Cardiac Cath Lab Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443588 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Cardiac Cath Lab Market Size

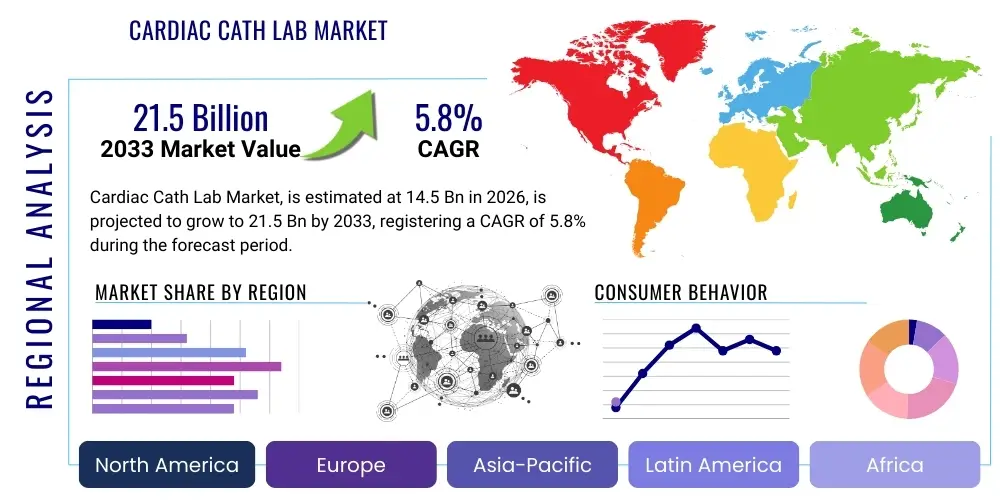

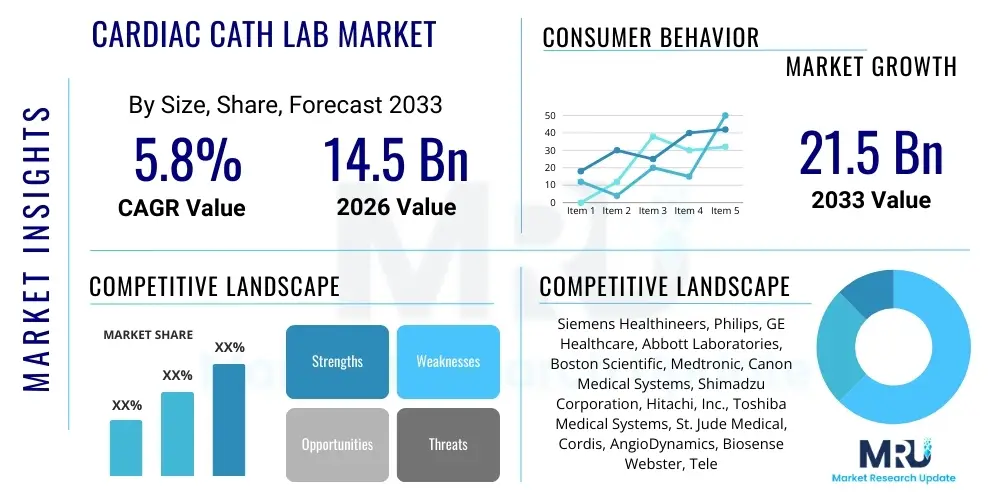

The Cardiac Cath Lab Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $21.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global incidence of cardiovascular diseases (CVDs), the rapid adoption of minimally invasive procedures, and continuous technological advancements enhancing diagnostic precision and procedural safety.

Cardiac Cath Lab Market introduction

The Cardiac Catheterization Laboratory (Cath Lab) Market encompasses the specialized equipment, systems, and consumables required for invasive and interventional cardiology procedures, including diagnosis and treatment of structural heart disease and coronary artery disease. These technologically advanced facilities house sophisticated imaging systems, hemodynamic monitoring devices, and various specialized catheters and stents, enabling physicians to perform complex procedures such as Percutaneous Coronary Intervention (PCI), electrophysiology studies, and complex structural heart interventions with high precision. The core product category includes angiography systems, intravascular ultrasound (IVUS), fractional flow reserve (FFR) measuring devices, and robotic navigation systems, all contributing to optimized patient outcomes.

Major applications of Cath Labs span across therapeutic interventions for acute myocardial infarction, chronic stable angina, and increasingly, complex structural heart repairs like Transcatheter Aortic Valve Replacement (TAVR) and Mitral Clip procedures. The primary benefit of utilizing Cath Labs is the shift from highly invasive open-heart surgery to minimally invasive techniques, which results in reduced patient recovery times, lower infection rates, and shorter hospital stays, thereby decreasing overall healthcare expenditure. Furthermore, advanced Cath Labs offer superior real-time imaging capabilities, allowing for precise placement of devices and immediate assessment of treatment efficacy, leading to improved prognosis and quality of life for cardiac patients.

The principal driving factors fueling market growth include demographic shifts, particularly the global aging population, which is highly susceptible to cardiac ailments, coupled with lifestyle changes leading to higher prevalence of risk factors such as hypertension, diabetes, and obesity. Additionally, increasing healthcare expenditure, particularly in emerging economies focused on modernizing medical infrastructure, significantly contributes to the installation and upgrade of advanced Cath Labs. Government initiatives supporting cardiac health awareness programs and reimbursement policies favoring interventional cardiology procedures further solidify the market's positive trajectory, making the implementation of state-of-the-art Cath Lab facilities a critical strategic priority for major hospital networks globally.

Cardiac Cath Lab Market Executive Summary

The Cardiac Cath Lab Market is characterized by intense technological innovation, focusing heavily on integrating artificial intelligence (AI) and robotics to enhance procedural success and workflow efficiency. Current business trends indicate a strong move toward hybrid operating rooms, which merge traditional Cath Lab imaging capabilities with surgical sterilization requirements, enabling seamless transitions between minimally invasive and open procedures. This expansion into hybrid facilities, particularly driven by the growing volume of structural heart interventions, is a key investment area for major medical device manufacturers. Furthermore, market competition is shifting toward comprehensive service contracts and integrated solutions rather than just hardware sales, forcing key players to offer continuous software upgrades, training, and robust clinical support to maintain competitive advantage in a complex procurement environment.

Regionally, North America maintains the largest market share due to established healthcare infrastructure, high awareness regarding advanced cardiac treatments, and significant reimbursement rates for interventional procedures. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), propelled by massive investments in healthcare infrastructure development, growing medical tourism, and a rapidly expanding middle class demanding access to advanced cardiac care in countries like China and India. European markets, while mature, are focusing on adopting regulatory-compliant, low-dose radiation imaging systems, driven by stringent safety mandates and public health policies aimed at reducing radiation exposure for both patients and clinical staff during lengthy procedures.

Segment trends reveal that the Equipment segment, specifically sophisticated Angiography Systems (C-arms), holds the dominant revenue share, largely due to high capital expenditure associated with initial setup and periodic replacement cycles. Within the procedure segment, the structural heart disease intervention category is experiencing exponential growth, outpacing traditional Coronary Angiography procedures, fueled by regulatory approvals and clinical data supporting TAVR and other minimally invasive valve treatments. End-user trends show hospitals remaining the largest consumer group, though the market penetration of Ambulatory Surgical Centers (ASCs) for routine diagnostic procedures is increasing, driven by cost-effectiveness and efficiency demands within decentralized healthcare models, posing a minor disruptive force to traditional hospital-centric service delivery models.

AI Impact Analysis on Cardiac Cath Lab Market

User inquiries regarding AI's influence in the Cardiac Cath Lab primarily revolve around three critical themes: procedural efficiency, diagnostic accuracy enhancement, and potential for workflow automation and staff resource optimization. Users are keen to understand how AI algorithms can reduce fluoroscopy time and radiation dosage, thereby improving safety for both patients and operators. Concerns often focus on the validation and regulatory approval processes for AI-driven diagnostic tools, particularly in complex areas like risk stratification and real-time image analysis. Expectations center on AI becoming an integrated, indispensable co-pilot in the Cath Lab, facilitating rapid decision-making, predictive maintenance of equipment, and standardized reporting, ultimately aiming to lower procedural variability and improve overall clinical outcomes in high-volume settings.

The integration of artificial intelligence is fundamentally transforming procedural workflows in the Cath Lab environment, moving beyond simple image enhancement to sophisticated predictive modeling. AI-powered algorithms are increasingly used to analyze intravascular images (IVUS and OCT), segmenting vessels, characterizing plaque morphology, and calculating metrics like fractional flow reserve (FFR) surrogates (e.g., QFR or vFFR) with exceptional speed and objectivity, assisting cardiologists in immediate decision-making regarding stent size and placement strategy. Furthermore, AI systems are being deployed to optimize resource allocation and scheduling, predicting potential procedural delays based on historical data and patient complexity, ensuring that expensive lab time is used maximally efficiently, which directly impacts the financial sustainability of interventional programs.

AI also plays a crucial role in post-procedural analysis and long-term patient management. Machine learning models are analyzing vast databases of patient outcomes, procedural variables, and imaging data to refine risk prediction models for major adverse cardiac events (MACE), allowing for highly personalized follow-up care plans and drug regimens. This shift towards predictive and personalized medicine, supported by intelligent data processing within the Cath Lab context, promises not only improved patient safety but also a powerful mechanism for quality assurance and continuous improvement within cardiac centers. However, data security and ensuring the transparency and explainability of AI recommendations remain critical concerns requiring robust governance frameworks before widespread, complete clinical trust can be achieved across all global regions.

- AI optimizes fluoroscopy image quality and reduces radiation dose exposure.

- Machine learning algorithms enhance diagnostic accuracy in IVUS/OCT image analysis and plaque characterization.

- Predictive analytics aid in patient risk stratification and personalized treatment planning.

- AI-driven robotic guidance systems enable precise catheter manipulation and positioning.

- Automation streamlines procedural documentation and reduces reporting burden on clinicians.

- AI tools optimize Cath Lab scheduling and resource management, improving operational efficiency.

DRO & Impact Forces Of Cardiac Cath Lab Market

The market for Cardiac Cath Labs is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces shaping investment decisions and technological focus across the industry. Key drivers, such as the alarming increase in chronic cardiovascular diseases worldwide, specifically heart attacks and structural heart defects, generate consistent demand for advanced interventional solutions. Coupled with continuous innovations in stent technology and catheter-based valve replacement devices, these drivers necessitate the installation and frequent technological upgrade of high-capacity Cath Labs capable of handling increasingly complex procedures. The expanding adoption of minimal access techniques over traditional open surgery further reinforces the necessity of these specialized units.

Conversely, significant restraints hinder growth, primarily centered around the exceptionally high capital investment required for purchasing and installing cutting-edge Cath Lab systems, which can be prohibitive for smaller healthcare facilities or those in developing regions. Furthermore, the specialized nature of these procedures demands highly skilled and trained personnel, leading to a global shortage of qualified interventional cardiologists, radiologic technologists, and nurses, which limits the operational capacity of installed labs. Regulatory hurdles and the complexity of securing favorable reimbursement for novel, high-cost structural heart interventions also pose challenges, potentially slowing down the adoption rate of the newest equipment in certain national health systems.

Opportunities for market stakeholders are substantial, particularly in the emerging trend of developing and integrating sophisticated hybrid Cath Labs that support both interventional and surgical needs, tapping into the burgeoning field of structural cardiology. Another major opportunity lies in the burgeoning markets of Asia Pacific and Latin America, where rapidly modernizing healthcare infrastructure and increasing disposable incomes create a fertile ground for new installations. The focus on remote monitoring technologies and tele-consultation capabilities, facilitated by robust connectivity within the Cath Lab environment, also offers avenues for improving patient access and providing expert support in geographically constrained areas, thus maximizing the reach and utilization of existing high-value assets across hospital networks.

Segmentation Analysis

The Cardiac Cath Lab Market is comprehensively segmented across product type, procedural application, and end-user facility, allowing for a detailed understanding of market dynamics and revenue generation streams. The analysis reveals distinct growth patterns within each category, largely influenced by technological lifecycles, evolving clinical guidelines, and healthcare expenditure allocation. The distinction between capital equipment and consumables is critical for revenue forecasting, as equipment sales drive large, initial investments, while the disposable segments (catheters, guide wires, contrast agents) ensure consistent, recurring revenue throughout the equipment's lifespan, tightly linked to procedural volume. The shift toward non-coronary interventions, particularly electrophysiology and structural procedures, is fundamentally reshaping the dominance structure across application segments, compelling manufacturers to diversify their product portfolios.

- Product Type:

- Equipment (Angiography Systems, Intravascular Ultrasound (IVUS) Devices, Optical Coherence Tomography (OCT) Devices, Hemodynamic Monitoring Systems, Electrophysiology Devices, Ablation Systems, Robotic Catheter Systems)

- Consumables (Guide Wires, Catheters, Balloons, Stents, Contrast Agents, Accessories)

- Procedure:

- Coronary Interventions (Angiography, Percutaneous Coronary Intervention (PCI))

- Structural Heart Interventions (TAVR, Mitral Valve Repair, PFO/ASD Closure)

- Electrophysiology Procedures (Ablation, Pacemaker/ICD Implantation)

- Neurovascular Procedures (Peripheral Interventions are sometimes included depending on scope definition)

- End-User:

- Hospitals (Public Hospitals, Private Hospitals, Academic Medical Centers)

- Ambulatory Surgical Centers (ASCs)

- Specialty Cardiac Centers

- Technology:

- Fixed Cath Labs

- Mobile Cath Labs

- Hybrid Cath Labs

Value Chain Analysis For Cardiac Cath Lab Market

The value chain for the Cardiac Cath Lab market begins with the Upstream Analysis, which encompasses the sourcing and manufacturing of high-precision components and materials. This includes specialized sensor technology, high-power X-ray tubes, advanced digital detectors, specialized alloys for catheter manufacturing, and complex software for image processing and navigation. Suppliers of these core technologies, often specialized firms in electronics and materials science, wield significant influence due to the stringent quality and regulatory requirements imposed on medical-grade components. Manufacturers often engage in long-term supply agreements to ensure consistency, mitigate supply chain risks, and maintain the complex integration necessary for reliable system performance in a clinical setting.

The midstream segment involves the original equipment manufacturers (OEMs) who design, assemble, and test the complete Cath Lab systems and associated consumables. These key players invest heavily in research and development (R&D) to integrate cutting-edge technologies like advanced robotics, low-dose imaging, and AI-driven diagnostic tools, ensuring regulatory compliance (FDA/CE Mark) before market release. Distribution channels are typically complex and rely heavily on technical expertise. Direct sales forces are preferred for high-value capital equipment (Cath Lab systems) to manage installation, customization, and long-term service contracts, ensuring direct accountability and facilitating strong relationships with hospital procurement managers and clinical leaders. This direct engagement is crucial for complex product demonstrations and tailored financing solutions.

The Downstream analysis involves the final placement and utilization of the equipment by End-Users (primarily hospitals and specialty cardiac centers). Indirect distribution channels, utilizing specialized medical equipment distributors and value-added resellers (VARs), are more frequently employed for the distribution of high-volume consumables and standardized lower-cost accessories, especially in geographically dispersed or emerging markets where the OEM may lack a strong localized footprint. Successful market penetration relies heavily on the quality of after-sales service, preventative maintenance schedules, and the provision of continuous clinical training to ensure optimal utilization of sophisticated imaging and therapeutic devices, thereby maximizing the lifetime value of the installed base and securing favorable repeat business for consumables.

Cardiac Cath Lab Market Potential Customers

The primary customers for Cardiac Cath Lab systems and associated consumables are healthcare delivery organizations focused on cardiology and cardiovascular surgery. This segment is dominated by large, tertiary care hospitals and academic medical centers (AMCs), which serve as critical hubs for complex cardiac procedures, clinical research, and training. These institutions require the highest specification, multi-purpose Cath Labs, often opting for hybrid configurations capable of supporting structural heart programs and advanced electrophysiology. Their purchasing decisions are driven by the need for cutting-edge technology, integration capabilities with electronic health records (EHRs), patient safety features (low-dose radiation), and the ability to attract top-tier interventional specialists.

A rapidly growing segment of potential customers includes specialized cardiac centers and large private hospital chains focusing exclusively on cardiovascular care. These facilities prioritize operational efficiency, patient throughput, and the ability to deliver cost-effective, high-quality interventions in a dedicated environment. They often require customized solutions that balance high technology performance with faster installation times and predictable maintenance costs, focusing on systems that minimize downtime. The acquisition strategy for this group often involves standardized deployment across multiple sites to leverage economies of scale in procurement and training, making them attractive targets for comprehensive service package offerings from major vendors.

Lastly, Ambulatory Surgical Centers (ASCs) are emerging as critical potential customers, particularly in mature markets like North America, for standardized, less complex diagnostic angiography procedures and routine device implantations (e.g., pacemakers). Although ASCs typically require smaller-footprint and less complex imaging systems compared to hybrid hospital labs, their purchasing is driven intensely by cost-efficiency, fast turnaround times, and ease of use. As outpatient cardiology procedures gain acceptance and favorable reimbursement, the ASC segment presents a significant opportunity for vendors offering scalable, cost-effective Cath Lab solutions optimized for high-volume, streamlined operations outside the traditional hospital setting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $21.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Healthineers, Philips, GE Healthcare, Abbott Laboratories, Boston Scientific, Medtronic, Canon Medical Systems, Shimadzu Corporation, Hitachi, Inc., Toshiba Medical Systems, St. Jude Medical, Cordis, AngioDynamics, Biosense Webster, Teleflex, Terumo Corporation, Getinge AB, Cook Medical, B. Braun Melsungen, Johnson & Johnson |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cardiac Cath Lab Market Key Technology Landscape

The technological landscape of the Cardiac Cath Lab market is undergoing rapid evolution, moving towards integrated, image-guided platforms designed to enhance precision, reduce patient exposure, and improve workflow dynamics. A core advancement is the integration of advanced 3D volumetric imaging and navigational tools, such as Fusion Imaging, which overlays real-time fluoroscopy with pre-procedural CT or MRI data, offering interventional cardiologists a highly detailed, comprehensive view of cardiac anatomy, essential for complex structural heart interventions like TAVR and left atrial appendage closure. Furthermore, the development of specialized intra-procedural imaging modalities like Optical Coherence Tomography (OCT) and advanced Intravascular Ultrasound (IVUS) provides high-resolution cross-sectional visualization within coronary arteries, allowing for precise plaque assessment and optimal stent deployment, dramatically reducing the risk of procedural complications and improving long-term vessel patency.

Another crucial technological focus is on dose reduction and patient safety. Modern C-arm angiography systems are incorporating innovative flat-panel detectors and advanced image processing software that maintain high image quality while significantly minimizing radiation exposure for both the patient and the operating staff. Alongside this, robotic catheter systems are gaining traction, providing enhanced stability, reduced operator fatigue, and superior dexterity for navigating complex coronary and peripheral vasculature, allowing specialists to operate remotely while reducing their own exposure to scatter radiation. These robotic platforms standardize procedures and potentially broaden access to specialized care by allowing experienced surgeons to guide cases from a distance, optimizing expertise distribution.

The shift towards Hybrid Operating Rooms (Hybrid ORs) represents the paramount technological convergence, combining the high-resolution imaging capabilities of a Cath Lab with the sterile environment and full surgical support systems of an operating room. This configuration is indispensable for the growth of structural heart interventions, as it permits an immediate transition to open surgery if procedural complications arise, ensuring maximum patient safety. Furthermore, seamless data connectivity and integration of multiple monitoring systems (hemodynamics, electrophysiology mapping, and imaging) within a unified digital platform are becoming standard, powered by high-speed networks and robust cybersecurity protocols, enabling instant data access and coordinated care across multidisciplinary teams, which is foundational for modern, high-throughput cardiac centers worldwide.

Regional Highlights

Regional dynamics heavily influence the adoption rates and technological sophistication of Cardiac Cath Labs, primarily reflecting differences in healthcare spending, disease prevalence, and regulatory frameworks.

- North America (NA): Dominates the global market share, driven by high prevalence of coronary artery disease, established reimbursement infrastructure, and early adoption of premium technologies like robotic catheter systems and hybrid operating rooms. The presence of major market players and continuous investment in R&D ensure sustained market leadership, focusing on maximizing efficiency in ASCs and integrating AI for clinical decision support.

- Europe: Characterized by mature markets (Germany, UK, France) exhibiting high replacement rates of older equipment, adherence to strict radiation safety standards (driving demand for low-dose systems), and strong government support for universal cardiac care access. Growth is steady, driven primarily by structural heart interventions and the rollout of sophisticated electrophysiology labs.

- Asia Pacific (APAC): Expected to register the highest CAGR due to rapid expansion of healthcare facilities, increasing disposable income, and a large, underserved patient population in countries like China and India. Government initiatives promoting indigenous manufacturing and attracting medical tourism are catalyzing major investments in new installations, favoring both cost-effective solutions and advanced technology upgrades.

- Latin America (LATAM): Exhibits moderate growth, concentrated in major economic hubs like Brazil and Mexico. Market growth is dependent on improving economic stability and securing adequate government funding for healthcare infrastructure upgrades, with a strong demand for mobile Cath Labs to serve remote or rural populations efficiently.

- Middle East and Africa (MEA): Growth is primarily confined to GCC countries (UAE, Saudi Arabia) which invest heavily in state-of-the-art facilities and international collaborations to establish regional cardiac excellence centers. The market is highly reliant on import of Western technology and is focused on establishing comprehensive structural heart programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cardiac Cath Lab Market.- Siemens Healthineers

- Philips

- GE Healthcare

- Abbott Laboratories

- Boston Scientific

- Medtronic

- Canon Medical Systems

- Shimadzu Corporation

- Hitachi, Inc.

- Toshiba Medical Systems

- St. Jude Medical

- Cordis

- AngioDynamics

- Biosense Webster

- Teleflex

- Terumo Corporation

- Getinge AB

- Cook Medical

- B. Braun Melsungen

- Johnson & Johnson

Frequently Asked Questions

Analyze common user questions about the Cardiac Cath Lab market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Cardiac Cath Lab Market?

Market growth is predominantly driven by the increasing global prevalence of cardiovascular diseases (CVDs), rapid technological integration (e.g., AI and robotics), and the growing preference for minimally invasive interventional cardiology procedures over traditional open surgeries due to improved patient outcomes and reduced recovery times.

How is the rise of hybrid operating rooms impacting the Cath Lab industry?

Hybrid operating rooms (ORs) are significantly impacting the industry by merging traditional Cath Lab imaging capabilities with surgical sterility, enabling complex structural heart procedures (like TAVR) that require immediate surgical backup, thereby enhancing patient safety and expanding the scope of services offered by interventional cardiology departments.

Which geographical region is projected to exhibit the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive investments in healthcare infrastructure, increasing health expenditure, and the large, aging population in countries such as China and India demanding modern cardiac treatment facilities.

What is the main restraint affecting the widespread adoption of advanced Cath Labs?

The most significant restraint is the exceptionally high capital investment required for purchasing, installing, and maintaining state-of-the-art Cath Lab systems, coupled with a persistent global shortage of highly specialized interventional cardiologists and trained technical personnel necessary to operate these sophisticated systems optimally.

What emerging technologies are redefining efficiency in the Cath Lab?

Key emerging technologies redefining efficiency include Artificial Intelligence (AI) for real-time image analysis and procedural optimization, advanced 3D mapping and fusion imaging for structural heart navigation, and robotic systems that enhance catheter precision while reducing clinician exposure to radiation.

The market analysis indicates a clear trajectory toward systems offering higher levels of integration and enhanced digital capabilities, shifting the competitive focus from hardware specifications alone to comprehensive clinical solutions that incorporate predictive maintenance, integrated training modules, and robust data management platforms. This holistic approach is essential for supporting the burgeoning field of structural heart interventions and optimizing patient care pathways globally. The long-term viability of market stakeholders rests upon their ability to effectively navigate stringent regulatory environments while delivering cost-effective and clinically superior products that address the critical need for advanced cardiac diagnostics and therapeutics across diverse regional healthcare ecosystems.

Further examination into the consumable segment reveals continuous innovation in stent technology, particularly bioresorbable scaffolds and drug-eluting balloons, which require compatible high-resolution imaging systems for optimal deployment verification within the Cath Lab setting. The procedural volume growth in complex chronic total occlusion (CTO) interventions also drives demand for specialized guidewires, microcatheters, and advanced mechanical support devices (like Impella), ensuring that the recurring revenue stream from disposables remains resilient and highly correlated with increasing procedural complexity. Vendors must strategically align their consumable offerings with the latest procedural guidelines and clinical consensus reports to maintain competitive relevance in this intensely dynamic segment.

In terms of end-user preference, academic medical centers (AMCs) frequently act as early adopters and validation sites for novel technologies, leveraging their research capabilities to inform purchasing decisions that often dictate future market trends. Their focus is not just on immediate clinical efficacy but also on systems that provide exceptional teaching and research utility. Conversely, private hospitals and ASCs prioritize systems that offer rapid turnover times and streamlined workflows, emphasizing reliability and low maintenance costs to maximize operational throughput and financial returns. Understanding these nuanced purchasing drivers is essential for tailoring effective sales and marketing strategies across the diversified customer base of the Cardiac Cath Lab Market, ensuring targeted communication of value proposition specific to each facility type and its core strategic objectives.

The sustained technological arms race among key players, particularly in the realm of interventional fluoroscopy and electrophysiology mapping systems, is continually raising the performance benchmark. Current generation angiography systems boast advanced features such as automatic table movement, customizable user interfaces, and seamless integration with patient monitoring systems, designed to minimize user errors and reduce procedure setup time, thereby enhancing overall lab efficiency. This focus on workflow optimization, coupled with regulatory pressure to transition to highly efficient digital detectors, assures that the capital equipment segment will remain a major driver of overall market revenue, fueled by scheduled replacement cycles and the increasing imperative to adopt radiation-sparing technologies across developed healthcare economies.

Moreover, the macroeconomic environment, including global supply chain robustness and fluctuating exchange rates, continues to exert influence on the profitability and market positioning of major Cath Lab vendors. Disruptions related to semiconductor shortages, essential for advanced imaging processors, have previously led to delays in system delivery and installation. Companies that have successfully diversified their manufacturing base and secured resilient supply chains are better positioned to meet the accelerating demand, particularly from emerging markets that require rapid scaling of cardiac care infrastructure. Future strategies must heavily emphasize supply chain resilience and localized manufacturing footprints to mitigate geopolitical and logistical risks inherent in the complex medical device market.

Finally, the growing acceptance of remote monitoring and telehealth solutions is creating new interfaces within the Cardiac Cath Lab ecosystem. While the procedures themselves remain highly localized, pre- and post-procedural care, including patient assessment and follow-up consultation, is increasingly leveraging digital platforms. This trend indirectly influences Cath Lab operations by optimizing scheduling and reducing non-essential in-person visits, allowing the high-value physical space to be dedicated solely to complex interventional work. Consequently, the connectivity and data security standards of new Cath Lab systems are becoming crucial selling points, facilitating the integration of real-world data collection necessary for value-based healthcare models and continuous quality improvement initiatives across health systems globally.

The convergence of advanced diagnostic imaging with therapeutic intervention is defining the next generation of Cath Labs. For instance, the integration of 3D rotational angiography provides highly detailed vascular roadmaps, which is critical for complex procedures involving chronic total occlusions (CTOs) or peripheral artery disease (PAD). This capability minimizes reliance on contrast media and excessive fluoroscopy, directly translating into enhanced patient safety, especially for those with compromised renal function. Manufacturers are dedicating substantial R&D resources to perfecting these multi-modality fusion technologies, recognizing that clinical acceptance is highest for systems that reduce complexity while maintaining or improving procedural outcomes across a wide spectrum of cardiac pathologies.

The consumables sector, vital for sustaining market revenue, sees continuous innovation focused on improved trackability, steerability, and biocompatibility of specialized catheters and guide wires. The push towards smaller, lower-profile delivery systems for devices like stents and transcatheter valves allows for access through smaller femoral or radial arteries, reducing patient trauma and accelerating mobilization post-procedure. The preference for radial access over femoral access in coronary intervention, due to reduced bleeding complications, necessitates specialized equipment optimized for smaller vessel navigation, thereby creating a distinct sub-market opportunity for niche consumable suppliers focused on radial intervention tools and accessories.

Furthermore, regulatory bodies worldwide, including the FDA and EMA, are streamlining approval pathways for breakthrough medical devices, particularly those addressing structural heart diseases with high unmet needs. This acceleration of market entry for novel devices encourages manufacturers to invest heavily in clinical trials and robust post-market surveillance data collection, often facilitated by the sophisticated data capture capabilities within modern Cath Labs. The interplay between faster regulatory approval, continuous technological innovation, and strong clinical evidence generation forms a powerful feedback loop that consistently propels the Cardiac Cath Lab market forward, ensuring that patients benefit from the most current and effective treatment modalities available in interventional cardiology.

The emphasis on interoperability and vendor-neutral archives (VNAs) is becoming a strategic requirement for hospital systems purchasing new Cath Labs. Hospitals seek systems that can seamlessly communicate with existing hospital information systems (HIS), picture archiving and communication systems (PACS), and electronic health records (EHRs). This ensures that critical imaging and procedural data are instantly accessible across the healthcare enterprise, facilitating multidisciplinary consultations and enhancing billing and reporting accuracy. The lack of standardized communication protocols can significantly impede workflow, thus manufacturers providing open architecture platforms and robust integration services gain a considerable competitive edge in procurement tenders, particularly in large integrated delivery networks (IDNs).

Finally, the long-term impact of value-based care models, which prioritize patient outcomes and cost-efficiency over volume, is forcing Cath Lab operators to critically evaluate the total cost of ownership (TCO) of their equipment. This shift favors vendors who can demonstrate not only clinical superiority but also predictable maintenance costs, high reliability (minimal downtime), and proven efficiency gains that lead to lower average procedure costs. Investment in staff training and simulation-based programs, often provided by the equipment manufacturer, becomes integral to maximizing system utilization and realizing the full clinical and economic potential of advanced Cath Lab installations, securing long-term customer loyalty and sustained market growth. The complex ecosystem surrounding the Cardiac Cath Lab Market requires strategic foresight, blending technological advancement with rigorous regulatory compliance and a deep commitment to clinical efficacy and patient safety. This nuanced market environment continues to drive investment toward solutions that integrate AI, robotics, and advanced imaging modalities to tackle the increasing complexity and volume of cardiovascular interventions globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager