Electronic Grade Hydrogen Peroxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435091 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electronic Grade Hydrogen Peroxide Market Size

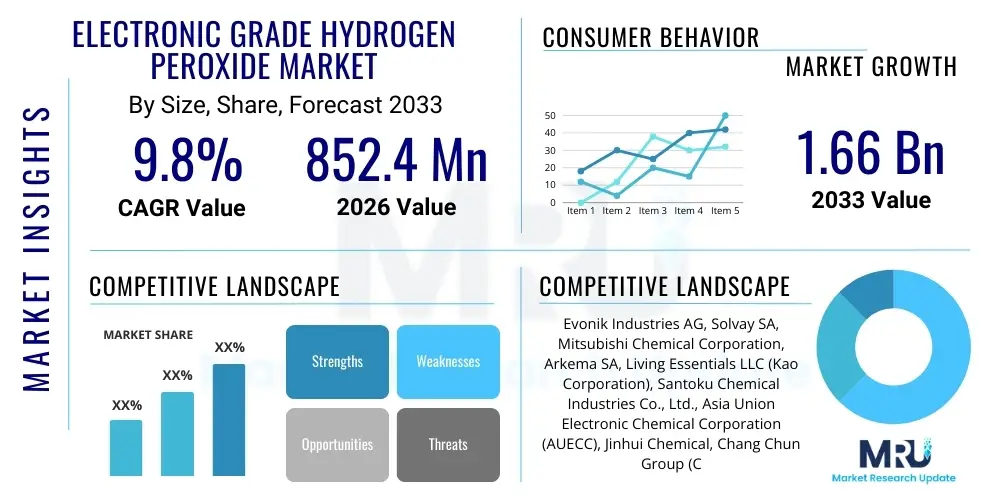

The Electronic Grade Hydrogen Peroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 852.4 million in 2026 and is projected to reach USD 1.66 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the relentless advancement in semiconductor fabrication technologies, particularly the transition to smaller process nodes (below 7nm and 5nm) which necessitates increasingly stringent purity standards for all process chemicals, ensuring optimal yield rates and device performance.

Electronic Grade Hydrogen Peroxide Market introduction

Electronic Grade Hydrogen Peroxide (EGHP), often referred to as Ultra-High Purity (UHP) H2O2, is a critical high-purity chemical used extensively in the manufacturing of microelectronic devices, including semiconductors, solar cells, and flat panel displays. It functions primarily as a potent oxidizing agent and a cleaning component, crucial for removing organic residues, metallic contaminants, and trace particles from silicon wafers during various stages of the fabrication process. The exceptional purity level required for EGHP, often measured in parts per trillion (ppt), distinguishes it sharply from standard industrial or cosmetic grades of hydrogen peroxide, making its production and handling a highly specialized and technologically demanding process.

Major applications of EGHP include its use in standard cleaning solutions such as SC-1 (Standard Clean 1, a mix of ammonia, hydrogen peroxide, and water) and SC-2 (Standard Clean 2, a mix of hydrochloric acid, hydrogen peroxide, and water), which are foundational steps in the RCA cleaning process. Furthermore, EGHP is essential in wet etching processes, chemical mechanical planarization (CMP), and photoresist stripping, where precise control over oxidation and contamination removal is paramount. The increasing complexity of 3D stacked integrated circuits (3D NAND and advanced packaging) and the move toward Extreme Ultraviolet (EUV) lithography are placing unprecedented demands on EGHP suppliers to achieve even lower impurity specifications, particularly regarding elements like aluminum, iron, and copper, which can severely compromise circuit integrity at the nanoscale.

The market's driving factors are deeply intertwined with global digital transformation trends, including the massive proliferation of 5G infrastructure, the burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML), and the continued global demand for high-resolution displays and sophisticated consumer electronics. The benefits derived from using EGHP include maximizing semiconductor yield, minimizing defects that lead to electronic failure, and enabling the fabrication of advanced microprocessors with higher transistor density. The industry's focus is shifting towards higher concentration grades (31% to 35%) and the development of specialized grades (G4 and G5) tailored for sub-10nm fabrication processes, ensuring the sustainability of Moore's Law progression.

Electronic Grade Hydrogen Peroxide Market Executive Summary

The Electronic Grade Hydrogen Peroxide market is characterized by intense technological competition and strict quality control mandates, primarily dictated by major semiconductor foundry operations in Asia Pacific. Business trends show a strong emphasis on backward integration by chemical suppliers seeking to secure highly purified raw material sources and optimize their proprietary purification technologies, thereby controlling costs and maintaining competitive pricing for premium grades. There is also a notable trend toward localized production within key consumption regions, driven by supply chain resilience concerns highlighted by recent geopolitical and logistical disruptions. The high capital expenditure required for establishing ultra-purification facilities acts as a significant barrier to entry, maintaining the dominance of established multinational chemical corporations.

Regional trends unequivocally highlight Asia Pacific (APAC), particularly Taiwan, South Korea, China, and Japan, as the undisputed epicenter of demand, commanding the largest market share due to the high concentration of advanced semiconductor manufacturing facilities, including major foundries and memory chip producers. However, recent governmental initiatives in North America and Europe, aimed at boosting domestic semiconductor manufacturing independence (e.g., the U.S. CHIPS Act and the EU Chips Act), are expected to catalyze significant investment in new EGHP manufacturing plants in these regions, diversifying the supply landscape and providing opportunities for market expansion outside of traditional APAC dominance. While APAC maintains volume leadership, North America and Europe are expected to show accelerated growth rates in the latter half of the forecast period.

Segmentation trends reveal that the highest growth is expected within the G5 (highest purity) grade segment, directly correlated with the industry's shift to sub-5nm manufacturing nodes where metallic and ionic contamination limits are reduced to below 10 ppt. Application-wise, wafer cleaning and etching remain the dominant revenue generators, but specialized applications, particularly those related to 3D NAND and advanced packaging, are projected to exhibit the steepest CAGR. In terms of concentration, the 31% to 35% categories are gaining traction over the standard 30% grade, offering improved process efficiency and reduced transportation costs for high-volume consumers, further solidifying the necessity for suppliers to innovate in purification and stabilization techniques across all segments.

AI Impact Analysis on Electronic Grade Hydrogen Peroxide Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electronic Grade Hydrogen Peroxide market predominantly focus on two primary areas: the massive increase in demand for advanced chips that AI systems require, and the utilization of AI/Machine Learning (ML) to optimize the EGHP manufacturing and application processes themselves. Users are keen to understand if the exponential growth of data centers, 5G networks, and specialized AI accelerators (such as GPUs and TPUs) will outstrip the current EGHP supply capacity, leading to potential shortages or significant price hikes for ultra-pure chemicals. Furthermore, there is significant interest in how advanced analytics are being deployed to enhance quality control, predictive maintenance of purification systems, and optimize the chemical formulation for specific semiconductor processes, potentially enabling the production of even higher purity grades (G6).

The surging demand for powerful AI processing units—essential for training large language models (LLMs) and supporting complex edge computing—directly translates into higher production volumes of advanced microchips built on the most cutting-edge process nodes. Since the complexity and number of cleaning steps increase drastically as feature sizes shrink (e.g., a 3nm wafer requires significantly more cleaning cycles than a 28nm wafer), the total consumption of EGHP per square centimeter of silicon dramatically rises. This fundamental requirement establishes AI adoption as a major structural driver of sustained long-term growth for the EGHP market, moving it beyond cyclical electronic demand fluctuations.

Beyond driving end-market demand, AI and ML are increasingly being integrated into the EGHP production supply chain. AI algorithms can analyze real-time data from purification columns, monitoring trace contaminant levels and automatically adjusting process parameters to maintain ultra-low impurity levels consistently. This application of AI minimizes batch variability, reduces waste, improves energy efficiency in the purification process, and, crucially, accelerates the development of next-generation chemical formulations necessary to meet the demanding specifications of future semiconductor nodes. The implementation of predictive maintenance based on AI further enhances the reliability and uptime of highly specialized EGHP manufacturing plants.

- AI drives unprecedented demand for advanced logic and memory chips, directly increasing EGHP consumption per wafer.

- Machine learning algorithms are utilized for real-time monitoring and optimization of the complex EGHP purification processes, ensuring consistent ppt-level purity.

- Predictive maintenance powered by AI minimizes downtime in high-capital EGHP manufacturing facilities, improving supply reliability.

- AI-driven simulation tools accelerate the R&D cycle for new, specialized EGHP grades (e.g., G5+), tailored for emerging transistor architectures.

- Increased adoption of AI in quality control reduces human error during chemical analysis and ensures compliance with increasingly stringent customer specifications.

DRO & Impact Forces Of Electronic Grade Hydrogen Peroxide Market

The Electronic Grade Hydrogen Peroxide market is heavily influenced by a unique set of synergistic and opposing forces centered on technological innovation, supply chain robustness, and environmental mandates. Key drivers include the exponential growth in demand for logic chips supporting AI, IoT, and 5G technologies, coupled with the inherent requirement for higher purity chemicals as semiconductor manufacturing moves below 7nm, significantly increasing the total number of wafer cleaning steps. Opportunities are emerging from advancements in 3D stacking and advanced packaging techniques (e.g., heterogeneous integration), which introduce new surfaces and interface cleaning challenges necessitating specialized EGHP formulations. However, the market faces significant restraints, primarily stemming from the extremely high cost and complexity associated with achieving and maintaining G4 and G5 purity levels, the strict logistical requirements for stable transportation (requiring specialized, stabilized tanks and refrigerated transport), and the continuous pressure from regulators to reduce the chemical footprint and waste generated during semiconductor fabrication.

A primary driver is the ongoing global expansion of semiconductor manufacturing capacity, particularly in regions previously underserved, such as North America and Europe. This geographic diversification not only increases the overall volume demand but also necessitates new, robust supply chains tailored to regional geopolitical stability requirements. Furthermore, the technical requirement for EGHP is escalating; as the industry adopts gate-all-around (GAA) transistors and other novel structures, conventional cleaning processes must be refined, ensuring the EGHP used is free of micro-contaminants that could interfere with ultra-thin film deposition or selective etching processes. These technical demands reinforce the competitive advantage of suppliers who possess proprietary multi-stage purification and stabilization technologies.

Restraints center on capital intensity and operational risk. Manufacturing EGHP requires colossal investment in cleanroom infrastructure and advanced analytical instrumentation (like ICP-Mass Spectrometry) capable of detecting contaminants in the ppt range. Furthermore, hydrogen peroxide, even in its diluted electronic grade, presents inherent handling and storage risks, necessitating stringent safety protocols that add significantly to operational expenditure. Opportunity lies in sustainability; the industry is actively exploring methods to recycle and regenerate spent process chemicals, including EGHP, to reduce consumption and environmental impact, presenting a niche market for specialized chemical regeneration services that could significantly alter the traditional linear supply model.

Segmentation Analysis

The Electronic Grade Hydrogen Peroxide market is strategically segmented based on crucial parameters including concentration, purity grade, application, and end-user, reflecting the diverse and highly specific requirements of the microelectronics industry. The fundamental segmentation criterion remains the Purity Grade, which directly correlates with the minimum feature size of the semiconductor devices being manufactured. As process nodes shrink, the required purity moves from Grade 1 (G1) suitable for older, larger nodes (e.g., 90nm+) to Grade 5 (G5) necessary for leading-edge foundry production (e.g., 5nm and below). This segmentation enables suppliers to price their products according to the investment required for purification and the value provided to high-yield semiconductor operations.

Application segmentation distinguishes between Wafer Cleaning, Etching, and Chemical Mechanical Planarization (CMP). Wafer cleaning, which includes pre-deposition cleaning and inter-layer cleaning, represents the largest volume segment as it is a repetitive and essential step at multiple points in the fabrication sequence. Concentration segmentation typically includes 30%, 31%, 32%, and 35% categories. Higher concentrations are increasingly preferred by large consumers to reduce logistics costs, although this necessitates greater care in dilution and stabilization at the point of use. The choice of concentration and grade is meticulously determined by the specific process protocol (e.g., SC-1 vs. SC-2) employed by the end-user.

The end-user segment highlights the market's dependence on the Semiconductor industry (including logic, memory, and specialized ICs), which is the primary consumer. Other significant segments include Flat Panel Displays (FPDs), especially those utilizing advanced OLED and MicroLED technologies, and Solar Photovoltaics (PV). While the purity requirements for FPD and Solar PV applications are generally less stringent than for advanced semiconductors, these sectors contribute significant volume, particularly in APAC, providing an important foundation for large-scale EGHP manufacturing infrastructure.

- By Purity Grade:

- G1 (Lower Purity, Older Nodes)

- G2

- G3

- G4 (High Purity, Sub-28nm)

- G5 (Ultra-High Purity, Sub-10nm)

- By Concentration:

- 30%

- 31% to 32%

- 35% and Above (Bulk Concentration)

- By Application:

- Wafer Cleaning (RCA Cleaning, SC-1/SC-2)

- Etching (Selective Oxidation)

- Photoresist Stripping

- Chemical Mechanical Planarization (CMP)

- By End-User Industry:

- Semiconductors (IC Manufacturing)

- Flat Panel Displays (FPDs)

- Solar Photovoltaics (PV)

Value Chain Analysis For Electronic Grade Hydrogen Peroxide Market

The value chain for Electronic Grade Hydrogen Peroxide is characterized by high barriers to entry at the purification stage and stringent logistical control requirements downstream. Upstream analysis focuses on the sourcing and preparation of base hydrogen peroxide (typically 50-70% concentration) via the Anthraquinone Process. The critical upstream challenge is securing highly purified deionized water, which is fundamental as it constitutes the majority component of the final product and must itself be nearly devoid of impurities to facilitate the subsequent ultra-purification steps. Raw material stability and consistent supply from specialized chemical manufacturers form the foundational layer of the value chain.

The midstream (processing) stage represents the highest value addition. This involves proprietary multi-stage purification technologies, including ion exchange, advanced filtration, distillation, and specialized stabilization techniques to eliminate metallic ions and organic residues down to the ppt range. Chemical manufacturers often utilize dedicated, isolated production lines within ISO Class 1 cleanroom environments to prevent external contamination. The ability to achieve G4 and G5 purity levels dictates a supplier's competitive positioning, requiring continuous investment in analytical instrumentation (ICP-MS, TOC analyzers) and process control systems to certify the chemical purity before shipment.

Downstream analysis covers distribution and end-use. Distribution channels are highly specialized, relying on a closed-loop supply system often managed directly by the chemical supplier or certified third-party logistics providers equipped to handle highly pure and sensitive chemicals. Direct channels dominate, as semiconductor fabricators require direct control over chemical specifications and delivery schedules. EGHP is typically transported in dedicated, stabilized polypropylene or high-density polyethylene tanks under controlled temperature conditions to prevent decomposition or leaching of contaminants. Indirect channels, involving regional distributors, are rare for the highest grades (G4/G5) but might be utilized for lower-volume markets or specific FPD and solar applications.

Electronic Grade Hydrogen Peroxide Market Potential Customers

The primary customers for Electronic Grade Hydrogen Peroxide are global semiconductor foundries and integrated device manufacturers (IDMs) that operate advanced wafer fabrication plants (fabs). These customers require vast volumes of certified, ultra-pure chemicals for their recurring cleaning, etching, and photolithography processes. Tier 1 foundries, such as TSMC, Samsung Foundry, and Intel, represent the most critical customer base due to their early adoption of next-generation nodes (5nm, 3nm, and upcoming 2nm), which drive the demand for the most expensive, highest-purity grades (G5).

The memory sector, comprising major DRAM and NAND flash manufacturers like SK Hynix, Micron, and Kioxia, forms another substantial customer segment. While memory production historically operated on slightly larger process nodes than leading-edge logic, the move towards complex 3D NAND structures, which involve hundreds of layers and intensive multi-step wet processing, has significantly increased their per-wafer EGHP consumption and tightened their purity specifications, making them high-value customers for bulk UHP chemicals. These customers demand guaranteed, stable, and localized supply chains to support continuous, 24/7 manufacturing operations.

Secondary, yet important, potential customers include manufacturers of advanced Flat Panel Displays, particularly those focused on high-resolution OLED and MicroLED screens for smartphones, tablets, and televisions. While FPD purity demands are not as extreme as leading-edge semiconductors, the sheer size of the substrates processed necessitates large bulk volumes of chemicals. Lastly, major solar cell manufacturers, specifically those producing high-efficiency heterojunction (HJT) and PERC cells, utilize EGHP for surface preparation and etching, providing an expanding customer base, particularly as global renewable energy goals accelerate PV manufacturing capacity worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 852.4 Million |

| Market Forecast in 2033 | USD 1.66 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, Solvay SA, Mitsubishi Chemical Corporation, Arkema SA, Living Essentials LLC (Kao Corporation), Santoku Chemical Industries Co., Ltd., Asia Union Electronic Chemical Corporation (AUECC), Jinhui Chemical, Chang Chun Group (CCG), BASF SE, PeroxyChem (now a part of Evonik), Wuxi Yanda Semiconductor Material Co., Ltd., Guangdong Meiyan Jishui New Material Technology Co., Ltd., Suzhou Crystal Clear Chemical Co., Ltd., ADVANCHEM, and others. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Hydrogen Peroxide Market Key Technology Landscape

The technological landscape of the Electronic Grade Hydrogen Peroxide market is fundamentally centered on achieving and sustaining ultra-high purity while ensuring long-term stability during storage and transport. The core technological challenge lies in removing trace metallic impurities (like Fe, Cu, Ni) and ionic contaminants down to levels below 10 parts per trillion (ppt), necessary for advanced G5 grades. Key purification technologies deployed include sophisticated multi-stage distillation, continuous ion exchange systems utilizing highly specialized resins, and advanced membrane filtration techniques (ultrafiltration and nanofiltration). Manufacturers continuously refine these processes, often leveraging proprietary chemical stabilizing agents that do not introduce new contaminants but effectively inhibit the decomposition of hydrogen peroxide, ensuring process stability at the end-user fabrication plant.

Furthermore, the technology for quality control is as crucial as the purification process itself. Leading suppliers utilize cutting-edge analytical equipment such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Total Organic Carbon (TOC) analyzers installed within controlled, cleanroom environments. These instruments must be capable of consistently and accurately quantifying contaminants at previously undetectable levels, allowing manufacturers to certify G4 and G5 materials. Investment in this analytical infrastructure is a significant technological differentiator, as semiconductor customers rely entirely on the supplier's certification of ppt-level impurity guarantees to maintain their high wafer yields. The integration of advanced data analytics and automation aids in minimizing human interaction, which is a key source of contamination risk in ultra-pure chemical production.

Beyond the chemical manufacturing process, specialty materials handling and packaging technology form a vital part of the landscape. Suppliers must utilize custom-designed, high-purity packaging materials (e.g., specialized fluoropolymers or high-density polyethylene) that are rigorously pre-cleaned and sealed to prevent leaching of container materials into the EGHP. Advanced logistics technology, including temperature monitoring and shock absorption systems, is incorporated into the distribution chain to preserve the chemical integrity until it reaches the point of use in the fabrication facility. Ongoing research focuses on developing real-time, in-line contamination sensors that can provide immediate feedback during the final packaging and delivery stages, ensuring the highest level of product assurance for mission-critical semiconductor applications.

Regional Highlights

The global demand for Electronic Grade Hydrogen Peroxide is heavily skewed towards Asia Pacific (APAC), which currently accounts for the dominant share of the market revenue and volume. This dominance is directly attributable to the high concentration of the world's leading semiconductor foundries (e.g., in Taiwan and South Korea), significant memory manufacturing bases, and the massive presence of Flat Panel Display and Solar PV production capacity, particularly in China. The continuous, rapid expansion of fabrication facilities in regions like mainland China and Southeast Asia, supported by substantial government investment in indigenous chip manufacturing capabilities, ensures that APAC will remain the primary consumer and growth engine for EGHP throughout the forecast period. The region demands robust, localized supply chains, often preferring local or regionally integrated suppliers who can provide just-in-time delivery and dedicated technical support.

North America holds a substantial market position, driven primarily by strong R&D activities, the presence of major IDMs (like Intel), and the recent strategic push for domestic semiconductor manufacturing resurgence, underpinned by favorable government policies such as the CHIPS and Science Act. While North America's consumption volume trails APAC, the region is critical for technological advancements, frequently pioneering the requirements for the next generation of EGHP grades (G5 and beyond) necessary for advanced microprocessor development. Significant capital expenditure in new fabs in Arizona, Ohio, and other states is poised to accelerate EGHP demand growth in this region significantly from 2026 onwards, creating opportunities for both local and global chemical suppliers to expand or establish new purification facilities within the continent.

Europe represents a crucial, albeit smaller, market segment, supported by established automotive and industrial electronics sectors, and increasing investment in domestic semiconductor production, notably in Germany, France, and Ireland, catalyzed by the European Chips Act. While the market volume is modest compared to APAC, Europe focuses intensively on high-value, specialized chemicals and adheres to some of the world's strictest environmental and safety regulations, driving innovation in sustainable EGHP manufacturing and chemical recycling technologies. The Middle East and Africa (MEA) and Latin America currently represent nascent markets, primarily serving smaller electronics assembly operations or foundational solar PV projects, but they are expected to register gradual growth as localized electronics manufacturing initiatives gain momentum, particularly in parts of Israel, Saudi Arabia, and Brazil.

- Asia Pacific (APAC): Dominates the market due to the concentration of global semiconductor foundries (Taiwan, South Korea) and massive FPD production (China). Expected to maintain highest consumption volume driven by new fab construction.

- North America: Experiencing accelerated growth due to governmental mandates (CHIPS Act) supporting domestic manufacturing, driving high demand for G4 and G5 grades for advanced logic chip production.

- Europe: Moderate growth driven by regional semiconductor initiatives (EU Chips Act) and established demand from automotive and industrial electronics sectors, focusing on high-quality and sustainable sourcing.

- Latin America (LATAM): Developing market, primarily serving regional electronics assembly and emerging solar PV projects; growth potential tied to increased foreign direct investment in electronics manufacturing.

- Middle East & Africa (MEA): Smallest regional share, focused on niche industrial and solar applications, with long-term growth potential linked to smart city developments and technology localization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Hydrogen Peroxide Market.- Evonik Industries AG

- Solvay SA

- Mitsubishi Chemical Corporation

- Arkema SA

- Kao Corporation (Living Essentials LLC)

- Santoku Chemical Industries Co., Ltd.

- Asia Union Electronic Chemical Corporation (AUECC)

- Jinhui Chemical

- Chang Chun Group (CCG)

- BASF SE

- Versum Materials (now part of Merck KGaA)

- Wuxi Yanda Semiconductor Material Co., Ltd.

- Guangdong Meiyan Jishui New Material Technology Co., Ltd.

- Suzhou Crystal Clear Chemical Co., Ltd.

- ADVANCHEM

- Sumitomo Chemical Co., Ltd.

- Fuji Film Corporation

- SK Materials Co., Ltd.

- Dongwoo Fine-Chem Co., Ltd.

- Hansol Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Hydrogen Peroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Hydrogen Peroxide (EGHP) and why is its purity level critical?

EGHP is an ultra-high purity oxidizing agent used exclusively in microelectronics manufacturing (semiconductors, displays) for cleaning and etching wafers. Its purity, measured in parts per trillion (ppt), is critical because trace metallic or organic contaminants can cause device failure and drastically reduce the yield of advanced microchips built on sub-10nm process nodes.

How is the demand for EGHP related to the transition to smaller semiconductor nodes?

As semiconductor nodes shrink (e.g., moving from 14nm to 5nm), the complexity and number of cleaning steps in the fabrication process increase exponentially to remove sub-nanometer contaminants. This directly translates into higher consumption of G4 and G5 purity EGHP per wafer, driving market volume and technological demand for ultra-pure grades.

Which region dominates the consumption of Electronic Grade Hydrogen Peroxide?

The Asia Pacific (APAC) region, specifically encompassing major semiconductor hubs in Taiwan, South Korea, and China, dominates the global EGHP market. This is due to the massive concentration of leading-edge semiconductor foundries and memory chip fabrication plants in these countries, which are the largest consumers of ultra-pure wet chemicals.

What are the primary logistical challenges facing the EGHP supply chain?

Logistical challenges include maintaining chemical stability during transport, requiring specialized, stabilized containers and temperature-controlled logistics to prevent decomposition. Furthermore, ensuring a contaminant-free, just-in-time delivery system to meet the continuous operational demands of multi-billion dollar fabrication facilities presents a significant supply chain complexity and cost constraint.

What role does AI technology play in the future growth of the EGHP market?

AI acts as a dual driver: it dramatically increases the end-market demand for advanced, high-performance semiconductor chips (which rely heavily on EGHP for production), and it is increasingly used within the manufacturing process itself to optimize purification systems and quality control, enabling the consistent production of next-generation, ultra-high-purity EGHP grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electronic Grade Hydrogen Peroxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electronic Grade Hydrogen Peroxide Market Statistics 2025 Analysis By Application (Semiconductor, Solar Energy, LCD Panel), By Type (EL (SEMI G1), UP (SEMI G2), UP-S (SEMI G3), UP-SS (SEMI G4), UP-SSS (SEMI G5)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager