DIY Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432112 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

DIY Market Size

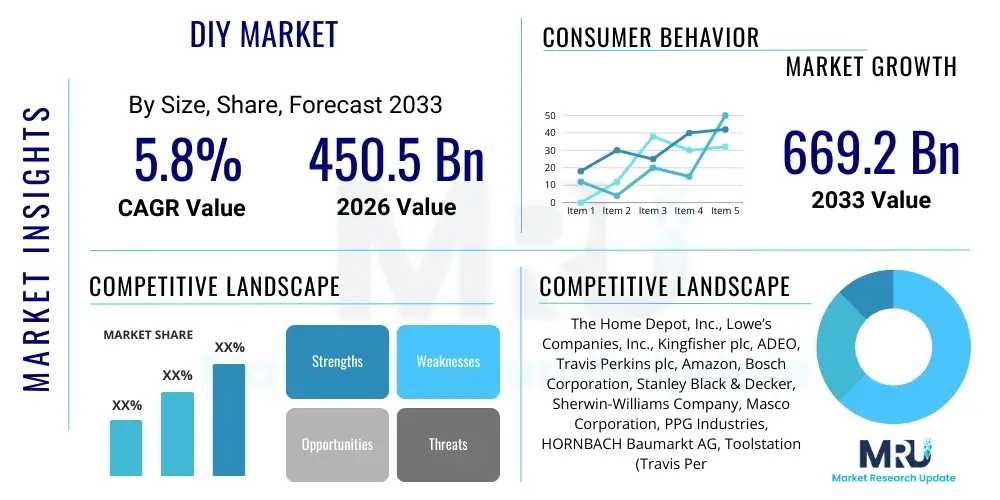

The DIY Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $450.5 Billion in 2026 and is projected to reach $669.2 Billion by the end of the forecast period in 2033.

DIY Market introduction

The Do-It-Yourself (DIY) Market encompasses the sale of materials, tools, and services aimed at consumers who undertake minor or major home improvement, maintenance, repair, and creative projects without the direct assistance of paid professionals. This expansive sector includes everything from basic hardware and power tools to sophisticated smart home installation kits and decorative arts supplies. The product description of the DIY market is highly diverse, covering core categories such as building materials, plumbing and electrical supplies, lawn and garden equipment, painting and decorating products, and automotive repair tools. The fundamental allure of the DIY approach is the combination of cost savings, personalization, and the satisfaction derived from completing a project independently.

Major applications of DIY products are primarily concentrated in residential settings, including interior renovation (kitchen and bathroom remodeling), exterior maintenance (roofing, deck construction, landscaping), and energy efficiency upgrades (insulation, smart thermostat installation). The intrinsic benefits fueling market expansion include increased home equity value derived from improvements, greater control over project timelines and costs, and the therapeutic aspect of manual work. Furthermore, the rising proliferation of digital platforms offering tutorials and educational content has significantly lowered the barrier to entry for novice DIY enthusiasts, expanding the consumer base substantially across various demographic groups.

Driving factors for the sustained growth of the DIY market are multifaceted, largely centered around elevated consumer interest in home aesthetics and functionality, stimulated by prolonged periods spent at home (post-pandemic effect), and a global shortage of skilled professional labor which drives up contractor costs. Economic volatility also plays a critical role; during inflationary periods or economic downturns, consumers often opt for DIY solutions to conserve capital. Technological advancements, such as easy-to-use smart tools, modular furniture systems, and augmented reality applications that facilitate visualization of finished projects, further catalyze market penetration and drive consumer confidence in undertaking complex tasks.

DIY Market Executive Summary

The DIY Market is undergoing a rapid evolution characterized by significant shifts across business models, consumer engagement, and geographic distribution. Business trends show a strong migration toward omni-channel retailing, where traditional brick-and-mortar hardware stores are heavily investing in robust e-commerce platforms, offering features like click-and-collect, precise inventory tracking, and expedited local delivery to manage the increased demand for immediate access to supplies. A dominant trend is the premiumization of tools and materials, driven by consumer desire for sustainable, durable, and technologically advanced products, such as cordless power tools with superior battery life and environmentally friendly building materials. Furthermore, there is an observable integration of specialized services, including virtual consultation and tool rental services, complementing core product offerings and diversifying revenue streams for major retailers.

Regional trends indicate that North America and Europe maintain dominance, primarily due to high levels of home ownership, established DIY culture, and disposable income dedicated to home improvement. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, propelled by rapid urbanization, increasing middle-class income, and governmental emphasis on housing infrastructure development, particularly in emerging economies like India and China, where the demand for basic building supplies and home maintenance kits is soaring. Latin America and the Middle East and Africa (MEA) are also showing promising expansion, spurred by digital literacy improvements and the availability of affordable entry-level DIY products tailored to local market needs and climatic considerations.

Segmentation trends highlight the increasing importance of the 'E-commerce' distribution channel, which is outpacing traditional retail growth, especially for smaller, high-value, or digitally marketed specialty items. Product segmentation sees particular strength in the categories of home décor, garden care, and energy management solutions, reflecting consumer priorities toward comfort, outdoor living, and cost-saving measures. Application-wise, repair and maintenance projects continue to form the largest share, although full-scale renovation projects exhibit the highest average transaction value. The market is also seeing polarization in end-users: while skilled DIYers demand professional-grade equipment, the beginner segment requires user-friendly kits and extensive digital instructional support, necessitating customized product lines and marketing strategies.

AI Impact Analysis on DIY Market

User queries regarding AI's influence on the DIY market primarily focus on three key areas: personalized project assistance, efficiency improvement in retail environments, and the democratization of complex tasks. Consumers frequently ask how AI can generate customized material lists based on project photos, provide real-time troubleshooting for technical challenges (e.g., plumbing or electrical issues), and simplify the shopping experience through predictive inventory stocking and virtual product placement (AR integration). Concerns often center on data privacy regarding home schematics and the reliability of AI recommendations replacing professional advice. The general expectation is that AI will transform DIY from a trial-and-error process into a guided, highly efficient, and less frustrating endeavor, dramatically lowering the expertise required to achieve professional-grade results.

- AI-Powered Project Planning: Generation of precise blueprints, material quantity calculations, and step-by-step instructions customized to specific home dimensions and user skill levels, minimizing waste and errors.

- Augmented Reality (AR) Tools: Utilizing smartphone or tablet cameras to overlay virtual products (paint colors, furniture, tiles) onto real home environments before purchase, enhancing visualization and reducing return rates.

- Predictive Maintenance: Integration of AI with smart home sensors to anticipate necessary repairs (e.g., roof damage, faulty appliance components) and proactively suggest required DIY solutions and parts.

- Optimized E-commerce Experience: AI-driven personalized product recommendations, efficient site search capabilities using natural language processing (NLP), and automated chatbot support for basic technical queries and tool operation guidance.

- Supply Chain and Inventory Management: AI algorithms optimizing inventory distribution for large DIY retailers, forecasting demand fluctuations based on seasonal trends and local construction permits, thereby ensuring product availability.

DRO & Impact Forces Of DIY Market

The DIY Market is significantly shaped by a compelling combination of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces guiding market trajectory. The primary driver remains the escalating cost of professional labor and the widespread availability of digital educational content (YouTube tutorials, DIY blogs), making previously specialized tasks accessible to the general public. This accessibility is compounded by the psychological reward of self-sufficiency and personalization. However, the market faces significant restraints, notably the time commitment required for DIY projects, which acts as a barrier for consumers with demanding schedules, and the potential for project failure or safety hazards due to lack of expertise, leading some consumers back to professional services. Opportunities are abundant in sustainable and smart home technologies, where consumers are increasingly willing to invest in high-efficiency and aesthetically pleasing products that offer long-term savings and convenience.

Impact forces are centered around macroeconomic conditions and technological adoption. A strong macroeconomic environment typically leads to increased disposable income, stimulating larger-scale remodeling projects, while periods of recessionary pressure often shift focus towards essential repairs and small-scale maintenance (the 'nesting effect'). The increasing environmental consciousness globally acts as a powerful accelerating force, pushing demand for eco-friendly paints, recycled materials, and energy-efficient insulation products. Regulatory frameworks concerning building codes and safety standards also exert force, requiring manufacturers to continuously update product specifications and requiring consumers to adhere to specific local installation guidelines, sometimes restraining complex projects.

The interaction between digital technology and physical retail is another core impact force. The demand for seamless omni-channel experiences forces traditional retailers to invest heavily in logistics and digital integration. Furthermore, social media influence plays a critical role, transforming DIY into a fashionable and shared activity, particularly among younger demographics who document their projects, generating organic demand and establishing trends in home aesthetics. The interplay of cost savings (Driver) versus complexity (Restraint) determines consumer choice for individual projects, solidifying the market's dynamic nature and its reliance on consumer confidence and digital empowerment.

Segmentation Analysis

The DIY market is intricately segmented across various dimensions, including the type of product purchased, the specific application or project undertaken, the distribution channel utilized for procurement, and the end-user profile. Understanding these segments is crucial for targeted marketing and inventory management, as the needs and purchasing behaviors of a professional-grade tool buyer differ fundamentally from those seeking basic decorative supplies. Product segmentation typically reflects the breadth of home components, ranging from heavy building materials to small decorative hardware. Application segmentation differentiates between planned major renovations versus necessary urgent repairs, influencing purchasing urgency and price sensitivity.

- By Product Type:

- Lumber and Building Materials (Wood, Drywall, Concrete)

- Tools and Equipment (Hand Tools, Power Tools, Accessories)

- Plumbing and Electrical Supplies (Pipes, Wiring, Fixtures)

- Hardware (Nails, Screws, Fasteners, Door/Window Hardware)

- Painting and Decorating (Paints, Coatings, Wallpaper, Brushes)

- Lawn and Garden (Equipment, Seeds, Fertilizers, Landscaping Materials)

- Home Organization and Storage

- By Application:

- Indoor Maintenance and Repair (Minor Fixes, Appliance Repair)

- Outdoor Maintenance and Repair (Decking, Fencing, Roofing Repair)

- Remodeling and Renovation (Kitchen, Bathroom, Major Structural Changes)

- Home Decor and Personalization (Crafts, Furniture Assembly, Aesthetic Upgrades)

- By Distribution Channel:

- Brick-and-Mortar Stores (Specialty Stores, Large Format Home Centers)

- E-commerce/Online Retail

- Wholesalers and Distributors

- By End-User:

- Renters

- Homeowners (First-Time, Experienced)

- Semi-Professional DIYers/Hobbyists

Value Chain Analysis For DIY Market

The value chain for the DIY Market is complex, stretching from raw material extraction and component manufacturing (upstream analysis) through final distribution and end-user consumption (downstream analysis). Upstream activities involve sourcing commodities like metals, timber, chemicals, and plastics, requiring robust logistics and quality control for consistency. Manufacturers then transform these raw materials into finished products such as power tools, paints, and standardized construction components. Efficiency at this stage is dictated by automation, scale, and adherence to global safety and environmental standards, with high specialization required for components like battery technology in cordless tools or complex chemical formulations in modern coatings.

The midstream segment involves sophisticated consolidation and distribution. Products move from primary manufacturers or specialized component suppliers to various distributors, including large global purchasing organizations. Distribution channels are bifurcated into direct and indirect routes. Direct sales often involve large manufacturers selling directly to massive retail chains (e.g., Home Depot, Lowe's), allowing for economies of scale and centralized marketing. Indirect channels involve regional wholesalers or specialized distributors who serve smaller independent hardware stores, specific trade outlets, or specialized e-commerce platforms, offering tailored services like regional inventory holding and credit facilities.

Downstream analysis focuses on retail and consumption. The dominant distribution methods involve large format home centers, which provide a comprehensive one-stop-shop experience, integrating product display, specialized advice centers, and ancillary services like key cutting and material mixing. E-commerce platforms represent the fastest-growing channel, offering convenience and broader product selection, often leveraging direct-to-consumer models or sophisticated third-party logistics networks. The success of the downstream operation relies heavily on efficient inventory management, tailored customer service (both in-person and digital), and leveraging digital content (tutorials and guides) to facilitate the actual usage of the products by the end-user.

DIY Market Potential Customers

The potential customer base for the DIY market is broad yet segmented, primarily encompassing homeowners, renters, and hobbyist crafters, all seeking cost-effective or personalized solutions for their living spaces. Homeowners, particularly those who have recently purchased older properties or those aiming to increase property valuation, represent the core target demographic for large-scale renovation and material purchases. These consumers often exhibit high engagement in digital content and value durability and brand reputation in their tool selection. The rising cost of housing and general inflationary pressures amplify the appeal of DIY as a financially viable alternative to professional contracting.

Renters, while traditionally engaging in less complex DIY, represent a growing segment, especially for movable, non-permanent improvements such as painting, shelving installation, and decorative fixes that personalize temporary living spaces. This group is highly responsive to modular, easy-to-install, and aesthetically trending products. A third major segment is the hobbyist or maker community, driven by creative motivation rather than necessity, purchasing specialized tools, materials, and components for crafts, woodworking, electronics, and automotive modifications. These users prioritize technical specifications, high precision, and community-driven product recommendations.

Geographically, potential customers are concentrated in regions with high home ownership rates and developed retail infrastructure. Demographic shifts also play a role; millennials and Generation Z are increasingly engaging in DIY, spurred by social media platforms that glamorize home transformation projects and offer accessible instructional content. Marketing efforts must therefore be highly targeted, addressing the specific needs: cost savings and value for homeowners, portability and ease of removal for renters, and technical excellence and community for hobbyists, ensuring the retail environment—whether physical or digital—provides relevant educational support and product categorization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Billion |

| Market Forecast in 2033 | $669.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Home Depot, Inc., Lowe’s Companies, Inc., Kingfisher plc, ADEO, Travis Perkins plc, Amazon, Bosch Corporation, Stanley Black & Decker, Sherwin-Williams Company, Masco Corporation, PPG Industries, HORNBACH Baumarkt AG, Toolstation (Travis Perkins), Makita Corporation, Sika AG, Fastenal Company, WÜRTH GROUP, RONA (Lowe’s Canada), Ace Hardware, Menards. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DIY Market Key Technology Landscape

The DIY market’s technological landscape is rapidly shifting, moving beyond traditional mechanical tools to sophisticated digital and connected solutions designed to simplify planning, execution, and project management. One of the most critical technologies is the advancement in cordless power tools, driven by superior lithium-ion battery technology, which offers extended runtimes, reduced charging cycles, and increased power output, effectively professionalizing the equipment available to consumers. This minimizes reliance on cumbersome cords and expands the usability of tools across diverse environments, from large gardens to remote garage spaces. Furthermore, tool manufacturers are increasingly integrating IoT capabilities, allowing tools to connect to apps for diagnostics, anti-theft tracking, and usage data analysis.

Digital technologies, particularly Augmented Reality (AR) and Virtual Reality (VR), are reshaping the pre-project planning phase. AR applications allow users to scan rooms and digitally place products—such as paint colors, flooring, or new furniture—to visualize the final outcome accurately before committing to a purchase. This significantly reduces decision fatigue and returns associated with aesthetic misjudgments. VR training simulations are also emerging, offering safe environments for beginners to practice complex tasks like tiling or electrical wiring, reducing the risk of costly mistakes or personal injury during actual execution. These planning tools contribute directly to increased consumer confidence and willingness to undertake more ambitious DIY projects.

E-commerce and logistics technology form the backbone of modern DIY retail. Advanced warehouse automation, last-mile delivery optimization, and sophisticated inventory algorithms (often AI-driven) are necessary to handle the sheer volume and diversity of SKUs found in the DIY sector, ranging from small screws to large sheets of drywall. Furthermore, the reliance on rich digital content—high-definition video tutorials, interactive guides, and personalized material calculators—requires robust content management systems and high-speed delivery networks. The convergence of smart home technology (for self-installation kits like smart thermostats and security cameras) with traditional hardware sales continues to be a major technological driver, bridging the gap between basic repairs and advanced automated home management.

Regional Highlights

- North America: This region maintains the largest market share, driven by a deeply ingrained home ownership culture, high disposable incomes, and the presence of global DIY retail giants (The Home Depot, Lowe's). The market is mature but focuses heavily on sustainable building materials, smart home integration, and rapid technological adoption in power tools. High labor costs provide a constant incentive for consumers to handle renovations themselves.

- Europe: Characterized by strong differentiation between Western Europe (mature markets like Germany, UK, France, focusing on refurbishment of older housing stock and strong emphasis on sustainability/energy efficiency) and Eastern Europe (emerging markets with high growth potential driven by new construction and rising middle-class income). The European market exhibits strong segment loyalty to local and specialized hardware store formats alongside growing large-format chains.

- Asia Pacific (APAC): Expected to register the fastest growth due to rapid urbanization, escalating construction activity, and increasing awareness of home improvement benefits in populous nations like China, India, and Southeast Asia. The market here is fragmented, with significant demand for basic, affordable tools and materials. E-commerce penetration is rapidly accelerating, bypassing traditional physical infrastructure in many areas.

- Latin America (LATAM): Growth is primarily fueled by improving economic stability and rising disposable income. The DIY concept is gaining traction, moving beyond essential repairs to decorative and personalization projects. Digital access and mobile commerce are key growth enablers, allowing retailers to reach previously underserved populations with targeted product offerings.

- Middle East and Africa (MEA): This region is driven by large infrastructure projects and expanding residential developments, particularly in the Gulf Cooperation Council (GCC) countries. The market demand is bifurcated, with high-end, professional-grade tools used in large construction projects, and basic home repair items catering to the growing urban population. Climate-specific products (e.g., cooling systems, specialized paints) are particularly relevant.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DIY Market.- The Home Depot, Inc.

- Lowe’s Companies, Inc.

- Kingfisher plc

- ADEO

- Travis Perkins plc

- Amazon

- Bosch Corporation

- Stanley Black & Decker

- Sherwin-Williams Company

- Masco Corporation

- PPG Industries

- HORNBACH Baumarkt AG

- Toolstation (Travis Perkins)

- Makita Corporation

- Sika AG

- Fastenal Company

- WÜRTH GROUP

- RONA (Lowe’s Canada)

- Ace Hardware

- Menards

Frequently Asked Questions

Analyze common user questions about the DIY market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the DIY Market through 2033?

The DIY Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period spanning from 2026 to 2033, indicating robust expansion driven by digital content accessibility and high contractor costs.

Which product segments are showing the highest growth potential in the DIY sector?

High growth potential is observed in smart home integration kits, energy-efficient building materials, cordless power tools utilizing advanced battery technology, and sustainable (eco-friendly) paint and decorating products, reflecting consumer prioritization of convenience and environmental responsibility.

How is Augmented Reality (AR) technology impacting the consumer DIY experience?

AR technology is significantly improving the pre-purchase decision process by allowing users to virtually test products like paint colors, flooring, and furniture in their actual living spaces, thereby enhancing visualization, reducing project errors, and lowering the rate of product returns in the e-commerce channel.

What primary restraints hinder the expansion of the DIY Market globally?

The primary restraints include the significant time commitment required for complex projects, the inherent risks of project failure due to lack of specialized skills, and safety concerns, which often motivate homeowners to opt for professional services despite the higher cost.

Which geographical region is expected to demonstrate the fastest DIY market growth?

The Asia Pacific (APAC) region is forecasted to achieve the fastest market growth, primarily fueled by rapid urbanization, substantial growth in the middle-class population, increasing home improvement awareness, and significant infrastructure development across countries like China and India.

The DIY Market is a dynamic sector driven by economic necessity, technological empowerment, and a cultural shift towards personalization. The integration of digital tools, coupled with the persistent labor shortage in professional trades, positions the DIY industry for sustained long-term growth. Manufacturers and retailers must prioritize omni-channel strategies, focusing on educational content and environmentally responsible product lines to capture the evolving consumer base. The competitive landscape demands continuous innovation in logistics and personalized customer support to maintain relevance in both physical and digital arenas. The convergence of hardware and software, particularly through smart home devices and AI-powered project assistance, represents the next major transformative phase in the market, ensuring that DIY accessibility continues to broaden across all skill levels and demographics. Success hinges on minimizing the perceived complexity of home projects and maximizing the convenience of procurement and support services.

Further analysis reveals that inflation, while typically a damper on consumer spending, has historically acted as a paradoxical accelerator for the DIY market, as it widens the cost gap between professional services and self-executed projects. This economic dynamic necessitates retailers maintaining competitive pricing strategies for essential materials while simultaneously investing in premium, high-margin tools targeting experienced users who value efficiency and longevity. Moreover, the aging housing stock in developed economies mandates consistent repair and maintenance activity, providing a resilient foundational demand for basic DIY supplies irrespective of short-term economic fluctuations. Investment in specialized training modules for retail staff remains crucial to bridge the technical knowledge gap that often intimidates novice DIY participants, solidifying the store environment as a trusted source of expertise alongside digital resources.

The regulatory environment, especially concerning environmental, social, and governance (ESG) factors, increasingly dictates product development and supply chain choices within the DIY sector. Consumers are actively seeking products with lower carbon footprints, sustainable sourcing certifications, and minimal volatile organic compound (VOC) emissions, particularly in paints and sealants. Companies that proactively integrate ESG principles into their core offerings gain a significant competitive edge, appealing to the growing segment of conscious consumers. Future market leadership will be defined not just by pricing or inventory breadth, but by the ability to offer genuinely sustainable solutions that simplify complex projects and reduce environmental impact, thereby meeting the dual demands of personal convenience and global responsibility.

Digital marketing strategies within the DIY space are heavily reliant on visual platforms and user-generated content, with platforms like Instagram, TikTok, and Pinterest serving as primary inspiration sources. Retailers must leverage these channels to showcase attainable project outcomes and provide immediate links to required tools and materials, effectively shortening the path from inspiration to purchase. The adoption of subscription models for consumables (e.g., filters, specific fasteners, batteries) or tool rental services managed through digital platforms further enhances customer loyalty and recurring revenue streams. This shift toward service-oriented models complements the core product sales, positioning large DIY chains as comprehensive home maintenance partners rather than just material suppliers.

The specialization of retail formats also marks a crucial evolutionary step. While large home centers cater to major renovations, smaller, strategically located urban stores or specialized tool outlets are focusing on immediate, small-scale repair needs and highly specific niche projects, optimizing inventory for speed and convenience. This micro-fulfillment strategy, supported by advanced geotargeting and rapid delivery networks, addresses the key restraint of time commitment, making quick fixes less burdensome for urban consumers. The future competitive advantage in DIY retail will likely involve mastery of hyper-local logistics and providing bespoke inventory solutions tailored to distinct neighborhood demands and construction practices.

Finally, the growing intersection of the DIY and professional construction markets cannot be ignored. Many professional contractors utilize DIY retail channels for convenient, immediate access to materials and tools, particularly for small jobs or urgent replacements. This cross-pollination requires manufacturers to maintain high standards of durability and performance in products marketed primarily to consumers, effectively blurring the lines between enthusiast-grade and professional-grade equipment. Monitoring the purchasing patterns of small-to-medium contractors within the consumer segment provides vital data for inventory planning and product assortment optimization, ensuring the market serves both the occasional home improver and the skilled tradesperson efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- DIY Home Improvement Retail Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- DIY (Do It Yourself) Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- DIY Home Improvement Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hair Rollers Market Size Report By Type (Hot rollers, Magnetic rollers, Velcro rollers, Foam rollers, Snap-on rollers, Plastic mesh rollers, Flexi-rods, Others), By Application (Professional hair care, DIY hair rolling), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Stone Plastic Composite (SPC) Flooring Market Statistics 2025 Analysis By Application (Commercial Use, Residential Use), By Type (DIY Installation, Professional Installation), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager