Dithiocarbamate Fungicides Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439403 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Dithiocarbamate Fungicides Market Size

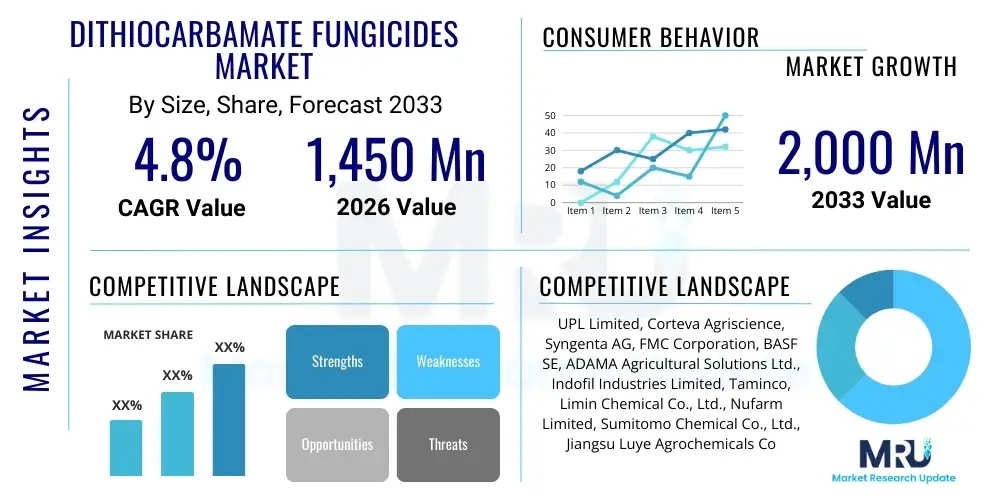

The Dithiocarbamate Fungicides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.75 billion by the end of the forecast period in 2033. This growth trajectory is underpinned by increasing global food demand, necessitating enhanced crop protection measures to maximize agricultural yields. The efficacy of dithiocarbamates against a broad spectrum of fungal diseases across various crops positions them as indispensable tools in modern agriculture, ensuring sustained market expansion despite evolving regulatory landscapes and the emergence of alternative solutions.

Dithiocarbamate Fungicides Market introduction

Dithiocarbamate fungicides represent a crucial class of chemical compounds extensively utilized in agriculture for controlling a wide range of fungal plant pathogens. These broad-spectrum contact fungicides function by inhibiting enzyme activity within fungal cells, thereby preventing spore germination and mycelial growth. Their versatility and effectiveness make them indispensable for protecting numerous crops from diseases such as early and late blight, downy mildew, rusts, and scab. Key products within this class include Mancozeb, Zineb, Propineb, and Thiram, each offering distinct applications and benefits. The primary applications span across fruit orchards, vegetable farms, grain fields, and ornamental horticulture, where they significantly contribute to yield preservation and quality maintenance. The benefits of dithiocarbamate fungicides include their multi-site mode of action, which helps manage fungicide resistance, their relatively low cost, and their proven efficacy over decades of use. The market is primarily driven by the ever-growing global population and the resultant pressure to increase food production, coupled with the rising incidence of crop diseases exacerbated by climate change. Additionally, the increasing adoption of modern farming practices and the demand for high-quality, blemish-free produce further propel the demand for effective crop protection solutions like dithiocarbamates. Despite regulatory scrutiny and environmental considerations, their continued importance in integrated pest management strategies underscores their market relevance.

Dithiocarbamate Fungicides Market Executive Summary

The Dithiocarbamate Fungicides Market is poised for steady growth, driven by fundamental shifts in global agriculture and evolving consumer demands. Business trends indicate a strategic focus by key players on developing advanced formulations that offer improved efficacy, reduced environmental impact, and extended residual activity. Companies are also investing in research to address potential resistance development and to comply with stringent global regulatory frameworks. Mergers and acquisitions, along with strategic partnerships, are prevalent as companies seek to consolidate market share, expand product portfolios, and enhance their geographical reach, particularly in emerging agricultural economies. The market also observes an increasing emphasis on sustainable agricultural practices, prompting manufacturers to explore compatibility with integrated pest management (IPM) systems.

Regional trends highlight the Asia Pacific as a dominant and rapidly growing market, primarily due to vast agricultural lands, increasing population density, and significant investments in modern farming techniques, especially in countries like China, India, and Southeast Asia. North America and Europe, while mature markets, demonstrate growth driven by the demand for high-value crops and the need for precision agriculture. Latin America is also emerging as a significant market, fueled by expanding cultivation of soybeans, corn, and fruits. The Middle East and Africa present nascent but promising opportunities, contingent on agricultural development initiatives and technological adoption. Each region exhibits unique crop patterns and regulatory environments that shape the local demand for dithiocarbamate fungicides.

Segmentation trends reveal that Mancozeb continues to be a leading product type due to its broad-spectrum activity and cost-effectiveness, though other dithiocarbamates like Propineb and Zineb maintain their niche applications. The fruits and vegetables segment is expected to remain the largest application area, driven by high consumer demand for fresh produce and the susceptibility of these crops to various fungal diseases. Grains and cereals also represent a substantial segment, crucial for global food security. In terms of form, wettable powders and suspension concentrates dominate the market, favored for their ease of application and effective dispersion. The industry is also seeing a shift towards more advanced liquid formulations that offer better adherence and systemic properties, optimizing the delivery and effectiveness of the active ingredients.

AI Impact Analysis on Dithiocarbamate Fungicides Market

User questions regarding AI's impact on the dithiocarbamate fungicides market frequently revolve around how artificial intelligence could enhance product efficacy, streamline supply chains, and optimize application methods, while also probing the potential for AI to facilitate the discovery of novel active ingredients or substitute existing chemical solutions. There is considerable curiosity about AI's role in precision agriculture, predictive disease modeling, and automating farming processes to reduce fungicide usage. Concerns often surface regarding data privacy, the economic accessibility of AI technologies for smaller farms, and the ethical implications of autonomous decision-making in crop protection. Users also inquire about AI's potential to accelerate regulatory approval processes through advanced data analysis, and whether AI could lead to the development of more environmentally friendly or targeted dithiocarcarbamate alternatives, thereby shaping the future competitive landscape.

- AI-driven precision agriculture enables optimized fungicide application, reducing waste and enhancing efficacy by identifying specific affected areas.

- Predictive analytics powered by AI can forecast disease outbreaks based on environmental data, allowing for prophylactic fungicide application and minimizing widespread infestations.

- AI algorithms can accelerate the discovery and development of new dithiocarbamate formulations or synergistic combinations, improving performance and addressing resistance challenges.

- Automated drone or robotic systems guided by AI can achieve highly accurate and uniform fungicide dispersal, improving coverage and reducing human exposure.

- AI-enhanced supply chain management optimizes inventory, logistics, and distribution of dithiocarbamate fungicides, ensuring timely availability for farmers.

- Data analytics can provide insights into fungicide performance under various conditions, aiding farmers in selecting the most effective product for their specific needs.

- Smart sensors and IoT devices integrated with AI can monitor crop health in real-time, providing immediate alerts for fungal infections and guiding targeted intervention.

- AI facilitates better adherence to environmental regulations by tracking application data and ensuring compliance with usage guidelines and restricted zones.

- Educational AI tools can assist farmers in understanding best practices for dithiocarbamate use, promoting responsible stewardship and integrated pest management strategies.

- Potential for AI to model fungicide residue levels and environmental fate, contributing to more sustainable and safer agricultural practices.

DRO & Impact Forces Of Dithiocarbamate Fungicides Market

The Dithiocarbamate Fungicides Market is profoundly shaped by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. A primary driver is the relentless increase in global food demand, necessitating robust crop protection strategies to maximize yields and ensure food security. Dithiocarbamates, with their proven efficacy against a wide spectrum of fungal diseases, are crucial for protecting staple crops like cereals, fruits, and vegetables from significant losses. Furthermore, the rising incidence of crop diseases, often exacerbated by climate change leading to more favorable conditions for pathogen proliferation, intensifies the reliance on effective fungicides. The multi-site mode of action of dithiocarbamates is another significant driver, offering a critical tool in managing fungicide resistance, a growing concern with single-site active ingredients.

Conversely, the market faces notable restraints, predominantly stringent environmental regulations and health concerns associated with pesticide residues. Regulatory bodies globally are increasingly scrutinizing the use of certain dithiocarbamates, leading to bans or restrictions on their application, especially in developed regions. The development of fungicide resistance, though less prevalent with multi-site action products, remains a long-term challenge requiring continuous research and development. Public perception and consumer demand for organic or residue-free produce also pose a constraint, pushing for alternative crop protection methods. The emergence of novel, biologically-derived fungicides and more targeted chemical solutions further contributes to competitive pressures that could limit dithiocarbamate market expansion.

Opportunities within the market largely stem from advancements in formulation technology, which can enhance the efficiency, safety, and environmental profile of dithiocarbamates. Innovations in controlled-release formulations, microencapsulation, and water-dispersible granules aim to improve adherence, reduce runoff, and extend residual activity, thereby optimizing dosage and minimizing environmental exposure. The integration of dithiocarbamates into comprehensive integrated pest management (IPM) programs also presents a significant opportunity, promoting their responsible and sustainable use alongside other control measures. Expansion into developing economies, particularly in Asia Pacific and Latin America, where agricultural intensification is high and awareness of advanced crop protection is growing, offers substantial untapped potential. Additionally, the development of synergistic mixtures with other active ingredients can broaden their spectrum of activity and improve resistance management, creating new market avenues. These impact forces collectively define the dynamic and evolving landscape of the dithiocarbamate fungicides market.

Segmentation Analysis

The Dithiocarbamate Fungicides Market is meticulously segmented across various dimensions to provide a granular understanding of its structure and dynamics. These segments help in identifying key growth areas, understanding competitive landscapes, and formulating effective market strategies. The segmentation primarily considers the diverse product types, the broad range of applications across different crops, the physical forms in which these fungicides are supplied, their specific mode of action, and the geographical regions driving demand. Each segment plays a crucial role in defining the market's overall trajectory and highlights the versatility and adaptability of dithiocarbamate fungicides within the global agricultural sector. Analyzing these distinct categories provides insights into consumer preferences, regulatory impacts, and technological advancements influencing each sub-market.

- By Product Type

- Mancozeb: A widely used broad-spectrum, multi-site contact fungicide, effective against a variety of fungal diseases in many crops. Its popularity stems from its broad utility and relatively low cost.

- Propineb: Known for its excellent rainfastness and quick-acting properties, primarily used on potatoes, grapes, and various vegetables.

- Zineb: An older dithiocarbamate with broad-spectrum activity, often used on vegetables, fruits, and ornamentals. Its use has seen some decline but it remains important in specific regions.

- Thiram: Primarily used as a seed treatment and a foliar fungicide for fruits and vegetables, also an animal repellent.

- Metiram: A complex of zineb and metiram, offering broad-spectrum disease control with good residual activity.

- Ferbam: One of the first organic fungicides, primarily used on fruits and ornamentals, especially effective against rusts.

- Others: Includes products like Nabam, Maneb, and other niche dithiocarbamate compounds used in specific agricultural contexts.

- By Application

- Fruits & Vegetables: The largest application segment, encompassing a vast array of crops such as grapes, potatoes, tomatoes, apples, bananas, and citrus fruits, which are highly susceptible to fungal diseases and have high market value.

- Grains & Cereals: Critical for protecting staple crops like wheat, rice, corn, and barley from diseases like rusts, blights, and mildews, essential for global food security.

- Oilseeds & Pulses: Includes crops such as soybeans, sunflowers, and lentils, where dithiocarbamates protect against various leaf spot diseases and rusts.

- Ornamentals: Used in nurseries and gardens to protect flowers, shrubs, and trees from cosmetic and destructive fungal infections.

- Other Crops: Includes sugar beets, coffee, and specialty crops where dithiocarbamates play a role in disease management.

- By Form

- Wettable Powder (WP): A solid formulation that disperses in water to form a suspension, widely used for foliar application due to its stability and ease of transport.

- Suspension Concentrate (SC): A liquid formulation containing finely ground solid particles suspended in a liquid, offering good adherence and easier handling than powders.

- Water Dispersible Granules (WDG): Granular formulations that dissolve or disperse in water to form a suspension, minimizing dust and improving safety during handling.

- Granules (GR): Solid granular formulations typically applied to the soil, offering sustained release and systemic protection.

- Other Formulations: Includes dusts, soluble concentrates, and emulsifiable concentrates, used for specific application methods or crop types.

- By Mode of Action

- Multi-site Contact Fungicides: Dithiocarbamates primarily fall into this category, meaning they affect multiple metabolic pathways in fungi, significantly reducing the risk of resistance development. This broad mode of action is a key advantage.

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Dithiocarbamate Fungicides Market

The value chain for the Dithiocarbamate Fungicides Market is a complex network involving multiple stages, from raw material sourcing to end-user application, highlighting the intricate processes and stakeholders involved. Upstream analysis focuses on the procurement of essential chemical intermediates and raw materials required for the synthesis of dithiocarbamate active ingredients. This includes sulfur, carbon disulfide, ammonia, and various amine derivatives. Manufacturers typically source these from a global network of chemical suppliers, with emphasis on purity, cost-effectiveness, and consistent supply. The quality and availability of these raw materials directly impact the production cost and final product quality of dithiocarbamate fungicides. Key activities at this stage involve raw material purification, initial chemical reactions, and the synthesis of the active ingredient, often carried out by specialized chemical manufacturers or integrated agrochemical companies with robust in-house production capabilities. Efficient upstream management is critical for controlling production costs and ensuring the steady supply of the active pharmaceutical ingredient (API).

Downstream analysis encompasses the formulation, packaging, distribution, and ultimate application of the fungicides. Once the active ingredient is synthesized, it undergoes formulation processes to create various end-use products such as wettable powders, suspension concentrates, or granules. This stage involves adding inert carriers, surfactants, dispersants, and other adjuvants to enhance stability, efficacy, and ease of application. Packaging is tailored for different market needs, ranging from bulk containers for large agricultural operations to smaller packs for individual farmers. The distribution channel is multifaceted, comprising both direct and indirect routes. Direct sales are often made to large commercial farms, cooperatives, or government agricultural bodies through a company's own sales force. Indirect distribution relies heavily on a network of wholesalers, distributors, retailers, and agricultural cooperatives, which facilitate market penetration into diverse geographical areas and cater to smaller-scale farmers. This extensive network ensures that products reach farmers efficiently, especially in remote agricultural regions.

The efficacy of the distribution channel is paramount for market success, influencing product availability, pricing, and customer support. Companies strategically manage their distribution to optimize reach and minimize logistics costs. After purchase, the end-users, primarily farmers and agricultural businesses, apply the fungicides to their crops. This final stage involves understanding proper dosage, timing, and application techniques to ensure maximum efficacy and compliance with safety regulations. Post-sales support, including technical advice and training, is also a critical component of the value chain, ensuring customer satisfaction and promoting responsible use. The entire value chain is subjected to rigorous quality control measures and regulatory oversight at each stage to ensure product safety, environmental compliance, and adherence to international standards.

Dithiocarbamate Fungicides Market Potential Customers

The Dithiocarbamate Fungicides Market caters to a diverse range of end-users and buyers, primarily within the agricultural sector, where effective disease management is paramount for crop health and yield optimization. The largest segment of potential customers comprises commercial farms, including large-scale corporate agricultural enterprises and individual family-owned farms across various crop types. These farms heavily rely on dithiocarbamates for prophylactic and curative treatments against prevalent fungal diseases in their extensive fields of grains, cereals, oilseeds, fruits, and vegetables. Their purchasing decisions are influenced by factors such as product efficacy, cost-effectiveness, ease of application, and compliance with local agricultural regulations and market demands for quality produce. They often purchase in bulk through distributors or directly from manufacturers, seeking consistent supply and technical support.

Another significant customer segment includes horticultural businesses, such as nurseries, greenhouses, and ornamental plant growers. These entities utilize dithiocarbamate fungicides to protect a wide array of flowers, shrubs, trees, and other ornamental plants from fungal pathogens that can cause significant aesthetic damage or even plant death. For ornamental growers, maintaining pristine plant appearance is crucial for marketability, making effective disease control indispensable. Similarly, specialized crop growers, such as those cultivating coffee, tea, or spices, also represent key end-users, leveraging dithiocarbamates to protect their high-value crops from specific regional fungal threats. These growers often face unique environmental conditions that necessitate tailored disease management strategies, making the broad-spectrum protection offered by dithiocarbamates highly valuable.

Furthermore, agricultural cooperatives and government agricultural departments also act as important buyers. Cooperatives aggregate demand from numerous smaller farmers, facilitating bulk purchases and ensuring access to essential fungicides. Government agencies often purchase dithiocarbamates for agricultural development programs, disease outbreak control, or to supply to smallholder farmers through subsidies and support initiatives. Research and development institutions, universities, and agricultural consultants also form a smaller, but influential, customer group, acquiring these fungicides for experimental purposes, efficacy testing, and providing recommendations to farmers. The diverse needs and operational scales of these potential customers necessitate a varied product offering and robust distribution strategies from manufacturers and suppliers in the dithiocarbamate fungicides market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 2.75 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Corteva Agriscience, Syngenta AG, UPL Limited, FMC Corporation, Adama Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd., Nufarm Limited, American Vanguard Corporation, Isagro SpA, Sipcam Oxon S.p.A., Indofil Industries Ltd., Taminco (a part of Eastman Chemical Company), Gowan Company, Certis USA LLC, Crop Science (subsidiary of Bayer), Albaugh LLC, Sharda Cropchem Ltd., Drexel Chemical Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dithiocarbamate Fungicides Market Key Technology Landscape

The technology landscape for the Dithiocarbamate Fungicides Market is continuously evolving, primarily focusing on enhancing product efficacy, improving user safety, and minimizing environmental impact through innovative formulation and application techniques. Traditional dithiocarbamates, while effective, often face challenges related to rainfastness, photostability, and ease of handling. To address these, manufacturers are increasingly employing advanced formulation technologies. Microencapsulation is a notable advancement, where active ingredients are enclosed in polymeric capsules. This technology allows for controlled release, extending the residual activity of the fungicide, reducing the frequency of application, and providing better protection against degradation from UV light or rainfall. It also improves operator safety by reducing direct exposure to the active chemical during mixing and application, thereby enhancing the overall safety profile of the product.

Another significant area of technological innovation lies in the development of sophisticated suspension concentrates (SC) and water dispersible granules (WDG). These modern formulations offer several advantages over older wettable powder (WP) forms, including reduced dust formation, improved flowability, easier mixing in water, and enhanced spray tank stability. The fine particle size achieved in SC formulations ensures better coverage and adherence to plant surfaces, leading to more uniform distribution and increased efficacy. WDG formulations, on the other hand, provide the convenience of granular products while dispersing readily in water, combining the benefits of solid and liquid forms. These advancements contribute to more precise and efficient fungicide application, optimizing the use of active ingredients and minimizing potential environmental runoff.

Furthermore, technological progress extends to application methodologies, with increasing adoption of precision agriculture techniques. This includes the use of drones and GPS-guided sprayers that can deliver dithiocarbamate fungicides with high accuracy, targeting specific affected areas rather than blanket application. Sensor technologies, coupled with predictive analytics and artificial intelligence, are also becoming instrumental in identifying early signs of fungal infection and determining optimal application timings and dosages. This data-driven approach not only maximizes the effectiveness of fungicides but also promotes judicious use, aligning with integrated pest management (IPM) principles. Research into synergistic mixtures, combining dithiocarbamates with other active ingredients (e.g., systemic fungicides or biological agents), is also a key technological trend aimed at broadening the spectrum of activity, enhancing efficacy, and managing resistance development more effectively. These technological advancements collectively contribute to a more sustainable and efficient use of dithiocarbamate fungicides in agriculture.

Regional Highlights

- North America: The North American market for dithiocarbamate fungicides is characterized by advanced agricultural practices, a strong emphasis on yield optimization for high-value crops like fruits, vegetables, and specialty grains, and stringent regulatory frameworks. The adoption of precision farming techniques, coupled with substantial research and development investments, drives demand for high-quality and efficient fungicide formulations. Major markets include the United States and Canada, where farmers face diverse fungal disease pressures across vast agricultural landscapes.

- Europe: Europe represents a mature market with a strong focus on sustainable agriculture, environmental protection, and food safety. While regulatory pressures on pesticides are high, leading to restrictions or bans on certain dithiocarbamates, their continued demand is driven by the need to protect high-value crops such as grapes, potatoes, and other vegetables. Innovation in safer, more targeted formulations and integration into IPM strategies are key trends. Western European countries like France, Germany, Italy, and Spain are significant consumers, balancing crop protection needs with ecological concerns.

- Asia Pacific (APAC): The Asia Pacific region is the largest and fastest-growing market for dithiocarbamate fungicides, fueled by its vast agricultural lands, increasing population, and growing food demand. Countries like China, India, and Southeast Asian nations are undergoing rapid agricultural intensification, with increasing adoption of modern farming techniques and crop protection chemicals. The prevalence of diverse fungal diseases due to varying climatic conditions and extensive cultivation of rice, fruits, and vegetables further boosts market growth. Economic development and government initiatives promoting agricultural productivity also contribute significantly to this region's dominance.

- Latin America: Latin America is a crucial market, particularly due to its extensive cultivation of soybeans, corn, sugarcane, and coffee. The region experiences significant fungal disease pressures due to its tropical and subtropical climates, driving consistent demand for effective fungicides. Brazil and Argentina are leading markets, characterized by large-scale commercial farming operations and increasing adoption of advanced crop protection solutions. Economic stability and expanding export-oriented agriculture further stimulate market growth in this dynamic region.

- Middle East & Africa (MEA): The MEA region represents an emerging market with considerable growth potential, primarily driven by ongoing agricultural development projects, efforts to enhance food security, and increasing foreign investments in the agricultural sector. While currently a smaller market compared to other regions, the rising awareness of crop protection benefits and the gradual adoption of modern farming technologies, particularly in countries with significant arable land, are expected to fuel future demand for dithiocarbamate fungicides. Climate change impacts on water scarcity and disease patterns also contribute to the growing need for effective crop protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dithiocarbamate Fungicides Market.- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta AG

- UPL Limited

- FMC Corporation

- Adama Agricultural Solutions Ltd.

- Sumitomo Chemical Co., Ltd.

- Nufarm Limited

- American Vanguard Corporation

- Isagro SpA

- Sipcam Oxon S.p.A.

- Indofil Industries Ltd.

- Taminco (a part of Eastman Chemical Company)

- Gowan Company

- Certis USA LLC

- Crop Science (subsidiary of Bayer)

- Albaugh LLC

- Sharda Cropchem Ltd.

- Drexel Chemical Company

Frequently Asked Questions

Analyze common user questions about the Dithiocarbamate Fungicides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are dithiocarbamate fungicides and how do they work?

Dithiocarbamate fungicides are a class of broad-spectrum, multi-site contact fungicides used to protect crops from various fungal diseases. They work by inhibiting multiple enzyme systems within fungal cells, preventing spore germination and mycelial growth, thereby disrupting fungal respiration and metabolic processes. This multi-site mode of action is key to their effectiveness and helps manage resistance development.

What are the primary applications of dithiocarbamate fungicides?

The primary applications of dithiocarbamate fungicides span a wide range of crops, including fruits (e.g., grapes, apples, bananas), vegetables (e.g., potatoes, tomatoes, onions), grains and cereals (e.g., wheat, rice, corn), and oilseeds & pulses (e.g., soybeans). They are crucial for controlling diseases like early and late blight, downy mildew, rusts, and scabs, ensuring crop health and yield.

Are dithiocarbamate fungicides safe for the environment and human health?

Dithiocarbamate fungicides are subject to rigorous regulatory scrutiny globally. When used according to label instructions and good agricultural practices, they are generally considered safe. Concerns exist regarding potential residues and environmental fate, leading to ongoing research into safer formulations and application methods. Adherence to recommended dosages and pre-harvest intervals is essential for minimizing risks.

What are the key market drivers and restraints for dithiocarbamate fungicides?

Key market drivers include increasing global food demand, rising incidence of crop diseases due to climate change, and the effectiveness of dithiocarbamates in resistance management due to their multi-site mode of action. Restraints involve stringent environmental regulations, public concerns over pesticide residues, and competition from emerging bio-fungicides and alternative crop protection solutions.

How is technology impacting the dithiocarbamate fungicides market?

Technology is significantly impacting the market through advanced formulation techniques like microencapsulation and water dispersible granules, which enhance efficacy, reduce environmental impact, and improve user safety. Precision agriculture, including drone-based spraying and AI-driven disease prediction, optimizes application, minimizes waste, and integrates dithiocarbamates into more sustainable farming practices, contributing to more efficient and targeted use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dithiocarbamate Fungicides Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dithiocarbamate Fungicides Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Propineb, Thiram, Mancozeb), By Application (Horticultural and ornamental crops, Plantations and estates, Agricultural), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager