Aerospace Titanium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427742 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Aerospace Titanium Market Size

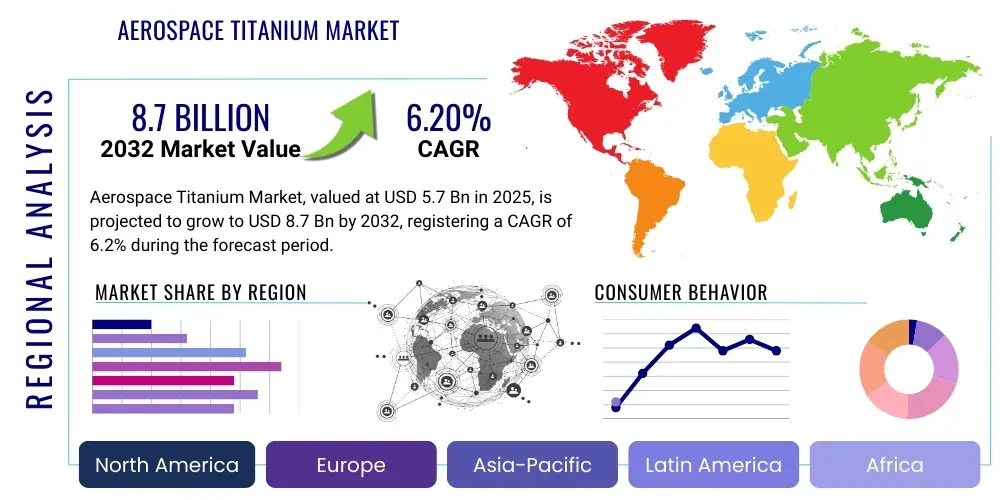

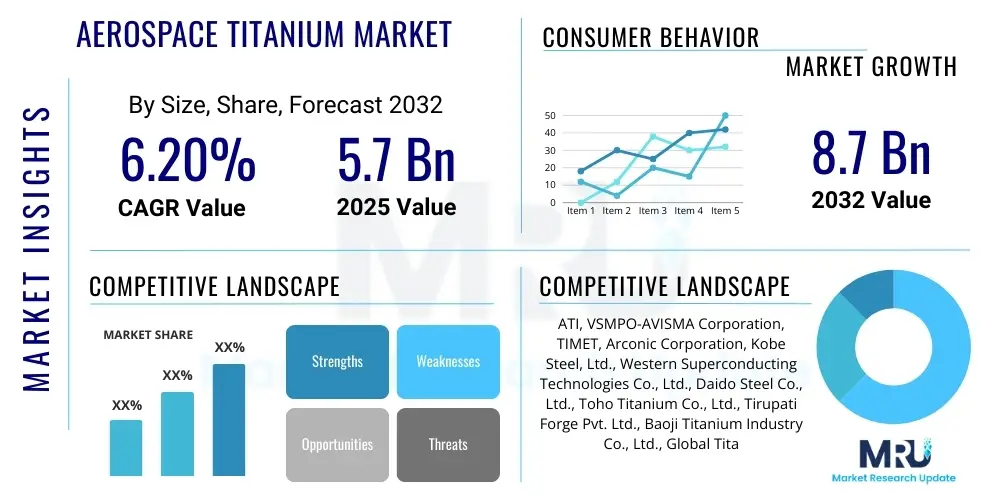

The Aerospace Titanium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2032. The market is estimated at USD 5.7 billion in 2025 and is projected to reach USD 8.7 billion by the end of the forecast period in 2032.

Aerospace Titanium Market introduction

The Aerospace Titanium Market encompasses the production and supply of titanium and its alloys specifically for aerospace applications, leveraging the materials unparalleled strength-to-weight ratio, excellent corrosion resistance, and ability to withstand high temperatures. Titanium is indispensable in the construction of modern aircraft, spacecraft, and missiles, playing a critical role in components such as airframes, engine parts, landing gear, and fasteners where performance and durability are paramount. The inherent benefits of titanium, including fuel efficiency gains due to lighter structures and enhanced operational longevity, drive its continuous demand across both commercial and military aviation sectors.

Major applications of aerospace titanium span across commercial aircraft, regional jets, business jets, military aircraft (fighters, transport, helicopters), and space exploration vehicles, including rockets and satellites. Its use contributes significantly to reducing the overall weight of these platforms, leading to improved fuel economy, increased payload capacity, and extended service life. The market is further propelled by global trends in increasing air travel demand, robust defense spending on advanced aircraft programs, and expanding investments in space exploration missions.

The demand for aerospace titanium is intrinsically linked to the aerospace manufacturing cycle, which involves long lead times and stringent qualification processes for new materials and components. This market is characterized by a limited number of specialized producers and processors, forming a highly integrated supply chain that prioritizes quality, reliability, and adherence to rigorous aerospace industry standards. Continuous innovation in titanium alloy development and manufacturing processes aims to further enhance performance characteristics and reduce production costs, solidifying titaniums critical position in the future of aerospace.

Aerospace Titanium Market Executive Summary

The Aerospace Titanium Market is experiencing robust growth driven by escalating global air travel, modernization of military fleets, and an intensifying focus on space exploration, creating a sustained demand for lightweight, high-strength materials. Business trends indicate a strong emphasis on supply chain resilience, vertical integration among key players, and significant investments in advanced manufacturing technologies such as additive manufacturing to optimize production efficiency and reduce material waste. Innovation in alloy development, aiming for enhanced performance characteristics and improved processability, remains a critical area of strategic focus, alongside efforts to increase the recycling and reuse of titanium scrap to address sustainability concerns and raw material costs.

Regionally, North America and Europe continue to be dominant markets, driven by the presence of major aerospace OEMs, established defense industries, and extensive research and development capabilities. However, the Asia-Pacific region is emerging as a significant growth hub, propelled by expanding commercial aircraft fleets, increasing defense expenditures, and burgeoning domestic aerospace manufacturing capacities, particularly in countries like China and India. This regional shift highlights the globalization of aerospace manufacturing and the diversification of market demand across various geographical segments.

Segmentation trends reveal a persistent demand for specific forms of titanium, including forgings, sheets, and plates, which are integral to airframe and engine construction. The commercial aircraft segment continues to be the largest consumer, while the military aircraft and space segments demonstrate steady growth, fueled by government defense budgets and ambitious space programs. The market also observes an increasing penetration of advanced titanium alloys, offering superior performance over conventional variants, as aerospace designers seek to push the boundaries of aircraft design and operational capabilities.

AI Impact Analysis on Aerospace Titanium Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the Aerospace Titanium Market, focusing on its potential to enhance material properties, optimize manufacturing processes, improve supply chain efficiency, and enable predictive maintenance. Key themes revolve around leveraging AI for advanced material discovery, simulating complex forging and machining operations to minimize defects and material waste, and streamlining the entire product lifecycle from design to disposal. Concerns often include the initial investment costs, data security implications, and the need for a skilled workforce to implement and manage AI-driven systems. Expectations are high for AI to deliver unprecedented levels of precision, speed, and cost-effectiveness in titanium production and application within the aerospace sector.

- AI can optimize alloy design by simulating material properties, accelerating the discovery of new, lighter, and stronger titanium alloys with improved characteristics for aerospace applications.

- Predictive analytics powered by AI can enhance manufacturing processes by identifying potential defects in real-time, optimizing machining parameters, and reducing scrap rates during titanium component fabrication.

- AI-driven supply chain management improves transparency, traceability, and efficiency, enabling better forecasting of titanium demand, managing inventory, and mitigating supply disruptions.

- Machine learning algorithms contribute to predictive maintenance for aerospace components, analyzing sensor data from titanium parts in operation to anticipate failures and schedule proactive repairs, extending asset lifespan.

- AI supports generative design in aerospace engineering, allowing designers to create optimized titanium part geometries that are structurally efficient and lighter, leading to improved fuel economy.

DRO & Impact Forces Of Aerospace Titanium Market

The Aerospace Titanium Market is primarily driven by the escalating demand for new commercial aircraft, propelled by increasing global air travel and the expansion of airline fleets, coupled with significant modernization initiatives within military aviation worldwide. These drivers are intrinsically linked to the imperative for fuel-efficient and high-performance aircraft, where titaniums superior strength-to-weight ratio and corrosion resistance offer distinct advantages. Opportunities in the market are abundant, particularly with advancements in additive manufacturing (3D printing) of titanium components, which promise reduced material waste, complex geometric capabilities, and shorter lead times, alongside the development of novel titanium alloys with enhanced properties for extreme aerospace environments. Furthermore, the growing focus on space exploration and satellite deployment also presents a long-term growth avenue for specialized titanium applications.

However, the market faces notable restraints, including the inherently high cost of titanium production, from raw material extraction to complex processing and machining, which can significantly impact the overall cost of aerospace programs. Supply chain volatility, influenced by geopolitical factors and the concentration of raw material sources and processing capabilities, poses a continuous challenge to market stability. Additionally, the stringent regulatory requirements and qualification processes for aerospace materials necessitate extensive testing and certification, leading to extended development cycles and high entry barriers for new participants. These factors collectively contribute to a complex operational landscape for titanium suppliers.

Impact forces on the market are diverse and pervasive. Technological advancements, particularly in metallurgy and manufacturing techniques, continuously shape the market by enabling the production of more advanced and cost-effective titanium parts. Economic cycles, global trade policies, and geopolitical stability directly influence defense budgets and commercial aviation investments, thereby impacting demand. Environmental regulations push for more sustainable production methods and increased recycling efforts, while the competitive landscape, characterized by a few dominant players, drives continuous innovation and efficiency improvements. The interplay of these forces dictates market dynamics and strategic decisions for stakeholders throughout the value chain.

Segmentation Analysis

The Aerospace Titanium Market is comprehensively segmented across various dimensions to provide granular insights into its diverse applications and material forms. This segmentation allows for a detailed understanding of market dynamics, specific demand drivers, and technological advancements within distinct categories, enabling stakeholders to identify key growth areas and tailor strategic approaches. The primary segmentation often includes product form, application, and end-user, reflecting the intricate requirements of the aerospace industry.

Product form segmentation categorizes titanium based on its processing and physical shape, which directly influences its suitability for different aircraft components. Application segmentation differentiates between the primary uses of titanium within the aerospace sector, ranging from structural components to critical engine parts. End-user segmentation then identifies the ultimate consumers of aerospace titanium, highlighting the distinct needs of commercial versus military or space-related manufacturers. Understanding these segments is crucial for market participants to navigate the complex landscape of aerospace material supply.

- By Product Type:

- Titanium Alloy Forgings

- Titanium Alloy Bars

- Titanium Alloy Sheets & Plates

- Titanium Alloy Tubes

- Titanium Alloy Wires

- Titanium Alloy Powders

- By Application:

- Commercial Aircraft

- Military Aircraft

- Spacecraft & Launch Vehicles

- Missiles & Drones

- By End-User:

- Aircraft Manufacturers

- Engine Manufacturers

- Component Manufacturers

- Maintenance, Repair, and Overhaul (MRO) Providers

- By Grade:

- CP Titanium (Commercially Pure)

- Ti-6Al-4V (Grade 5)

- Ti-6Al-2Sn-4Zr-2Mo (Grade 11)

- Ti-5Al-2.5Sn (Grade 6)

- Other Alloys (e.g., Ti-10V-2Fe-3Al)

Aerospace Titanium Market Value Chain Analysis

The Aerospace Titanium Market value chain is a complex, multi-tiered structure beginning with the extraction and refining of titanium ore, primarily ilmenite and rutile, followed by the crucial production of titanium sponge. This upstream segment is capital-intensive and concentrated in a few global regions. The titanium sponge is then melted and refined into ingots, which serve as the foundational material for various aerospace-grade titanium products. Strict quality control and certification are paramount at every stage, given the critical applications of the end product.

Moving downstream, these ingots undergo various processing stages, including forging, rolling into sheets and plates, extrusion into bars and tubes, and drawing into wires. These intermediate products are then supplied to component manufacturers who machine, form, and assemble them into specific aircraft parts, such as airframe structures, engine casings, landing gear components, and fasteners. The distribution channels are predominantly direct, with major titanium producers supplying directly to Tier 1 aerospace suppliers and Original Equipment Manufacturers (OEMs), ensuring strict adherence to specifications and seamless integration into the manufacturing process. Indirect channels, involving specialized distributors, typically cater to smaller component manufacturers or MRO operations requiring specific material forms in smaller quantities.

The entire value chain is characterized by long lead times, significant R&D investment for new alloys and processing techniques, and a high degree of collaboration between material producers, processors, and aerospace OEMs. Upstream risks include raw material availability and geopolitical stability, while downstream risks relate to aircraft production rates and design changes. The direct relationship between titanium suppliers and major aerospace companies ensures tight control over quality, traceability, and intellectual property, solidifying the markets emphasis on high performance and reliability.

Aerospace Titanium Market Potential Customers

The primary potential customers and end-users of aerospace titanium are overwhelmingly concentrated within the global aerospace and defense industry, reflecting the materials specialized applications and stringent performance requirements. These customers span various segments of the aviation and space sectors, each with distinct needs and procurement processes. The demand is largely driven by the production cycles of new aircraft, maintenance, repair, and overhaul (MRO) activities for existing fleets, and the ongoing development of advanced military and space systems.

Key customers include major commercial aircraft manufacturers such as Boeing, Airbus, Embraer, and Bombardier, who require significant volumes of titanium for airframes, wings, and structural components. Engine manufacturers like GE Aviation, Rolls-Royce, and Pratt & Whitney are also critical buyers, utilizing titanium for turbine blades, compressor discs, and casings due to its high-temperature strength. Additionally, leading defense contractors and military aircraft manufacturers, including Lockheed Martin, Northrop Grumman, and Dassault Aviation, represent substantial end-users, integrating titanium into fighter jets, transport aircraft, and missile systems where weight reduction and ballistic performance are crucial.

Beyond these large-scale manufacturers, the market also serves component manufacturers who specialize in specific parts like landing gear (e.g., Safran Landing Systems), fasteners, and hydraulic systems. Space agencies and commercial space companies (e.g., NASA, SpaceX, Blue Origin) are emerging customers, requiring titanium for rockets, satellites, and various spacecraft components where extreme conditions and precise material performance are non-negotiable. Furthermore, a segment of the MRO market, focusing on the repair and replacement of high-value titanium parts in existing aircraft, also constitutes a vital customer base, ensuring the sustained operational readiness of global fleets.

Aerospace Titanium Market Key Technology Landscape

The Aerospace Titanium Market is continuously shaped by advanced technological developments aimed at improving material properties, optimizing manufacturing processes, and reducing overall production costs while maintaining stringent aerospace quality standards. Key innovations focus on metallurgy, processing techniques, and digital integration. These technologies are crucial for meeting the evolving demands of lighter, stronger, and more fuel-efficient aircraft, as well as for enabling the design and production of complex components for next-generation aerospace platforms. The technological landscape is dynamic, with ongoing research and development efforts across the entire value chain.

One of the most transformative technologies is additive manufacturing (AM), particularly for titanium powders, enabling the production of highly complex geometries with reduced material waste and shorter lead times. Techniques such as Electron Beam Melting (EBM) and Laser Powder Bed Fusion (LPBF) are gaining traction for producing near-net-shape components, minimizing the need for extensive machining. Alongside AM, advanced forging and machining techniques, including isothermal forging and superplastic forming, continue to be refined to produce high-integrity, high-performance titanium parts with enhanced mechanical properties and improved surface finishes. These methods are critical for large structural components where material integrity is paramount.

Furthermore, the development of new titanium alloys tailored for specific aerospace applications is a continuous area of technological focus. This includes high-strength, high-temperature alloys for engine components and fire-resistant alloys, as well as alloys with improved fatigue life and fracture toughness for airframes. Surface engineering technologies, such as advanced coatings (e.g., thermal barrier coatings, wear-resistant coatings) and surface treatments (e.g., shot peening, laser shock peening), are also crucial for enhancing the durability, corrosion resistance, and operational lifespan of titanium components in harsh aerospace environments. Digital technologies like computational materials engineering, finite element analysis, and artificial intelligence are increasingly integrated into material design and process optimization, significantly accelerating innovation cycles and improving product reliability.

Regional Highlights

- North America: This region holds a significant share of the Aerospace Titanium Market, driven by the presence of major aircraft manufacturers (Boeing, Lockheed Martin), strong defense spending, and advanced research and development capabilities. The United States leads in both production and consumption, with a robust ecosystem of specialized titanium processors and component manufacturers.

- Europe: A substantial market led by countries with prominent aerospace industries like France (Airbus, Safran), the UK (Rolls-Royce, BAE Systems), and Germany. High investments in commercial aviation programs and military modernization contribute to sustained demand.

- Asia-Pacific: Emerging as the fastest-growing market due to increasing commercial air travel, significant investments in new aircraft fleets, and expanding domestic aerospace manufacturing capabilities in countries such as China, India, and Japan. Rising defense budgets also fuel the demand for military aircraft titanium.

- Middle East & Africa: Exhibits steady growth, primarily driven by expanding airline fleets and ambitious infrastructure projects in the commercial aviation sector. While not a major production hub, the region is a significant consumer due to its growing air transportation needs.

- Latin America: Represents a smaller but growing market, influenced by regional airline expansion and modernization efforts, particularly in Brazil with manufacturers like Embraer. The demand here is more focused on commercial and regional aircraft requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aerospace Titanium Market.- ATI (Allegheny Technologies Incorporated)

- VSMPO-AVISMA Corporation

- TIMET (Titanium Metals Corporation)

- Arconic Corporation

- Kobe Steel, Ltd.

- Western Superconducting Technologies Co., Ltd. (WST)

- Daido Steel Co., Ltd.

- Toho Titanium Co., Ltd.

- Tirupati Forge Pvt. Ltd.

- Baoji Titanium Industry Co., Ltd. (BAOTI)

- Global Titanium Inc.

- RTI International Metals (now part of Alcoa)

- Nippon Steel Corporation

- Safran S.A. (indirectly through engine components)

- Rolls-Royce plc (indirectly through engine components)

Frequently Asked Questions

What are the primary drivers for the Aerospace Titanium Market growth?

The market growth is primarily driven by increasing global air travel demand, leading to larger commercial aircraft fleets, significant military aircraft modernization programs, and expanding investments in space exploration missions requiring lightweight, high-performance materials.

What challenges does the Aerospace Titanium Market face?

Key challenges include the high production costs of titanium, complex and energy-intensive manufacturing processes, volatility in raw material supply chains, and stringent regulatory and qualification requirements for aerospace-grade materials, leading to high entry barriers and extended development cycles.

How is additive manufacturing impacting the aerospace titanium industry?

Additive manufacturing, or 3D printing, is significantly impacting the industry by enabling the production of highly complex titanium components with reduced material waste, shorter lead times, and enhanced design flexibility, leading to lighter and more efficient aerospace parts.

Which regions are leading the demand for aerospace titanium?

North America and Europe currently lead in aerospace titanium demand due to established aerospace and defense industries. However, the Asia-Pacific region is experiencing rapid growth driven by commercial fleet expansion and increasing defense expenditures.

What types of titanium alloys are most commonly used in aerospace?

The most commonly used titanium alloys include Ti-6Al-4V (Grade 5) for its excellent strength-to-weight ratio and corrosion resistance, and various commercially pure (CP) titanium grades for less demanding applications. Specialized alloys like Ti-6Al-2Sn-4Zr-2Mo are used for high-temperature engine components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager