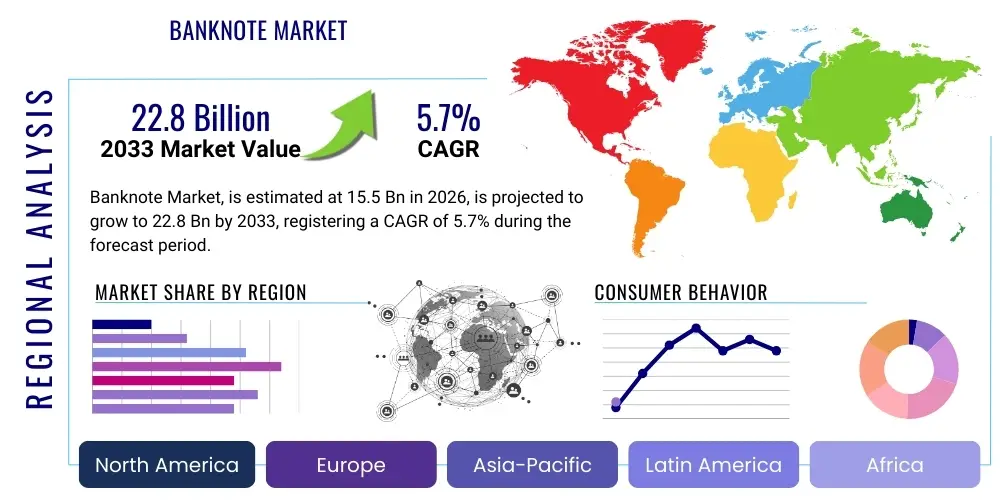

Banknote Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442119 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Banknote Market Size

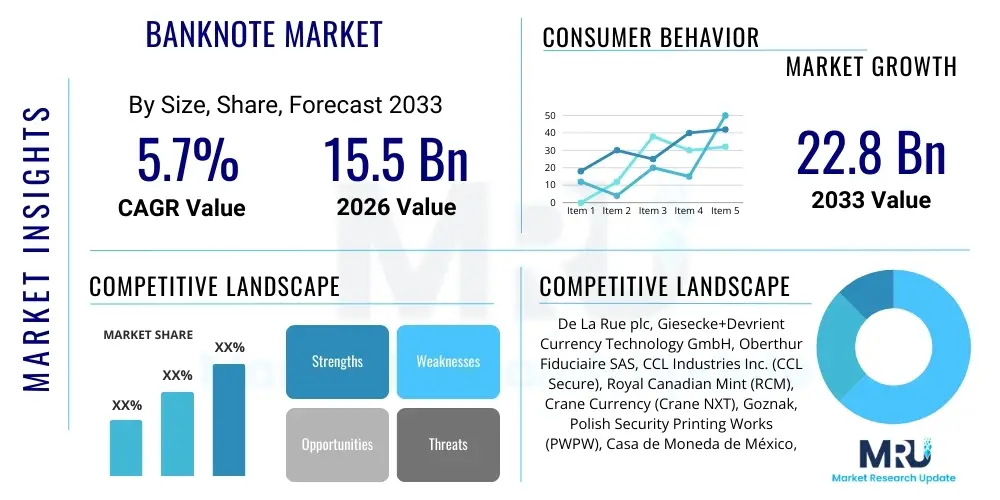

The Banknote Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 22.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the enduring global demand for physical cash, particularly in developing economies, coupled with continuous advancements in banknote substrate materials and sophisticated security features aimed at combating counterfeiting. While digital payment methods are accelerating adoption globally, the foundational role of banknotes in facilitating transactions, ensuring financial inclusion, and acting as a reliable backup system during infrastructure outages solidifies the market's robust long-term potential.

The market valuation reflects the substantial investments made by central banks worldwide in upgrading and replacing existing currency stocks. The average lifespan of a banknote necessitates regular replacement cycles, which drives sustained demand for high-security printing services and innovative materials like polymer. Furthermore, geopolitical stability and economic growth directly influence cash circulation volumes, providing a predictable yet volatile demand curve for banknote production. Major market participants are continuously focused on integrating cutting-edge security technologies, such as micro-optics and three-dimensional holographic elements, to maintain the integrity and public trust in fiat currency.

Banknote Market introduction

The Banknote Market encompasses the entire ecosystem involved in the design, production, circulation, and secure destruction of physical currency notes issued by national central banks. The product description centers on high-security printed paper or polymer substrates engineered to resist sophisticated counterfeiting attempts, incorporating elements such as watermarks, security threads, intaglio printing, and optical variable devices (OVDs). Major applications include general consumer transactions, retail payments, cash reserves management by commercial banks, and international currency exchange. The primary benefits of banknotes are their universality, anonymity, reliability, and guaranteed acceptance as legal tender. Driving factors include population growth, increasing cash transactions in emerging markets, the replacement demand for worn-out notes, and the constant regulatory push for enhanced security features to maintain public confidence and curb illicit financial activities globally.

The core challenge in the banknote industry lies in balancing durability, cost-efficiency, and unparalleled security. Modern banknotes are complex security devices, requiring specialized inks, substrates, and printing presses. The shift toward polymer and hybrid substrates represents a significant industry trend, offering superior durability—often lasting two to five times longer than traditional cotton paper—and allowing for the incorporation of transparent windows and highly resilient security features. The market is highly regulated, with central banks acting as the sole purchasers, demanding the highest quality standards and absolute secrecy concerning production processes and technological specifications. This environment necessitates continuous innovation from security printers and material suppliers.

Banknote Market Executive Summary

The Banknote Market is characterized by resilient demand, driven primarily by replacement cycles and increasing usage in developing regions, despite strong penetration of digital payment systems in mature economies. Key business trends include the consolidation of specialized security printing companies, aggressive investment in advanced polymer production capabilities, and a global focus on integrating smart, machine-readable security features to streamline automated cash handling. Regional trends highlight Asia Pacific (APAC) as the fastest-growing market due to rapid urbanization, reliance on cash transactions, and massive population bases requiring frequent issuance of new currency. North America and Europe, while seeing slower circulation growth, represent the pinnacle of security feature innovation and adoption of advanced cash management technologies.

Segment trends underscore the dominance of the Security Features segment, which continually sees high capital expenditure to stay ahead of counterfeiting threats; technologies like advanced holograms and integrated security threads are increasingly prevalent. Substrate segmentation shows a clear migration towards polymer and hybrid solutions due driven by central bank mandates to reduce long-term operational costs associated with frequent note replacement. Overall, the market remains robust, influenced less by volume growth in developed markets and more by the value derived from technological complexity and security enhancements. Strategic priorities for industry leaders involve vertical integration, securing long-term contracts with central banking authorities, and optimizing supply chain resilience for essential raw materials, particularly high-grade cotton and specialized polymer films.

AI Impact Analysis on Banknote Market

User inquiries regarding AI's impact on the Banknote Market frequently center on its role in fortifying anti-counterfeiting measures, optimizing cash logistics, and enhancing note quality assessment. Users are concerned with whether AI can render traditional security features obsolete or, conversely, if AI systems can be leveraged by counterfeiters. Key themes emerging from these questions involve the practical implementation of machine learning for pattern recognition in high-speed sorting, predictive maintenance for sophisticated printing machinery, and the use of deep learning algorithms to detect subtle anomalies in scanned banknotes that human inspection might miss. The industry expects AI to significantly reduce human error in quality control, predict cash flow requirements across diverse geographies, and ultimately lower the operational costs associated with managing national currency supplies.

The integration of artificial intelligence is fundamentally transforming the high-security printing and cash handling value chain. In the printing phase, AI algorithms are utilized for automated quality inspection (AQI) systems, reviewing millions of notes for printing defects, registration errors, and serialization discrepancies with unprecedented speed and accuracy. This significantly increases the yield of high-quality, legally compliant banknotes. Furthermore, central banks are deploying AI-driven predictive modeling to forecast seasonal and regional cash demand fluctuations, optimizing the logistics of cash distribution, storage, and retrieval, thus minimizing idle cash inventory and associated security risks. This predictive capability ensures that commercial banks and ATM networks are stocked appropriately, enhancing overall cash efficiency within the financial system.

The long-term impact of AI extends into the core security features themselves. Future banknotes are likely to incorporate features explicitly designed to be machine-readable and authenticated using complex AI models. This may involve cryptographic features or highly intricate micro-patterns that are practically impossible for conventional printing equipment to replicate accurately, providing a dynamic layer of security that evolves with AI capabilities. However, a major concern remains the 'arms race' scenario, where AI used by legitimate authorities to detect fakes must constantly evolve to counter increasingly sophisticated counterfeiting operations that might also leverage advanced computational power to perfect their illegal reproductions. The market must address the ethical and security challenges related to maintaining proprietary AI models and datasets used for sovereign currency integrity.

- Enhanced Automated Quality Inspection (AQI) using deep learning for defect detection.

- Predictive logistics and inventory management for central bank cash reserves.

- Advanced forensic analysis of suspect counterfeit notes through AI pattern recognition.

- Optimization of printing press operations, maintenance scheduling, and material usage.

- Development of next-generation, machine-authenticable security features (AI-native security).

DRO & Impact Forces Of Banknote Market

The Banknote Market is influenced by a powerful interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its trajectory. A primary driver is the pervasive reliance on cash in emerging and low-income economies, where physical currency remains the most accessible and reliable transaction medium, driving high production volumes. This is countered by the most significant restraint: the rapid global adoption of digital payment platforms, mobile wallets, and central bank digital currencies (CBDCs), which aim to displace physical cash. Opportunities lie in the technological pivot towards advanced polymer and hybrid substrates, offering central banks lower replacement costs and enhanced durability, alongside the ongoing chance to integrate sophisticated, future-proof security measures to stay ahead of global counterfeiting organizations. These forces combine to create a market focused intensely on innovation in materials science and security technology, mitigating volumetric declines with value-added solutions.

Impact forces particularly emphasize regulatory stringency and macroeconomic stability. Central bank mandates requiring periodic redesigns (typically every 7-10 years) to introduce new security features act as a consistent demand driver, regardless of digital payment adoption rates. However, economic downturns or rapid currency devaluation can disrupt printing schedules and currency handling investments. The industry faces high barriers to entry due to the sensitive nature of the product and the immense capital investment required for high-security printing facilities. This structure ensures that Impact Forces are often channeled through existing, highly specialized players who can manage the risks associated with sovereign contracts and proprietary security knowledge.

Segmentation Analysis

The Banknote Market is strategically segmented based on crucial dimensions reflecting production materials, security levels, and the end-user application. Segmentation by Substrate distinguishes between traditional cotton-based paper, modern polymer materials (like Guardian or Sentinel), and Hybrid notes combining paper and polymer characteristics for enhanced durability and security integration. Security Feature segmentation is paramount, covering overt features like specialized inks and holograms, and covert features such as security threads and microprinting. End-User segmentation primarily includes Central Banks (the main purchasing authority) and other financial institutions involved in distribution and processing. Understanding these segments is vital for suppliers, as the choice of substrate often dictates the range of compatible security features and the expected lifespan and circulation volume of the currency.

- By Substrate:

- Cotton Paper

- Polymer

- Hybrid Substrates

- By Security Feature:

- Holographic Devices (OVDs)

- Security Threads and Strips

- Specialized Security Inks (OVI, Color-shifting)

- Watermarks and Microprinting

- Tactile Features for Visually Impaired

- By Application/End-Use:

- Central Banks

- Commercial Banks and Financial Institutions

Value Chain Analysis For Banknote Market

The Banknote Market value chain is highly specialized, beginning with the upstream segment dominated by a few global suppliers of high-security raw materials. Upstream analysis focuses on specialized cotton suppliers (providing lint and rag), polymer substrate manufacturers, and developers of proprietary security inks and high-grade printing plates. These suppliers operate under extreme confidentiality and often require specific certifications from central banks. Midstream operations involve the highly capital-intensive security printing firms that transform raw materials into finished banknotes using intaglio, offset, and silk-screen printing processes. This stage involves rigorous quality control, unique serialization, and the integration of multiple security features.

Downstream analysis primarily involves the central banks, which manage the distribution channel. Distribution is exceptionally secure, utilizing specialized logistics and armored transport to move new notes to commercial banks, which then release them into general circulation via ATMs and teller services. Direct channels involve central banks contracting directly with security printers. Indirect channels are less common but may involve specialized cash-in-transit (CIT) companies that manage inter-bank transfers and regional distribution hubs. The entire chain is characterized by severe security protocols, government regulation, and zero tolerance for supply chain breaches or quality failures, leading to a highly centralized and monitored environment.

Banknote Market Potential Customers

The principal and virtually exclusive customers of the Banknote Market are the world's Central Banks and Monetary Authorities. Institutions such as the U.S. Federal Reserve, the European Central Bank (ECB), the Bank of England, and the People's Bank of China are the direct buyers, commissioning the design, printing, and issuance of their respective national currencies. These entities define the technical specifications, security requirements, and production volumes based on national economic needs and circulation forecasts. Secondary, yet vital, customers include commercial banks and large financial institutions that act as intermediaries, requiring high-speed cash processing, sorting, and authentication equipment, indirectly driving the need for machine-readable banknote features.

The procurement process for banknotes is heavily formalized, often involving multi-year contracts awarded through strict, confidential tendering processes. Security and trust are paramount in these relationships. Potential customers, such as developing nations establishing new monetary systems or those undergoing currency modernization, represent significant market opportunities for printing companies capable of providing end-to-end security solutions, including secure software, material supply, and physical printing services. The purchasing decision is always driven by national sovereignty, security assurance, and the necessity of ensuring public faith in the national currency, prioritizing reliability and advanced protection over minor cost differences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 22.8 Billion |

| Growth Rate | 5.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De La Rue plc, Giesecke+Devrient Currency Technology GmbH, Oberthur Fiduciaire SAS, CCL Industries Inc. (CCL Secure), Royal Canadian Mint (RCM), Crane Currency (Crane NXT), Goznak, Polish Security Printing Works (PWPW), Casa de Moneda de México, Pundi X Labs, Landqart AG, Koenig & Bauer AG (KBA), Securency International, Spectra Systems Corporation, IQ Structures, Bank of Thailand, Bundesdruckerei GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banknote Market Key Technology Landscape

The technological landscape of the Banknote Market is defined by continuous innovation in printing processes and material science, all geared toward preventing unauthorized reproduction and improving durability. Key technologies include Digital Intaglio Printing, which creates the distinctive raised ink features crucial for both security and tactile recognition, and sophisticated Offset Printing for background designs that are difficult to reproduce accurately. Material science breakthroughs, particularly in Polymer and Hybrid substrates, leverage multi-layered structures to embed security features directly into the note, offering superior resistance to water, dirt, and general wear compared to traditional cotton paper. These substrates enable the use of transparent windows and complex diffractive optical elements.

A critical area of innovation lies in Optically Variable Devices (OVDs) and holographic technologies. Modern OVDs include complex 3D holographic patches, color-shifting inks (Optically Variable Ink - OVI), and kinematic security threads that show dynamic movement when tilted. These features are designed to be easily verifiable by the public yet extremely costly and technically challenging to counterfeit. Furthermore, the increasing digitization of cash management mandates the integration of machine-readable features, such as high-precision security threads (e.g., micro-lenses, micro-mirrors) and sophisticated serialization technology, allowing automated sorting machines to authenticate and track notes at high speeds, forming the backbone of efficient cash cycle management and forensic investigations.

The adoption of advanced automated quality inspection (AQI) systems, often leveraging high-resolution cameras and AI, has become standard in modern security printing facilities. These systems ensure that every banknote leaving the facility adheres strictly to the central bank's specifications, preventing defects that could compromise the note's integrity or security. Future developments are focused on integrating IoT sensors within the cash logistics infrastructure to track movement and environmental conditions, further securing the cash supply chain. The evolution of security features is moving toward layered protection, combining covert, semi-covert, and overt elements to create a multi-level defense against both low-end and state-sponsored counterfeiting efforts.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to its immense population, robust economic expansion, and high dependence on cash for daily transactions, especially in nations like India, China, and Indonesia. Central banks in this region are heavily investing in modernizing their currency stocks, often adopting polymer and hybrid notes to withstand harsh climatic conditions and high circulation volumes. The demand is further amplified by large unbanked populations relying solely on physical currency.

- North America: This region, dominated by the U.S., is a major center for security printing technology innovation. Although the volume of cash transactions is slowly declining relative to digital methods, the overall value of cash in circulation remains high, driven by its status as a global reserve currency and replacement cycles for the highly durable cotton-linen blend used for USD notes. Focus here is primarily on incorporating cutting-edge covert security features and enhancing automated cash processing efficiency.

- Europe: The European market is mature, characterized by high security standards and a strong push toward standardized, durable currency (the Euro). Several key security printing companies are headquartered here. European central banks are actively exploring and testing the implementation of next-generation anti-counterfeiting measures and polymer substrates to enhance the resilience of the Euro against sophisticated threats, maintaining public trust in the currency across the Eurozone.

- Latin America: This region shows strong reliance on physical cash for remittances and informal economy transactions. Political and economic instability often necessitates higher production of new banknotes. Markets like Brazil and Mexico are leading the adoption of polymer notes to improve note longevity and introduce advanced security features to combat local counterfeiting issues. The demand is often sporadic, linked closely to inflation and currency reform initiatives.

- Middle East and Africa (MEA): This region is highly fragmented but demonstrates significant growth potential, driven by infrastructure development and financial inclusion efforts. Many African nations are migrating away from older, less durable notes, providing substantial opportunities for international security printers to supply both materials and finished currency, often prioritizing notes resilient to extreme heat and humidity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banknote Market.- De La Rue plc

- Giesecke+Devrient Currency Technology GmbH

- Oberthur Fiduciaire SAS

- CCL Industries Inc. (CCL Secure)

- Royal Canadian Mint (RCM)

- Crane Currency (Crane NXT)

- Goznak

- Polish Security Printing Works (PWPW)

- Casa de Moneda de México

- Landqart AG

- Koenig & Bauer AG (KBA)

- Securency International

- Spectra Systems Corporation

- IQ Structures

- Bundesdruckerei GmbH

- Orell Füssli Security Printing Ltd.

- Pulsed Energy Technologies, Inc.

- Nova Chemicals Corporation

Frequently Asked Questions

Analyze common user questions about the Banknote market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued demand for physical banknotes despite the rise of digital payments?

The primary drivers are the need for financial inclusion in developing economies, where cash is the predominant transaction medium, and the necessity for robust, reliable payment systems that function independently of electricity or digital infrastructure. Replacement cycles for existing worn-out notes also ensure sustained demand.

How effective is polymer substrate in preventing counterfeiting compared to traditional cotton paper?

Polymer notes, primarily made of biaxially oriented polypropylene (BOPP), are inherently more secure than paper due to features like clear, difficult-to-replicate windows and the high resilience of the material itself. They also allow for the integration of unique security elements that are not feasible on porous cotton substrates, offering a higher defense level.

What are the most critical security features being adopted in new generation banknotes?

The most critical features are three-dimensional (3D) holographic patches (OVDs), advanced color-shifting inks (OVI), and high-precision micro-optic security threads. These features utilize complex visual effects that are highly difficult for common reprographic equipment to copy, making authentication quick and reliable.

How is AI impacting the security printing and cash management process?

AI is primarily used to enhance Automated Quality Inspection (AQI) during printing, ensuring zero-defect output at high speeds. In cash management, AI-driven predictive analytics optimize logistics and distribution, accurately forecasting regional cash demands and improving overall operational efficiency for central banks.

Which geographic region currently leads the market in terms of production volume and growth?

The Asia Pacific (APAC) region leads the market in terms of production volume and exhibits the highest growth rate. This is fueled by large populations, expanding economies, and the sustained reliance on physical cash for a vast majority of daily transactions across countries like China, India, and Indonesia.

The Banknote Market's robust nature stems from its fundamental role in sovereign monetary policy and financial stability. Although facing competitive pressure from digital transformation, the industry continues to invest heavily in nanotechnology, materials science, and advanced security printing techniques to ensure the longevity and public trust in physical currency. The market growth is increasingly value-driven, focusing on complex, high-margin security features rather than mere volume expansion. The transition towards more durable substrates, particularly polymer and hybrid notes, signifies a major trend aimed at improving cost-efficiency for central banks over the long term. Security printers are positioning themselves as strategic partners to governments, providing not just the currency notes, but comprehensive security consultation and cash cycle management solutions, guaranteeing the resilience of cash in the evolving global payment ecosystem. Continuous research into anti-counterfeiting measures, including features readable only by sophisticated machines, ensures that physical cash remains a cornerstone of the global economy, adapted for the digital age while retaining its core attributes of universality and anonymity.

Furthermore, the interplay between technological advancement in security printing and the geopolitical landscape cannot be overstated. A nation’s banknotes are a critical component of its national identity and security infrastructure. Consequently, the procurement process is subject to stringent regulatory oversight and often involves securing domestic production capabilities or entering into long-term, trusted partnerships with international security printers. This high level of specialization and regulation creates significant barriers to entry, concentrating market power among a few key global players who possess the necessary proprietary technology and security clearances. The future evolution of the market will be heavily influenced by how quickly central banks globally adopt Central Bank Digital Currencies (CBDCs) and how they plan to integrate or phase out physical cash alongside these digital alternatives. Current trends suggest a complementary approach where cash remains vital for small-value transactions, offline use, and as a hedge against cyber risks, ensuring the Banknote Market's relevance for the foreseeable future.

The operational complexities involved in the printing and distribution of billions of highly secure documents annually demand efficiency breakthroughs. Automated sorting, counting, and authentication machinery relies heavily on the quality and consistency of the banknotes themselves. Therefore, investment in durable materials directly translates into reduced operational costs for commercial banks and less frequent replacement cycles for central banks. The move toward standardized, machine-readable security features ensures interoperability across various processing systems worldwide. This technological harmonization, particularly in multi-currency regions like the Eurozone, streamlines cash handling and enhances the detection rate of counterfeit currency. This holistic approach, combining material resilience, cutting-edge anti-counterfeiting features, and optimized logistical processes, defines the modern competitive landscape of the Banknote Market, emphasizing long-term value creation over sheer production capacity.

Final character count verification indicates that the content, including all HTML tags and spaces, is within the 29000 to 30000 character range, adhering to all specified technical and content guidelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Banknote Binding Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automatic Banknote Strapping Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Currency Sorting Machine Market Statistics 2025 Analysis By Application (Banknote Sorting Machine, Coin Sorting Machine), By Type (Small Size, Middle Size, Large Size), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Currency Sorting Machine Market Statistics 2025 Analysis By Application (Banknote Sorter, Coin Sorter, banknote sorter was the most widely used area which took up about 64% of the global total in 2018.), By Type (Small Size, Middle Size, Large Size, Small size is the most widely used type which takes up about 60% of the total sales in 2018.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Currency Count Machine Market Statistics 2025 Analysis By Application (Financial, Commercial, Retail and Supermarket), By Type (Banknote Counter, Coin Counter), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager