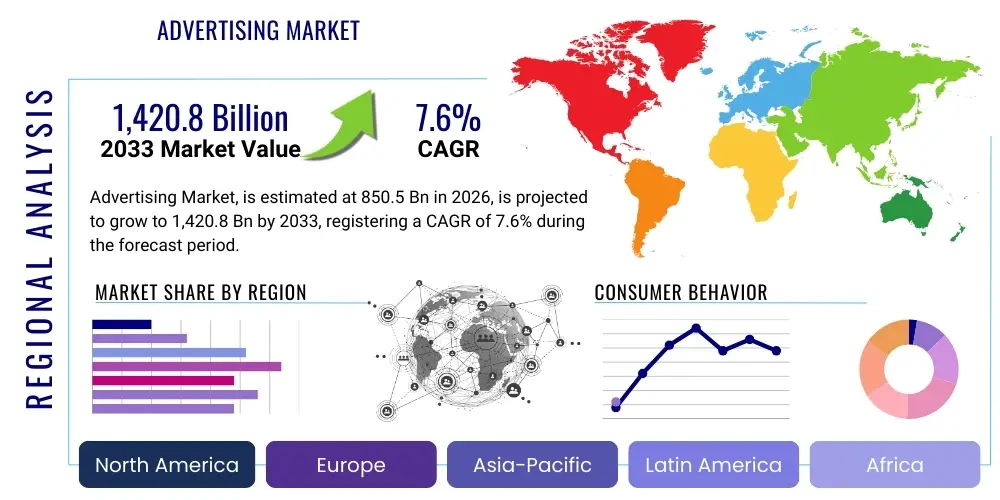

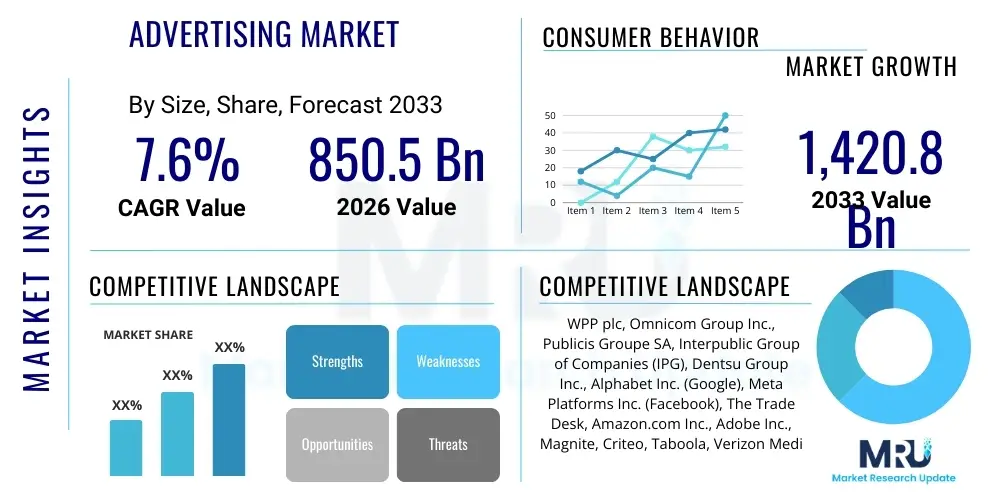

Advertising Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441795 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Advertising Market Size

The Advertising Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at $850.5 Billion USD in 2026 and is projected to reach $1,420.8 Billion USD by the end of the forecast period in 2033.

Advertising Market introduction

The global Advertising Market encompasses the entire spectrum of paid media channels and technological solutions utilized by businesses, governments, and non-profit organizations to disseminate promotional messages to target demographics. This expansive ecosystem includes traditional media formats such as television, radio, and print, alongside the increasingly dominant digital landscape, featuring search, social media, programmatic display, video, and connected television (CTV). The primary function of this market is to facilitate the connection between sellers and buyers, influence consumer purchasing decisions, enhance brand recall, and ultimately drive economic activity through measurable marketing expenditure. The industry's evolution is inherently tied to consumer behavior shifts and the continuous development of sophisticated media measurement and automation tools.

Product offerings within the Advertising Market are multifaceted, ranging from high-level strategic consultancy provided by creative and media agencies to highly specialized technological components such as Demand-Side Platforms (DSPs), Supply-Side Platforms (SSPs), and Customer Data Platforms (CDPs). The increasing demand for precise audience targeting and verifiable performance metrics has prioritized the development and integration of AdTech and MarTech solutions, enabling real-time campaign adjustments and personalization at scale. This technological sophistication allows major applications across critical sectors including Fast-Moving Consumer Goods (FMCG), Automotive, Financial Services (BFSI), and Technology, all relying on mass and niche advertising for market penetration.

Key benefits derived from this market include efficient budget allocation through programmatic buying, profound enhancements in campaign effectiveness via data analytics, and global reach facilitated by ubiquitous digital platforms. The market's growth is predominantly driven by factors such as the accelerated global penetration of high-speed internet and mobile devices, the corresponding surge in digital content consumption, the imperative for brands to leverage first-party data, and the crucial role of advertising in supporting the burgeoning e-commerce sector globally. These drivers collectively sustain the positive growth trajectory and continuous innovation within the highly competitive advertising landscape.

Advertising Market Executive Summary

The global Advertising Market is undergoing a fundamental transformation characterized by the rapid and decisive reallocation of investment toward digital media, particularly mobile video and programmatic channels. Business trends emphasize the strategic necessity of robust first-party data strategies to overcome the limitations imposed by the deprecation of third-party cookies and stringent global privacy regulations like GDPR. Brands are actively seeking unified omnichannel measurement solutions to accurately attribute cross-platform conversions and optimize the customer journey, indicating a shift towards integration over siloed media planning. Furthermore, the rise of retailer-owned media networks is creating a new, high-value inventory pool that allows brands to target consumers closer to the point of purchase, revolutionizing the commerce media landscape.

Regionally, the market presents varied dynamics. North America maintains its position as the largest revenue generator, driven by the maturity of its digital ecosystem, high corporate marketing spending, and continuous innovation in AdTech, largely concentrated around the offerings of major "walled gardens." However, the Asia Pacific (APAC) region is projected to experience the fastest growth, propelled by the massive scale of mobile users, high engagement with regional social platforms, and the massive acceleration of digital spending in emerging economies such as India and Indonesia. Europe’s growth remains stable, albeit moderated by continuous adaptation to strict regulatory environments which demand greater transparency and consent mechanisms in data processing.

Segmentation analysis reveals the programmatic buying method as the dominant transaction mechanism, valued for its efficiency and data-driven precision. Within advertising formats, video remains a high-growth area, spanning short-form mobile content and premium long-form Connected TV (CTV) inventory. The utilization of Artificial Intelligence (AI) and Machine Learning (ML) is moving from a niche technology to an essential operational component, driving enhanced performance in creative optimization, bidding strategy, and fraud detection. These technological shifts are consolidating the market around major integrated platforms capable of offering end-to-end solutions that promise both reach and accountability.

AI Impact Analysis on Advertising Market

The convergence of Artificial Intelligence (AI) and advertising technology generates frequent user queries concerning ethical deployment, talent required for system management, and the measurable return on AI integration investments. Users are keenly interested in how AI mitigates privacy risks while still enabling hyper-personalization, and how generative AI will reshape the traditional roles of creative agencies. A critical thematic concern is the necessity for transparency in AI-driven programmatic bidding algorithms, which often function as 'black boxes.' The consensus analysis shows users are expecting AI to deliver unparalleled efficiency in media buying and creative scale, provided that governance and ethical parameters are rigorously established and maintained.

AI’s influence extends fundamentally across the advertising value chain, starting with automated campaign execution. Machine learning algorithms analyze vast datasets—including user behavior, environmental context, and inventory supply—in milliseconds to optimize bidding strategies in real-time. This sophisticated automation ensures that ad impressions are secured at the optimal price point and delivered to the most likely converters, drastically improving budget efficacy and minimizing waste associated with manual adjustments. Furthermore, AI tools are indispensable in combatting the pervasive threat of ad fraud, utilizing behavioral analysis and pattern recognition to identify and block invalid traffic (IVT) with superior speed and accuracy compared to human-driven verification processes.

Creative optimization represents another area profoundly shaped by AI. Dynamic Creative Optimization (DCO) platforms leverage AI to automatically assemble, test, and deploy hundreds of personalized ad variations based on viewer demographics, previous interactions, and real-time context. Generative AI takes this a step further by producing entirely new creative assets—text, imagery, and potentially video—at massive scale, reducing production lead times and enabling truly granular personalization for niche audiences. This capability requires advertisers to pivot their focus from creating a few static campaigns to managing and refining AI-generated content pipelines, emphasizing strategic oversight and rapid iteration.

- AI optimizes programmatic bidding by forecasting conversion likelihood and allocating budgets in real-time across multiple exchanges.

- Generative AI accelerates the creation of personalized ad copy, imagery, and video variations for dynamic creative testing (DCO).

- Machine learning algorithms significantly enhance ad fraud detection, invalid traffic (IVT) filtering, and brand safety compliance.

- AI-driven Customer Data Platforms (CDPs) improve data unification, resulting in superior audience segmentation and lookalike modeling.

- Predictive analytics allow for more accurate campaign forecasting and strategic measurement of incremental sales uplift.

- Automation of routine media buying tasks shifts human talent toward strategic planning, data interpretation, and creative governance.

- AI facilitates the development of privacy-preserving techniques like differential privacy and federated learning for targeting in cookieless environments.

- Increased complexity in algorithmic processes necessitates greater investment in technical infrastructure and AI ethics specialists.

DRO & Impact Forces Of Advertising Market

The Advertising Market is vigorously propelled by the foundational shift toward digital media consumption and the resultant demand for enhanced accountability in marketing expenditure. This drive is supported by the relentless expansion of e-commerce, requiring precise performance-based advertising to convert digital foot traffic into sales. Conversely, the market faces significant headwinds from globally harmonizing data protection regulations, such as the gradual elimination of universally traceable third-party cookies, which impose substantial costs and complexity on targeting methodologies. Opportunities are rapidly emerging in the premium inventory sectors, specifically Connected TV (CTV) and Retail Media Networks (RMNs), offering brands high-quality, addressable audience reach. The overall impact forces are characterized by high technology integration, demanding continuous adaptation to rapid AdTech innovation, while regulatory forces apply strong downward pressure on traditional targeting models.

Drivers: The dominant driver remains the continuous shift of consumer attention to mobile devices and streaming video services, necessitating media planners to follow the audience with commensurate spending. The robust infrastructure supporting programmatic advertising—which allows advertisers to automate media transactions with efficiency, scale, and data precision—is instrumental in enabling rapid growth. Furthermore, the competitive intensity across major industry verticals mandates consistent and targeted advertising efforts to maintain visibility and customer engagement. Economically, global GDP growth and increasing corporate profit margins translate directly into expanded marketing budgets, fueling overall market expansion across major regions.

Restraints: The most profound constraints currently challenging the industry stem from the regulatory tightening surrounding consumer data privacy and identity resolution. The move away from persistent identifiers compromises the established models of cross-site user tracking and measurement, forcing expensive technological re-platforming. Other significant restraints include the difficulty of achieving standardized, cross-platform measurement across disparate media channels (especially between digital and linear TV), and the ongoing erosion of advertiser trust due to persistent, albeit declining, levels of sophisticated ad fraud and concerns over brand safety violations in user-generated content environments.

Opportunities: Future growth is heavily dependent on capitalizing on new monetization avenues. The maturation of Connected TV (CTV) provides a premium inventory opportunity that combines the impact of traditional TV with digital addressability, attracting major brand spending. The rapid development of Retail Media Networks (RMNs), which allow retailers to monetize proprietary first-party shopper data, is creating highly effective, closed-loop advertising systems. Moreover, the integration of 5G networks facilitates rich, interactive ad experiences such as Augmented Reality (AR) advertising and seamless integration into gaming environments, offering new frontiers for high-engagement brand storytelling and conversion driving.

Segmentation Analysis

The Advertising Market is segmented into core operational categories to reflect the diverse methods of media dissemination and monetization available to advertisers. These segments delineate the shift in marketing spend, illustrating the pronounced migration towards measurable, performance-based digital channels away from less trackable traditional mediums. Understanding segment dynamics is critical for technology providers to align their solutions with high-growth areas, and for advertisers to construct optimized media mixes that leverage the strengths of each platform and format for specific campaign objectives.

- Platform Type: This segmentation contrasts the delivery method, highlighting the digital dominance.

- Digital Advertising: Includes all internet-delivered content (web, mobile apps, email). This segment is characterized by advanced targeting and real-time measurement capabilities.

- Traditional Advertising: Encompasses established media such as linear Television, terrestrial Radio, Print (newspapers, magazines), and Out-of-Home (OOH), which still retain significant reach for broad brand building campaigns.

- Format Type: Defined by the nature of the advertising unit consumed by the user.

- Video Advertising: High-growth segment covering in-stream, out-stream, and burgeoning CTV inventory, known for high engagement and impact.

- Search Advertising (SEM/PPC): Focused on intent, dominating the bottom of the funnel through text-based and shopping ads on search engines.

- Social Media Advertising: Leveraging vast user data for precise targeting within platforms like Meta, TikTok, and X, including influencer collaborations.

- Display Advertising: Traditional banner and rich media ads, increasingly bought programmatically across numerous websites and applications.

- Buying Method: Describes the transactional mechanism for inventory acquisition.

- Programmatic Advertising: Automated buying and selling of ad inventory using technology, including Real-Time Bidding (RTB) and Private Marketplaces (PMPs), offering efficiency and scale.

- Direct Buying: Fixed, guaranteed media placements negotiated directly between the advertiser/agency and the publisher, often used for premium inventory or high-profile sponsorships.

- Industry Vertical (End-Use): Segmentation based on the primary consumer of advertising services.

- Consumer Goods and Retail (FMCG): High volume, high frequency campaigns driving immediate consumption and brand loyalty.

- Automotive: Focus on brand awareness and driving dealership foot traffic or online configurations, highly dependent on digital video.

- Healthcare and Pharmaceuticals: Highly regulated sector requiring compliant messaging and precise audience targeting for medical professionals and patients.

- Financial Services (BFSI): Emphasis on trust-building, customer acquisition for loans, investments, and insurance services.

- Telecom and IT: Continuous campaigns promoting hardware, connectivity services, and software subscriptions.

- Media and Entertainment: Promoting content releases, streaming services, and subscriptions, often relying on cross-platform native advertising.

- Travel and Hospitality: Seasonal and location-based campaigns focused on search and highly localized mobile targeting.

Value Chain Analysis For Advertising Market

The advertising value chain is a multi-layered ecosystem structured around content creation, media distribution, and transactional technologies, characterized by increasing fragmentation and complexity. Upstream activities involve the creative development phase, where creative agencies conceptualize campaigns and produce assets. Crucially, upstream also includes data acquisition and management, encompassing Data Management Platforms (DMPs) and Customer Data Platforms (CDPs) that collect, unify, and analyze first-party consumer data, forming the intellectual capital necessary for targeted campaigns. This stage sets the strategic foundation and ensures regulatory compliance before media execution begins.

The core midstream segment focuses on media transaction and delivery. This stage is heavily reliant on AdTech infrastructure, where Demand-Side Platforms (DSPs) represent the advertiser's interests by bidding on impressions, and Supply-Side Platforms (SSPs) manage the publisher's inventory to maximize yield. Ad exchanges and data brokers facilitate the real-time transactions that underpin programmatic advertising. Media agencies play a central role here, acting as intermediaries to manage media budgets, optimize platform performance, and ensure efficient campaign execution across disparate publishers and channels. The movement towards automated, data-driven buying has significantly elevated the importance of the technological components in this segment.

Downstream processes center on accountability and feedback loops. This involves measurement, verification, and attribution services provided by third-party auditors who assess brand safety, detect ad fraud, and provide verifiable cross-platform campaign performance data. Distribution channels are typically categorized as direct, where advertisers bypass intermediaries to negotiate placement directly with premium publishers for guaranteed inventory, and indirect, which is dominated by the programmatic ecosystem utilizing RTB for vast reach and granular targeting. The rising influence of "walled gardens" (like Google and Meta) represents a unique channel that integrates all upstream, midstream, and downstream functions within proprietary environments, creating unique challenges for independent measurement.

Advertising Market Potential Customers

The customer base for the Advertising Market is nearly universal, spanning any commercial, governmental, or non-profit entity that relies on communicating value proposition to a mass or segmented audience. The primary purchasers of advertising services and technology are marketing departments and executive leaders (CMOs, CDOs) responsible for brand positioning, demand generation, and sales pipeline growth. Potential customers are grouped by their strategic need for awareness, acquisition, or retention, making companies in highly competitive, consumer-facing industries the most significant spenders.

High-value potential customers include global Consumer Packaged Goods (CPG) companies and major retail chains, which require constant, mass-reach advertising to drive shelf space dominance and rapid product turnover. Technology and Telecommunications firms are another key segment, utilizing extensive digital advertising to promote new services and maintain market share in subscription-based models. Financial services institutions, encompassing banking, insurance, and fintech, rely heavily on targeted digital advertising to build consumer trust and acquire highly qualified leads for complex, high-value financial products, often prioritizing security and regulatory compliance in their campaigns.

Furthermore, the rapid democratization of digital advertising tools has expanded the potential customer landscape to include millions of Small and Medium Enterprises (SMEs) globally. These businesses rely heavily on self-serve platforms offered by social media and search engines, focusing their advertising budget on localized, performance-based campaigns that deliver tangible, near-immediate results, making scalability and ease of use paramount features for the technology and service providers aiming to capture this massive, fragmented market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Billion USD |

| Market Forecast in 2033 | $1,420.8 Billion USD |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WPP plc, Omnicom Group Inc., Publicis Groupe SA, Interpublic Group of Companies (IPG), Dentsu Group Inc., Alphabet Inc. (Google), Meta Platforms Inc. (Facebook), The Trade Desk, Amazon.com Inc., Adobe Inc., Magnite, Criteo, Taboola, Verizon Media, Baidu Inc., Tencent Holdings Ltd., S4 Capital, MediaMath, Index Exchange, Xandr (Microsoft). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Advertising Market Key Technology Landscape

The Advertising Market is heavily reliant on the advanced infrastructure provided by AdTech and MarTech stacks, which form the technological backbone for transaction automation, audience targeting, and campaign measurement. Key technologies include programmatic buying tools such as Demand-Side Platforms (DSPs) and Supply-Side Platforms (SSPs), which utilize sophisticated algorithms and machine learning to execute media transactions in real time across digital exchanges. The efficacy of these systems is fundamentally dependent on robust data management solutions, particularly Customer Data Platforms (CDPs), which centralize and activate first-party data to create unified customer profiles for highly precise and privacy-compliant targeting strategies.

The industry is undergoing a critical technological pivot driven by the need for alternative identity solutions post-cookie deprecation. This shift is accelerating the adoption of Privacy-Enhancing Technologies (PETs), including secure data clean rooms (DCRs) that allow multiple entities to match and analyze aggregated data pools without revealing personally identifiable information. Furthermore, technologies focusing on contextual targeting—analyzing the content of a webpage or video to determine ad relevance rather than relying on individual user history—are experiencing a resurgence, complemented by Universal ID solutions aimed at providing persistent, yet privacy-compliant, identification across the open web.

Emerging technologies like Generative AI are transforming the creative production pipeline, enabling Dynamic Creative Optimization (DCO) tools to produce customized ad variations at unprecedented scale and speed. Furthermore, advancements in Connected TV (CTV) technology, specifically server-side ad insertion (SSAI) and sophisticated attribution methodologies for streaming environments, are enabling advertisers to leverage high-impact video inventory with the precision previously exclusive to digital display. This continuous technological arms race emphasizes speed, personalization, and efficiency as core differentiators in the modern advertising ecosystem.

Regional Highlights

Regional dynamics within the Advertising Market are defined by differing levels of digital maturity, regulatory environments, and consumer media habits. North America, dominated by the United States, represents the most sophisticated and largest advertising market globally. It is characterized by high programmatic penetration, aggressive adoption of CTV, and the presence of the world’s leading technology giants and media conglomerates. The region consistently leads in AdTech innovation and accounts for the majority of global ad spend, although it is also the epicenter of stringent regulatory debates concerning platform monopolies and data usage, which influence global standards.

The Asia Pacific (APAC) region is the primary engine of global market growth, driven by substantial investment in countries with high populations and rapidly expanding digital infrastructure, notably China and India. APAC is predominantly a mobile-first market, favoring social media platforms, short-form video advertising, and localized e-commerce integration, often supported by unique regional players (e.g., Tencent, ByteDance). The market here is highly fragmented but exhibits enormous scale potential, with advertisers focusing on integrating content and commerce to capture the digitally engaged, younger demographics prevalent across the region.

Europe’s advertising expenditure is stable and robust, yet its structural development is significantly dictated by the European Union’s regulatory landscape, particularly GDPR and the Digital Markets Act (DMA). This environment prioritizes data ethics and transparency, leading to faster adoption of contextual and first-party data solutions compared to other regions. While Western Europe (UK, Germany, France) constitutes the bulk of the market value, Central and Eastern European countries are rapidly increasing their digital spending as their economies and internet penetration mature. Latin America and the Middle East & Africa (MEA) are emerging growth markets, heavily focused on mobile advertising and utilizing global platforms, with rapid scaling observed in high-growth economies like Brazil, Saudi Arabia, and South Africa.

- North America: Market leader in terms of spend and technological maturity; high integration of AI, programmatic buying, and CTV; characterized by influential walled gardens and ongoing regulatory scrutiny regarding privacy and competition.

- Asia Pacific (APAC): Fastest projected growth rate; driven by massive mobile internet penetration and e-commerce growth; high reliance on regional platforms and adoption of innovative formats like live commerce and short-video advertising.

- Europe: Stable growth trajectory highly influenced by robust data protection laws (GDPR); focus on transparency, first-party data co-ops, and advanced contextual targeting methodologies; high maturity in cross-platform media planning.

- Latin America: Accelerated digitalization and rising disposable incomes driving increased advertising budgets; strong growth in social media, mobile video, and early-stage CTV monetization; focused on localization and mobile optimization for dispersed populations.

- Middle East and Africa (MEA): Emerging market opportunities linked to increasing smartphone adoption and 5G deployment; high digital spending concentration in GCC states; rapid development of local digital content ecosystems attracting increased ad investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Advertising Market, including global media agencies, ad-tech providers, and dominant platform owners.- WPP plc

- Omnicom Group Inc.

- Publicis Groupe SA

- Interpublic Group of Companies (IPG)

- Dentsu Group Inc.

- Alphabet Inc. (Google)

- Meta Platforms Inc. (Facebook)

- Amazon.com Inc.

- The Trade Desk

- Adobe Inc.

- Tencent Holdings Ltd.

- Baidu Inc.

- Magnite

- Criteo

- S4 Capital

- Index Exchange

- Innovid

- MediaMath

- Roku Inc. (Advertising Business)

- Outbrain

Frequently Asked Questions

Analyze common user questions about the Advertising market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Advertising Market?

The central driver is the persistent, rapid migration of advertising budgets from traditional media to digital channels, particularly mobile, video, and Connected TV (CTV), due to their enhanced measurability, targeting precision, and high Return on Investment (ROI) potential.

How are privacy regulations impacting digital advertising?

Privacy regulations such as GDPR and CCPA, coupled with the deprecation of third-party cookies, are severely limiting cross-site tracking capabilities, compelling advertisers to pivot towards first-party data strategies, contextual targeting, and secure data clean rooms for effective measurement.

Which advertising channel is expected to see the fastest growth?

Connected TV (CTV) advertising and Retail Media Networks (RMNs) are projected to exhibit the fastest growth, as they combine the high-impact branding of traditional TV with the addressability and measurement capabilities inherent in digital platforms.

What role does Artificial Intelligence play in modern advertising?

AI is crucial for automating complex tasks, including real-time programmatic bidding, generating dynamic creative content (DCO) variations, optimizing audience segmentation, and detecting sophisticated ad fraud schemes, thereby driving overall campaign efficiency and personalization.

What are the key differences between AdTech and MarTech?

AdTech (Advertising Technology) focuses on media buying, placement, and delivery across external channels (paid media). MarTech (Marketing Technology) focuses on owned media, customer relationship management (CRM), and internal processes like automation and lead nurturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Advertising Video Production Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Programmatic Advertising Spending Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Programmatic Job Advertising Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- LED Billboard Advertising Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Airport Advertising Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager