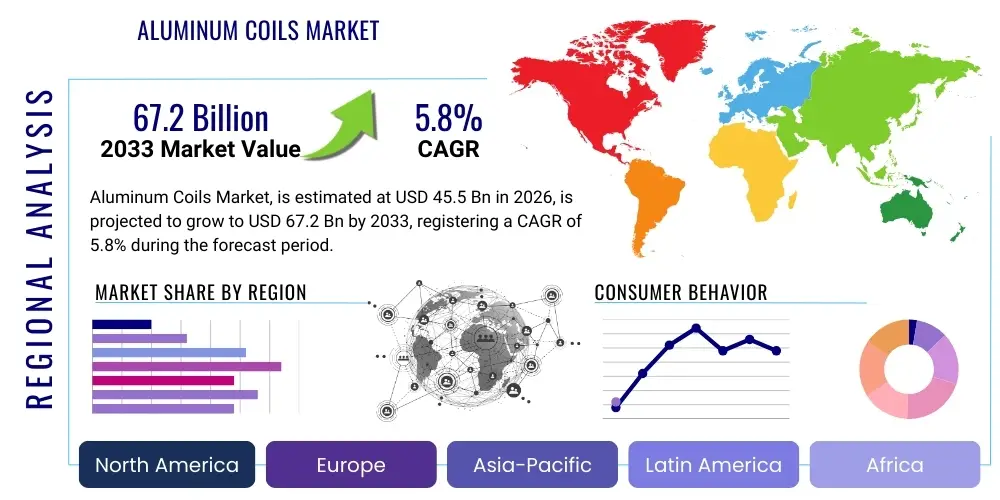

Aluminum Coils Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441846 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Aluminum Coils Market Size

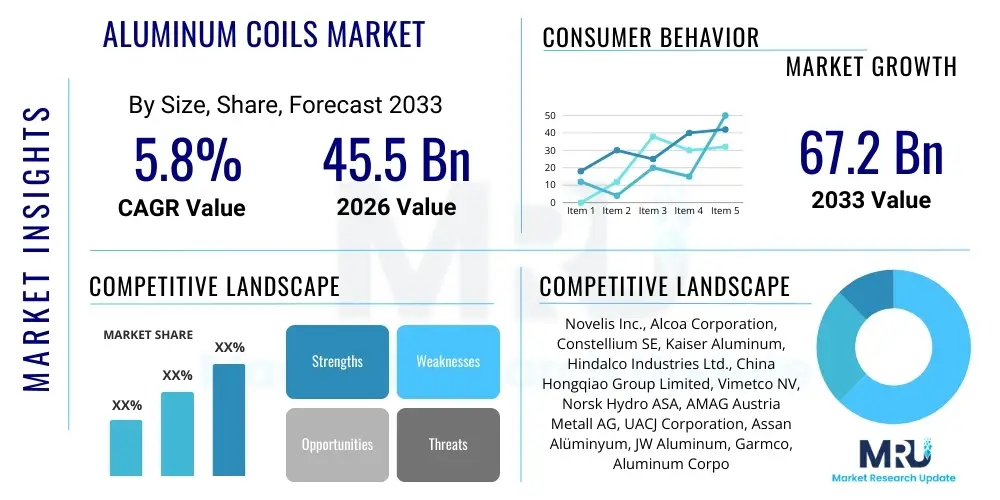

The Aluminum Coils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 30.5 Billion in 2026 and is projected to reach USD 44.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand from critical end-use sectors, particularly construction and automotive manufacturing, which increasingly favor lightweight, corrosion-resistant, and recyclable materials. The global shift toward sustainable infrastructure and fuel-efficient vehicles positions aluminum coils as an indispensable raw material, ensuring consistent market buoyancy over the next decade.

The market valuation reflects robust investment in advanced rolling and coating technologies, enabling manufacturers to produce coils with enhanced specifications tailored for specific high-performance applications. Geographical expansion, notably across fast-growing economies in the Asia Pacific region, further contributes to the overall market scale. These economies are undergoing rapid urbanization and industrialization, creating persistent high volume requirements for roofing, cladding, and packaging materials derived from aluminum coils. Market maturity in developed regions, combined with high growth potential in emerging regions, establishes a complex but highly lucrative landscape for aluminum coil producers and processors.

Aluminum Coils Market introduction

The Aluminum Coils Market encompasses the production, processing, and trade of flat-rolled aluminum products, delivered in coiled form for subsequent downstream manufacturing processes. These coils are typically manufactured via continuous casting or hot rolling followed by cold rolling processes, resulting in thin sheets of specific alloys, gauges, and surface finishes. Aluminum coils are highly valued for their exceptional properties, including low density, high strength-to-weight ratio, excellent corrosion resistance, superior thermal and electrical conductivity, and 100% recyclability, making them a cornerstone material across numerous industrial applications globally.

Major applications of aluminum coils span diverse industries, most notably in building and construction for architectural purposes, roofing, and siding; in the transportation sector for automotive body panels, aerospace components, and heat exchangers; and within the packaging industry for beverage cans, food containers, and pharmaceutical foils. The intrinsic benefits of aluminum coils—such as reducing vehicle weight to improve fuel efficiency and prolonging the lifespan of construction materials—are primary driving factors propelling market growth. Furthermore, the increasing global emphasis on sustainable material usage and circular economy principles significantly boosts the attractiveness and market penetration of aluminum coils compared to traditional materials like steel or specialized plastics.

Key market drivers include stringent environmental regulations promoting lightweighting in the automotive industry, massive infrastructure development initiatives globally, and continuous innovation in surface treatments, such as advanced coatings and anodization, which expand the aesthetic and functional utility of the coiled product. These factors collectively solidify the market's trajectory, ensuring steady demand across established and nascent industrial segments seeking high-performance, cost-effective, and environmentally sound material solutions for their manufacturing requirements.

Aluminum Coils Market Executive Summary

The Aluminum Coils Market demonstrates resilient business trends characterized by intense focus on capacity expansion, integration of advanced rolling technologies, and strategic mergers and acquisitions aimed at supply chain stabilization and raw material security. Business growth is currently concentrated on producing specialized products, particularly pre-painted and high-strength aluminum alloys, addressing the stringent performance requirements of the automotive and construction sectors. Manufacturers are investing heavily in digitally integrated mills to optimize production efficiency, minimize waste, and ensure the consistent quality required for high-speed manufacturing processes downstream. The increasing volatility in raw aluminum prices necessitates sophisticated risk management strategies and long-term supply contracts to maintain competitive pricing and profitability.

Regional trends indicate that the Asia Pacific (APAC) region remains the undisputed growth engine, propelled by China, India, and Southeast Asian nations undergoing explosive urbanization and infrastructure buildup. North America and Europe, while exhibiting slower volume growth, maintain high value market dominance, focusing on premium, custom-fabricated coils for specialized automotive (electric vehicle components) and high-end architectural projects. These developed markets are also pioneering circular economy practices, leading to higher utilization rates of recycled aluminum scrap, which influences the market dynamics concerning primary aluminum production volumes and sustainability metrics.

Segmentation trends highlight the dominance of Mill Finish Aluminum Coils by volume, yet Coated Aluminum Coils command superior value due to their extensive use in construction and consumer durables requiring specific aesthetic and protective qualities. The Construction application segment holds the largest market share, driven by demand for resilient roofing, siding, and window frames. However, the Automotive segment is experiencing the fastest growth rate, fueled by the global electrification movement and the mandatory shift towards lightweighting to extend battery range and meet rigorous emissions standards. This strategic shift is forcing coil manufacturers to develop ultra-high-strength aluminum alloys suitable for structural applications.

AI Impact Analysis on Aluminum Coils Market

User queries regarding AI's impact on the Aluminum Coils Market predominantly revolve around production optimization, predictive maintenance, quality control enhancement, and supply chain resilience. Users are deeply interested in how AI algorithms can minimize material waste during the rolling process (a significant cost factor), predict equipment failures in high-capital rolling mills, and optimize scheduling to improve overall energy efficiency. Key concerns also include the integration challenges of AI systems with legacy manufacturing infrastructure and the reliability of machine learning models in predicting complex variables like alloy microstructure performance and market demand fluctuations. Essentially, the market seeks concrete evidence of return on investment (ROI) derived from AI implementation in highly standardized, capital-intensive manufacturing environments like aluminum rolling.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and competitive landscape of the aluminum coil manufacturing industry. AI-driven predictive maintenance significantly reduces unplanned downtime of high-speed rolling mills and annealing furnaces, which are critical assets whose failure can halt production and incur massive costs. Furthermore, sophisticated ML models are being deployed for real-time quality assurance, analyzing surface finish, gauge thickness, and material composition data captured by inline sensors. This allows for immediate adjustments to process parameters, minimizing the volume of off-spec material that previously required human inspection and subsequent re-processing or scrapping, thereby achieving unprecedented levels of material yield and product quality consistency.

Beyond the factory floor, AI is transforming the strategic aspects of the aluminum coil market by enhancing supply chain management and demand forecasting. AI systems integrate data from raw material suppliers, energy markets, geopolitical events, and end-user consumption patterns to generate highly accurate demand forecasts, enabling manufacturers to optimize inventory levels and hedging strategies for volatile aluminum commodity prices. This capability reduces procurement costs and ensures material availability for Just-in-Time (JIT) manufacturing requirements of major buyers, such as large automotive original equipment manufacturers (OEMs) and major construction material suppliers. The resulting efficiency gains translate directly into competitive advantages and improved margins across the value chain.

- Real-time surface defect detection and classification using computer vision systems.

- Predictive maintenance scheduling for rolling mills and furnaces, minimizing operational downtime.

- Optimization of energy consumption during the hot and cold rolling processes via ML-driven parameter control.

- Enhanced alloy recipe optimization and microstructure control through data-driven material science modeling.

- Automated inventory management and dynamic pricing strategies based on predictive market analytics.

- Improved supply chain visibility and risk assessment regarding raw material sourcing and logistics.

DRO & Impact Forces Of Aluminum Coils Market

The Aluminum Coils Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively determine its growth trajectory and competitive intensity. The primary Drivers revolve around the global momentum toward lightweighting in transportation and the increasing use of pre-painted aluminum in sustainable construction projects. Restraints primarily center on the high capital expenditure required for establishing or modernizing rolling facilities, coupled with the inherent volatility and price sensitivity of the primary aluminum commodity market. Opportunities are significant, driven by the emergence of new high-growth applications, such as specialized coils for electric vehicle battery enclosures and increased demand for sustainable packaging solutions, all underpinned by advancements in processing technology and green energy integration.

Key drivers include the automotive industry's continuous need to reduce vehicle mass to meet stringent fuel economy and emissions standards, a trend accelerated by the proliferation of Electric Vehicles (EVs) where lightweight materials are crucial for maximizing battery range. Furthermore, favorable governmental policies promoting green building codes and sustainable infrastructure investments globally mandate the use of durable, recyclable materials like aluminum coils for long-term construction projects. The versatility and customization potential of aluminum coils—allowing for varying thicknesses, strengths, and coating options—ensure their continued preference over alternative materials in high-spec engineering applications, reinforcing demand across multiple sectors simultaneously.

Conversely, the market faces significant restraints, including intense price competition, particularly from large, integrated producers in Asia, leading to pressure on profit margins for smaller manufacturers. The rolling process is energy-intensive, and fluctuations in global energy prices directly impact operating costs, adding a layer of economic risk. Moreover, the environmental scrutiny surrounding primary aluminum production (due to high greenhouse gas emissions) necessitates continuous investment in renewable energy sources and recycling infrastructure, imposing regulatory and financial burdens. Opportunities for market expansion lie in developing advanced alloys (e.g., 7xxx series) specifically designed for structural automotive components, capitalizing on the shift towards sustainable and recyclable packaging, and penetrating emerging markets in Africa and Latin America that are beginning large-scale infrastructure projects requiring durable cladding and roofing materials.

Segmentation Analysis

The Aluminum Coils Market is highly fragmented and analyzed based on key segmentations including Product Type, Application, End-Use Industry, and Thickness. Understanding these segments is crucial for strategic market planning, as each exhibits distinct growth drivers, regulatory landscapes, and pricing dynamics. The differentiation across these segments allows manufacturers to specialize and cater to specific high-value niches, such as high-purity coils for electronics or heavily coated coils for severe exterior environments in construction. The interplay between thickness and alloy type determines the suitability for specific end applications, ranging from ultra-thin foil stock to thick plate coils used in heavy machinery and shipbuilding.

The segmentation by Product Type, notably between Mill Finish and Coated coils, reflects the two dominant supply pathways. Mill Finish coils represent the fundamental product, used where surface appearance is secondary or where further fabrication (like anodizing or post-painting) is performed by the end-user. Coated coils, including pre-painted and laminated products, offer immediate value-added functionality, providing resistance against weather, corrosion, and wear, significantly reducing processing steps for downstream manufacturers, particularly in roofing and siding applications. Meanwhile, segmentation by Application highlights the crucial role of construction as the largest volume consumer, juxtaposed with transportation as the fastest growing value segment due to the premium associated with complex, high-strength auto body alloys.

Furthermore, the segmentation analysis reveals regional disparities in material preferences and regulatory requirements. For example, North American construction favors thicker gauge, heavily coated coils for extreme weather resilience, while Asian markets prioritize cost-efficiency and high-volume packaging applications using thinner gauge materials. This heterogeneity means successful market players must maintain diverse production capabilities and specialized distribution networks to effectively serve the varied demands across global segments, ensuring optimization of both capacity utilization and product mix based on prevailing regional economic and industrial growth indicators.

- By Product Type:

- Coated Aluminum Coils (Pre-painted, Anodized, Laminated)

- Mill Finish Aluminum Coils (Bare Aluminum)

- By Application:

- Construction (Roofing, Siding, Architectural Panels, Gutters)

- Automotive & Transportation (Body Panels, Heat Exchangers, Truck Trailers)

- Packaging (Beverage Cans, Food Containers, Foil Stock)

- HVAC & Machinery (Ductwork, Heat Sinks)

- Electrical & Electronics

- By End-Use Industry:

- Building & Construction

- Transportation

- Packaging

- Consumer Durables

- Electrical & Electronics

- By Thickness:

- Thin Gauge Coils (Under 0.2 mm)

- Medium Gauge Coils (0.2 mm to 1.5 mm)

- Thick Gauge Coils (Over 1.5 mm)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Aluminum Coils Market

The value chain of the Aluminum Coils Market begins with upstream activities centered on the procurement and processing of raw materials, primarily bauxite mining, alumina refining, and primary aluminum smelting. Energy intensity is exceptionally high at the smelting stage, making electricity cost a critical determinant of upstream competitiveness. Suppliers of primary aluminum ingots or slabs then feed these materials into the coil manufacturing stage, which involves hot rolling, cold rolling, annealing, and finishing processes. Efficiency in this midstream segment hinges on capital investment in advanced rolling mills and capacity utilization rates. Technological advancements, especially continuous casting, have streamlined slab production, reducing energy consumption and improving material yield before the rolling phase.

The midstream manufacturing processes convert the aluminum slabs into high-specification coils. This stage includes critical value-adding activities such as surface treatment (cleaning, degreasing), alloy composition customization, and specialized coating or painting processes to meet demanding customer specifications, particularly for pre-painted aluminum coils used in architectural applications. Quality control is paramount here, utilizing sophisticated gauging equipment and non-destructive testing to ensure product integrity. Downstream, the distribution network plays a vital role in connecting manufacturers to diverse end-users, requiring specialized logistics for handling heavy, delicate coils and managing inventory across different regional markets.

Distribution channels for aluminum coils are categorized into direct and indirect routes. Direct sales are common for high-volume, long-term contracts with major end-users, such as large automotive OEMs or major beverage can manufacturers, offering customized specifications and direct technical support. Indirect channels utilize metal service centers and distributors who purchase bulk coils, slit them into smaller sizes, and provide local warehousing, financing, and just-in-time delivery services to smaller fabricators and diverse end-users across construction and minor manufacturing sectors. The effectiveness of the indirect channel is crucial for market penetration and addressing the fragmented demand profile characteristic of the building and construction segment. This segmented approach ensures efficient market coverage, balancing the need for large-scale production efficiency with localized service delivery requirements.

Aluminum Coils Market Potential Customers

The potential customers and primary end-users of aluminum coils are widely distributed across several major industrial sectors, reflecting the versatility of the material. The largest consumption base lies within the Building & Construction industry, encompassing large commercial construction firms, residential developers, and specialized roofing and siding contractors who require durable, weather-resistant materials for exterior cladding, insulation, and architectural aesthetics. These customers are highly sensitive to longevity, maintenance costs, and energy efficiency, driving demand for high-quality, pre-painted aluminum coils with superior coating warranties and structural integrity suitable for various climatic conditions.

Another critical set of buyers resides in the Transportation sector, which includes major Automotive Original Equipment Manufacturers (OEMs), Tier 1 suppliers specializing in components like heat exchangers and chassis parts, and aerospace manufacturers. These customers prioritize lightweighting and high-strength alloys (such as 5xxx and 6xxx series) to enhance vehicle performance, improve fuel economy, or increase the range of electric vehicles. Procurement decisions in this sector are driven by stringent material specifications, long-term contractual stability, and the capacity of the coil supplier to guarantee highly consistent material properties across large batches, often demanding significant technical collaboration during product development cycles.

Furthermore, the Packaging industry, particularly manufacturers of beverage cans (two-piece cans), food containers, and flexible foils, represents a consistently high-volume purchaser. These customers demand thin-gauge, highly formable, and food-grade compliant aluminum coil stock, prioritizing recyclability and consistent surface quality crucial for high-speed printing and forming operations. Other emerging customer segments include manufacturers of HVAC systems (ductwork and cooling fins), consumer durable goods (appliances), and power transmission components, all seeking aluminum's unique combination of conductivity, thermal performance, and corrosion resistance to enhance the efficiency and lifespan of their respective final products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 30.5 Billion |

| Market Forecast in 2033 | USD 44.9 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novelis (Hindalco), Constellium, Hydro, Alcoa, RUSAL, UACJ Corporation, Arconic, China Hongqiao Group, Kaiser Aluminum, Norsk Hydro ASA, Gulf Aluminium Rolling Mills (GARMCO), JW Aluminum, Lotte Aluminium, Jiangsu Changjiang Lishui Aluminum, Hulamin, Halyard, Kobelco Aluminum, Vimetco NV, Aleris (part of Novelis), Vedanta Resources. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Coils Market Key Technology Landscape

The technology landscape governing the Aluminum Coils Market is defined by continuous advancements focused on increasing efficiency, improving material properties, and reducing environmental impact. A primary focus is on Continuous Casting (CC) technology, which bypasses the traditional ingot casting and hot rolling stage for certain alloys, resulting in cost savings, reduced energy use, and improved microstructure control for thinner gauge products, predominantly used in packaging and foil stock. Parallel advancements are seen in specialized Cold Rolling Mills (CRM) that utilize sophisticated automatic gauge control (AGC) systems, ensuring precise thickness tolerance across the entire length of the coil, a critical requirement for high-speed downstream processing in the automotive and aerospace industries.

Surface treatment and coating technologies represent another high-innovation area. The development of advanced coil coating lines enables the application of high-performance polymer coatings (like PVDF and SMP) with superior durability, UV resistance, and scratch resistance, expanding the lifespan and aesthetic applications of pre-painted aluminum coils in harsh outdoor environments. Furthermore, anodization technologies are becoming more refined, offering enhanced corrosion resistance and unique color finishes without the use of paints. Research into chemical conversion coatings free of chrome, driven by environmental regulations, is also a significant technological trend aimed at improving the sustainability profile of the product.

The adoption of Industry 4.0 principles, including integrated sensor technology, industrial IoT, and data analytics, is transforming the operations of rolling mills. These technologies facilitate real-time monitoring of temperature, tension, speed, and thickness, allowing for immediate process adjustments and proactive maintenance strategies. Crucially, material science innovation is driving the creation of new high-strength 6xxx and 7xxx series aluminum alloys specifically tailored for complex structural integrity in modern automotive platforms, balancing the need for ductility, crash resistance, and weight reduction. These technological shifts require substantial R&D investment and are key differentiators among top market competitors, shaping future product offerings and manufacturing competitiveness.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum

The Asia Pacific region commands the largest market share and is projected to exhibit the highest CAGR during the forecast period. This dominance is fundamentally fueled by explosive growth in two major areas: infrastructure investment and burgeoning demand for consumer goods. Countries like China, India, and Vietnam are undergoing rapid urbanization, necessitating massive volumes of aluminum coils for commercial buildings, residential housing, and transportation networks (railways and automotive production). Government policies supporting domestic manufacturing and robust construction activity create a fertile ground for high volume consumption of both coated and mill finish aluminum coils, particularly in roofing, exterior cladding, and HVAC applications. Furthermore, APAC serves as a global hub for packaging production, driving sustained demand for thin-gauge coil stock for food and beverage cans.

The region is also characterized by intense competition and the presence of several integrated large-scale producers capable of achieving economies of scale. While environmental regulations are tightening, particularly concerning primary smelting emissions, the demand for aluminum coils continues to outpace regulatory restrictions, necessitating investment in modern, high-efficiency rolling mills to meet domestic and export demands. The shift toward Electric Vehicles (EVs) in China, supported by strong governmental backing, is rapidly increasing the need for specialized aluminum alloys for battery casing and structural lightweighting components, diversifying the region’s coil consumption beyond traditional construction uses and solidifying its position as the market's primary growth driver.

- North America: Focus on Premium and Automotive Lightweighting

The North American market, comprising the United States and Canada, is characterized by a strong focus on high-value, high-specification aluminum coils, driven primarily by the automotive and aerospace sectors. The stringent Corporate Average Fuel Economy (CAFE) standards and the rapid transition towards EV production compel automotive manufacturers to incorporate aluminum coils extensively for body structures, closures, and heat management systems. This market segment demands stringent quality control and certified high-strength alloys, often requiring specialized tooling and finishing capabilities from coil producers. The construction sector here also remains a significant consumer, favoring durable, heavily coated coils resistant to extreme temperature fluctuations.

Market growth in North America is supported by significant recycling capacity, with a strong emphasis on using secondary (recycled) aluminum, reducing the market's reliance on higher-emission primary sources. Regulatory environments increasingly favor sustainable sourcing and manufacturing practices. The recent influx of infrastructural spending initiatives, particularly in renovation and resilience projects, is expected to provide a steady, reliable demand source for architectural aluminum products throughout the forecast period. Service centers play a crucial role in the distribution network, managing inventory and providing customized processing services to a diverse but quality-conscious customer base.

- Europe: Sustainability, Circular Economy, and Regulatory Push

The European Aluminum Coils Market is heavily influenced by strict sustainability mandates, robust environmental regulations, and a pioneering commitment to the circular economy. European consumption is driven by high standards in both the automotive and construction industries, where product durability, recyclability, and low carbon footprint are key procurement criteria. The adoption of pre-painted aluminum coils for energy-efficient facades and roofing systems is particularly strong across Western European countries, reflecting a mature market that values quality and long-term performance over initial material cost.

The European Union’s push toward carbon neutrality and mandatory recycling targets has spurred significant investment in innovative rolling technologies and recycling infrastructure to maximize the use of post-consumer aluminum scrap. This has led to a technological focus on developing high-quality alloys that maintain performance characteristics even with increased recycled content. While the region faces economic headwinds and high energy costs impacting production, the inherent stability and high-value nature of its end-use sectors, particularly specialized transportation (rail and aerospace) and complex architectural projects, maintain steady demand for premium aluminum coil products.

- Latin America and Middle East & Africa (LAMEA): Emerging Infrastructure Growth

The LAMEA regions represent markets with high potential driven by ongoing large-scale infrastructure and industrial development projects. In the Middle East, substantial investment in non-oil economic diversification, coupled with major construction undertakings (e.g., smart city developments), is generating strong demand for building envelope materials, including aluminum coils for cladding and aesthetic panels. Proximity to major regional smelters offers certain competitive advantages regarding raw material access.

Latin American market dynamics are often influenced by local economic stability, but major consumer markets like Brazil and Mexico are significant consumers, particularly in the packaging and transportation sectors. Across both regions, the growth is characterized by increasing foreign direct investment in manufacturing capabilities and a rising middle class driving demand for consumer durable goods and packaged foods, ultimately increasing the consumption of aluminum coils for both structural and packaging applications. However, challenges related to logistical complexity and fluctuating import tariffs remain key factors influencing market accessibility and pricing structures within the LAMEA segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Coils Market.- Novelis (Hindalco)

- Constellium

- Hydro

- Alcoa

- RUSAL

- UACJ Corporation

- Arconic

- China Hongqiao Group

- Kaiser Aluminum

- Norsk Hydro ASA

- Gulf Aluminium Rolling Mills (GARMCO)

- JW Aluminum

- Lotte Aluminium

- Jiangsu Changjiang Lishui Aluminum

- Hulamin

- Halyard

- Kobelco Aluminum

- Vimetco NV

- Aleris (part of Novelis)

- Vedanta Resources

Frequently Asked Questions

Analyze common user questions about the Aluminum Coils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Aluminum Coils Market?

The Aluminum Coils Market is projected to grow at a CAGR of 5.8% between 2026 and 2033, driven by sustained demand from the construction and automotive sectors globally.

Which application segment drives the highest demand for aluminum coils?

The Building and Construction application segment currently accounts for the largest volume consumption of aluminum coils, primarily utilized for roofing, siding, architectural panels, and general building envelope applications due to aluminum's durability and corrosion resistance.

How does the shift to Electric Vehicles (EVs) impact the aluminum coils market?

The EV shift significantly boosts the demand for high-strength aluminum coils for vehicle lightweighting, battery enclosures, and structural components. This is essential for maximizing battery range and optimizing energy efficiency, making the automotive segment the fastest growing consumer of specialized coils.

What are the primary restraints affecting market growth?

Key restraints include the volatile nature of primary aluminum commodity prices, high capital expenditure required for rolling mill operations, and intense competition from large-scale manufacturers in the Asia Pacific region, pressuring profit margins across the value chain.

Which geographical region dominates the Aluminum Coils Market?

The Asia Pacific (APAC) region dominates the Aluminum Coils Market both in terms of production capacity and consumption volume, driven by rapid urbanization, massive infrastructure development projects, and its position as a global manufacturing hub for packaging and transportation components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager