DIP Cords Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443525 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

DIP Cords Market Size

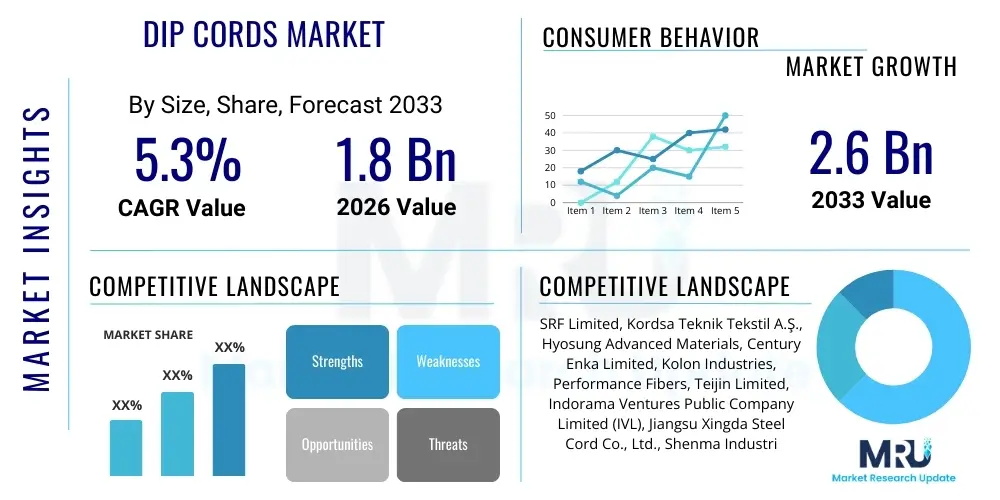

The DIP Cords Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing global demand for reliable, high-density electrical interconnect solutions across critical industrial and high-technology sectors. DIP Cords, characterized by their precision engineering for Dual In-line Package (DIP) or similar specialized connections, are essential components in complex electronic assemblies where signal integrity and physical robustness are paramount. The steady digitalization of manufacturing processes and the expansion of the Electric Vehicle (EV) landscape are significant contributors to this sustained market expansion, necessitating higher volumes of specialized wiring harnesses and cord sets.

The valuation reflects a growing technological reliance on compact, resilient, and standardized wiring solutions in environments ranging from aerospace and defense to medical diagnostics. Investment in automated manufacturing lines capable of producing high-tolerance DIP cords is escalating, driving down unit costs while improving quality consistency, thereby fueling adoption across a wider range of applications. Furthermore, the push for miniaturization in consumer electronics and embedded systems, which paradoxically requires extremely dependable yet space-efficient internal wiring, ensures a continuous pipeline of demand for innovative DIP cord designs. This growth is not merely volume-driven but also value-driven, as the complexity and performance specifications of the cords increase in line with evolving industry standards, particularly those concerning electromagnetic compatibility (EMC) and high-speed data transmission capabilities.

DIP Cords Market introduction

The DIP Cords Market encompasses specialized electrical cords, cable assemblies, and wiring harnesses primarily designed for connecting Dual In-line Package (DIP) components or facilitating reliable, structured interconnections within electronic devices and industrial equipment. These cords are characterized by high-quality insulation materials, precise crimping, and often include robust shielding to ensure superior signal integrity and protection against environmental factors like moisture, temperature fluctuations, and vibration. The product range includes flat ribbon cables terminated with DIP connectors, specialized molded cord sets, and custom harnesses used extensively in control systems, telecommunications infrastructure, and automated testing equipment. Their primary function is to provide highly secure, multi-pin electrical connections essential for transmitting power and data signals reliably within complex machinery, thereby establishing them as critical, non-negotiable components in modern technological ecosystems.

Major applications for DIP Cords span critical sectors such as industrial automation, where they connect programmable logic controllers (PLCs) and sensor arrays; automotive electronics, particularly in engine control units (ECUs) and advanced driver-assistance systems (ADAS); and medical devices, where reliability is paramount for patient safety and diagnostic accuracy. In computing and telecommunications, they are vital for internal connectivity within servers, networking equipment, and data centers, supporting high-speed data transfer requirements and minimizing crosstalk. The versatility of DIP cords, allowing for customization in length, wire gauge, and connector type, makes them indispensable across various Original Equipment Manufacturer (OEM) markets. Their consistent performance under stress and adherence to strict geometric tolerances make them the preferred choice over standard wiring in mission-critical applications where failure is not an option.

The key driving factors propelling the market include the global surge in industrial IoT (IIoT) adoption, necessitating intricate machine-to-machine connectivity; the rapid expansion of electric vehicle manufacturing, which demands robust, specialized internal harnesses; and sustained government investment in smart city infrastructure and communication networks globally. Benefits of using high-quality DIP Cords include enhanced system reliability, reduced installation complexity due to pre-terminated assemblies, improved diagnostic capabilities, and significant longevity compared to field-installed wiring. These structured assemblies contribute directly to minimizing system downtime and maintenance costs, presenting a compelling total cost of ownership advantage for end-users, thus reinforcing their crucial role in supporting the technological advancements defining the Fourth Industrial Revolution and beyond.

DIP Cords Market Executive Summary

The DIP Cords Market is experiencing robust expansion driven primarily by key business trends focused on automation integration, supply chain resilience, and product miniaturization, particularly within the Asia Pacific region. Business trends reflect a move toward vertically integrated manufacturing processes where key players are acquiring specialized raw material suppliers to mitigate volatility in copper and polymer pricing, ensuring cost stability and production continuity. Furthermore, there is a pronounced strategic shift towards offering value-added services, such including advanced harness design consultation, rapid prototyping, and sophisticated testing capabilities, moving beyond simple component supply to become integrated solution providers. This focus on end-to-end service delivery is crucial for navigating the increasingly stringent quality and safety standards imposed by sectors like aerospace and medical technology, creating a competitive advantage for firms that can guarantee comprehensive compliance and long-term reliability for their complex wiring solutions.

Regionally, the market is profoundly influenced by the manufacturing dynamism in the Asia Pacific (APAC), which accounts for the largest share due to the concentration of global electronics and automotive manufacturing hubs in countries like China, South Korea, and Japan, complemented by emerging economies like Vietnam and India. North America and Europe demonstrate mature market characteristics, focusing primarily on high-value, specialized applications such as defense, medical instrumentation, and advanced industrial robotics, demanding extremely high-reliability and low-volume customized production runs. The regional disparity lies in volume versus value: APAC leads in sheer production volume for mass-market consumer and automotive electronics, while Western markets lead in revenue generated per unit for highly specialized, regulatory-intensive applications, driving continuous innovation in materials and shielding technologies to meet extreme performance specifications in demanding operating environments.

In terms of segmentation, the demand for rubber and silicone-insulated DIP cords is escalating due to their superior thermal stability and flexibility, making them ideal for harsh environments encountered in heavy industry and engine compartments. Application-wise, the automotive segment dominates, fueled by the accelerating transition to Electric Vehicles (EVs) and the proliferation of sensor technology within autonomous driving systems, which require complex, modular, and highly reliable wiring harnesses for battery management systems and connectivity modules. The trend within the product segment is leaning heavily towards pre-molded, overmolded, and environmentally sealed cord sets that offer enhanced ingress protection (IP ratings) and mechanical stability, minimizing the potential for connection failure due to vibration or moisture ingress in ruggedized systems, which ultimately dictates the overall reliability and lifespan of the host equipment.

AI Impact Analysis on DIP Cords Market

User queries regarding the impact of Artificial Intelligence (AI) on the DIP Cords market primarily center on three themes: predictive maintenance and quality assurance in manufacturing, optimization of supply chain logistics, and the role of AI in driving demand through advanced application development (e.g., autonomous vehicles). Users are concerned about whether AI integration will lead to fully automated assembly lines, reducing the need for manual labor, and simultaneously improving defect detection beyond human capability, particularly for micro-cracks or insulation anomalies in specialized harnesses. Key expectations involve AI algorithms enhancing material efficiency by minimizing scrap rates during cable cutting and termination processes, optimizing inventory levels based on real-time end-user demand forecasting, and facilitating quicker customization of complex cord designs based on evolving OEM specifications. The overall consensus is that while AI won't replace the physical product, it will drastically refine the efficiency, quality control, and responsiveness of the manufacturing and distribution ecosystem surrounding DIP cords.

AI's initial impact is most visible in optimizing the highly complex production processes involved in cord assembly, which often requires precise termination, soldering, and overmolding. Machine vision systems powered by deep learning algorithms are now deployed to perform high-speed, 100% inspection of critical connection points, identifying microscopic faults, incorrect wire sequencing, or insufficient crimp heights far more reliably and faster than traditional human inspection or simple automated testing methods. This real-time quality control dramatically reduces the overall cost of defects and ensures that the high-reliability demands of end-user sectors, such as medical and aerospace, are consistently met. Furthermore, AI-driven process control uses historical manufacturing data to dynamically adjust machine parameters (e.g., thermal profiling for molding, or pressure settings for termination), ensuring optimal consistency across different production batches and material sources, leading to superior final product quality.

In the supply chain, AI provides predictive analytics that allow manufacturers to anticipate fluctuations in raw material costs (copper, specialized polymers) and forecast demand with greater accuracy, optimizing inventory holding costs and reducing lead times for complex custom orders. Through advanced route optimization and network analysis, AI systems can manage global logistics for the specialized connectors and cable components required for DIP cords, ensuring JIT (Just-in-Time) delivery to demanding OEM assembly plants worldwide. For the end-user application sphere, the increasing sophistication of AI-powered systems, such as advanced robotics and Level 4/5 autonomous vehicles, fundamentally drives the demand for DIP cords of higher complexity and greater performance specifications, as these advanced systems require reliable, high-speed internal data highways that only specialized, shielded harnesses can provide reliably under operational stress.

- AI-enhanced Quality Control: Implementation of machine vision and deep learning for automated, non-destructive inspection of crimping and insulation integrity, drastically minimizing defect rates in complex assemblies.

- Predictive Maintenance: AI algorithms analyze equipment performance data on assembly lines to predict potential machine failures, optimizing uptime and minimizing production delays.

- Supply Chain Optimization: Utilization of machine learning for highly accurate demand forecasting and real-time raw material price prediction, improving inventory management and cost efficiency.

- Design Optimization: Generative AI tools assist engineers in rapidly iterating complex harness designs, considering factors like thermal management, signal integrity, and space constraints simultaneously.

- Automation Acceleration: AI drives the need for more complex, high-reliability interconnects within robotics and autonomous systems, indirectly fueling market growth for advanced DIP cord types.

DRO & Impact Forces Of DIP Cords Market

The market trajectory for DIP Cords is shaped by a powerful confluence of internal market drivers, external restraining forces, and strategic emerging opportunities. A primary driver is the accelerating trend of industrial automation globally, which necessitates millions of standardized yet highly reliable cable assemblies to connect sensors, actuators, and control modules in factory settings, demanding precise cord sets that guarantee uptime. This is strongly complemented by the robust growth in the Electric Vehicle (EV) sector, where specialized, high-voltage, and environmentally sealed DIP cords are crucial for battery management systems and power distribution units, pushing innovation in materials science for lightweight and durable solutions. Simultaneously, the relentless pursuit of data center expansion and the rollout of 5G infrastructure require dependable internal wiring to maintain signal integrity across high-density computing arrays, further bolstering demand for superior quality, low-latency cord sets capable of handling extremely high-frequency signals with minimal loss.

However, the market faces notable restraints, most significantly the extreme volatility in the price of key raw materials, primarily copper conductors and specialized engineering polymers such as high-grade PVC, PTFE, and silicone elastomers. These fluctuations introduce significant instability in manufacturing costs, making long-term pricing contracts challenging, and potentially squeezing profit margins for manufacturers without robust vertical integration or diversified supply chains. Another major challenge is the increasing regulatory complexity worldwide, particularly concerning environmental directives (e.g., RoHS, REACH) and safety standards (e.g., UL, CE), which require continuous investment in compliance testing and material reformulation. Moreover, the long-term competition from advanced wireless connectivity technologies, particularly in low-data-rate industrial applications, poses a structural threat, although high-speed, high-power, and mission-critical applications remain fundamentally reliant on robust physical interconnects.

Opportunities for growth are abundant, particularly in emerging markets across Asia Pacific and Latin America, where rapid industrialization and infrastructural development are creating massive, untapped demand for basic and sophisticated cord sets in telecommunications and consumer electronics manufacturing. Furthermore, the global push toward miniaturization in medical devices (e.g., portable monitoring equipment) and aerospace systems is creating a high-value niche for ultra-fine-gauge, high-flex DIP cords that meet rigorous spatial and performance requirements. Strategic investment in smart cable technology, incorporating embedded sensors for monitoring temperature, vibration, or connection integrity, represents a futuristic opportunity to transform the product from a passive component into an active, intelligent asset within the IIoT ecosystem, significantly enhancing the value proposition and potentially unlocking premium pricing structures in specialized industrial applications demanding real-time operational diagnostics and failure prevention capabilities.

Segmentation Analysis

The DIP Cords Market is intricately segmented based on core attributes, including the type of material used for insulation and jacketing, the specific application industry, and the channel through which the product is distributed to the end-user. Understanding these segments is vital for manufacturers to tailor their product offerings and marketing strategies to meet diverse global performance standards and application-specific requirements. The segmentation reveals a market that balances high-volume, cost-sensitive production for commodity electronics with highly specialized, low-volume, high-performance production mandated by sectors such as defense and specialized industrial machinery, where materials must withstand extreme temperatures and harsh chemical exposure.

Material segmentation, including PVC (Polyvinyl Chloride), Polyurethane (PUR), and specialized rubbers (Silicone, TPE), reflects the performance trade-offs required by different operating environments. PVC dominates in cost-effective, general-purpose applications, while PUR and specialized rubber compounds are sought after for applications demanding superior abrasion resistance, chemical resistance, and flexibility, such as robotics and mobile industrial equipment. Application segmentation highlights the dominance of the automotive sector, driven by complex vehicle wiring harnesses, closely followed by industrial automation, which requires high reliability for factory floor equipment. The continuous differentiation across these segments dictates the varying technical specifications, pricing sensitivity, and regulatory hurdles manufacturers must navigate to achieve sustainable market penetration and growth across the highly diverse end-user landscape.

Further granularity exists within the application types, separating demands between OEM (Original Equipment Manufacturer) and the aftermarket. OEM contracts typically demand high volumes of customized cords integrated directly into new products, characterized by long-term strategic relationships and rigorous quality audits. Conversely, the aftermarket requires replacement and repair cord sets, often driven by shorter lead times and distributed through indirect channels like specialized electrical distributors and retailers. The type of termination (e.g., standard crimp connectors, specialized IDC connectors, or overmolded assemblies) also forms a crucial segmentation axis, reflecting the level of robustness and environmental sealing required, directly influencing the complexity of the manufacturing process and the ultimate cost of the final specialized cord product.

- By Insulation Material:

- PVC (Polyvinyl Chloride)

- Polyurethane (PUR)

- Rubber and Silicone

- Fluoropolymers (e.g., PTFE, FEP)

- By Termination Type:

- Standard Crimp Connectors

- Insulation Displacement Connectors (IDC)

- Overmolded Assemblies

- Custom/Specialized Terminations

- By Application:

- Automotive (EVs, ADAS, Infotainment)

- Industrial Automation and Robotics

- Telecommunications and Data Centers

- Medical Devices and Diagnostics

- Aerospace and Defense

- Consumer Electronics

- By End-Use Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket/Replacement

Value Chain Analysis For DIP Cords Market

The value chain for the DIP Cords Market commences with the upstream segment, dominated by the procurement and processing of fundamental raw materials, chiefly high-purity copper for conductors, and specialized polymer resins for insulation and jacketing. Key upstream activities involve smelting, wire drawing, and the compounding of specific plastic and rubber formulations tailored for electrical insulation properties, flame retardancy, and environmental resistance. The complexity in this phase lies in managing the commodity price volatility of copper and ensuring a consistent supply of specialized, high-performance polymers (like cross-linked polyethylene or fluorinated ethylene propylene) required for high-temperature or high-flex applications. Suppliers at this stage must adhere to rigorous material specifications, as any inconsistency directly compromises the signal integrity and mechanical reliability of the finished DIP cord product, requiring intensive quality control measures and established supplier certifications to guarantee compliance.

The core manufacturing and assembly stage involves multiple critical steps: precision cutting of conductors, wire stripping, meticulous crimping and soldering of terminals, and the final assembly into complex harnesses or overmolded cord sets. This stage often includes significant capital expenditure on automated equipment, such as wire processing machines and high-precision molding equipment, to achieve the necessary tight tolerances and high production volumes while maintaining low defect rates. Manufacturers often invest heavily in testing equipment to perform continuity checks, dielectric strength tests, and mechanical stress evaluations, ensuring the finished cord meets all required performance specifications before exiting the factory. The intellectual property often resides in the design of specialized connectors and proprietary molding compounds that enhance environmental sealing and strain relief, providing a barrier to entry for new market participants.

The downstream analysis focuses on the distribution channels, which are bifurcated into direct sales to large OEMs and indirect sales through specialized distributors and regional agents catering to the aftermarket and smaller customers. Direct channels are characterized by long-term contracts, custom product specifications, and direct technical collaboration between the manufacturer and the end-user engineering teams, which is typical for automotive or aerospace clients. Indirect channels utilize global and regional distributors who maintain inventory, offer local support, and provide integration services, essential for reaching diverse industrial clients and repair shops. Efficient logistics and strategically located warehousing are crucial in the downstream segment to ensure quick response times and reliable delivery of highly customized products, directly impacting the final customer experience and overall market competitiveness in regions undergoing rapid industrial expansion and infrastructure development.

DIP Cords Market Potential Customers

The primary customer base for DIP Cords is highly diversified, centered on sectors that require reliable, often customized, electrical interconnects for critical operational functionality. Original Equipment Manufacturers (OEMs) within the automotive sector represent the largest cluster of high-volume buyers. This includes manufacturers of passenger vehicles (especially Electric Vehicle and Hybrid Electric Vehicle producers), commercial vehicles, and Tier 1 suppliers specializing in component systems like engine control units (ECUs), sensor arrays for Advanced Driver-Assistance Systems (ADAS), and complex battery management systems (BMS). These buyers demand stringent adherence to industry standards (e.g., ISO, SAE) and often require specialized cords that can withstand high temperatures, oil exposure, and intense vibration inherent to vehicle operation. The decision-making process for these buyers is heavily weighted toward longevity, failure rate statistics, and the supplier's capacity for global production scalability and adherence to zero-defect quality programs.

Industrial automation and robotics manufacturers form the second major customer cohort. These companies procure DIP Cords for connecting controllers, robotic arms, human-machine interfaces (HMIs), and various sensing devices within smart factories and production lines. Their key purchasing criteria emphasize durability, resistance to continuous flexing (high flex-life cables), and resistance to industrial chemicals or solvents. Furthermore, the medical device industry, encompassing manufacturers of diagnostic imaging equipment, patient monitoring systems, and surgical robotics, represents a high-value, quality-sensitive customer segment. For medical buyers, regulatory compliance (FDA clearance, ISO 13485) and biocompatibility of the cord materials are paramount, leading them to source specialized, often sterilized, cable assemblies where the cost is secondary to guaranteed reliability and patient safety, necessitating rigorous documentation and traceability throughout the manufacturing process.

Telecommunications and IT infrastructure providers, including server manufacturers, data center operators, and network equipment producers, also constitute a significant customer group. These buyers prioritize high-speed data transmission capabilities, minimal signal crosstalk, and robust shielding to ensure peak network performance and uptime. Their purchasing cycle is often dictated by new technological rollouts (e.g., 5G, fiber optic expansion) and demands rapid, large-scale supply capabilities. Generally, these potential customers are sophisticated industrial buyers who prioritize technical specifications, audited quality systems, and demonstrated supply chain stability over marginally lower pricing, reinforcing the market’s focus on high-performance engineering and specialized manufacturing capabilities, which are essential for navigating the complex procurement requirements of these diverse, technically demanding end-user sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol Corporation, Delphi Technologies, Molex, Yazaki Corporation, Sumitomo Electric Industries, Aptiv PLC, Prysmian Group, Belden Inc., 3M Company, Leoni AG, Huber+Suhner, Nexans, LAPP Group, HELUKABEL, Alpha Wire, Southwire Company, General Cable, Volex PLC, Phoenix Contact |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DIP Cords Market Key Technology Landscape

The manufacturing of high-performance DIP Cords relies heavily on advanced material science and precision engineering technologies focused on maximizing electrical performance and mechanical robustness. A core technological area involves sophisticated automation in wire processing, utilizing high-speed, computer-controlled cutting, stripping, and termination machines that ensure micron-level accuracy in conductor handling and crimping force application. The quality of the electrical connection is paramount, driving adoption of laser stripping techniques for extremely fine gauge wires and highly specialized, monitored crimping systems that provide real-time feedback on connection integrity, reducing the potential for intermittent faults under operational stress. Furthermore, specialized extrusion technologies are employed to apply insulation and jacketing materials with precise concentricity and wall thickness, critical for maintaining signal characteristic impedance and ensuring effective electromagnetic shielding, particularly for cords used in high-frequency data applications.

Innovation in the market is also heavily concentrated on material technology, specifically the development of new polymer compounds and composite materials. Manufacturers are increasingly utilizing flame-retardant, low-smoke, zero-halogen (LSZH) materials for cords deployed in public infrastructure and confined spaces to enhance safety compliance. For harsh industrial and automotive environments, the technological focus is on cross-linked elastomers and thermoplastic polyurethanes (TPU/TPE) that offer superior flexibility, thermal stability up to 150°C, and excellent resistance to oils, abrasion, and UV exposure, extending the product lifecycle significantly. The use of advanced shielding techniques, including tightly woven copper braids, foil wraps, and conductive fillers, is becoming standard practice to mitigate electromagnetic interference (EMI) and radio-frequency interference (RFI), which are critical concerns in densely packed electronic systems where interference can severely degrade system performance.

Looking forward, the integration of smart technology represents the next frontier for DIP Cords. This involves embedding micro-sensors and passive RFID or NFC tags directly into the cord's jacket or connector housing during the overmolding process. These integrated features enable real-time monitoring of critical parameters such as cable temperature, mechanical strain, or operational hours, allowing for proactive, condition-based maintenance strategies rather than reactive repairs. This shift transforms the traditional passive component into an intelligent element of the industrial internet of things (IIoT), providing valuable diagnostic data for the host system. Additionally, the increasing demand for miniaturization is driving advancements in micro-coaxial cable technology and ultra-fine pitch connectors that require nanometer-scale precision in assembly and termination processes, pushing the boundaries of current manufacturing capabilities and demanding specialized cleanroom assembly environments.

Regional Highlights

The global DIP Cords market exhibits distinct regional dynamics driven by local manufacturing concentrations, technological adoption rates, and regulatory environments. North America and Europe represent mature, high-value markets characterized by demand for specialized, low-volume, high-reliability cords primarily serving the aerospace, defense, medical device, and high-end industrial automation sectors. These regions emphasize compliance with rigorous standards (e.g., AS9100, medical device regulations) and often prioritize technical sophistication and material provenance over marginal cost savings. The presence of major automotive research and development centers in Germany and the robust defense contracting sector in the United States maintain a consistent demand for highly customized, high-specification DIP cord assemblies, driving technological innovation focused on extreme performance parameters like resistance to nuclear, biological, and chemical (NBC) agents or ultra-high flexing capabilities.

Asia Pacific (APAC) dominates the market in terms of volume and is the fastest-growing region, fueled by the vast concentration of global consumer electronics, IT hardware, and automotive (internal combustion engine and EV) manufacturing bases, particularly in China, Japan, South Korea, and Southeast Asian nations. The region benefits from lower manufacturing costs and substantial government investments in smart factory initiatives and communication infrastructure expansion (5G rollout), generating colossal demand for standard and customized DIP cords. This rapid industrialization, combined with the region’s role as the world's primary manufacturing hub, positions APAC as the epicenter for both high-volume commodity cord production and rapid adoption of mid-range specialized cords needed for domestically produced industrial machinery and renewable energy systems, resulting in intense price competition among local and international suppliers.

Latin America and the Middle East & Africa (MEA) currently hold smaller, yet rapidly expanding, market shares. Growth in MEA is primarily driven by large-scale oil and gas investments requiring ruggedized, explosion-proof cable assemblies, coupled with increasing infrastructure spending in construction and telecommunications, particularly in the UAE and Saudi Arabia. Latin America's market growth is tied to the recovery and expansion of regional automotive manufacturing (Brazil, Mexico) and agricultural machinery, demanding standard industrial cord sets. These regions represent significant untapped opportunity, particularly as local industrialization accelerates, gradually shifting their reliance from imported finished goods to establishing localized manufacturing and assembly plants that subsequently require a robust local supply chain for components like DIP Cords, necessitating a strategic focus on regional distribution networks and compliance with local electrical safety codes and regulations.

- Asia Pacific (APAC): Market volume leader and fastest growing, driven by massive consumer electronics and EV manufacturing; focus on high-volume production and competitive pricing.

- North America: High-value market focused on defense, aerospace, and advanced medical devices; emphasis on high reliability and strict regulatory compliance.

- Europe: Mature market characterized by advanced industrial automation, high-end automotive systems, and stringent environmental standards (RoHS, REACH); innovation focused on sustainable materials.

- Latin America (LATAM): Growth driven by recovery in the automotive sector and investment in local infrastructure development, primarily requiring standard and mid-range industrial cords.

- Middle East & Africa (MEA): Growth tied to oil and gas sector (ruggedized cords) and large infrastructural projects (telecom, construction); demand centered on extreme environment tolerance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DIP Cords Market.- TE Connectivity

- Amphenol Corporation

- Delphi Technologies

- Molex (A Subsidiary of Koch Industries)

- Yazaki Corporation

- Sumitomo Electric Industries

- Aptiv PLC

- Prysmian Group

- Belden Inc.

- 3M Company

- Leoni AG

- Huber+Suhner

- Nexans

- LAPP Group

- HELUKABEL

- Alpha Wire

- Southwire Company

- General Cable (A Brand of Prysmian Group)

- Volex PLC

- Phoenix Contact

Frequently Asked Questions

What is a DIP Cord and where is it primarily utilized?

A DIP Cord, or Dual In-line Package Cord, refers to specialized electrical cable assemblies and harnesses designed for precise, multi-pin interconnection, often terminated with connectors compatible with DIP electronic interfaces or custom industrial connections. They are primarily utilized in mission-critical applications across industrial automation, automotive electronics (especially EVs), medical diagnostic equipment, and telecommunication infrastructure where signal integrity and reliability are paramount for system functionality.

What are the primary factors driving the growth of the DIP Cords Market?

Market growth is largely propelled by the global acceleration of industrial automation and the proliferation of IoT devices, which necessitate high volumes of reliable interconnects. Furthermore, the rapid expansion of the Electric Vehicle (EV) industry, requiring complex, high-voltage, and thermally stable wiring harnesses for battery management systems, acts as a significant demand catalyst. Technological advancements in miniaturization also drive the need for specialized, compact cord sets.

How is raw material volatility impacting DIP Cord manufacturers?

The extreme volatility in the cost of copper (the primary conductor material) and specialized polymers (for insulation) directly impacts the manufacturing costs and profit margins of DIP Cord producers. Manufacturers must employ robust hedging strategies, diversify their supply chain geographically, and focus on vertical integration to mitigate these pricing risks and ensure stable output pricing for long-term OEM contracts.

Which geographical region holds the largest market share for DIP Cords?

The Asia Pacific (APAC) region currently holds the largest market share in terms of production volume, driven by the massive concentration of global manufacturing bases for consumer electronics, automotive components, and general industrial equipment in countries like China, Japan, and South Korea. This region benefits from favorable manufacturing ecosystems and aggressive infrastructure development, making it the highest volume market.

How does AI technology affect the quality control process for DIP Cords?

AI technology significantly enhances quality control by implementing machine vision systems powered by deep learning algorithms. These systems perform automated, high-speed inspection of critical processes like crimping and molding, detecting microscopic flaws, wire sequencing errors, and insulation inconsistencies with far greater precision and speed than human inspection, thereby ensuring superior product reliability essential for mission-critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager