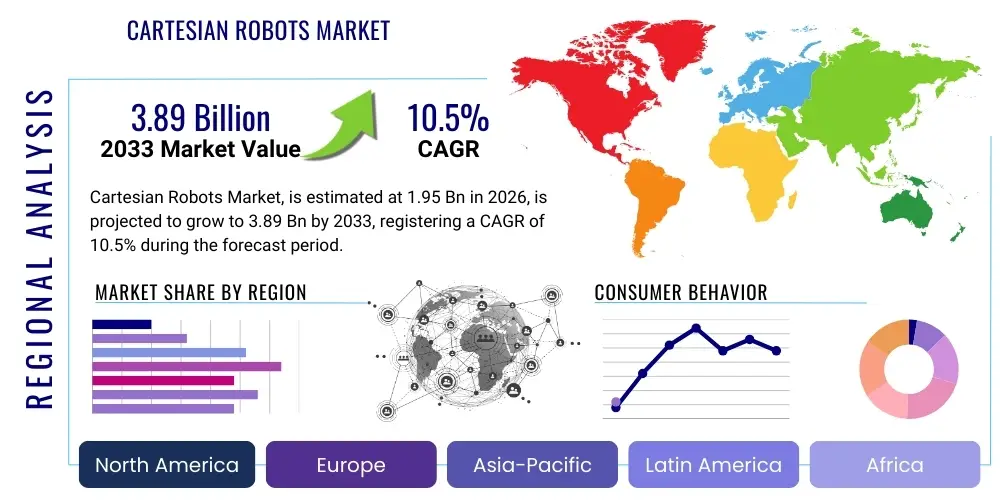

Cartesian Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442546 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Cartesian Robots Market Size

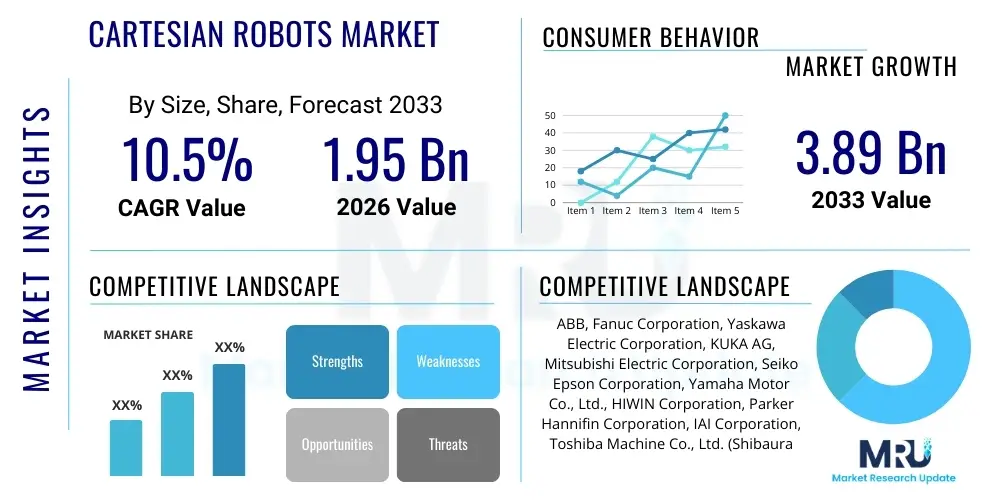

The Cartesian Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.89 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating trend of industrial automation across key manufacturing sectors, particularly electronics, automotive, and pharmaceuticals, where high precision and repeatability in linear motion tasks are paramount. The inherent structural simplicity and scalability of Cartesian systems, often referred to as gantry robots, allow for cost-effective deployment in large workspaces, making them highly attractive for material handling and assembly operations.

The growth trajectory is further supported by technological advancements focusing on enhanced speed, load capacity, and integration capabilities. Modern Cartesian systems are increasingly equipped with advanced control software and sensor technologies, allowing seamless integration into Industry 4.0 environments. Furthermore, the rising labor costs and the continuous global push for manufacturing efficiency are compelling small and medium-sized enterprises (SMEs) to adopt modular and flexible automation solutions, positioning Cartesian robots as a preferred choice over more complex articulated systems for specific linear tasks, thus driving significant market volume expansion.

Cartesian Robots Market introduction

Cartesian robots, also known as linear robots or gantry robots, are industrial manipulators characterized by three principal axes (X, Y, and Z) that are mutually perpendicular, allowing movement along straight lines within a defined rectangular envelope. These systems utilize a linear configuration for precise movement and positioning, distinguishing them from articulated or SCARA robots. Their core appeal lies in their high rigidity, exceptional repeatability, and ability to handle heavy payloads over large working areas, making them indispensable in applications requiring reliable, large-scale, and straightforward automation. Major applications span pick-and-place operations, machine tending, automated assembly, dispensing, inspection, and welding, particularly in sectors where the workspace is constrained linearly or demands overhead movement.

The primary benefits of implementing Cartesian robots include enhanced operational speed, reduced cycle times, superior precision in repetitive tasks, and reduced dependency on manual labor, leading to significant long-term cost savings. Their modular design facilitates customization and scalability, allowing manufacturers to easily adapt the system to varying production requirements without significant overhaul. Key driving factors underpinning the market include the global transition towards smart manufacturing, rapid growth in the electronics and semiconductor industries necessitating micron-level precision, and the increasing demand for high-volume, continuous production processes across Asia Pacific and emerging industrial economies.

Furthermore, the evolution of motion control systems, incorporating servo motors, linear motors, and advanced feedback mechanisms, has drastically improved the dynamic performance and efficiency of Cartesian robots. This technological maturation has expanded their applicability into demanding environments, such as clean rooms for semiconductor fabrication and hazardous environments in chemical processing. The inherent design simplicity also translates to easier maintenance and programming compared to multi-axis rotational robots, lowering the total cost of ownership and accelerating their adoption rate across diverse manufacturing verticals globally.

Cartesian Robots Market Executive Summary

The global Cartesian Robots Market is characterized by robust business trends driven by cross-industry adoption of flexible automation and integrated supply chain management solutions. Key market strategies involve developing modular components, standardized interfaces, and high-load capacity systems to cater to evolving demands in logistics and heavy machinery manufacturing. Regional trends indicate that Asia Pacific (APAC), led by China, Japan, and South Korea, dominates the market due to concentrated electronics manufacturing and high investments in industrial infrastructure. North America and Europe show steady growth, focusing on specialized, high-precision applications, particularly in medical devices and aerospace. Segment trends highlight that the material handling application segment maintains the largest market share, while the linear motor-based technology segment is poised for the highest growth rate, reflecting the industry's shift towards faster, more dynamic motion solutions.

Strategic initiatives among leading market players emphasize vertical integration, offering complete automation cells rather than just components, thereby providing comprehensive solutions tailored to specific end-user requirements. This shift towards solution-based selling improves profitability and secures long-term client relationships. Furthermore, sustainability concerns are influencing product development, with manufacturers focusing on energy-efficient designs and incorporating lightweight, durable materials to reduce operational expenditure and environmental footprint. The competitive landscape is moderately fragmented, with large automation conglomerates competing fiercely through continuous innovation in software integration and offering cloud-based monitoring and predictive maintenance services, which are critical for maximizing uptime in high-throughput production lines.

The future trajectory of the market is heavily reliant on advancements in collaborative robotics and the integration of advanced vision systems, allowing Cartesian robots to perform complex tasks requiring dynamic obstacle avoidance and adaptive path planning. The rising influx of private equity and venture capital into automation startups focused on niche applications, such as micro-assembly and customized dispensing, further underscores the market's dynamism. Economic resilience in sectors like e-commerce logistics, which rely extensively on fast, reliable gantry systems for sorting and warehousing, provides a stable growth platform, mitigating risks associated with cyclical downturns in traditional manufacturing sectors like automotive assembly, ensuring sustained overall market expansion.

AI Impact Analysis on Cartesian Robots Market

Common user questions regarding AI's influence on the Cartesian Robots Market typically revolve around operational intelligence: "How can AI improve the precision and speed of gantry systems?" "Will AI reduce the complexity of programming Cartesian robots for variable tasks?" and "What is the role of machine learning in predictive maintenance for linear drives?" The overarching theme indicates a strong user expectation that AI will transition Cartesian robots from rigidly programmed, fixed-path devices to flexible, adaptive automation tools. Users are keen to understand how AI-driven vision systems and reinforcement learning will enable these robots to handle part variability, optimize complex paths in real-time, and significantly reduce unplanned downtime by accurately forecasting component failure based on operational data. There is a clear interest in moving beyond basic automation towards intelligent, autonomous systems capable of continuous self-optimization within dynamic industrial environments.

The integration of Artificial Intelligence transforms the operational paradigm of Cartesian robots, enhancing their efficiency and applicability significantly. AI algorithms are crucial for optimizing path planning in environments with multiple constraints, ensuring the shortest cycle time while minimizing energy consumption and mechanical wear. Furthermore, through deep learning, vision systems mounted on Cartesian robots can achieve superior object recognition and defect detection capabilities, far exceeding traditional rule-based programming. This allows for automated quality inspection that adapts to subtle variations in product characteristics, which is highly valuable in high-mix, low-volume production settings.

Moreover, AI plays a pivotal role in advanced diagnostics and predictive maintenance (PdM). By analyzing vast streams of operational data—including motor current, vibration, temperature, and cycle time—machine learning models can accurately predict component degradation (such as linear guide wear or belt fatigue) long before failure occurs. This capability shifts maintenance from reactive or scheduled interventions to truly proactive measures, drastically increasing the Mean Time Between Failures (MTBF) and overall equipment effectiveness (OEE), thereby lowering operational costs for end-users and extending the lifespan of the robotic system.

- AI-Driven Path Optimization: Enhancing operational efficiency by calculating real-time, optimal movement trajectories, minimizing acceleration/deceleration stress.

- Predictive Maintenance (PdM): Utilizing machine learning on sensor data (vibration, temperature) to forecast mechanical failures, maximizing uptime.

- Adaptive Quality Control: Implementing deep learning vision systems for flexible, high-speed inspection and defect classification with dynamic tolerance adjustment.

- Simplified Programming: Employing AI for teachless programming and simulation, reducing setup time and the reliance on specialized programming expertise.

- Dynamic Load Balancing: Optimizing speed and acceleration based on real-time payload variations, improving energy efficiency and mechanical reliability.

- Human-Robot Collaboration (HRC): Facilitating safe, proximity-aware operation alongside human workers through AI-enabled sensor fusion and planning.

DRO & Impact Forces Of Cartesian Robots Market

The Cartesian Robots Market expansion is primarily driven by the increasing global emphasis on streamlined manufacturing processes and the necessity for high-throughput automation, especially in high-growth sectors such as semiconductor fabrication and e-commerce logistics, which require expansive, precise handling capabilities. Restraints, however, include the initial capital expenditure associated with complex multi-axis systems and the relative lack of flexibility compared to articulated robots in applications requiring complex angular dexterity. Opportunities abound in the development of modular, light-weight composite materials and the integration of advanced sensor technology, particularly in emerging markets where new manufacturing facilities are being established. The market impact forces are categorized by a strong influence from technological advancements (Force 1) focusing on linear motor technology, followed by economic drivers (Force 2) related to labor cost arbitrage and global competitiveness mandates, ensuring continuous investment in automation despite short-term economic fluctuations.

Key drivers include the technological superiority of Cartesian systems for handling large work envelopes and heavy loads with high precision, making them ideal for large-scale assembly and pick-and-place operations. Furthermore, the global miniaturization trend in electronics demands robots capable of microscopic placement and inspection tasks, an area where the inherent rigidity and linear precision of Cartesian systems excel. Conversely, market growth faces restraints from the complexity of integrating these large systems into existing, often legacy, manufacturing setups, and the potential need for significant modifications to facility infrastructure. Additionally, the increasing competition from faster, more compact SCARA robots in smaller-scale assembly tasks represents a niche challenge to market expansion in certain applications.

Opportunities for growth are significant in customized automation solutions for non-traditional industries, such as agriculture (vertical farming automation) and specialized medical device manufacturing, where bespoke gantry systems offer unmatched scalability and sterile environment compatibility. The increasing standardization of communication protocols (e.g., OPC UA) and the move towards plug-and-play components further lower entry barriers for SMEs. Impact forces are currently dominated by the push for Industry 4.0 connectivity, requiring robots to be fully integrated data sources (Force 3), alongside regulatory demands for improved worker safety and reduced environmental impact (Force 4), which favors enclosed, precise, and energy-efficient automation cells utilizing Cartesian kinematics.

Segmentation Analysis

The Cartesian Robots Market is segmented based on several crucial parameters including component type, axis type, technology employed, load capacity, application, and end-user industry. This granular segmentation allows for a detailed understanding of market dynamics and adoption patterns across different industrial environments globally. Component segmentation, covering hardware, software, and services, shows that hardware, particularly the mechanical structure and linear drives, constitutes the dominant share, reflecting the capital-intensive nature of these systems. The segmentation by axis configuration, which typically includes 2-axis, 3-axis, and 4/5-axis gantry systems, demonstrates that 3-axis systems are the most commonly deployed due to their versatility in standard industrial automation tasks involving linear movement and vertical manipulation.

Technology-wise, the market is differentiated by drive mechanisms, including belt-driven, lead screw-driven, pneumatic, and linear motor-driven systems. Linear motor-driven Cartesian robots represent the fastest-growing segment, offering superior speed, acceleration, and precision crucial for semiconductor and display manufacturing. Load capacity segmentation ranges from light-duty (less than 1 kg) used in micro-assembly to heavy-duty (over 100 kg) utilized in automotive stamping and large material handling. Application analysis reveals material handling, assembly, dispensing, welding, and cleanroom applications as major revenue generators, with material handling and pick-and-place remaining the foundational use cases driving volume.

Finally, end-user segmentation clearly outlines the core demand centers, with the electronics and semiconductor industries being the largest consumers due to the need for large-scale, high-precision automation in processes like wafer handling and circuit board assembly. The automotive sector utilizes heavy-duty Cartesian robots for large component placement and welding, while the pharmaceutical and healthcare sectors rely on them for sterile packaging and lab automation. Understanding these distinct segments is vital for manufacturers planning R&D investments and market entry strategies, ensuring product offerings are optimally matched to specific industrial requirements for load, speed, and environmental conditions.

- By Component:

- Hardware (Mechanical components, actuators, drives, sensors)

- Software (Control systems, HMI, simulation)

- Services (Installation, Maintenance, Training)

- By Axis Type:

- 2-Axis (X-Y)

- 3-Axis (X-Y-Z)

- 4/5-Axis Gantry Systems

- By Technology:

- Belt Driven

- Lead Screw Driven

- Pneumatic Actuators

- Linear Motor Driven (Fastest Growing)

- By Load Capacity:

- Light Duty (Up to 1 kg)

- Medium Duty (1 kg – 20 kg)

- Heavy Duty (Over 20 kg)

- By Application:

- Material Handling and Logistics (Largest Share)

- Assembly and Disassembly

- Dispensing and Packaging

- Welding and Cutting

- Quality Inspection and Testing

- Cleanroom and Laboratory Automation

- By End-User Industry:

- Electronics and Semiconductor

- Automotive and Aerospace

- Pharmaceutical and Medical Devices

- Food and Beverage

- Metals and Machinery

Value Chain Analysis For Cartesian Robots Market

The value chain for the Cartesian Robots Market begins with upstream activities involving the sourcing of high-precision components, including servo motors, linear actuators (ball screws, linear motors), high-strength structural materials (aluminum profiles, carbon fiber composites), and advanced control systems (PLCs, motion controllers). Key suppliers in this phase are specialized manufacturers of motion control hardware and industrial electronics. Efficiency and quality at this stage are critical, as the precision and reliability of the final robotic system are directly dependent on the tolerance and durability of these core components. Supplier relationships focus on long-term partnerships to ensure steady supply chain resilience and access to the latest technological advancements in drives and materials engineering, often requiring stringent quality audits.

Midstream activities encompass the manufacturing, integration, and assembly of the Cartesian robot structure. This involves frame fabrication, meticulous alignment of linear guides, integration of motors and control systems, and final calibration and testing. Major robot manufacturers perform extensive software development for path planning, operational control, and safety protocols. Downstream distribution channels are multifaceted, ranging from direct sales models for large, highly customized gantry systems to indirect distribution through authorized system integrators, distributors, and value-added resellers (VARs). System integrators play a vital role by providing application-specific programming, installation, and commissioning services, bridging the gap between the robot manufacturer and the diverse needs of end-users across various industries.

The distribution network relies heavily on trained technical sales teams and integration partners who can offer local support and expertise. The direct channel is often preferred for high-value contracts with major automotive or aerospace clients, allowing for maximum control over customization and service. Conversely, the indirect channel is essential for reaching smaller enterprises and specialized market segments, providing tailored automation solutions and regional support. Post-sales service and maintenance, facilitated through both direct service centers and certified partners, complete the value chain, ensuring high operational uptime and long-term customer satisfaction, ultimately driving repeat business and positive brand reputation within the highly competitive industrial automation sector.

Cartesian Robots Market Potential Customers

Potential customers for Cartesian robots are predominantly organizations seeking to automate processes that demand high repeatability, large operational envelopes, and stringent linear motion precision, often involving tasks unsuitable for human labor due to scale, complexity, or environment. The largest segment of end-users comprises manufacturers within the Electronics and Semiconductor industry, including companies involved in PCB assembly, wafer handling, and display panel fabrication, where micron-level accuracy across extensive workspaces is mandatory. These customers utilize Cartesian systems for dispensing adhesives, soldering components, and precise pick-and-place operations of fragile, tiny components, valuing the robot's inherent stiffness and consistency over traditional methods.

Another major buyer category includes Tier 1 and Tier 2 suppliers within the Automotive and Aerospace sectors. These heavy industry users require robust, high-load Cartesian gantry systems for large-scale welding, sealant application, component testing, and handling heavy engine parts or structural fuselage sections. Their purchasing decisions are driven by the need for increased throughput, reduced material waste, and compliance with strict quality standards. Furthermore, the rapid expansion of e-commerce and logistics has created a significant demand from warehouse operators and fulfillment centers who rely on fast, large-scale gantry systems for sorting, palletizing, and de-palletizing tasks, optimizing the flow of goods within modern automated warehouses.

Beyond traditional manufacturing, the Pharmaceutical and Medical Devices industry represents a growing clientele, requiring Cartesian robots for sterile handling, laboratory automation (e.g., liquid handling, sample preparation), and precision packaging in controlled environments (clean rooms). These customers prioritize reliability, compliance with regulatory standards (e.g., FDA), and the ability of the system to operate autonomously within confined or sterile spaces. Essentially, any industry grappling with rising labor costs, pursuing higher manufacturing tolerances, or needing robust automation across expansive linear distances is a prime potential customer for advanced Cartesian robotic solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.89 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Fanuc Corporation, Yaskawa Electric Corporation, KUKA AG, Mitsubishi Electric Corporation, Seiko Epson Corporation, Yamaha Motor Co., Ltd., HIWIN Corporation, Parker Hannifin Corporation, IAI Corporation, Toshiba Machine Co., Ltd. (Shibaura Machine), Denso Wave Incorporated, Bosh Rexroth AG, Gudel Group AG, TMI Automation, SANYO DENKI CO., LTD., Stäubli International AG, Comau (FCA Group), Universal Robots (Teradyne), Delta Electronics, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cartesian Robots Market Key Technology Landscape

The technological landscape of the Cartesian Robots Market is rapidly evolving, driven primarily by advancements in motion control, materials science, and digital connectivity. Linear motor technology represents the most significant breakthrough, offering superior acceleration, velocity, and positional accuracy compared to traditional belt or ball screw drives. These systems eliminate mechanical linkages, reducing wear, simplifying maintenance, and providing the necessary precision for critical tasks like semiconductor wire bonding and micro-dispensing. The adoption of voice coil motors and ironless core linear motors is expanding the dynamic range and minimizing friction, making high-speed, long-travel gantry systems increasingly viable for logistics and high-volume assembly lines. Furthermore, sophisticated encoder and feedback systems, including magnetic and optical scales, ensure closed-loop control with nanometer resolution, a requirement for next-generation manufacturing processes.

Material innovations are also playing a crucial role, particularly the increased use of lightweight, high-stiffness materials such as carbon fiber reinforced polymers and specialized aluminum alloys in the structural components (gantry beams and carriages). This shift allows for significantly lower inertia, enabling higher acceleration and faster cycle times without compromising the robot's inherent stiffness or load capacity. Simultaneously, advanced vibration damping technologies and active compliance control are being integrated into the mechanics and control algorithms to mitigate unwanted oscillations, thereby maintaining end-effector stability during high-speed movements. These mechanical improvements are essential for pushing the boundaries of throughput in automation cells globally.

In terms of digital technology, the market is characterized by pervasive connectivity aligning with Industry 4.0 principles. Modern Cartesian robots utilize industrial Ethernet protocols (e.g., EtherCAT, PROFINET) for high-speed, deterministic communication between the controller, motors, and sensors. The control software is becoming increasingly sophisticated, featuring integrated simulation tools (digital twins) for process optimization and rapid deployment. Furthermore, the embedding of edge computing capabilities enables real-time data processing and the deployment of AI algorithms directly at the machine level, supporting features like collision avoidance, adaptive path correction, and autonomous diagnostics, solidifying the role of Cartesian robots as intelligent components within the smart factory ecosystem.

Regional Highlights

The regional analysis of the Cartesian Robots Market reveals distinct growth drivers and dominance patterns influenced by local industrial policies and manufacturing concentration.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily fueled by massive industrial expansion in China, South Korea, and Japan. China’s government initiatives supporting domestic automation and the region's concentration of electronics, semiconductor, and automotive manufacturing drive immense demand for precise gantry systems. South Korea and Japan are leaders in high-end automation, focusing on linear motor technology for cleanroom applications, ensuring continuous innovation and high market penetration.

- North America: This region demonstrates strong adoption, particularly in the aerospace, medical device, and specialized machinery sectors. The focus here is less on volume manufacturing and more on high-value, complex applications requiring customization, advanced software integration, and compliance with stringent quality and safety standards. The resurgence of domestic manufacturing and investment in advanced logistics infrastructure further bolsters market growth.

- Europe: Europe, led by Germany, Italy, and Scandinavia, maintains a mature market characterized by early adoption of robotics and a strong emphasis on industrial innovation (Industry 4.0). Demand is concentrated in automotive manufacturing, high-precision engineering, and packaging automation. European users often prioritize modularity, energy efficiency, and high integration capability with existing enterprise resource planning (ERP) systems.

- Latin America (LATAM): The LATAM market is emerging, driven by foreign direct investment in manufacturing (especially automotive in Mexico and Brazil) and the need to upgrade aging industrial infrastructure. Adoption rates are increasing, albeit slower than APAC, focusing initially on cost-effective, medium-duty Cartesian systems for material handling and basic assembly tasks.

- Middle East and Africa (MEA): MEA is the smallest but rapidly growing region, powered by diversification efforts away from oil economies. Investments in food and beverage processing, pharmaceuticals (particularly in the GCC nations), and nascent assembly industries are creating initial demand for reliable and robust automation solutions, often sourced via established European and Asian manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cartesian Robots Market.- ABB

- Fanuc Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Mitsubishi Electric Corporation

- Seiko Epson Corporation

- Yamaha Motor Co., Ltd.

- HIWIN Corporation

- Parker Hannifin Corporation

- IAI Corporation

- Toshiba Machine Co., Ltd. (Shibaura Machine)

- Denso Wave Incorporated

- Bosh Rexroth AG

- Gudel Group AG

- TMI Automation

- SANYO DENKI CO., LTD.

- Stäubli International AG

- Comau (FCA Group)

- Universal Robots (Teradyne)

- Delta Electronics, Inc.

Frequently Asked Questions

Analyze common user questions about the Cartesian Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Cartesian robots over articulated robots?

The key advantage of Cartesian robots is their inherent high rigidity, exceptional precision, and superior capacity for managing heavy loads over expansive, linear work envelopes. They are geometrically simple, offering straightforward programming and easier scalability for processes requiring movement along straight lines, such as large-format dispensing or gantry material handling.

Which end-user industry is driving the most significant growth in the Cartesian Robots Market?

The Electronics and Semiconductor industry is the most significant growth driver. The continuous demand for miniaturization and high-volume production of electronic components, requiring high-speed, high-precision linear movement for tasks like wafer handling and surface mount technology (SMT) assembly, heavily favors the rigid structure of Cartesian robots.

How does linear motor technology impact the performance of Cartesian robot systems?

Linear motor technology drastically improves performance by eliminating mechanical transmission components, resulting in significantly higher acceleration, top speed, and positional accuracy. This technology is critical for cleanroom environments and high-throughput applications where maintenance-free operation and ultra-precise dynamic motion are required.

What are the main restraints hindering the broader adoption of Cartesian robots?

The primary restraints include the high initial capital investment required, particularly for large-scale gantry installations, and the spatial requirements, as these systems often occupy a larger footprint compared to articulated or SCARA robots. Additionally, complex installations may require specialized system integration expertise.

How is Industry 4.0 influencing the design and functionality of new Cartesian robot models?

Industry 4.0 demands are driving the integration of advanced sensors, high-speed industrial Ethernet communication, and embedded AI/edge computing capabilities into Cartesian robots. This allows for real-time performance monitoring, predictive maintenance, seamless data exchange with factory systems, and adaptive path optimization, transforming them into intelligent assets within smart factory networks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Gantry and Cartesian Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cartesian Robots Market Size Report By Type (1-Axis, 2-Axis, 3-Axis), By Application (Automotive, Electrical and electronics, Chemical and petrochemical, Food and beverage), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Gantry/Cartesian Robots Market Size Report By Type (XY-X Series, 2X-Y-Z Series, 2X-2Y-Z Series), By Application (Loading & Unloading Workpiece, Palletizing & Handling, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager