire manufacturing capacity, coupled with rapid industrialization and escalating domestic and export demand across China, India, and Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager