Contact Center Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442802 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Contact Center Market Size

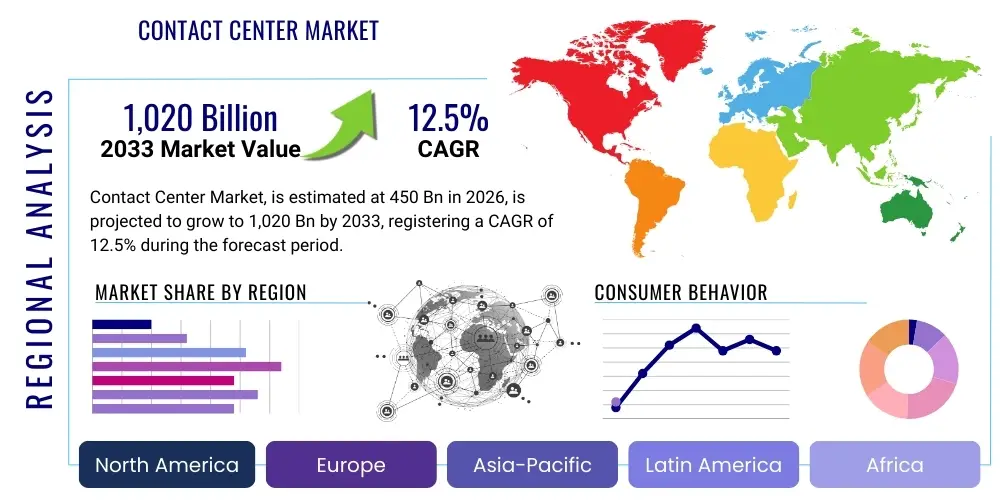

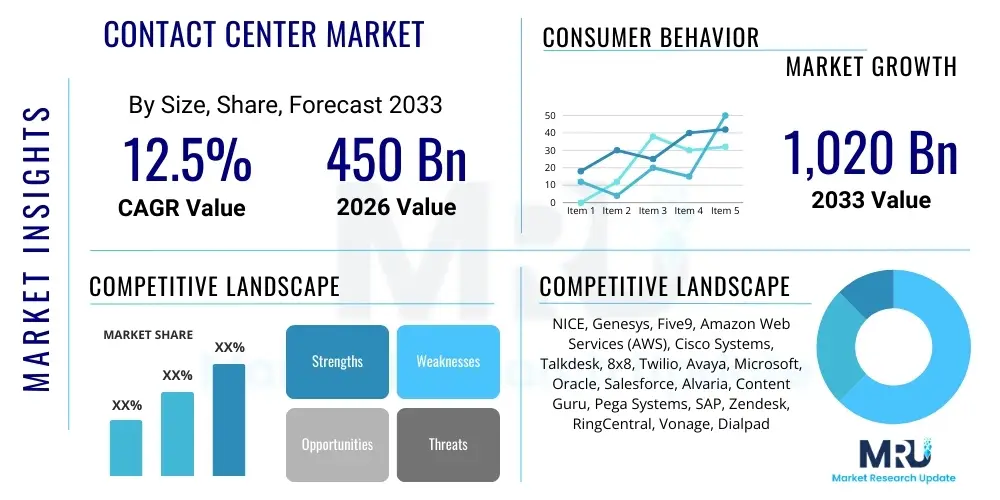

The Contact Center Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450 Billion in 2026 and is projected to reach USD 1,020 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global transition towards cloud-based Contact Center as a Service (CCaaS) models and the massive infusion of Artificial Intelligence (AI) and Machine Learning (ML) technologies aimed at optimizing customer experience (CX) and operational efficiency. Enterprises across various verticals, including banking, financial services, insurance (BFSI), retail, and healthcare, are aggressively modernizing their infrastructure to support seamless omnichannel interactions, moving away from legacy, premise-based systems that often lacked the flexibility and scalability required in the digital age. The increasing complexity of customer journeys necessitates robust, intelligent platforms capable of handling high volumes of interactions across voice, chat, email, and social media channels simultaneously.

The valuation reflects not just the adoption of core contact center software and hardware, but also the growing investment in supplementary intelligence layers, such as predictive analytics, workforce optimization (WFO) tools, and sophisticated self-service solutions like intelligent virtual agents (IVAs) and advanced interactive voice response (IVR) systems. North America and Europe currently represent the largest revenue shares due to early adoption of advanced technologies and the presence of major solution providers, coupled with stringent regulatory requirements concerning data security and customer privacy which necessitate high-quality, auditable contact center solutions. However, the Asia Pacific (APAC) region is poised to exhibit the highest growth trajectory, spurred by rapid digitalization, expanding middle-class consumer bases, and significant foreign investment in establishing regional shared service centers (SSCs) and business process outsourcing (BPO) hubs. The competitive landscape is characterized by constant innovation, mergers, and acquisitions, as vendors race to offer fully integrated, end-to-end customer engagement ecosystems.

Contact Center Market introduction

The Contact Center Market encompasses the technologies, solutions, and services utilized by organizations to manage inbound and outbound customer interactions across multiple communication channels. This includes sophisticated software platforms, intelligent hardware infrastructure, and professional services designed to enhance customer service, optimize sales processes, and improve overall operational performance. The fundamental shift from traditional call centers, which primarily handled voice calls, to modern contact centers is defined by the integration of digital channels (chat, email, social media, SMS) and the incorporation of AI-driven tools for automation and predictive routing. Modern solutions are typically offered as either on-premise deployments, or, increasingly, as scalable, pay-as-you-go cloud services (CCaaS), enabling businesses to manage workforce fluctuations and scale operations rapidly without extensive capital investment. Key product descriptions include Automatic Call Distribution (ACD), Computer Telephony Integration (CTI), Workforce Management (WFM), and Customer Relationship Management (CRM) integration tools that serve as the technological backbone for efficient interaction handling.

Major applications of contact center solutions span across customer service, technical support, sales and marketing, and debt collection. In customer service, the focus is on first-call resolution (FCR) and personalized service delivery, often utilizing AI-powered chatbots for initial triage and agent-assist tools for complex queries. Technical support leverages knowledge bases and screen-sharing capabilities to resolve technical issues efficiently, reducing downtime for customers. Driving factors for market growth are numerous and deeply rooted in the current business climate, primarily centering on the necessity of delivering exceptional Customer Experience (CX) to maintain competitive advantage. As consumers demand instantaneous, context-aware service across their preferred channel, organizations are compelled to invest in seamless omnichannel capabilities. Furthermore, the global proliferation of mobile devices and the rise of social media as a primary communication medium have necessitated platforms capable of integrating these diverse touchpoints into a unified agent desktop view, enhancing efficiency and reducing customer effort.

The inherent benefits derived from advanced contact center solutions are manifold, including significant reductions in operational costs through automation, increased agent productivity via optimized workflow management, and substantial improvements in customer satisfaction scores (CSAT) and Net Promoter Scores (NPS). The market is also heavily driven by the need for better data utilization; sophisticated analytical tools embedded within contact center platforms allow organizations to extract actionable insights from vast volumes of interaction data, leading to proactive service adjustments and personalized customer outreach. This continuous cycle of data collection, analysis, and optimization is crucial for maintaining relevance in a highly competitive digital ecosystem. Moreover, regulatory compliance, particularly concerning data privacy like GDPR and CCPA, requires robust recording, archiving, and security features, further driving investment in compliant and secure contact center infrastructure.

Contact Center Market Executive Summary

The Contact Center Market is undergoing a rapid technological transformation, shifting its foundational architecture from premise-based infrastructure to flexible, scalable, and resilient cloud-based models, encapsulated by the burgeoning popularity of CCaaS. Key business trends indicate a massive uptake in AI and automation, moving beyond simple chatbots to sophisticated Conversational AI capable of handling complex transactional tasks autonomously, thereby freeing human agents to focus on high-value, emotionally nuanced interactions. This transition is not merely about cost reduction; it is fundamentally about leveraging intelligence to personalize every customer touchpoint and ensure seamless context transfer across channels, optimizing the crucial element of Customer Effort Score (CES). Enterprises are aggressively seeking integrated platforms that unify CRM, WFM, and contact center operations, minimizing system fragmentation and providing holistic views of the customer journey, which is paramount for competitive differentiation in service-intensive industries.

From a regional perspective, North America maintains its dominance, driven by technological maturity, high labor costs necessitating automation, and the early widespread adoption of cloud solutions by large enterprises and BPOs. Europe follows closely, characterized by a complex landscape of varied languages and stringent data protection regulations (GDPR), pushing vendors to develop highly secure, multi-language, and geo-compliant solutions. The APAC region, however, is the engine of future growth; countries like India, China, and the Philippines are witnessing exponential growth in digitalization and BPO activity, leading to massive investments in scalable cloud infrastructure. Latin America is also emerging, driven by increasing smartphone penetration and the urgent need for cost-effective customer service solutions tailored to high-growth emerging economies. These regional variations dictate different demands for solution features, ranging from advanced security in regulated Western markets to robust mobile and low-latency connectivity solutions in developing regions.

Segment trends confirm the accelerating momentum of the Cloud deployment model, which is rapidly outpacing the traditional On-Premise segment due to lower Total Cost of Ownership (TCO), faster deployment cycles, and inherent scalability. In terms of components, the Services segment, particularly professional services (implementation, integration, managed services) and consulting, is experiencing robust growth as organizations require specialized expertise to manage complex migration projects and integrate AI capabilities effectively into existing workflows. Vertical trends highlight that the BFSI sector remains the largest consumer, driven by intense regulatory scrutiny, high transaction volumes, and the necessity of fraud detection and compliant customer verification processes. Simultaneously, the Healthcare and E-commerce sectors are showing explosive growth in contact center adoption, fueled by the demand for telehealth services and the rapid expansion of online retail, respectively, both requiring highly responsive and scalable customer interaction management systems.

AI Impact Analysis on Contact Center Market

Users frequently inquire about the practical implementation, ROI, and job displacement potential associated with Artificial Intelligence in the Contact Center market. Common questions revolve around: "How effective are Generative AI chatbots compared to rule-based bots?", "What specific tasks can AI automate, and how does this affect agent roles?", and "What is the true cost of implementing a full Conversational AI suite?" The core themes emerging from user analysis concern the successful integration of AI into existing legacy systems, the ability of AI to truly handle complex, emotionally charged interactions, and the overall governance and ethical implications of using intelligent systems to manage sensitive customer data. Expectations are high regarding hyper-personalization and predictive analytics—users anticipate AI-driven platforms that can anticipate customer needs before they are explicitly voiced, thus transforming the contact center from a cost center into a proactive profit driver. Concerns predominantly focus on maintaining a human touch, ensuring AI accuracy, and managing the skills gap among existing contact center personnel who must now work alongside intelligent automation tools.

The immediate and profound impact of AI is the establishment of the 'Augmented Agent' paradigm, where AI tools do not replace human agents entirely but significantly enhance their capabilities. AI-powered tools such as real-time sentiment analysis, next-best-action recommendations, and automated knowledge retrieval empower agents to resolve issues faster and with greater accuracy, significantly improving both agent and customer satisfaction. Furthermore, AI is crucial in managing the exponential increase in data generated by omnichannel interactions. Machine learning algorithms analyze these vast data sets to identify customer churn predictors, optimize resource allocation through advanced forecasting, and personalize communication strategies based on interaction history and demographic profiles. This shift moves the contact center strategic function from reactive problem-solving to proactive relationship management, driven by intelligence.

Generative AI, in particular, is revolutionizing content creation and summarization within the contact center environment. Instead of relying on static scripts, advanced models can dynamically generate nuanced responses, summarize lengthy chat transcripts or call recordings instantly, and even assist agents in drafting follow-up emails, drastically reducing post-call wrap-up time (ACW). However, the long-term impact involves ethical governance, specifically ensuring transparency regarding when a customer is interacting with a bot versus a human, and preventing algorithmic bias that could lead to discriminatory service. Successful implementation requires a delicate balance between automation efficiency and preserving the empathy and nuance that only human agents can provide, particularly during moments of crisis or high emotional intensity, cementing the future role of the contact center as a hybrid operational model.

- Enhanced Customer Self-Service: Deployment of sophisticated conversational AI and IVAs reducing reliance on human agents for transactional queries.

- Agent Augmentation: Real-time coaching, sentiment analysis, and knowledge retrieval tools boosting human agent productivity and first-call resolution (FCR).

- Predictive Routing: ML algorithms optimizing interaction distribution based on agent skill sets and customer personality/intent, improving matching success.

- Data Synthesis and Insight Generation: Automated analysis of all interaction types (voice, text) to derive actionable business intelligence and optimize processes.

- Operational Cost Reduction: Significant lowering of operational expenditures through automation of routine tasks and optimized workforce management.

DRO & Impact Forces Of Contact Center Market

The dynamics of the Contact Center Market are shaped by powerful Drivers promoting growth, critical Restraints impeding full realization, abundant Opportunities for expansion, and potent Impact Forces influencing strategic decisions. The overarching driver is the global emphasis on elevating Customer Experience (CX) as a primary competitive differentiator, compelling organizations to invest in technologies that support unified, personalized, and efficient interactions across all channels. However, this growth is partially restrained by the significant complexity involved in migrating large, established enterprises from legacy on-premise infrastructure to cloud environments, which often entails high initial capital outlay, extensive data migration risks, and deep integration challenges with existing enterprise resource planning (ERP) and CRM systems. Simultaneously, the market is presenting lucrative opportunities in integrating advanced behavioral analytics and hyper-personalization technologies, allowing businesses to predict customer behavior and automate proactive outreach, especially within emerging high-growth verticals like ed-tech and telehealth.

Drivers: A paramount driver is the accelerated digital transformation triggered by shifting consumer preferences towards digital communication channels—namely chat, social media, and messaging apps—necessitating true omnichannel integration rather than siloed channel management. The imperative for remote work capabilities, amplified by global events, has dramatically increased the demand for flexible, cloud-native CCaaS solutions that ensure business continuity and operational agility, regardless of the agent's location. Furthermore, the fierce competition across service-oriented industries mandates faster resolution times and higher service quality, achievable only through sophisticated routing, AI assistance, and robust quality management features. The growing maturity of AI and ML, coupled with the proven ROI in automation, solidifies these technologies as foundational drivers, pushing continuous optimization and intelligence into every facet of contact center operations.

Restraints: Significant restraints include the persistent data security and compliance concerns, particularly in highly regulated industries like BFSI and healthcare, where sensitive personal information is handled. Cloud adoption, while rapid, is slowed down by perceived security risks associated with multi-tenant architectures and the complexity of adhering to varied international data residency regulations. Another major restraint is the difficulty in securing and retaining skilled contact center professionals proficient in utilizing sophisticated AI tools and managing complex customer interactions; the high agent attrition rate (or "churn") necessitates continuous investment in training and advanced Workforce Optimization (WFO) solutions. Furthermore, the integration hurdles presented by fragmented IT environments, especially for companies utilizing multiple legacy systems, pose a substantial challenge to achieving seamless omnichannel functionality and a unified customer view.

Opportunities: Opportunities abound in expanding the application of Conversational AI beyond simple FAQs to complex transactional tasks, such as automated loan applications or healthcare claims processing. The shift towards "Experience as a Service" models represents a significant opportunity for vendors to offer comprehensive, outcome-based solutions that bundle technology, consulting, and managed services, providing end-to-end management of the customer engagement lifecycle. Geographic expansion into high-growth APAC and Latin American markets, coupled with focusing on small and medium-sized enterprises (SMEs) through streamlined, affordable CCaaS packages, offers untapped revenue streams. Additionally, the development of specialized solutions leveraging Voice Biometrics and advanced identity verification technology presents an opportunity to address critical security concerns while enhancing the customer authentication process, streamlining complex high-security interactions.

- Drivers: Increasing focus on enhancing Customer Experience (CX); accelerated cloud migration (CCaaS adoption); proliferation of digital communication channels; demand for remote and flexible agent models.

- Restraints: High initial investment and complexity of integrating cloud solutions with legacy systems; stringent data privacy and regulatory compliance requirements (e.g., GDPR); high rate of agent turnover and difficulty in skill acquisition.

- Opportunity: Expansion into predictive and proactive customer service models using AI; targeting Small and Medium Enterprises (SMEs) with flexible solutions; integration of specialized biometrics and security features; growth in managed services and consulting.

- Impact Forces: Technological disruption from Generative AI; intense vendor competition driving down subscription costs; evolving regulatory landscape mandating enhanced data security; consumer demand for hyper-personalized, instantaneous service.

Segmentation Analysis

The Contact Center Market is broadly segmented based on Component, Deployment Model, Organization Size, and Industry Vertical. Analyzing these segments provides a granular view of market dynamics and adoption patterns across different enterprise types and regional requirements. The segmentation highlights the underlying industry trend favoring service-oriented, cloud-based solutions over capital-intensive software licensing and on-premise installations. This is particularly evident in the rapid expansion of the Services segment, which includes managed services, implementation support, and ongoing consulting needed to fully leverage complex AI and omnichannel platforms. Enterprises are increasingly seeking partners who can offer not just the technology stack, but also the strategic guidance and operational support necessary to maintain peak efficiency in a constantly evolving technological environment. The choice of segmentation is crucial for vendors designing targeted marketing strategies and product roadforces, ensuring alignment with the specific pain points and technological maturity of their target customers.

The component segmentation distinguishes between Software and Services. Software includes core elements like Omnichannel Routing, Workforce Management (WFM), Analytics and Reporting, and Interactive Voice Response (IVR). The software market is increasingly dominated by integrated suites that offer unified desktop experiences for agents. The Services segment, however, is projected to grow faster, reflecting the demand for specialized expertise in AI integration, customization, and cloud migration. Deployment models clearly delineate the shift from On-Premise (requiring dedicated infrastructure and IT staff) to Cloud-Based (offering flexibility, OpEx structure, and quick scalability), with Hybrid models bridging the gap for organizations with complex regulatory or security requirements that necessitate keeping specific data or processes locally managed. The shift to cloud is highly influenced by organization size, as smaller organizations (SMEs) find the lower TCO and subscription model of CCaaS highly attractive and accessible.

Segmentation by Organization Size classifies the market into Small and Medium Enterprises (SMEs) and Large Enterprises. Large enterprises, with their high transaction volumes and complex needs, were the initial primary adopters, often opting for custom, robust solutions. However, the SME segment is the fastest growing, catalyzed by the availability of scalable and affordable CCaaS solutions tailored to smaller operational scales. Finally, the segmentation by Industry Vertical reveals concentrated investment areas, with BFSI, Telecommunications, and Retail dominating the adoption landscape due to their high customer interaction volumes and critical need for secure, efficient service delivery. The emerging verticals, such as government and public sector organizations, are rapidly investing in contact center solutions to improve citizen engagement and digital service accessibility, signaling diversification in market demand beyond traditional commercial users.

- By Component:

- Software (ACD, IVR, WFM, Analytics, Reporting, Omnichannel Routing)

- Services (Integration and Implementation, Managed Services, Consulting, Training)

- By Deployment Model:

- On-Premise

- Cloud-Based (CCaaS)

- Hybrid

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- Telecommunications and IT

- Healthcare and Life Sciences

- Government and Public Sector

- Others (Media, Travel, Education)

Value Chain Analysis For Contact Center Market

The Contact Center Market value chain begins with upstream activities, which primarily involve technology development and component provisioning. This phase includes foundational providers of infrastructure (cloud vendors like AWS, Azure, Google Cloud), hardware manufacturers (telephony equipment, server components), and core software developers specializing in fundamental communication protocols and AI/ML frameworks. The success of this upstream segment is contingent upon continuous research and development, particularly in areas like low-latency network performance, secure data encryption standards, and the advancement of robust natural language processing (NLP) capabilities, which form the intelligent core of modern contact center solutions. Strategic partnerships between specialized software developers and large cloud providers are crucial here to ensure scalability and global reach, allowing integrated platforms to be deployed efficiently across diverse geographical locations and regulatory environments.

The midstream component involves the core contact center solution providers (the key market players) who integrate these foundational technologies into comprehensive, functional platforms (CCaaS suites). This is the phase where customization, packaging, and integration with existing enterprise systems (CRM, ERP) take place. Solution providers focus heavily on optimizing the agent desktop experience, developing robust APIs for third-party integration, and implementing specialized features like Workforce Optimization (WFO) and Quality Management (QM). Distribution channels play a critical role here; solutions are distributed through direct sales teams targeting large enterprises, and extensively through indirect channels—including system integrators, value-added resellers (VARs), and channel partners—who are vital for reaching the vast SME market and for providing localized support and implementation expertise in various regions. These indirect channels often add value through consulting and post-sales managed services, tailored to specific vertical requirements.

Downstream analysis focuses on the end-users—the businesses employing the contact center technologies—and the professional services supporting them. This stage includes implementation services, ongoing technical support, consulting for operational refinement, and specialized training for agents and managers to maximize the utilization of intelligent tools. The ultimate value delivery is measured by improvements in customer satisfaction, operational efficiency, and revenue generation for the end-user. Effective downstream execution requires highly skilled technical support staff capable of diagnosing and resolving complex integration issues, particularly in hybrid deployment environments. The feedback loop from end-users back to solution providers is essential for product iteration and continuous improvement, ensuring that feature development aligns with real-world operational demands, especially as AI adoption accelerates and new channels emerge, requiring constant platform adaptation and integration.

Contact Center Market Potential Customers

Potential customers for Contact Center solutions are universally found across any organization that engages directly with consumers or business partners for service, support, or sales purposes. The primary segment comprises large, multinational enterprises, particularly those in high-transaction volume sectors, which require complex, high-availability, and highly scalable solutions capable of handling millions of interactions daily across global time zones. These buyers demand sophisticated security features, deep customization options, and integrated AI capabilities to manage efficiency and ensure regulatory adherence, making them ideal targets for premium CCaaS offerings and bespoke on-premise solutions where necessary. Their purchasing decisions are driven by the necessity of competitive differentiation through superior customer experience and the imperative of reducing high operational labor costs through automation and WFO tools.

The second, and rapidly expanding, segment includes Small and Medium Enterprises (SMEs). Historically underserved by complex, costly legacy systems, SMEs are now rapidly adopting cloud-based CCaaS solutions due to their affordability, quick deployment, and minimal IT overhead requirements. These buyers prioritize ease of use, swift scalability to manage seasonal fluctuations, and essential omnichannel functionality to compete effectively with larger organizations. Their buying behavior is heavily influenced by the Total Cost of Ownership (TCO) and the availability of bundled services that simplify implementation and management. The proliferation of digital-native SMEs, particularly in the e-commerce and SaaS sectors, further fuels this demand, as these businesses require instant, reliable communication platforms built for the digital consumer journey from inception.

Beyond commercial entities, government agencies, non-profits, and educational institutions represent growing potential customer segments. These organizations require reliable contact center platforms to manage citizen inquiries, disaster response communications, and high-volume administrative tasks, often with a unique focus on accessibility and robust data privacy mandates. Healthcare providers, driven by the shift towards telehealth and remote patient monitoring, are increasingly high-value targets, requiring solutions that integrate seamlessly with Electronic Health Records (EHR) systems and comply strictly with standards like HIPAA, prioritizing security and patient data integrity above all else. Consequently, solution providers are increasingly tailoring specific vertical-market packages, embedding industry-specific regulatory compliance and integration features directly into their core offerings to meet the highly specialized demands of these crucial customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Billion |

| Market Forecast in 2033 | USD 1,020 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NICE, Genesys, Five9, Amazon Web Services (AWS), Cisco Systems, Talkdesk, 8x8, Twilio, Avaya, Microsoft, Oracle, Salesforce, Alvaria, Content Guru, Pega Systems, SAP, Zendesk, RingCentral, Vonage, Dialpad |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contact Center Market Key Technology Landscape

The Contact Center Market is fundamentally defined by the adoption and integration of several sophisticated technologies designed to enhance connectivity, intelligence, and operational efficiency. Central to this landscape is the dominance of Cloud Computing Infrastructure, specifically the Contact Center as a Service (CCaaS) model. CCaaS provides the necessary scalability, flexibility, and operational expenditure (OpEx) financial model favored by modern enterprises, allowing for rapid deployment and continuous feature updates without burdensome on-premise hardware management. This infrastructure is underpinned by highly resilient and secure API integration capabilities, which are essential for connecting the contact center platform with core enterprise systems like Customer Relationship Management (CRM) databases, knowledge management systems, and back-office applications, ensuring that customer data and context flow seamlessly across all touchpoints and departmental silos. The technological focus is moving away from proprietary telephony hardware towards software-defined communication solutions.

The second pillar of the technology landscape is Artificial Intelligence (AI) and Machine Learning (ML). AI manifests in various mission-critical applications: Conversational AI powers intelligent virtual agents (IVAs) and chatbots for self-service automation; Predictive Analytics engines use ML models to forecast call volumes, optimize agent scheduling (WFM), and route customers based on propensity to churn or purchase; and Real-Time Agent Assist tools utilize NLP to listen to live conversations and provide instantaneous guidance, scripts, and relevant knowledge articles to human agents. Furthermore, sophisticated biometrics and voice authentication technology are increasingly being integrated to streamline high-security interactions, enhancing customer experience by eliminating frustrating manual identity verification processes while simultaneously mitigating fraud risk. The effectiveness of these AI layers is directly proportional to the quality and volume of data they are trained on, making robust data governance and analytics platforms a critical technological requirement.

Omnichannel Experience Management is a critical technological objective, moving beyond simple multi-channel support to true contextual synchronization across voice, email, chat, social media, and emerging video channels. This requires sophisticated routing engines (ACD) that maintain the customer's journey history regardless of the channel switch, ensuring a personalized and friction-free experience. Furthermore, the integration of Workforce Optimization (WFO) and Workforce Engagement Management (WEM) suites, utilizing technologies like gamification, performance dashboards, and automated coaching modules, is paramount. These tools leverage deep analytics to enhance agent morale, reduce attrition, and ensure high levels of service quality, treating the human element of the contact center as a vital, high-tech asset that must be strategically managed and continuously optimized alongside the technical infrastructure. The amalgamation of these technologies is converging toward unified, highly personalized, and intelligent Customer Experience (CX) platforms.

Regional Highlights

- North America: This region remains the largest market share holder, driven by the presence of major technology innovators (e.g., Silicon Valley), high adoption rates of AI and cloud technologies (CCaaS), and a strong emphasis on optimizing customer service due to high labor costs and fierce competition. The US market, in particular, leads in investment in next-generation technologies like Generative AI for complex customer interactions and advanced WFM solutions to manage highly dispersed, remote workforces. Stringent compliance requirements in sectors like healthcare (HIPAA) and finance further necessitate advanced, secure, and auditable contact center platforms.

- Europe: The European market is characterized by diverse language requirements and complex, rigorous data protection regulations, notably GDPR. This drives demand for multi-language support, robust data residency features, and highly secure cloud platforms. Western European countries (UK, Germany, France) are mature markets prioritizing digital transformation and omnichannel integration, while Eastern Europe is emerging as a growing hub for BPO activities, accelerating the adoption of scalable CCaaS solutions across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive digitalization initiatives across countries like India and China, and the expansion of the middle-class consumer base which demands better service quality. Significant investment is pouring into BPO operations and shared service centers, creating high demand for high-volume, cost-effective cloud-based solutions. The challenge in this region lies in infrastructure disparities and managing connectivity issues in diverse geographical areas, demanding flexible deployment options.

- Latin America (LATAM): This region is an emerging market seeing rapid growth due to increasing smartphone penetration, the rising use of social messaging platforms for service (e.g., WhatsApp), and the urgent need for cost-efficient solutions to manage evolving consumer demands. Countries like Brazil and Mexico are leading adoption, focusing primarily on mobile-first engagement strategies and leveraging CCaaS to bypass the high capital expenditures associated with traditional on-premise setups.

- Middle East and Africa (MEA): Growth in MEA is concentrated around Gulf Cooperation Council (GCC) countries, driven by government-led digital transformation agendas and large-scale smart city projects requiring advanced citizen service capabilities. The market is smaller but highly focused on cutting-edge technologies, particularly in the banking and telecom sectors, seeking secure, locally hosted solutions to meet data sovereignty laws and improve efficiency in oil and gas and public services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contact Center Market.- NICE

- Genesys

- Five9

- Amazon Web Services (AWS)

- Cisco Systems

- Talkdesk

- 8x8

- Twilio

- Avaya

- Microsoft

- Oracle

- Salesforce

- Alvaria

- Content Guru

- Pega Systems

- SAP

- Zendesk

- RingCentral

- Vonage

- Dialpad

Frequently Asked Questions

Analyze common user questions about the Contact Center market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the shift to CCaaS?

The primary driver is the necessity for scalability, flexibility, and reduced Total Cost of Ownership (TCO), enabling businesses to rapidly adapt to remote work models and manage fluctuating customer interaction volumes without large, fixed capital investments.

How is AI fundamentally changing the role of a contact center agent?

AI is transforming the agent's role from reactive transaction handlers to augmented advisors. AI automates routine tasks, providing agents with real-time intelligence (agent assist) so they can focus exclusively on complex problem-solving and emotionally nuanced customer relationship management.

Which industry vertical is adopting contact center solutions most rapidly?

While BFSI remains the largest consumer, the Healthcare and E-commerce/Retail sectors are currently exhibiting the most rapid growth in adoption, driven by the expansion of telehealth services and the exponential rise of online purchasing demanding scalable digital customer support.

What are the main security concerns associated with cloud-based contact centers?

Key security concerns include data residency compliance (especially in GDPR and CCPA regions), ensuring end-to-end data encryption across multi-tenant architectures, and managing the risks associated with API integration into sensitive enterprise resource planning (ERP) systems.

What is the difference between omnichannel and multichannel in contact centers?

Multichannel offers support across various siloed channels (phone, email, chat), whereas omnichannel provides a unified, continuous customer experience where context and history are seamlessly carried over regardless of the channel the customer uses to transition or interact.

What is Workforce Engagement Management (WEM) and why is it important?

WEM refers to software tools that integrate WFM, quality monitoring, performance management, and agent feedback/gamification to improve agent morale, productivity, and reduce the high turnover rates common in contact centers, making it crucial for operational sustainability.

What impact does Generative AI have specifically on self-service solutions?

Generative AI enhances self-service by enabling highly natural, human-like conversations, moving beyond script-based chatbots. It allows virtual agents to handle complex, non-linear queries, dynamically generate personalized responses, and summarize large documents for immediate customer access, increasing deflection rates.

Are premise-based solutions becoming entirely obsolete in the market?

No, while cloud adoption dominates growth, premise-based solutions remain relevant for highly regulated organizations with extreme security requirements, specific legacy integration needs, or those that must adhere to strict internal data residency policies that preclude public cloud usage.

How is predictive analytics used within contact center technology?

Predictive analytics uses machine learning to forecast future events, such as anticipating staffing needs (optimizing WFM), identifying customers likely to churn for proactive intervention, and routing calls based on the predicted optimal agent for resolution and customer lifetime value (CLV).

What is the significance of the API economy in the contact center landscape?

The API economy is critical because it enables seamless integration between the core contact center platform and external enterprise applications (like CRM, ticketing systems, and HR tools). This flexibility allows organizations to customize their CX ecosystem without vendor lock-in and ensures unified data flow.

Which region shows the highest growth rate and why?

The Asia Pacific (APAC) region exhibits the highest projected CAGR, primarily due to rapid digitalization initiatives, high investment in BPO centers, and a massive, underserved consumer base demanding modern, efficient customer service across emerging digital channels.

What role does Workforce Optimization (WFO) play in the modern contact center?

WFO ensures operational efficiency by integrating tools for forecasting, scheduling, quality monitoring, and performance management. Its role is to align agent availability and skill sets with anticipated customer demand, minimizing costs while maximizing service quality metrics like FCR and AHT.

What are the implications of the shift from CTI to software-defined contact center architecture?

The shift replaces reliance on specialized, expensive hardware (CTI) with flexible, cost-effective software solutions. This allows for easier remote deployment, faster scaling, and seamless integration of voice and digital channels via open APIs, driving down operational costs and increasing agility.

How do businesses measure the Return on Investment (ROI) of a new contact center system?

ROI is measured through key performance indicators (KPIs) such as reduced Average Handle Time (AHT), improved First Call Resolution (FCR) rates, lower operational costs due to automation, higher agent retention rates, and improved customer satisfaction scores (CSAT/NPS).

What is 'digital deflection' and how is it achieved using contact center technology?

Digital deflection is the strategy of steering customers away from costly channels (like voice calls) toward lower-cost automated digital channels (like chatbots or IVAs). It is achieved through intelligent routing and effective self-service powered by Conversational AI and advanced knowledge bases.

Why is data governance becoming increasingly crucial in contact center operations?

Data governance is essential due to the massive amount of sensitive PII and interaction data handled, requiring strict adherence to global privacy laws (GDPR, CCPA). Robust governance ensures data security, regulatory compliance, and ethical use of customer data for training AI models.

What defines a 'unified agent desktop' in an omnichannel environment?

A unified agent desktop is a single, integrated screen interface that provides the agent with a holistic view of the customer's identity, history, and current context across all communication channels, eliminating the need to toggle between disparate applications and vastly improving efficiency.

How are financial institutions leveraging contact center AI beyond basic service?

Financial institutions are using AI for advanced fraud detection, biometric authentication for secure transactions, automated compliant record-keeping, and personalized product recommendations based on predictive analytics of customer financial behavior.

What is the challenge presented by the high agent attrition rate?

The high agent attrition rate (or churn) leads to substantial recruitment, training, and operational costs. The solution involves implementing advanced WEM tools, providing continuous training, improving the agent experience, and ensuring workload is optimized through smart AI deflection.

Which segment of the market, software or services, is forecasted to grow faster?

The Services segment (including managed services, implementation, and consulting) is forecasted to grow faster than the core software segment, reflecting the high demand for specialized expertise required to integrate, customize, and manage complex, AI-enabled cloud platforms effectively.

-- End of Report --

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Contact Center Quality Assurance Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Contact Center Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Contact Center Transformation Market Statistics 2025 Analysis By Application (BFSI, Consumer Goods & Retail, Government, Healthcare, IT & Telecom, Travel & Hospitality), By Type (Cloud-Based, On-Premise), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Contact Center Solution Market Statistics 2025 Analysis By Application (BFSI, Consumer Goods & Retail, Government, Healthcare, IT & Telecom, Travel & Hospitality), By Type (Integration & Deployment, Support & Maintenance, Training & Consulting, Managed Services), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cloud-Based Contact Center Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Automatic Call Distribution (ACD), Agent Performance Optimization (APO), Dialers, Interactive Voice Response (IVR), Others), By Application (BFSI, Consumer Goods and Retail, Government and Public Sector, Healthcare and Life Sciences, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager