Aluminium Coated Glass Cloth Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441743 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Aluminium Coated Glass Cloth Market Size

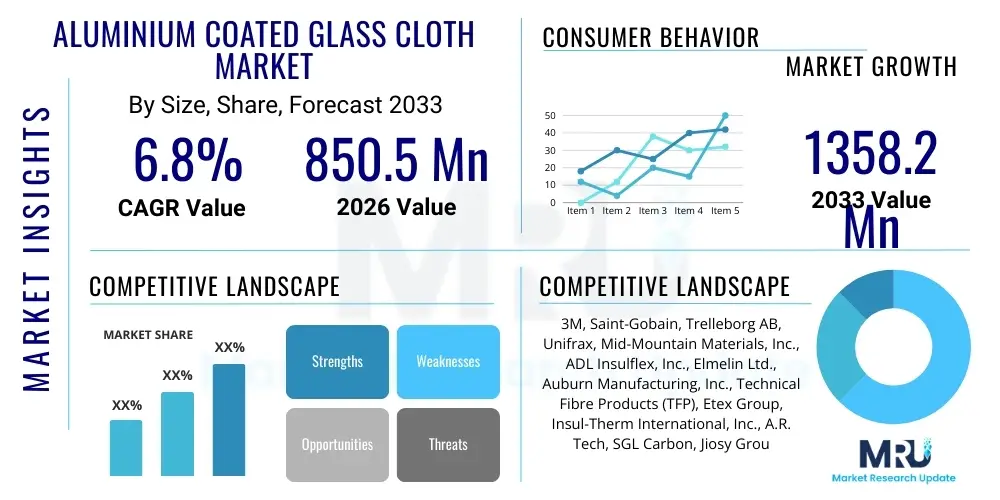

The Aluminium Coated Glass Cloth Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.35 Billion by the end of the forecast period in 2033.

Aluminium Coated Glass Cloth Market introduction

Aluminium Coated Glass Cloth (ACGC) is a high-performance, multilayer composite material engineered specifically for demanding thermal management and fire protection applications. It is fundamentally composed of a woven fiberglass fabric substrate, known for its exceptional mechanical strength, chemical resistance, and non-combustible properties, laminated with a highly reflective, thin layer of aluminum foil utilizing advanced, specialized heat-resistant adhesives. This unique combination maximizes the intrinsic benefits of both materials: the glass cloth provides structural stability and integrity up to extreme temperatures, while the aluminum layer functions as an efficient radiant heat shield, reflecting up to 95% of thermal energy away from the protected surface. The resultant material is lightweight, flexible, durable, and highly effective as both a thermal insulator and a crucial fire barrier, positioning it as a preferred material over traditional insulation solutions in rigorous industrial environments.

The primary applications of ACGC are extensive and critical, spanning various sectors where operational safety and energy conservation are paramount. In industrial settings, ACGC is widely used for insulating high-temperature pipelines, boilers, and machinery to minimize heat loss, thereby significantly improving energy efficiency and reducing operational costs. For personal and infrastructure safety, it serves as the base material for fire blankets, welding curtains, and emergency fire barriers due to its inherent resistance to flame spread and high melting point. The product's versatility extends into specialized fields such as automotive manufacturing, where it is utilized as thermal shielding in engine bays and exhaust system wraps, and in the burgeoning electric vehicle (EV) market for battery thermal management systems (BTMS) to mitigate the risks associated with thermal runaway events. This broad application spectrum underscores the material’s indispensable role in modern safety and efficiency protocols.

The market is predominantly driven by increasing global mandates for stringent fire safety standards in both commercial and residential construction, coupled with the accelerating worldwide push for enhanced industrial energy efficiency measures. Governments and regulatory bodies are enforcing stricter compliance regarding flame spread rating and smoke density, directly fueling the demand for non-combustible, high-performance materials like ACGC. Furthermore, technological improvements in adhesive systems, enabling thinner and lighter ACGC variants that retain high thermal resistance, are opening up new opportunities, particularly in the aerospace and automotive sectors which require high performance-to-weight ratios. The continuous need for robust, long-lasting thermal protection in infrastructure upgrades and new industrial projects ensures the sustained expansion and technological evolution within the ACGC market throughout the forecast period.

Aluminium Coated Glass Cloth Market Executive Summary

The Aluminium Coated Glass Cloth market is poised for significant expansion, fueled by regulatory tailwinds and technological advancements focused on improving thermal performance and ease of installation. Current business trends highlight a key shift toward customization and specialty product development, particularly materials engineered to withstand highly specific environmental challenges, such as continuous vibratory stress or exposure to corrosive chemical agents common in the oil and gas industry. Manufacturers are aggressively investing in advanced lamination technologies, including precision hot-melt systems, to ensure superior adhesion strength and uniformity, addressing historical concerns regarding potential delamination under cyclic heating conditions. Supply chain resilience remains a central strategic focus, with companies establishing dual sourcing strategies for critical inputs like high-purity fiberglass yarn and specialized aluminum alloys to mitigate risks associated with fluctuating commodity prices and geopolitical instability, thereby securing stable production capabilities across key geographical hubs.

Regionally, the market dynamics are heavily skewed towards the Asia Pacific (APAC) region, which dominates both in terms of consumption volume and production capacity. This supremacy is directly linked to the rapid infrastructural build-out, massive industrial expansion, and the accelerating pace of urbanization across developing economies like China, India, and Indonesia, which mandate large volumes of insulating and fire protection materials. In contrast, mature markets in North America and Europe are characterized by demand for premium, high-specification products targeted at technologically sophisticated sectors such as aerospace, defense, and specialized high-temperature manufacturing, where adherence to complex certifications (e.g., FAA, UL, and CE standards) is a prerequisite. The Middle East demonstrates rapidly increasing consumption, driven by colossal energy projects and large-scale, high-end commercial construction requiring materials capable of effectively managing extreme ambient heat conditions.

Segmentation trends reveal that the Industrial Insulation application segment retains the largest market share, essential for optimizing energy expenditure in process-heavy industries, yet the Fire Protection segment is registering the fastest growth, propelled by rapidly updating global building and safety codes. By material characteristics, medium to heavyweight ACGC fabrics remain the backbone of industrial demand, valued for their durability. However, the Lightweight ACGC segment is experiencing accelerated adoption, particularly in mobility applications, responding to the automotive industry’s urgent need for mass reduction without sacrificing thermal shielding capabilities, crucial for enhancing EV range and safety. The ongoing trend toward high-barrier double-sided coated glass cloth emphasizes the market's trajectory towards solutions offering maximal thermal reflection and vapor barrier performance in highly moisture-sensitive or corrosive environments.

AI Impact Analysis on Aluminium Coated Glass Cloth Market

Common user inquiries regarding AI's influence on the ACGC market often revolve around efficiency gains, predictive quality control, and the acceleration of material innovation. Users frequently ask how AI can automate complex process adjustments during lamination to minimize variances in coating thickness, which is vital for maintaining consistent thermal performance. A significant theme of concern is whether AI can reliably predict the long-term degradation rates of various adhesive systems under extreme operating conditions (e.g., high heat combined with chemical exposure), thus extending the guaranteed service life of the product. Furthermore, stakeholders are keenly interested in utilizing AI-driven analysis to pinpoint optimal sourcing strategies for specialty glass fibers and fire-retardant components, thereby minimizing supply chain risk and optimizing input costs in a volatile commodity market.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) models is significantly enhancing operational efficiency and product integrity within the ACGC manufacturing sector. In production, AI systems analyze continuous data streams from high-speed thermal cameras and ultrasonic sensors monitoring the coating line. These sophisticated algorithms detect subtle inconsistencies, such as microscopic pinholes in the aluminum foil or deviations in adhesive bonding pressure, far faster and more accurately than human operators. By instantly flagging and adjusting process parameters—such as curing oven temperature or roller pressure—AI ensures near-perfect bond consistency, drastically reducing the occurrence of defects that could compromise the material's radiant heat reflectivity and structural integrity over time. This predictive quality assurance is paramount for products destined for mission-critical applications like aircraft components or nuclear insulation.

Beyond the factory floor, AI-powered predictive modeling is transforming research and development and strategic planning. Machine learning enables rapid simulation of novel composite structures by manipulating variables like weave pattern, aluminum foil thickness, and adhesive formulation to predict thermal conductivity and fire resistance performance without expensive and time-consuming physical prototyping. This capability accelerates the innovation cycle, allowing companies to quickly develop next-generation ACGC materials optimized for emerging demands, such as ultra-high-temperature requirements in advanced manufacturing or highly flexible textiles for robotics and articulated machinery insulation. Strategically, AI algorithms analyze vast datasets encompassing global construction spending, industrial capacity utilization, and competitive pricing dynamics to generate highly accurate demand forecasts, optimizing inventory holdings and ensuring market leaders can strategically allocate resources to regions experiencing peak demand growth.

- AI-driven Quality Control: Real-time, non-destructive inspection of coating integrity and uniformity, minimizing waste and ensuring compliance with strict thermal specifications.

- Process Optimization: ML algorithms automatically adjust lamination speed, temperature, and pressure to maintain optimal bonding and material quality, maximizing throughput.

- Predictive Maintenance: AI identifies early warning signs of mechanical wear in lamination equipment, preventing unplanned downtime and extending equipment lifespan.

- Accelerated R&D: Machine learning models simulate the performance of new material combinations, reducing the time-to-market for innovative, high-performance ACGC variants.

- Enhanced Supply Chain Resilience: AI analyzes geopolitical and economic data to predict supply bottlenecks and commodity price spikes, optimizing raw material procurement strategies.

DRO & Impact Forces Of Aluminium Coated Glass Cloth Market

The market for Aluminium Coated Glass Cloth is principally propelled by a confluence of global regulatory imperatives and industrial modernization trends. The most potent driver is the continuous tightening of international fire safety codes, such as NFPA standards in North America and comparable European norms (Eurocodes), which necessitate non-combustible barriers and high-performance insulation in commercial, public, and industrial structures. Parallelly, the intensifying focus on achieving ambitious energy efficiency targets across all industrial sectors globally mandates the replacement of older, less efficient insulation materials with modern reflective barriers like ACGC, which demonstrably minimize heat transfer and energy waste in high-temperature processes. Furthermore, the exponential growth in the Electric Vehicle (EV) manufacturing segment introduces a critical new area of demand, as ACGC is vital for providing lightweight, effective thermal shielding within battery casings to enhance safety and prevent catastrophic thermal events, cementing its role as a necessary component in sustainable mobility solutions.

Despite these robust drivers, the market faces significant structural and external restraints. Primary among these is the inherent volatility and cost fluctuation of key raw materials, including the high-pgrade aluminum foil required for optimum reflectivity and specialized E-glass or S-glass fibers which form the substrate. These materials are susceptible to sharp price shifts dictated by global commodity markets and energy costs, making stable long-term pricing and margin maintenance challenging for ACGC producers. Moreover, the process of manufacturing high-quality ACGC requires significant upfront investment in sophisticated lamination, weaving, and quality assurance equipment. This high capital expenditure creates a substantial barrier to entry for new competitors, often leading to market consolidation and limiting the proliferation of niche suppliers, thereby potentially slowing competitive pricing and rapid diversification.

Opportunities for market growth are centered on innovation tailored for harsh and emerging application environments. The development of ACGC products with enhanced chemical and abrasion resistance opens doors to specialized applications in aggressive chemical processing plants and waste incineration facilities, where traditional materials rapidly degrade. Geographically, significant untapped potential exists in rapidly developing regions, particularly in Southeast Asia and parts of Africa, where industrial expansion is outpacing current local capacity for high-performance safety materials, creating a vacuum for imported specialized ACGC products that meet new international quality standards. The overarching impact force shaping the long-term market landscape is the shift toward sustainable and circular economy principles, forcing manufacturers to innovate in areas such as using recycled aluminum content, developing bio-based or recyclable high-temperature adhesives, and designing products for extended lifecycles, ensuring the material remains competitive against rapidly evolving alternative insulation technologies.

Segmentation Analysis

The Aluminium Coated Glass Cloth market segmentation reflects the diverse functional demands placed upon the material across various end-use industries, offering tailored solutions based primarily on physical characteristics, intended application, and the complexity of the manufacturing process. Segmentation by Fabric Thickness is fundamental, as it dictates mechanical strength and insulation capacity: lightweight fabrics (typically 6-10 oz/sq yard) prioritize flexibility and low mass for thermal wraps in tight spaces, such as automotive engine components and HVAC ducting. Medium-weight fabrics (10-20 oz/sq yard) strike a balance between durability and handling, dominating general industrial insulation, while heavyweight fabrics (above 20 oz/sq yard) are utilized for extreme-duty applications requiring maximum puncture and abrasion resistance, such as industrial furnace blankets and protective welding screens.

The Application segmentation is crucial for understanding demand concentration. Industrial Insulation represents the largest volume market, driven by mandatory energy management systems in energy-intensive sectors like petrochemicals and power generation, where ACGC is used to protect infrastructure components from radiant heat and reduce heat loss from high-temperature process piping. Meanwhile, the Fire Protection segment is the fastest growing, encompassing a range of products from certified architectural fire barriers to essential Personal Protective Equipment (PPE), stimulated by rapidly updating occupational safety regulations and building codes demanding non-combustible, high-integrity materials. A further growing segment is Transportation, covering sophisticated thermal barriers in aerospace for engine compartments and critical heat shielding within the rapidly expanding Electric Vehicle (EV) battery architecture.

The End-Use Industry segmentation illustrates where the product’s value is realized. The Construction & Building sector is a constant consumer, leveraging ACGC for improving passive thermal efficiency and fire compartmentation in commercial structures. The Oil & Gas and Petrochemical industry requires specialized, chemically resistant variants for insulation in challenging environments. Finally, the Aerospace & Defense sector represents the high-value, low-volume segment, demanding meticulously certified, ultra-lightweight materials that meet rigorous performance and traceability requirements, often driving innovation in lightweight composite manufacturing techniques and high-specification adhesive technologies.

- Fabric Thickness:

- Lightweight (Under 10 oz/sq yard)

- Medium Weight (10 – 20 oz/sq yard)

- Heavyweight (Above 20 oz/sq yard)

- Application:

- Industrial Insulation (Piping, Equipment, Furnaces)

- Fire Protection (Curtains, Blankets, Smoke Barriers)

- HVAC Ducting & Insulation (Reflective Barriers)

- Automotive Thermal Barriers (Engine and Exhaust Systems)

- Aerospace Composites & Heat Shields (Engine and Fuselage)

- Protective Apparel (Welding Screens, Jackets)

- End-Use Industry:

- Construction & Building

- Automotive & Transportation

- Marine & Shipbuilding

- Oil & Gas and Petrochemicals

- Power Generation (Thermal, Nuclear, Renewable)

- Aerospace & Defense

- Metal Processing & Foundry

- Coating Type:

- Single-sided Aluminium Coating

- Double-sided Aluminium Coating

- Aluminium Foil/Film Lamination

- Fiber Type:

- E-Glass

- S-Glass

- Other Specialty Fibers (e.g., Basalt)

Value Chain Analysis For Aluminium Coated Glass Cloth Market

The value chain for Aluminium Coated Glass Cloth initiates at the upstream level, focused on the highly specialized procurement and processing of core raw materials. This stage involves sophisticated fiberglass yarn production, primarily utilizing E-glass for standard applications and S-glass for high-strength requirements, where optimizing filament diameter and sizing chemistry is critical to the final product's performance. Concurrently, aluminum suppliers provide thin-gauge foil, often requiring specific surface treatments to maximize reflectivity and ensure optimal adhesion. The procurement of specialized adhesive systems, typically high-temperature silicone, acrylic, or specialized resin formulations, constitutes a highly technical upstream segment. Efficient management of these commodity inputs, including strategic bulk purchasing and hedging against volatile metal prices, is essential for maintaining competitive manufacturing costs and stable margins within the midstream sector.

The midstream phase represents the core manufacturing and value addition process, beginning with weaving the fiberglass yarn into fabrics of defined weight, thickness, and weave pattern (e.g., plain, satin, twill). The most critical step is the lamination process, where advanced coating machinery applies the adhesive and bonds the aluminum foil to the woven substrate under precise control of heat and pressure. Key technological investments here include high-precision coating heads (such as kiss or slot dies) and continuous monitoring systems to ensure uniform coating weight and defect-free bonding, as any inconsistency can lead to thermal degradation or premature delamination. Process optimization efforts in this stage focus on maximizing lamination speed while minimizing adhesive curing time and energy consumption, defining the overall efficiency and quality output of the ACGC manufacturer.

Downstream activities involve the conversion, distribution, and final installation of the ACGC products. Conversion activities often include custom slitting, die-cutting, sewing, and fabrication of the cloth into finished goods such as removable insulation jackets, fire curtains, or specific protective shields tailored to OEM specifications. Distribution channels are bifurcated: high-volume standard products are often moved through large industrial distributors and supply houses, which provide logistical support and localized inventory management. Conversely, customized, high-specification products (e.g., aerospace components) are typically managed via direct sales channels, involving direct contracts with specialized contractors or large Original Equipment Manufacturers (OEMs). Effective downstream service involves providing technical support, certification documentation, and ensuring compliance with varied international safety standards, bridging the manufacturer's capabilities with the end-user's rigorous application requirements.

Aluminium Coated Glass Cloth Market Potential Customers

The clientele base for the Aluminium Coated Glass Cloth market is heavily concentrated in industries that prioritize non-negotiable standards for safety, operational efficiency, and thermal management, demanding certified materials that offer durability and high performance. The largest group includes major Engineering, Procurement, and Construction (EPC) firms, insulation contractors, and commercial builders engaged in large-scale infrastructure projects. These customers utilize vast quantities of ACGC for insulation wraps around HVAC systems, as reflective barriers in building envelopes, and for mandated fire separation in large commercial and industrial complexes, focusing heavily on materials that meet regional fire safety codes (such as those governing flame spread and smoke toxicity) and contribute positively to overall building energy performance ratings.

A second critical customer segment comprises industrial Original Equipment Manufacturers (OEMs) and maintenance/repair/operations (MRO) divisions within energy-intensive sectors, most notably Oil & Gas, Petrochemicals, and Power Generation facilities. For these end-users, ACGC is essential for insulating complex, high-temperature piping networks, reactors, and turbines, mitigating heat loss crucial for process efficiency, and crucially, protecting plant personnel from contact burns and mitigating potential fire risks. Purchasing decisions in this segment are characterized by requirements for extreme chemical resistance, resistance to prolonged vibration, and documentation proving performance over extended operational lifecycles, often requiring specialized, heavy-duty variants of ACGC tailored for continuous service at maximum rated temperatures.

The fastest-evolving customer pool is found within the high-technology transportation sectors, including aerospace, defense contractors, and specialized electric vehicle (EV) manufacturers. These customers require bespoke, ultra-lightweight ACGC solutions that minimize mass while maximizing thermal protection. In aerospace, materials must meet stringent airworthiness certifications for fire protection within engine bays and composite structures. For the rapidly expanding EV sector, customers necessitate high-integrity ACGC layers used as thermal blankets and barriers within complex battery module assemblies to contain potential thermal runaway events, thereby protecting occupants and prolonging battery life. These segments demand traceability, superior quality control, and materials engineered to precise, unique specifications, driving innovation toward thinner and more flexible fabric configurations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.35 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mid-Mountain Materials Inc., Auburn Manufacturing Inc., Technical Absorbents Ltd., Hi-Temp Material Solutions, Saint-Gobain S.A., 3M Company, Unifrax Corporation, ADL Insulflex Inc., Elmelin Ltd., Superior Industrial Products Inc., Lydall Inc. (now part of Unifrax), The Zottola Group Inc., Skaps Industries, Thermiculite Ltd., Newtex Industries Inc., Darco Southern Inc., AVS Industries, China Beihai Fiberglass Co. Ltd., Jiangsu C&J Fireproof Materials Co. Ltd., Haining Jiatong Composite Material Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminium Coated Glass Cloth Market Key Technology Landscape

The technological evolution within the Aluminium Coated Glass Cloth market centers on optimizing the critical interface between the glass fiber and the aluminum coating to enhance thermal stability and mechanical durability. A key area of innovation is in the field of adhesive technology. Modern production relies heavily on sophisticated, non-halogenated, high-solids silicone and modified acrylic adhesives that offer superior thermal stability, maintaining the structural bond integrity up to continuous service temperatures exceeding 500°C. These advanced adhesive systems also incorporate additives to enhance UV resistance and flexibility, crucial for ACGC used in outdoor applications or areas subject to continuous vibration, ensuring the reflective aluminum layer remains securely bonded throughout the expected product lifespan and preventing performance degradation.

Manufacturing process technology has advanced significantly through the implementation of highly automated precision lamination lines. These systems utilize sophisticated gravure, knife-over-roll, or hot-melt coating techniques coupled with closed-loop process control to ensure a microscopically uniform application of the adhesive and precise alignment of the aluminum foil. This precision is essential to eliminate air entrapment and prevent localized thermal bridging, which can severely compromise the material's thermal barrier properties. Furthermore, pre-treatment of the woven fiberglass fabric using advanced chemical sizing (or coupling agents) is standard practice. This treatment enhances the chemical affinity between the inorganic glass surface and the organic adhesive matrix, dramatically improving peel strength and reducing the probability of catastrophic delamination under high-stress thermal cycling.

Emerging technology trends are focused on material performance enhancement and sustainability. Research into incorporating specialized fillers or utilizing nanoparticulate reinforcement within the coating matrix is underway to improve surface hardness and abrasion resistance without sacrificing flexibility. For high-end aerospace and defense applications, manufacturers are exploring the use of higher-performance basalt or S-glass fibers in conjunction with ceramic-loaded aluminum coatings to achieve even greater temperature resilience and reduced weight, targeting applications exceeding the thermal limits of standard E-glass based products. Sustainability efforts involve transitioning to lower Volatile Organic Compound (VOC) adhesive systems and developing ACGC products where the aluminum foil can be more easily separated from the fiberglass substrate at end-of-life, supporting greater recyclability and aligning the market with evolving environmental, social, and governance (ESG) criteria.

Regional Highlights

The Asia Pacific (APAC) region stands out as the predominant market driver for Aluminium Coated Glass Cloth, reflecting its unparalleled scale of industrial expansion and infrastructural investment. Nations like China and India are rapidly increasing their manufacturing capacity in sectors such as automotive, heavy industry, and consumer electronics, all of which require reliable, certified thermal and fire protection materials. Furthermore, governmental initiatives across the region mandating higher energy efficiency in new commercial and public building constructions directly translate into high demand for ACGC for HVAC ducting and reflective insulation barriers. The APAC market is highly price-sensitive but increasingly values compliance with international standards, pushing local manufacturers to upgrade technology and certification status to meet both internal development needs and export opportunities.

North America and Europe constitute highly mature, technology-intensive markets characterized by stringent regulatory environments and a strong preference for certified, high-performance materials. North America's demand is heavily influenced by the sophisticated aerospace, defense, and oil & gas sectors, which require ACGC products adhering to the most rigorous standards, often demanding customized, lightweight solutions with full traceability and specific military or UL certifications. In Europe, market growth is sustained by continuous compliance with the Energy Performance of Buildings Directive (EPBD) and REACH regulations, driving substantial demand for ACGC in retrofitting old infrastructure and modernizing industrial plants to achieve mandated carbon reduction targets. European companies prioritize material sustainability, longevity, and adherence to complex CE marking requirements.

The Middle East and Africa (MEA) region is emerging as a critical growth vector, primarily due to large-scale, state-sponsored infrastructure projects, particularly in Saudi Arabia and the UAE, alongside massive investments in expanding petrochemical and energy processing facilities. The extremely high ambient temperatures in the GCC countries make ACGC's superior radiant heat reflection capability indispensable for building envelope protection and reducing cooling loads in industrial complexes. Demand in the MEA is focused on durable, heavyweight fabrics capable of withstanding harsh desert environments and requiring specific certifications relevant to oil and gas operations. Latin America presents a fragmented but growing market, with demand tied mainly to domestic manufacturing recovery, automotive assembly plants, and necessary maintenance and safety upgrades in aging industrial facilities across countries such as Brazil and Mexico, favoring cost-effective yet certified thermal management solutions.

- Asia Pacific (APAC): Market volume leader and fastest growth region, driven by urbanization, infrastructure build-out, and heavy industrial output, particularly in China's rapidly expanding EV battery manufacturing ecosystem.

- North America: High-value market focused on highly customized, certified materials for aerospace, defense, and petrochemical sectors; characterized by stringent safety and performance standards (NFPA, UL).

- Europe: Stable growth fueled by strict energy efficiency mandates, comprehensive industrial modernization, and a strong regulatory push towards non-combustible building materials and low-VOC adhesive systems.

- Middle East & Africa (MEA): Rapid demand acceleration linked to significant investment in large-scale energy infrastructure and construction, emphasizing materials required for extreme ambient heat management and fire safety in oil & gas operations.

- Latin America (LATAM): Developing market offering growth potential through essential infrastructure upgrades and increasing localization of automotive and heavy machinery manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminium Coated Glass Cloth Market.- Mid-Mountain Materials Inc.

- Auburn Manufacturing Inc.

- Saint-Gobain S.A.

- 3M Company

- Unifrax Corporation

- ADL Insulflex Inc.

- Elmelin Ltd.

- Superior Industrial Products Inc.

- Newtex Industries Inc.

- The Zottola Group Inc.

- Technical Absorbents Ltd.

- Hi-Temp Material Solutions

- Lydall Inc. (now part of Unifrax)

- Skaps Industries

- Thermiculite Ltd.

- Darco Southern Inc.

- AVS Industries

- China Beihai Fiberglass Co. Ltd.

- Jiangsu C&J Fireproof Materials Co. Ltd.

- Haining Jiatong Composite Material Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Aluminium Coated Glass Cloth market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Aluminium Coated Glass Cloth over standard insulation?

ACGC provides superior radiant heat reflectivity, capable of reflecting up to 95% of heat, while also offering high tensile strength and non-combustibility due to the glass fiber base, making it ideal for high-temperature thermal barriers and fire protection where standard materials would fail. Its durability under mechanical stress is also a key differentiator.

Which key industries drive the current market demand for heavyweight ACGC materials?

Heavyweight ACGC (above 20 oz/sq yard) demand is predominantly driven by heavy industries such as Oil & Gas, Power Generation (boiler and turbine insulation), and Metals Processing, where maximum mechanical durability, high abrasion resistance, and protection against intense, continuous heat exposure are essential for operational safety.

How is the adoption of Electric Vehicles (EVs) influencing the ACGC market?

The rapid growth of the EV sector necessitates specialized, lightweight ACGC materials for battery pack thermal management and enclosure fire barriers. ACGC helps prevent the inter-cell propagation of thermal runaway within high-density battery packs, addressing critical safety and vehicle range concerns.

What role does the coating adhesive play in the longevity of Aluminium Coated Glass Cloth?

The adhesive is crucial as it maintains the permanent bond between the highly reflective aluminum foil and the glass cloth under extreme thermal cycling and mechanical stress. Advanced silicone or high-temperature resin adhesives prevent delamination, ensuring the thermal performance remains intact throughout the product's extended service life.

Which geographical region is expected to show the fastest growth rate for ACGC adoption?

The Asia Pacific (APAC) region, driven by extensive industrialization, unprecedented infrastructure development, and increasingly stringent local and imported fire safety regulations across key economies, is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) for the ACGC market through 2033.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager