Electronic Grade Hydrogen Peroxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440666 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Electronic Grade Hydrogen Peroxide Market Size

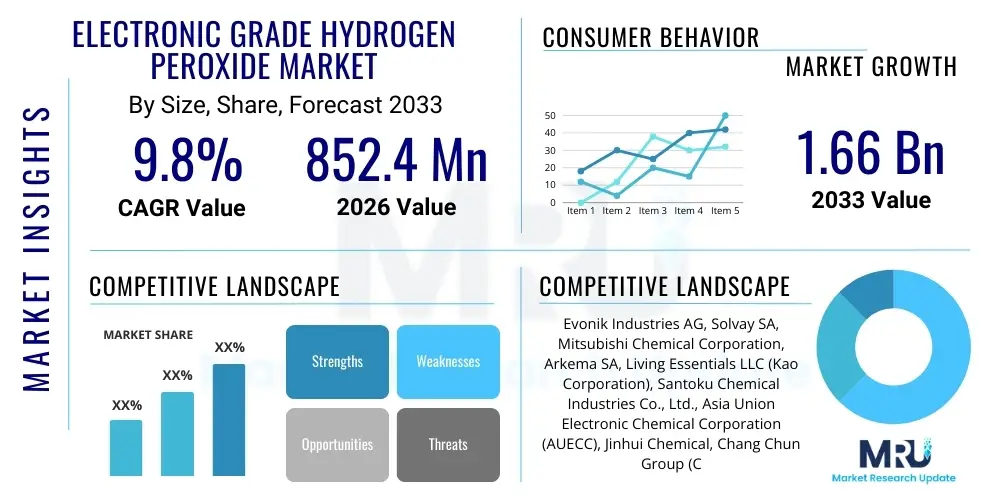

The Electronic Grade Hydrogen Peroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.75 Billion in 2026 and is projected to reach USD 3.16 Billion by the end of the forecast period in 2033.

Electronic Grade Hydrogen Peroxide Market introduction

The Electronic Grade Hydrogen Peroxide (EGH2O) market is a highly specialized and critical segment within the broader chemical industry, catering exclusively to the demanding requirements of the electronics manufacturing sector. EGH2O is a super-high purity chemical, meticulously manufactured to contain extremely low levels of metallic and organic impurities, as well as particulates. Its indispensable role stems from the escalating complexity and miniaturization in modern electronic devices, where even trace contaminants can severely impair device performance, reliability, and yield. This market is fundamentally driven by the relentless innovation in semiconductors, flat panel displays, and solar cells, all of which necessitate ultra-clean processing environments.

As a key process chemical, EGH2O is primarily utilized for its powerful oxidizing and cleaning properties. It acts as a primary component in various wet chemical processes, including the removal of organic residues, metallic contaminants, and photoresist stripping from semiconductor wafers. Its ability to achieve precise etching and cleaning without leaving behind detrimental residues is paramount for fabricating advanced integrated circuits (ICs) with feature sizes down to a few nanometers. The market continuously evolves with new grades of EGH2O, such as Ultra-Large Scale Integration (ULSI) grades, being developed to meet increasingly stringent purity specifications required for next-generation memory and logic chips.

Major applications of EGH2O span across the semiconductor industry for wafer cleaning and etching, the flat panel display (FPD) manufacturing for cleaning glass substrates, and the solar cell industry for silicon wafer surface preparation. The benefits of using EGH2O include enhanced device performance, reduced defect rates, and improved manufacturing yields, which are critical for cost-efficiency and competitiveness in the electronics sector. The driving factors for this market's robust growth are deeply intertwined with global digital transformation trends, including the surging demand for high-performance computing, artificial intelligence (AI), 5G technology, the Internet of Things (IoT), and advanced consumer electronics, all of which rely on sophisticated electronic components requiring EGH2O in their production.

Electronic Grade Hydrogen Peroxide Market Executive Summary

The Electronic Grade Hydrogen Peroxide market is characterized by several key business trends, predominantly driven by the technological advancements and geographical shifts within the global electronics manufacturing landscape. A significant trend involves intense research and development efforts aimed at producing even higher purity grades of EGH2O, often classified as G5 or ULSI grades, to support the production of sub-7nm and sub-5nm semiconductor nodes. Manufacturers are investing heavily in advanced purification technologies and quality control systems to meet the increasingly stringent specifications of leading-edge foundries. Furthermore, there is a growing focus on supply chain resilience and localization strategies, particularly in regions striving for semiconductor manufacturing independence, which influences strategic partnerships and regional production capacities. Consolidations and collaborations among chemical suppliers and equipment manufacturers are also common, aiming to offer integrated solutions and maintain competitive advantages.

Regional trends highlight the undeniable dominance of the Asia Pacific (APAC) region, particularly countries like Taiwan, South Korea, China, and Japan, which serve as the world's primary manufacturing hubs for semiconductors, flat panel displays, and solar cells. This concentration of end-user industries directly translates into the highest demand and consumption of EGH2O in APAC. While North America and Europe, traditionally strong in semiconductor R&D and niche manufacturing, maintain a significant market share, their growth is often tied to specialized high-end applications and the development of new process technologies. Emerging economies within APAC are also witnessing substantial investments in electronics manufacturing, further solidifying the region's market leadership. Geopolitical factors and trade policies increasingly influence the establishment of new manufacturing facilities and the associated demand for specialty chemicals like EGH2O in various regions.

Segmentation trends reveal that the ULSI (Ultra-Large Scale Integration) and G5 purity grades are experiencing the fastest growth, primarily due to the increasing adoption of advanced process nodes in semiconductor manufacturing. These segments command premium pricing owing to the complex purification processes involved. In terms of application, wafer cleaning and etching remain the largest and most critical segments, with consistent demand driven by the sheer volume of wafer processing. The burgeoning demand for next-generation memory (DRAM, NAND) and logic devices, fueled by AI and high-performance computing, is also a significant driver for these application segments. End-user wise, the semiconductor industry continues to be the dominant consumer, but growth in flat panel displays, especially for OLED technologies, and renewable energy sectors also contributes significantly to the overall market expansion, diversifying the revenue streams for EGH2O manufacturers.

AI Impact Analysis on Electronic Grade Hydrogen Peroxide Market

User inquiries about AI's impact on the Electronic Grade Hydrogen Peroxide market frequently revolve around potential shifts in demand, optimization of manufacturing processes, and the role of AI in quality control and R&D. Common questions explore whether AI will lead to a surge in semiconductor production, consequently boosting EGH2O demand, or if it will enable more efficient usage, potentially reducing consumption. There is also significant interest in how AI can enhance the purity and consistency of EGH2O, improve supply chain predictability, and accelerate the discovery of new chemical formulations or processing techniques to meet future electronics requirements. Users are keen to understand the dual potential of AI as both a driver of increased EGH2O consumption through higher chip demand and an enabler of more efficient, precise, and sustainable production and application within semiconductor fabrication.

- Increased demand for high-performance semiconductors driving EGH2O consumption.

- AI-powered process optimization in EGH2O manufacturing leading to higher yield and purity.

- Enhanced quality control and inline monitoring systems for EGH2O using AI algorithms.

- Predictive maintenance for EGH2O production equipment, improving uptime and efficiency.

- AI-driven material discovery for advanced EGH2O formulations or alternatives.

- Automation in semiconductor fabrication facilities increasing demand for consistent, high-purity EGH2O.

- Optimized supply chain logistics and demand forecasting for EGH2O using AI analytics.

- Reduction in chemical waste through AI-guided process adjustments and resource management.

DRO & Impact Forces Of Electronic Grade Hydrogen Peroxide Market

The Electronic Grade Hydrogen Peroxide market is influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces. A primary driver is the insatiable global demand for advanced semiconductors, fueled by the proliferation of Artificial Intelligence (AI), 5G technology, the Internet of Things (IoT), data centers, and electric vehicles. These technologies necessitate increasingly powerful and compact integrated circuits, leading to a continuous demand for higher purity EGH2O for wafer cleaning and etching at ever-smaller process nodes. Furthermore, the stringent purity requirements for sub-7nm and sub-5nm fabrication processes continuously push for advancements in EGH2O quality, driving innovation and market growth. The expansion of flat panel display manufacturing, particularly for OLED technologies, and the solar cell industry also contribute significantly to the market's upward trajectory, requiring EGH2O for their respective cleaning and surface treatment processes.

Despite robust drivers, several restraints challenge the market. The high production cost associated with achieving and maintaining ultra-high purity levels for EGH2O is a significant barrier, impacting pricing and market accessibility. The manufacturing process is inherently complex, involving specialized equipment and rigorous quality control measures to prevent contamination. The hazardous nature of hydrogen peroxide, particularly in concentrated forms, poses challenges related to transportation, storage, and handling, necessitating strict safety protocols and specialized infrastructure, which adds to operational costs. Furthermore, environmental regulations concerning chemical waste management and effluent treatment are becoming increasingly stringent, requiring manufacturers to invest in sustainable practices and potentially increasing compliance costs. Any disruptions in the supply chain for raw materials or logistical challenges can also severely impact production and delivery, given the time-sensitive nature of electronics manufacturing.

Opportunities in the EGH2O market are abundant, particularly in emerging economies that are rapidly expanding their electronics manufacturing capabilities, presenting new avenues for market penetration and growth. Significant opportunities also lie in the development of advanced material research, focusing on novel purification techniques, on-site generation technologies to reduce transportation risks and costs, and closed-loop systems for chemical recycling and reuse, which align with sustainability goals. The continuous evolution of electronics, including the advent of quantum computing, advanced packaging technologies, and new sensor applications, will undoubtedly create demand for even more specialized and ultra-pure chemical grades. From a Porter's Five Forces perspective, the bargaining power of buyers is high due to the concentrated nature of large semiconductor manufacturers, who demand competitive pricing and high quality. The bargaining power of suppliers, especially for key raw materials and specialized purification equipment, is moderate to high. The threat of new entrants is low due due to high capital requirements, complex technology, and stringent regulatory hurdles. The threat of substitutes is also relatively low, as EGH2O remains a foundational chemical with no direct, equally effective, and cost-efficient alternatives for critical applications, while competitive rivalry among existing players is intense, driving continuous innovation and efficiency improvements.

Segmentation Analysis

The Electronic Grade Hydrogen Peroxide market is meticulously segmented to reflect the diverse purity requirements, applications, and end-user demands within the electronics industry. These segmentations are crucial for understanding market dynamics, identifying growth pockets, and tailoring product offerings to specific industry needs. The purity level segmentation is perhaps the most critical, as even minor variations in contaminant levels can have profound impacts on delicate electronic components. Each grade, from G1 to G5 and ULSI, corresponds to progressively lower impurity concentrations, directly correlating with the increasing sophistication of the semiconductor devices they are used to manufacture. Application-wise, the market is broadly divided into critical processes such as cleaning, etching, and oxidation, each requiring precise chemical properties and concentrations. The end-user industry segmentation highlights the primary sectors consuming EGH2O, with semiconductors dominating, followed by flat panel displays and solar cells, reflecting the global demand for these electronic components.

- By Purity Level

- ULSI (Ultra-Large Scale Integration) Grade

- G1

- G2

- G3

- G4

- G5

- SEMI Grade

- By Application

- Cleaning

- Etching

- Sterilization

- Oxidation

- Others

- By End-User Industry

- Semiconductor

- Flat Panel Display (FPD)

- Solar Cells

- Printed Circuit Boards (PCBs)

- Others

- By Form

- Liquid

- Vapor

Value Chain Analysis For Electronic Grade Hydrogen Peroxide Market

The value chain for Electronic Grade Hydrogen Peroxide is a complex network, beginning with the procurement of raw materials and culminating in its use by sophisticated electronics manufacturers. Upstream analysis involves the sourcing of primary raw materials: high-purity hydrogen, oxygen, and deionized water. The purity of these initial components is paramount, as any contamination at this stage can propagate through the entire manufacturing process, making it challenging to achieve the stringent EGH2O specifications. Key suppliers in the upstream segment include industrial gas companies and specialized water treatment providers. The manufacturing process itself involves advanced chemical synthesis and multiple stages of purification, including distillation, ion exchange, and various filtration techniques, often performed in highly controlled cleanroom environments to prevent external contamination. Energy consumption is also a significant factor in the upstream and manufacturing phases, influencing production costs and environmental footprint.

Midstream activities involve the actual production and refinement of EGH2O to various purity grades, followed by rigorous quality control and analytical testing. Manufacturers invest heavily in sophisticated analytical instrumentation to detect trace impurities down to parts per trillion (ppt) levels, ensuring the product meets the exact specifications required by semiconductor fabricators. Packaging, storage, and transportation are also critical midstream elements, requiring specialized containers and logistics to maintain product integrity and safety. Given the reactive and hazardous nature of hydrogen peroxide, particularly in high concentrations, its handling necessitates strict adherence to safety protocols and the use of inert materials to prevent decomposition or contamination during transit. Regional production facilities are strategically located near major electronics manufacturing hubs to minimize lead times and logistical complexities.

Downstream analysis focuses on the distribution channels and end-users of EGH2O. Distribution typically occurs through direct sales channels, where EGH2O manufacturers supply directly to large semiconductor foundries, IDMs (Integrated Device Manufacturers), flat panel display manufacturers, and solar cell producers. This direct model facilitates closer technical collaboration, allowing suppliers to tailor products to specific process requirements and provide technical support. Indirect distribution, though less common for the highest purity grades, may involve specialized chemical distributors who manage warehousing and delivery for smaller or geographically dispersed clients. These distributors must possess the necessary infrastructure and expertise to handle hazardous chemicals safely and maintain product purity. The ultimate end-users, such as Intel, Samsung, TSMC, LG Display, and BOE, are highly demanding customers who rely on consistent, high-quality EGH2O for their critical fabrication steps, emphasizing the importance of a robust and reliable supply chain.

Electronic Grade Hydrogen Peroxide Market Potential Customers

The potential customers for Electronic Grade Hydrogen Peroxide are predominantly the sophisticated manufacturers within the global electronics industry, who require ultra-high purity chemicals for their intricate production processes. At the forefront are semiconductor manufacturers, including integrated device manufacturers (IDMs) like Intel and Samsung, as well as pure-play foundries such as TSMC and GlobalFoundries. These companies are the largest consumers, utilizing EGH2O extensively for critical wafer cleaning, etching, and surface preparation steps in the fabrication of microprocessors, memory chips (DRAM, NAND), and other advanced logic devices. The relentless pursuit of smaller feature sizes and higher transistor densities in semiconductors drives an ever-increasing demand for EGH2O with lower impurity levels, making these firms the primary and most significant customer base for the market.

Beyond semiconductors, manufacturers of flat panel displays (FPDs) represent another substantial customer segment. Companies like LG Display, Samsung Display, and BOE Technology Group rely on EGH2O for cleaning glass substrates and various process steps in the production of LCD, OLED, and other advanced display technologies. The demand here is driven by the global consumption of smartphones, televisions, tablets, and other display-integrated devices. Furthermore, the solar cell manufacturing industry is a significant consumer, utilizing EGH2O for etching and cleaning silicon wafers to optimize photovoltaic efficiency. As the renewable energy sector continues its rapid expansion, the demand for EGH2O from solar cell producers is expected to grow proportionally. Other potential customers include manufacturers of advanced packaging solutions, LEDs, and high-end printed circuit boards (PCBs) where precise chemical cleaning and etching are essential to ensure product reliability and performance.

In essence, the end-users of Electronic Grade Hydrogen Peroxide are any entities involved in the high-tech manufacturing of electronic components where contamination control is paramount. Their operational success, yield rates, and product quality are directly linked to the purity and consistency of the process chemicals they employ. This interdependence creates a strong, long-term demand for reliable suppliers of EGH2O, fostering enduring relationships between chemical manufacturers and their high-tech clientele. The continuous innovation in these end-user industries directly translates into evolving requirements for EGH2O, compelling suppliers to continuously invest in R&D and product improvement to maintain their competitive edge and customer loyalty.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 3.16 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA (EMD Performance Materials), Evonik Industries AG, Solvay S.A., Arkema S.A., Mitsubishi Gas Chemical Company, Inc., Hansol Chemical, Daicel Corporation, Kanto Chemical Co., Inc., Changchun Group, Asia Union Electronic Chemical Corp. (AUECC), Jianghua Micro-electronic Materials, Jiangsu Xinghuo Silicone, Guangdong Huate Gas Co., Ltd., JSC "Volgograd-HIMPROM", Anhui Xiangbang Chemical, ADEKA Corporation, Honeywell International Inc., Versum Materials (now Entegris), SACHEM, Inc., Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Grade Hydrogen Peroxide Market Key Technology Landscape

The Electronic Grade Hydrogen Peroxide market is underpinned by an advanced and continuously evolving technology landscape, primarily focused on achieving and maintaining ultra-high purity levels required by the electronics industry. A core technological aspect involves sophisticated purification methods. These typically include multi-stage distillation processes, specialized ion exchange resins, and ultra-fine filtration techniques capable of removing sub-micron particulates and metallic impurities down to parts per trillion (ppt) levels. Manufacturers leverage proprietary purification chemistries and designs to optimize contaminant removal efficiency, often requiring investments in custom-built equipment and cleanroom facilities that minimize environmental contamination during production. The precision and consistency of these purification technologies are paramount to meet the stringent specifications of the latest semiconductor process nodes, which are becoming increasingly sensitive to trace impurities.

Beyond purification, the technology landscape encompasses advanced analytical and quality control techniques. Manufacturers employ cutting-edge analytical instrumentation such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) to detect ultra-trace metallic impurities, and Particle Counters for monitoring particulate levels. Online, real-time monitoring systems are becoming increasingly prevalent, integrating sensors and data analytics to ensure continuous product quality and consistency throughout the manufacturing process, from raw material intake to final packaging. These systems are crucial for maintaining statistical process control (SPC) and ensuring that every batch of EGH2O adheres to the customer's specific purity grade requirements. The integration of artificial intelligence and machine learning in these quality control systems is also emerging, enabling predictive maintenance and more efficient anomaly detection.

Furthermore, significant technological developments are focused on the safe and effective handling, storage, and delivery of EGH2O. This includes the design of specialized high-purity packaging materials, such as fluoropolymer-lined drums and intermediate bulk containers, which prevent leaching of contaminants into the chemical. Advanced tanker designs and material handling systems are crucial for transportation, ensuring product integrity from the manufacturing site to the end-user facility. Innovations in on-site generation technologies are also gaining traction, where hydrogen peroxide is produced directly at the customer's fabrication plant. This approach aims to reduce transportation costs, minimize safety risks associated with chemical transport, and ensure a fresher, potentially purer supply of EGH2O, thereby offering significant logistical and quality control advantages for large-volume consumers.

Regional Highlights

The Electronic Grade Hydrogen Peroxide market exhibits distinct regional dynamics, largely mirroring the global distribution of advanced electronics manufacturing. Asia Pacific (APAC) stands as the undisputed leader in this market, driven by the massive concentration of semiconductor foundries, integrated device manufacturers (IDMs), flat panel display producers, and solar cell manufacturers in countries like Taiwan, South Korea, China, and Japan. These nations are at the forefront of global electronics production, necessitating immense volumes of high-purity EGH2O for their intricate fabrication processes. The continuous investments in new fabs and the expansion of existing facilities across APAC further solidify its dominance, making it the primary growth engine for the EGH2O market. Regional suppliers and international players have established robust production and distribution networks within APAC to cater to this high demand, often engaging in strategic partnerships to enhance supply chain resilience and localized support.

North America and Europe represent significant, albeit more mature, markets for Electronic Grade Hydrogen Peroxide. North America, particularly the United States, is a hub for advanced semiconductor research and development, as well as specialized high-end manufacturing. While not matching APAC's volume, the demand from this region is characterized by requirements for ultra-high purity grades for cutting-edge technologies and specialized applications, including defense and aerospace electronics. Europe also houses a strong base for R&D in semiconductor materials and niche electronics manufacturing. Both regions focus heavily on innovation, sustainable manufacturing practices, and developing next-generation process technologies that continue to drive demand for the most advanced EGH2O grades. Environmental regulations and supply chain ethics play a more prominent role in these regions, influencing procurement strategies and favoring suppliers with strong sustainability credentials.

Latin America and the Middle East and Africa (MEA) currently represent smaller but emerging markets for Electronic Grade Hydrogen Peroxide. While their electronics manufacturing bases are less developed compared to APAC, North America, and Europe, growing investments in consumer electronics assembly, telecommunications infrastructure, and nascent semiconductor or solar energy initiatives in certain countries within these regions indicate future growth potential. As these regions expand their industrial capabilities and integrate more into global supply chains for electronics, the demand for specialty chemicals like EGH2O is expected to gradually increase. However, market penetration in these areas often requires overcoming logistical challenges, navigating diverse regulatory landscapes, and adapting to varying economic conditions. The overall global market for EGH2O is heavily influenced by geopolitical stability, trade policies, and technological collaborations, with each region playing a critical and evolving role in the intricate global electronics ecosystem.

- Asia Pacific (APAC): Dominant market due to high concentration of semiconductor, FPD, and solar cell manufacturing hubs (Taiwan, South Korea, China, Japan).

- North America: Key market for advanced R&D, high-end semiconductor manufacturing, and specialized applications.

- Europe: Significant for niche electronics manufacturing, R&D in materials science, and stringent environmental standards.

- Latin America: Emerging market with growing investments in electronics assembly and infrastructure.

- Middle East and Africa (MEA): Nascent market with potential growth driven by developing industrial and technology sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Grade Hydrogen Peroxide Market.- Merck KGaA (EMD Performance Materials)

- Evonik Industries AG

- Solvay S.A.

- Arkema S.A.

- Mitsubishi Gas Chemical Company, Inc.

- Hansol Chemical

- Daicel Corporation

- Kanto Chemical Co., Inc.

- Changchun Group

- Asia Union Electronic Chemical Corp. (AUECC)

- Jianghua Micro-electronic Materials

- Jiangsu Xinghuo Silicone

- Guangdong Huate Gas Co., Ltd.

- JSC "Volgograd-HIMPROM"

- Anhui Xiangbang Chemical

- ADEKA Corporation

- Honeywell International Inc.

- Versum Materials (now Entegris)

- SACHEM, Inc.

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Electronic Grade Hydrogen Peroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Electronic Grade Hydrogen Peroxide (EGH2O)?

Electronic Grade Hydrogen Peroxide is an ultra-high purity chemical with extremely low levels of metallic, organic, and particulate impurities, specifically manufactured for the stringent requirements of the electronics industry, primarily used for cleaning and etching in semiconductor fabrication.

Why is EGH2O critical for semiconductor manufacturing?

EGH2O is critical because even trace contaminants can cause defects in sub-nanometer scale integrated circuits, leading to device failure. Its high purity ensures effective, residue-free cleaning and etching, which is essential for achieving high yields and performance in advanced semiconductor production.

Which purity grades of EGH2O are most in demand?

The highest purity grades, particularly G4, G5, and ULSI (Ultra-Large Scale Integration) grades, are experiencing the highest demand due to the increasing adoption of sub-7nm and sub-5nm process nodes in advanced semiconductor manufacturing.

What are the main drivers of the EGH2O market growth?

Key drivers include the surging global demand for advanced semiconductors (fueled by AI, 5G, IoT), the continuous miniaturization of electronic devices, and the expansion of the flat panel display and solar cell industries, all requiring ultra-pure chemicals for production.

What challenges does the EGH2O market face?

The market faces challenges such as high production costs for maintaining ultra-purity, complex manufacturing processes, stringent safety and environmental regulations for handling hazardous chemicals, and potential disruptions in the global supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electronic Grade Hydrogen Peroxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electronic Grade Hydrogen Peroxide Market Statistics 2025 Analysis By Application (Semiconductor, Solar Energy, LCD Panel), By Type (EL (SEMI G1), UP (SEMI G2), UP-S (SEMI G3), UP-SS (SEMI G4), UP-SSS (SEMI G5)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager