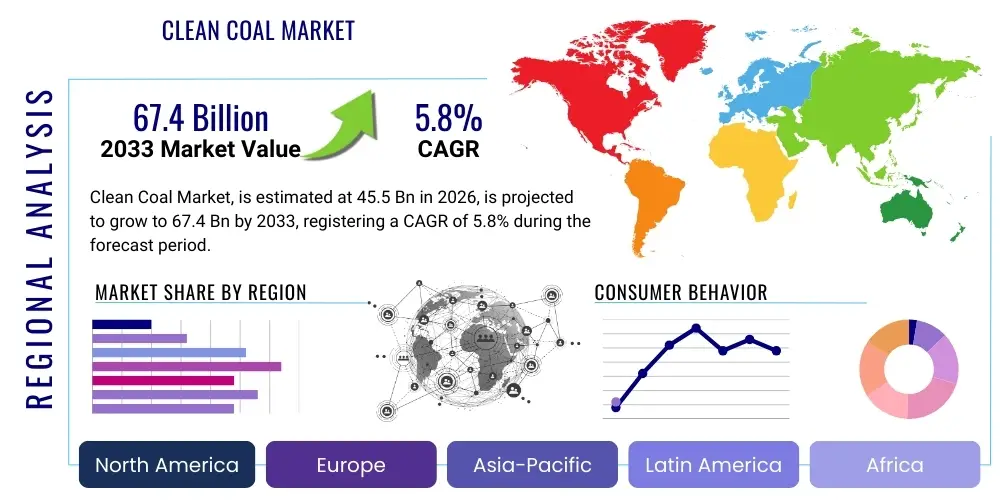

Clean Coal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441394 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Clean Coal Market Size

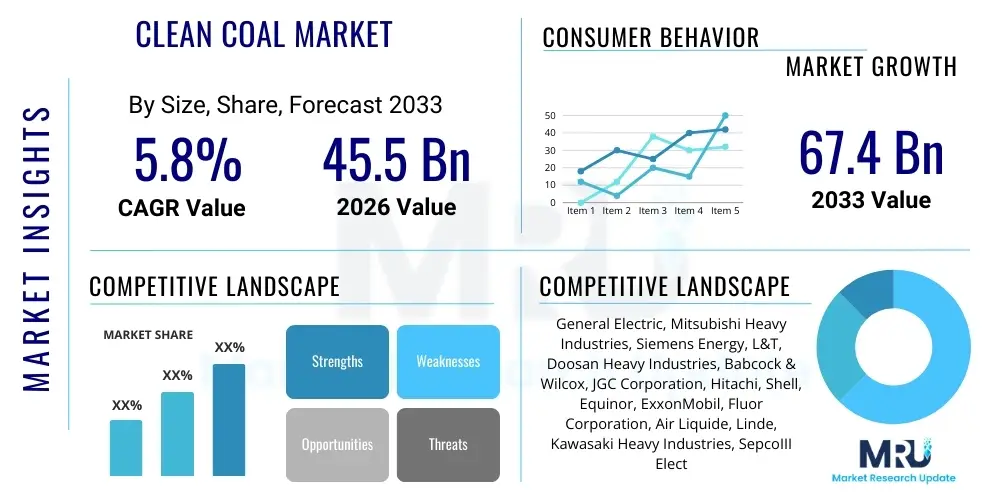

The Clean Coal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 67.4 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the persistent global demand for stable base-load energy sources coupled with increasing regulatory pressures mandating lower carbon emissions from existing coal-fired power infrastructure. Investment in retrofitting aging plants with High-Efficiency, Low-Emissions (HELE) technologies is a significant contributor to this market valuation.

Clean Coal Market introduction

The Clean Coal Market encompasses technologies designed to mitigate the environmental impact of utilizing coal for energy generation, primarily focusing on reducing greenhouse gases and pollutants such as sulfur dioxide (SO2), nitrogen oxides (NOx), and particulate matter. Key products include advanced coal processing techniques like coal washing and preparation, and sophisticated combustion methods such as Integrated Gasification Combined Cycle (IGCC) and Circulating Fluidized Bed (CFB) systems. The market is defined by the integration of Carbon Capture and Storage (CCS) or Carbon Capture, Utilization, and Storage (CCUS) technologies, which are critical for meeting ambitious long-term climate targets while ensuring energy security. The adoption of these technologies allows nations highly dependent on coal resources, particularly those in the Asia Pacific region, to transition toward lower-carbon operations without immediate, drastic shifts in their energy mix.

Major applications of clean coal technologies reside predominantly within the power generation sector, where they are applied to new constructions (especially in developing economies) and retrofitting existing thermal power plants. Furthermore, these technologies are crucial in heavy industrial applications, including cement production and steel manufacturing, which rely heavily on coal derivatives but face stringent environmental regulations regarding emissions intensity. The primary benefits derived from the deployment of clean coal solutions include extended operational lifespans for coal assets, enhanced energy efficiency (reducing fuel consumption per megawatt-hour generated), substantial reduction in air pollutants (improving public health), and crucially, the ability to achieve deep decarbonization targets via effective capture of CO2, positioning coal as a transitional fuel in the global energy landscape.

Driving factors propelling this market include renewed emphasis on energy independence and resilience, particularly in response to geopolitical volatility affecting natural gas supplies. Government mandates and subsidy programs, such as tax credits and incentives for CCS deployment (e.g., the 45Q tax credit in the United States), significantly de-risk large-scale infrastructure projects. Furthermore, technological advancements have reduced the cost and improved the efficiency of capture technologies, making clean coal solutions increasingly viable compared to immediate wholesale replacement of coal infrastructure. The persistent low cost and abundance of coal reserves worldwide cement its role, necessitating emission control solutions to comply with international agreements like the Paris Agreement.

Clean Coal Market Executive Summary

The global Clean Coal Market exhibits robust business trends characterized by increased public-private partnerships aimed at scaling CCS infrastructure and a shift toward standardized modular designs to lower capital expenditure associated with retrofitting. Key players are diversifying their portfolios, integrating advanced digital twin technologies and AI-driven optimization into their HELE plants to maximize operational efficiency and predictive maintenance schedules. The market sees strong M&A activity, particularly among engineering, procurement, and construction (EPC) firms and technology providers, seeking to consolidate expertise in complex capture and transport logistics, ensuring a streamlined deployment pipeline across major industrialized nations and emerging economies facing escalating power demand requirements.

Regionally, Asia Pacific (APAC) remains the dominant engine of growth, driven by colossal power demands in China and India, where coal dependency is deeply entrenched and capacity expansion continues, albeit with mandated integration of high-efficiency standards. North America and Europe, while prioritizing accelerated renewable integration, focus heavily on the deployment segment of CCS, utilizing existing coal fleet sites as major points of CO2 capture to anchor regional decarbonization hubs. Regulatory divergence remains a challenge; however, the unification of carbon pricing mechanisms in certain jurisdictions is beginning to stabilize investment frameworks for long-term projects in regions such as the European Union and parts of Canada, fostering stability crucial for multi-billion-dollar infrastructure ventures.

Segmentation trends highlight the increasing importance of the technology segment focused on post-combustion capture, which is highly adaptable to existing infrastructure, thereby offering faster market penetration compared to capital-intensive pre-combustion or oxy-fuel combustion methods. The application segment remains dominated by the utilities sector, but the industrial capture segment (cement, steel, chemicals) is gaining significant momentum as these heavy industries realize the immediate need for carbon management solutions where electrification is not yet technologically or economically feasible. Further market stratification is noted within the capture solvent and sorbent materials segment, where research into metal-organic frameworks (MOFs) and solid sorbents promises breakthroughs in reducing the energy penalty associated with CO2 separation and regeneration processes.

AI Impact Analysis on Clean Coal Market

Common user questions regarding AI's influence on the Clean Coal Market frequently revolve around how artificial intelligence can reconcile the continued use of coal with aggressive climate goals. Users are keen to understand if AI can make aging coal assets environmentally and economically viable, specifically querying AI's role in optimizing Carbon Capture and Storage (CCS) processes—a historically expensive and energy-intensive element of clean coal technology. Key concerns often focus on the scalability of AI solutions, the integration difficulty with legacy plant control systems, and whether AI predictive maintenance can truly minimize downtimes and maximize the efficiency of advanced combustion methods like IGCC. The overarching expectation is that AI will serve as a crucial efficiency multiplier, reducing the operational expenditure (OPEX) barrier that currently hinders widespread adoption of clean coal solutions.

AI's impact is transformative, moving beyond simple data analysis to enable complex predictive modeling for operational parameters within coal power plants equipped with HELE and CCS technologies. Machine learning algorithms are now utilized to dynamically adjust combustion stoichiometry, optimizing boiler efficiency in real-time based on coal quality variations and load demands, thereby ensuring minimal fuel consumption and pollutant generation. This level of optimization minimizes energy consumption and operational volatility, directly enhancing the economic competitiveness of coal power compared to intermittent renewable sources, especially when providing essential grid stability services. The adoption of AI in this context shifts the narrative of coal assets from static polluters to highly flexible and efficient components of a balanced energy portfolio.

Moreover, AI is pivotal in de-risking the complex supply chain and operational phases of CCS infrastructure. Advanced neural networks are employed to analyze geological survey data for optimal CO2 sequestration sites, predicting reservoir behavior and long-term storage integrity with higher accuracy than traditional simulation methods. Furthermore, within the capture facility itself, AI algorithms optimize solvent regeneration cycles, reducing the substantial energy penalty typically associated with CO2 absorption/desorption processes. This continuous optimization driven by AI is instrumental in reducing the overall Levelized Cost of Energy (LCOE) for clean coal facilities, accelerating their commercial viability and alignment with market cost benchmarks required by utility-scale operators globally.

- AI-driven optimization of combustion parameters for peak fuel efficiency and minimum pollutant output.

- Machine learning applied to predictive maintenance, reducing costly downtimes in complex HELE and IGCC systems.

- Enhanced modeling and simulation for CO2 transport pipeline logistics and geological sequestration security.

- Real-time adjustment of solvent regeneration rates in post-combustion capture units to minimize energy parasitic load.

- Automation of plant monitoring and control systems to handle the increased complexity of integrated clean coal technologies (e.g., CCS integration).

- Utilization of digital twin technology for risk assessment and virtual commissioning of new clean coal projects.

DRO & Impact Forces Of Clean Coal Market

The Clean Coal Market is shaped by powerful and often conflicting market forces, summarized by critical Drivers, persistent Restraints, and transformative Opportunities. Key drivers include unwavering global energy demand, especially in APAC economies, which necessitates stable, base-load power generation, and the geopolitical imperative for resource security that favors locally abundant coal. However, significant restraints are imposed by the high capital expenditure required for CCS infrastructure, regulatory uncertainty surrounding long-term liability for sequestration sites, and intense market competition from rapidly dropping renewable energy costs. The primary opportunity lies in the maturation of CCUS technology, turning CO2 from a waste product into a valuable resource for enhanced oil recovery (EOR) or industrial applications, thereby creating new revenue streams and offsetting operational costs, fundamentally altering the economic model of coal-fired power plants. These forces collectively dictate the pace and direction of technological deployment and investment flow within the sector.

Drivers are heavily influenced by policy and technology readiness. Government support through R&D funding and production tax credits (such as the US 45Q credit) significantly lowers the financial threshold for adoption. Furthermore, the imperative to decarbonize heavy industrial sectors (cement, steel) that cannot easily switch from coal necessitates clean coal solutions like co-firing biomass or utilizing coal derivatives in conjunction with capture technologies. These drivers ensure that even in the face of strong renewable energy integration, a subset of coal assets will remain vital for grid stability and industrial processes, sustaining the market for abatement technologies. Technological advancements, particularly in sorbent chemistry and modular capture units, further reduce the footprint and complexity of deployment.

Restraints primarily center on economic feasibility and public perception. The cost of capturing and compressing CO2 still represents a significant parasitic load on the power plant’s output, often increasing the electricity generation cost by 40% or more, making the LCOE uncompetitive without heavy subsidies. Additionally, powerful environmental lobbying and public opposition often delay or halt new clean coal project developments, favoring immediate retirement of coal assets over expensive retrofitting. The long lead times (often 5-10 years) required for large-scale CCS projects, coupled with the risk of future regulatory changes or carbon price volatility, create substantial financial risk for investors, restraining rapid market growth in developed economies.

Opportunities are rooted in innovation and market expansion. The development of CCUS (Carbon Capture, Utilization, and Storage) offers the chance to commercialize captured CO2, providing a critical pathway to profitability. Utilizing captured carbon for synthesizing fuels, chemicals, or materials transforms the economics. Geographically, there is a massive opportunity in rapidly industrializing nations that are locking in coal infrastructure for the next few decades; these countries present a greenfield market for advanced HELE and integrated capture systems. Moreover, the integration of hydrogen production (blue hydrogen derived from coal gasification with CCS) opens new, highly lucrative energy markets for coal assets capable of deep decarbonization, positioning clean coal technology as a bridging solution toward a net-zero future.

Segmentation Analysis

The Clean Coal Market is primarily segmented by Technology, Application, and Capture Method, reflecting the diverse approaches utilized to mitigate the environmental impact of coal usage. The market structure emphasizes the bifurcation between efficiency enhancements (HELE technologies) and deep decarbonization solutions (CCS/CCUS). The technology segment is crucial as it determines the feasibility and cost of integration into existing power grids, focusing heavily on proven, commercially ready methods such as Ultra-Supercritical (USC) combustion which offer immediate gains in efficiency and reductions in emissions intensity. This granularity allows utilities and industrial consumers to select tailored solutions based on their specific operational lifecycles, regulatory environment, and available capital expenditure budgets, optimizing the transition pathway toward lower emissions.

Within the technology landscape, Integrated Gasification Combined Cycle (IGCC) systems represent the premium segment, offering high efficiencies and producing a highly concentrated stream of CO2 ideal for capture (pre-combustion). While IGCC requires significant upfront investment, its superior performance and ease of capture integration make it highly attractive for new construction projects seeking the lowest possible emissions footprint. Conversely, retrofitting projects largely rely on optimizing existing infrastructure through upgrades to USC and Circulating Fluidized Bed (CFB) boiler technology, offering substantial emissions reduction without complete plant overhaul. The segmentation analysis thus highlights the delicate balance between maximum technical efficiency and the financial realities of global fleet management.

The Application segmentation further defines market growth areas, with Electric Power Generation dominating the market share due to the sheer volume of coal consumed globally by thermal power plants. However, the rapidly expanding Industrial sector application—specifically in the manufacturing of cement, iron, steel, and fertilizers—is anticipated to exhibit the highest CAGR during the forecast period. These heavy industries face immense pressure to decarbonize but lack widespread, commercially viable alternatives to process heat generated by coal or coal derivatives, making targeted clean coal technologies and industrial-scale CCUS essential for their continued operation and compliance with global climate objectives. This sectoral shift represents a crucial diversification opportunity for technology providers in the clean coal space.

- By Technology

- Carbon Capture and Storage (CCS)

- Pre-combustion Capture (e.g., IGCC systems)

- Post-combustion Capture (e.g., amine scrubbing retrofits)

- Oxy-fuel Combustion

- High-Efficiency, Low-Emissions (HELE) Technologies

- Ultra-Supercritical (USC) Power Plants

- Supercritical Power Plants

- Advanced Ultra-Supercritical (A-USC)

- Coal Preparation and Cleaning

- Coal Washing and Beneficiation

- Chemical Cleaning

- Carbon Capture and Storage (CCS)

- By Application

- Electric Power Generation

- Utility-Scale Thermal Power Plants

- Captive Power Generation

- Industrial Use

- Cement Manufacturing

- Iron and Steel Production

- Chemical and Fertilizer Plants

- Petrochemical Refineries

- Electric Power Generation

- By Capture Method

- Absorption (Chemical Solvents)

- Adsorption (Solid Sorbents, MOFs)

- Membrane Separation

- Cryogenic Separation

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Clean Coal Market

The value chain of the Clean Coal Market is intricate, beginning with the upstream sourcing and preparation of coal and extending through sophisticated downstream processes involving power generation, carbon capture, and eventual CO2 storage or utilization. Upstream activities focus on minimizing impurities, primarily through advanced coal washing and beneficiation techniques to reduce ash and sulfur content before combustion, thereby immediately improving efficiency and lowering conventional air pollution. This stage is critical as the quality of the processed coal directly impacts the performance and operational lifespan of HELE components. Major coal mining companies and specialized coal preparation service providers dominate this initial phase, emphasizing consistency and quality control crucial for high-pressure, high-temperature combustion systems.

Midstream processes involve the deployment of core clean coal technologies. This encompasses the engineering, procurement, and construction (EPC) of new USC or IGCC plants and the retrofitting of existing facilities with post-combustion capture units. Technology licensors (often global engineering conglomerates) provide proprietary designs for boilers, turbines, and capture systems. Distribution channels for electricity, the final product, involve large utility companies, which are the primary buyers and operators of these assets. The integration of CO2 transport—via dedicated pipelines or specialized shipping—introduces a complex logistical layer that bridges the capture facility with geological sequestration sites or utilization hubs, requiring significant collaboration between energy firms and pipeline infrastructure operators.

Downstream activities are segmented into two distinct paths: direct electricity supply to the grid and the novel carbon management infrastructure. Direct sales of power generated by clean coal plants remain the core revenue stream. However, the indirect revenue generated by CCUS—through sales of captured CO2 for enhanced oil recovery (EOR), or as a feedstock for producing materials like aggregates, concrete, and synthetic fuels—is growing rapidly. Direct distribution involves the power grid; indirect distribution leverages specialized CO2 pipelines, managed by dedicated carbon infrastructure companies, leading to deep saline aquifers or depleted oil and gas reservoirs. This utilization pathway strengthens the overall financial model, making clean coal a more competitive option compared to traditional coal power generation and positioning it favorably in a carbon-constrained economy.

Clean Coal Market Potential Customers

The primary consumers and end-users of clean coal technologies and services are major entities in the global power and industrial sectors, characterized by their high reliance on coal and massive capital investment capacity. The most significant customer segment comprises Electric Utilities and Independent Power Producers (IPPs). These entities operate large fleets of thermal power plants and are mandated by regulatory bodies to either retire older, inefficient assets or retrofit them with advanced emission control and efficiency technologies, such as USC or post-combustion CCS. Their purchasing decisions are driven by long-term strategic energy planning, regulatory compliance mandates, and the need for reliable base-load power generation capabilities that support grid stability while meeting decarbonization targets.

A rapidly growing segment of potential customers is the Heavy Industrial Sector, specifically producers of steel, cement, aluminum, and fertilizers. These industries require high-intensity process heat and often use coal as a direct feedstock, making electrification difficult or impractical. For these customers, the adoption of clean coal involves integrating CCUS directly into their production streams to capture process emissions (which can be up to 70% of total emissions in cement kilns). Their purchasing criteria are focused less on power generation efficiency and more on robust, high-volume capture solutions that minimize process disruption and meet rapidly intensifying industrial carbon emission standards set by regional regulators and international trade agreements.

Finally, governmental bodies and state-owned energy enterprises, particularly in emerging markets like China, India, and Southeast Asia, represent massive potential customers. In these regions, energy security and rapid industrialization necessitate the continued deployment of coal-fired power, but with mandatory integration of advanced HELE standards. These customers often procure large, multi-billion-dollar EPC contracts for entire power complexes, prioritizing proven, cost-effective technologies like A-USC systems. Furthermore, specialized CO2 logistics and sequestration companies, often subsidiaries of major oil and gas companies, emerge as customers for carbon utilization technologies, purchasing captured CO2 streams for commercial applications such as Enhanced Oil Recovery (EOR) operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 67.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric, Mitsubishi Heavy Industries, Siemens Energy, L&T, Doosan Heavy Industries, Babcock & Wilcox, JGC Corporation, Hitachi, Shell, Equinor, ExxonMobil, Fluor Corporation, Air Liquide, Linde, Kawasaki Heavy Industries, SepcoIII Electric Power Construction, China Energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clean Coal Market Key Technology Landscape

The core of the Clean Coal Market technology landscape revolves around increasing thermal efficiency and capturing resultant carbon dioxide emissions. High-Efficiency Low-Emissions (HELE) technologies, particularly Ultra-Supercritical (USC) and Advanced Ultra-Supercritical (A-USC) boilers, are the foundational pillars. These systems operate at significantly higher temperatures and pressures than conventional power plants, achieving net efficiencies that can exceed 45%, thereby requiring less coal per unit of electricity generated and consequently reducing CO2 emissions by up to 30%. The materials science supporting these systems is continuously evolving, utilizing nickel alloys and advanced steels to withstand extreme operational conditions, ensuring both reliability and efficiency improvements necessary to keep coal competitive with gas-fired generation.

Integrated Gasification Combined Cycle (IGCC) represents the most advanced thermal conversion technology. In IGCC, coal is converted into a synthetic gas (syngas) which is then cleaned of pollutants before being combusted in a gas turbine and used to power a steam turbine (combined cycle). This process inherently allows for easier, cheaper pre-combustion CO2 capture because the syngas stream is small and highly concentrated. While IGCC systems offer superior environmental performance and high efficiency, their complexity and higher initial capital costs have limited widespread global adoption compared to the more readily deployable USC retrofits. However, ongoing R&D focuses on modular IGCC designs and improved gasification reactor efficiency to reduce the cost barrier and enhance market penetration.

Carbon Capture and Storage (CCS) technologies are the definitive differentiator in the clean coal space, crucial for achieving deep decarbonization. Post-combustion capture (PCC), typically using amine-based solvents, is the most mature technology for retrofitting existing facilities. While highly effective, the energy penalty associated with solvent regeneration is substantial. To address this, the industry is aggressively developing next-generation capture methods, including solid sorbents, membrane separation, and cryogenic capture, which promise lower parasitic loads and increased cost-effectiveness. Furthermore, the emphasis on CCUS leverages breakthroughs in catalytic conversion of captured CO2 into marketable products, transforming the perception and economic viability of the entire clean coal technology portfolio by integrating circular economy principles.

Regional Highlights

- Asia Pacific (APAC): The APAC region, led by China and India, dominates the global clean coal market, primarily driven by massive energy demand and reliance on abundant domestic coal reserves. Government policies in these nations, while supporting renewable expansion, also mandate the deployment of HELE technologies (USC and A-USC) for all new coal power installations to balance development needs with pollution control. China, specifically, is a global leader in deploying commercial-scale USC capacity and is aggressively researching large-scale CCS/CCUS demonstration projects, supported by heavy state investment and strict air quality targets.

- North America: The market in North America is highly focused on CCS/CCUS deployment, largely spurred by federal incentives like the 45Q tax credits in the United States, which provides a strong financial incentive for permanently sequestering CO2. While new coal plant construction is negligible, the focus is on retrofitting existing, strategically important coal assets (often in regions with high geological storage potential) and integrating captured carbon with Enhanced Oil Recovery (EOR) operations, particularly in Texas and Alberta.

- Europe: The European market is characterized by rapid coal phase-out policies, yet clean coal technologies remain relevant for managing strategic industrial emissions (cement, steel) and supporting transition economies in Eastern Europe. The region is a leader in advanced CCS research and regulatory frameworks (e.g., the EU Emissions Trading System), focusing on developing shared, cross-border CO2 transport infrastructure to facilitate sequestration in the North Sea.

- Latin America (LATAM): Growth in LATAM is concentrated in key coal-producing nations such as Colombia and Chile. The market is emerging, driven by the need to modernize aging infrastructure and comply with initial environmental performance standards. Investment is currently skewed towards basic coal preparation and highly efficient supercritical technology, with large-scale CCS projects remaining in the feasibility or pilot stages due to capital constraints.

- Middle East and Africa (MEA): The MEA region’s clean coal sector is closely tied to its oil and gas sector. Investment focus is on high-efficiency power generation coupled with large-scale CO2 capture for EOR operations, particularly in the Middle East, where high-pressure gasification technologies are being explored for synergistic energy and industrial applications. South Africa represents the primary coal-focused market, driven by the necessity of addressing massive domestic energy shortages and reducing reliance on aging, high-emission power stations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clean Coal Market.- General Electric (GE)

- Mitsubishi Heavy Industries (MHI)

- Siemens Energy AG

- Babcock & Wilcox Enterprises, Inc.

- Doosan Heavy Industries & Construction Co., Ltd.

- Larsen & Toubro Limited (L&T)

- Hitachi, Ltd.

- JGC Corporation

- Fluor Corporation

- Shell plc (CCS/CCUS focus)

- Equinor ASA (CCS/Storage focus)

- Exxon Mobil Corporation (CCUS utilization focus)

- Air Liquide S.A.

- Linde plc

- Drax Group plc

- China Energy Investment Corporation (CEIC)

- SepcoIII Electric Power Construction Co., Ltd.

- Sumitomo Corporation

- Toshiba Energy Systems & Solutions Corporation

- Sasol Limited

Frequently Asked Questions

Analyze common user questions about the Clean Coal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary economic benefits of adopting Ultra-Supercritical (USC) technology over conventional coal plants?

USC technology significantly boosts thermal efficiency (often exceeding 44%), meaning less coal is burned per megawatt-hour generated. This directly translates to lower fuel costs, reduced operational expenditure, and a substantial decrease in CO2, SOx, and NOx emissions intensity, improving overall economic competitiveness and regulatory compliance.

How do Carbon Capture and Storage (CCS) incentives, such as the US 45Q tax credit, affect project viability?

Tax credits like 45Q provide critical financial support by subsidizing the capital and operational costs associated with CO2 capture and permanent geological storage. These incentives de-risk large-scale projects, accelerate investment decisions, and make the Levelized Cost of Energy (LCOE) from clean coal facilities competitive with other low-carbon power sources.

What is the main challenge limiting the widespread implementation of Integrated Gasification Combined Cycle (IGCC) systems?

The primary constraint for IGCC adoption is the high upfront capital expenditure (CapEx) required compared to traditional pulverized coal plants or USC retrofits. While IGCC offers superior environmental performance and ease of CO2 capture, its technological complexity and high initial investment cost slow down market penetration, especially in regions lacking robust financial subsidies.

In which geographical region is the demand for clean coal technology expanding most rapidly?

Asia Pacific (APAC) is experiencing the fastest expansion due to persistent, high electricity demand driven by industrialization in China and India. These nations are mandating the integration of HELE technologies and increasingly investing in large-scale CCS demonstration projects to address severe pollution and meet future energy requirements.

What role does Carbon Capture, Utilization, and Storage (CCUS) play in the future sustainability of the clean coal market?

CCUS is vital as it transforms captured CO2 from a waste liability into a commercial asset, used for enhanced oil recovery (EOR) or industrial feedstock production. This utilization creates new, independent revenue streams, effectively lowering the net cost of decarbonization and establishing a more sustainable economic model for coal asset longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Clean Coal Technologies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Clean Coal Technology Market Size Report By Type (Supercritical, Ultra-Supercritical, Combined heat & Power, Others), By Application (Mining, Dyes and Pigments, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Clean Coal Technology Market Statistics 2025 Analysis By Application (Coal Preparation, Coal Burning, Post-Burning), By Type (Carbon Capture and Storage Technology, Carbon Sequestration Technology), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager