Anaerobic Digester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442152 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Anaerobic Digester Market Size

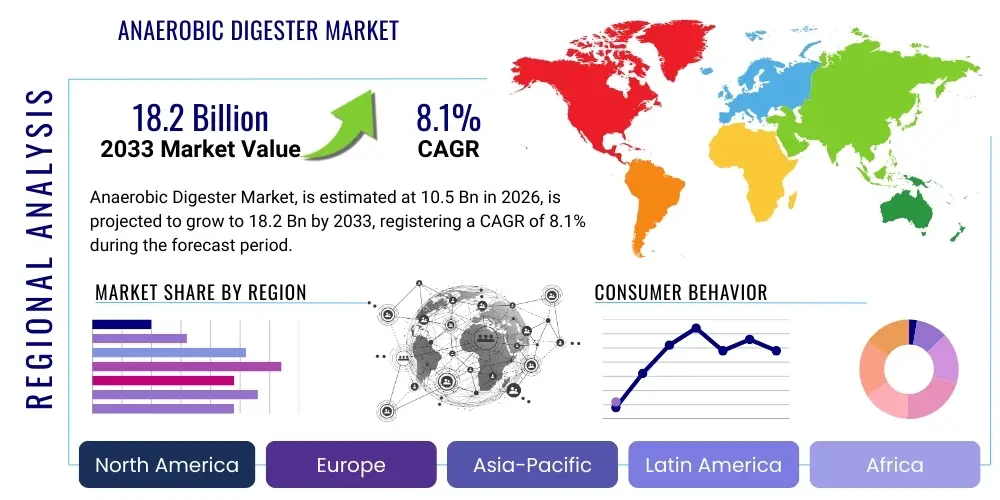

The Anaerobic Digester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by increasing global legislative pressure to divert organic waste from landfills, coupled with robust government incentives designed to accelerate the deployment of renewable natural gas (RNG) infrastructure. The valuation reflects the comprehensive capital investment across the entire anaerobic digestion lifecycle, including advanced reactor technology, sophisticated biogas upgrading units, and necessary infrastructure for digestate management and nutrient recovery systems. Project financing availability and technological maturity in handling diverse feedstocks are critical elements sustaining this upward market trajectory throughout the forecast period.

The projected financial growth is underpinned by two parallel trends: the expansion of municipal solid waste (MSW) processing capabilities and the rapid proliferation of large-scale agricultural digesters, particularly in North America, dedicated to RNG production. Investments are shifting toward integrated, high-rate digestion systems that offer greater operational stability and higher methane yields per unit of feedstock processed. Furthermore, the market size calculation accounts for the increasing deployment of ancillary services and components crucial for operational excellence, such as sulfur removal systems, water treatment units, and intelligent process control software. The inherent value proposition of anaerobic digestion—turning environmental liabilities into energy and fertilizer assets—positions the market favorably amidst volatile global energy prices and rising costs associated with traditional waste disposal methods, justifying the strong CAGR projected.

Geographically, market value accumulation is expected to be highest in regions implementing aggressive decarbonization strategies, such as Europe and North America, where established gas pipeline infrastructure facilitates the efficient monetization of biomethane. However, Asia Pacific, driven by population growth and ensuing urbanization challenges in waste management, represents the largest potential volume growth market, although often characterized by smaller, decentralized project sizes. The estimated total market size encapsulates the revenue generated from the sale of AD systems (CapEx), as well as long-term revenue derived from operations, maintenance contracts, and the value of the resulting energy and fertilizer byproducts (OpEx monetization), ensuring a holistic representation of the market's economic footprint by 2033.

Anaerobic Digester Market introduction

The Anaerobic Digestion (AD) market is integral to the global transition towards sustainable waste management and renewable energy generation, serving as a cornerstone of the circular economy paradigm. Anaerobic digesters are sophisticated bio-chemical reactors utilized to break down complex organic matter—sourced from agricultural waste (manure, crop residues), municipal streams (sewage sludge, food waste), and industrial effluents—in a controlled environment devoid of oxygen. This natural, time-tested biological process yields two primary high-value outputs: biogas, a flexible, dispatchable renewable energy source rich in methane, and digestate, a nutrient-rich, bio-secure byproduct extensively used as fertilizer or soil conditioner. The market introduction phase is critically defined by stringent global environmental regulations aimed at reducing greenhouse gas emissions, particularly fugitive methane from landfills, and the growing mandate to transition high-carbon waste streams into valuable low-carbon resources. The accelerating demand for energy resilience and decentralized power generation further bolsters the significant global adoption of AD technologies across diverse geographical and industrial settings.

The core product offering within this market spans a variety of technological configurations, tailored to specific feedstock characteristics and throughput volumes, ranging from small-scale agricultural dome digesters to immense centralized waste processing plants utilizing sophisticated reactor designs such as Continuous Stirred-Tank Reactors (CSTR), robust Plug-Flow Reactors, and high-rate Upflow Anaerobic Sludge Blanket (UASB) systems. Major applications include combined heat and power (CHP) generation for on-site energy independence, upgrading raw biogas to pipeline-quality biomethane (Renewable Natural Gas or RNG) for grid injection or use as sustainable vehicle fuel, and the production of advanced soil amendments through specialized digestate refinement. The economic viability of AD projects is increasingly attractive due to compelling supportive government policies, including lucrative feed-in tariffs (FITs), market-based mechanisms such as Renewable Energy Certificates (RECs) and carbon credit schemes, and tax incentives that incentivize private sector investment and technological innovation, particularly focusing on optimizing feedstock preprocessing, enhancing gas purity, and maximizing nutrient recovery from the digestate stream.

A significant, overarching driving factor propelling the AD market is the inherent dual benefit of environmental remediation combined with secure renewable resource creation, making it a powerful tool for carbon abatement. AD facilities offer crucial mitigation of landfill dependence, substantially reducing the environmental footprint of waste disposal and mitigating potent methane emissions. Concurrently, they provide a reliable, baseload source of energy that complements intermittent renewables like solar and wind power, positioning AD systems as crucial components in future decentralized, smart energy grids. The benefits extend substantially beyond energy production to encompass improved odor control associated with intensive livestock farming, effective destruction of pathogens in sewage sludge, and the stimulation of economic activity, job creation, and energy independence in rural communities. These integrated, systemic advantages underscore the critical role of the anaerobic digester market in achieving overarching sustainability goals, fostering circular economy principles globally, and enhancing overall resource security and efficiency within the complex modern infrastructure landscape.

Anaerobic Digester Market Executive Summary

The global Anaerobic Digester Market demonstrates accelerated growth, primarily driven by international protocols on methane reduction and significant regulatory action across North America and Europe mandating organic waste diversion. Business trends reveal a powerful industry movement toward sophisticated integration, digital operation, and strategic scaling. Operators are rapidly adopting advanced sensors and utilizing Artificial Intelligence (AI) and Machine Learning (ML) for rigorous process optimization, which allows for precision control over the sensitive biological parameters and significantly enhances biogas yield predictability and consistency. Additionally, advanced pretreatment technologies, such as Thermal Hydrolysis Process (THP), are becoming standardized to maximize feedstock biodegradability and reduce retention times, substantially boosting the overall return on investment (ROI). Corporate sustainability commitments are forcing major players in the food, beverage, and agricultural sectors to invest directly in or form long-term partnerships with AD facilities to manage waste and secure certified low-carbon energy sources. This consolidation trend, marked by frequent mergers and strategic acquisitions, signals a maturation of the sector where technology specialization is integrated into larger waste and utility management portfolios.

Regional trends delineate clear divergences in market maturity and focus. Europe, particularly led by countries such as Germany, Denmark, and the Netherlands, constitutes the most mature market, characterized by comprehensive national biomethane targets, an emphasis on sustainable agricultural practices, and highly efficient infrastructure for grid injection, supported by long-standing, robust subsidy programs. Conversely, North America, spearheaded by the United States, is experiencing the fastest and most capital-intensive growth phase, focused heavily on maximizing the production of Renewable Natural Gas (RNG) from large-scale agricultural operations (dairy farms) and landfills, primarily capitalizing on the lucrative incentives offered through the Renewable Fuel Standard (RFS) program. Asia Pacific represents the frontier of volume growth, driven by enormous governmental investments in China and India aimed at addressing severe urban organic waste crises and promoting energy generation from agricultural residues, often through decentralized, community-scale AD installations designed to simultaneously address sanitation and rural energy access challenges.

Segment trends highlight a pivotal shift in technological deployment and end-use priorities. While the Wet Digestion segment remains foundational, handling high-volume liquid streams like municipal sewage and liquid manure, the Dry Digestion segment is demonstrating accelerating adoption, owing to its efficiency in processing high-solids feedstocks such as source-separated municipal organics and commercial food waste, reflecting global regulatory movement toward banning wet waste disposal. Application-wise, the market emphasis is rapidly migrating from simple Combined Heat and Power (CHP) generation toward high-value Biogas Upgrading for Biomethane (RNG) production, driven by the substantial premium commanded by RNG in transportation fuel markets and pipeline injection tariffs. This strategic realignment reinforces the agricultural sector's transition from being solely waste disposers to becoming critical renewable energy infrastructure providers. Furthermore, the increasing integration of nutrient recovery systems within AD projects, transforming digestate into marketable fertilizer products, establishes a vital secondary revenue stream and enhances the environmental appeal and profitability across all primary market segments.

AI Impact Analysis on Anaerobic Digester Market

User analysis regarding the impact of Artificial Intelligence (AI) on the Anaerobic Digester Market predominantly reveals key concerns surrounding optimization, reliability, and data complexity. Users frequently inquire about the application of Machine Learning (ML) models to overcome the inherent biological volatility of the AD process, seeking reliable methods to predict and mitigate process upsets such as foaming, volatile fatty acid accumulation, and methane slippage. A primary expectation is that AI will allow operators to shift from time-consuming, reactive troubleshooting to fully proactive, preventative management, leading to maximized continuous uptime and consistent product quality—specifically high methane concentration. Users are highly interested in how AI can optimize the complex blending of heterogeneous feedstocks to maintain a stable organic loading rate, thereby minimizing chemical inputs and operational variance. Underlying concerns include the significant initial capital required for sophisticated sensor deployment, the development of robust, secure data lakes necessary to train ML models, and the specialized workforce training required to effectively leverage complex AI recommendations in traditional utility or agricultural settings.

The actual deployment of AI and advanced analytical tools is fundamentally revolutionizing the operational efficiency and financial performance metrics of anaerobic digester facilities across the globe. AI algorithms utilize extensive, high-frequency operational data—including influent composition, temperature, pH, alkalinity ratios, and trace gas analysis—to discern intricate, non-linear correlations between operational inputs and methane outputs that are impossible for human operators to track manually. This analytical capability enables the implementation of high-precision control mechanisms that automatically adjust critical parameters like nutrient dosage, mixing speed, heating profiles, and hydraulic retention time, ensuring the delicate microbial ecosystem operates near its theoretical maximum efficiency. Predictive modeling capabilities powered by AI allow operators to forecast potential operational deviations hours or even days before process indicators cross critical thresholds, enabling rapid, preemptive corrective actions that significantly enhance biogas yield consistency, reduce system stress, and drastically lower the risk of catastrophic biological failure, directly addressing the core historical vulnerability of AD technology.

Beyond core biological process optimization, AI is instrumental in streamlining resource logistics and ensuring proactive infrastructure maintenance. Advanced predictive maintenance systems leverage real-time vibration, temperature, and acoustic sensor data from essential mechanical assets—such as pumps, mixers, heat exchangers, and compressors—to accurately predict the probability and timing of equipment failure. This allows maintenance scheduling to be performed optimally during planned outages, minimizing disruptive, unscheduled downtime and substantially extending the useful life of capital-intensive equipment. Furthermore, in facilities managing multiple feedstock streams, ML models dynamically optimize blending ratios to maximize energy output while meeting constraints related to input volume and cost, ensuring the overall operational expense (OpEx) is minimized. This comprehensive, data-driven management system effectively transforms the conventional AD plant into a highly adaptable, self-optimizing biochemical manufacturing facility, dramatically enhancing overall competitiveness and significantly accelerating the payback period on major capital investments.

- Enhanced Biogas Yield Prediction: Utilizing Machine Learning models to forecast methane production rates based on the real-time analysis of influent quality and internal biological parameters.

- Automated Real-Time Process Control: Implementing sophisticated control loops that autonomously adjust dosing, mixing energy, and thermal inputs to instantaneously maintain biological equilibrium and stability.

- Predictive Maintenance Strategies: Analyzing sensor data streams to anticipate mechanical or electrical equipment failures, thereby minimizing unplanned operational shutdowns and reducing repair costs.

- Optimal Feedstock Blending: Employing algorithms to dynamically determine the most cost-effective and biologically stable combination of diverse organic inputs for consistent loading rates and maximum energy conversion.

- Nutrient Recovery Optimization: AI-guided systems optimizing the chemical processes involved in extracting and purifying high-value fertilizer byproducts from the digestate (e.g., struvite and ammonium salts).

- Advanced Anomaly Detection: Continuous monitoring of system variables to rapidly identify and isolate subtle deviations or impending upsets hours before they escalate into process failure.

- Energy Market Integration: Utilizing AI to optimize the timing of biogas upgrading, storage, or electricity generation based on fluctuating utility rates and carbon credit market values.

DRO & Impact Forces Of Anaerobic Digester Market

The Anaerobic Digester Market is driven by a powerful confluence of regulatory mandates, robust economic incentives, and overwhelming societal demand for sustainability solutions. Primary drivers include the global imperative to mitigate climate change through drastic methane emission reductions, directly targeting the high-emission profile of conventional organic waste landfills. Government action, particularly the implementation of circular economy packages and stringent organic waste diversion mandates in major economies, provides a non-negotiable pull for AD infrastructure. Additionally, financial incentives such as lucrative feed-in tariffs (FITs), high-value carbon credits (e.g., RFS and LCFS programs), and significant tax breaks dramatically improve the economic viability of complex AD projects, transforming them from merely waste treatment facilities into profitable renewable energy asset classes. The ongoing global search for energy security and independence further accelerates demand for decentralized, domestically sourced Renewable Natural Gas (RNG), positioning AD as a critically strategic element of national energy infrastructure planning, independent of international fuel market volatility.

Despite these powerful drivers, market expansion is significantly constrained by several inherent structural and financial barriers. The most critical restraint is the exceptionally high initial capital expenditure (CapEx) associated with constructing technologically advanced AD facilities, especially those incorporating sophisticated pretreatment systems (like THP) and high-efficiency biogas upgrading units, making project financing complex and often requiring specialized debt instruments. Furthermore, operational stability remains a technical hurdle, largely due to the chronic variability and inconsistency of feedstock quality (e.g., contamination levels, organic content fluctuations) and volume availability, which directly impacts the delicate biological balance and methane output. Logistical challenges related to securing long-term, diverse feedstock supply contracts and the increasing complexity of permits and public acceptance for siting new facilities also impose considerable friction on market growth. Lastly, the lack of universal, standardized regulatory clarity regarding the classification and marketing of digestate—is it a waste product or a certified commercial fertilizer?—creates significant logistical and market access challenges for monetizing the valuable byproduct.

The opportunities within the market are highly concentrated in technological innovation and strategic market penetration. The most substantial commercial opportunity lies in the burgeoning Renewable Natural Gas (RNG) segment, specifically for pipeline injection and utilization as ultra-low-carbon transportation fuel, which commands a high premium in regulated markets. This shift necessitates investment in advanced gas cleanup and compression infrastructure. A secondary, but increasingly critical opportunity resides in advanced nutrient recovery technologies; by treating digestate to extract purified phosphate and nitrogen compounds (e.g., struvite), operators can create high-value, marketable fertilizer products, transforming digestate management from a necessary cost into a reliable, scalable revenue stream. The overarching impact forces shaping this market are characterized by a powerful regulatory push (mandates for waste diversion and carbon reduction) combined with a compelling technological pull (enhanced process efficiency via AI, modular design, and high-rate reactors). These combined forces accelerate the displacement of traditional, carbon-intensive waste management and energy production methods, ensuring the long-term, sustained growth and indispensable role of anaerobic digestion in global sustainable infrastructure.

Segmentation Analysis

The Anaerobic Digester Market is meticulously analyzed through key segmentation criteria based on Type, Application, and End-use Sector, allowing for granular understanding of technology preference, revenue generation mechanisms, and sectoral adoption rates across various geographies. Segmentation by reactor Type distinguishes between Wet Digestion systems, optimized for processing high-moisture slurries and low-solids content feedstocks like municipal sewage sludge and liquid manure, and Dry Digestion systems, which are specifically engineered to handle high-solids content organic waste streams such as source-separated municipal food scraps, green waste, and agricultural residues. Application segmentation details the primary monetization pathway of the biogas output, including on-site Electricity Generation (often via Combined Heat and Power, CHP), lucrative Biomethane Generation (upgrading raw gas to RNG for grid injection or vehicle fuel), and Direct Heat Utilization for internal or proximate industrial processes. The critical segmentation by End-use Sector highlights the diverse customer base, categorized into Municipal (public utilities), Agricultural (livestock operations), and Industrial (food processing, pulp & paper), each with unique feedstock profiles, regulatory compliance needs, and economic drivers, necessitating bespoke technical solutions and strategic market approaches.

- By Type:

- Wet Digestion (Suitable for low-solids content, liquid-heavy feedstocks; dominant in municipal wastewater treatment.)

- Dry Digestion (Optimized for high-solids content, stackable feedstocks; growing rapidly in centralized MSW processing.)

- By Application:

- Electricity Generation (On-site CHP utilized primarily for cost offsetting and energy resilience.)

- Biogas Upgrading (Focus on Biomethane/RNG production for pipeline injection and vehicle fuel markets; highest revenue potential.)

- Direct Heat Utilization (Thermal energy used for internal process heating or sold to nearby industrial/residential consumers.)

- By End-use Sector:

- Municipal (The foundational sector, driven by sludge stabilization and organic MSW diversion mandates.)

- Agricultural (The fastest-growing segment, driven by manure management and high-value RNG production incentives.)

- Industrial (Utilizes AD for treating high-strength liquid effluents, focusing on energy cost reduction and compliance.)

- By Region:

- North America (Focus on RNG)

- Europe (Focus on Biomethane grid injection and circular economy)

- Asia Pacific (APAC) (Focus on decentralized solutions and waste management)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Anaerobic Digester Market

The Anaerobic Digester market’s value chain is a multi-layered ecosystem, commencing with robust upstream activities focused on securing high-quality feedstock supply and providing specialized technological components, extending through the capital-intensive midstream digestion process, and culminating in complex downstream activities related to energy and byproduct marketing. The upstream segment is fundamentally defined by the procurement of organic inputs—manure, municipal sludges, food waste, and industrial effluents—requiring long-term, reliable supply contracts and advanced logistical infrastructure for collection and transportation. Simultaneously, the upstream includes manufacturers of core equipment: large-scale steel or concrete reactor vessels, advanced mixing apparatus (mechanical and gas), heat exchangers, precise instrumentation (gas analyzers, temperature/pH sensors), and crucial preprocessing machinery like shredders, pasteurizers, and degritters. The technological sophistication of these suppliers directly determines the long-term efficiency and stability of the downstream digestion process, placing a high value on engineering excellence and durable component quality.

The midstream segment is dominated by the Engineering, Procurement, and Construction (EPC) phase, where specialized contractors design, build, and commission the AD facility, followed by the actual operations and maintenance (O&M) activities. This stage converts the raw organic material into the two marketable products: biogas and digestate. The efficiency of the midstream operation is highly dependent on process control technology, including SCADA systems and increasingly, AI-driven monitoring platforms that optimize biological performance. Distribution channels for the primary energy output—biogas/biomethane—are multifaceted. Direct distribution involves utilizing the gas on-site, typically through Combined Heat and Power (CHP) units, with the electricity and heat used internally to power the facility or sold directly to proximate commercial users. Indirect distribution, which is now the dominant high-value pathway, involves upgrading the raw biogas to high-purity Renewable Natural Gas (RNG), compressing it, and injecting it into existing national natural gas transmission and distribution networks, necessitating specialized interconnection infrastructure and regulatory clearances.

The downstream activities are critical for monetizing all facility outputs and maximizing total project returns. For the energy component, this involves selling power or heat under long-term power purchase agreements (PPAs) or, more lucratively, marketing RNG under complex contracts that monetize its commodity value along with associated high-value environmental credits (e.g., RINs, LCFS credits). The distribution and utilization of digestate form the secondary crucial downstream pathway. Direct marketing involves transporting the solid or liquid digestate to nearby farms for use as a sustainable, nutrient-rich soil amendment, substituting chemical fertilizers. Indirectly, specialized digestate processing firms further refine the material using technologies like ammonia stripping or struvite precipitation to produce highly concentrated, commercially packageable fertilizer products. This strategic downstream focus on resource recovery ensures the AD project adheres to circular economy principles, minimizes disposal costs, and secures multiple, diversified revenue streams necessary for attracting long-term institutional investment.

Anaerobic Digester Market Potential Customers

The spectrum of potential customers for Anaerobic Digester technology encompasses any entity that generates significant volumes of organic waste and simultaneously seeks cost-effective, sustainable solutions for waste management, energy generation, and carbon footprint reduction. The largest established customer base resides within the Municipal sector, specifically public utilities responsible for managing Wastewater Treatment Plants (WWTPs). These facilities are driven by stringent regulatory requirements for sludge stabilization and disposal. By adopting AD systems, they transform sewage sludge into a manageable byproduct while generating biogas to power their operations, often achieving energy neutrality and significant operational cost savings. Furthermore, municipal solid waste (MSW) departments represent a rapidly expanding customer group, utilizing centralized AD plants (especially dry fermentation) to comply with increasing mandates that ban organic materials from traditional landfills, seeking high-volume, continuous processing capabilities for food waste and yard waste.

The Agricultural sector constitutes the fastest-growing and most dynamic customer segment, characterized predominantly by large-scale Confined Animal Feeding Operations (CAFOs), particularly dairy and hog farms. These customers are driven not only by the need to manage massive volumes of manure and mitigate severe odor and nutrient runoff issues but fundamentally by the attractive financial incentives for producing Renewable Natural Gas (RNG). Regulatory frameworks like the U.S. Renewable Fuel Standard have made RNG production highly profitable, transforming livestock farms into major decentralized energy infrastructure hubs. These customers seek robust, scalable AD solutions—often utilizing covered lagoons or specialized plug-flow reactors—that offer maximum uptime and efficient integration with existing farm infrastructure, viewing AD as a long-term investment that provides environmental compliance, energy revenue, and enhanced nutrient management capabilities through digestate application.

The Industrial sector comprises a diverse, specialized customer base that generates high-strength organic effluents, including major players in the food and beverage industry (e.g., breweries, slaughterhouses, dairy producers), pharmaceutical manufacturing, and the pulp and paper industry. For these customers, the primary motivations are adherence to strict wastewater pretreatment standards before discharge into municipal systems, and the ability to significantly offset their high energy consumption. They typically require specialized, high-load-rate digesters, such as UASB or EGSB reactors, capable of rapid and efficient treatment of concentrated liquid waste streams. Industrial buyers prioritize process reliability, small physical footprint, and tailored engineering solutions that integrate seamlessly with existing production processes, recognizing AD as a crucial operational sustainability tool for managing resource consumption, mitigating regulatory risk, and demonstrably achieving ambitious corporate Environmental, Social, and Governance (ESG) targets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BioConstruct GmbH, Engie SA, Veolia Environnement S.A., Ameresco, Inc., WELTEC BIOPOWER GmbH, Eisenmann Corporation, Xylem Inc., GWE Biogas, PlanET Biogas Group, L'Air Liquide S.A., DMT Environmental Technology, Siemens AG, GE Water & Process Technologies, Hitachi Zosen Inova AG, Waste Management, Inc., Wärtsilä Corporation, Zorg Biogas, Biofrigas Sweden AB, Pöring Umwelttechnik GmbH, Greenlane Renewables Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anaerobic Digester Market Key Technology Landscape

The technological landscape of the Anaerobic Digester market is characterized by relentless innovation focused on optimizing biological performance, enhancing feedstock flexibility, and maximizing the purity of the end products. The foundational technology revolves around reactor design, where established options include the Continuous Stirred-Tank Reactor (CSTR), widely used for homogeneous slurries, and the Plug-Flow Reactor (PFR), preferred for feedstocks with higher total solids and lower pumpability, such as agricultural biomass. However, the market is increasingly adopting high-rate digestion systems like the Upflow Anaerobic Sludge Blanket (UASB) and the Expanded Granular Sludge Bed (EGSB), particularly in industrial wastewater treatment. These advanced reactors significantly reduce the hydraulic retention time (HRT) and footprint compared to conventional systems, leveraging specialized granular sludge beds to achieve extremely high organic loading rates, a critical efficiency factor in confined industrial settings where process speed is paramount. Another significant advancement is the two-stage digestion process, which spatially and temporally separates the initial acid formation stage from the final methane production stage, offering superior process control, stability, and higher overall methane yields, especially when treating complex or difficult-to-digest substrates.

A major focus of technological advancement and investment is Biogas Upgrading Technology, necessary to refine raw biogas into high-purity biomethane, or Renewable Natural Gas (RNG), suitable for injection into natural gas pipelines (requiring >95% methane purity) or use as compressed vehicle fuel. Leading upgrading technologies include Pressure Swing Adsorption (PSA), which physically separates gases based on molecular characteristics; water scrubbing, which uses pressurized water to dissolve and remove CO2; and highly efficient Chemical Absorption methods, such as amine scrubbing, utilized for large-scale operations requiring exceptionally high purity. Membrane Separation technology is emerging as a preferred choice due to its relatively low energy consumption, reduced chemical reliance, and scalability, making it increasingly attractive for medium-sized agricultural RNG projects. The selection criteria for these upgrading units are heavily influenced by the volume of biogas produced, the specific contaminant profile (e.g., levels of hydrogen sulfide, siloxanes), and the required purity dictated by the final market application and gas grid specifications.

Furthermore, extensive technological development is concentrated on Feedstock Preprocessing and Digestate Management to maximize operational returns and minimize environmental risk. The Thermal Hydrolysis Process (THP) represents a significant breakthrough in pretreatment, particularly for municipal sewage sludge; by subjecting the sludge to elevated temperatures and pressures, THP breaks down microbial cell walls, dramatically increasing the biodegradability of the feedstock, reducing downstream retention time, and boosting biogas yield by up to 30%, while also ensuring complete pathogen destruction. Regarding digestate, the market is witnessing rapid deployment of Nutrient Recovery technologies. These include ammonia stripping, membrane filtration, and chemical precipitation processes like Struvite recovery, which selectively extract high-value concentrated nitrogen and phosphorous compounds. These technologies transform the voluminous, low-value digestate into transportable, commercial-grade fertilizer products, providing an indispensable secondary revenue stream, minimizing disposal complexities, and ensuring the AD plant operates within a truly closed-loop resource recovery model, thereby cementing its role in sustainable infrastructure development.

Regional Highlights

The global Anaerobic Digester market exhibits pronounced regional variations, reflecting disparate regulatory frameworks, feedstock availability, and maturity levels of energy infrastructure. Europe stands as the mature leader, driven by decades of consistent policy support, including comprehensive feed-in tariffs, green gas mandates, and ambitious circular economy directives set forth by the European Union. Countries like Germany, France, and Denmark have extensive experience in biogas production, with a specific focus on upgrading biogas to biomethane for injection into the highly interconnected continental gas grid. The European market prioritizes sustainability and local resource utilization, promoting the use of agricultural residues and manure, alongside stringent mandates for the management of source-separated municipal organic waste, ensuring steady, high-value demand for advanced AD technology, high-efficiency upgrading systems, and specialized digestate nutrient management solutions.

North America, particularly the United States, represents the market’s high-growth epicenter, propelled by powerful economic forces rather than purely environmental compliance. The key driver is the federal Renewable Fuel Standard (RFS) and state-level Low Carbon Fuel Standards (LCFS), which assign significant economic value to Renewable Natural Gas (RNG) used as transportation fuel. This regulatory landscape has catalyzed explosive investment in large-scale agricultural digesters, particularly those processing dairy manure, and extensive landfill gas recovery projects. The North American market is characterized by massive project scale, a near-exclusive focus on high-purity RNG output over traditional Combined Heat and Power (CHP), and intense private equity funding attracted by the lucrative monetization pathways for environmental credits, positioning the region as the global benchmark for large-scale, private-sector-led RNG infrastructure development.

The Asia Pacific (APAC) region, encompassing vast developing economies such as China and India, represents the largest potential market volume, driven by unprecedented urbanization and resulting catastrophic crises in municipal waste management, coupled with a fundamental need to address rural energy poverty and sanitation deficiencies. Governmental initiatives across the region are channeling massive subsidies toward decentralized waste-to-energy projects and promoting the use of abundant agricultural residues (e.g., rice straw, sugarcane bagasse). While the average project size in APAC tends to be smaller and the infrastructure less mature than in Western markets, the sheer scale of population and waste generation ensures immense long-term growth. The primary regional challenges center on standardizing feedstock collection logistics, enhancing local technical expertise, and developing robust financing mechanisms suitable for both large industrial ventures and widespread community-scale installations.

- Europe: High market maturity, regulatory dominance, strong biomethane grid integration, and heavy reliance on agricultural feedstock and centralized municipal AD.

- North America: Fastest growth trajectory, investment driven by high-value RNG credits (RFS/LCFS), concentration of large-scale dairy and landfill gas projects, and private equity engagement.

- Asia Pacific (APAC): Significant long-term volume potential, fueled by urgent municipal waste crises, urbanization, and government programs supporting decentralized energy and sanitation improvement.

- Latin America (LATAM): Emerging adoption concentrated around industrial users (agro-processing, breweries) and large urban centers seeking robust sewage sludge management solutions.

- Middle East & Africa (MEA): Nascent market primarily focused on implementing AD technology in large municipal wastewater treatment facilities to address rising water scarcity and energy demand in rapidly expanding urban environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anaerobic Digester Market.- BioConstruct GmbH

- Engie SA

- Veolia Environnement S.A.

- Ameresco, Inc.

- WELTEC BIOPOWER GmbH

- Eisenmann Corporation

- Xylem Inc.

- GWE Biogas

- PlanET Biogas Group

- L'Air Liquide S.A.

- DMT Environmental Technology

- Siemens AG

- GE Water & Process Technologies

- Hitachi Zosen Inova AG

- Waste Management, Inc.

- Wärtsilä Corporation

- Zorg Biogas

- Biofrigas Sweden AB

- Pöring Umwelttechnik GmbH

- Greenlane Renewables Inc.

Frequently Asked Questions

Analyze common user questions about the Anaerobic Digester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Renewable Natural Gas (RNG) and how does the Anaerobic Digester Market contribute to its production?

RNG, or biomethane, is a high-purity energy source derived from raw biogas through a rigorous upgrading process that removes carbon dioxide and trace contaminants. The Anaerobic Digester market is fundamental, as it generates the raw biogas from diverse organic waste streams, establishing the critical first step in the sustainable production pathway for pipeline-quality RNG used in heating or transportation.

What are the primary challenges limiting the widespread adoption of anaerobic digestion technology?

The most significant constraints include the substantial initial capital expenditure required for facility construction and advanced technology integration (CapEx), ensuring a consistent and high-quality feedstock supply, navigating complex and often fragmented regulatory environments, and managing the technical challenges associated with maintaining optimal biological stability and efficiency over long operational periods.

How do governments incentivize investment in Anaerobic Digestion projects globally?

Governments employ a variety of powerful financial mechanisms, including favorable long-term energy contracts such as feed-in tariffs (FITs), granting significant capital subsidies and investment tax credits, and providing access to lucrative market-based mechanisms like carbon credit monetization programs (e.g., the RFS and LCFS in North America) to substantially enhance project economic returns.

Which end-use sector is expected to show the highest growth in the AD market and why?

The Agricultural sector is projected to demonstrate the highest compound growth rate. This accelerated expansion is primarily driven by the strong financial attractiveness of producing high-value RNG from large volumes of livestock manure and agricultural residues, incentivized heavily by governmental programs that recognize these waste-derived fuels for their low carbon intensity.

What role does the byproduct digestate play in establishing a robust circular economy model?

Digestate, the nutrient-rich organic residue, plays an indispensable role by serving as a high-quality, sustainable alternative to synthetic chemical fertilizers. Its effective application allows AD facilities to close the nutrient loop, recycle essential soil components, reduce reliance on resource-intensive chemical production, and enhance local agricultural sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Anaerobic Digester Covers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Anaerobic Digester Market Statistics 2025 Analysis By Application (Paper Industry, Food & Beverage Industry, Chemical Industry), By Type (Upflow Anaerobic Sludge Blanket (UASB), Internal Circulation Reactor(IC Reactor), Expanded Granular Sludge Bed Digestion (EGSB)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager