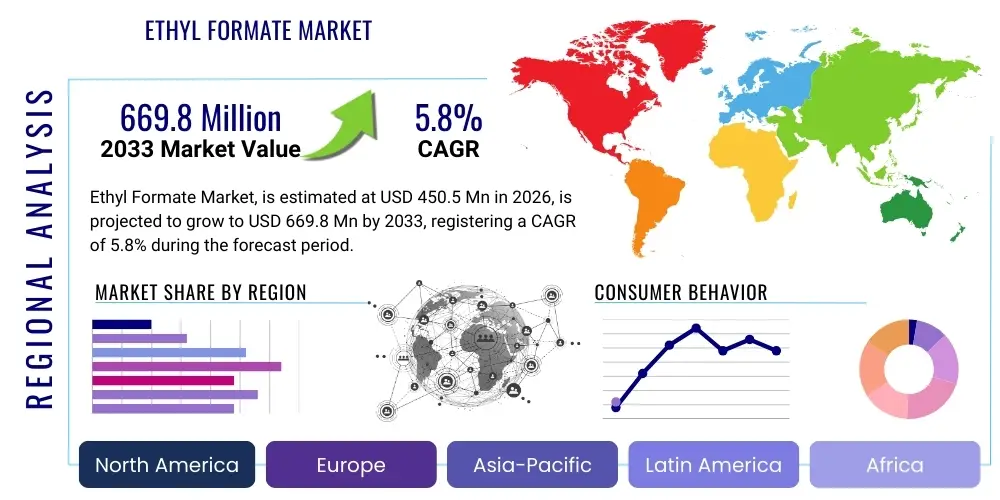

Ethyl Formate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435867 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Ethyl Formate Market Size

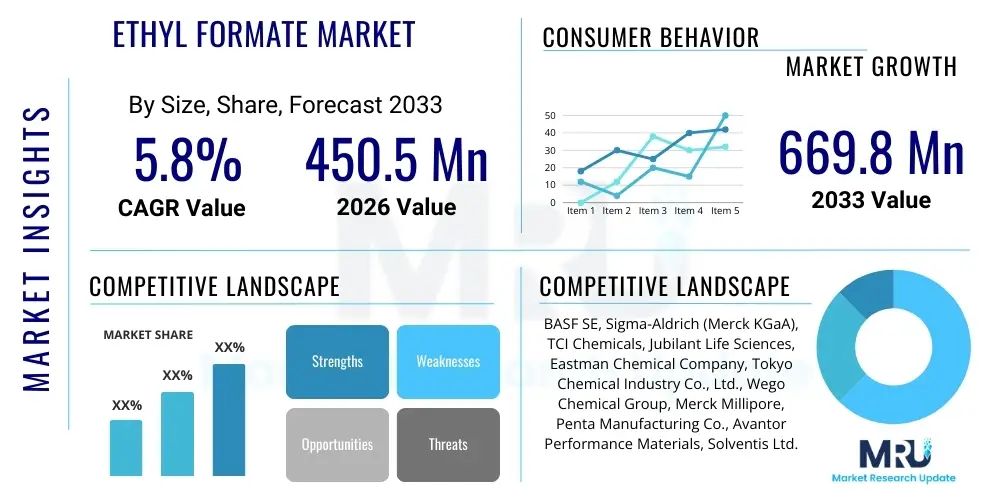

The Ethyl Formate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $450.5 Million USD in 2026 and is projected to reach $669.8 Million USD by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing demand for high-quality, synthetic flavoring agents in the burgeoning food and beverage industry, coupled with the rising adoption of ethyl formate as an efficient and less toxic alternative solvent in various industrial and pharmaceutical processes. The stable characteristics of ethyl formate, combined with its relatively low cost of production, position it favorably against substitute chemicals, ensuring steady demand across established and emerging applications.

Ethyl Formate Market introduction

Ethyl Formate, chemically known as ethyl methanoate (C3H6O2), is a colorless, flammable liquid with a pleasant, rum-like odor, which is fundamentally utilized across diverse industrial sectors. This organic compound is the ethyl ester of formic acid and plays a crucial role in applications ranging from artificial flavor synthesis to serving as a fumigant for foodstuffs and tobacco. Its high volatility and solvency power make it a preferred intermediate chemical. The market dynamics are largely governed by the growth in the packaged food sector, where ethyl formate is extensively used as a synthetic flavor component mimicking the taste of raspberries, rum, and various fruits.

The primary applications of ethyl formate extend into pharmaceuticals and cosmetics, where it acts as a solvent in the production of specific drugs and chemical intermediates. Furthermore, in agriculture and storage, its efficacy as a fumigant, particularly against pests in dried fruits, nuts, and cereals, underscores its commercial significance. Key driving factors for the overall market include the global expansion of the processed food and beverage industry, stricter regulatory requirements favoring less hazardous solvents over conventional alternatives, and continuous research and development aimed at leveraging its potential in novel applications, such as the production of specialty polymers and resins. The versatility and benign environmental profile, compared to some legacy solvents, secure its robust position in the chemical landscape.

Ethyl Formate Market Executive Summary

The Ethyl Formate market demonstrates strong growth potential, underpinned by favorable business trends in the global food and fragrance industries. Market expansion is propelled by innovation in green chemistry, as manufacturers increasingly seek bio-based or naturally derived forms of ethyl formate to cater to the consumer shift toward sustainable products. Key business developments involve capacity expansions by major chemical producers, particularly in Asia Pacific, to meet the soaring demand from the rapidly industrialized manufacturing bases in China and India. Strategic collaborations focused on optimizing synthesis processes and reducing energy consumption are defining competitive strategies among market leaders, ensuring stable supply chains despite geopolitical volatilities.

Regionally, Asia Pacific is the dominant market, characterized by immense consumption volumes in industrial solvents and robust expansion in the food and beverage processing sectors. North America and Europe maintain strong positions due to high regulatory standards necessitating the use of certified flavorings and safe fumigants, driving the demand for high-purity, pharmaceutical-grade ethyl formate. Segment trends indicate that the application of ethyl formate as an intermediate for flavor and fragrance compounds holds the largest market share, while the segment related to biodegradable solvents is anticipated to exhibit the highest CAGR through the forecast period. The purity-based segmentation reveals increasing demand for 99% and above purity grades, driven by stringent quality control in end-use industries like pharmaceuticals and high-end cosmetics.

AI Impact Analysis on Ethyl Formate Market

Common user questions regarding AI's impact on the Ethyl Formate market frequently revolve around how artificial intelligence can optimize the complex, multi-stage synthesis processes, improve product consistency, and ensure regulatory compliance, especially concerning residual impurities. Users are keen to understand if AI-driven predictive maintenance models can reduce downtime in production facilities and how machine learning algorithms might accelerate the discovery of novel, efficient catalysts for esterification reactions. Furthermore, significant interest exists in utilizing AI for supply chain resilience, predicting raw material cost fluctuations (formic acid, ethanol), and optimizing inventory levels for highly volatile components. The core expectation is that AI integration will lead to unprecedented efficiency gains, enhanced quality control, and faster time-to-market for specialized, high-purity grades of ethyl formate essential for sensitive applications.

- AI algorithms optimize catalyst selection and reaction parameters (temperature, pressure) in the esterification process, minimizing by-product formation and increasing yield.

- Predictive modeling utilizes historical production data to forecast equipment failure, enabling proactive maintenance and substantially reducing unscheduled production stoppages.

- Machine learning enhances quality control (QC) by rapidly analyzing chromatographic data, detecting trace impurities, and ensuring adherence to stringent regulatory specifications (e.g., FEMA standards for flavorings).

- AI-powered demand forecasting integrates macroeconomic indicators and end-user consumption patterns (F&B seasonal peaks) to improve inventory management of volatile raw materials and finished products.

- Robotic process automation (RPA) is deployed in packaging and material handling, ensuring safer and more efficient processing of the flammable substance, ethyl formate.

DRO & Impact Forces Of Ethyl Formate Market

The dynamics of the Ethyl Formate market are governed by a complex interplay of driving factors stemming from the robust growth of its primary end-use sectors, constraints related to handling and environmental regulations, and significant opportunities emerging from the green chemistry movement. Key drivers include the escalating demand for processed foods and standardized flavorings globally, requiring reliable sourcing of ethyl formate as a fundamental ingredient. Furthermore, its efficacy as an environmentally safer fumigant compared to traditional halogenated compounds drives adoption in grain storage and agricultural applications. The solvent properties of ethyl formate are also increasingly valued in the plastics and coatings industry, providing steady demand.

Restraints primarily encompass the volatility and flammability of the compound, necessitating stringent safety protocols and high capital investment in specialized storage and transportation infrastructure, which can inflate operational costs. Additionally, regulatory hurdles, particularly in developed economies, regarding allowable residual levels in food products and strict occupational exposure limits (OELs) pose ongoing challenges for manufacturers. The availability and price volatility of key feedstocks, ethanol and formic acid, also represent an economic restraint, impacting the final pricing and profitability margins across the value chain. Substitutability, though limited in high-purity flavor applications, exists in the solvent market, pressuring manufacturers to maintain cost competitiveness and superior product quality.

Opportunities for market growth are vast, centered around the development of high-purity, pharmaceutical-grade ethyl formate for sophisticated drug synthesis where quality control is paramount. The increasing global focus on sustainable chemistry provides a strong platform for bio-based ethyl formate derived from fermentation or renewable feedstocks, appealing to eco-conscious brands. Moreover, exploring novel applications, such as its use in polymer manufacturing or as an intermediate in new chemical processes, offers avenues for diversification and market penetration. These forces—Drivers, Restraints, and Opportunities—collectively shape the competitive landscape and strategic direction for stakeholders in the Ethyl Formate market.

Segmentation Analysis

The Ethyl Formate market is primarily segmented based on purity level, application, and geography, reflecting the diverse and often specialized requirements of various end-use industries. Segmentation by purity level is critical, as high-purity grades (99.5% and above) are mandatory for sensitive applications such as pharmaceutical synthesis and food flavorings, commanding premium prices, while lower-purity industrial grades suffice for solvent and fumigant uses. Analyzing these segments helps market players tailor their product offerings and manufacturing processes to meet specific regulatory and technical specifications demanded by sectors like Food & Beverage (F&B), where compliance with regulatory bodies like FEMA (Flavor and Extract Manufacturers Association) is essential. The complex functional requirements across these applications necessitate distinct manufacturing standards, directly influencing pricing and market positioning.

Application-based segmentation reveals the largest revenue contributor is the flavoring and fragrance sector, leveraging ethyl formate’s characteristic odor and low toxicity profile when used in small concentrations. The rapid industrial segment includes its utilization as a solvent for cellulose acetate and nitrocellulose, contributing substantially to bulk demand. Furthermore, the specialized segment of fumigation is poised for incremental growth, driven by global food security concerns and the need for effective post-harvest protection. Geographical segmentation highlights the distinct consumption patterns and production capacities across regions, with Asia Pacific dominating production volume due to lower operational costs and robust chemical manufacturing clusters. Understanding these hierarchical segments is vital for strategic market entry and investment decisions, ensuring resource allocation targets the most profitable and high-growth areas within the chemical industry.

- By Purity Level:

- Industrial Grade (95% - 99%)

- Pharmaceutical/Flavoring Grade (99% and above)

- By Application:

- Flavoring and Fragrance Agents

- Solvents (Cellulose Acetate, Nitrocellulose)

- Fumigants and Pesticide Intermediates

- Pharmaceutical Intermediates

- Chemical Synthesis (e.g., Formamide production)

- By End-User Industry:

- Food & Beverage

- Pharmaceuticals

- Agriculture and Storage

- Paints and Coatings

- Plastics and Polymers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ethyl Formate Market

The Ethyl Formate value chain initiates with the upstream sourcing of crucial raw materials, primarily ethanol and formic acid, which are typically derived from petrochemical or, increasingly, bio-based sources. Efficiency and cost optimization at this stage are paramount, as the price volatility of these commodity chemicals directly impacts the final production cost of ethyl formate. Major chemical companies often vertically integrate to control feedstock quality and supply stability. The core manufacturing process involves catalytic esterification, a highly energy-intensive step requiring specialized reactors and purification columns to achieve the high-purity grades mandated by the food and pharmaceutical sectors. Innovation in upstream processes focuses on developing heterogeneous catalysts that offer high selectivity and recyclability, reducing waste and energy input.

Moving downstream, the distribution channel for ethyl formate is complex due to its classification as a flammable liquid, requiring adherence to strict HazMat shipping regulations (Direct and indirect). Distribution relies heavily on specialized logistics providers equipped to handle bulk chemical transport (e.g., ISO tanks and drums). Direct sales often occur between large manufacturers and major industrial end-users, such as bulk flavor houses or large-scale plastic manufacturers. Conversely, smaller purchasers, particularly in the agricultural or niche pharmaceutical sectors, rely on indirect channels involving regional distributors and specialty chemical traders who manage smaller batch sizes and localized compliance. The final stage involves the incorporation of ethyl formate into finished products, where stringent quality control and formulation expertise are critical to ensure product efficacy and safety, particularly when used as a flavoring or drug intermediate.

Ethyl Formate Market Potential Customers

Potential customers for Ethyl Formate span a wide array of industrial sectors, predominantly centering around industries that require high-purity chemical intermediates, specialized solvents, or approved flavoring agents. The Food and Beverage (F&B) industry represents a significant end-user base, comprising major flavor and fragrance houses, food processing giants, and beverage manufacturers who utilize ethyl formate to impart artificial fruit and rum notes. These buyers prioritize purity, consistency, and compliance with global food safety standards (such as FDA and EFSA regulations). Demand from this sector is resilient, driven by the persistent global appetite for convenience and packaged food products that require standardized flavor profiles.

Another major segment includes pharmaceutical and fine chemical manufacturers. These customers utilize ethyl formate as a reaction solvent or as a building block in synthesizing specific drug molecules, requiring ultra-high purity grades (often 99.8%+) and detailed documentation regarding its origin and processing. The growing generics market, particularly in Asia, has boosted demand for chemical intermediates like ethyl formate. Furthermore, agricultural corporations and large-scale grain storage facilities constitute crucial buyers, leveraging its effective fumigation properties to prevent post-harvest losses. These diverse customer needs underscore the necessity for suppliers to offer customized packaging, varying purity levels, and robust regulatory support to capture maximum market share across these essential industrial segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Million USD |

| Market Forecast in 2033 | $669.8 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Sigma-Aldrich (Merck KGaA), TCI Chemicals, Jubilant Life Sciences, Eastman Chemical Company, Tokyo Chemical Industry Co., Ltd., Wego Chemical Group, Merck Millipore, Penta Manufacturing Co., Avantor Performance Materials, Solventis Ltd., Loba Chemie Pvt. Ltd., Guangzhou Sun Honesty Chemicals, Vertellus Specialties Inc., Yantai Gelun Chemical Technology Co., Ltd., Spectrum Chemical Manufacturing Corp., Finar Chemicals Pvt. Ltd., Jiangyin City Huada Chemical Co., Ltd., China National Petroleum Corporation (CNPC), and Mitsubishi Chemical Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethyl Formate Market Key Technology Landscape

The technological landscape of the Ethyl Formate market is primarily defined by advancements in esterification processes aimed at increasing yield, reducing energy consumption, and achieving extremely high levels of purity necessary for sensitive applications. The traditional method involves the acid-catalyzed reaction between formic acid and ethanol, often requiring high temperatures and pressures. Current innovations focus on heterogeneous catalysis, utilizing solid acid catalysts such as zeolites or ion-exchange resins. These solid catalysts simplify downstream separation processes, eliminating the need for neutralizing the acid catalyst, thereby reducing waste generation and operational costs. Furthermore, the development of continuous flow reactors (microreactors) is gaining traction, allowing for precise control over reaction kinetics and improving safety, which is paramount when handling highly flammable reagents.

A significant emerging technological trend is the shift towards bio-based synthesis routes. Driven by sustainability mandates and consumer preference for natural ingredients, researchers are exploring methods to produce ethyl formate through biological pathways, primarily fermentation using engineered microorganisms. While still commercially nascent compared to petrochemical routes, this technology promises a renewable source of feedstock and a potentially lower carbon footprint. Furthermore, process intensification techniques, including reactive distillation, are being adopted by leading manufacturers. Reactive distillation combines reaction and separation in a single unit operation, enhancing thermodynamic efficiency, and proving particularly beneficial for equilibrium-limited reactions like esterification, thereby boosting overall plant productivity and significantly contributing to the cost-effectiveness of bulk ethyl formate production.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Ethyl Formate market both in terms of production volume and consumption value. The robust growth is fueled by rapid industrialization, particularly in chemical manufacturing hubs like China and India, where large-scale production facilities benefit from economies of scale and competitive labor costs. The escalating demand from the food processing and packaging sectors, driven by rising disposable incomes and expanding urban populations, solidifies the region's lead. Furthermore, APAC nations are major exporters of chemical intermediates, positioning them as critical supply points for global flavor and fragrance houses. Investments in petrochemical infrastructure and increasing governmental support for chemical industry expansion contribute significantly to the region's market dominance, though regulatory diversity across nations presents a challenge for standardized quality control.

- North America: North America represents a mature and high-value market characterized by stringent regulatory oversight, particularly concerning food additives (FDA) and workplace safety (OSHA). The demand here is primarily focused on high-purity, flavor-grade ethyl formate used extensively by the region's sophisticated food and beverage, and pharmaceutical industries. Innovation is concentrated on developing highly efficient, safe handling processes and exploring environmentally benign alternatives. The presence of major flavor and fragrance companies drives consistent demand, emphasizing quality and traceability. The region is also a key adopter of advanced fumigation technologies for stored grains, ensuring high market stability despite slower volume growth compared to APAC.

- Europe: Europe is a critical market, driven by its extensive cosmetics, perfumery, and specialty chemical sectors, which rely on ethyl formate as a high-quality solvent and fragrance constituent. European regulations, particularly REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), impose strict requirements on chemical safety and environmental impact, driving innovation toward bio-based and sustainable production methods. Germany, France, and the UK are major consumption centers. The region demonstrates a strong preference for ethyl formate derived from sustainable sources, signaling a significant future growth pathway for suppliers capable of certifying their eco-friendly manufacturing credentials, despite high manufacturing costs compared to Asian competitors.

- Latin America (LATAM): The LATAM market is characterized by emerging potential, with Brazil and Mexico leading the regional consumption. Growth is spurred by the expanding domestic food processing industry and the increasing professionalization of agriculture, boosting demand for effective fumigants. Economic volatility and inconsistent trade policies can pose short-term challenges, but the long-term outlook remains positive due to urbanization and growing consumer bases. Localized production is relatively limited, relying heavily on imports from Asia and North America, indicating a significant opportunity for market penetration and establishing localized distribution networks to mitigate long supply chain lead times and associated costs.

- Middle East and Africa (MEA): MEA is currently the smallest market segment for ethyl formate, though it shows promise, largely tied to investments in new infrastructure, particularly food storage and petrochemical downstream industries in the Gulf Cooperation Council (GCC) countries. Demand for fumigants is steady due to reliance on imported foodstuffs and the necessity for effective preservation in hot climates. The region's market development is highly dependent on foreign investment and the establishment of local manufacturing capabilities to reduce reliance on costly imports, positioning it as an opportunistic market for global chemical players looking to establish early footholds in developing industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Formate Market.- BASF SE

- Sigma-Aldrich (Merck KGaA)

- TCI Chemicals

- Jubilant Life Sciences

- Eastman Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- Wego Chemical Group

- Merck Millipore

- Penta Manufacturing Co.

- Avantor Performance Materials

- Solventis Ltd.

- Loba Chemie Pvt. Ltd.

- Guangzhou Sun Honesty Chemicals

- Vertellus Specialties Inc.

- Yantai Gelun Chemical Technology Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Finar Chemicals Pvt. Ltd.

- Jiangyin City Huada Chemical Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Mitsubishi Chemical Group

Frequently Asked Questions

Analyze common user questions about the Ethyl Formate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Ethyl Formate market?

The primary driver is the accelerating global demand from the Food and Beverage (F&B) sector, where ethyl formate is essential as a synthetic flavoring agent (imparting rum and fruit notes) and the shift towards utilizing it as a less toxic, efficient solvent in industrial and pharmaceutical applications.

In which applications is high-purity Ethyl Formate most critical?

High-purity Ethyl Formate (typically 99%+) is critical in the flavoring and fragrance industry, where trace impurities can alter sensory profiles, and in pharmaceutical synthesis, where stringent regulatory requirements mandate exceptional purity levels for use as a reliable reaction intermediate or solvent.

How do volatile raw material prices affect the market profitability?

The profitability of ethyl formate manufacturers is directly sensitive to the price volatility of key feedstocks, ethanol and formic acid. Fluctuations necessitate sophisticated hedging strategies and optimized production efficiencies to stabilize margins and maintain competitive pricing, especially for bulk industrial grades.

Which geographical region holds the largest market share for Ethyl Formate?

The Asia Pacific (APAC) region currently holds the largest market share, driven by massive manufacturing capacities in countries like China and India, high volume consumption in the rapidly growing packaged food industry, and strong export activities of chemical intermediates.

Is there a movement towards bio-based Ethyl Formate production?

Yes, driven by global sustainability goals and consumer demand for green chemistry, significant R&D efforts are focused on developing bio-based synthesis routes, primarily fermentation processes, to produce ethyl formate from renewable raw materials, offering a sustainable alternative to traditional petrochemical methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Methyl Formate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ethyl Formate Market Size Report By Type (Superior Grade, First Grade), By Application (Solvent, Pharmaceutical Intermediates, Insecticide and Bactericides, Flavors, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager