Dithiocarbamate Fungicides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434158 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dithiocarbamate Fungicides Market Size

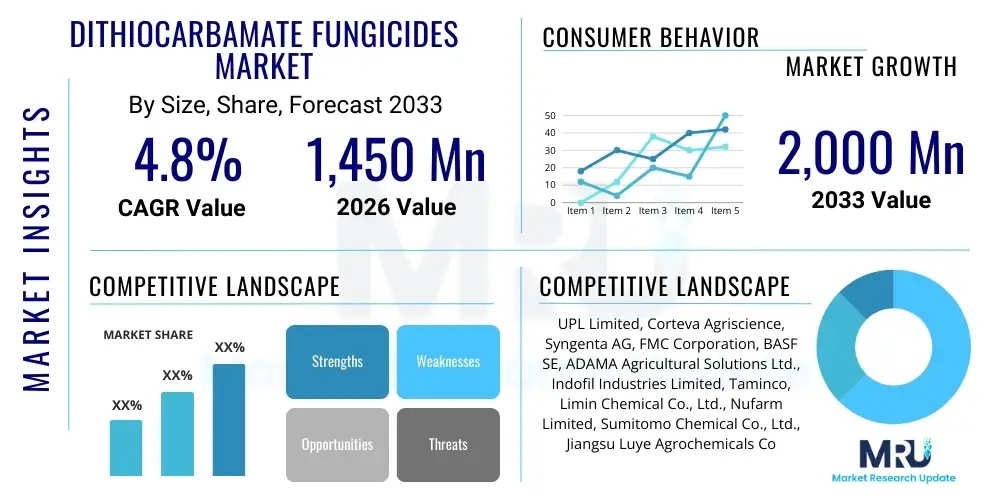

The Dithiocarbamate Fungicides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.45 Billion in 2026 and is projected to reach USD 2.00 Billion by the end of the forecast period in 2033.

Dithiocarbamate Fungicides Market introduction

The Dithiocarbamate Fungicides Market encompasses agricultural inputs derived from dithiocarbamic acid, widely utilized globally for protecting various crops against fungal diseases. These fungicides act primarily as multi-site contact protectants, meaning they inhibit spore germination and mycelial growth through interference with several essential metabolic processes within the fungal cell. Key dithiocarbamates include Mancozeb, Maneb, Zineb, and Propineb, each offering broad-spectrum efficacy against common diseases such as early and late blight, rusts, scab, and downy mildew across major food crops.

The principal applications of dithiocarbamate fungicides span field crops like potatoes, cereals, and cotton, as well as high-value fruits and vegetables including tomatoes, grapes, and apples. Their effectiveness stems from their unique mode of action, which minimizes the risk of resistance development when compared to single-site systemic fungicides, making them indispensable components of integrated pest management (IPM) strategies, particularly in regions facing high disease pressure and variability in climate conditions. Furthermore, their relatively low cost of production and ease of application contribute significantly to their enduring popularity among growers seeking reliable crop protection solutions.

Driving factors for sustained market growth include the escalating global demand for food security, the increasing prevalence of fungicide-resistant pathogens necessitating multi-site chemistries, and supportive regulatory frameworks in developing economies that prioritize effective crop yields. Despite facing scrutiny regarding environmental and health impacts leading to restrictions in some Western markets, the fundamental need for yield maximization, especially in densely populated regions of Asia Pacific and Latin America, ensures continued strong demand for these proven fungicidal agents.

Dithiocarbamate Fungicides Market Executive Summary

The Dithiocarbamate Fungicides Market is characterized by stable demand driven by large-scale agricultural operations and the persistent threat of crop diseases, balanced against tightening regulatory scrutiny in mature markets like Europe. Business trends indicate a focus on developing advanced formulations, particularly those with improved adhesion and rainfastness, alongside strategies to manage the supply chain volatility associated with key raw materials like carbon disulfide and ethylenediamine. Strategic partnerships between large agrochemical corporations and regional distributors are defining market access, optimizing penetration in high-growth agricultural economies of Asia and South America. Furthermore, there is a distinct shift toward products offering compliance with Maximum Residue Limits (MRLs) and enhanced worker safety profiles, influencing R&D investments.

Regional trends highlight the Asia Pacific region as the dominant consumer, primarily driven by expansive cultivation of rice, potatoes, and various fruits, coupled with favorable government policies supporting fertilizer and pesticide subsidies. North America and Europe, while established, are experiencing slower growth due to mature agriculture sectors and stringent environmental regulations concerning specific dithiocarbamates, particularly Mancozeb, prompting manufacturers to explore alternatives or invest heavily in product stewardship. Conversely, Latin America, particularly Brazil and Argentina, demonstrates robust expansion fueled by commercial farming of soybeans and corn, where dithiocarbamates remain vital for disease control in humid climates. This geographic diversity in demand and regulation creates complex global market dynamics.

Segmentation trends reveal that the Mancozeb product type continues to hold the largest market share due to its broad-spectrum efficacy and cost-effectiveness, although Propineb and Zineb formulations are gaining traction in specific crop applications and regional niches requiring lower residue profiles. Application-wise, fruits and vegetables collectively represent the largest segment, reflecting the high economic value and intense disease management requirements of these crops. The powder and wettable granule (WG) formulations dominate the market due to their ease of storage, transportation, and mixing characteristics, though liquid suspension concentrates (SC) are becoming increasingly popular for mechanized large-scale farming operations seeking efficient spray tank preparation and minimal dust exposure.

AI Impact Analysis on Dithiocarbamate Fungicides Market

Common user questions regarding AI's impact on the Dithiocarbamate Fungicides Market primarily revolve around how machine learning can optimize application rates, predict disease outbreaks more accurately, and automate compliance monitoring related to residue limits and environmental runoff. Users are keenly interested in whether AI-driven precision agriculture systems can extend the effective life of dithiocarbamates by reducing unnecessary prophylactic spraying, thereby mitigating regulatory risks and environmental concerns. The key themes summarized from user queries focus on the integration of AI-powered diagnostic tools (image recognition for early blight detection), real-time weather modeling to refine treatment timing, and prescriptive analytics to determine the minimal effective dose, ultimately aiming for resource efficiency and optimization of fungicide stewardship within IPM frameworks.

While AI does not directly influence the chemical synthesis or formulation of dithiocarbamates, its disruptive potential lies entirely in the downstream application and utilization phases. Precision agriculture platforms leveraging AI algorithms analyze vast datasets encompassing satellite imagery, drone surveillance, weather patterns, and soil conditions to create highly localized disease risk maps. This capability allows growers to transition from blanket preventative spraying to targeted, needs-based applications, resulting in significant cost savings in inputs—including dithiocarbamate fungicides—and a substantial reduction in the overall environmental load. This operational efficiency is critical for modern farming systems striving for sustainability and regulatory adherence.

Moreover, AI systems are increasingly being deployed in supply chain management and predictive maintenance for application equipment, ensuring that fungicides are available and applied correctly. In the context of regulatory compliance, AI tools can track application histories across large farms, automatically generate compliance reports detailing MRL adherence, and provide alerts regarding regulatory changes specific to dithiocarbamates in various export markets. This level of granular control and automated documentation enhances transparency and supports the continued, responsible use of these traditional crop protection chemicals, addressing concerns related to their longevity in the global market.

- AI-driven disease forecasting optimizes dithiocarbamate application timing, shifting from calendar-based to need-based spraying.

- Precision agriculture platforms utilize AI for variable rate technology (VRT), reducing overall fungicide volume used.

- Machine learning improves early detection of fungal pathogens (e.g., late blight on potatoes), maximizing the protective efficacy of multi-site fungicides.

- AI aids in automated regulatory tracking and compliance monitoring regarding Maximum Residue Limits (MRLs) for export crops.

- Supply chain logistics are optimized using predictive analytics, ensuring timely availability of high-demand dithiocarbamate formulations.

DRO & Impact Forces Of Dithiocarbamate Fungicides Market

The Dithiocarbamate Fungicides Market is heavily influenced by a dynamic interplay of drivers, restraints, and opportunities (DRO), shaped significantly by global agricultural output requirements and evolving chemical safety regulations. Key drivers include the inherent advantage of dithiocarbamates as multi-site inhibitors, which remain vital for resistance management against single-site fungicides, ensuring their continued use in sequential spray programs. The sheer scale of global row crop cultivation, particularly in emerging economies where effective, low-cost protection is paramount for food security, provides a fundamental demand floor. Furthermore, the persistent threat of major fungal diseases exacerbated by climate change volatility drives consistent demand for robust preventative treatments.

Restraints primarily revolve around increasing regulatory hurdles, notably the phasing out or stricter usage limits imposed on certain dithiocarbamates like Mancozeb in the European Union and other developed markets due to concerns over chronic toxicity and potential environmental persistence. The need for significant reinvestment in product stewardship, comprehensive residue testing, and reformulation to meet stringent global MRLs imposes substantial costs on manufacturers. Additionally, public perception and consumer demand for pesticide-free or reduced-chemical produce create long-term market pressure favoring biological and bio-based alternatives, potentially eroding market share over the forecast period, especially in high-end consumer markets.

Opportunities for growth lie in geographical expansion into underserved agricultural regions, the development of enhanced, safer formulations (e.g., dustless granules or encapsulated products), and their strategic integration into high-tech IPM systems driven by AI and data analytics. The need for robust fungicides in specialty crops, particularly high-value fruits and vegetables prone to intense fungal pressure, offers premium market potential. Impact forces, such as the increasing costs of key raw materials like ethylene diamine and carbon disulfide, and the consolidation within the agrochemical industry, also critically shape market competitiveness, favoring larger players capable of navigating complex chemical sourcing and regulatory landscapes while maintaining economies of scale.

Segmentation Analysis

The Dithiocarbamate Fungicides Market is comprehensively segmented based on product type, crop application, and formulation type, reflecting the diverse utilization patterns across the global agricultural sector. Understanding these segments is crucial for manufacturers to tailor their production, marketing, and distribution strategies effectively, especially when facing differential regional regulations and crop-specific requirements. The market is highly differentiated by the chemical structure of the active ingredient, with Mancozeb being the dominant commercial product due to its broad-spectrum efficacy, followed by the historically significant Maneb and Zineb, which maintain market presence in specific regions and application niches.

The segmentation by crop is driven by the economic value and vulnerability of the crop to dithiocarbamate-targetable diseases. High-value crops like fruits (grapes, apples, citrus) and vegetables (potatoes, tomatoes, peppers) constitute the largest consumption base because effective disease control translates directly into significant returns on investment. Field crops, including cereals and cotton, represent a large volume segment, essential for maintaining global commodity supply chains. Meanwhile, the segmentation by formulation reflects user preference, application equipment capabilities, and the need for optimal efficacy, covering solid forms like Wettable Powders (WP) and Water Dispersible Granules (WG), and liquid forms such as Suspension Concentrates (SC).

- By Product Type:

- Mancozeb

- Maneb

- Zineb

- Propineb

- Thiram

- Other Dithiocarbamates (e.g., Ferbam, Metam Sodium)

- By Crop Application:

- Fruits and Vegetables

- Cereals and Grains (Wheat, Barley, Rice)

- Oilseeds and Pulses (Soybean, Cotton)

- Other Crops (Ornamentals, Turf)

- By Formulation Type:

- Wettable Powders (WP)

- Water Dispersible Granules (WG)

- Suspension Concentrates (SC)

- Emulsifiable Concentrates (EC)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Dithiocarbamate Fungicides Market

The value chain for Dithiocarbamate Fungicides begins with the upstream procurement and manufacturing of key chemical intermediates, primarily involving carbon disulfide (CS2), ethylene diamine, and zinc/manganese salts, which are synthesized under high pressure and temperature conditions. This raw material phase is capital-intensive and subject to volatility in petrochemical and mining commodity markets. Major global chemical manufacturers typically handle the primary synthesis of the technical grade material, requiring specialized reactor facilities and adhering to strict chemical process safety standards. Efficiency at this stage is crucial, as the cost of the technical material heavily influences the final product price in a highly competitive market.

Midstream activities involve the formulation and packaging of the technical material into commercial products like Wettable Powders (WP), Water Dispersible Granules (WG), or Suspension Concentrates (SC). Formulation science is critical here, focusing on improving dispersibility, suspension stability, tank-mix compatibility, and reducing user exposure during application. The distribution channel plays a vital role in connecting manufacturers to end-users. This involves large multinational agrochemical distributors and regional wholesalers (indirect channels) who manage inventory, logistics, and credit facilitation across vast agricultural geographies. Direct distribution channels are often employed for large commercial farms or government procurement programs, allowing for better margin control and specialized technical support.

Downstream activities center on application and consumption by farmers and agricultural cooperatives. Technical advisory services, including guidance on optimal application rates, disease identification, and resistance management protocols, are essential support functions provided by distributors and manufacturers. The effectiveness of the fungicide is realized at the field level, monitored through crop yields and disease incidence reduction. Post-market surveillance, including residue testing and compliance with domestic and international MRLs, completes the value chain, linking the product back to regulatory bodies and ultimately, to the consumer food supply chain.

Dithiocarbamate Fungicides Market Potential Customers

The primary potential customers and end-users of Dithiocarbamate Fungicides are diverse, spanning large-scale commercial farming enterprises, individual smallholder farmers, and specialized horticultural businesses globally. Commercial growers operating extensive fields of commodity crops such as corn, soybeans, potatoes, and wheat represent the largest consumption volume due to the necessity of broad-spectrum, cost-effective disease control across massive acreage. These customers prioritize proven efficacy, favorable economics, and multi-site mode of action for resistance management within their intensive rotational spray programs.

High-value crop producers, specifically those involved in viticulture (grapes), pome fruits (apples, pears), stone fruits, and fresh market vegetables (tomatoes, brassicas), are critical buyers. These growers require impeccable disease control to ensure produce quality and marketability, often necessitating frequent, targeted applications of protectant fungicides. Since dithiocarbamates offer reliable control against difficult diseases like downy mildew and scab, they are standard components in spray schedules for these premium segments, despite the higher regulatory scrutiny often associated with their application near harvest.

Beyond traditional agriculture, potential customers include large government agencies and agricultural cooperatives in developing nations responsible for national food programs and pest control campaigns, where bulk procurement of reliable crop protection solutions is common. Additionally, specialized users such as professional turf managers (golf courses, sports fields) utilize dithiocarbamates like Mancozeb and Propineb for controlling turfgrass diseases, and ornamental plant nurseries employ them for protecting high-value greenhouse and outdoor plants against leaf spots and rusts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,450 Million |

| Market Forecast in 2033 | $2,000 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UPL Limited, Corteva Agriscience, Syngenta AG, FMC Corporation, BASF SE, ADAMA Agricultural Solutions Ltd., Indofil Industries Limited, Taminco, Limin Chemical Co., Ltd., Nufarm Limited, Sumitomo Chemical Co., Ltd., Jiangsu Luye Agrochemicals Co., Ltd., Kureha Corporation, Hailir Pesticides and Chemicals Group Co., Ltd., Wynca Group, Lianyungang Jindun Agrochemical Co., Ltd., SinoHarvest, Gowan Company, Certis USA, Albaugh LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dithiocarbamate Fungicides Market Key Technology Landscape

The technology landscape for the Dithiocarbamate Fungicides Market is primarily centered on enhancing formulation efficacy, improving safety profiles, and integrating application techniques with modern agricultural technology, rather than fundamentally altering the core chemical structure. A major technological focus is the transition away from traditional, dusty Wettable Powders (WP) toward sophisticated Water Dispersible Granules (WG) and flowable Suspension Concentrates (SC). WG formulations offer improved handling safety, reduced inhalation risk for applicators, and better performance metrics such as faster dispersion and higher active ingredient loading. SC formulations provide superior tank-mix compatibility and easier liquid measurement, optimizing application efficiency in large-scale mechanized operations.

Furthermore, microencapsulation technology represents a significant advancement, where the active dithiocarbamate ingredient is encased in polymeric shells. This technology is designed to control the release rate of the fungicide, extending its residual activity and enhancing rainfastness, thereby maximizing crop protection between spray intervals. Such controlled-release systems are particularly valuable for maximizing the effective duration of protectant fungicides, especially in regions characterized by heavy rainfall or prolonged periods of high humidity. These technological improvements are crucial for maintaining the market relevance of dithiocarbamates in the face of competitive newer systemic chemistries.

In the application domain, the integration of dithiocarbamates with sensor technology and Geographic Information Systems (GIS) is becoming standard practice. Variable Rate Application (VRA) systems, guided by detailed field maps and disease models, ensure that the fungicide is applied precisely where and when needed, minimizing waste and environmental impact. This technological shift, coupled with advanced drone and satellite imagery for monitoring disease onset, ensures responsible stewardship of these multi-site chemistries, making them part of a data-driven, sustainable crop management strategy. Investment in closed transfer systems (CTS) is also increasing, aiming to further minimize applicator exposure during the mixing and loading phases, addressing core safety concerns.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for dithiocarbamate fungicides globally. This dominance is attributed to vast agricultural land, reliance on staple crops (rice, potato, cotton, and vegetables), and high disease pressure fueled by tropical and subtropical climates. Countries like China, India, and Southeast Asian nations utilize Mancozeb extensively for protecting potato and rice yields. Favorable government policies, subsidies for agrochemicals, and the necessity for high input use to feed large populations cement APAC's leading position, driving substantial volume consumption despite relatively lower average pricing compared to Western markets.

- North America: The North American market is mature, characterized by sophisticated agricultural practices and high product quality standards. Dithiocarbamates, particularly Mancozeb, are primarily used in high-value specialty crops (e.g., potatoes, tomatoes, tree nuts) and seed treatment applications. While volume growth is steady, innovation focuses heavily on formulation technology (WG and SC) and integrated management programs to comply with stringent environmental regulations set by the EPA and state-level authorities. Crop rotation and integrated pest management (IPM) drive the sequential use of dithiocarbamates alongside systemic fungicides for resistance management.

- Europe: Europe presents a complex and restrictive regulatory environment. The market is facing structural shifts, notably the phase-out of certain key dithiocarbamates like Mancozeb in the EU due to concerns over environmental safety and potential endocrine disruption. This has necessitated a strong pivot toward approved alternatives, strict residue management, and increased adoption of biological solutions. Consequently, the European market is characterized by declining usage volumes but sustained demand for highly specialized and safer formulations of remaining products, emphasizing product stewardship and traceability.

- Latin America: Latin America, particularly Brazil, Argentina, and Mexico, represents a high-growth region driven by extensive production of commodity crops such as soybeans, corn, and fruits. The region’s humid climate creates ideal conditions for fungal proliferation, making protectant fungicides essential. Dithiocarbamates are critical for managing diseases like rusts in soybeans and late blight, offering cost-effective protection for export-oriented agriculture. Market dynamics here are influenced by economic stability, currency fluctuations, and the expansion of large-scale commercial farming operations.

- Middle East and Africa (MEA): The MEA market is developing, with growth concentrated in countries enhancing their domestic agricultural capabilities, such as South Africa, Egypt, and Turkey. Dithiocarbamates find strong application in horticulture, vineyard protection, and vegetable cultivation. Market growth is dependent on investment in irrigation infrastructure, technology adoption, and stable government policies promoting modern farming techniques, ensuring reliable imports and local manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dithiocarbamate Fungicides Market.- UPL Limited

- Corteva Agriscience

- Syngenta AG

- FMC Corporation

- BASF SE

- ADAMA Agricultural Solutions Ltd.

- Indofil Industries Limited

- Taminco

- Limin Chemical Co., Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Jiangsu Luye Agrochemicals Co., Ltd.

- Kureha Corporation

- Hailir Pesticides and Chemicals Group Co., Ltd.

- Wynca Group

- Lianyungang Jindun Agrochemical Co., Ltd.

- SinoHarvest

- Gowan Company

- Certis USA

- Albaugh LLC

Frequently Asked Questions

Analyze common user questions about the Dithiocarbamate Fungicides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mode of action for dithiocarbamate fungicides?

Dithiocarbamate fungicides operate as broad-spectrum, multi-site contact protectants. They inhibit fungal growth by interfering with multiple metabolic pathways within the fungal cell, specifically impacting enzyme function necessary for spore germination, which significantly reduces the risk of fungicide resistance development.

Which dithiocarbamate product holds the largest market share globally?

Mancozeb is the leading product type within the dithiocarbamate market segment. Its dominance is attributed to its high efficacy, broad-spectrum activity against numerous diseases (like late blight and rusts), and cost-effectiveness across major crops, including potatoes, tomatoes, and grapes.

How are regulatory restrictions impacting the Dithiocarbamate Fungicides market, particularly in Europe?

Regulatory restrictions, especially the withdrawal of approvals for certain dithiocarbamates like Mancozeb in the European Union, are forcing manufacturers to invest in new, safer formulations (WG/SC) and redirect focus toward high-growth, less-regulated regions, primarily in Asia Pacific and Latin America, where the demand remains strong for staple crop protection.

What role do dithiocarbamates play in modern resistance management strategies?

As multi-site protectants, dithiocarbamates are critical components of Fungicide Resistance Management (FRM) strategies. They are often tank-mixed or alternated with newer, single-site systemic fungicides to protect the efficacy of the latter and prevent pathogen populations from developing widespread resistance.

What technological advancements are shaping the future of dithiocarbamate applications?

Key technological advancements include the development of advanced formulations such as Water Dispersible Granules (WG) and Suspension Concentrates (SC) for enhanced safety and handling, and the integration of AI-driven precision agriculture systems for optimized, targeted application rates, extending product longevity and minimizing environmental footprint.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dithiocarbamate Fungicides Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dithiocarbamate Fungicides Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Propineb, Thiram, Mancozeb), By Application (Horticultural and ornamental crops, Plantations and estates, Agricultural), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager