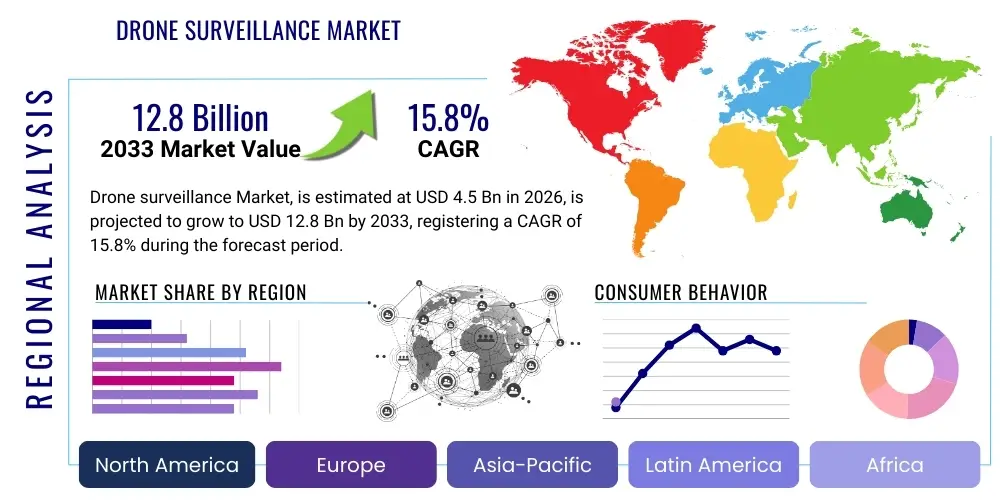

Drone surveillance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437415 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Drone surveillance Market Size

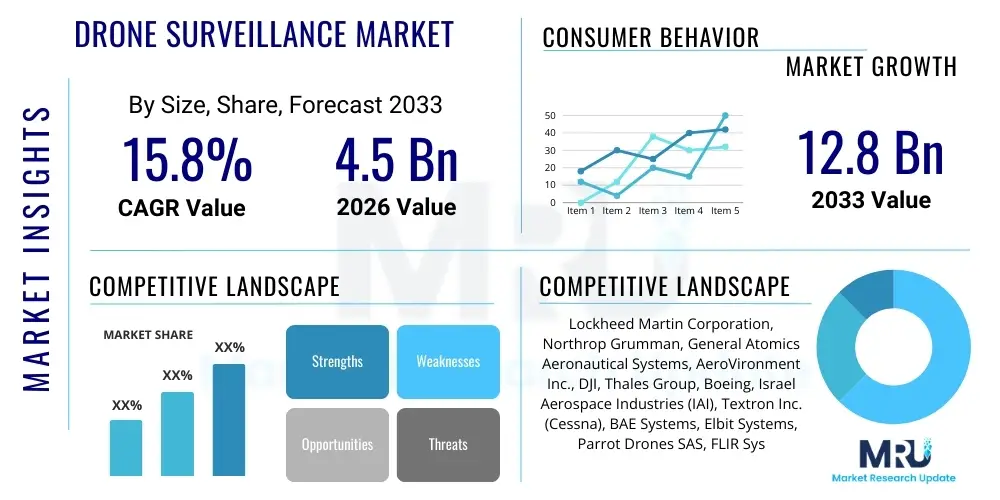

The Drone surveillance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for advanced security solutions across critical infrastructure sectors and the continued relaxation of regulatory frameworks allowing for broader commercial and governmental deployment of Unmanned Aerial Systems (UAS). The integration of artificial intelligence and machine learning algorithms into drone surveillance platforms is further enhancing operational efficiency, driving market valuation upwards significantly throughout the forecast period.

Drone surveillance Market introduction

The Drone Surveillance Market encompasses the technologies, hardware (drones), software (analytics and control systems), and services utilized for aerial monitoring, data collection, and security applications across various domains. These systems, ranging from small quadcopters to large fixed-wing UAS, are equipped with sophisticated payloads such as high-resolution cameras, thermal sensors, LiDAR, and communication interception devices. Key applications span military intelligence, public safety, border patrol, critical infrastructure inspection (oil and gas pipelines, power grids), and large event monitoring. The core benefit of drone surveillance lies in its ability to provide real-time, high-definition, persistent aerial views over vast or hazardous terrains quickly and cost-effectively, minimizing human risk associated with traditional monitoring methods.

The product description for modern drone surveillance systems emphasizes autonomy, persistence, and data fusion capabilities. Contemporary platforms often feature beyond visual line of sight (BVLOS) operation capabilities, enabling extensive coverage for applications like perimeter defense or search and rescue missions. Major applications include disaster response management where immediate situational awareness is paramount, environmental monitoring to detect unauthorized dumping or poaching, and agricultural surveillance for large-scale farm health assessments. Furthermore, in urban environments, drones are increasingly utilized for traffic management and monitoring large public gatherings, providing law enforcement agencies with crucial real-time intelligence for maintaining order and security.

Driving factors propelling this market include the global increase in asymmetric security threats, necessitating continuous and scalable surveillance capabilities, coupled with substantial government and defense spending allocated to modernizing intelligence, surveillance, and reconnaissance (ISR) assets. Technological advancements in battery life, sensor miniaturization, and secure data transmission protocols have significantly improved the operational viability and reliability of these systems. However, the market growth is intrinsically linked to regulatory developments concerning airspace management and privacy laws, which dictate the speed and scale of deployment across different geographical regions.

Drone surveillance Market Executive Summary

The Drone Surveillance Market is characterized by vigorous growth, primarily fueled by technological convergence between robotics, AI, and telecommunications infrastructure. Business trends indicate a strong shift towards Software-as-a-Service (SaaS) models for analytics and data management, moving revenue away from pure hardware sales towards high-margin recurring software subscriptions for automated threat detection and predictive surveillance. Strategic partnerships between traditional aerospace contractors and agile tech startups specializing in computer vision are defining the competitive landscape. Furthermore, the push for standardized counter-drone (C-UAS) systems acts as a complementary market driver, ensuring the security and integrity of regulated airspace where surveillance drones operate.

Regionally, North America remains the dominant market, driven by robust military investment in advanced ISR platforms and the early adoption of commercial drone technology in oil and gas, utility, and law enforcement sectors. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, spurred by rapid urbanization, extensive infrastructure development projects requiring continuous monitoring (e.g., smart city initiatives), and increasing military modernization efforts in countries like China, India, and South Korea. European market expansion is steady but often constrained by complex, fragmented regulatory environments concerning BVLOS operations and stringent General Data Protection Regulation (GDPR) requirements impacting data collection practices.

Segment trends highlight the dominance of the governmental and defense segments, which account for the largest share due to high acquisition costs of sophisticated military-grade UAS and consistent demand for long-endurance platforms. Nonetheless, the commercial segment, particularly critical infrastructure inspection and construction monitoring, is rapidly increasing its market share. By type, fixed-wing drones offer persistence crucial for border patrol, while multirotor drones dominate urban surveillance due to their vertical takeoff and landing (VTOL) capabilities and superior maneuverability. The services component, encompassing maintenance, training, and data analytics outsourcing, is expected to grow at the highest CAGR, reflecting the increasing complexity of operating and deriving actionable intelligence from drone-collected data.

AI Impact Analysis on Drone surveillance Market

Users frequently inquire about how Artificial Intelligence (AI) transforms raw drone footage into actionable intelligence, specifically focusing on the capabilities of autonomous object detection, predictive analytics for threat assessment, and the ethical governance surrounding autonomous decision-making in surveillance missions. Common concerns revolve around the accuracy of AI algorithms in diverse weather conditions, the latency introduced during cloud-based processing, and the development of robust edge computing capabilities that allow drones to analyze data in real-time without reliance on constant communication links. Furthermore, stakeholders seek clarity on how AI integration impacts the total cost of ownership (TCO) and whether AI-powered platforms are easier or harder to operate than conventional, manually piloted systems.

The integration of AI, machine learning (ML), and deep learning (DL) into the Drone Surveillance Market is fundamentally shifting the operational paradigm from mere data capture to intelligent data interpretation and autonomous mission execution. AI algorithms are crucial for automating labor-intensive tasks such as identifying specific individuals, tracking vehicles in complex traffic flows, or detecting subtle anomalies during infrastructure inspections. This automation capability dramatically reduces the burden on human operators, allowing them to focus solely on high-level strategic oversight rather than routine monitoring, thereby enhancing surveillance scalability and efficiency across large geographical areas or extended time periods.

The most significant impact of AI lies in enhancing sensor fusion and operational autonomy. AI enables drones to process data simultaneously from multiple payloads—such as integrating thermal signatures with visual spectrum imagery—to provide a comprehensive and accurate environmental assessment. Furthermore, AI drives advanced path planning, enabling drones to autonomously navigate complex urban canyons, avoid dynamic obstacles, and optimize flight trajectories based on real-time environmental data and mission objectives, which is paramount for achieving safe and efficient BVLOS operations, thus directly influencing regulatory acceptance and commercial viability of surveillance solutions.

- AI enhances autonomous navigation and obstacle avoidance in complex environments.

- Machine Learning algorithms enable real-time object recognition and classification (e.g., unauthorized vehicles, specific persons, prohibited items).

- Deep learning facilitates predictive surveillance by identifying patterns indicative of potential threats or security breaches before they escalate.

- AI optimizes data compression and transmission, allowing high-resolution video streams to be efficiently transmitted over limited bandwidth connections (Edge AI).

- Sensor fusion capabilities powered by AI integrate data from visual, thermal, and LiDAR sensors for highly accurate situational awareness.

- Automated anomaly detection reduces human workload, accelerating the identification of compromised infrastructure elements (cracks, rust, leaks).

- AI supports sophisticated counter-UAS strategies by autonomously identifying and tracking unauthorized airborne threats.

- Ethical AI frameworks are required for compliance regarding facial recognition and data retention policies in public surveillance applications.

- AI models are constantly refined through continuous learning, improving accuracy over time based on mission data feedback loops.

- Autonomous decision-making allows drones to prioritize targets and re-route missions based on evolving real-time security threats.

DRO & Impact Forces Of Drone surveillance Market

The Drone Surveillance Market is primarily driven by escalating security requirements globally and technological advancements that enhance drone capabilities; however, stringent airspace regulations and persistent privacy concerns act as significant restraints. Opportunities are abundant in the emerging fields of 5G integration for enhanced connectivity and the widespread adoption of drones for monitoring expansive critical national infrastructure. The overall market trajectory is defined by high impact forces stemming from increasing governmental expenditure on defense modernization and the rapid reduction in hardware costs combined with improved reliability metrics, making advanced surveillance capabilities accessible to a broader range of end-users.

Drivers include the increasing necessity for real-time situational awareness in disaster zones, the proliferation of low-cost, high-capability drone hardware enabling rapid deployment, and the growing adoption of drones by non-traditional users such as construction and resource extraction companies for site security and compliance monitoring. Furthermore, the shift towards utilizing drones for inspection of aging infrastructure, where human access is difficult or dangerous, provides a significant, consistent demand base. Restraints primarily involve the complexity of obtaining regulatory approval for BVLOS and nighttime operations in controlled airspace, coupled with public resistance and legal challenges related to privacy violations and misuse of aerial data collected by surveillance platforms, demanding robust ethical guidelines.

Opportunities center on the development of specialized drone fleets capable of seamless integration into Smart City ecosystems, providing automated, responsive monitoring services. The transition to 5G networks unlocks potential for low-latency, high-volume data transmission, crucial for effective remote control and real-time AI processing of high-definition video feeds. Moreover, the burgeoning need for effective Counter-UAS (C-UAS) technology creates an ecosystem of complementary products and services focused on airspace security, offering substantial growth avenues for companies focused on defense and regulatory compliance solutions. Impact forces ensure continuous innovation, particularly concerning battery endurance and sensor sophistication, maintaining the competitive edge of aerial surveillance over traditional terrestrial monitoring systems.

Segmentation Analysis

The Drone Surveillance Market is broadly segmented based on type (fixed-wing, rotary-wing, hybrid), application (border security, critical infrastructure inspection, law enforcement, search and rescue), end-user (defense, commercial, government), and component (hardware, software, services). This layered segmentation reflects the diverse operational requirements and technological maturity across different sectors. The rotary-wing segment, specifically multirotor drones, typically dominates in urban environments due to their agility and VTOL capabilities, while fixed-wing and hybrid platforms are preferred for long-range, persistent monitoring essential for military and expansive linear infrastructure surveillance.

Further granularity exists within the component segment, where the services sub-segment is rapidly gaining prominence. This is driven by end-users increasingly relying on third-party experts for complex operations, specialized training, data interpretation, and maintenance protocols, allowing organizations to leverage drone technology without substantial internal operational overhead. Application segmentation underscores the strong governmental investment in defense and border security, which requires the most advanced and highly customized surveillance systems capable of operating in contested environments. Conversely, the commercial sector, focused on surveillance of construction sites, utility corridors, and agricultural land, drives demand for more cost-effective, readily deployable solutions with integrated cloud-based analytics.

Understanding these segmentations is critical for market stakeholders, as growth rates vary significantly. While hardware provides the foundational revenue base, software and services represent the fastest-growing and highest-margin opportunities, particularly those leveraging AI/ML for automated threat detection and compliance reporting. Geographic segmentation also plays a vital role, with military applications dominating North America and parts of Asia, while critical infrastructure and public safety applications drive momentum in Europe and emerging economies. These variances necessitate tailored product development and market entry strategies based on regional regulatory constraints and end-user priorities.

- By Type:

- Fixed-Wing Drones (Long-endurance, high-speed surveillance)

- Rotary-Wing Drones (Multirotor, VTOL capability, urban surveillance)

- Hybrid Drones (VTOL capability with fixed-wing endurance)

- By Application:

- Border Security and Maritime Patrol

- Critical Infrastructure Inspection and Monitoring (Energy, Utilities, Telecom)

- Law Enforcement and Public Safety (Crowd monitoring, traffic surveillance)

- Search and Rescue Operations (Disaster response, casualty location)

- Environmental Monitoring and Wildlife Protection

- Industrial Asset Monitoring and Perimeter Security

- Military Intelligence, Surveillance, and Reconnaissance (ISR)

- By End-User:

- Defense and Military Organizations (Highest budget, specialized needs)

- Government and Public Sector (Homeland Security, Police, Fire Departments)

- Commercial Enterprises (Construction, Energy, Mining, Agriculture)

- By Component:

- Hardware (Airframes, Payloads, Sensors, Ground Control Systems)

- Software (Flight Control, Data Processing, Analytics, AI Algorithms)

- Services (Training, Maintenance, Data Acquisition, Managed Surveillance Services)

- By Platform Size:

- Tactical Drones (Small UAS - SUAS)

- Medium Altitude Long Endurance (MALE) Drones

- High Altitude Long Endurance (HALE) Drones

Value Chain Analysis For Drone surveillance Market

The value chain of the Drone Surveillance Market begins with the upstream suppliers responsible for core components, including advanced sensor manufacturers (thermal, hyperspectral, LiDAR), specialized battery producers, and high-performance microchip and processing unit developers. The quality and reliability of these upstream inputs directly determine the performance capabilities (e.g., flight time, image resolution) of the final drone surveillance system. Strong negotiating power resides with suppliers offering proprietary technologies, particularly in the realm of miniaturized AI-enabled processors and long-duration power sources, necessitating close collaboration between component suppliers and platform integrators.

The midstream involves drone manufacturers and system integrators who assemble the airframes, integrate the payloads, and develop the proprietary flight control and navigation software. This stage adds significant value through system customization, ensuring the platform meets specific operational needs, such as secure data links for military applications or BVLOS readiness for commercial infrastructure inspection. Direct distribution channels are prevalent, especially for large defense contracts and sophisticated enterprise solutions, where sales involve complex negotiations, extensive integration testing, and long-term service agreements. This often bypasses traditional retail or broad commercial distributors.

Downstream elements encompass service providers and end-users. Service providers offer crucial operational support, including pilot training, regulatory compliance consulting, and sophisticated data analytics services (Drone-as-a-Service, DaaS). The final link involves the end-users—governments, defense agencies, and corporations—who utilize the surveillance data for decision- making. Indirect distribution occurs through regional value-added resellers (VARs) and system integrators who specialize in specific vertical markets (e.g., oil and gas, utilities) and bundle drone technology with existing security or IT infrastructure, ensuring comprehensive deployment and localized support for complex deployments.

Drone surveillance Market Potential Customers

The primary end-users and potential customers in the Drone Surveillance Market are governmental and defense organizations, driven by mandates to enhance national security, monitor vast international borders, and conduct global intelligence, surveillance, and reconnaissance (ISR) missions. These entities require platforms with exceptional endurance, secure communication links, and highly specialized, often military-grade, sensor payloads. High governmental procurement budgets ensure these customers remain the largest revenue generators for advanced surveillance drone manufacturers, focusing heavily on MALE and HALE systems for persistent, wide-area monitoring capabilities.

A rapidly expanding customer base resides within the critical infrastructure and public safety sectors. This includes municipal law enforcement agencies, fire departments, and emergency management services utilizing drones for immediate situational awareness during accidents, crowd control, and search and rescue operations. Infrastructure customers, such as power grid operators, pipeline companies, and transportation authorities, represent a substantial and continuous demand pool for inspection-focused surveillance, leveraging drones to detect subtle faults, unauthorized activity, and environmental risks across vast linear assets, prioritizing safety and regulatory compliance.

Furthermore, large commercial enterprises, including mining operations, construction firms, and large-scale agricultural operations, are increasingly adopting drone surveillance for comprehensive site security, asset management, and risk mitigation. These commercial buyers seek cost-effective, scalable solutions that integrate seamlessly with existing security protocols and provide automated reporting features. The demand here leans towards robust, easy-to-deploy rotary-wing systems and bundled software solutions that offer immediate ROI through reduced inspection time and enhanced security posture, driving the growth of the commercial DaaS (Drone-as-a-Service) model.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Northrop Grumman, General Atomics Aeronautical Systems, AeroVironment Inc., DJI, Thales Group, Boeing, Israel Aerospace Industries (IAI), Textron Inc. (Cessna), BAE Systems, Elbit Systems, Parrot Drones SAS, FLIR Systems (Teledyne FLIR), Draganfly Inc., Teledyne Technologies, Insitu (Boeing Subsidiary), Saab AB, Leonardo SpA, Turkish Aerospace Industries (TAI), Kratos Defense & Security Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drone surveillance Market Key Technology Landscape

The technological landscape of the Drone Surveillance Market is characterized by rapid advancements focused on three core areas: persistent operational capability, superior data collection payloads, and intelligent data processing at the edge. Crucial technologies include high-density lithium-ion and potentially solid-state batteries that extend flight endurance significantly, transitioning smaller UAS from short patrol missions to persistent surveillance roles. Furthermore, the adoption of satellite communication links complements traditional RF control systems, enabling true global BVLOS operation for military and long-range utility inspection missions, essential for covering large geographical areas efficiently and securely.

Payload technology is continually evolving, moving beyond standard visual cameras to sophisticated multi-spectral and hyperspectral sensors that can detect hidden objects or analyze material composition, which is critical for environmental monitoring and advanced intelligence gathering. Thermal and infrared imaging systems are standard for nighttime operations and detecting heat signatures associated with unauthorized activities or equipment malfunctions. More recently, LiDAR (Light Detection and Ranging) systems are being integrated to create highly accurate 3D mapping and terrain models in real-time, greatly enhancing the utility of surveillance data for planning and infrastructure maintenance, especially in complex environments.

A transformative technology is the integration of Edge Computing and 5G connectivity. Edge AI processors deployed directly on the drone allow for instantaneous analysis of video and sensor data, reducing latency and bandwidth requirements by only transmitting actionable intelligence rather than raw footage. This is vital for time-sensitive public safety and defense applications. Concurrently, the proliferation of 5G infrastructure provides the robust, low-latency, and high-throughput communication backbone necessary to reliably command and control large fleets of autonomous surveillance drones simultaneously, thereby paving the way for scalable Drone Traffic Management (UTM) systems crucial for market expansion.

Regional Highlights

Regional dynamics play a significant role in shaping the deployment and technological focus of drone surveillance, driven primarily by differing regulatory environments, security priorities, and infrastructure investment levels. North America (NA), led by the United States, represents the largest market share due to substantial governmental investment in defense and homeland security, coupled with a relatively mature commercial regulatory framework, particularly for BVLOS waivers in industrial corridors. NA leads in the adoption of AI-powered analytics and the establishment of sophisticated Counter-UAS systems, driven by major aerospace and defense contractors.

The Asia Pacific (APAC) region is poised for the fastest growth, fueled by massive investments in smart city projects, urbanization, and critical infrastructure expansion (e.g., extensive high-speed rail networks, new energy pipelines). Countries such as China, India, and Japan are rapidly deploying drone technology for public safety, traffic monitoring, and border surveillance, supported by less restrictive initial regulatory hurdles compared to Europe. The APAC market focuses heavily on scalable, cost-effective solutions capable of mass deployment, often leveraging local manufacturing capabilities to drive down hardware costs.

Europe demonstrates steady, strong demand, particularly for border surveillance (Schengen Area) and environmental protection. However, the market growth pace is often moderated by fragmented national regulations concerning airspace integration and strict GDPR requirements governing the collection and retention of video data, especially facial recognition in public spaces. The Middle East and Africa (MEA) region exhibits growing demand, heavily weighted toward defense, internal security, and oil and gas infrastructure protection. High geopolitical instability in certain MEA areas drives consistent, significant procurement of advanced long-endurance surveillance platforms, often sourced from Israeli and US defense technology providers.

- North America: Dominant market share due to high military spending, established regulatory frameworks (FAA waivers), and strong adoption in oil & gas, utilities, and law enforcement; focus on advanced AI analytics and C-UAS integration.

- Asia Pacific (APAC): Highest CAGR expected, driven by rapid urbanization, extensive infrastructure development (Smart Cities), and increasing government investment in public safety and large-scale environmental monitoring; China and India are key growth hubs.

- Europe: Steady growth, characterized by demand for maritime and internal border surveillance; market constrained by complex, country-specific regulations and strong privacy concerns (GDPR) impacting widespread public deployment.

- Middle East and Africa (MEA): Growth centered on defense modernization, oil and gas asset protection, and internal security requirements; strong demand for long-endurance, high-payload ISR platforms from regional governments.

- Latin America (LATAM): Emerging market primarily focused on combating illegal activities such as drug trafficking, illegal mining, and deforestation; increasing adoption by police and environmental protection agencies for monitoring remote, difficult-to-access terrain.

- Key Country Focus (US): Leaders in technology development and defense procurement.

- Key Country Focus (China): Massive internal market for public security and rapid development of domestic drone technology platforms.

- Key Country Focus (Germany/UK): Focus on industrial inspection and regulatory harmonization efforts across the EU.

- Key Country Focus (Israel): Global leader in military UAV technology and export of specialized surveillance systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drone surveillance Market.- Lockheed Martin Corporation (Specializing in large, military ISR platforms and integration services)

- Northrop Grumman Corporation (Developer of Global Hawk and Triton HALE systems)

- General Atomics Aeronautical Systems Inc. (Leading manufacturer of Predator/Reaper series MALE drones)

- DJI Technology Co., Ltd. (Dominant player in commercial and public safety small UAS platforms)

- AeroVironment Inc. (Specializes in tactical military reconnaissance systems and SUAS)

- Thales Group (Focus on defense, secure communications, and airspace management systems)

- The Boeing Company (Through its Insitu subsidiary and broader defense portfolio)

- Israel Aerospace Industries (IAI) (Pioneer in strategic long-endurance surveillance UAVs)

- Textron Inc. (Through its subsidiaries focusing on defense and specialized aerial systems)

- BAE Systems plc (Integration of intelligence platforms and C-UAS technologies)

- Elbit Systems Ltd. (Leading provider of sophisticated intelligence and electro-optic payloads)

- Parrot Drones SAS (Focus on commercial and professional-grade surveillance solutions)

- Teledyne FLIR (Critical provider of thermal imaging and advanced sensor payloads)

- Draganfly Inc. (Specializes in public safety, medical delivery, and proprietary surveillance solutions)

- Kratos Defense & Security Solutions (Developer of high-performance tactical and target drone systems)

- Saab AB (Integration of surveillance capabilities into maritime and ground systems)

- Leonardo SpA (Focus on defense electronics and aerospace surveillance systems)

- Turkish Aerospace Industries (TAI) (Rapidly growing developer of indigenous MALE and combat drones)

- PrecisionHawk (Focus on aerial intelligence software and data analytics services)

- Skydio Inc. (Specializes in autonomous flight technology for enterprise inspection and security)

Frequently Asked Questions

Analyze common user questions about the Drone surveillance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory constraints impacting the global expansion of drone surveillance operations?

The primary constraints are stringent governmental regulations, particularly the prohibition or severe restriction of Beyond Visual Line of Sight (BVLOS) flights and operations over populated areas. Additionally, privacy laws, such as GDPR in Europe, mandate strict protocols regarding data collection, retention, and the use of facial recognition technology, significantly influencing operational deployment strategies for surveillance drones.

How is Artificial Intelligence (AI) fundamentally changing drone surveillance capabilities?

AI transforms drone surveillance by enabling autonomous operations, real-time data processing through edge computing, and superior automated threat detection. AI algorithms rapidly analyze high-volume video and sensor data, identifying anomalies, classifying objects (e.g., vehicles, people), and optimizing flight paths, thereby moving from manual monitoring to predictive and scalable surveillance systems.

Which segments are driving the highest revenue growth in the Drone Surveillance Market?

The highest revenue growth is driven by the Defense and Government sectors due to consistent demand for high-cost, long-endurance military Intelligence, Surveillance, and Reconnaissance (ISR) platforms. However, the Services component (data analytics, maintenance, and DaaS models) is experiencing the fastest Compound Annual Growth Rate (CAGR) as enterprises outsource complex operational requirements.

What are the key technological advancements expected to sustain market growth through 2033?

Sustained market growth will be driven by advancements in battery technology (increasing flight endurance), enhanced sensor miniaturization (LiDAR and hyperspectral imaging), the widespread integration of 5G for low-latency command and control, and the continuous refinement of counter-UAS (C-UAS) systems to ensure secure airspace operations.

What are the critical infrastructure applications benefiting most from drone surveillance technology?

Critical infrastructure sectors benefiting most include energy (oil and gas pipelines, power grids), utilities, and transportation networks. Drones offer highly efficient, safer inspection capabilities for detecting faults, monitoring security perimeters, and ensuring regulatory compliance across vast, geographically dispersed assets that are challenging or dangerous for human inspection teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Drone Surveillance System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Drone Surveillance Platform Market Statistics 2025 Analysis By Application (Sensitive Industrial Sites, Oil & Gas, Power Plants, Ports, Data Centers, Logistics), By Type (Autonomous Surveillance Platform, Man-Controlled Surveillance Services), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Autonomous Drone Surveillance Platform Market Statistics 2025 Analysis By Application (Sensitive Industrial Sites, Oil & Gas, Power Plants, Ports, Data Centers, Logistics), By Type (Max Minutes Per Flight 30 min, Max Minutes Per Flight > 30 min), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Drone Surveillance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Multirotor, Fixed Wing, Hybrid), By Application (Pipeline Monitoring & Inspection, Offshore Platform Inspection, Power Plant Inspection, Inspection of Power Distribution Lines, Wind Turbine Inspection, Solar Panel Inspection, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager