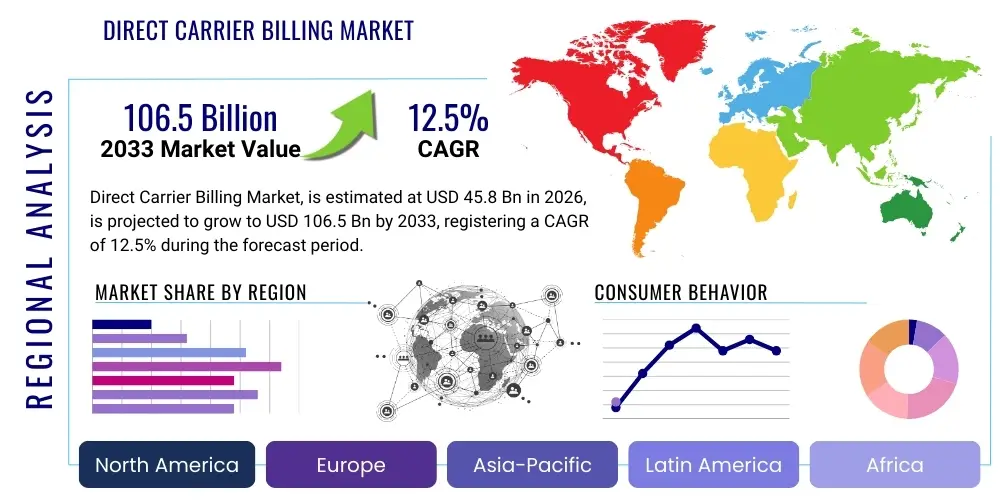

Direct Carrier Billing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439120 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Direct Carrier Billing Market Size

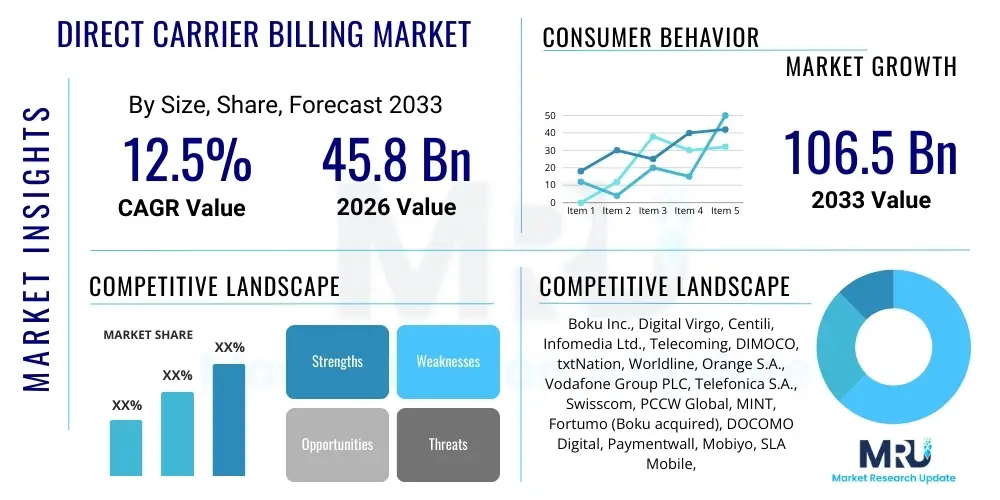

The Direct Carrier Billing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 106.5 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing ubiquity of mobile connectivity across developing economies and the sustained demand for seamless, secure, and accessible digital transaction methods that bypass traditional banking infrastructure.

Market expansion is particularly driven by the adoption of subscription services, digital content, and mobile gaming, areas where DCB offers unparalleled ease of use for micropayments. The transition towards 5G networks and the resultant increase in mobile data consumption are creating fertile grounds for telecom operators to monetize their subscriber base through integrated billing services. Furthermore, partnerships between Mobile Network Operators (MNOs) and large digital content providers (such as streaming platforms and app stores) are standardizing DCB as a primary payment option, cementing its role in the global digital economy.

Direct Carrier Billing Market introduction

Direct Carrier Billing (DCB) is a payment mechanism that allows consumers to purchase digital goods, physical goods (in some contexts), or services by charging the cost directly to their mobile phone bill or deducting it from their prepaid credit. This system acts as a crucial bridge for the unbanked and underbanked populations, providing a readily available and highly convenient method of payment requiring only a mobile subscription. The product description of DCB involves a complex technological infrastructure facilitated by aggregators who connect MNOs with merchants, ensuring secure authentication and transactional processing without requiring sensitive financial details like credit card numbers.

Major applications of DCB span across several high-growth sectors, including mobile gaming (in-app purchases, subscriptions), streaming services (music and video content), digital media subscriptions (news, e-books), and utility payments, particularly in regions with low credit card penetration. The primary benefits of DCB include unparalleled user convenience, high conversion rates for merchants due to the frictionless checkout process, enhanced security (as no banking information is shared), and reduced churn rates for subscription services. These inherent advantages position DCB as a critical component in the mobile monetization landscape, especially for small-value transactions.

Key driving factors propelling the DCB market include the exponential rise in smartphone ownership globally, particularly in Asia Pacific and Africa; the increased consumption of digital content fueled by faster mobile networks; and the strategic push by MNOs to diversify revenue streams beyond traditional voice and data services. Regulatory environments, while challenging in some respects, are gradually becoming more supportive of mobile financial services, further enabling DCB market penetration and standardization across borders, thereby solidifying its status as a viable alternative payment method.

Direct Carrier Billing Market Executive Summary

The Direct Carrier Billing market demonstrates vigorous expansion driven by synergistic business trends focused on strategic partnerships between Mobile Network Operators (MNOs) and global Over-The-Top (OTT) content providers. A critical business trend involves the shift towards subscription-based models, which leverage the recurring billing capabilities inherent in DCB systems. Furthermore, market players are heavily investing in sophisticated fraud detection technologies to instill greater merchant trust and minimize revenue leakage, which is paramount for sustainable long-term growth. The industry is witnessing a consolidation phase where technology aggregators are playing a central role in simplifying the integration complexity for smaller merchants, standardizing APIs, and extending geographical reach.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, fueled by vast unbanked populations and robust mobile-first payment behaviors, particularly in India, Indonesia, and Southeast Asia. Europe, characterized by stringent data protection laws (like GDPR), focuses on enhancing the security and compliance aspects of DCB, positioning the method as a highly trustworthy option for digital content consumption. North America, while historically slower due to high credit card penetration, is seeing specialized DCB adoption for micro-transactions and services targeting specific demographic segments not fully utilizing traditional finance. Emerging markets in Latin America and the Middle East & Africa (MEA) are vital opportunity zones, propelled by increasing infrastructure investment and a societal leapfrogging directly to mobile commerce.

Segmentation trends highlight that the Application segment, specifically mobile gaming and video streaming, contributes the largest share of revenue due to high transaction volumes and recurring payments. From the User Type perspective, the Prepaid segment continues to hold a significant market share, especially in emerging economies where prepaid mobile subscriptions dominate the landscape, benefiting from instantaneous credit deduction. Platform trends show that Android-based transactions command higher volumes globally, correlating with Android's massive global smartphone market share, although iOS transactions often reflect a higher Average Revenue Per User (ARPU) in developed markets, necessitating tailored DCB strategies for each operating system.

AI Impact Analysis on Direct Carrier Billing Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can safeguard DCB transactions against rising sophistication in fraudulent activities, such as premium SMS scams and unauthorized third-party charges. Common questions also revolve around AI’s role in personalizing payment offers, predicting user churn based on billing history, and automating the notoriously complex reconciliation process between MNOs, aggregators, and merchants. Key concerns center on whether AI implementation will lead to faster authorization times without compromising security, and how predictive analytics can be leveraged to optimize pricing strategies for digital content, ultimately enhancing the monetization capability of MNOs and content providers.

The integration of AI is transforming DCB operations from a reactive loss prevention mechanism to a proactive revenue generation tool. AI algorithms significantly enhance fraud detection by analyzing immense volumes of transactional data in real-time, identifying complex patterns that are invisible to rule-based systems, thus drastically reducing chargebacks and improving merchant confidence. Furthermore, ML models are crucial for segmentation and personalization; they can predict a user's likelihood of purchasing specific digital content via DCB based on their usage history, location, and device type, allowing MNOs to deliver highly targeted promotions directly into the user interface or through personalized billing alerts.

Operational efficiency is another domain profoundly impacted by AI; automated systems utilizing Natural Language Processing (NLP) are streamlining customer support related to billing inquiries, providing instant resolutions, and reducing the operational load on call centers. AI also plays a pivotal role in optimizing traffic routing and load balancing within the DCB infrastructure, ensuring high availability and minimal latency during peak transaction periods. This pervasive technological integration is moving the DCB ecosystem towards 'smart monetization,' ensuring scalability and improved profitability while mitigating regulatory risks associated with financial transactions.

- AI enhances real-time fraud detection through behavioral analytics and anomaly recognition.

- Machine Learning optimizes dynamic pricing and personalized promotional offers for content monetization.

- Predictive modeling forecasts subscriber churn risk related to billing disputes or high usage.

- Automated reconciliation systems reduce operational costs and time associated with settling payments between stakeholders.

- Natural Language Processing (NLP) improves the efficiency and accuracy of customer service for billing queries.

- AI-driven authentication protocols strengthen user verification without requiring additional friction.

- Optimization algorithms improve network traffic management specific to transaction processing, enhancing latency.

DRO & Impact Forces Of Direct Carrier Billing Market

The DCB market is governed by a robust set of dynamic forces: Drivers include the unmatched convenience and security of mobile payments, eliminating the need for bank accounts or credit cards, which is a major accelerator in emerging markets. Restraints often center on the persistent threat of mobile fraud (e.g., fraudulent subscriptions, phishing scams), which erodes consumer trust, along with complex and often fragmented regulatory requirements across different jurisdictions that complicate cross-border scaling. Opportunities are vast, primarily tied to the global expansion of high-monetization services like 5G-enabled cloud gaming and high-definition video streaming, and the strategic expansion of DCB into utility payments and transportation ticketing, transforming it from a niche content payment solution into a holistic mobile payment method.

Impact forces dictate the overall market momentum. The significant shift towards subscription economies globally places DCB at a strategic advantage, as its inherent capability for managing recurring monthly payments simplifies the user experience for services like Netflix, Spotify, or various utility bundles offered by MNOs. However, the rapidly evolving competition from mobile wallets (e.g., Apple Pay, Google Pay) and local fintech solutions presents a considerable challenge, requiring DCB providers to continuously innovate and integrate value-added services, such as loyalty programs or installment payment options. The regulatory scrutiny on consumer protection, particularly regarding transparency of charges and ease of unsubscribing, further acts as a critical impact force, mandating high levels of operational compliance and technical sophistication.

The interplay of these factors suggests a highly competitive environment where success is defined by technological reliability, secure aggregation platforms, and the ability to forge strong, mutually beneficial partnerships between MNOs and global content developers. Sustained infrastructure investment, especially in secure API development and robust data analytics for fraud management, is essential for capitalizing on the increasing mobile penetration rates. Furthermore, proactive engagement with regulatory bodies to establish clear, standardized consumer protection guidelines will be vital for mitigating risks and unlocking full market potential, especially in new geographic territories where mobile commerce is just beginning to mature.

Segmentation Analysis

The Direct Carrier Billing Market segmentation provides a granular view of market dynamics, categorized typically by Component (Solution and Service), End User (App Store/Aggregator, MNO, Merchant), Platform (iOS, Android, Windows), and Application (Digital Content, Gaming, Subscriptions). Analyzing these segments helps stakeholders—from MNOs to independent software vendors—identify high-growth niches and tailor their offerings effectively. The Solution segment, encompassing the core billing platforms and gateway technology, is crucial for market infrastructure, while the Service segment, which includes technical support, integration, and fraud management, is seeing accelerated growth due to the complex regulatory and operational demands of the modern digital landscape. Understanding these segment differences allows for optimized resource allocation and targeted marketing strategies.

The dominance of the Application segment, particularly digital content and mobile gaming, underscores the core value proposition of DCB: ease of transaction for high-volume, low-value items. The strategic move by major app stores to actively promote DCB as an alternative payment option, especially in markets where credit card usage is low, confirms the importance of the App Store/Aggregator End User segment. Furthermore, the segmentation by Platform is essential for content developers, as the monetization models and integration requirements vary significantly between open-source systems like Android and closed ecosystems like iOS, necessitating tailored technical solutions to maximize reach and conversion rates across all device types.

Future growth is expected to be concentrated in the Subscription segment, driven by the global shift towards recurring revenue models for software and media services. The increased competition requires DCB providers to move beyond mere transaction processing and offer comprehensive analytics and value-added services, thereby elevating the Service component's market share. Moreover, the Merchant segment, encompassing everything from small independent developers to large e-commerce platforms, is expanding rapidly as more non-traditional services recognize the high conversion benefits of integrating carrier billing, ensuring that segmentation analysis remains a vital tool for strategic market mapping.

- Component:

- Solutions (Billing Gateway, Authentication System)

- Services (Managed Services, Professional Services, Fraud Management)

- Platform:

- Android

- iOS

- Other (Windows, Feature Phones)

- User Type:

- Prepaid

- Postpaid

- Application:

- Mobile Gaming

- Video and Audio Streaming

- Digital Content and Apps

- Ticketing and Utility Payments

- End User:

- Mobile Network Operators (MNOs)

- Aggregators/Vendors

- Merchants (Content Providers)

Value Chain Analysis For Direct Carrier Billing Market

The Direct Carrier Billing value chain is intricate, involving multiple critical stakeholders who collaborate to deliver seamless transaction processing. The chain begins with the upstream analysis, which primarily involves Mobile Network Operators (MNOs) as the central infrastructure providers, owning the billing relationship and the network connection. Also upstream are the core technology providers who supply the billing platform infrastructure and secure API interfaces. These entities invest heavily in network maintenance, compliance infrastructure, and the underlying technological stacks that enable the secure transfer of billing data and user authentication, forming the foundational layer of the DCB ecosystem. The efficiency and reliability of these upstream components directly influence the entire system's performance and scalability.

The middle segment is dominated by DCB Aggregators (or payment vendors), who act as the essential bridge connecting thousands of content merchants to hundreds of MNOs globally. These aggregators handle complex tasks such as localized regulatory compliance, currency conversions, fraud scrubbing, and managing the technical integration through standardized APIs. Their role is critical in driving the widespread adoption of DCB by simplifying the integration process for merchants, thereby accelerating the time-to-market for digital products. Aggregators are also responsible for managing distribution channels, which include direct integration with major app stores and indirect partnerships with advertising networks and digital marketing agencies.

The downstream analysis focuses on the final delivery and consumption of services. This involves the Merchants (content providers, app developers, streaming services) who utilize DCB to monetize their offerings, and ultimately, the End Consumer, who initiates the transaction. The distribution channels are predominantly digital and indirect, flowing through the content ecosystems (like Google Play or Apple App Store) or directly via merchant websites integrated with aggregator services. The effectiveness of the value chain is measured by conversion rates at the consumer level, timely reconciliation between merchants and MNOs, and the overall security and transparency maintained throughout the transaction lifecycle, ensuring stakeholder satisfaction and sustainable revenue sharing.

Direct Carrier Billing Market Potential Customers

The primary potential customers and end-users of Direct Carrier Billing services are diverse, ranging from individual consumers seeking convenience to large multinational corporations requiring high conversion rates in difficult-to-penetrate markets. Foremost among end-users are digital content consumers, specifically mobile gamers who make frequent micro-transactions for in-game assets, and subscribers to audio and video streaming services who prefer the simplicity of charging recurring fees directly to their phone bill. This consumer segment values the immediate accessibility and security offered by DCB, particularly in markets where credit card ownership remains low or where users are hesitant to share sensitive financial data online.

On the enterprise side, the immediate buyers of DCB services are Merchants and Content Aggregators. High-volume merchants, such as global Over-The-Top (OTT) platforms (e.g., streaming providers, social media services offering premium features), view DCB as a non-negotiable payment option to maximize global reach and reduce payment friction, especially in developing economies. Furthermore, governmental agencies and local municipalities are emerging customers, utilizing DCB for minor public service payments, such as parking fees, public transport ticketing, and low-cost utility bills, capitalizing on the high penetration rate of mobile phones within the population.

The long-term growth potential lies in expanding the customer base beyond traditional digital content. Emerging segments include utility providers looking for efficient low-cost billing solutions for customers, and physical goods e-commerce platforms exploring carrier billing for low-value impulse buys, particularly those marketed through mobile advertising. Essentially, any business that requires high transactional volume, quick payment authorization, and accessibility across all demographics, irrespective of banking status, represents a prime potential customer for integrating advanced DCB solutions into their core monetization strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 106.5 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boku Inc., Digital Virgo, Centili, Infomedia Ltd., Telecoming, DIMOCO, txtNation, Worldline, Orange S.A., Vodafone Group PLC, Telefonica S.A., Swisscom, PCCW Global, MINT, Fortumo (Boku acquired), DOCOMO Digital, Paymentwall, Mobiyo, SLA Mobile, Telenor Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direct Carrier Billing Market Key Technology Landscape

The Direct Carrier Billing market is underpinned by a sophisticated technological landscape centered on secure transaction processing, robust API management, and advanced authentication protocols. A critical element is the core Billing Gateway infrastructure, which must integrate seamlessly with the MNO’s internal billing systems (often leveraging legacy BSS/OSS systems) while providing modern, standardized APIs (Application Programming Interfaces) for aggregators and merchants. These APIs must handle high transaction volumes with extremely low latency, ensuring real-time authorization and confirmation, which is essential for maintaining a frictionless user experience. Furthermore, the shift towards microservices architecture is enabling DCB providers to deploy and update features more rapidly, enhancing scalability and resilience against system failures.

Security technologies form the backbone of trust in the DCB ecosystem. This includes robust mechanisms for user authentication, such as Mobile Originated (MO) confirmation, One-Time Passwords (OTPs), and increasingly, advanced biometric verification tools integrated via the mobile operating system. Fraud management relies heavily on Machine Learning (ML) algorithms that analyze transactional metadata, device fingerprints, IP addresses, and behavioral patterns to detect and mitigate fraudulent activity instantly. The adoption of tokenization, where sensitive billing identifiers are replaced with non-sensitive substitutes, further enhances security, particularly in subscription models, reducing the risk of data breaches for both MNOs and merchants, while ensuring compliance with global data protection standards.

Emerging technologies are also influencing the future of DCB. Blockchain technology is being explored for its potential to create immutable, transparent ledgers for reconciliation and settlement between multiple parties (MNOs, aggregators, merchants), potentially reducing disputes and streamlining the notoriously complex financial closing process. Furthermore, the deployment of 5G networks is enabling new high-bandwidth, low-latency applications (like cloud gaming and augmented reality services) that require instant, secure payment processing, pushing DCB platforms to enhance their capacity and speed. This technological evolution ensures DCB remains competitive against alternative payment methods by offering unparalleled speed and system reliability in the evolving mobile commerce ecosystem.

Regional Highlights

The global Direct Carrier Billing market exhibits distinct geographical dynamics influenced by regulatory frameworks, smartphone penetration, and consumer banking habits. North America, while having high credit card usage, shows strategic DCB adoption focusing on niche content and youth markets, often driven by partnerships between major carriers and prominent digital content providers. Europe presents a mature market characterized by strict data privacy and consumer protection regulations (like PSD2 and GDPR), which necessitate high operational standards for DCB providers, making security and transparency key differentiators. Countries like the UK and Germany demonstrate high DCB usage for media and entertainment subscriptions, benefiting from well-established regulatory clarity.

Asia Pacific (APAC) stands out as the highest-growth region, driven by sheer population size, rapidly increasing smartphone penetration, and a significant unbanked population relying solely on mobile subscriptions for digital access. Markets in Southeast Asia (e.g., Indonesia, Vietnam, Philippines) and India are experiencing exponential growth in mobile gaming and digital content consumption, where DCB is often the default or only viable payment mechanism for millions of users. MNOs in this region are aggressively expanding their DCB partnerships to capture a larger share of the digital economy, investing heavily in infrastructure to handle the massive transaction volumes characteristic of these emerging mobile-first populations.

Latin America (LATAM) and the Middle East and Africa (MEA) are critical emerging markets characterized by strong prepaid mobile usage and low penetration of traditional financial instruments. In LATAM, DCB provides essential access to global content services, overcoming geographical barriers and banking limitations. Similarly, in MEA, especially Sub-Saharan Africa, DCB is a vital tool for enabling digital commerce, sometimes extending into essential services like electricity top-ups and micro-insurance. The expansion in these regions is heavily dependent on MNO consolidation and regulatory stability, as DCB offers a foundational layer for mobile financial inclusion, making these areas key investment targets for global DCB aggregators.

- Asia Pacific (APAC): Dominates market growth due to vast unbanked populations, high smartphone adoption, and exponential demand for mobile gaming and streaming services. Key markets include China, India, and Indonesia.

- Europe: Mature market focused on compliance, security, and integration with subscription services. Strong regulatory environment (GDPR, PSD2) dictates high standards for DCB platforms.

- North America: Strategic niche adoption for micro-transactions, digital media, and services targeting segments underserved by traditional banking. High ARPU in digital content.

- Latin America (LATAM): High growth potential fueled by low credit card usage and strong prepaid mobile culture. DCB facilitates access to global entertainment and utility services.

- Middle East and Africa (MEA): Emerging powerhouse where DCB is crucial for financial inclusion and enabling mobile commerce for essential and digital services across sub-Saharan Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direct Carrier Billing Market.- Boku Inc.

- Digital Virgo

- Centili

- Infomedia Ltd.

- Telecoming

- DIMOCO

- txtNation

- Worldline

- Orange S.A.

- Vodafone Group PLC

- Telefonica S.A.

- Swisscom

- PCCW Global

- MINT

- Fortumo (Boku acquired)

- DOCOMO Digital

- Paymentwall

- Mobiyo

- SLA Mobile

- Telenor Group

Frequently Asked Questions

Analyze common user questions about the Direct Carrier Billing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Direct Carrier Billing (DCB) and why is it important for the unbanked population?

Direct Carrier Billing is a mobile payment mechanism that allows users to charge purchases for digital goods or services directly to their mobile phone bill or prepaid balance. It is crucially important for the globally unbanked population because it bypasses the requirement for traditional bank accounts, credit cards, or complex financial registrations, enabling immediate access to the digital economy using only a standard mobile subscription.

How does the Direct Carrier Billing market mitigate the risk of fraud?

The DCB market mitigates fraud primarily through advanced technological integration, including real-time authentication protocols like Mobile Originated (MO) confirmation and One-Time Passwords (OTPs). Increasingly, dedicated anti-fraud platforms leverage Machine Learning (ML) and AI to analyze transactional behavior, identifying and blocking suspicious patterns, device anomalies, and unauthorized third-party charges instantly before they can impact consumer trust or merchant revenue.

What major segments drive the revenue growth in the DCB market?

The primary revenue growth drivers are the Application segments, specifically mobile gaming (in-app purchases and subscriptions) and digital media streaming (video and audio services). These segments generate high transactional volume and often rely on recurring billing models, which DCB systems efficiently manage. Additionally, the Asia Pacific region, due to its massive mobile user base, is the highest geographical contributor to overall market revenue.

What is the role of Mobile Network Operators (MNOs) in the Direct Carrier Billing value chain?

Mobile Network Operators (MNOs) are the foundational stakeholders in the DCB value chain. They own the critical billing relationship with the consumer and the telecommunications infrastructure. Their role encompasses authenticating the user, processing the transaction through their internal billing systems, collecting the payment on behalf of the merchant, and managing the overall settlement and reconciliation process with the DCB aggregators.

What is the impact of 5G technology on the future growth of Direct Carrier Billing?

5G technology is expected to significantly boost DCB growth by enabling new high-bandwidth, low-latency applications such as cloud gaming, AR/VR experiences, and high-definition streaming services. These advanced services necessitate instant and frictionless payment solutions. 5G’s enhanced capacity and speed facilitate higher transaction volumes and open DCB up to new, highly monetizable services that demand secure, real-time micro-transaction capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Direct Carrier Billing Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Direct Carrier Billing Market Size Report By Type (Limited DCB, Pure DCB, MSISDN Forwarding, PIN or MO Base Window, Others), By Application (Apps and Games, Online Media and Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Direct Carrier Billing Platform Market Size Report By Type (Limited DCB, Pure DCB, MSISDN Forwarding, PIN or MO Base Window, Others), By Application (Apps and Games, Online Media and Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager