Ceric Ammonium Nitrate Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442758 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Ceric Ammonium Nitrate Powder Market Size

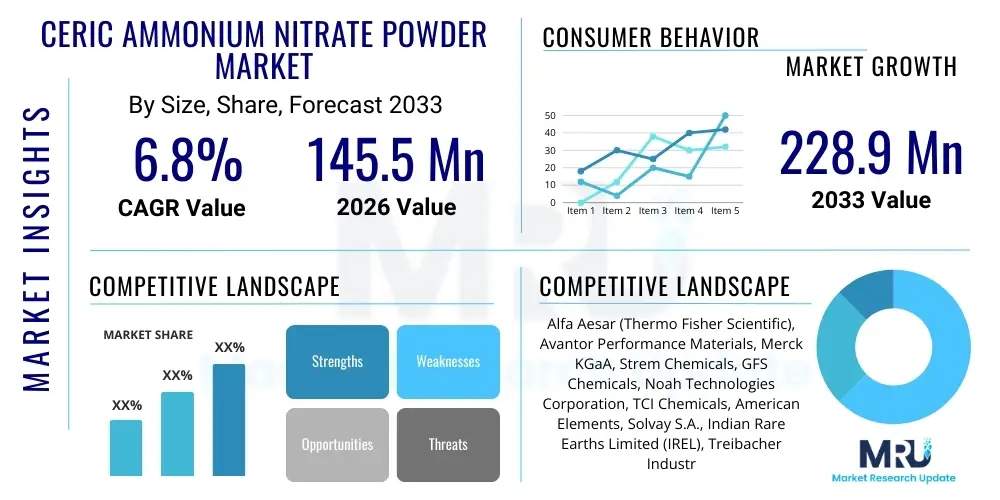

The Ceric Ammonium Nitrate Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.75% between 2026 and 2033. The market is estimated at USD 250.8 Million in 2026 and is projected to reach USD 390.1 Million by the end of the forecast period in 2033.

Ceric Ammonium Nitrate Powder Market introduction

Ceric Ammonium Nitrate (CAN) powder, chemically represented as (NH4)2Ce(NO3)6, is a powerful oxidizing agent widely utilized across numerous industrial and scientific applications. This yellow-orange crystalline compound is predominantly known for its exceptionally high redox potential, making it indispensable in organic synthesis, particularly for oxidative cleavage reactions and as a strong titrant in analytical chemistry. Its unique chemical properties stem from the presence of cerium in its +4 oxidation state, which readily accepts electrons, driving forward complex chemical transformations. The high solubility of CAN in polar organic solvents, alongside water, further enhances its versatility in laboratory settings and large-scale manufacturing processes, ensuring its consistent demand within the fine chemicals sector.

The primary applications of CAN span the electronics, pharmaceutical, and chemical manufacturing industries. In the electronics sector, high-purity CAN serves as a critical etchant, notably in the production of printed circuit boards (PCBs) and the fabrication of semiconductor devices, where precise material removal is paramount. Within the pharmaceutical and agrochemical industries, CAN acts as an effective catalyst or reagent in the synthesis of complex organic molecules, including APIs (Active Pharmaceutical Ingredients) and specialized intermediates, often leveraging its capacity for selective oxidation. The inherent benefits of utilizing CAN include high reaction efficiency, predictable yields, and the ability to operate under relatively mild conditions compared to alternative strong oxidizers, driving its continuous adoption in precision manufacturing.

Market expansion is significantly driven by the escalating global demand for advanced electronic components, particularly in Asia Pacific, where semiconductor and PCB manufacturing facilities are rapidly increasing their capacity. Furthermore, the growing complexity of organic synthesis in drug discovery and development mandates the use of highly selective and efficient reagents like CAN. Regulatory support for cleaner chemical processes and the continuous innovation in synthetic methodologies that favor cerium-based reagents are also major factors contributing to sustained market growth, counterbalancing fluctuations associated with the sourcing and purification of cerium raw materials.

Ceric Ammonium Nitrate Powder Market Executive Summary

The global Ceric Ammonium Nitrate (CAN) powder market is currently characterized by robust expansion, primarily fueled by synergistic growth in the high-tech electronics and specialized chemical industries. Business trends indicate a persistent focus on achieving ultra-high purity grades of CAN, often exceeding 99.99%, necessitated by stringent requirements in semiconductor fabrication and advanced materials research. Key industry movements include vertical integration among major producers to secure cerium raw material supply chains and increased investment in process optimization to minimize hazardous waste generated during CAN synthesis, reflecting a broader trend toward sustainability within the specialty chemicals market. Strategic partnerships between chemical manufacturers and high-volume consumers, such as PCB fabricators, are becoming common to ensure stable supply and tailor product specifications.

Regional dynamics clearly highlight Asia Pacific (APAC) as the undisputed leader in consumption and manufacturing, driven by extensive investment in the electronics hub regions of China, South Korea, Taiwan, and Japan. The intense production of consumer electronics, 5G infrastructure components, and automotive electronics dictates high demand for CAN etchants and polishing agents. North America and Europe maintain significant market shares, predominantly due to strong pharmaceutical R&D spending and established specialty chemical manufacturing bases, where CAN is extensively used in complex drug synthesis and advanced materials research. Regulatory environments in these regions place high emphasis on handling and disposal protocols, influencing the adoption of safer, encapsulated forms of CAN or specialized handling services.

Segmentation trends reveal that the High Purity Grade segment (99.9% and above) is experiencing the fastest growth trajectory, largely due to its critical role in high-precision electronics manufacturing, where trace impurities can severely compromise device performance. Application-wise, the Etching Agent segment dominates the volume landscape, while the use of CAN as a homogeneous catalyst in specialized organic synthesis processes is gaining momentum, offering substantial growth opportunities. End-use analysis confirms the electronics sector as the primary revenue generator, but the biotechnology and pharmaceutical research segment is showing accelerated demand for smaller, customized batches of research-grade CAN, reflecting innovation in chemical biology.

AI Impact Analysis on Ceric Ammonium Nitrate Powder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ceric Ammonium Nitrate (CAN) market primarily revolve around three central themes: optimizing the complex synthesis and purification processes of high-purity CAN, enhancing predictive modeling for raw material stability (specifically cerium supply chain resilience), and utilizing AI-driven material informatics for discovering novel applications or substitutes for CAN. Concerns often focus on the capital expenditure required for integrating AI systems into existing manufacturing infrastructure and whether AI can effectively manage the inherent variability in rare earth element sourcing. Expectations are high regarding AI's potential to accelerate quality assurance procedures, particularly the automated spectroscopic analysis required for 99.99% purity validation, ensuring consistent output essential for semiconductor applications.

AI's influence is transforming traditional chemical manufacturing by introducing predictive maintenance and dynamic process control. Machine learning algorithms are being employed to analyze vast datasets pertaining to reaction temperature, pressure, reagent concentration, and crystallization kinetics during the production of CAN. This data-driven approach allows manufacturers to fine-tune reaction parameters in real-time, significantly increasing yield, reducing energy consumption, and crucially, improving the consistency of the final powder's morphology and purity. Such optimization is paramount, especially for meeting the demanding specifications of the electronics industry, thereby securing a competitive edge for companies adopting these advanced techniques.

Furthermore, AI and generative modeling are proving invaluable in advanced materials discovery and synthesis planning. By simulating molecular interactions and predicting the outcomes of potential catalytic reactions involving the cerium(IV) ion, AI can rapidly screen thousands of synthetic pathways, potentially uncovering novel, more efficient, or greener methods for using CAN or identifying related cerium compounds that offer improved performance in specific applications, such as specialized redox flow batteries or next-generation display technologies. This predictive capability reduces the reliance on traditional, lengthy trial-and-error laboratory experiments, significantly speeding up innovation cycles and fostering future market expansion.

- AI-driven optimization of crystallization and precipitation processes, leading to higher purity CAN yields (up to 99.999%).

- Predictive modeling for supply chain risks related to rare earth element (Cerium) sourcing and price fluctuation mitigation.

- Automated spectroscopic analysis and quality control checks, accelerating batch release in high-volume electronics manufacturing.

- Machine learning applied to synthetic chemistry, identifying novel, eco-friendly pathways for CAN production and waste reduction.

- Simulation of catalytic reactions to discover new applications for CAN in pharmaceutical synthesis and advanced materials.

DRO & Impact Forces Of Ceric Ammonium Nitrate Powder Market

The Ceric Ammonium Nitrate (CAN) market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all contributing to substantial impact forces influencing supply and demand dynamics. A primary driver is the pervasive expansion of the global electronics sector, characterized by the miniaturization and increased complexity of semiconductor chips and Printed Circuit Boards (PCBs). CAN's superior properties as a selective etchant are essential for these high-precision applications, securing its status as a critical material. Concurrently, the rising tide of sophisticated organic synthesis in pharmaceutical R&D leverages CAN’s potent oxidizing capabilities to synthesize complex chiral molecules and drug intermediates efficiently. These demand-side pressures are compounded by technological advancements in manufacturing processes that continually require higher purity grades of the reagent.

However, the market faces inherent restraints, most notably the dependency on cerium, a critical rare earth element, whose supply chain can be susceptible to geopolitical instability, trade policies, and volatile pricing. Furthermore, the corrosive and oxidizing nature of CAN necessitates strict regulatory compliance regarding transportation, storage, and waste disposal, particularly in environmentally conscious regions like Europe and North America. The high capital investment required for establishing ultra-high purity manufacturing facilities, coupled with the rigorous energy consumption associated with the demanding purification steps, poses a barrier to entry for potential new manufacturers, thereby concentrating market power among a few established players.

Opportunities for significant market growth lie in the emerging fields of green chemistry and advanced energy storage solutions. Researchers are exploring CAN’s role as a recyclable and highly effective redox mediator in certain battery technologies, offering a diversification pathway beyond traditional etching applications. Moreover, the development of specialized, encapsulated or micro-particulate forms of CAN aims to enhance handling safety and stability, thereby making the product more palatable for deployment in sensitive environments or specialized catalysis. The increasing adoption of 3D ICs and advanced packaging technologies in semiconductors will necessitate even higher precision etching processes, potentially driving demand for customized, ultra-fine particle CAN powders, representing a significant technological opportunity.

Segmentation Analysis

The Ceric Ammonium Nitrate Powder market is systematically segmented based on Grade, Application, and End-Use Industry, enabling a granular assessment of demand and growth trajectories across various commercial and scientific fields. Segmentation by grade is vital as purity levels directly correlate with applicability and pricing, distinguishing between research-grade material used in laboratory settings and ultra-high purity grades mandated by the stringent requirements of the electronics and semiconductor sectors. Analyzing the market through these segments helps stakeholders understand which industrial verticals are driving volume versus which are generating premium revenue, thereby informing strategic investments in purification technologies and targeted marketing efforts.

The application segmentation illustrates the functional diversity of CAN, highlighting its primary roles as a potent oxidizing agent, a selective etchant, and a versatile catalyst. The Etching Agent segment consistently captures the largest market share due to the massive scale of PCB and semiconductor manufacturing globally. However, the Catalysis segment, though smaller in volume, often represents higher value due to its deployment in complex, intellectual property-rich fields such as chiral synthesis and polymer chemistry. Understanding the growth rate disparity between these applications is crucial for chemical manufacturers looking to optimize their production capacity utilization and tailor product specifications to specific reaction environments, potentially focusing on tailored particle sizes or unique formulations.

End-Use segmentation provides insight into the ultimate consumers of CAN powder, dominated by the Electronics industry, followed closely by Pharmaceuticals and Research & Academia. The electronics segment is characterized by high volume, consistent demand, and exacting quality standards, whereas the pharmaceutical sector demands smaller, extremely high-purity batches and relies heavily on CAN for synthesizing complex molecular structures required for drug development. The increasing synergy between high-tech manufacturing and complex chemical synthesis means that the market dynamics in one end-use sector often influence the supply chain and pricing in the others, underscoring the interconnected nature of the Ceric Ammonium Nitrate Powder market landscape.

- By Grade:

- Reagent Grade (99.0% - 99.5%)

- High Purity Grade (99.8% - 99.99%)

- Ultra-High Purity Grade (99.999% and above)

- By Application:

- Etching Agent (PCB, Semiconductor)

- Oxidizing Agent (Organic Synthesis)

- Catalyst (Polymerization, Redox Reactions)

- Analytical Reagent (Titration, Standardization)

- By End-Use Industry:

- Electronics and Semiconductor

- Pharmaceutical and Biotechnology

- Chemical Manufacturing

- Research and Academia

- Others (Aerospace, Specialty Coatings)

Value Chain Analysis For Ceric Ammonium Nitrate Powder Market

The value chain for the Ceric Ammonium Nitrate (CAN) powder market commences with the upstream extraction and refinement of rare earth elements, specifically Cerium (Ce), which is the principal raw material. This initial stage involves mining operations, separation of cerium from other lanthanides, and conversion into precursor compounds like cerium nitrate or cerium carbonate. Because Cerium is classified as a critical material, the upstream segment is heavily influenced by geopolitical factors, resource availability, and the processing efficiency of major rare earth refiners, predominantly located in China. Manufacturers of CAN must maintain robust supplier relationships and employ stringent quality checks to ensure the purity of the cerium source material, as this dictates the initial quality ceiling for the final CAN powder.

The midstream process involves the complex chemical synthesis of CAN powder from the cerium precursors, primarily involving dissolution, nitrification, purification, and crystallization stages. Achieving ultra-high purity (e.g., 99.999%) is the most capital-intensive and technologically demanding part of the value chain, requiring specialized cleanroom facilities, advanced filtration systems, and rigorous analytical testing. Distribution channels for CAN are bifurcated: direct and indirect. Direct distribution is favored for large-volume customers, such as major semiconductor fabrication plants (fabs) and large chemical companies, where tailored packaging and just-in-time delivery are essential. This direct model allows for specialized technical support and greater quality control oversight throughout the logistics process.

Indirect distribution involves specialized chemical distributors and regional agents who manage smaller volumes and research-grade materials, serving universities, smaller pharmaceutical R&D labs, and niche manufacturers. Downstream analysis focuses on the end-use applications, where the value of CAN is realized through its functional performance, particularly its efficiency as an etchant or its selectivity as an oxidizing agent in high-value synthetic processes. Efficiency gains or yield improvements achieved through the use of high-quality CAN translate into significant economic benefits for the end-users in electronics and pharmaceuticals, confirming the material's critical role in high-tech manufacturing ecosystems globally.

Ceric Ammonium Nitrate Powder Market Potential Customers

Potential customers and primary end-users of Ceric Ammonium Nitrate (CAN) powder are highly diversified yet concentrated within technologically advanced sectors that demand reagents of exceptional purity and functional reliability. The largest group of buyers resides within the electronics and semiconductor manufacturing ecosystem, including global leaders in Printed Circuit Board (PCB) fabrication and specialized semiconductor device manufacturers (SDMs). These buyers utilize CAN predominantly as a high-precision chemical etchant for copper, stainless steel, and other alloys, crucial for creating the complex, multilayer structures found in modern electronic devices. Their purchasing decisions are primarily governed by purity specifications, batch-to-batch consistency, and the ability of the supplier to handle high-volume, reliable contracts.

Another major consumer segment is the pharmaceutical and biotechnology industry, encompassing both large multinational drug manufacturers and smaller Contract Research Organizations (CROs) or academic labs focused on drug discovery. In this context, CAN is procured as a potent, yet selective, oxidizing agent and catalyst essential for synthesizing complex Active Pharmaceutical Ingredients (APIs) and fine chemicals. Customers in this segment require high-purity, often research-grade, materials with robust documentation and compliance certificates, prioritizing technical performance and regulatory traceability over sheer volume, leading to higher average selling prices for these specialized batches.

Furthermore, the broader chemical manufacturing sector constitutes a reliable customer base, where CAN is used as an industrial oxidizing agent, a component in specialized coatings, or as a laboratory analytical reagent for quality control and titration methods. Specific buyers also include academic institutions and government research laboratories focusing on inorganic chemistry, materials science, and clean energy technology research. These institutional customers often purchase smaller quantities but drive the demand for new, higher-specification grades as they explore innovative applications, such as cerium-based materials for solid oxide fuel cells or specialized catalytic converters, representing the future growth areas for CAN consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.8 Million |

| Market Forecast in 2033 | USD 390.1 Million |

| Growth Rate | 6.75% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA (MilliporeSigma), American Elements, Treibacher Industrie AG, AEM, Sisco Research Laboratories Pvt. Ltd., Otto Chemie Pvt. Ltd., Strem Chemicals, Alfa Aesar (Thermo Fisher Scientific), ProChem, Inc., GFS Chemicals, Inc., Wako Pure Chemical Industries, Ltd., Loba Chemie Pvt. Ltd., Nippon Rare Earth Co., Ltd., Huizhou Jinhai Chemical Co., Ltd., China Rare Earth Holdings Limited, Xiamen Tungsten Co., Ltd., Solvay S.A., Indian Rare Earths Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceric Ammonium Nitrate Powder Market Key Technology Landscape

The technological landscape surrounding the Ceric Ammonium Nitrate (CAN) market is primarily defined by advancements in high-purity synthesis, impurity removal, and powder morphology control, all crucial for meeting the hyper-critical standards of the electronics industry. Traditional manufacturing methods involve complex dissolution and crystallization steps, which are being continually refined through the implementation of continuous processing reactors and optimized solvent systems to enhance yield and reduce batch variability. Key technologies now focus on reducing metallic impurities to parts per billion (ppb) levels, often utilizing ion-exchange resins and selective precipitation techniques, ensuring the final CAN product is suitable for sensitive applications like 3D NAND flash memory production, where contamination is highly detrimental.

A significant technological focus is directed toward optimizing the crystallization process to control particle size distribution and morphology, which is essential for uniform performance, especially when CAN is used as an etchant or in fine chemical synthesis. Advanced spray drying and controlled precipitation techniques are employed to generate ultra-fine, highly uniform CAN powder, which dissolves more readily and provides better surface etching uniformity compared to standard crystalline products. Furthermore, process analytical technology (PAT) is being integrated into manufacturing lines. PAT employs real-time monitoring tools, such as in-situ spectroscopy and ultrasonic sensors, to dynamically adjust reaction conditions, minimizing off-spec batches and maximizing resource efficiency, thereby enhancing overall production reliability.

Emerging technology trends include the exploration of alternative, non-aqueous synthesis routes to improve the environmental footprint of CAN production by minimizing wastewater generation, often associated with traditional aqueous purification steps. Furthermore, specialized packaging and handling technologies, such as inert atmosphere packaging and moisture-resistant containers, are critical for maintaining the stability and purity of the hygroscopic CAN powder during transit and storage. Innovation in waste management, including the recovery and recycling of spent cerium from etching baths, represents a crucial area of technological investment, driven by both economic incentives and mounting regulatory pressure to manage rare earth materials responsibly and sustainably throughout their lifecycle.

Regional Highlights

Regional dynamics play a crucial role in shaping the Ceric Ammonium Nitrate Powder market, reflecting the geographical concentration of high-tech manufacturing, pharmaceutical research, and rare earth resource management.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for CAN, primarily driven by massive investments in the semiconductor and Printed Circuit Board (PCB) industries across China, South Korea, Taiwan, and Japan. These countries serve as global manufacturing hubs for consumer electronics, automotive electronics, and telecom infrastructure, necessitating high-volume consumption of high-purity CAN as an etchant. Rapid industrialization and government support for localized chip production further solidify APAC's dominance in both consumption and production capacity.

- North America: This region holds a mature market share, characterized by high demand from the advanced pharmaceutical and biotechnology sectors, utilizing CAN extensively in R&D and complex organic synthesis (primarily the Oxidizing Agent and Catalyst applications). The presence of major specialty chemical producers and strict regulatory frameworks drives the focus toward ultra-high purity grades and continuous innovation in handling safety and waste management technologies.

- Europe: Europe is a key consumer, particularly within the fine chemical manufacturing, automotive, and aerospace industries, where CAN is valued for its reliable performance in specialized coatings and high-end component manufacturing. Environmental and sustainability regulations (e.g., REACH) significantly influence sourcing and production practices, promoting greener synthesis methods and responsible rare earth element procurement throughout the supply chain.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent smaller but developing markets. Growth is gradually increasing due to burgeoning domestic electronics assembly plants and expanding chemical manufacturing infrastructure. Investment in resource processing and establishing localized research facilities are expected to gradually increase the regional demand for research-grade and industrial-grade CAN in the long-term forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceric Ammonium Nitrate Powder Market.- Merck KGaA (MilliporeSigma)

- American Elements

- Treibacher Industrie AG

- AEM (Advanced Engineering Materials)

- Sisco Research Laboratories Pvt. Ltd.

- Otto Chemie Pvt. Ltd.

- Strem Chemicals

- Alfa Aesar (Thermo Fisher Scientific)

- ProChem, Inc.

- GFS Chemicals, Inc.

- Wako Pure Chemical Industries, Ltd.

- Loba Chemie Pvt. Ltd.

- Nippon Rare Earth Co., Ltd.

- Huizhou Jinhai Chemical Co., Ltd.

- China Rare Earth Holdings Limited

- Xiamen Tungsten Co., Ltd.

- Solvay S.A.

- Indian Rare Earths Limited

- Shandong Dongfang Technology Co., Ltd.

- Cerac Inc.

Frequently Asked Questions

Analyze common user questions about the Ceric Ammonium Nitrate Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ceric Ammonium Nitrate (CAN) primarily used for in the electronics industry?

CAN is predominantly utilized as a high-precision chemical etchant for copper and other metallic layers during the manufacturing processes of Printed Circuit Boards (PCBs) and semiconductor devices, due to its strong and highly selective oxidizing properties.

Which purity grade of Ceric Ammonium Nitrate powder drives the highest market revenue?

The Ultra-High Purity Grade (99.99% and above) segment generates the highest premium revenue due to its necessity in advanced semiconductor fabrication, where trace impurities can severely compromise device performance and yield.

How does the volatility of cerium sourcing impact the CAN market?

As cerium is a key rare earth element precursor, supply chain volatility, often influenced by geopolitical factors and mining concentration, can lead to significant price fluctuations and supply disruptions for Ceric Ammonium Nitrate manufacturers and end-users.

What are the key drivers for market growth outside of the electronics sector?

Key growth drivers include the increasing complexity of Active Pharmaceutical Ingredient (API) synthesis, which relies on CAN as a selective oxidizing agent and catalyst, and growing research into its application in advanced energy storage systems like redox flow batteries.

Which geographical region dominates the consumption of Ceric Ammonium Nitrate powder?

The Asia Pacific (APAC) region dominates the global consumption of Ceric Ammonium Nitrate powder, driven by the massive scale of electronics, semiconductor, and PCB manufacturing hubs located primarily in China, South Korea, and Taiwan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager