Calcium Silicate Boards Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441909 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Calcium Silicate Boards Market Size

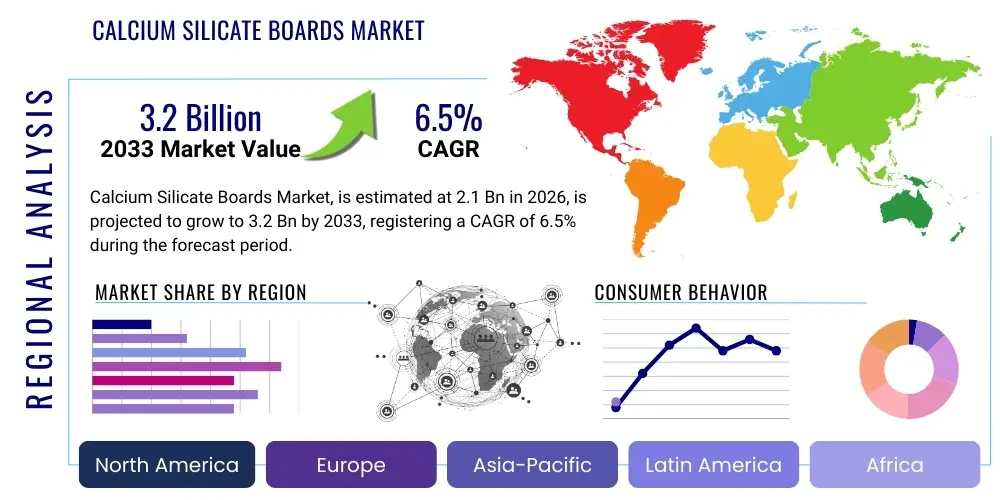

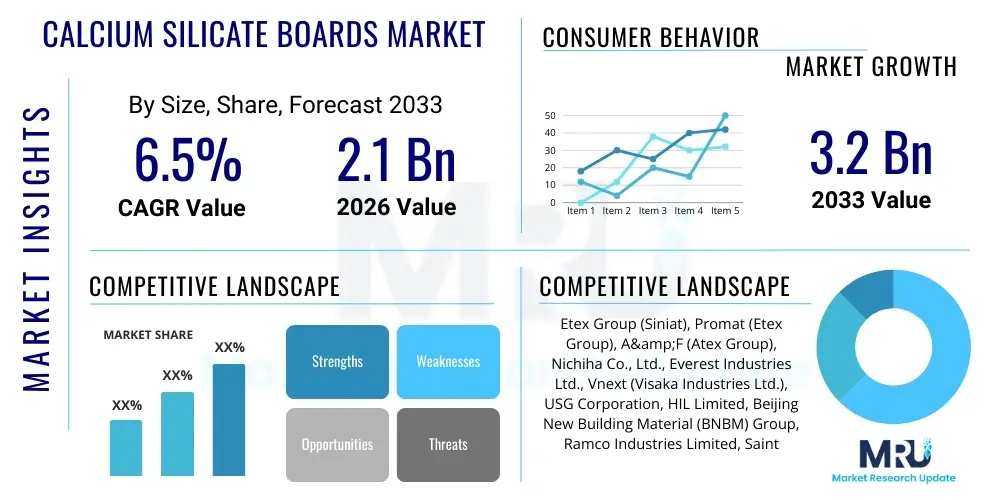

The Calcium Silicate Boards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Calcium Silicate Boards Market introduction

Calcium Silicate Boards (CSB) represent a crucial material in the contemporary construction and industrial insulation sectors, characterized by their high performance in thermal insulation, fire resistance, and dimensional stability. These boards are primarily composed of silica, lime, and cellulose fibers, processed through an autoclaving method that yields a lightweight yet durable product. The inherent non-combustibility and excellent moisture resistance of CSBs make them indispensable in applications where safety and longevity are paramount, positioning them as superior alternatives to traditional gypsum boards or plywood in certain demanding environments. Market growth is fundamentally tied to the accelerating global construction activities, particularly in emerging economies where rapid urbanization necessitates reliable, standardized building materials.

Product descriptions of modern CSBs emphasize customizable densities and thicknesses tailored for specific uses, ranging from external cladding systems to internal partitioning and ceiling installations. A significant driver for their adoption is the stringent regulatory environment worldwide, which increasingly mandates the use of fire-rated materials in commercial, high-rise, and public infrastructure projects. Furthermore, the growing focus on energy-efficient buildings has bolstered the demand for CSBs due to their commendable thermal performance, contributing significantly to reduced heating and cooling loads over the lifecycle of a structure. This dual advantage—superior safety features combined with energy savings—underpins the material's increasing market penetration across diverse geographical regions.

Major applications span residential construction, commercial buildings (offices, hotels, retail), and highly specialized industrial settings such, as power plants and petrochemical facilities, where high-temperature insulation is critical. The versatility of CSBs allows them to be used effectively as subflooring, exterior wall sheathing, roof decks, and for passive fire protection in critical structural elements. Key benefits driving market expansion include their resistance to pests, fungi, and mold, ease of installation, and environmental profile, often incorporating recycled materials and low-toxicity components. The driving factors are intrinsically linked to sustainable building trends, infrastructure investment, and evolving fire safety standards globally.

Calcium Silicate Boards Market Executive Summary

The Calcium Silicate Boards Market is poised for robust expansion, driven primarily by favorable macroeconomic factors such as increasing global infrastructure spending and evolving regulatory frameworks favoring fire-resistant and sustainable building practices. Business trends indicate a strong focus on product innovation, particularly the development of high-density boards for structural applications and lighter-weight panels optimized for non-load bearing interior finishes. Key market players are intensifying their supply chain optimization efforts and focusing on vertical integration to maintain cost competitiveness amidst fluctuating raw material prices (silica and lime). Strategic mergers, acquisitions, and technological partnerships aimed at expanding geographical footprint and diversifying product portfolios remain central to the competitive strategy across leading firms.

Regionally, the Asia Pacific (APAC) stands out as the predominant growth engine, fueled by massive residential and commercial construction booms in countries like China, India, and Southeast Asian nations, where urbanization rates are highest. North America and Europe demonstrate mature market conditions but exhibit steady demand driven by renovation projects, strict energy efficiency codes, and the replacement of older, non-compliant building materials. Emerging regional trends involve substantial investment in manufacturing capacity in the Middle East and Africa (MEA) to serve rapidly developing construction markets, often focusing on high-insulation CSBs suitable for extreme climatic conditions. Furthermore, governmental initiatives promoting affordable housing compliant with modern safety standards significantly impact demand patterns across all major regions.

Segment trends reveal that the use of High-Density CSBs is rapidly increasing in industrial and high-rise commercial structures due to stringent load-bearing and fire compartmentalization requirements. Conversely, Medium and Low-Density boards maintain strong demand in standard residential and interior applications, valued for their lightweight nature and ease of handling. The application segment analysis highlights commercial construction maintaining the largest market share, though industrial applications, driven by petrochemical and power generation sectors needing high-temperature insulation, are witnessing the highest CAGR due to specialized product requirements. The market's resilience is supported by the diversified end-use base, mitigating risks associated with cyclical downturns in any single construction segment.

AI Impact Analysis on Calcium Silicate Boards Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Calcium Silicate Boards Market typically revolve around three core themes: optimization of manufacturing processes, predictive maintenance for production lines, and AI-assisted design and material specification within the construction ecosystem. Users frequently ask if AI can reduce the energy consumption associated with the high-temperature autoclaving process, a major cost component in CSB production. Concerns also focus on how predictive analytics can minimize defects, ensuring the high quality and uniformity required for specialized fire-rated applications. Expectations are high concerning the integration of AI tools (like Generative Design) into Building Information Modeling (BIM) workflows, enabling automated selection of the optimal type and thickness of CSB based on project-specific thermal, acoustic, and fire safety requirements, thereby enhancing efficiency and reducing material waste on site.

The practical application of AI in this sector is currently focused on enhancing operational efficiency and material quality control. Machine learning algorithms are being deployed to analyze real-time data collected from sensors within the autoclaves and mixing equipment. These algorithms optimize parameters such as temperature, pressure, and curing time, which directly influence the finished board's density and structural integrity, ensuring adherence to strict performance specifications. This optimization leads to reduced cycle times, lower energy use per unit produced, and a more consistent product outcome, directly addressing the common user concern about manufacturing efficiency and cost reduction.

Furthermore, AI is instrumental in supply chain resilience. Predictive analytics models analyze raw material availability, logistics bottlenecks, and demand forecasts across different geographical markets. This allows manufacturers to proactively manage inventory levels of lime, silica, and fibers, mitigating risks associated with supply volatility and ensuring timely delivery to large construction projects. In the quality assurance phase, image recognition systems powered by deep learning scrutinize manufactured boards for surface defects, cracks, or inconsistencies that might compromise fire rating or structural performance far more reliably than manual inspection, setting a new benchmark for product quality in the market.

- AI-driven optimization of autoclaving processes to reduce energy consumption and improve curing efficiency.

- Predictive maintenance analytics minimizing unscheduled downtime in manufacturing plants.

- Machine learning algorithms enhancing quality control by analyzing material composition and defect detection.

- Integration of AI into BIM software for automated material selection based on fire and thermal performance criteria (Generative Design).

- Optimization of complex logistics and supply chain management for raw materials (silica, lime).

- Simulation models predicting material performance under extreme fire and moisture conditions, accelerating R&D cycles.

DRO & Impact Forces Of Calcium Silicate Boards Market

The Calcium Silicate Boards Market dynamics are heavily influenced by a confluence of accelerating drivers, critical restraints, and substantial growth opportunities. The primary driver is the global emphasis on enhancing fire safety standards in infrastructure, particularly following high-profile incidents that exposed deficiencies in non-compliant materials. This regulatory push, especially in developed markets (Europe and North America) and increasingly in rapidly urbanizing APAC countries, compels developers to specify CSBs for their superior non-combustible properties. Concurrently, the sustainable construction movement provides another significant impetus, as CSBs are often viewed favorably due to their inert, mineral composition and long lifespan, aligning with green building certifications like LEED and BREEAM. These drivers collectively create a robust foundational demand, ensuring sustained growth regardless of minor cyclical fluctuations in the overall construction sector.

However, the market faces notable restraints that temper its growth potential. The most significant constraint is the high initial manufacturing cost associated with the autoclaving process, which requires substantial energy input and capital investment, leading to higher price points compared to conventional alternatives such as standard gypsum board. This cost sensitivity particularly affects adoption rates in price-competitive developing markets. Furthermore, the availability and transportation costs of key raw materials, namely high-purity silica and lime, often present logistical and economic challenges, especially in regions lacking localized supply chains. Competitive threats from advanced material substitutes, such as Magnesium Oxide (MgO) boards and specialized cement fiberboards, also pose a challenge, forcing CSB manufacturers to continually justify the premium price based on superior, verifiable performance data.

Opportunities for expansion are abundant, centered on product diversification and geographical penetration. There is a burgeoning opportunity in the niche markets of acoustic insulation and structural reinforcement systems where specific CSB formulations can provide multi-functional benefits, transcending simple fire protection. Furthermore, the massive global market for prefabricated and modular construction offers fertile ground for CSBs, as their lightweight and easy-to-install properties are ideally suited for factory-controlled, high-speed assembly processes. Leveraging new chemical compositions to enhance flexibility or moisture resistance, coupled with targeted market entry strategies into underserved regions in Africa and Latin America, represents tangible pathways for long-term growth. The strategic interaction of these forces defines the current competitive landscape and future trajectory of the market.

Segmentation Analysis

The Calcium Silicate Boards market segmentation provides a granular view of demand patterns based on density, application, and end-use. Density is a critical differentiating factor, directly correlating with the board's mechanical strength, thermal properties, and suitability for specific environments. High-density boards (typically exceeding 1,000 kg/m³) are favored for high-performance structural and heavy-duty industrial applications requiring maximum durability and fire resistance, whereas medium and low-density boards are optimized for general thermal insulation and non-structural interior finishes. This stratification allows manufacturers to precisely target different segments of the construction industry with optimized product specifications.

Application segmentation typically divides the market into interior applications (walls, ceilings, partitions), exterior applications (cladding, facades), and specialized industrial uses (furnace insulation, pipe insulation). The largest revenue share often falls within interior applications due to the widespread necessity for fire-rated partitions in all types of buildings, but exterior applications are showing significant momentum driven by aesthetic versatility and robust weather resistance requirements. The end-use analysis—covering commercial, residential, and industrial construction—confirms commercial infrastructure (offices, retail, healthcare) remains the primary consumer segment globally, though residential use is accelerating due to rising disposable incomes and stricter housing safety codes in emerging economies.

- By Density:

- Low Density (Used primarily for non-structural thermal insulation and false ceilings)

- Medium Density (Balanced for interior partitioning and moderate fire protection)

- High Density (Heavy-duty applications, structural sheathing, and industrial fire protection)

- By Application:

- Interior Applications (Partitions, Ceilings, Drywall systems)

- Exterior Applications (Facades, Cladding, Weatherproofing)

- Industrial Insulation (High-temperature insulation in furnaces, kilns, and pipelines)

- By End-Use Sector:

- Residential Construction

- Commercial Construction (Offices, Retail, Hospitality)

- Industrial Construction (Power Plants, Manufacturing Units, Petrochemical)

- Infrastructure (Tunnels, Airports, Railways)

Value Chain Analysis For Calcium Silicate Boards Market

The value chain for Calcium Silicate Boards commences with the upstream extraction and processing of core raw materials: high-purity silica (sand or fly ash), lime (calcium hydroxide), and reinforcing cellulose fibers. The quality and stable supply of these inputs are paramount, as variations directly impact the final product's performance characteristics, such as density and fire rating. Key suppliers in the upstream segment are specialized mining and chemical companies. Manufacturers often seek long-term contracts or pursue backward integration to stabilize costs and ensure consistent quality, particularly for the specific grades of silica required for the autoclaving process. Efficiency in milling and mixing these raw ingredients constitutes a critical initial step in managing overall production costs and energy consumption.

The core manufacturing stage involves the hydrothermal synthesis and autoclaving of the mixed slurry under high pressure and temperature, transforming the raw materials into rigid calcium silicate hydrate structures. This phase is characterized by significant capital expenditure and high fixed operating costs due to the required sophisticated machinery and intense energy use. Downstream activities involve finishing, cutting, shaping, and packaging the boards according to standard sizes and specific customer requirements. Quality assurance and certification processes, particularly compliance with international fire safety and mechanical standards (e.g., ISO, ASTM, CE markings), add substantial value and are essential for market acceptance, particularly in highly regulated construction markets.

Distribution channels are multifaceted, utilizing both direct and indirect routes. Direct sales are common for large industrial projects and major commercial developers, allowing manufacturers to offer technical support and specialized installation guidance. Indirect distribution relies heavily on partnerships with wholesale distributors, specialized building material retailers, and large format hardware chains, which facilitate market penetration into the residential and smaller-scale commercial renovation sectors. Effective logistical management is crucial, as CSBs, while durable, are bulky and require specialized handling to prevent damage during transit, especially over long distances. Optimized inventory management across the distribution network is necessary to meet fluctuating regional construction demand efficiently.

Calcium Silicate Boards Market Potential Customers

The primary consumers and end-users of Calcium Silicate Boards are professional entities within the global construction, engineering, and industrial maintenance sectors. General contractors and large-scale residential developers constitute a significant customer base, demanding substantial volumes of CSBs for fireproofing, moisture control, and thermal envelope creation in new housing and apartment projects. Architectural and design firms act as crucial specifiers, integrating CSBs into structural plans based on performance requirements, making them indirect but highly influential customers who define product choice during the early design phase of commercial and high-rise developments.

Furthermore, owners and operators of specialized industrial facilities form a high-value customer segment. This includes petrochemical plants, oil refineries, thermal and nuclear power generation facilities, and heavy manufacturing units. These end-users require CSBs for critical high-temperature insulation and passive fire protection systems that must withstand extreme conditions and meet stringent safety standards (e.g., in furnace linings or pipe insulation). Their purchasing decisions are driven less by price and more by verifiable performance, longevity, and compliance certifications, demanding specialized, high-density industrial-grade products tailored for continuous operation at elevated temperatures. This segmentation highlights the diverse functional demands placed upon the material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Etex Group (Siniat), Promat (Etex Group), A&F (Atex Group), Nichiha Co., Ltd., Everest Industries Ltd., Vnext (Visaka Industries Ltd.), USG Corporation, HIL Limited, Beijing New Building Material (BNBM) Group, Ramco Industries Limited, Saint-Gobain, CSR Limited, Scangroup, Lloyd Insulations, Skamol A/S, Microtherm Group, Toray Industries, Inc., China Fibre Cement, Kalsi, Johns Manville. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Silicate Boards Market Key Technology Landscape

The technological landscape of the Calcium Silicate Boards market is defined by continuous process refinements aimed at improving performance characteristics while simultaneously addressing the high energy intensity of production. A key focus remains on optimizing the hydrothermal synthesis (autoclaving) process. Advanced automation systems and real-time sensor integration are now standard, ensuring precise control over curing temperatures and pressures. This level of precision is vital for creating the desired crystal structure (primarily tobermorite) that imparts the board’s exceptional heat and fire resistance. Innovative methods include utilizing mineralizers to accelerate the hydration process, reducing curing time, and thus lowering overall operational costs, making CSBs more competitive against alternative building materials.

Material science innovation is also driving the market forward, specifically through the modification of raw material inputs. Manufacturers are increasingly exploring the substitution of traditional silica with industrial by-products such as fly ash and ground granulated blast-furnace slag (GGBS). This not only offers a sustainable component by utilizing waste materials but can also subtly alter the resulting board properties, potentially enhancing strength or reducing density without sacrificing fire resistance. Furthermore, the development of specialized reinforcing fibers—moving beyond standard cellulose to include synthetic fibers or micro-reinforcements—is crucial for developing high-flexibility and crack-resistant CSBs suitable for seismic zones or challenging external cladding applications where material movement is a concern. The integration of hydrophobic additives during the mixing stage is another crucial technology, dramatically improving the board’s moisture resistance and suitability for wet areas.

In terms of product finishing, manufacturers are leveraging advanced surface treatment technologies. This includes specialized coatings and primers applied post-production that enhance UV resistance, paint adhesion, and overall aesthetic quality for exterior applications, expanding the material's usability as a visible facade material. Digital manufacturing, including precision cutting and pre-drilling using CNC machines, enables rapid, accurate production of custom-sized panels for modular construction projects, minimizing on-site waste and installation time. The combination of sustainable material inputs, precise manufacturing controls, and advanced surface finishing technologies collectively defines the cutting edge of the CSB market, prioritizing performance, efficiency, and environmental compliance.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and competitive structure of the Calcium Silicate Boards Market, with each major geographical area presenting unique opportunities and regulatory drivers. Asia Pacific (APAC) currently dominates the global market share and is expected to maintain the highest growth rate throughout the forecast period. This dominance is attributed to massive governmental spending on infrastructure development, rapid urbanization, and a burgeoning middle class driving residential construction in economies like China, India, and Indonesia. Furthermore, stricter enforcement of building codes related to fire safety in high-density urban areas, often modeled after international standards, significantly boosts the demand for high-performance, non-combustible materials like CSBs. Local production capacities are rapidly expanding to meet this exponential demand, often focusing on cost-effective, medium-density boards for general construction.

North America and Europe represent mature markets characterized by steady, stable demand driven primarily by renovation, retrofitting, and rigorous energy efficiency mandates. In Europe, the Energy Performance of Buildings Directive (EPBD) strongly encourages the use of highly insulating materials, positioning CSBs favorably for exterior insulation and finish systems (EIFS) and internal thermal bridging solutions. The focus here is less on sheer volume growth from new construction and more on specialized, high-specification products that offer enhanced thermal and acoustic performance. Regulatory bodies in both regions continuously update fire and safety standards, necessitating the replacement of legacy materials with certified CSBs, thereby providing consistent, albeit moderate, market growth.

Latin America (LA) and the Middle East & Africa (MEA) are emerging as high-potential regions. In the MEA, particularly the Gulf Cooperation Council (GCC) states, large-scale commercial and mixed-use megaprojects—often operating under extreme climatic conditions—demand durable, fire-resistant, and heat-insulating materials. Government-led diversification initiatives and hosting major international events necessitate rapid, high-quality construction, fueling demand for CSBs in specialized applications like high-rise façades and internal fire separation walls. Latin America's market growth is more segmented, driven by infrastructure investment and housing initiatives in major economies like Brazil and Mexico, where improved product awareness and supply chain development are gradually accelerating the adoption of premium building materials over conventional low-cost options.

- Asia Pacific (APAC): Dominant market share and highest CAGR, driven by massive urbanization, infrastructure projects (e.g., affordable housing schemes), and increasingly stringent fire safety codes in China, India, and Southeast Asia. Focus on both volume and localized manufacturing.

- North America: Stable growth fueled by residential renovation, strict seismic requirements, and adoption of CSBs in green building certifications. Emphasis on high-performance, specialized boards for thermal envelopes and passive fire protection.

- Europe: Demand anchored by strict EU energy efficiency directives (EPBD) and high standards for non-combustible construction. Significant market activity in retrofitting historical structures and integrating CSBs into advanced EIFS systems across Western and Central Europe.

- Middle East & Africa (MEA): High growth potential linked to large-scale commercial and residential megaprojects in the GCC. Demand is concentrated on high-density boards providing superior thermal insulation and fire safety compliance necessary for hot climates.

- Latin America (LA): Gradual adoption driven by expanding commercial construction sectors and increasing awareness of long-term material benefits over immediate low cost. Growth is localized, concentrating in economic hubs that prioritize modern construction techniques.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Silicate Boards Market.- Etex Group (Siniat, Promat)

- Nichiha Co., Ltd.

- Everest Industries Ltd.

- Vnext (Visaka Industries Ltd.)

- HIL Limited

- Beijing New Building Material (BNBM) Group

- Ramco Industries Limited

- Saint-Gobain

- CSR Limited

- Skamol A/S

- Microtherm Group

- Toray Industries, Inc.

- China Fibre Cement

- Kalsi

- Johns Manville

- Lloyd Insulations

- Scangroup

- USG Corporation

- A&F (Atex Group)

- Hebei Jiemai Building Materials Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Calcium Silicate Boards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Calcium Silicate Boards and traditional gypsum boards?

The primary difference lies in fire resistance and moisture performance. Calcium Silicate Boards (CSBs) are non-combustible and offer superior fire ratings (up to 4 hours or more) and excellent resistance to water and mold. Gypsum boards, while common and inexpensive, are not non-combustible and degrade quickly when exposed to significant moisture or prolonged fire conditions, limiting their use in high-risk or wet environments.

In which end-use sector is the demand for High-Density Calcium Silicate Boards highest?

The demand for High-Density Calcium Silicate Boards is highest in the Industrial Construction and Specialized Commercial sectors. These boards are required for passive fire protection in critical areas, such as high-temperature industrial insulation (furnaces, refineries) and structural sheathing in high-rise commercial buildings where superior mechanical strength and certified fire compartmentalization are essential.

How do global sustainability trends influence the Calcium Silicate Boards Market?

Sustainability trends significantly influence the market by favoring CSBs due to their inert mineral composition, durability, and potential for incorporating recycled industrial waste (like fly ash). Their superior thermal insulation properties directly contribute to energy-efficient building designs, making them preferred materials for projects aiming for green building certifications (e.g., LEED, BREEAM), thus driving adoption over less eco-friendly alternatives.

Which region is expected to lead the growth of the Calcium Silicate Boards Market through 2033?

The Asia Pacific (APAC) region is expected to lead the market growth through 2033, driven by unparalleled levels of urbanization, massive government investment in new infrastructure, and the continuous implementation and enforcement of stricter fire and building safety standards across major developing economies, particularly China and India.

What are the main technical challenges facing CSB manufacturers?

The main technical challenges center on managing the high energy costs associated with the autoclaving process and ensuring consistent, high-quality raw material supply (silica and lime). Manufacturers must also continuously innovate to develop cost-competitive products that meet increasingly complex performance demands related to flexibility, lighter weight, and improved hydrothermal stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Non-asbestos Calcium Silicate Boards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Calcium Silicate Boards Market Size Report By Type (High Density, Medium Density, Low Density), By Application (Commercial Buildings, Industrial Buildings, Residential Construction), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager