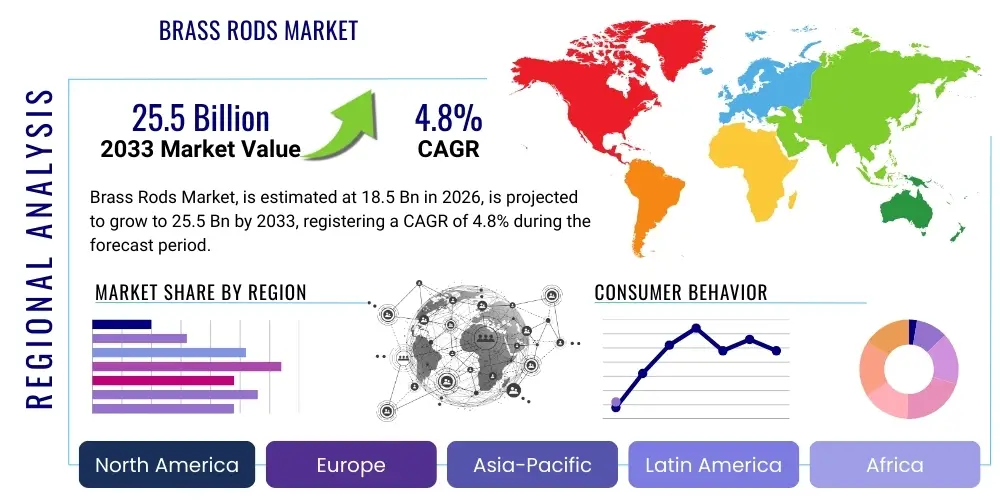

Brass Rods Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442866 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Brass Rods Market Size

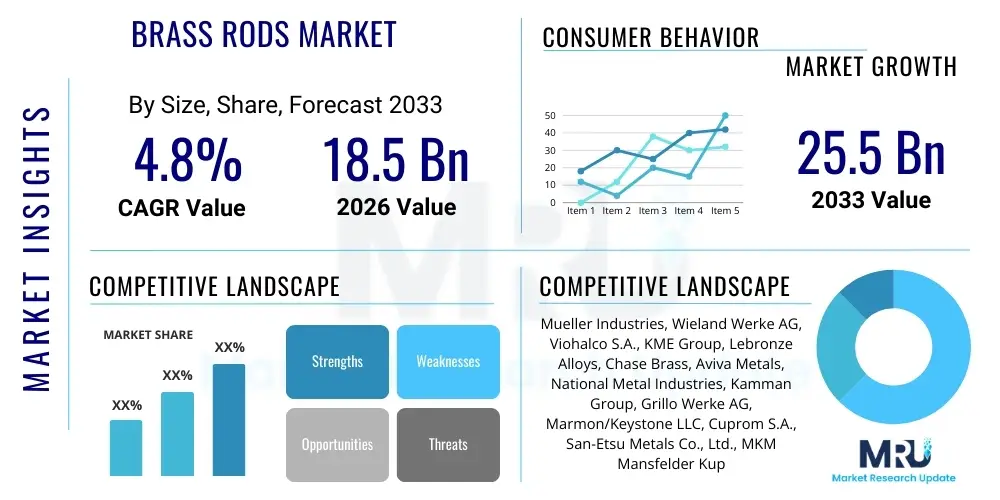

The Brass Rods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.5 Billion by the end of the forecast period in 2033.

Brass Rods Market introduction

Brass rods are semi-finished metallic products predominantly composed of copper and zinc, often incorporating minor amounts of other elements like lead (for machinability) or tin. These materials are manufactured primarily through extrusion or casting processes, resulting in consistent geometric cross-sections that are vital for subsequent fabrication processes such as forging, machining, and drawing. Their superior characteristics, including high strength, excellent corrosion resistance, favorable thermal conductivity, and most crucially, outstanding machinability, make them indispensable across a multitude of heavy and precision industries globally. The adaptability of brass rods allows for the production of complex components with tight tolerances, serving critical roles in fluid handling, electrical conductivity, and structural integrity.

Major applications of brass rods span critical infrastructure sectors. In the automotive industry, they are used for manufacturing connectors, radiator parts, and sensor components due to their anti-corrosion properties and reliable conductivity. The plumbing and sanitary ware sector relies heavily on brass rods for producing durable valves, fittings, and faucets, benefiting from the material’s resistance to dezincification and its ability to withstand high water pressure. Furthermore, the electrical and electronics industry utilizes high-conductivity brass rods for terminals, switches, and heat sinks, where reliability and minimal energy loss are paramount. The construction sector also contributes significantly to demand, particularly for architectural hardware and durable fastenings.

The market is primarily driven by robust growth in end-use industries, particularly the increasing global focus on sophisticated urbanization and infrastructure development in emerging economies. The inherent benefits of brass, such as its recyclability and non-sparking characteristics, contribute to its sustained relevance, positioning it as a preferred material over certain alternatives in specific hazardous or sensitive environments. Continuous innovation in alloying techniques to meet stringent environmental regulations, particularly concerning lead content (e.g., introduction of lead-free brass options), further solidifies the market’s positive trajectory and expansion into specialized high-performance applications.

Brass Rods Market Executive Summary

The Brass Rods Market demonstrates resilient growth, underpinned by sustained demand from the automotive, construction, and plumbing sectors. Key business trends indicate a critical shift toward specialization, with manufacturers increasingly focusing on producing lead-free and eco-friendly brass alloys to comply with evolving global environmental mandates, notably in North America and Europe. Supply chain optimization remains a central focus, driven by the volatile pricing of raw materials, primarily copper and zinc. Furthermore, technological adoption, specifically in advanced extrusion and continuous casting techniques, is improving efficiency, reducing production costs, and enabling the creation of rods with enhanced mechanical properties and tighter dimensional accuracy, thereby supporting higher-value applications.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of both production capacity and consumption, fueled by unprecedented infrastructure investment and rapid industrialization in countries like China and India. However, regulatory pressures regarding materials specifications are more pronounced in mature markets such as Europe and North America, necessitating significant R&D investments by regional players to maintain competitiveness. The Middle East and Africa (MEA) region presents significant growth opportunities, driven by large-scale construction projects and diversification efforts away from oil dependence, which require substantial volumes of metal components for new utilities and housing developments.

Segment trends highlight the dominance of free-cutting brass rods due to their extensive use in high-volume, automated machining processes crucial for manufacturing precision components. Concurrently, the application segment is witnessing the fastest growth in electrical and electronics, spurred by the global push for smart devices, renewable energy infrastructure (which requires reliable connectors), and high-efficiency electrical systems. The demand for forging brass rods is also expanding, driven by the automotive sector’s need for complex, high-strength forged components used in transmission and braking systems, emphasizing the criticality of material density and structural integrity.

AI Impact Analysis on Brass Rods Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Brass Rods Market center on themes of predictive maintenance, optimization of complex manufacturing processes, and enhanced material quality control. Users frequently question how AI algorithms can predict equipment failure in extrusion presses, thereby minimizing expensive downtime, and how machine learning (ML) can optimize alloying composition in real-time to ensure material consistency and reduce scrap rates. Concerns also revolve around the potential for AI-driven automation to redefine workforce requirements and the need for new skill sets in monitoring and managing sophisticated, interconnected production lines. The overarching expectation is that AI will drive efficiency gains, improve consistency, and provide competitive advantages through enhanced operational transparency and reduced reliance on manual quality inspections.

- Predictive Maintenance Implementation: AI algorithms analyze sensor data from extrusion and drawing machinery to predict potential mechanical failures, significantly reducing unplanned downtime and maintenance costs.

- Process Optimization: Machine learning models optimize heating parameters, drawing speeds, and cooling rates during manufacturing, resulting in superior metallurgical properties and consistent dimensional tolerances.

- Alloy Composition Management: AI systems continuously monitor and adjust the input mix of copper, zinc, and additives during casting to ensure precise chemical composition and minimize waste.

- Quality Control Automation: Computer vision and AI-enabled non-destructive testing (NDT) automate defect detection on the rod surface, ensuring faster and more reliable quality assurance than traditional inspection methods.

- Supply Chain Forecasting: AI enhances the accuracy of forecasting raw material (copper and zinc) demand and price volatility, enabling strategic procurement and inventory management.

- Energy Consumption Reduction: Optimized scheduling and parameter control driven by AI minimize energy use during high-temperature processes, contributing to lower operational expenditure and environmental compliance.

- Workforce Training Adaptation: AI introduction necessitates specialized training for operators and engineers in data analysis and AI model supervision, changing required skills in the manufacturing environment.

DRO & Impact Forces Of Brass Rods Market

The Brass Rods Market is influenced by a dynamic interplay of factors encompassing strong demand from key end-use sectors, strict regulatory environments, and the inherent volatility of primary raw material costs. Drivers include the global expansion of plumbing and sanitary infrastructure, particularly in rapidly urbanizing regions, and the persistent need for highly reliable, corrosion-resistant components in automotive and industrial applications. However, these positive trends are counterbalanced by restraints such as the fluctuating prices of copper and zinc, which directly impact manufacturing costs and pricing stability, along with increasing competitive substitution from materials like engineered plastics and specialized stainless steel in certain non-critical applications.

Opportunities for market expansion are significant, primarily centered on the accelerating transition to lead-free brass formulations, driven by health and environmental regulations (e.g., the Safe Drinking Water Act amendments in the US). This regulatory shift mandates innovation and creates high-growth avenues for companies capable of producing technologically advanced, compliant brass alloys. Furthermore, the rising adoption of electric vehicles (EVs) offers a specialized opportunity, as EVs require high-conductivity, precision-engineered brass components for battery systems and charging infrastructure, distinct from traditional internal combustion engine applications.

The impact forces driving market evolution are predominantly centered on regulatory compliance and technological advancement. Regulatory mandates necessitate significant R&D investment to maintain market access, particularly in advanced economies. Concurrently, advancements in manufacturing technologies, such as continuous casting and high-speed multi-spindle machining, are essential for improving material utilization efficiency and reducing the cost per unit produced, acting as powerful forces shaping market competitiveness and pricing structures. The overall market trajectory suggests steady growth, conditional on effective management of raw material cost risks and successful adoption of next-generation, compliant alloys.

Segmentation Analysis

The Brass Rods Market is comprehensively segmented based on Type, Process, and Application, allowing for detailed analysis of market dynamics across various industrial specifications and uses. Type segmentation distinguishes products based on alloying composition and intended use, ranging from highly machinable alloys to high-strength variants. Process segmentation examines the primary manufacturing method, which dictates the rod's microstructure and final mechanical properties. Application segmentation provides a crucial view of demand drivers across key end-use sectors, such as automotive, electrical, and construction, helping to identify lucrative growth pockets and key consumer preferences regarding material specifications and performance requirements across different geographical areas.

- By Type:

- Free Cutting Brass Rods (Leaded and Low-Leaded)

- High Tensile Brass Rods

- Forging Brass Rods

- Naval Brass Rods

- Lead-Free Brass Rods (Eco-friendly variants)

- By Process:

- Extrusion Process

- Continuous Casting

- Drawing and Finishing

- By Application:

- Plumbing and Sanitary Ware (Valves, Fittings, Faucets)

- Automotive Components (Connectors, Fasteners, Radiator Parts)

- Electrical and Electronics (Terminals, Switches, Heat Sinks)

- Industrial Machinery (Bushings, Gears, Bearings)

- Fasteners and Architectural Hardware

- Ammunition Components

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Brass Rods Market

The value chain for the Brass Rods Market initiates with the upstream procurement and processing of primary raw materials: copper and zinc, along with minor alloying elements like lead, tin, or manganese. This stage is characterized by high price volatility, commodity market speculation, and reliance on global mining and refining operations. Key suppliers, including large-scale mining corporations and copper/zinc producers, exert significant influence over upstream costs. Efficient sourcing and hedging strategies are critical for brass manufacturers to mitigate raw material price risk, which constitutes the largest portion of the final product cost. Recycled brass scrap is also a vital input, reducing dependence on virgin materials and offering a crucial cost advantage while enhancing the sustainability profile of the final product.

The midstream phase involves the core manufacturing process, beginning with melting, alloying, and casting the raw materials into billets or ingots, followed by primary processing via extrusion or continuous casting to form the rough rods. Subsequent steps include drawing, annealing, and finishing processes (such as straightening and cutting) to meet specific dimensional and metallurgical requirements demanded by end-users. Distribution channels are highly varied; large volumes move directly from integrated producers to major original equipment manufacturers (OEMs) in the automotive and plumbing sectors, representing the direct distribution route. Indirect distribution, involving specialized metals distributors, service centers, and regional agents, serves smaller fabricators and maintenance, repair, and overhaul (MRO) markets, ensuring wide geographical availability and localized inventory management.

Downstream analysis focuses on the end-user markets, where brass rods are machined, forged, or stamped into final components like valves, fittings, electrical terminals, and complex machinery parts. The key downstream players include Tier 1 automotive suppliers, global sanitary ware manufacturers, and specialized electronics component producers. The efficiency and quality of the brass rods directly impact the downstream users' production costs and product performance. The overall value chain emphasizes material quality, supply chain resilience, and the ability of manufacturers to adapt quickly to stringent regulatory shifts, particularly the global move toward lead-free alloys which requires close collaboration between midstream processors and downstream component fabricators to ensure functional equivalence.

Brass Rods Market Potential Customers

Potential customers and primary buyers of brass rods are large-scale industrial consumers and component manufacturers whose final products require high durability, excellent corrosion resistance, and precise mechanical properties. The largest segment of buyers includes manufacturers specializing in fluid control systems, such as valve and faucet producers for residential and commercial plumbing infrastructure. These buyers seek brass rods that comply with strict drinking water safety standards, specifically lead-free or low-lead formulations, prioritizing reliability and longevity of components under constant pressure and exposure to water impurities.

Another major customer base resides within the heavy machinery and automotive sectors. Automotive component suppliers, particularly those focused on braking systems, complex connectors, and thermal management parts, require high-strength and fatigue-resistant brass rods capable of withstanding harsh operating conditions. Similarly, manufacturers of industrial equipment and machinery utilize brass rods for high-precision components such as bushings, bearings, and specialized gears, where superior wear resistance and consistent material integrity are non-negotiable prerequisites for operational reliability and extended service life in demanding environments.

Furthermore, the electrical and electronics industries represent a growing customer segment. Buyers here include manufacturers of switchgear, electrical terminals, high-power connectors, and telecommunications equipment. These customers prioritize brass rods with superior electrical conductivity and high resistance to heat and oxidation, ensuring minimal signal loss and robust performance in critical electrical circuits. The procurement decisions of these end-users are driven by technical specifications, bulk pricing stability, adherence to stringent industry certifications (like ISO and RoHS compliance), and the supplier’s capability for high-volume, consistent production tailored to precise engineering specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mueller Industries, Wieland Werke AG, Viohalco S.A., KME Group, Lebronze Alloys, Chase Brass, Aviva Metals, National Metal Industries, Kamman Group, Grillo Werke AG, Marmon/Keystone LLC, Cuprom S.A., San-Etsu Metals Co., Ltd., MKM Mansfelder Kupfer und Messing GmbH, Luvata Oy, Bharat Metal Corporation, Metrod Holdings Berhad, Tase Copper, Rajoo Engineers Limited, PMX Industries Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Brass Rods Market Key Technology Landscape

The Brass Rods Market is continuously evolving through technological advancements aimed at improving material properties, enhancing production efficiency, and ensuring compliance with stringent environmental standards. One of the most critical technologies currently employed is the advanced Continuous Casting process, which enables the production of brass billets or rods with highly uniform microstructure and reduced internal defects compared to traditional static casting methods. This uniformity is crucial for high-speed machining applications downstream, minimizing tool wear and maximizing fabrication throughput. Furthermore, the implementation of automated process control systems, often integrated with AI, allows for precise management of temperatures and cooling rates, guaranteeing consistent metallurgical quality across large production batches, which is a vital competitive differentiator.

Another significant technological focus is on high-pressure Extrusion systems. Modern extrusion presses utilize advanced tooling materials and lubrication techniques to process complex alloy compositions, including the newer lead-free variants, which often exhibit greater difficulty in processing compared to standard leaded brass. These technologies ensure that the final extruded rods possess exceptional surface finish and tight dimensional tolerances, minimizing the need for extensive post-extrusion finishing. The industry is also investing heavily in advanced spectrophotometric and ultrasonic testing equipment for non-destructive testing (NDT), ensuring 100% defect inspection and material verification before the rods reach the customer, thereby enhancing product reliability and reducing liabilities.

The evolution toward sustainable manufacturing is driving the adoption of specialized alloying technologies. The development of bismuth and silicon-based lead-free brass alloys (often referred to as ECO-Brass or low-leaded brass) requires sophisticated mixing and alloying techniques to ensure that the replacement elements provide comparable machinability and mechanical performance without compromising environmental safety. Furthermore, recycling technology plays a crucial role; efficient segregation and processing of brass scrap are leveraged using advanced sorting and melting technologies to maintain purity and reduce the environmental footprint, aligning the industry with circular economy principles and managing cost volatility associated with virgin copper procurement.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for brass rods globally, driven predominantly by massive infrastructural investments, rapid urbanization, and a flourishing manufacturing base, particularly in China, India, and Southeast Asia. The region’s demand is concentrated in the construction, automotive (including EV manufacturing), and expanding electronics assembly sectors. Government policies supporting 'Made in' initiatives and the relocation of global manufacturing facilities contribute significantly to the high consumption volume.

- North America: This region is characterized by high adoption of premium, specialized brass rod variants, particularly those adhering to strict lead-free mandates, such as the requirements of the U.S. Safe Drinking Water Act for plumbing applications. Growth here is steady, fueled by renewed focus on upgrading aging municipal infrastructure and strong demand from the high-precision aerospace and defense industries, which require high-specification, certified brass components.

- Europe: Europe is a mature market focused heavily on stringent environmental regulations (REACH, RoHS) and efficiency. The market emphasizes specialized high-performance and lead-free alloys. Demand is strong in the high-end automotive, industrial machinery, and premium sanitary ware sectors, where quality, compliance, and product traceability are paramount. Germany and Italy remain significant production hubs and major consumers of brass rods for precision engineering applications.

- Latin America: This region exhibits moderate but accelerating growth, primarily supported by industrial expansion in Brazil and Mexico. The construction sector and local automotive manufacturing activities are the main demand drivers. Market maturation is constrained slightly by economic instability and variable regulatory environments, but long-term potential remains positive as foreign direct investment in manufacturing increases.

- Middle East and Africa (MEA): The MEA market is experiencing high growth spurred by mega-infrastructure projects, particularly in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia). The massive scale of new city developments, utilities, and commercial real estate requires substantial inputs of brass fittings and components for plumbing, HVAC, and architectural hardware, positioning MEA as a key emerging consumption center.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Brass Rods Market.- Mueller Industries

- Wieland Werke AG

- Viohalco S.A.

- KME Group

- Lebronze Alloys

- Chase Brass

- Aviva Metals

- National Metal Industries

- Kamman Group

- Grillo Werke AG

- Marmon/Keystone LLC

- Cuprom S.A.

- San-Etsu Metals Co., Ltd.

- MKM Mansfelder Kupfer und Messing GmbH

- Luvata Oy

- Bharat Metal Corporation

- Metrod Holdings Berhad

- Tase Copper

- Rajoo Engineers Limited

- PMX Industries Inc.

- Ningbo Jintian Copper (Group) Co., Ltd.

- Shanghai Metal Corporation

- Jiangsu Changbao Steel Tube Co., Ltd.

- Tongling Nonferrous Metals Group Co., Ltd.

- Hindalco Industries Limited

Frequently Asked Questions

Analyze common user questions about the Brass Rods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Brass Rods Market?

The Brass Rods Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period spanning from 2026 to 2033, driven by increasing industrial application and infrastructure development globally.

Which application segment primarily drives the demand for Free Cutting Brass Rods?

Free Cutting Brass Rods are primarily demanded by manufacturers in the automotive and industrial machinery sectors for producing high-volume, precision-engineered components, such as fittings, connectors, and highly machined parts, due to their superior machinability and reduced cycle times.

How do global regulations impact the future of brass rod manufacturing?

Global regulations, notably environmental mandates concerning lead content (e.g., in North America and Europe), are significantly impacting manufacturing by necessitating a transition toward specialized lead-free and low-leaded brass alloy production, requiring substantial investment in new processing technologies.

Which geographical region holds the largest market share for brass rods?

The Asia Pacific (APAC) region currently holds the largest market share for brass rods, attributable to extensive infrastructure projects, robust growth in the construction and manufacturing industries, and rapid industrialization across major economies like China and India.

What are the primary raw material concerns affecting the Brass Rods Market?

The primary concern involves the significant price volatility of key raw materials, specifically copper and zinc. These fluctuations directly impact the input costs for manufacturers, necessitating strategic procurement, effective hedging, and increased reliance on recycled brass scrap to stabilize production economics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lead Free Brass Rods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Lead Free Brass Rods Market Size Report By Type (Cu-Zn-Bi, Cu-Zn-Si, Cu-Zn-Sb, Others), By Application (Electrical and Telecommunications Industry, Transportation Industry, Bathroom, Drinking Water Engineering Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- High Tensile Brass Rods Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thickness<100mm, 100-200mm, Thickness>200mm), By Application (Free Cutting Brass Rods, Fasteners, gears, architectural extrusions, Automotive engineering parts, Pressing materials like knobs, hardware, Bending, hot forging and other applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Forging Brass Rods Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thickness<100mm, 100-200mm, Thickness>200mm), By Application (Free Cutting Brass Rods, Fasteners, gears, architectural extrusions, Automotive engineering parts, Pressing materials like knobs, hardware, Bending, hot forging and other applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Naval Brass Rods Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thickness<100mm, 100-200mm, Thickness>200mm), By Application (Free Cutting Brass Rods, Fasteners, gears, architectural extrusions, Automotive engineering parts, Pressing materials like knobs, hardware, Bending, hot forging and other applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager