Electrolyte Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433238 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electrolyte Analyzers Market Size

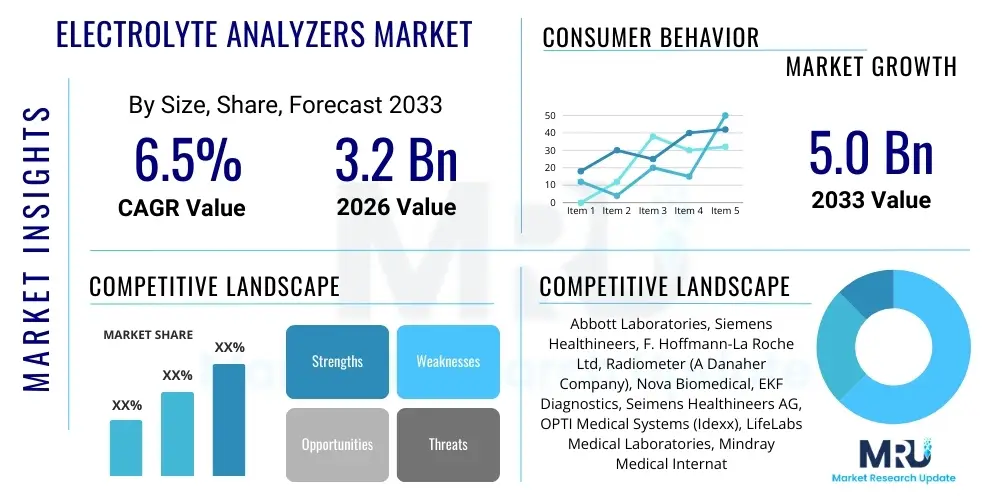

The Electrolyte Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Electrolyte Analyzers Market introduction

Electrolyte analyzers are sophisticated diagnostic devices designed to measure the concentration of vital ions, such as sodium, potassium, chloride, and bicarbonate, in biological fluids, predominantly blood serum and urine. These measurements are crucial for assessing and managing fluid balance, kidney function, cardiac health, and metabolic disorders in patients. The primary technology driving these instruments is Ion-Selective Electrodes (ISE), which offer rapid, precise, and cost-effective testing compared to traditional laboratory methods. The increasing prevalence of chronic conditions requiring routine electrolyte monitoring, such as diabetes, hypertension, and renal failure, underpins the robust demand for these diagnostic tools across healthcare settings.

The product portfolio encompasses high-throughput benchtop systems suitable for central laboratories and compact, portable devices optimized for Point-of-Care Testing (POCT). The ability of modern analyzers to provide quick results is essential for critical care environments, including emergency rooms and intensive care units, where timely intervention based on electrolyte status can significantly impact patient outcomes. Continuous technological advancements, particularly in miniaturization and integration with other diagnostic panels, are expanding the functional scope and accessibility of electrolyte analyzers, facilitating broader adoption in both developed and emerging economies.

Major applications of electrolyte analyzers span clinical diagnostics, disease management, and toxicology screening. The crucial clinical benefits include early detection of electrolyte imbalances (dysnatremias, dyskalemias), optimization of intravenous fluid therapy, and continuous monitoring during surgery. The market is primarily driven by the rising geriatric population, which is more susceptible to kidney and cardiac issues necessitating frequent electrolyte assessment, alongside the global shift towards decentralized diagnostic testing provided by POCT instruments.

Electrolyte Analyzers Market Executive Summary

The Electrolyte Analyzers Market exhibits sustained growth driven by the escalating demand for rapid diagnostic capabilities and the expansion of point-of-care services globally. Business trends highlight a significant competitive shift towards instruments offering multi-parameter analysis (electrolytes combined with blood gases and metabolites) and integrated calibration and quality control features, reducing manual intervention and improving laboratory efficiency. Strategic mergers, acquisitions, and collaborations focused on expanding distribution networks, particularly in Asia Pacific, are defining the competitive landscape. Furthermore, manufacturers are increasingly focusing on developing user-friendly interfaces and robust connectivity features, enabling seamless data transfer within Hospital Information Systems (HIS) and Laboratory Information Management Systems (LIMS), thereby aligning with broader digital health initiatives.

Regionally, North America maintains market leadership due to advanced healthcare infrastructure, high awareness regarding diagnostic screening, and substantial expenditure on technologically superior instruments. However, Asia Pacific is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by improving healthcare accessibility, increasing patient volumes, and government initiatives promoting centralized and decentralized diagnostic services in countries like China and India. Europe also represents a mature market, emphasizing the adoption of automated, high-throughput systems to address labor shortages and stringent quality standards set by regulatory bodies.

Segmentation trends indicate that the consumables segment (reagents, electrodes, quality controls) accounts for a major market share due to the recurring nature of purchases associated with installed base growth. By modality, the Point-of-Care Testing (POCT) segment is witnessing the fastest expansion, driven by its utility in emergency medicine, remote clinics, and home healthcare settings, addressing the growing need for immediate diagnostic results outside traditional laboratory walls. Among end-users, hospitals and clinical laboratories remain primary purchasers, although specialized segments like diagnostic centers and research institutes are increasingly adopting advanced, dedicated electrolyte testing platforms.

AI Impact Analysis on Electrolyte Analyzers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electrolyte Analyzers Market frequently center on predictive diagnostics, automation of quality control, and the integration of large datasets for clinical decision support. Users are keenly interested in how AI algorithms can analyze complex electrolyte patterns in conjunction with other patient parameters (e.g., vital signs, medication history) to forecast impending imbalances before they become critical. Key themes include the reliability of AI-driven result flagging, the potential for AI to optimize instrument maintenance and throughput, and the ethical implications of relying on machine learning models for critical patient management decisions, especially concerning the differentiation between true imbalances and sample handling errors. This focus reflects a collective expectation that AI will transition electrolyte analysis from a purely measurement-focused task to a predictive and proactive diagnostic tool.

- AI-powered predictive modeling for forecasting severe electrolyte dysregulation in critically ill patients.

- Enhanced automation of quality control (QC) procedures, utilizing machine learning to detect subtle shifts in performance and schedule proactive maintenance.

- Integration of AI tools for interpreting complex multi-parameter diagnostic panels (electrolytes, blood gases, metabolites) to aid clinical decision support systems (CDSS).

- Optimization of workflow and resource allocation in central laboratories by using AI to predict testing volume fluctuations.

- Development of smart calibration systems that use algorithms to minimize reagent waste and ensure maximum accuracy across varying environmental conditions.

- Improved pattern recognition for identifying interferences and minimizing false-positive or false-negative results, enhancing diagnostic specificity.

DRO & Impact Forces Of Electrolyte Analyzers Market

The Electrolyte Analyzers Market dynamics are heavily influenced by the escalating incidence of non-communicable diseases (NCDs) and the subsequent requirement for frequent and accurate electrolyte monitoring, acting as a primary driver. Restraints primarily involve the high initial capital expenditure associated with high-throughput laboratory systems and the competitive pressure from multi-parameter devices that integrate electrolyte testing alongside blood gas analysis, sometimes marginalizing dedicated electrolyte analyzers. Opportunities are abundant in the expansion into untapped emerging markets and the development of cost-effective, wireless POCT devices, potentially integrating with telemedicine platforms. The collective impact forces—spanning technology advancement, regulatory mandates for rapid diagnostics, and shifting healthcare delivery models toward decentralization—exert a strong influence, favoring solutions that offer speed, precision, and integration capabilities across various clinical settings globally.

Drivers: The global rise in chronic diseases such as Chronic Kidney Disease (CKD), Congestive Heart Failure (CHF), and diabetes necessitates continuous assessment of electrolyte balance to prevent life-threatening complications. The increased adoption of point-of-care testing (POCT) in emergency settings and remote locations is fundamentally changing diagnostic accessibility, pushing the demand for portable, fast-result electrolyte analyzers. Furthermore, technological leaps, particularly in Ion-Selective Electrode (ISE) technology, have improved the precision, stability, and longevity of electrodes, making the instruments more reliable and reducing operating costs, thereby encouraging broader institutional adoption.

Restraints: Significant barriers include the stringent regulatory hurdles and time-consuming approval processes required for novel medical diagnostic devices, which can slow down market entry. A persistent challenge is the reimbursement scenario in specific regions, where complex diagnostic panels often receive favorable reimbursement over dedicated, single-focus electrolyte tests, indirectly limiting the purchasing power for specialized analyzers. Moreover, the necessity for trained personnel to operate and maintain these sophisticated analyzers, especially in resource-limited settings, presents a logistical constraint, affecting operational efficiency and data quality assurance.

Opportunities: The substantial growth potential lies in the development of microfluidics-based and lab-on-a-chip technologies that promise ultra-low sample volumes and even faster turnaround times, enabling near real-time monitoring. Expanding strategic partnerships with healthcare providers in developing economies offers a significant growth avenue, capitalizing on improving healthcare infrastructure and rising disposable incomes. The push toward personalized medicine and home healthcare presents an opportunity for developing highly miniaturized, consumer-grade, wearable or handheld electrolyte sensors capable of longitudinal, non-invasive monitoring for chronic disease management.

Impact Forces Analysis: The cumulative effect of these forces suggests a moderately high growth trajectory. Drivers related to chronic disease prevalence and POCT adoption are substantial and constant. While capital costs pose a restraint, the technological opportunity to produce cheaper, integrated sensors mitigates this friction over the long term. The strongest positive impact is derived from the convergence of speed, accuracy, and portability—essential attributes demanded by modern, decentralized healthcare systems, ensuring that solutions prioritizing these aspects gain significant market traction.

Segmentation Analysis

The Electrolyte Analyzers Market is comprehensively segmented based on product type, modality, test type, end-user, and technology. This segmentation provides a granular view of market dynamics, revealing that the market structure is complex and highly influenced by the healthcare setting where the device is utilized. Product segmentation distinguishes between instruments and consumables, with consumables generating the stable revenue stream critical for market sustenance. Technology segmentation underscores the dominance of Ion-Selective Electrode (ISE) methodology due to its reliability and speed, while end-user segmentation highlights hospitals and clinical laboratories as the foundational customer base, although POCT utilization is driving rapid shifts in deployment strategy.

Segmentation by modality clearly separates the high-volume, centralized testing apparatus (benchtop/floor-standing) required by large laboratories from the increasingly dominant portable and handheld devices optimized for decentralized and emergency care. The trend toward integration is evident in the rise of multi-parameter systems, blurring the lines between dedicated electrolyte analysis and broader critical care panels. Understanding these segments is vital for manufacturers to tailor their R&D investments, ensuring compliance with diverse regulatory environments and meeting the specific throughput and precision requirements of different clinical environments, ranging from primary care physician offices to major university hospitals.

The growth dynamics within segments suggest that while traditional benchtop analyzers maintain market stability, the handheld and portable segment, driven by the POCT trend, is poised for accelerated growth, especially in remote diagnostics and ambulance services. Similarly, within the test type category, the simultaneous measurement of sodium, potassium, and chloride remains the standard offering, but demand for integrated measurement of calcium and bicarbonate, which are essential for metabolic assessment, is rapidly increasing, pushing manufacturers toward more expansive reagent and sensor arrays.

- By Product Type:

- Instruments (Benchtop/Floor-Standing Analyzers, Portable/Handheld Analyzers)

- Consumables (Reagents, Electrodes, Quality Controls, Calibrators)

- By Modality:

- Laboratory-Based Analyzers (Centralized Testing)

- Point-of-Care (POC) Analyzers (Decentralized Testing)

- By Test Type:

- Sodium (Na+)

- Potassium (K+)

- Chloride (Cl-)

- Bicarbonate (HCO3-)

- Others (e.g., Ionized Calcium (iCa2+), pH)

- By Technology:

- Ion-Selective Electrode (ISE)

- Flame Photometry

- Indirect Potentiometry

- Direct Potentiometry

- By End-User:

- Hospitals and Clinics

- Diagnostic Laboratories

- Research and Academic Institutes

- Ambulatory Surgical Centers

Value Chain Analysis For Electrolyte Analyzers Market

The value chain for the Electrolyte Analyzers Market begins with the upstream activities centered on the procurement and refinement of raw materials, specifically specialized materials for electrode manufacturing (e.g., glass membranes, polymers, reference solutions) and high-purity chemical reagents. Critical upstream factors include maintaining a stable supply chain for highly sensitive sensor components, which are often proprietary and require sophisticated manufacturing processes. Companies heavily invest in R&D at this stage to enhance electrode longevity and stability, directly impacting the analyzer's overall cost-efficiency and accuracy. The competitive advantage upstream often lies in intellectual property related to unique sensor designs and specialized reagent formulations, which ensure calibration stability and rapid measurement.

Midstream activities involve the actual design, assembly, and rigorous testing of the analyzer instruments, ranging from complex benchtop systems to microfluidic handheld devices. This stage is characterized by high capital investment in automated manufacturing facilities and strict adherence to quality assurance standards (such as ISO 13485 and FDA regulations). Key operational efficiencies are achieved through modular design, allowing for easier service and upgrading, and the integration of sophisticated software for result processing, quality control management, and data connectivity. The ability to integrate electrolyte analysis with other critical tests (like blood gas) during assembly provides a significant differentiator for manufacturers.

Downstream analysis focuses on distribution and sales, covering both direct sales forces targeting major hospital networks and indirect channels utilizing third-party distributors, particularly for reaching decentralized and international markets. The distribution channel must manage complex logistics, including inventory management for consumables with limited shelf lives (reagents and electrodes). After-sales service, including maintenance contracts, technical support, and continuous training for end-users, is crucial as these services often define customer loyalty and recurring revenue streams for consumables. Direct channels provide greater control over pricing and customer relationship management, while indirect channels offer essential access to geographically fragmented or difficult-to-penetrate markets.

Electrolyte Analyzers Market Potential Customers

The primary customers for electrolyte analyzers are institutions and practitioners requiring immediate, accurate assessment of patient fluid and metabolic status. Hospitals, particularly those with high-traffic departments such as emergency rooms (ERs), intensive care units (ICUs), and surgical suites, constitute the largest segment of end-users, demanding both high-throughput laboratory systems and portable POCT devices for critical care diagnostics. Clinical laboratories serve as central hubs, requiring automated, benchtop analyzers capable of processing large batches of samples efficiently and accurately for routine diagnostic screening and chronic disease management across diverse patient populations.

Beyond the core hospital and lab market, specialized healthcare providers represent significant purchasing power. Ambulatory surgical centers and outpatient clinics increasingly adopt mid-to-low volume analyzers to offer quick pre-operative and post-operative screening without reliance on external reference labs. Furthermore, research and academic institutions utilize specialized, high-precision analyzers for clinical trials, pharmacological studies, and advanced physiological research related to renal function, cardiac dynamics, and metabolic pathways, driving demand for technologically advanced and customizable systems.

The growing trend of home healthcare and telemedicine is paving the way for non-traditional buyers, including independent nurse practitioners, remote clinics, and potentially even consumers managing chronic conditions under strict medical supervision. These users prioritize ease of use, minimum sample volume requirements, and robust data connectivity features integrated with Electronic Health Records (EHRs). Consequently, market success increasingly depends on developing scalable solutions that cater to the diverse needs of high-volume centralized labs and low-volume, decentralized care settings simultaneously.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, F. Hoffmann-La Roche Ltd, Radiometer (A Danaher Company), Nova Biomedical, EKF Diagnostics, Seimens Healthineers AG, OPTI Medical Systems (Idexx), LifeLabs Medical Laboratories, Mindray Medical International Limited, Edan Instruments, Instrumentation Laboratory (Werfen), General Electric Healthcare, Medica Corporation, Thermo Fisher Scientific, Beckman Coulter, Inc., Alere (now Abbott), Horiba Ltd., Becton, Dickinson and Company (BD), A. Menarini Diagnostics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrolyte Analyzers Market Key Technology Landscape

The technological core of the Electrolyte Analyzers Market remains rooted in Ion-Selective Electrode (ISE) technology, which utilizes specific membranes that selectively interact with target ions (Na+, K+, Cl-) to generate an electrical potential proportional to the ion concentration. Modern advancements in ISE focus heavily on miniaturizing these electrodes and improving the long-term stability and calibration frequency required. Direct potentiometry, used primarily in point-of-care devices, allows for measurement on whole blood samples without prior dilution, providing exceptionally rapid results crucial for critical care settings. This continuous refinement in electrode chemistry and engineering ensures rapid turnaround times (TAT) and minimizes sample volume requirements, enhancing user efficiency.

Beyond traditional ISE, the market is increasingly integrating microfluidics and lab-on-a-chip technologies, particularly for multi-parameter handheld devices. These microfluidic platforms allow for precise handling of extremely small sample volumes and facilitate the integration of electrolyte analysis with blood gas and metabolite testing onto a single disposable cartridge. This integration reduces complexity, eliminates the need for external reagents, and standardizes testing protocols, making the devices highly suitable for non-laboratory personnel in decentralized settings. Connectivity is also a critical technological feature, with analyzers now equipped with LIS/HIS compatibility, Bluetooth, and Wi-Fi capabilities to ensure seamless electronic documentation and remote quality monitoring.

Future technological trends include the development of solid-state sensors and non-invasive technologies, aiming to replace liquid-junction reference electrodes, which are often sources of drift and maintenance issues. The convergence of electrochemical sensing with advanced optics and machine learning algorithms is enabling analyzers to self-diagnose performance issues and automatically compensate for potential interferences, further driving accuracy and reducing the total cost of ownership. This trajectory toward "smart" analyzers is essential for accommodating the high demands placed on centralized labs while simultaneously democratizing advanced diagnostics via user-friendly POCT platforms.

Regional Highlights

The global Electrolyte Analyzers Market demonstrates varied maturity levels and growth rates across different geographical regions, reflecting disparities in healthcare spending, technological adoption, and disease burden.

- North America: This region holds the largest market share, driven by highly established healthcare infrastructure, high patient awareness of preventative and diagnostic testing, and the rapid adoption of advanced integrated diagnostic platforms. Significant R&D investment, favorable reimbursement policies for critical care diagnostics, and the strong presence of key market players contribute to its dominance. The US leads regional consumption, emphasizing automated high-throughput systems in large hospital networks and substantial investment in decentralized POCT devices for emergency services.

- Europe: Characterized by mature markets such as Germany, the UK, and France, Europe is the second-largest market. Growth is sustained by stringent regulatory quality controls demanding highly accurate instruments and the high prevalence of cardiovascular and kidney diseases. Emphasis is placed on automation and workflow efficiency in centralized laboratories, coupled with increasing penetration of portable analyzers in primary care settings and remote patient monitoring initiatives aimed at managing aging populations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily due to expanding healthcare access, rising disposable incomes, and large patient populations in India and China. Government initiatives to improve diagnostic infrastructure, growing medical tourism, and the establishment of new clinical laboratories drive the demand for both affordable benchtop models and POCT solutions tailored for low-resource settings. This region presents substantial untapped potential for market penetration and expansion.

- Latin America (LATAM): The LATAM market shows promising growth, spurred by improving economic conditions, increased healthcare expenditure, and the necessity to manage high rates of chronic conditions such as diabetes and hypertension. Brazil and Mexico are key contributors, focusing on upgrading existing diagnostic facilities and gradually adopting cost-effective, reliable electrolyte testing solutions to improve critical care diagnostics access in urban centers.

- Middle East and Africa (MEA): Growth in MEA is moderate but steady, largely concentrated in Gulf Cooperation Council (GCC) countries due to significant government investment in modernizing healthcare infrastructure and promoting specialized medical services. Challenges remain in broader Africa due to limited healthcare budgets and infrastructure gaps, but opportunities exist for durable, low-maintenance POCT devices in mobile clinics and public health programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrolyte Analyzers Market.- Abbott Laboratories

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd

- Radiometer (A Danaher Company)

- Nova Biomedical

- EKF Diagnostics

- Instrumentation Laboratory (Werfen)

- Mindray Medical International Limited

- Medica Corporation

- General Electric Healthcare

- Thermo Fisher Scientific

- Beckman Coulter, Inc.

- OPTI Medical Systems (Idexx)

- Edan Instruments

- Horiba Ltd.

- Becton, Dickinson and Company (BD)

- Lifelabs Medical Laboratories

- A. Menarini Diagnostics

- Bio-Rad Laboratories, Inc.

- Shenzhen Landwind Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electrolyte Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Electrolyte Analyzers Market?

The market growth is primarily driven by the increasing global prevalence of chronic diseases (like CKD and CHF) requiring routine electrolyte monitoring, the expansion of rapid Point-of-Care Testing (POCT) in emergency and decentralized settings, and continuous technological advancements improving analyzer accuracy and speed.

How does Ion-Selective Electrode (ISE) technology impact modern electrolyte analysis?

ISE is the foundational technology providing rapid, precise, and cost-effective measurement of ions (Na+, K+, Cl-). Its technological refinement enables miniaturization for handheld POCT devices and integration into high-throughput laboratory automation, establishing it as the industry standard due to minimal reagent requirements and efficiency.

Which market segment holds the largest revenue share and why?

The Consumables segment (including reagents, electrodes, and quality controls) typically holds the largest revenue share. This is due to the recurring nature of purchases tied directly to the installed base of instruments and the high volume of tests conducted globally across hospitals and diagnostic laboratories.

What role does the shift toward decentralized testing play in market dynamics?

The shift toward decentralized testing (POCT modality) accelerates market demand for portable, user-friendly, and highly accurate analyzers. This trend reduces Turnaround Time (TAT) in critical care, improves patient management efficiency, and broadens diagnostic accessibility outside traditional central laboratory environments.

Which geographic region is expected to exhibit the fastest growth rate?

Asia Pacific (APAC) is projected to record the highest CAGR, propelled by significant government investment in healthcare infrastructure modernization, rising medical expenditure per capita, and the expanding patient pool requiring sophisticated critical care and diagnostic services in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Blood Gas and Electrolyte Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Electrolyte Analyzers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Semi-automatic, Fully-automatic), By Application (Experimental Applications, Medical Applications, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager