Aerospace Titanium Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443112 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Aerospace Titanium Market Size

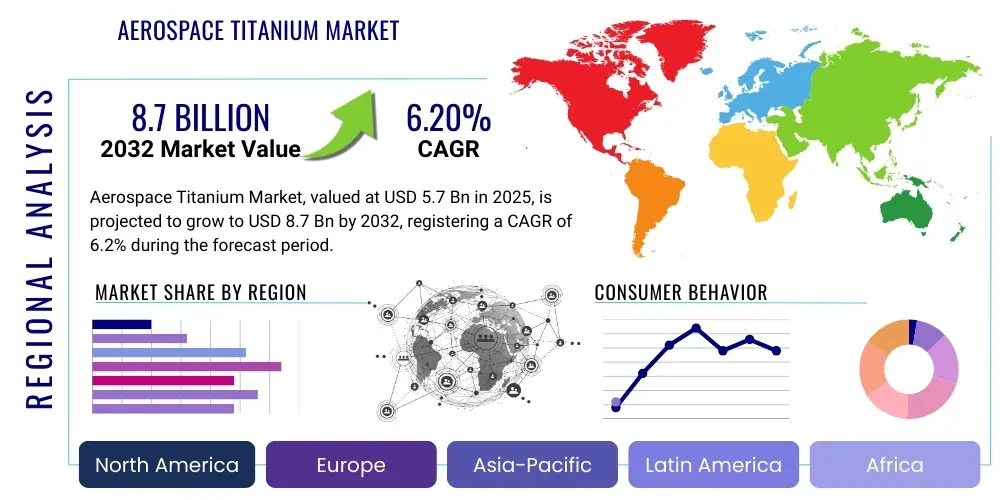

The Aerospace Titanium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033.

Aerospace Titanium Market introduction

The Aerospace Titanium Market encompasses the global supply and demand of titanium alloys specifically used in critical airframe and engine components for commercial, military, and general aviation sectors. Recognized for its unparalleled strength-to-weight ratio, superior corrosion resistance, and ability to withstand extreme thermal and mechanical stresses, titanium is indispensable in modern aircraft manufacturing. The market's foundational drivers include the ongoing need for fuel efficiency, which necessitates lighter structural materials, and the increasing global demand for new commercial aircraft, particularly in emerging economies.

Titanium alloys, notably Ti-6Al-4V (Grade 5), represent the cornerstone of applications ranging from landing gear systems, engine compressor blades and casings, to hydraulic tubing and critical structural supports within the airframe. The material's high melting point allows it to operate effectively in the hot sections of jet engines where materials like aluminum would fail. Furthermore, its excellent fatigue performance ensures the longevity and safety required for civilian and military platforms operating under cyclical stress loads.

Key market benefits driving adoption include significant weight reduction compared to steel, leading directly to lower operating costs through reduced fuel consumption. Major applications are concentrated in the structural components of wide-body aircraft and high-performance military jets, where titanium often constitutes between 10% to 15% of the total airframe weight. The market is currently being influenced by technological advancements such as additive manufacturing (3D printing), which promises to reduce material waste and shorten lead times for complex titanium parts.

Aerospace Titanium Market Executive Summary

The global Aerospace Titanium Market is characterized by robust business trends driven primarily by recovery in commercial aerospace production following pandemic-related delays and heightened geopolitical tensions necessitating increased defense spending. Manufacturers are increasingly focused on optimizing their supply chains to ensure a reliable source of high-quality titanium sponge and billets, mitigating historical volatility associated with raw material sourcing. A significant shift is observed in processing technologies, with key industry players investing heavily in 'near-net-shape' manufacturing techniques, such as powder metallurgy, advanced forging, and additive manufacturing (AM), to minimize the substantial material waste historically associated with machining titanium blocks.

Regionally, North America maintains its dominance due to the presence of major aerospace original equipment manufacturers (OEMs) like Boeing, Lockheed Martin, and Northrop Grumman, coupled with substantial government defense procurement budgets. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is fueled by massive expansion in Maintenance, Repair, and Overhaul (MRO) facilities, rapid urbanization driving air travel demand in countries like China and India, and increasing localized aircraft manufacturing capabilities, such as those related to COMAC programs.

Segment trends indicate that the commercially pure titanium segment, while essential for certain airframe sections, is being outpaced in value growth by specialized alloys, particularly high-strength, high-temperature varieties required for advanced turbofan engines (e.g., next-generation engine cores). The application segment is heavily skewed toward engines and airframes, with the engine components sub-segment showing faster value growth due to continuous technological upgrades focusing on higher thrust-to-weight ratios. Furthermore, the rising adoption of recycled titanium, driven by sustainability targets and cost reduction pressures, represents a pivotal trend influencing raw material sourcing strategies across the industry.

AI Impact Analysis on Aerospace Titanium Market

Common user questions regarding AI’s influence often revolve around how artificial intelligence can mitigate the extremely high manufacturing costs and material waste inherent in titanium processing, specifically in complex machining operations. Users are also keenly interested in AI’s capability to accelerate the discovery and certification of new titanium alloys with even better performance characteristics. Key concerns frequently raised involve data security in integrated supply chains and the necessary standardization of AI-driven Non-Destructive Testing (NDT) protocols to ensure regulatory compliance for flight-critical components. Overall, the market anticipates AI will be a transformative tool, moving titanium manufacturing from a highly empirical, lengthy process to a predictive, optimized, and rapid production environment.

The introduction of AI and Machine Learning (ML) models is significantly impacting the design phase, allowing for generative design of lightweight titanium structures that optimize topology based on stress load simulations, leading to fewer design iterations and reduced material usage. In manufacturing, AI is integrated with Computer Numerical Control (CNC) machinery to monitor tool wear, predict optimal cutting parameters, and minimize scrap rate during the highly complex and energy-intensive machining of titanium alloys. This predictive maintenance capability ensures higher machine uptime and improved quality control, directly addressing the restraint of high processing costs.

Furthermore, AI algorithms are playing a crucial role in enhancing the quality and reliability of aerospace titanium components, especially those produced via additive manufacturing (AM). Real-time monitoring systems utilize AI to analyze sensor data from AM machines (e.g., thermal signatures, melt pool geometry) to detect micro-defects during the build process, ensuring component integrity before extensive post-processing is even required. This level of quality assurance is vital for titanium parts, which often serve critical safety functions, thereby accelerating the regulatory approval process for AM-produced flight hardware.

- AI-driven Generative Design: Optimizes component topology for weight reduction and structural integrity, reducing design cycles.

- Predictive Machining Optimization: Uses ML to adjust CNC parameters in real-time, minimizing tool wear and high scrap rates associated with titanium.

- Supply Chain Resilience: AI models forecast raw material demand and predict geopolitical risks affecting titanium sponge sourcing.

- Advanced Quality Assurance: Real-time defect detection in Additive Manufacturing (AM) through sensor data analysis, enhancing part certification.

- Accelerated Material Discovery: ML screens potential new titanium alloy compositions to achieve desired strength, temperature, and fatigue properties faster than traditional R&D.

DRO & Impact Forces Of Aerospace Titanium Market

The dynamics of the Aerospace Titanium Market are shaped by a complex interplay of driving forces, inherent limitations, and significant emerging opportunities, all of which are subject to high-impact external forces such as global defense spending and commercial airline procurement cycles. The primary drivers revolve around the continuous mandate for lightweight materials to achieve superior fuel efficiency across both new and legacy aircraft fleets, coupled with a secular trend of increased utilization of titanium per aircraft as designs become more complex and operating temperatures rise. Conversely, the market faces significant restraints rooted in the intensive capital requirements for titanium sponge production, the protracted and technically demanding manufacturing process (high cost of machining), and the reliance on a few concentrated global sources for raw materials, creating geopolitical supply vulnerabilities.

A major driving force is the extensive backlog of commercial aircraft orders held by major OEMs, specifically for fuel-efficient narrow-body and advanced wide-body aircraft which heavily utilize titanium in their construction. Alongside this commercial impetus, substantial global military modernization programs, particularly in the US, Europe, and Asia, involving fifth- and sixth-generation fighter jets and advanced military transport aircraft, provide a steady, high-specification demand for titanium alloys. Opportunities are primarily centered on mitigating the high cost of production through technological innovation, such as the adoption of advanced powder metallurgy and Electron Beam Melting (EBM) techniques for near-net-shape components, which dramatically reduces the "buy-to-fly" ratio (the ratio of raw material required to the final part weight).

Key impact forces include volatile pricing mechanisms for titanium sponge due to energy costs and dependence on specific geographic suppliers. Furthermore, stringent regulatory barriers, particularly certification requirements imposed by agencies like the FAA and EASA, impact market entry and material change adoption. The overarching strategic force remains the geopolitical environment; titanium’s designation as a strategic material means its supply chain security is paramount to national defense interests, leading to governmental interventions and investment in domestic sourcing capabilities. The drive toward a circular economy is also an increasingly influential factor, promoting the establishment of efficient, high-purity titanium recycling loops to address both cost and sustainability concerns.

Segmentation Analysis

The Aerospace Titanium Market is rigorously segmented based on material type, form, application, and end-user, providing a granular view of demand across the aviation value chain. Segmentation by type differentiates between commercially pure titanium and high-strength alloys, with alloys dominating the high-value engine component sector. Form-based segmentation highlights the prominence of billets, bars, and plates, which serve as the feedstock for forging and machining operations, alongside the rapidly growing segment of powder used in additive manufacturing. Application analysis reveals airframes and engines as the critical consumption points, reflecting titanium’s structural and thermal resistance roles in flight. These segmentations are critical for stakeholders to align investment and R&D efforts with high-growth areas, particularly in specialized alloy forms demanded by next-generation engine platforms.

- By Type:

- Commercially Pure Titanium (CP Grade)

- Titanium Alloys (e.g., Ti-6Al-4V, Ti-5Al-2.5Sn, Ti-10V-2Fe-3Al)

- By Form:

- Billet and Bar

- Plate and Sheet

- Tube

- Casting and Forging

- Powder (for Additive Manufacturing)

- By Application:

- Airframe (Structure, Landing Gear, Fasteners)

- Engine Components (Compressor Blades, Casings, Disks, Nacelles)

- Other Components (Hydraulics, Exhaust Systems)

- By End-User:

- Commercial Aerospace

- Military and Defense Aerospace

- General Aviation

Value Chain Analysis For Aerospace Titanium Market

The Aerospace Titanium value chain is complex, capital-intensive, and highly consolidated, starting with the upstream extraction and refinement of titanium minerals. The process typically begins with ilmenite or rutile ores, which are processed into titanium tetrachloride (TiCl4). This compound then undergoes the energy-intensive Kroll process to produce titanium sponge—the foundational raw material. The quality and purity of the titanium sponge are paramount for aerospace applications, requiring stringent quality control and certification. Upstream risks are highly concentrated, as global sponge production is dominated by a few key nations, making supply chain diversification a critical strategic concern for downstream consumers.

Midstream activities involve melting and alloying processes, where sponge is converted into ingots and then processed into various mill products such as billets, bars, plates, and tubes. This stage is dominated by specialized aerospace material suppliers who possess the necessary vacuum arc re-melting (VAR) or electron beam cold hearth melting (EBCHM) capabilities to ensure material homogeneity and defect-free products required by aerospace standards. Component manufacturing—the most complex and value-adding segment—involves advanced forging, hot isothermal forging, and subsequent precision machining or emerging additive manufacturing techniques. The high cost of specialized machining equipment and the necessity of highly skilled labor contribute significantly to the final component price, driving demand for near-net-shape technologies to improve the 'buy-to-fly' ratio.

The downstream distribution channel primarily flows directly from component manufacturers and large material suppliers to the Original Equipment Manufacturers (OEMs), such as Boeing and Airbus, or major Tier 1 suppliers like Safran and Spirit AeroSystems. Due to the critical nature and high cost of titanium components, indirect distribution through generalized distributors is minimal; most contracts are long-term, direct procurement agreements. Specialized, certified distributors play a role in serving the global Maintenance, Repair, and Overhaul (MRO) market, providing replacement parts and smaller volume requirements. The entire chain is characterized by rigorous certification requirements (e.g., AS9100, specific OEM qualifications) which act as significant barriers to entry for new suppliers, reinforcing the control held by established market players.

Aerospace Titanium Market Potential Customers

The primary customers for aerospace titanium are the major global Original Equipment Manufacturers (OEMs) who design and assemble commercial and military aircraft. Companies such as Boeing, Airbus, Lockheed Martin, COMAC, and Embraer drive massive, sustained demand for bulk titanium products, particularly billets and forgings for airframe structures and engine components. These OEMs place a premium on long-term supply stability, consistent material properties, and competitive pricing, often demanding highly tailored alloy specifications and certified traceability throughout the entire supply chain. Their procurement strategies often involve dual-sourcing or long-term agreements with Tier 1 component manufacturers to guarantee input reliability for multi-year production backlogs.

Tier 1 system integrators and component manufacturers constitute the second largest customer segment. Companies like General Electric Aviation, Rolls-Royce, Pratt & Whitney (for engines), and Spirit AeroSystems (for airframe components) purchase mill products and specialized forms to produce finished, certified parts, such as engine disks, fan blades, complex fittings, and landing gear assemblies. These customers require materials processed to specific near-net shapes to minimize machining waste and cost. As engine manufacturers continuously push for higher temperature and pressure performance, their demand focuses increasingly on advanced, niche titanium alloys capable of withstanding extreme operational environments.

Finally, the Maintenance, Repair, and Overhaul (MRO) sector and various governmental defense agencies serve as crucial end-users. MRO operations demand titanium for spare parts and replacement components for aging fleets, particularly in high-cycle fatigue areas. Military end-users, managed through government contracts (e.g., DoD in the US), require highly specialized, performance-driven alloys for stealth aircraft and high-speed platforms, often prioritizing performance and supply security over marginal cost savings. The increasing global fleet size ensures a consistent and growing demand from the MRO segment for the foreseeable future, providing market stability even during new aircraft production slowdowns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VSMPO-AVISMA Corporation, ATI Metals, Haynes International, Howmet Aerospace, TIMET (Titanium Metals Corporation), Precision Castparts Corp. (PCC), Baoji Titanium Industry Co. Ltd., Western Superconducting Technologies Co., Ltd., Arconic Corporation, Aperam S.A., RTI International Metals, Kobelco Group (Kobe Steel, Ltd.), Global Titanium Inc., Firth Rixson Ltd. (a subsidiary of PCC), Daido Steel Co. Ltd., Eramet, Puris LLC, AMG Advanced Metallurgical Group N.V., Universal Stainless & Alloy Products, Carpenter Technology Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aerospace Titanium Market Key Technology Landscape

The technological landscape of the Aerospace Titanium Market is rapidly evolving, driven by the imperative to reduce costs, minimize material waste, and improve component performance. Additive Manufacturing (AM), particularly using technologies like Electron Beam Melting (EBM) and Laser Powder Bed Fusion (LPBF), represents a disruptive technological shift. These processes enable the creation of highly complex geometries with significantly reduced material input compared to traditional subtractive manufacturing (machining). AM is particularly beneficial for producing low-volume, high-complexity parts for both prototyping and final flight hardware, accelerating the qualification process for specific components in areas like engine secondary structures and small airframe fittings.

Beyond AM, traditional manufacturing processes are undergoing modernization. Advanced forging techniques, such as Hot Isothermal Forging (HIF) and Near-Net-Shape Forging, are employed to produce components, like engine discs and landing gear parts, closer to their final geometry. This modernization significantly improves the 'buy-to-fly' ratio, which can be as high as 10:1 in conventional machining. Furthermore, specialized surface treatment technologies, including various forms of shot peening and chemical milling, are crucial for enhancing the fatigue life and corrosion resistance of titanium components, ensuring they meet the demanding operational standards of aerospace use.

In terms of materials science, the focus is on developing advanced titanium aluminides (TiAl) for high-temperature applications in the low-pressure turbine sections of jet engines, offering significant weight savings compared to nickel-based superalloys. Simultaneously, digital thread integration across the manufacturing ecosystem, utilizing advanced sensors and data analytics, is optimizing quality control and material traceability. This technological convergence—combining advanced metallurgy, near-net-shape processing, and AI-enhanced quality monitoring—is crucial for sustaining the high-growth trajectory of the market while meeting stringent regulatory demands for safety and performance.

Regional Highlights

- North America: Dominates the global market, anchored by the presence of major aerospace and defense OEMs (Boeing, Lockheed Martin, Pratt & Whitney). The region benefits from substantial, continuous government defense spending and a mature, vertically integrated supply chain, leading technological advancements in AM and advanced material processing.

- Europe: A strong second market, largely driven by the production of Airbus commercial aircraft and major engine programs by Rolls-Royce and Safran. Europe is a key center for specialized titanium component manufacturing and leads in research focused on high-performance alloys and sustainable recycling practices.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by massive fleet expansion, new localized aircraft programs (e.g., China’s COMAC), and exponential growth in the MRO sector, especially in China and India. Growing regional self-sufficiency in titanium processing is a major emerging trend.

- Latin America (LATAM): Exhibits moderate growth, primarily driven by maintenance requirements for existing commercial fleets and military modernization efforts in key countries like Brazil. Embraer’s presence ensures a consistent, albeit smaller, demand pool for general and regional aviation titanium components.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf nations, driven by significant investment in commercial airline hubs (Emirates, Qatar Airways) which necessitates substantial MRO infrastructure, creating specialized demand for repair and replacement titanium parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Titanium Market.- VSMPO-AVISMA Corporation

- ATI Metals (Allegheny Technologies Incorporated)

- TIMET (Titanium Metals Corporation)

- Precision Castparts Corp. (PCC)

- Howmet Aerospace (formerly Arconic)

- Baoji Titanium Industry Co., Ltd. (BAOTI)

- Kobe Steel, Ltd. (Kobelco Group)

- Western Superconducting Technologies Co., Ltd. (WST)

- Haynes International

- GfE (Gesellschaft für Elektrometallurgie)

- Global Titanium Inc.

- Advanced Metallurgical Group (AMG) N.V.

- Carpenter Technology Corporation

- Universal Stainless & Alloy Products

- Daido Steel Co., Ltd.

- Eramet S.A.

- Triton Systems, Inc.

- Puris LLC

- Aperam S.A.

- Safran S.A.

Frequently Asked Questions

Analyze common user questions about the Aerospace Titanium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most common titanium alloy used in aerospace applications?

The most widely utilized alloy is Ti-6Al-4V (Grade 5). This alpha-beta alloy offers an excellent balance of high strength, relatively low density, and good corrosion resistance, making it ideal for airframe structures and critical engine components.

How does the high cost of titanium material affect market adoption?

The high cost, largely driven by the energy-intensive Kroll process for producing titanium sponge, remains a major restraint. Market players mitigate this through specialized 'near-net-shape' manufacturing techniques and increasing the recycling efficiency of titanium scrap to reduce the overall material expenditure.

What role does Additive Manufacturing (AM) play in the titanium market?

AM, particularly Electron Beam Melting (EBM) and Laser Powder Bed Fusion (LPBF), is crucial for reducing material waste and enabling the rapid production of complex, lightweight geometries that are difficult or impossible to manufacture via traditional forging and machining. This improves the cost-efficiency of titanium parts.

Which regions are leading the demand and supply for aerospace titanium?

North America is the dominant demand center due to large OEM presence and defense spending. However, supply chain leadership is heavily influenced by Russia (VSMPO-AVISMA) and China (BAOTI, WST) for raw material sponge, while Western nations lead in high-end alloy processing.

What are the primary applications of titanium in modern jet engines?

Titanium alloys are used extensively in the cooler sections of jet engines, primarily in the compressor stages (fan blades, disks, casings) due to their high strength-to-weight ratio and ability to resist the rotational stresses and moderate thermal loads generated during operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager