Ethernet Test Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432246 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ethernet Test Equipment Market Size

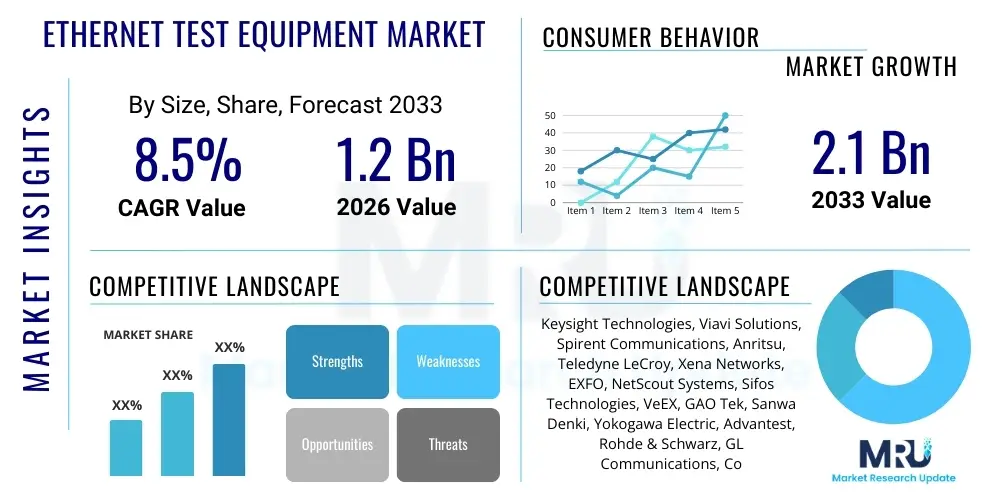

The Ethernet Test Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.1 Billion by the end of the forecast period in 2033.

Ethernet Test Equipment Market introduction

The Ethernet Test Equipment Market encompasses a wide array of devices and software solutions designed to verify, qualify, and troubleshoot Ethernet networks, ensuring optimal performance, reliability, and standards compliance. These sophisticated instruments are crucial for network operators, service providers, and equipment manufacturers navigating the rapid evolution of network speeds from 10G and 40G to cutting-edge 400G and emerging 800G technologies. The primary function of this equipment is to simulate real-world traffic scenarios, measure parameters such as jitter, latency, packet loss, and validate physical layer integrity (PHY testing), thereby guaranteeing Quality of Service (QoS) and adherence to IEEE standards across complex data center, telecommunication, and enterprise infrastructures. The escalating demand for high-bandwidth applications, driven primarily by cloud computing, 5G deployment, and the proliferation of IoT devices, is fundamentally reshaping the complexity and scale of network testing requirements, making specialized Ethernet testing solutions indispensable tools in the modern digital ecosystem.

Product categories within this market spectrum include high-performance chassis-based systems used for rigorous stress testing of network devices (routers, switches), portable handheld testers utilized by field technicians for installation and maintenance (I&M), and highly specialized conformance test systems crucial for validating interoperability standards during the design and manufacturing phase. Major applications span across lab and manufacturing environments for product validation, deployment environments for installation verification, and operational environments for ongoing monitoring and troubleshooting. The benefits derived from utilizing this equipment are significant, ranging from accelerated time-to-market for new network hardware and reduced operational expenditures (OPEX) due to efficient troubleshooting, to enhanced network security and superior end-user experience resulting from verified performance metrics. Effective testing minimizes network downtime, prevents costly performance degradations, and ensures that increasingly demanding applications, such as ultra-low latency financial transactions or high-definition streaming, function reliably.

Key driving factors propelling market growth are centered on infrastructural modernization and the global digital transformation initiative. The widespread deployment of 5G networks necessitates significant upgrades to backhaul and core Ethernet infrastructure, demanding rigorous testing of new hardware capable of handling massive data throughputs and synchronization requirements. Furthermore, the massive expansion of hyperscale and edge data centers requires constant performance validation of high-density interconnects, driving demand for 400G and 800G test solutions. The ongoing convergence of traditional telecom networks with IT infrastructures, coupled with stringent regulatory demands for network resilience and reliability, further reinforces the critical role of advanced Ethernet testing tools. Innovations in automated testing, combined with the integration of AI/ML for predictive network analytics, are also acting as powerful catalysts, allowing network professionals to anticipate failures and optimize performance proactively.

Ethernet Test Equipment Market Executive Summary

The Ethernet Test Equipment Market is currently characterized by significant technological acceleration, shifting rapidly towards solutions capable of addressing ultra-high speed connectivity (400G/800G) and complex network virtualization necessitated by cloud and 5G expansion. Business trends indicate a strong move away from traditional dedicated hardware towards flexible, software-defined testing (SDT) platforms and modular chassis systems that offer scalability and support for hybrid environments, including both physical and virtual network functions (VNFs). Key industry players are focusing on strategic mergers, acquisitions, and collaborations to integrate advanced analytics, deep packet inspection, and security testing capabilities directly into their core Ethernet test platforms, thereby offering comprehensive validation suites. The transition to automation and remote testing capabilities, spurred by efficiency mandates and the increasing complexity of distributed network architectures, represents a major commercial opportunity for vendors specializing in automated test scripts and centralized management software. Furthermore, sustainability in networking, driven by energy efficiency standards, is beginning to influence test requirements, particularly concerning power consumption optimization in high-speed network interfaces.

Regionally, North America maintains its dominance due to the early and aggressive adoption of advanced networking technologies, including hyperscale data center construction, pioneering 5G deployment, and significant defense and governmental investments in resilient network infrastructure. The Asia Pacific (APAC) region, however, is projected to exhibit the fastest growth rate, fueled by massive infrastructural build-out in emerging economies like China, India, and Southeast Asia, coupled with substantial government support for nationwide fiber optics and smart city projects. Europe remains a critical market, driven by stringent regulatory frameworks (e.g., GDPR, NIS Directive) that mandate high levels of network performance and security, thus accelerating the demand for conformance and security-focused Ethernet testing tools. Investment patterns across these regions are heavily skewed towards capital expenditure (CAPEX) on 400G readiness and operational expenditure (OPEX) on sophisticated monitoring and troubleshooting solutions that minimize service downtime for end-users.

In terms of segmentation trends, the 400G and Beyond segment is the primary growth engine, reflecting the urgency of network operators to handle exponential data growth. While traditional 10G and 40G segments remain stable due to ongoing maintenance requirements in legacy enterprise networks, the strategic focus and R&D investment are concentrated on higher speeds, particularly addressing challenges related to Forward Error Correction (FEC) and complex modulation schemes like PAM4. By application, installation and maintenance (I&M) remains a financially large segment, driven by the vast number of field deployments, but the monitoring and troubleshooting segment is showing accelerated adoption rates, primarily due to the shift towards proactive, continuous network performance management rather than reactive failure resolution. End-user dynamics highlight the telecommunications sector, specifically mobile operators and Tier 1 service providers, as the dominant consumers, heavily investing in specialized synchronicity and latency measurement tools essential for 5G network slices and optimized mobile backhaul.

AI Impact Analysis on Ethernet Test Equipment Market

Common user questions regarding AI's impact on Ethernet Test Equipment often revolve around automation capabilities, predictive failure analysis, and the ability of AI to simplify complex testing routines associated with 400G/800G infrastructure. Users frequently inquire: "How can AI reduce the time spent on manual test setup?" "Can AI models predict potential network errors before they cause outages?" and "Will AI integration make dedicated test engineers redundant?" The collective concern centers on leveraging AI and Machine Learning (ML) to handle the exponentially growing complexity of modern networks—specifically, the challenge of correlating billions of data points generated during high-speed testing (e.g., latency measurements across multi-path networks, analysis of intermittent bit errors, and optimization of FEC parameters). The underlying expectation is that AI will transform testing from a reactive, manual process into a proactive, automated, and self-optimizing system, significantly improving efficiency, reducing human error, and ensuring faster validation cycles for new networking equipment and services.

The integration of AI into Ethernet test platforms fundamentally shifts the diagnostic paradigm. Instead of merely generating traffic and reporting measured statistics, AI-powered tools can analyze vast historical and real-time network performance data to identify subtle anomalies, patterns, and performance bottlenecks that human analysis might miss. This capability is particularly vital in virtualized and Software-Defined Networking (SDN) environments where network paths are dynamic and transient. AI algorithms can be employed to automatically generate optimized test cases based on network topology and traffic profiles, ensuring coverage of the most critical operational scenarios, thereby moving beyond static, predefined test suites. Furthermore, AI contributes significantly to debugging, using sophisticated pattern recognition to pinpoint the root cause of complex, multi-layered protocol failures much faster than traditional manual log analysis, especially crucial in environments utilizing dense, high-speed interconnects like those found in disaggregated data centers.

The future application of AI lies in creating self-healing and self-optimizing test environments. By integrating ML models trained on device-under-test (DUT) characteristics and network behavior, the equipment can dynamically adjust test parameters—such as traffic load, burst rate, or latency thresholds—to stress the network in ways most likely to induce failure under specific operational conditions. This predictive testing approach minimizes the need for extensive, time-consuming exhaustive testing required for standards compliance, accelerating the validation pipeline. Moreover, AI aids in synthesizing complex test reports, translating raw performance data into actionable insights for both engineering and executive stakeholders, enhancing the overall value proposition of high-end Ethernet test solutions and ensuring compliance with stringent performance SLAs (Service Level Agreements) required by 5G and cloud services.

- AI integration automates complex test scenario generation and optimization, reducing manual setup time.

- Machine learning algorithms enable predictive network failure analysis based on historical performance data.

- AI enhances root cause analysis by rapidly correlating multi-domain faults across physical and virtual layers.

- Predictive maintenance schedules for test hardware are improved using integrated AI monitoring.

- Optimization of Forward Error Correction (FEC) training and calibration for 400G and 800G links is managed by intelligent algorithms.

DRO & Impact Forces Of Ethernet Test Equipment Market

The dynamics of the Ethernet Test Equipment Market are primarily driven by the imperative need for high-speed connectivity spurred by 5G rollout and hyperscale data center growth, mandating continuous upgrades to network infrastructure and validation tools. However, this growth is significantly restrained by the high capital expenditure associated with purchasing and maintaining advanced test platforms, particularly those required for 400G and 800G speeds, alongside the scarcity of highly skilled engineers capable of operating these complex, evolving systems. Opportunities lie predominantly in the development of flexible, software-centric testing models (Test-as-a-Service or subscription models) that lower the entry barrier for smaller enterprises, as well as the substantial potential in integrating security performance testing, focusing on validating network resilience against sophisticated cyber threats within the Ethernet layer. These competing forces create a dynamic environment where technological innovation must constantly offset deployment costs and skill shortages to sustain market momentum, particularly as network lifecycles shorten.

The primary driving forces include the exponential increase in global data traffic, necessitating immediate capacity upgrades across telecom and cloud networks. The shift from traditional copper to high-speed fiber optics (Fiber-to-the-Home, FTTx) and the complexity introduced by network function virtualization (NFV) and Software-Defined Networking (SDN) demand specialized testing to ensure seamless performance and interoperability across decoupled hardware and software layers. Conversely, major restraints include the intense pricing pressure exerted by end-users, especially telecommunications carriers seeking cost-effective solutions in highly competitive markets. Furthermore, the rapid obsolescence cycle of networking standards means that test equipment investments must be justified over shorter periods, increasing financial risk for vendors and purchasers alike. Supply chain challenges, though easing post-pandemic, still affect the availability and cost of high-precision components required for advanced testing solutions.

Impact forces driving market growth are characterized by technological pull and regulatory push. The technological pull is exemplified by the transition to PAM4 signaling for 400G and higher speeds, which requires completely new testing methodologies to analyze signal integrity and error correction mechanisms. The regulatory push includes increasingly strict governmental requirements globally concerning network performance, resilience, and security protocols, especially for critical infrastructure, forcing operators to invest in rigorous conformance and stress testing. The primary opportunity lies in addressing the emerging edge computing paradigm; as processing moves closer to the user, there is an escalating need for highly distributed, portable, yet powerful testing tools capable of validating ultra-low latency and synchronization requirements critical for industrial IoT and autonomous systems. Vendors who successfully pivot to offer integrated, simplified, and cloud-managed testing solutions targeting this distributed edge environment are poised for significant future growth.

Segmentation Analysis

The Ethernet Test Equipment market segmentation provides a granular view of demand across various product capabilities, applications, and end-user requirements, reflecting the diversified needs of modern network infrastructure stakeholders. Segmentation by speed (10G, 40G, 100G, 400G, and Beyond) is the most critical determinant of value, correlating directly with the required complexity and technological sophistication of the testing instrument. The market is increasingly concentrated in the 400G and emerging 800G segments, where high-performance chassis systems dominate the R&D and manufacturing phases, while the lower speeds (10G, 40G) primarily service field installation and troubleshooting needs. This segmentation highlights the dual market requirement: extremely high precision and capacity for core network validation, juxtaposed against portability and ruggedness for field maintenance applications.

Application-based segmentation divides the market based on the testing phase. Installation & Maintenance (I&M) solutions focus on verifying physical layer connectivity, cabling, and basic service activation parameters, typically using handheld or portable devices. Troubleshooting involves diagnostic activities post-failure or during performance degradation, often requiring tools with deep packet inspection and protocol analysis capabilities. Conformance Testing, a highly specialized segment, ensures that new networking products adhere strictly to IEEE and OIF standards during development, driving the demand for complex, high-port-density test beds. The fastest growing application segment is continuous Monitoring, driven by the shift towards proactive network management and the use of centralized software agents to track performance SLAs in real-time across large, distributed networks, especially crucial in service provider environments.

End-user segmentation reveals that Telecommunications remains the largest consumer, driven by continuous investment in access, metro, and core network modernization (5G infrastructure). Enterprise customers, encompassing financial services, healthcare, and large tech firms, form a substantial segment requiring robust testing for internal data centers and campus networks. The manufacturing sector, particularly semiconductor and network equipment manufacturers (NEMs), are critical buyers of high-end conformance test solutions needed for product validation prior to commercial launch. Understanding these segments is vital for vendors to tailor their product offerings, focusing on chassis scalability and high-speed complexity for NEMs and Telecoms, while emphasizing simplicity, automation, and cost-effectiveness for the broader Enterprise and Field Maintenance segments.

- By Speed: 10G, 40G, 100G, 400G, 800G and Beyond

- By Type: Field Portable Testers, High-Performance Chassis Systems, Standalone Modules

- By Application: Installation and Maintenance (I&M), Troubleshooting and Diagnostics, Conformance Testing, Monitoring and Performance Management

- By End-User: Telecommunications Service Providers, Enterprise (Data Centers, IT), Network Equipment Manufacturers (NEMs), Government and Defense, Semiconductor Industry

Value Chain Analysis For Ethernet Test Equipment Market

The value chain for the Ethernet Test Equipment Market begins with upstream activities dominated by specialized component suppliers, including providers of high-speed optical transceivers, complex Application-Specific Integrated Circuits (ASICs), Field-Programmable Gate Arrays (FPGAs), and precision timing components critical for 400G and 800G PHY layer testing. These upstream partners are crucial as the performance and accuracy of the final test solution are entirely dependent on the quality and synchronization capability of these highly sophisticated inputs. Research and Development (R&D) forms the most significant value addition stage, requiring immense investment to develop proprietary software intellectual property (IP) for protocol stack analysis, traffic generation, and advanced signal integrity measurements, ensuring compliance with evolving standards like OIF and IEEE.

Midstream activities involve the manufacturing, assembly, and rigorous calibration of the test platforms. Due to the need for high accuracy and low measurement uncertainty, manufacturing often requires specialized cleanroom environments and highly controlled processes. The competitive advantage here lies in modular design, allowing customers flexibility and future-proofing their investments through easy field upgrades. Downstream activities involve distribution channels, which are typically bifurcated into direct sales channels for major telecommunications and hyperscale clients, requiring specialized technical consultation, and indirect sales channels (distributors, resellers, and system integrators) serving the broader enterprise and regional markets. Direct sales offer higher margins and closer customer relationships, essential for customizing high-end chassis systems.

The distribution strategy is heavily influenced by the product type. High-performance, complex chassis systems (e.g., Keysight’s AresONE, Spirent’s TestCenter) are almost exclusively handled through direct sales and specialized support teams, owing to the high technical complexity and large contract values. Conversely, portable field testers (e.g., Viavi T-BERD/MTS series) utilize a more extensive indirect channel network to reach dispersed field service organizations and smaller contractors globally. Efficient after-sales support, calibration services, and timely software updates (especially critical for supporting new standards and protocols) represent significant ongoing revenue streams and are crucial determinants of vendor lock-in and customer loyalty within this specialized market.

Ethernet Test Equipment Market Potential Customers

The primary cohort of potential customers for high-end Ethernet Test Equipment consists of Tier 1 and Tier 2 Telecommunication Service Providers (Telcos) and Mobile Network Operators (MNOs). These entities are constantly engaged in massive network modernization projects, particularly the migration to 5G Standalone (SA) architectures, which demand rigorous testing of backhaul, fronthaul, and core transport networks for synchronization, latency, and massive capacity provisioning. Telcos rely on these tools for validating network function virtualization (NFV) performance, ensuring interoperability between multi-vendor hardware, and maintaining compliance with strict Service Level Agreements (SLAs) for enterprise clients, making them the segment with the highest ongoing capital expenditure.

Another crucial customer segment is the hyperscale Data Center and Cloud Service Provider (CSP) community (e.g., AWS, Microsoft Azure, Google Cloud). These customers are the primary drivers of 400G and 800G adoption, requiring complex test solutions to validate internal fabric performance, network cards, and high-density optical transceivers under extreme load conditions. For CSPs, testing is crucial for optimizing energy efficiency, maximizing port utilization, and validating sophisticated load balancing and failover mechanisms within their vast network footprints. They often prefer modular, automated testing solutions that can be seamlessly integrated into their internal DevOps and validation processes, favoring API-driven software platforms over traditional standalone hardware.

Finally, Network Equipment Manufacturers (NEMs), including major router, switch, and semiconductor companies (e.g., Cisco, Juniper, Broadcom, Intel), represent the third most significant customer base. NEMs utilize Ethernet test equipment extensively throughout their product lifecycle: in R&D labs for design verification (DV), in manufacturing for quality assurance (QA), and for conformance testing to ensure that new products meet international standards before shipment. Since NEMs require the most advanced capabilities often supporting pre-standard or emerging speeds, they are the earliest adopters of next-generation test platforms, driving the market for proprietary and specialized validation features essential for debugging complex new silicon and system architectures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Viavi Solutions, Spirent Communications, Anritsu, Teledyne LeCroy, Xena Networks, EXFO, NetScout Systems, Sifos Technologies, VeEX, GAO Tek, Sanwa Denki, Yokogawa Electric, Advantest, Rohde & Schwarz, GL Communications, Copper Mountain Technologies, Trend Networks, JDSU, Ixia (now Keysight) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethernet Test Equipment Market Key Technology Landscape

The technology landscape of the Ethernet Test Equipment market is undergoing a profound transformation driven by the mandatory shift to higher speeds and the complexity of modern signaling techniques. The most significant technological leap is the widespread adoption of Pulse Amplitude Modulation 4-Level (PAM4) signaling for 50G, 100G, 200G, and 400G Ethernet. Unlike traditional NRZ (Non-Return-to-Zero) signaling, PAM4 utilizes four voltage levels to transmit two bits per clock cycle, effectively doubling data throughput over the same bandwidth. This introduces severe challenges in signal integrity, noise, and intersymbol interference, necessitating highly specialized test equipment capable of precise Eye Diagram analysis, jitter decomposition, and sophisticated Forward Error Correction (FEC) testing, particularly KP4 FEC utilized in long-reach optical links. Test vendors are embedding complex digital signal processing (DSP) capabilities directly into their equipment to analyze these non-linear signals accurately, a core technological requirement for high-speed validation.

Another pivotal technological development is the move towards software-defined testing (SDT) and virtualization. As networks transition to Software-Defined Networking (SDN) and utilize Network Function Virtualization (NFV), the traditional reliance on physical hardware testing is becoming insufficient. Modern test solutions now incorporate virtual test agents (VTA) that can be deployed as virtual machines or containers within the customer's cloud or NFV infrastructure. This allows for end-to-end service testing, measuring performance metrics like latency and jitter across virtualized network slices without requiring specialized physical probes at every point. The architecture requires robust APIs (Application Programming Interfaces) for integration into automation frameworks (e.g., DevOps pipelines) and orchestration platforms, enabling continuous integration/continuous deployment (CI/CD) practices for network services and significantly improving the speed of validation cycles for service providers.

Furthermore, the convergence of Ethernet testing with advanced security and synchronization tools is shaping the technological landscape. With 5G requiring nanosecond-level timing accuracy (IEEE 1588 PTP), test equipment must integrate highly precise clock and synchronization testing capabilities alongside traditional bandwidth and throughput measurements. Simultaneously, security testing, which validates the network device's resilience against attacks (e.g., DDoS traffic generation, fuzz testing) while operating under high load, is becoming a mandatory feature. Vendors are also heavily investing in integrating AI and Machine Learning capabilities not just for automated testing, but also for advanced data visualization and predictive analytics. These tools analyze the massive performance data generated during 400G stress tests, helping engineers quickly isolate performance regressions and optimize network protocol parameters, thereby accelerating the deployment of highly reliable, high-performance network infrastructures globally.

Regional Highlights

Regional dynamics illustrate divergent maturity and growth rates across the globe, heavily influenced by local infrastructure investment cycles, regulatory environments, and the speed of 5G deployment. North America stands as the market leader, characterized by early adoption of 400G Ethernet technologies driven by the intense competition among hyperscale cloud providers and the continuous capacity expansion of telecom carriers. This region benefits from a high concentration of market leaders in both networking equipment manufacturing and test equipment provision, fostering an environment where R&D for next-generation 800G solutions is immediately commercialized. The regulatory push for resilient infrastructure in defense and finance sectors also mandates sophisticated testing protocols, ensuring sustained investment in high-end, conformance-grade equipment.

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is primarily attributed to large-scale national infrastructure projects in countries such as China, India, Japan, and South Korea, focusing on nationwide fiber optic deployment, massive 5G build-outs, and significant investment in new mega data centers. APAC service providers are leapfrogging older technologies, often moving directly to 100G and 400G for metro and core networks, generating substantial demand for cost-effective, high-port-density test solutions. Government initiatives supporting smart cities and industrial digitalization further amplify the need for reliable, rigorously tested Ethernet backbones, positioning APAC as the strategic growth engine for the market.

Europe represents a mature yet steadily growing market, driven largely by regulatory requirements related to data privacy (GDPR), network performance mandates, and the ongoing upgrade of legacy copper infrastructure to fiber (FTTx). The focus in Europe is often placed on interoperability and detailed protocol compliance testing, reflecting the diverse vendor landscape and the need for seamless integration across national borders. The Middle East and Africa (MEA), alongside Latin America (LATAM), represent emerging markets with substantial long-term potential. Growth in these regions is currently concentrated on urban 5G deployment and essential fiber optic network expansion, driving demand primarily for robust, portable, and versatile field test equipment necessary for initial installation and basic service activation verification in challenging operational environments.

- North America: Market leader due to hyperscale cloud expansion, aggressive 5G deployment, and strong R&D presence in networking hardware.

- Asia Pacific (APAC): Fastest growing region fueled by governmental mandates for digital infrastructure build-out and rapid adoption of 400G technology in emerging economies.

- Europe: Stable growth driven by FTTx rollout, stringent regulatory compliance for network reliability, and focus on multi-vendor interoperability testing.

- Latin America and MEA: Emerging markets prioritizing initial fiber and 5G core network activation, driving demand for portable field maintenance solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethernet Test Equipment Market.- Keysight Technologies

- Viavi Solutions

- Spirent Communications

- Anritsu

- Teledyne LeCroy

- Xena Networks

- EXFO

- NetScout Systems

- Sifos Technologies

- VeEX

- GAO Tek

- Sanwa Denki

- Yokogawa Electric

- Advantest

- Rohde & Schwarz

- GL Communications

- Copper Mountain Technologies

- Trend Networks

- JDSU

- Ixia (now Keysight)

Frequently Asked Questions

Analyze common user questions about the Ethernet Test Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for 400G and 800G Ethernet test equipment?

Demand is driven by the explosive growth of data traffic in hyperscale data centers and the core networks supporting 5G mobile backhaul. These high-speed architectures require test equipment capable of validating complex signaling schemes like PAM4, managing high channel density, and verifying sophisticated Forward Error Correction (FEC) protocols to ensure network integrity and throughput.

How is the adoption of Software-Defined Networking (SDN) impacting testing requirements?

SDN and Network Function Virtualization (NFV) necessitate a shift from physical hardware testing to software-defined testing (SDT). This involves deploying virtual test agents and utilizing API-driven automation tools to validate dynamic network slices and service chains, allowing performance monitoring to be integrated seamlessly into agile DevOps and orchestration workflows.

What are the primary differences between portable and chassis-based Ethernet testers?

Portable testers are optimized for field deployment (Installation and Maintenance or I&M) and focus on basic connectivity, cable qualification, and service activation. Chassis-based systems are high-performance, modular lab solutions used by NEMs and Telco R&D for rigorous stress testing, conformance analysis, and high-port-density validation of devices operating at 400G and 800G speeds.

Which geographical region is showing the fastest growth in the Ethernet Test Equipment market?

The Asia Pacific (APAC) region is exhibiting the fastest growth due to aggressive national investments in 5G infrastructure, widespread fiber network modernization, and the construction of numerous new hyperscale data centers, particularly in key emerging markets like China and India.

Are synchronization and timing tests becoming more critical for Ethernet test equipment?

Yes, synchronization is increasingly critical, particularly with the rollout of 5G. Ethernet networks must support precise nanosecond-level timing accuracy (PTP IEEE 1588) for 5G radio access networks (RAN) and industrial IoT applications. Test equipment must now offer integrated, high-precision clock analysis capabilities alongside traditional performance metrics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Gigabit Ethernet Test Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Gigabit Ethernet Test Equipment Market Statistics 2025 Analysis By Application (Telecommunication, Automotive, Manufacturing, Other), By Type (10 GBE, 50 GBE, 100 GBE, 200 GBE, 400 GBE), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ethernet Test Equipment Market Statistics 2025 Analysis By Application (Enterprise, Government and Utilities, Service Providers and Network Equipment Manufacturers), By Type (10G, 40G, 100G, 200G and Above), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager