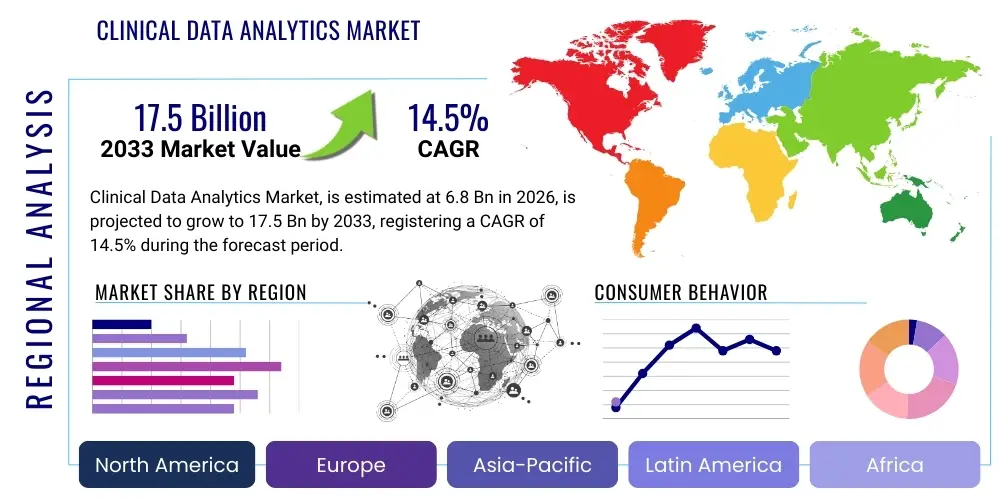

Clinical Data Analytics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443067 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Clinical Data Analytics Market Size

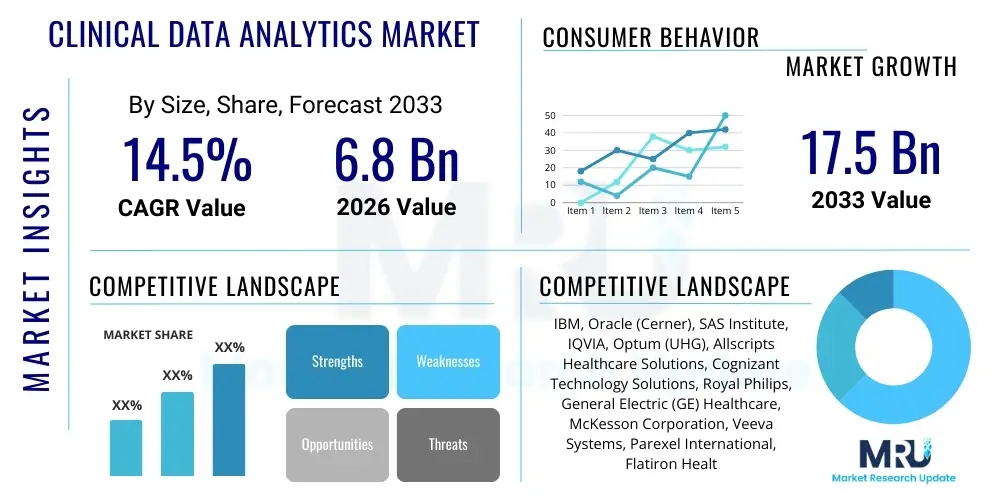

The Clinical Data Analytics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033.

Clinical Data Analytics Market introduction

The Clinical Data Analytics market encompasses sophisticated solutions designed to process, analyze, and interpret complex data generated across various healthcare settings, including electronic health records (EHRs), clinical trials, genomic sequencing, and patient monitoring systems. These solutions leverage advanced computational techniques, statistical models, and machine learning algorithms to transform raw clinical data into actionable insights. The primary objective is to enhance patient outcomes, optimize resource allocation, reduce healthcare costs, and accelerate the discovery and deployment of new therapeutic interventions. Given the exponential rise in digital patient data and the increasing regulatory pressure for value-based care models, clinical data analytics platforms are becoming indispensable tools for providers, payers, and pharmaceutical companies globally. This technological shift enables personalized medicine strategies and supports large-scale population health management initiatives, driving substantial investment in robust data infrastructure.

The core product offerings within this market segment typically include sophisticated software platforms, specialized professional services for integration and consultation, and the underlying computational hardware infrastructure necessary for processing massive datasets. Key applications span across improving the efficiency of clinical trials by optimizing patient recruitment and site selection, enhancing diagnostic accuracy through predictive modeling, managing risk within hospital systems, and ensuring regulatory compliance (such as HIPAA and GDPR). The descriptive, predictive, and prescriptive capabilities offered by these platforms are fundamentally reshaping how medical decisions are made, moving from reactive treatments toward proactive, preventative care strategies. Furthermore, the inherent benefits of clinical data analytics—such as reduced medical errors, improved operational workflows, and enhanced financial performance—solidify its position as a critical enabler of modern healthcare delivery.

Major driving factors fueling the market growth include the escalating volume of clinical data generated daily, primarily driven by the proliferation of wearable devices, IoT in healthcare, and the ubiquitous adoption of EHR systems across developed and developing economies. Simultaneously, the global shift towards value-based care models, which prioritize quality outcomes over sheer volume of services, mandates the use of analytics to demonstrate efficacy and manage financial risks. Furthermore, increasing government and private sector funding for research and development, particularly in areas like oncology and rare diseases, necessitates high-throughput data analysis capabilities, further embedding clinical data analytics solutions into the mainstream healthcare ecosystem. The inherent promise of precision medicine, reliant entirely on deep clinical data insights, also serves as a perpetual stimulus for market expansion.

Clinical Data Analytics Market Executive Summary

The Clinical Data Analytics Market is characterized by robust growth, propelled by the urgent need for data-driven decision-making in highly regulated healthcare environments. Business trends are dominated by strategic partnerships and mergers, particularly between large technology firms (such as Microsoft, Google, and AWS) and established healthcare IT vendors, aiming to integrate cloud computing scalability with deep clinical domain expertise. There is a discernible trend toward platform unification, where specialized analytical tools are bundled into comprehensive, enterprise-wide solutions that address multiple clinical and operational needs simultaneously. Furthermore, the rising demand for real-time analytics, critical for acute care and dynamic patient monitoring, is pushing vendors to develop faster processing speeds and more intuitive visualization dashboards. Investment is heavily concentrated in developing AI/ML models capable of automating complex tasks, such as clinical document abstraction and predictive risk scoring, significantly reducing human effort and error.

Regionally, North America maintains market dominance, attributed to high healthcare expenditure, early and extensive adoption of EHR systems, and a mature regulatory framework that encourages technological innovation in clinical research and patient care delivery. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rapidly expanding digital healthcare infrastructure, growing medical tourism, and large, diverse patient populations suitable for clinical trials. Government initiatives in countries like India, China, and Japan promoting digital health records and implementing national health data strategies are key catalysts. European markets show stable growth, heavily influenced by strict data privacy regulations (like GDPR), which necessitate advanced, compliant data governance and anonymization capabilities within analytical tools. Adoption rates are increasingly tied to achieving measurable improvements in public health metrics and optimizing operational efficiency within national health services.

Segment trends reveal that the Services component segment, encompassing consulting, implementation, and managed services, holds a significant market share, reflecting the complexity of integrating these advanced systems into existing hospital IT environments and the ongoing need for custom model development. Cloud-based deployment models are rapidly outpacing on-premise solutions due to their flexibility, scalability, and lower capital expenditure requirements, aligning well with the need for multi-site data aggregation in large health systems. Application-wise, Population Health Management (PHM) analytics is experiencing accelerated demand, as health organizations focus on identifying high-risk cohorts and intervening proactively to reduce readmission rates and chronic disease burdens. This focus underscores the market's evolution from purely descriptive analysis towards proactive, prescriptive guidance critical for value-based contracts and accountable care organizations (ACOs).

AI Impact Analysis on Clinical Data Analytics Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Clinical Data Analytics Market frequently revolve around themes of reliability, job displacement, ethical implications, and the speed of diagnostic improvement. Common questions include: "How accurately can AI predict patient outcomes compared to traditional statistical methods?", "Will AI automate the role of clinical researchers or analysts?", "What are the regulatory challenges associated with using black-box AI models in critical patient care?", and "How quickly will AI accelerate drug discovery and clinical trial optimization?". Analysis of these inquiries reveals high expectations regarding AI's ability to handle unstructured data (e.g., clinical notes, imaging) at scale and generate personalized treatment recommendations. Simultaneously, there is significant concern about data bias, model interpretability (the 'black box' problem), and ensuring that AI integration does not compromise patient safety or data privacy, driving demand for explainable AI (XAI) solutions tailored for clinical environments. Expectations are exceptionally high concerning AI's role in drastically reducing the time and cost associated with drug development, particularly through optimizing target identification and biomarker discovery, transforming clinical data analytics from a retrospective tool into a proactive engine of innovation and precision medicine.

AI's influence is fundamentally transformative, enabling clinical data analytics to move beyond correlation analysis to causation inference and sophisticated predictive modeling. Machine learning algorithms, particularly deep learning networks, excel at processing massive, heterogeneous datasets—merging longitudinal patient records, real-time physiological sensor data, and high-dimensional genomic information—a task impossible for traditional BI tools. This capability allows for the creation of digital phenotyping and risk stratification models that identify patients at risk of adverse events or chronic disease progression far earlier than conventional methods. Consequently, analytics solutions are evolving from providing static reports to delivering dynamic, context-aware insights embedded directly into the clinical workflow, such as generating alerts for sepsis risk or flagging discrepancies in medication adherence, thereby significantly augmenting clinical decision support systems.

The strategic deployment of AI within the analytics lifecycle is also driving significant market restructuring. Automation powered by Natural Language Processing (NLP) is dramatically improving the capture and structuring of data locked within unstructured clinical notes and discharge summaries, reducing the administrative burden on healthcare professionals and improving data quality for subsequent analysis. Furthermore, reinforcement learning is being explored to optimize complex operational processes, such as resource scheduling, operating room efficiency, and supply chain logistics within hospital systems, indirectly benefiting clinical data analysts by providing cleaner, more complete datasets. The market's future growth is intrinsically linked to the successful integration of trusted, validated, and transparent AI models that can withstand rigorous clinical scrutiny and regulatory oversight, ensuring that the technology delivers on its promise of revolutionizing diagnostic and therapeutic pathways while maintaining patient trust.

- AI accelerates diagnostic workflows by integrating and interpreting multi-modal data (genomics, imaging, EHRs).

- Natural Language Processing (NLP) improves data capture from unstructured clinical notes, enhancing dataset completeness.

- Machine Learning (ML) algorithms enable precision medicine by identifying subtle biomarkers and patient subtypes for targeted therapies.

- AI optimizes clinical trial design, patient recruitment, and synthetic control arm creation, reducing R&D timelines and costs.

- Predictive modeling enhances population health management by accurately forecasting disease outbreaks and resource demand.

- Explainable AI (XAI) development is crucial for building trust and ensuring regulatory compliance in clinical decision support.

DRO & Impact Forces Of Clinical Data Analytics Market

The Clinical Data Analytics market is shaped by a complex interplay of drivers, restraints, opportunities, and impactful market forces that dictate its trajectory and velocity. Key drivers include the mandatory shift towards electronic health records (EHRs) worldwide and the critical need to curb escalating healthcare costs by improving operational efficiencies and reducing waste. The transition to value-based care models, which financially incentivize demonstrable patient outcomes, acts as a powerful force mandating the adoption of sophisticated analytics to track, measure, and report quality metrics. Opportunities arise significantly from the untapped potential of real-world data (RWD) and real-world evidence (RWE) in accelerating regulatory submissions and post-market surveillance for pharmaceuticals, creating a high-value niche for specialized analytical platforms. These positive forces collectively pressure healthcare stakeholders across the continuum—from independent clinics to massive integrated delivery networks—to invest heavily in data infrastructure and analytical capabilities to remain competitive and compliant in the evolving health economy.

However, significant restraints temper this growth. The most prominent challenges involve stringent regulatory requirements concerning patient data privacy and security, such as HIPAA in the US and GDPR in Europe, which necessitate high barriers to entry and complex data governance strategies. Furthermore, the persistent shortage of skilled healthcare data scientists and informatics professionals capable of integrating, maintaining, and deriving meaningful insights from these advanced systems poses a major operational bottleneck for providers. Data standardization and interoperability remain perennial issues; fragmented IT systems and proprietary data formats within hospitals often make aggregating comprehensive patient longitudinal records difficult, hindering the effectiveness of enterprise-wide analytics solutions. Addressing these restraints requires significant investment in training, collaborative standardization efforts among vendors, and the implementation of robust security protocols.

The combined impact forces—regulatory changes, technological advancements in cloud infrastructure, and the macroeconomic push for cost containment—are fundamentally reshaping the competitive landscape. Technological forces favor vendors offering cloud-native, scalable solutions that can handle massive, heterogeneous data streams securely and efficiently. Economic pressures necessitate solutions that demonstrate clear Return on Investment (ROI) quickly, focusing vendor development efforts on highly impactful applications like revenue cycle management and population risk stratification. Furthermore, the evolving geopolitical environment and increased risk of cyber threats place immense pressure on security and compliance capabilities, influencing purchasing decisions towards established, highly secure platforms. The market environment strongly rewards vendors who can simplify complex data integration processes and provide clear, actionable clinical insights directly within existing electronic workflows.

Segmentation Analysis

The Clinical Data Analytics Market is highly fragmented, segmented based on components offered, deployment models utilized, the specific applications addressed, and the diverse end-users served. Understanding these segments is crucial for strategic planning, as market needs vary significantly between large pharmaceutical companies requiring high-throughput genomic analysis and smaller community hospitals focused primarily on operational efficiency and risk management. The Components segment, which includes software, services, and hardware, reflects the total investment across the technology stack necessary for deploying effective analytics. Services, particularly implementation and consulting, often represent a non-discretionary expenditure due to the complexity of integrating analytics into existing legacy IT infrastructure. The segmentation highlights the market's maturity, moving beyond generic Business Intelligence (BI) tools towards specialized, clinically validated platforms designed for specific healthcare use cases, thereby catering precisely to the nuanced demands of modern medical practice and research.

Deployment segmentation is critically impacted by evolving security needs and scalability demands. The shift towards cloud-based solutions is rapidly accelerating, primarily due to the elasticity and favorable pricing structures offered by major cloud providers, which are essential for handling the unpredictable data loads generated during clinical trials or large-scale population health initiatives. Conversely, the Application segment demonstrates where the highest growth potential lies, particularly in areas where data-driven insights yield the most significant immediate impact, such as improving care quality and managing financial risk associated with accountable care models. Market participants must carefully align their product roadmaps with these high-growth application areas to maximize market penetration and ensure that their offerings address the most pressing pain points faced by healthcare providers and researchers in managing increasingly complex patient data and regulatory environments.

End-user segmentation shows that Hospitals and Clinical Research Organizations (CROs) are the dominant consumers of these analytics solutions, given their large patient volumes and critical role in both care delivery and medical innovation. Hospitals utilize these tools primarily for operational efficiency, predictive staffing, and quality improvement metrics, while pharmaceutical and biotechnology companies leverage clinical data analytics for drug discovery, clinical trial optimization, and post-market surveillance. The increasing sophistication of analytical needs among academic research institutions, particularly for large-scale, multi-site studies and genomic research, also represents a growing and influential customer demographic. Successful vendors prioritize segment-specific tailoring, recognizing that a generalized platform often fails to meet the unique data security and workflow requirements of distinct clinical and research environments, demanding specialized vertical expertise.

- Component:

- Software (Standalone/Integrated Platforms, Visualization Tools)

- Services (Consulting, Implementation, Support & Maintenance, Training)

- Hardware (Storage Infrastructure, Servers, High-Performance Computing Clusters)

- Deployment Model:

- Cloud-based

- On-premise

- Application:

- Quality Care Reporting and Management

- Risk Management and Fraud Detection

- Population Health Management (PHM)

- Clinical Trials Optimization and Management (CTO/CTM)

- Precision Health and Genomic Analysis

- Drug Discovery and Development

- End User:

- Hospitals and Integrated Delivery Networks (IDNs)

- Pharmaceutical and Biotechnology Companies

- Clinical Research Organizations (CROs)

- Academic Medical Centers and Research Institutions

- Payer Organizations (Insurance Companies)

Value Chain Analysis For Clinical Data Analytics Market

The value chain for Clinical Data Analytics is characterized by a high degree of integration between specialized technology providers and clinical expertise, spanning from raw data collection to the delivery of actionable clinical insights. The upstream activities involve foundational components such as data infrastructure providers (cloud services, storage), data ingestion and integration specialists (EHR vendors, interoperability software), and data governance and security firms. Data standardization and quality assurance form a critical initial step, ensuring that the disparate data sources—including structured EHR fields, unstructured clinical notes, and high-dimensional omics data—are normalized and prepared for analysis. Upstream success hinges on robust data aggregation capabilities and adherence to complex global regulatory compliance standards, laying the groundwork for effective downstream analytical processing and model development.

Midstream activities center around the core analytical engine, involving the development and refinement of proprietary algorithms, statistical models, and machine learning platforms by specialized analytics vendors. This stage focuses on extracting meaning from the clean data, including predictive modeling for patient risk, descriptive analysis for operational metrics, and prescriptive recommendations for treatment pathways. The distribution channel analysis highlights the shift towards indirect distribution through strategic partnerships, where analytics vendors collaborate extensively with established EHR providers, cloud hyperscalers (like AWS and Azure), and system integrators to achieve deep market penetration. Direct sales remain crucial for large, custom enterprise deployments, particularly within pharmaceutical R&D, where complex customization is required, but the leverage provided by indirect distribution channels, offering pre-integrated solutions, is increasingly dominant in the hospital segment.

Downstream activities involve the practical application and deployment of the insights generated. This segment includes clinical decision support system (CDSS) integration, dashboard visualization for clinicians and administrators, and ongoing consulting services to help organizations translate data insights into measurable changes in clinical practice and operational policy. The final delivery relies heavily on user-friendly interfaces and seamless integration into existing clinical workflows (e.g., embedding risk scores directly within the physician's charting interface). Success at the downstream end is measured not just by the accuracy of the models, but by their real-world usability and ability to drive behavioral change among end-users. The continuous feedback loop from end-users back to the midstream algorithm developers is vital for iterative improvement and maintaining the clinical relevance and efficacy of the analytical products over time.

Clinical Data Analytics Market Potential Customers

The primary customers and buyers of Clinical Data Analytics solutions represent entities across the entire healthcare and life sciences ecosystem who require sophisticated data interpretation capabilities to enhance operational efficiency, improve patient care quality, and accelerate research timelines. Key end-users include large Hospital Systems and Integrated Delivery Networks (IDNs), which utilize analytics to optimize resource allocation, manage population health for covered lives, reduce readmission rates, and improve revenue cycle management by identifying billing anomalies. These organizations typically seek enterprise-level solutions that can integrate seamlessly across numerous departments and disparate IT systems, prioritizing scalability, robust security, and the ability to demonstrate clear, measurable improvements in clinical outcomes to justify significant capital investment.

Another crucial buyer segment is Pharmaceutical and Biotechnology Companies, who are fundamentally reliant on clinical data analytics for drug discovery, target validation, and the increasingly complex management of global clinical trials. These customers require highly specialized tools for genomic data analysis, biomarker identification, and the synthesis of real-world evidence (RWE) to support regulatory submissions and market access strategies. Their purchasing decisions are often driven by the platform's ability to accelerate R&D cycles, reduce trial costs, and manage proprietary, high-dimensional datasets securely. Clinical Research Organizations (CROs) also function as significant purchasers, using analytics to enhance their service offerings, optimize site performance metrics, and provide data-driven consultancy to their pharmaceutical clients.

Furthermore, Payer Organizations, including private insurance companies and government health agencies, constitute a rapidly expanding customer base. Payers leverage clinical data analytics primarily for risk stratification, fraud detection, waste and abuse prevention, and developing accurate actuarial models for future coverage planning. They seek predictive models that forecast high-cost claimants and enable targeted intervention programs, thereby controlling overall healthcare utilization costs. Finally, Academic Medical Centers and Research Institutions are constant consumers of advanced analytics, utilizing these tools for public health surveillance, large-scale epidemiological studies, and pioneering personalized medicine research initiatives that rely on merging clinical, imaging, and genomic datasets for complex hypothesis testing and validation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Oracle (Cerner), SAS Institute, IQVIA, Optum (UHG), Allscripts Healthcare Solutions, Cognizant Technology Solutions, Royal Philips, General Electric (GE) Healthcare, McKesson Corporation, Veeva Systems, Parexel International, Flatiron Health (Roche), Microsoft Corporation, Amazon Web Services (AWS), Google Cloud, Tableau Software (Salesforce), Nuance Communications (Microsoft), Epic Systems Corporation, Medidata Solutions (Dassault Systèmes). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Clinical Data Analytics Market Key Technology Landscape

The technology landscape of the Clinical Data Analytics market is rapidly evolving, driven primarily by the maturation of artificial intelligence and high-performance cloud computing. At the core, solutions rely on robust Big Data technologies, including Hadoop and Spark ecosystems, necessary for the efficient storage and processing of petabytes of clinical, genomic, and imaging data. Data warehousing solutions tailored for healthcare, often incorporating features necessary for regulatory compliance and audit trails, remain fundamental. However, the paradigm is shifting from traditional relational databases to NoSQL and graph databases, which are better suited for handling the complex, interconnected nature of patient data, such as disease pathways and treatment outcomes, allowing for more nuanced relationship modeling and faster retrieval of clinically relevant information.

The most significant technological advancements are centered around the utilization of Machine Learning (ML) and Deep Learning (DL) models. Specific techniques like Natural Language Processing (NLP) are essential for unlocking the value contained within 80% of clinical data, which is typically trapped in unstructured formats like physician notes, radiology reports, and discharge summaries. Furthermore, predictive analytics employing supervised and unsupervised learning techniques are crucial for developing risk stratification scores, predicting patient adherence, and optimizing hospital operational flows. These advanced algorithms necessitate powerful computational infrastructure, leading to heavy reliance on cloud providers that offer specialized, secure, and HIPAA-compliant environments, accelerating the shift away from resource-intensive on-premise deployments.

Another critical area involves data visualization and business intelligence (BI) tools specifically adapted for clinical end-users. While sophisticated models provide the underlying insight, the effectiveness of clinical data analytics hinges on the ability to present complex information in an intuitive, actionable format for clinicians (physicians, nurses) and non-technical decision-makers (administrators). Technology focuses on interactive dashboards, real-time alerting systems, and mobile interfaces that integrate seamlessly with existing electronic workflows (EHR integration via APIs like FHIR). Ensuring high levels of interoperability through adherence to standards such as FHIR (Fast Healthcare Interoperability Resources) is a mandatory technological prerequisite for modern analytical platforms, facilitating the necessary data exchange between disparate systems and contributing significantly to the overall efficiency and scalability of the solution portfolio.

Regional Highlights

- North America: North America, led by the United States, commands the largest share of the Clinical Data Analytics Market. This dominance is attributable to the high maturity of its healthcare IT infrastructure, substantial healthcare spending, and widespread adoption of Electronic Health Records (EHRs) spurred by governmental mandates like the HITECH Act. The presence of major market vendors, a strong focus on clinical research (especially in oncology and rare diseases), and the early adoption of advanced technologies such as AI and cloud computing contribute significantly to this market size. The transition to risk-sharing models and Accountable Care Organizations (ACOs) in the US necessitates complex analytics for quality measurement and cost control, maintaining the region's position as a primary innovation hub and revenue generator. Regulatory compliance, specifically HIPAA, drives sophisticated data security and governance requirements within analytical solutions.

- Europe: The European market demonstrates steady, substantial growth, primarily driven by investments in national health systems (NHS in the UK, centralized systems in Nordic countries) aiming for efficiency and standardization of care delivery. Key drivers include the region's aging population, necessitating better management of chronic diseases, and strong governmental initiatives pushing for digital transformation in healthcare. However, the region faces unique challenges related to data fragmentation across different national health systems and stringent adherence to the General Data Protection Regulation (GDPR), which demands complex anonymization and data sovereignty capabilities, influencing the architecture of deployed analytics solutions. Western European countries, particularly Germany, France, and the UK, are leading in the adoption of analytics for population health management and clinical trials optimization.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market due to rapidly improving healthcare infrastructure, increasing adoption of digital health technologies, and large, diverse patient populations highly suitable for clinical research. Countries like China and India are seeing massive governmental investment in digitalizing health records and building smart hospitals, creating a fertile ground for analytics adoption. The sheer volume of population data presents a unique opportunity for large-scale epidemiological studies and preventative health programs, leveraging analytics. However, challenges include the heterogeneity of IT infrastructure across nations, varying regulatory landscapes, and the need for culturally and linguistically adapted analytical interfaces and data models. Japan and Australia stand out for their advanced adoption rates driven by high technology penetration and standardized healthcare systems.

- Latin America (LATAM): The LATAM market is in an nascent stage but is experiencing promising growth, particularly in Brazil and Mexico. Market expansion is fueled by increasing awareness regarding the benefits of data-driven healthcare, coupled with government initiatives aimed at improving primary care access and efficiency. Economic constraints often favor cloud-based and outsourced analytical services over large capital expenditure investments in on-premise hardware. The primary applications focus on resource allocation, infectious disease tracking, and basic operational efficiency improvement within constrained budgets. Data quality and IT infrastructure reliability remain significant hurdles that vendors must address through highly resilient and cost-effective solutions tailored for regional economic realities.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated primarily in the Gulf Cooperation Council (GCC) countries, such as Saudi Arabia and the UAE, where high government expenditure is supporting the development of world-class digital health infrastructure and smart cities initiatives. These countries are adopting advanced analytics to support specialized care centers, manage non-communicable diseases (like diabetes), and integrate sophisticated e-health platforms. The African sub-region faces infrastructure limitations, though basic analytics solutions are gaining traction in public health management, focusing predominantly on combating infectious diseases and optimizing resource distribution in resource-scarce environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Clinical Data Analytics Market.- IBM

- Oracle (Cerner)

- SAS Institute

- IQVIA

- Optum (UnitedHealth Group)

- Allscripts Healthcare Solutions

- Cognizant Technology Solutions

- Royal Philips

- General Electric (GE) Healthcare

- McKesson Corporation

- Veeva Systems

- Parexel International

- Flatiron Health (Roche)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud

- Tableau Software (Salesforce)

- Nuance Communications (Microsoft)

- Epic Systems Corporation

- Medidata Solutions (Dassault Systèmes)

Frequently Asked Questions

Analyze common user questions about the Clinical Data Analytics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of Clinical Data Analytics in precision medicine?

Clinical Data Analytics is essential for precision medicine by integrating disparate datasets—including clinical, genomic, imaging, and lifestyle data—to create highly personalized patient profiles. This analysis enables researchers and clinicians to identify specific biomarkers and predict optimal treatment responses for individual patients, moving care strategies beyond generalized population statistics to targeted therapeutic interventions.

How are regulatory compliance and data security challenges addressed in cloud-based clinical analytics?

Cloud providers address regulatory compliance (e.g., HIPAA, GDPR) through specialized, highly secure, and certified environments that offer encryption, detailed audit logs, access controls, and data residency guarantees. Vendors partner with these certified platforms (e.g., AWS, Azure) and implement robust data governance frameworks, including pseudonymization and de-identification techniques, to protect patient privacy while allowing necessary data processing.

Which application segment holds the highest growth potential in the Clinical Data Analytics market?

Clinical Trials Optimization and Population Health Management (PHM) are exhibiting the highest growth potential. PHM is driven by the global transition to value-based care, requiring proactive identification and management of high-risk patient cohorts. Clinical Trials Optimization leverages advanced analytics and AI to drastically improve patient recruitment efficiency, site selection, and synthetic control arm generation, accelerating pharmaceutical R&D timelines.

What are the key differences between clinical data analytics and traditional healthcare business intelligence (BI)?

Traditional healthcare BI primarily focuses on retrospective and descriptive analysis (what happened), often limited to structured operational and financial data. Clinical Data Analytics, conversely, utilizes predictive and prescriptive models (what will happen and what should be done), handling massive volumes of complex, unstructured clinical, genomic, and real-time patient data to derive actionable medical and research insights.

What impact does lack of interoperability have on the effectiveness of clinical data analytics solutions?

Lack of interoperability severely limits the effectiveness of clinical data analytics by hindering the ability to create comprehensive, longitudinal patient records. Fragmented data across different IT systems reduces the accuracy of predictive models, prevents holistic population health views, and increases the administrative burden associated with manual data aggregation, thereby undermining the investment in advanced analytical tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Clinical Data Analytics Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Clinical Data Analytics Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud, On-premise), By Application (Pharmaceuticals, Healthcare Providers, Biotechnology, Academia, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager