Distribution System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431772 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Distribution System Market Size

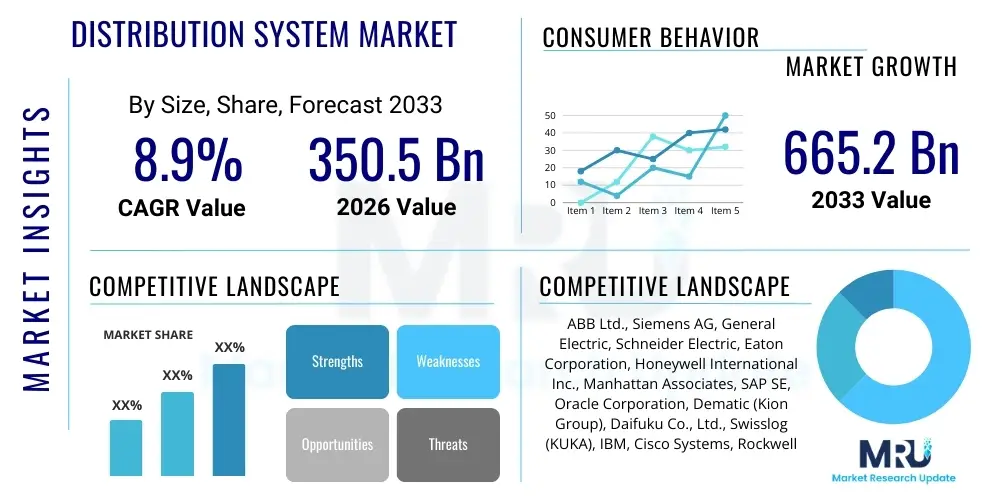

The Distribution System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 665.2 Billion by the end of the forecast period in 2033.

Distribution System Market introduction

The Distribution System Market encompasses the technologies, hardware, software, and services required to efficiently move products, services, or energy from the point of origin to the point of consumption. This broad market includes sophisticated supply chain logistics, modern electrical grid infrastructure (Smart Grids), and complex software platforms managing inventory and flow. Modern distribution systems are critical infrastructure for global commerce, ensuring reliability, speed, and cost-effectiveness across various sectors, including power utilities, retail, manufacturing, and e-commerce.

The core product offerings within this market range from automated material handling equipment (like robotics and conveyors) and warehouse management systems (WMS) to advanced distribution management systems (DMS) used by power utilities to regulate voltage and manage distributed energy resources (DERs). Major applications span last-mile delivery optimization, dark store management, integration of renewable energy sources into the grid, and sophisticated inventory tracking through technologies like RFID and IoT sensors. The increasing complexity of global supply chains and the rapid urbanization and electrification drive continuous demand for advanced, scalable, and resilient distribution solutions.

Key benefits derived from investing in advanced distribution systems include enhanced operational efficiency, significant reduction in energy waste and logistical errors, improved customer satisfaction through faster and more accurate deliveries, and increased grid resilience against physical and cyber threats. Driving factors for market expansion are primarily the exponential growth of e-commerce necessitating faster fulfillment networks, government mandates for modernizing aging power infrastructure, and the continuous push towards industrial automation (Industry 4.0) to achieve competitive advantages in dynamic global markets.

Distribution System Market Executive Summary

The Distribution System Market is currently experiencing transformative growth fueled by interconnected business trends centered on digitization and sustainability. Key business trends include the massive influx of venture capital into logistics automation startups, the consolidation of major software providers offering end-to-end supply chain visibility solutions, and a significant shift in utility spending towards non-wires alternatives (NWAs) and grid edge management systems. Companies are increasingly prioritizing scalable cloud-based distribution platforms over legacy on-premise solutions, driving recurring revenue models and enhancing market valuation multiples.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure spending in countries like China and India, coupled with the world's highest density of e-commerce activity. North America and Europe, while mature, lead in adopting sophisticated technologies such as AI-driven route optimization and high-voltage DC (HVDC) transmission distribution, emphasizing cybersecurity and integration of complex renewable sources. Emerging markets in Latin America and MEA are seeing substantial foundational investments, particularly in cold chain logistics for pharmaceuticals and perishable goods, indicating robust long-term potential as trade corridors mature.

Segmentation trends highlight the dominance of the Software and Services segments, particularly those focusing on predictive analytics and prescriptive maintenance within both logistics and utility domains. Within the application segment, the E-commerce and Retail sector demonstrates the highest velocity of adoption, constantly seeking faster and more flexible distribution models. Technology-wise, the convergence of IoT for real-time asset tracking and edge computing for localized control in smart substations are critical factors defining competitive advantage, suggesting that integration capabilities will be the determining factor for segment leadership over the next five years.

AI Impact Analysis on Distribution System Market

Users frequently inquire about AI's role in optimizing delivery routes, forecasting demand volatility, and enhancing grid reliability management. Common concerns revolve around data privacy when integrating AI across diverse physical assets, the cost of implementing machine learning models on legacy infrastructure, and the potential displacement of human labor in warehouse and logistical operations. Expectations are high regarding AI’s ability to move beyond reactive management toward truly predictive and prescriptive distribution, allowing for dynamic re-routing of goods or power flows in real-time based on fluctuating environmental or operational factors. Users are specifically seeking validated case studies demonstrating measurable ROI in inventory optimization and fault detection within utility distribution networks.

The key themes emerging from user questioning indicate a strong desire to leverage AI for complex decision-making processes that human operators find challenging due to data volume and velocity. This includes optimizing multimodal transport logistics, dynamically adjusting inventory placement based on hyper-local demand signals, and utilizing computer vision in warehouses for error reduction and quality control. Furthermore, in the energy sector, users are focused on how AI can manage the intermittent nature of renewable energy, predict grid congestion, and isolate faults much faster than traditional SCADA (Supervisory Control and Data Acquisition) systems, thereby minimizing outage duration and improving overall service quality. The shift is less about basic automation and more about achieving cognitive optimization throughout the entire distribution lifecycle.

- AI-driven route optimization reduces fuel consumption and delivery times by analyzing real-time traffic and weather conditions.

- Predictive maintenance using machine learning identifies potential equipment failures (e.g., transformers, conveyors) before they occur, minimizing downtime.

- Advanced demand forecasting improves inventory accuracy and reduces stockouts/overstocking in retail distribution centers.

- AI enhances grid resilience by rapidly detecting, isolating, and restoring power faults in complex smart distribution networks.

- Natural Language Processing (NLP) streamlines communication and improves efficiency in processing customer service inquiries related to distribution status.

- Computer vision systems automate quality checks and ensure accurate parcel sorting within high-throughput distribution hubs.

- Algorithmic pricing and dynamic allocation of resources optimize capacity utilization across fragmented distribution channels.

DRO & Impact Forces Of Distribution System Market

The Distribution System Market is profoundly shaped by powerful drivers such as the relentless expansion of e-commerce, which mandates faster and more complex distribution networks globally. Concurrently, strict regulatory requirements pushing for grid modernization and the integration of decentralized energy sources (DERs) act as a significant impetus for technology adoption in the utility sector. Restraints include the extremely high upfront capital expenditure required to overhaul legacy physical infrastructure and the persistent cybersecurity risks associated with interconnected, smart distribution systems. Opportunities are vast in developing specialized cold chain logistics solutions for pharmaceuticals and foods, and in leveraging 5G and edge computing to enable low-latency, real-time control across sprawling distribution ecosystems, positioning the market for sustained, technology-led growth despite economic volatility.

A primary driver is the accelerating trend toward urbanization, which complicates last-mile delivery and increases the density demands on utility distribution infrastructure. Smart cities initiatives globally are adopting integrated distribution platforms to manage everything from waste removal logistics to energy consumption, creating a holistic demand pull for sophisticated solutions. Furthermore, the global mandate for supply chain resilience, exacerbated by recent geopolitical tensions and the COVID-19 pandemic, forces companies to invest in highly flexible and localized distribution systems capable of rapid pivoting. These factors collectively push market participants toward adopting IoT and advanced analytics to optimize physical asset performance and material flow.

Impact forces currently shaping the competitive landscape include regulatory changes requiring standardized data exchange (interoperability) across the supply chain, forcing technology providers to develop open-architecture solutions. The rising cost of labor, particularly in warehousing and transportation, is accelerating the adoption of robotics and fully automated storage and retrieval systems (AS/RS), shifting investment from operational costs to capital expenditure. Conversely, environmental, social, and governance (ESG) pressures are influencing distribution strategies, favoring sustainable logistics (electric vehicle fleets, optimized packaging, and reduced carbon footprint in supply chain design), making sustainability a critical differentiator in procurement decisions.

- Drivers: E-commerce growth, Grid Modernization mandates, Industrial Automation (Industry 4.0), Rise of Distributed Energy Resources (DERs).

- Restraints: High initial investment costs, Cybersecurity vulnerability, Integration challenges with legacy systems, Skilled labor shortage for maintenance.

- Opportunities: Specialized Cold Chain logistics, Deployment of 5G and Edge Computing, Application of Blockchain for supply chain transparency, Autonomous delivery vehicles.

- Impact Forces: ESG compliance requirements, Labor cost inflation, Regulatory push for interoperability, Geopolitical disruption demanding supply chain redundancy.

Segmentation Analysis

The Distribution System Market is primarily segmented based on the components used (Hardware, Software, Services), the technology deployed (Smart Grid, SCADA, WMS, TMS), and the major application sectors (Utilities, Retail & E-commerce, Manufacturing, Automotive). This multi-layered segmentation allows for precise targeting of solutions, recognizing that the distribution needs of a massive power utility managing high-voltage lines are distinct from those of an e-commerce giant managing millions of daily parcel movements. The dominance of the software segment, particularly specialized analytic and optimization platforms, reflects the market's current trajectory towards cognitive logistics and predictive grid management, where data utilization drives efficiency gains far exceeding those from simple physical upgrades.

Geographic segmentation remains crucial, with high-growth regions prioritizing infrastructure build-out (hardware and basic WMS implementation), while mature markets focus intensively on value-added services, system integration, and advanced optimization algorithms. The trend towards vertical specialization is also notable; for instance, the demand for highly regulated cold chain distribution systems is segmenting itself away from general logistics, driven by strict requirements from the pharmaceutical and specialized food industries. This granular specialization ensures that solutions are highly compliant and optimized for specific regulatory and physical constraints.

- By Component:

- Hardware (Transformers, Switchgears, Substations, Conveyors, Robotics)

- Software (Distribution Management System (DMS), Warehouse Management System (WMS), Transportation Management System (TMS), SCADA)

- Services (Consulting, Integration & Deployment, Maintenance & Support)

- By Technology:

- Smart Grid Distribution

- Automation and Robotics

- Internet of Things (IoT) and Telemetry

- Cloud Computing

- Blockchain

- By Application:

- Utilities and Energy Sector

- Retail and E-commerce

- Manufacturing and Industrial

- Automotive and Transportation

- Pharmaceuticals and Healthcare

- Food and Beverage (Cold Chain)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Distribution System Market

The Value Chain for the Distribution System Market begins upstream with raw material suppliers and component manufacturers who provide essential items like advanced semiconductors, steel, polymers, and communication modules crucial for building hardware (e.g., transformers, sensors, robotics). This upstream activity requires high levels of R&D investment to ensure component reliability and efficiency, especially in power electronics and durable materials for ruggedized logistics equipment. Key activities at this stage include sourcing, primary component manufacturing, and the initial integration of embedded software into hardware units, setting the foundational quality and performance metrics for the entire system.

The midstream involves system integrators, software developers, and engineering, procurement, and construction (EPC) firms. This is the stage where customized solutions are designed, software platforms (WMS, DMS) are developed and configured, and the integration of diverse hardware and software components takes place. Distribution channels are varied: direct sales are common for high-value utility projects involving complex tenders, while indirect channels, relying on specialized value-added resellers (VARs) and third-party logistics (3PL) providers, dominate the retail and e-commerce logistics segment. The selection of the channel depends heavily on the complexity of the deployment and the required level of post-installation support.

Downstream activities center on deployment, maintenance, and support, reaching the end-users and buyers. Direct channels maintain control over installation and long-term service contracts, ensuring proprietary software and hardware performance is maximized. Indirect channels rely on regional service partners for last-mile support and localized technical assistance. The final step involves end-user utilization and continuous optimization, where data gathered by the distribution system is fed back to the midstream developers for software updates and efficiency improvements, completing the cyclical value chain and ensuring continuous system enhancement based on real-world operational feedback.

Distribution System Market Potential Customers

The primary consumers of distribution system solutions are large-scale enterprises and public utilities that manage complex, high-volume flows of materials or energy. In the energy sector, potential buyers are Investor-Owned Utilities (IOUs), Municipal Utilities, and Rural Electric Cooperatives seeking to modernize their aging grids, improve reliability indices (SAIDI/SAIFI), and effectively manage decentralized energy resources such as solar arrays and battery storage. These customers require robust, secure Distribution Management Systems (DMS) and physical grid hardening solutions to comply with stringent regulatory performance standards and meet increasing consumer demand for clean energy integration.

In the commercial sector, the largest buyer segment is dominated by Global Retailers, E-commerce Giants, and Third-Party Logistics (3PL) Providers. These buyers are focused intensely on optimizing their fulfillment capabilities, reducing operating expenses, and meeting extremely tight service level agreements (SLAs) for delivery speed and accuracy. Their purchases concentrate on automated warehouse systems (robotics, AS/RS), Transportation Management Systems (TMS) for complex multi-modal shipping, and specialized software for inventory planning and last-mile optimization. The buying cycle for these customers is driven by competitive necessity and scalability demands rather than regulatory mandate.

Other significant end-user/buyer groups include large multinational Manufacturers, particularly in the Automotive and Aerospace industries, who utilize distribution systems to manage intricate Just-in-Time (JIT) supply chains and internal factory logistics. Furthermore, the Healthcare and Pharmaceutical sector represents a high-growth segment, specifically demanding specialized, validated cold chain distribution systems capable of maintaining strict temperature control and transparency throughout the supply chain for sensitive products like vaccines and biologics. These customers prioritize compliance, traceability (often via blockchain), and system validation above pure cost minimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 665.2 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric, Schneider Electric, Eaton Corporation, Honeywell International Inc., Manhattan Associates, SAP SE, Oracle Corporation, Dematic (Kion Group), Daifuku Co., Ltd., Swisslog (KUKA), IBM, Cisco Systems, Rockwell Automation, Toshiba Corporation, Mitsubishi Electric, Tesla (Energy), UPS, FedEx |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Distribution System Market Key Technology Landscape

The Distribution System Market is undergoing a rapid technological evolution defined by convergence and decentralization. A central element is the proliferation of the Industrial Internet of Things (IIoT), which involves deploying millions of sensors, smart meters, and connected devices across both physical warehouses and power grids. This sensor layer generates the voluminous real-time data necessary for advanced analytics. This data deluge is managed by Edge Computing infrastructure, which processes information locally, allowing for near-instantaneous decision-making, crucial for tasks like immediate fault isolation in a smart grid or controlling autonomous guided vehicles (AGVs) on a warehouse floor without reliance on centralized cloud connectivity, thus minimizing latency and enhancing operational security.

Furthermore, the integration of Artificial Intelligence and Machine Learning (AI/ML) is transforming system capabilities from merely descriptive monitoring to prescriptive action. AI algorithms are used extensively for complex, multi-variable optimization problems, such as predicting equipment lifespan, optimizing inventory holding costs across a network of facilities, and dynamically adjusting voltage support based on instantaneous renewable energy generation. The energy sector relies heavily on sophisticated Distribution Management Systems (DMS) that leverage AI to coordinate Distributed Energy Resources (DERs) and manage bidirectional power flow, fundamentally shifting the grid from a centralized to a decentralized architecture. This necessitates robust cybersecurity frameworks, often incorporating quantum-resistant encryption, to protect critical infrastructure.

In logistics and supply chain distribution, Robotics and Advanced Automation Systems are standard technologies. Automated Storage and Retrieval Systems (AS/RS), autonomous mobile robots (AMRs), and sophisticated conveying systems are becoming essential to manage the high throughput demands of e-commerce fulfillment. Complementing this is the emergence of Blockchain technology, primarily used for building transparent and immutable records of product provenance, especially critical in pharmaceutical and food safety distribution chains. These technologies collectively focus on removing manual intervention, enhancing accuracy, reducing variable operating costs, and establishing a high degree of supply chain transparency and accountability from origin to destination.

Regional Highlights

The global Distribution System Market exhibits highly differentiated growth profiles and technology adoption rates across major regions, driven by local economic factors, regulatory environments, and infrastructure maturity. North America and Europe, representing mature economies, focus heavily on incremental improvements, sophisticated software integration, and system hardening, particularly in response to stringent cybersecurity and data privacy regulations (e.g., GDPR). Asia Pacific, however, leads in greenfield site deployment and sheer volume of new infrastructure investment, reflecting rapid industrialization and the massive scale of its domestic e-commerce markets.

The investment priorities across regions reflect local challenges. North America is characterized by large, decentralized power grids facing increasing weather-related stresses, driving demand for advanced sensor technologies and grid resilience software. European markets are characterized by a high penetration of renewable energy and electric vehicles (EVs), necessitating distribution systems capable of highly complex load management and V2G (vehicle-to-grid) integration. Conversely, Latin America and MEA are investing strategically in foundational infrastructure to unlock complex trade routes and modernize older facilities, with a strong emphasis on scalable, modular, and sometimes containerized distribution solutions to manage rapid deployment cycles in diverse geographic conditions.

- North America: Focus on Smart Grid resilience, cybersecurity, and logistics automation driven by high labor costs and complex regulatory environments.

- Europe: Leading adoption of EV charging infrastructure distribution, high integration of renewables, and robust compliance with sustainability (ESG) standards.

- Asia Pacific (APAC): Highest volume growth driven by e-commerce expansion, rapid urbanization, and massive government investment in utility modernization projects (especially China and India).

- Latin America (LATAM): Emerging market growth focused on infrastructure stability, cold chain logistics, and initial adoption of WMS/TMS solutions in key commercial hubs.

- Middle East and Africa (MEA): Significant investment in large-scale logistics hubs (e.g., Dubai, Saudi Arabia) and foundational smart power initiatives to support massive urbanization and diversification goals.

North America Distribution System Market Analysis

North America maintains a robust market position characterized by high technological maturity and significant ongoing investment in infrastructure resilience. The utility sector is heavily focused on replacing aging T&D (Transmission and Distribution) components and implementing advanced Distribution Automation (DA) and Fault Location, Isolation, and Service Restoration (FLISR) technologies. This expenditure is largely driven by regulatory incentives aimed at improving System Average Interruption Duration Index (SAIDI) and protecting critical grid assets from severe weather events and escalating cyber threats. The region is also a global leader in integrating sophisticated Demand Response (DR) programs, requiring highly granular distribution system management software to interact effectively with industrial and residential load resources.

In the logistics segment, the United States, in particular, dominates the global adoption of warehouse automation. High labor costs and intense competition among retail and e-commerce giants necessitate continuous investment in robotics, high-speed sortation systems, and predictive Transportation Management Systems (TMS). The rapid shift toward decentralized fulfillment models, including micro-fulfillment centers and dark stores, places unique demands on distribution software providers to offer flexible, scalable, and highly optimized inventory placement strategies. Furthermore, the region is pioneering the deployment of autonomous vehicles and drones for last-mile distribution, pushing the technological boundaries of delivery infrastructure.

The market benefits from a strong ecosystem of established technology vendors and innovative startups, particularly in software development (AI/ML for optimization) and specialized hardware manufacturing. Cybersecurity regulations, such as those imposed by NERC (North American Electric Reliability Corporation), mandate constant upgrades to network security infrastructure within distribution systems. This regulatory pressure ensures sustained investment in security services and compliant hardware, positioning North America as a high-value, highly demanding market segment that prioritizes reliability, security, and next-generation optimization tools.

Europe Distribution System Market Analysis

The European Distribution System Market is primarily influenced by ambitious decarbonization goals and strong regulatory support for energy transition. The emphasis is heavily placed on managing high levels of variable renewable energy sources (wind and solar) interconnected at the distribution level, which necessitates sophisticated grid management systems capable of handling frequent changes in power flow direction and voltage levels. European utilities are leading the way in integrating Vehicle-to-Grid (V2G) technology and managing localized microgrids, which requires advanced metering infrastructure and Distribution System Operators (DSOs) that can perform complex balancing acts across large, interconnected national grids.

In logistics, Europe exhibits a strong focus on sustainable distribution practices. Regulations promoting reduced carbon emissions are driving the rapid adoption of electric vehicle fleets for last-mile delivery and the implementation of sophisticated route optimization software that prioritizes lower fuel consumption alongside speed. The fragmentation of the continent into multiple national markets, each with its own regulatory and language requirements, drives demand for highly flexible and customizable Warehouse Management Systems (WMS) and cross-border Transportation Management Systems. Standardization efforts under the European Union aim to harmonize technical specifications, which will facilitate easier cross-country deployment of distribution technologies in the coming years.

Investment is also robust in advanced manufacturing distribution (particularly Germany's Industry 4.0 initiatives), where internal factory logistics are being fully automated using AGVs and centralized production control systems. This region demonstrates a strong preference for integrated solutions that seamlessly merge internal production flows with external supply chain distribution. Furthermore, the high degree of digital readiness and stringent data privacy laws (GDPR) means that European buyers demand best-in-class, privacy-by-design software solutions, influencing global standards for data handling within connected distribution networks.

Asia Pacific (APAC) Distribution System Market Analysis

The Asia Pacific region is the powerhouse for market volume growth, driven by unprecedented levels of urbanization, massive industrial expansion, and the largest e-commerce markets globally, particularly in China and India. This region is characterized by greenfield deployments and large-scale infrastructure projects, leading to high demand for foundational hardware components (transformers, switchgear) and basic to mid-level automation solutions. Governments across APAC are heavily investing in modernizing distribution grids to meet escalating energy demand, often leapfrogging older technologies directly to smart grid solutions to manage load growth efficiently and reduce transmission losses.

The e-commerce sector in APAC demands unparalleled logistics throughput, leading to substantial investment in automated fulfillment centers and highly specialized sortation systems capable of handling massive parcel volumes. Local logistics providers are rapidly adopting proprietary WMS and TMS solutions tailored to dense urban environments and fragmented geographical logistics challenges. Furthermore, the development of mega-cities necessitates sophisticated urban logistics planning, driving demand for centralized control towers and traffic management integration with distribution systems to manage congestion and time-sensitive deliveries efficiently.

Challenges in APAC include diverse regulatory environments, varying levels of grid infrastructure quality across countries, and the need for scalable solutions that can be adapted to vastly different population densities and economic realities. Despite these challenges, the sheer scale of energy demand and consumer market expansion guarantees that APAC will remain the fastest-growing market segment, particularly for integrated solutions combining power distribution optimization with consumer product logistics, ensuring continuous high-volume contracts for leading vendors.

Latin America (LATAM) Distribution System Market Analysis

The Distribution System Market in Latin America is characterized by strategic growth focused on improving operational efficiency, reducing high rates of technical and non-technical losses in power grids, and establishing reliable cold chain logistics. Many LATAM countries are initiating modernization programs to stabilize power infrastructure, which suffers from chronic underinvestment, leading to foundational demand for smart meters, remote monitoring devices, and basic distribution automation functionality to curb revenue leakage and improve service quality. The primary drivers here are efficiency gains and basic infrastructure stabilization, rather than cutting-edge decarbonization initiatives.

The logistics segment in LATAM is rapidly maturing, driven by the expansion of international retailers and the growth of domestic e-commerce platforms. This has generated significant demand for professional warehouse management systems (WMS) and integrated transportation planning software to manage complex cross-border customs processes and fragmented road networks. Investment in specialized cold chain capabilities is particularly strong, supporting the large agricultural export sector and the expanding pharmaceutical market, requiring verified temperature control and advanced traceability features.

Market adoption is often constrained by economic volatility and higher financing costs, making modular, pay-as-you-go, or service-based distribution solutions more appealing. However, long-term potential remains significant due to the region's large population base and continued foreign direct investment into energy and supply chain infrastructure. Key customer segments include national oil and gas companies, large agricultural cooperatives, and major utility providers seeking cost-effective and robust solutions to enhance operational visibility and control.

Middle East and Africa (MEA) Distribution System Market Analysis

The MEA Distribution System Market is bifurcated, with the Middle East focusing on massive, state-funded mega-projects and rapid technological adoption, while Africa focuses more on foundational electrification and localized microgrid solutions. Middle Eastern nations (e.g., UAE, Saudi Arabia) are investing heavily in futuristic, integrated distribution systems to support new smart cities and global logistics hubs, driving demand for high-end automation, sensor technology, and advanced cooling distribution systems required for extreme climates. Their utilities are adopting smart grid technology rapidly to manage energy demand and integrate large solar generation facilities.

In logistics, the Middle East serves as a critical global trade corridor, necessitating world-class warehousing and port logistics distribution systems. This has resulted in substantial contracts for automated material handling systems, high-speed cargo screening, and advanced inventory management platforms, often incorporating blockchain for trade transparency. The focus is on throughput capacity and speed to maintain competitive advantage as global transshipment points.

The African component of the market is characterized by urgent need for basic energy access and distributed power solutions. Demand is high for off-grid and mini-grid distribution systems, small-scale transformers, and prepaid metering solutions. Logistical requirements center on resilience and robust systems capable of operating in challenging infrastructure environments. The underlying trend across MEA is high infrastructure spending, backed by both government mandates and international development financing, making it a market with high foundational demand and significant long-term growth potential in both utility and commercial distribution segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Distribution System Market.- ABB Ltd.

- Siemens AG

- General Electric (GE)

- Schneider Electric SE

- Eaton Corporation plc

- Honeywell International Inc.

- Manhattan Associates

- SAP SE

- Oracle Corporation

- Dematic (Kion Group)

- Daifuku Co., Ltd.

- Swisslog (KUKA AG)

- IBM

- Cisco Systems Inc.

- Rockwell Automation

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Tesla (Energy Products)

- UPS (Logistics Technology)

- FedEx (Logistics Technology)

- Wartsila

- Emerson Electric Co.

- Vanderlande Industries

- TGW Logistics Group

Frequently Asked Questions

Analyze common user questions about the Distribution System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Smart Distribution Systems in the utility sector?

The key driver is the integration of Distributed Energy Resources (DERs), such as rooftop solar and battery storage. These resources necessitate a bi-directional grid capable of managing reverse power flow and ensuring system stability, requiring advanced Distribution Management Systems (DMS) for real-time control and voltage optimization across the grid edge. Regulatory mandates for improved resilience against outages also heavily influence this demand, pushing utilities toward sophisticated automation technologies.

How is the growth of e-commerce impacting the demand for warehouse automation within the distribution market?

E-commerce growth mandates significantly faster fulfillment cycles and high accuracy, directly driving the demand for specialized warehouse automation solutions. This includes Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (AS/RS), and high-speed sortation equipment. These technologies are crucial for retailers and 3PLs to manage massive SKU proliferation and consumer expectations for next-day or same-day delivery, mitigating high operational costs associated with manual labor.

What are the major cybersecurity risks associated with modern interconnected distribution systems?

Modern distribution systems, relying heavily on IoT sensors and remote control, are increasingly vulnerable to sophisticated cyber attacks. Major risks include denial-of-service (DoS) attacks targeting SCADA systems, ransomware threats against operational technology (OT) networks, and data breaches compromising customer or operational data. Utilities and logistics firms must invest heavily in network segmentation, continuous threat monitoring, and strong endpoint security protocols to maintain system integrity and resilience.

Which geographical region is expected to demonstrate the highest CAGR in the distribution system market, and why?

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is due to two primary factors: massive government-led infrastructure investment in modernizing aging power grids to serve rapidly expanding urban populations, and the unparalleled scale and growth velocity of the e-commerce and retail sectors across countries like China, India, and Southeast Asia, demanding continuous build-out of new logistical fulfillment infrastructure.

Beyond simple route planning, how does AI contribute to optimizing complex supply chain distribution?

AI provides deep optimization by integrating demand forecasting with inventory allocation, predicting maintenance needs for distribution assets (trucks, machinery), and dynamically re-optimizing multimodal logistics across air, sea, and land in response to real-time disruptions (e.g., weather, port congestion). AI shifts the system from reacting to events to proactively prescribing actions, minimizing costs, reducing waste, and maximizing resource utilization across the entire network.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Underfloor Air Distribution System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Electronic Brake Force Distribution System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Electrical Computer Aided Design Market Size Report By Type (Software, Services), By Application (Industrial Machine Controls, Plant Design, Mining Equipment Control, Rail Signaling, Switchgear Design, Water Treatment and Distribution System Control, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Smart Power Distribution System Market Size Report By Type (Software, Hardware), By Application (Industrial, Commercial, Residential), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Travel Technology Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Airline & Hospitality IT Solutions, Global Distribution System (GDS)), By Application (Travel Industry, Tourism Industry, Hospitality Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager