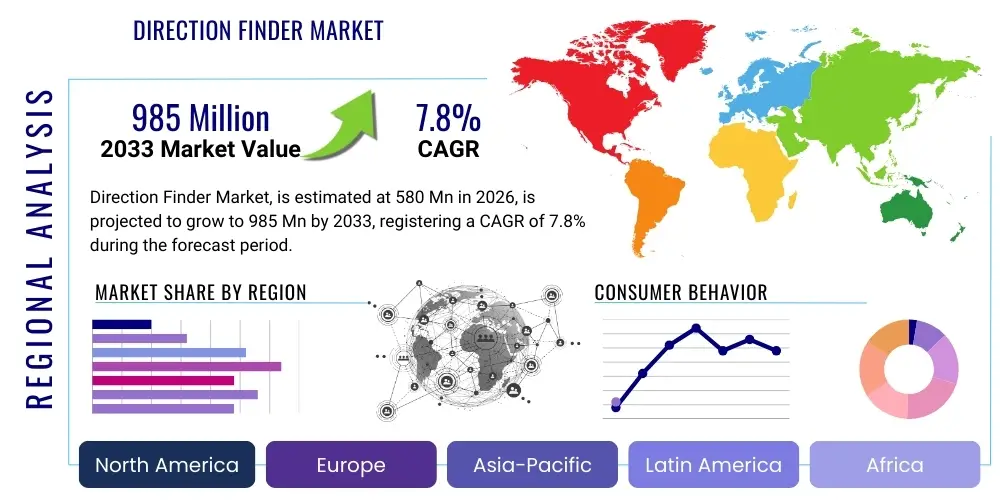

Direction Finder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441848 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Direction Finder Market Size

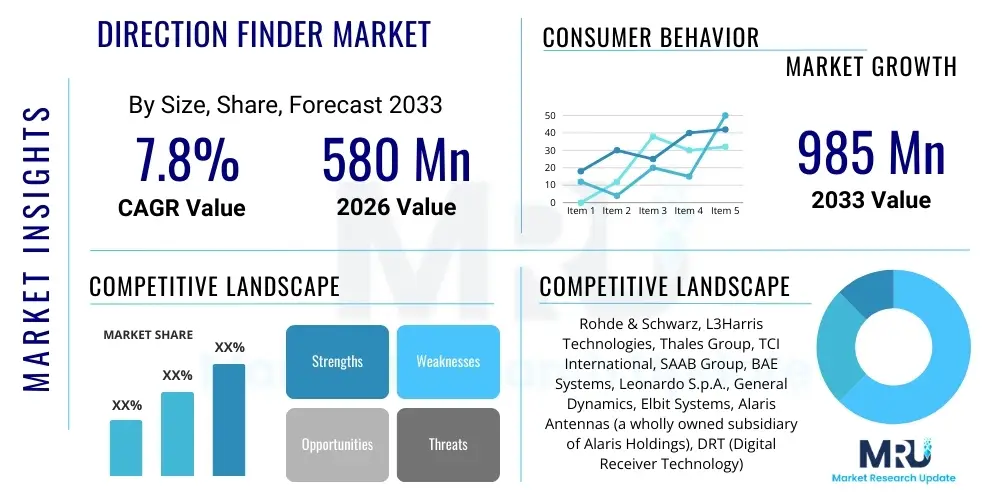

The Direction Finder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 985 Million by the end of the forecast period in 2033.

Direction Finder Market introduction

The Direction Finder Market encompasses specialized electronic systems designed to determine the precise direction or bearing of a source of electromagnetic emission, primarily utilized across air, maritime, and land applications for navigation, surveillance, search and rescue (SAR), and signal intelligence (SIGINT). These sophisticated devices rely on technologies ranging from amplitude comparison and phase comparison to more advanced time difference of arrival (TDOA) techniques, facilitating accurate positional awareness in complex operational environments. Historically, direction finders were vital for analog radio navigation, but modern systems have evolved into software-defined radios (SDR) integrated with digital processing capabilities, enabling the rapid identification and classification of complex digital signals.

Major applications of direction finding technology span governmental sectors, including defense and homeland security, where they are critical for electronic warfare (EW), border monitoring, and threat analysis. In the commercial sector, direction finders are essential for air traffic control (ATC), ensuring safe aircraft separation, and for maritime safety, locating distress beacons (EPIRBs and PLBs). The inherent benefit of these systems lies in their passive nature; they typically do not transmit, making them crucial tools for clandestine operations and non-cooperative target tracking. Furthermore, regulatory mandates by organizations like the International Civil Aviation Organization (ICAO) and the International Maritime Organization (IMO) ensure a continuous demand for certified direction-finding equipment in mandatory safety systems.

Driving factors for market growth include the increasing complexity of the electromagnetic spectrum due to the proliferation of wireless devices, coupled with the rising global expenditure on defense modernization and intelligence gathering capabilities. The shift towards higher frequency bands and the requirement for rapid geo-location of non-traditional signals, such as drones and illegal spectrum usage, necessitate continuous investment in advanced DF technology. Miniaturization, enhanced processing speed, and the integration of autonomous capabilities further accelerate the adoption across portable and unmanned platforms, expanding the traditional market scope significantly beyond fixed installations.

Direction Finder Market Executive Summary

The Direction Finder Market is experiencing robust expansion, fundamentally driven by escalating geopolitical tensions demanding sophisticated Electronic Warfare (EW) capabilities and the widespread integration of spectrum monitoring technologies across civil infrastructure. Business trends indicate a strong move toward platform integration, where DF systems are increasingly miniaturized and embedded within Unmanned Aerial Vehicles (UAVs), patrol vessels, and ground vehicles, moving away from large, stationary installations. Key vendors are focusing on developing Software-Defined Radio (SDR) platforms that offer modularity and future-proofing against evolving signal protocols, ensuring that investment in hardware translates into long-term operational flexibility. Furthermore, service models, particularly in spectrum management and regulatory compliance for telecommunications, are emerging as significant revenue streams, complementing traditional hardware sales.

Regionally, North America and Europe maintain dominance due to high defense spending, stringent regulatory requirements governing aviation and maritime safety, and the presence of major technological innovators. However, the Asia Pacific (APAC) region is poised for the fastest growth, primarily fueled by extensive naval and air force modernization programs in countries like China, India, and South Korea, coupled with significant investments in enhancing civil ATC infrastructure to manage rapidly growing air traffic volumes. The Middle East and Africa (MEA) are also showing promising opportunities, especially in border security applications and the establishment of sophisticated coastal surveillance networks to protect critical maritime trade routes and offshore energy assets.

Segment trends reveal that the defense sector remains the largest consumer, prioritizing multi-channel and wideband DF systems capable of handling complex communications and radar signals. Technology-wise, Interferometer-based DF systems are gaining traction due to their superior accuracy and fast processing speeds, crucial for tracking high-speed targets. Application-wise, Search and Rescue (SAR) missions are driving the demand for highly sensitive, portable, and reliable DF systems that can rapidly locate emergency beacons, often integrating them with satellite connectivity. Moreover, the growing threat posed by unauthorized drone activity is establishing spectrum monitoring and Counter-UAS (C-UAS) direction finding as a high-growth segment, necessitating advanced triangulation capabilities in urban and congested environments.

AI Impact Analysis on Direction Finder Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Direction Finder Market revolve around how AI can enhance signal classification, reduce operator cognitive load, and improve the speed and accuracy of target geo-location, especially in crowded spectrum environments. Users frequently inquire about AI’s ability to differentiate between legitimate and adversarial signals, predict target movement patterns, and automate the optimization of antenna arrays for maximizing signal reception. The primary themes emerging from user concerns include the reliability of machine learning algorithms in novel electromagnetic environments (e.g., electronic attack scenarios) and the security implications of integrating advanced analytics into sensitive defense systems. Expectations are high for AI to transform passive sensing into proactive intelligence, moving the technology from mere positional identification to predictive situational awareness.

- AI enables automated real-time signal classification and recognition of complex modulation schemes, significantly reducing false positives and operator latency.

- Machine Learning algorithms optimize direction-finding processes by predicting optimal antenna beamforming based on environmental conditions and historical signal characteristics.

- Deep Learning models enhance processing speed for Wideband Direction Finding (WBDF) systems, allowing instantaneous analysis of signals across vast frequency ranges.

- AI supports non-cooperative target tracking through behavioral analysis and predictive trajectory modeling, improving overall situational awareness for intelligence missions.

- Autonomous DF networks utilize AI to manage resource allocation and triangulation fusion, optimizing data flow and accuracy across geographically dispersed sensors.

- AI facilitates automated jamming detection and localization, identifying and classifying sources of electronic interference rapidly in congested battle spaces.

- Integration of AI in cognitive radio systems allows DF equipment to adapt autonomously to new, previously unclassified electronic threats and signatures.

DRO & Impact Forces Of Direction Finder Market

The Direction Finder Market is fundamentally shaped by powerful synergistic forces, where technological drivers accelerate adoption, while specific operational restraints necessitate continuous innovation. Key drivers include stringent regulatory requirements for safety equipment in aviation and maritime transport, coupled with the relentless modernization efforts by global defense forces to counter asymmetric electronic threats. Opportunities are heavily concentrated in the emerging domains of 5G spectrum monitoring, Counter-UAS systems, and the application of DF technology in space-based surveillance platforms. These forces create a dynamic environment where systems must become smaller, more accurate, and capable of operating across increasingly wider frequency bands to meet diverse end-user demands.

Restraints, however, pose challenges; these primarily include the high initial cost of sophisticated, wideband digital DF systems, which limits adoption in smaller commercial vessels or budget-constrained organizations. Furthermore, the inherent complexity of accurately locating signals in heavily cluttered urban or mountainous terrain, characterized by multi-path interference, continues to challenge even the most advanced techniques, requiring significant computational power for signal processing and error correction. The operational effectiveness of DF systems is also highly dependent on the training and expertise of personnel, a resource that remains scarce globally, particularly in specialized signal intelligence roles.

The impact forces are profoundly evident in the shift toward integrated solutions. The need for rapid, high-confidence geo-location data is pushing DF systems away from standalone functionality and into networked architectures, where data fusion from multiple passive sensors drastically improves accuracy and coverage. This requirement for interconnectedness, driven by the need for actionable intelligence, ensures that vendors prioritizing system-level integration and interoperability will gain significant market leverage. Conversely, the continuous pressure to operate silently and effectively against complex low probability of intercept (LPI) signals necessitates sustained R&D investment, making innovation capability a critical force shaping market competitiveness.

Segmentation Analysis

The Direction Finder Market segmentation provides a granular view of specific technological preferences, operational requirements, and end-user demands across various industry verticals. Segmentation primarily occurs based on the core technology deployed (e.g., Interferometry, TDOA), the platform upon which the system is mounted (e.g., fixed, portable, airborne), the broad application area (e.g., defense, commercial), and the operating frequency range. This structural breakdown helps vendors tailor specialized equipment packages, such as ruggedized, long-range systems for military use versus high-precision, low-cost systems for civil air traffic management. Understanding these distinct segments is vital for strategic planning, allowing companies to allocate resources effectively toward high-growth niches like C-UAS or satellite-based signal monitoring.

The technology segment, specifically, reflects the ongoing evolution from traditional rotating loop antennas to modern digital processing techniques. Interferometer systems dominate high-accuracy applications due to their precision and speed, while TDOA systems offer superior coverage across large geographical areas by using multiple synchronized receivers. Meanwhile, the platform segmentation highlights the trend of miniaturization, enabling the deployment of capable DF sensors on tactical vehicles and increasingly, on small form-factor UAVs for reconnaissance and tactical signal mapping, thereby expanding the potential addressable market significantly.

Application segmentation reveals the deep divergence in requirements between defense and civil sectors. Defense applications prioritize survivability, wide frequency coverage, and integration with Electronic Warfare suites, often requiring proprietary, classified technologies. Conversely, commercial applications, such as maritime navigation and emergency response, focus heavily on reliability, adherence to international standards (e.g., GMDSS requirements), and cost-effectiveness. This dichotomy ensures continuous innovation specific to both high-specification military needs and volume-driven commercial compliance requirements.

- By Platform:

- Fixed/Ground-Based

- Airborne (Manned and Unmanned)

- Naval/Maritime

- Portable/Handheld

- By Technology:

- Interferometry

- Time Difference of Arrival (TDOA)

- Amplitude Comparison

- Phase Comparison

- Software-Defined Radio (SDR) Based

- By Application:

- Signal Intelligence (SIGINT) and Electronic Warfare (EW)

- Search and Rescue (SAR)

- Air Traffic Control (ATC) and Navigation

- Spectrum Monitoring and Management

- Homeland Security and Border Patrol

- By Frequency Range:

- HF (High Frequency)

- VHF/UHF (Very High Frequency / Ultra High Frequency)

- SHF/EHF (Super High Frequency / Extremely High Frequency)

- By End-User:

- Government and Defense

- Commercial (Aviation, Maritime, Telecommunications)

Value Chain Analysis For Direction Finder Market

The Value Chain for the Direction Finder Market begins with highly specialized upstream activities centered around the procurement and design of core technological components, primarily sophisticated high-frequency RF integrated circuits, advanced digital signal processors (DSPs), and specialized antenna arrays. The upstream segment is characterized by reliance on niche suppliers capable of meeting stringent performance criteria, especially concerning signal noise and processing speed. Key activities include foundational research in electromagnetic propagation, development of proprietary algorithms for angle of arrival (AOA) calculation, and the manufacturing of ruggedized, weather-proof enclosures suitable for harsh operational environments. Supply chain stability, particularly regarding high-performance semi-conductors and military-grade components, is critical in this phase.

The core manufacturing and assembly stage involves the complex integration of RF front-ends, processing units, and user interface software into a cohesive system. Quality control and rigorous testing, especially calibration to ensure directional accuracy and compliance with military (MIL-STD) or civil (ICAO/IMO) standards, form the crucial value addition here. Direct channels often serve governmental and defense clients, facilitating highly tailored sales, maintenance contracts, and classified technology transfer. Indirect channels, involving specialized avionics and maritime equipment distributors, focus on selling standard commercial-off-the-shelf (COTS) DF systems to civil aviation and shipping entities, leveraging local expertise for installation and post-sales support across diverse geographical markets.

Downstream activities are dominated by system installation, integration into larger platforms (e.g., EW suites, VTS systems), ongoing maintenance, and software updates, which are essential given the rapid evolution of signal protocols and digital threats. Aftermarket services, including training military personnel or ATC operators on effective system usage, represent a significant revenue component, ensuring prolonged product lifecycle value. The final end-user interaction involves the application of the DF data—whether for tactical decision-making in defense or safety-critical functions in maritime traffic—demonstrating the high mission criticality of the technology provided through the established distribution and service networks.

Direction Finder Market Potential Customers

The primary customers for direction finding systems are government and defense organizations, encompassing military forces (air, ground, and naval) and various security agencies, including coast guards, border patrol, and national intelligence services. These entities require high-specification, multi-functional DF systems for critical operational tasks such as electronic reconnaissance, combat search and rescue (CSAR), threat geo-location, and maritime domain awareness. Procurement decisions in this segment are typically long-cycle, driven by national defense budgets, geopolitical threat assessments, and the need for system interoperability within existing command and control structures, often favoring bespoke, ruggedized solutions compliant with military standards.

A significant commercial customer base includes the aviation and maritime sectors. In aviation, Air Navigation Service Providers (ANSPs) and major airports are constant buyers of ground-based direction finders used for air traffic control, monitoring aircraft movements, and rapidly locating emergency position indicating radio beacons (ELTs). Similarly, the maritime industry, including international shipping companies, port authorities (for Vessel Traffic Services or VTS), and offshore energy operators, relies on DF systems for navigation safety and regulatory compliance concerning Global Maritime Distress and Safety System (GMDSS) requirements. These commercial buyers prioritize certified reliability, low maintenance overhead, and seamless integration with standard bridge or tower electronics.

Emerging customer groups include regulatory bodies and large corporations focused on telecommunications and spectrum management. National telecommunications authorities utilize DF technology to enforce spectrum licenses, locate sources of interference, and manage the growing demands of 5G infrastructure deployment. Furthermore, large infrastructure operators and critical asset protection services are increasingly becoming potential buyers, particularly for portable or rapidly deployable DF systems used in Counter-UAS (C-UAS) applications to detect and track unauthorized drone communications near airports, prisons, or sensitive governmental facilities, indicating a broadening horizontal market application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 985 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rohde & Schwarz, L3Harris Technologies, Thales Group, TCI International, SAAB Group, BAE Systems, Leonardo S.p.A., General Dynamics, Elbit Systems, Alaris Antennas (a wholly owned subsidiary of Alaris Holdings), DRT (Digital Receiver Technology), Thinkom Solutions, GEW Technologies, Procom A/S, Roke Manor Research, Elettronica Group, Argon ST, Southwest Research Institute (SwRI), Cobham Advanced Electronic Solutions (CAES), and EADS Defence and Security. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Direction Finder Market Key Technology Landscape

The technological core of the Direction Finder Market is rapidly shifting towards digital and software-centric architectures, moving past traditional analog systems. Software-Defined Radio (SDR) technology is paramount, offering unparalleled flexibility to adapt to new or changing signal protocols and frequency bands merely through software updates, mitigating the risk of hardware obsolescence. Modern DF systems utilize advanced digital signal processing (DSP) to handle extremely wide instantaneous bandwidths, which is critical for intercepting complex, frequency-hopping, or low-power signals across the VHF, UHF, and microwave spectrums. The shift towards multi-band, multi-polarization antenna arrays, often utilizing advanced array processing techniques, allows for simultaneous monitoring and greater spatial accuracy, particularly in dense electromagnetic environments.

Interferometry and Time Difference of Arrival (TDOA) remain the two dominant methodologies, distinguished by their operational profiles. Interferometer systems, relying on measuring the phase difference between signals arriving at geometrically spaced antennas, offer high accuracy and rapid localization, making them ideal for tactical, short-to-medium-range applications such as C-UAS or localized spectrum policing. Conversely, TDOA systems, which synchronize multiple geographically separated receivers to calculate the time difference of signal arrival, excel in wide-area surveillance and strategic SIGINT applications, requiring sophisticated timing accuracy (often GPS-disciplined) and robust network fusion capabilities to triangulate targets over vast distances.

Further innovation is concentrated in passive geo-location techniques that incorporate data fusion from non-traditional sources. This includes integrating DF data with hyperspectral imaging, electronic support measures (ESM), and telemetry data to create a comprehensive operational picture. Miniaturization technology is enabling tactical deployment, allowing high-performance DF capabilities to be integrated into man-portable packs, small UAV payloads, and covert ground sensors. The adoption of advanced calibration techniques and error correction algorithms, often AI-enhanced, is crucial for maintaining performance consistency in dynamic, real-world conditions where the assumption of a flat plane wave signal often fails due to environmental interference and reflections.

Regional Highlights

North America holds the largest share of the Direction Finder Market, driven by the massive defense spending of the United States and Canada, focused heavily on modernizing Electronic Warfare capabilities and investing in sophisticated border security technologies. The region is characterized by the presence of global leaders in aerospace and defense technology, fostering continuous innovation in SDR and TDOA systems. Strict regulatory requirements imposed by the Federal Aviation Administration (FAA) and the U.S. Coast Guard mandate the deployment of certified DF systems for ATC and SAR operations, ensuring a stable commercial baseline demand. Furthermore, the proactive monitoring of the spectrum for 5G rollout and national security interests significantly contributes to the high market valuation and technological maturity of the region.

Europe represents the second-largest market, underpinned by robust spending on joint defense initiatives (e.g., NATO modernization) and stringent adherence to civil aviation and maritime safety protocols established by EASA and EMSA. Countries such as the UK, Germany, and France are key consumers, particularly in naval and airborne platforms, emphasizing wideband surveillance and intelligence gathering to counter evolving transnational threats. The European market shows a strong preference for high-quality, high-reliability Interferometer-based DF systems for localized, high-precision applications, alongside significant investment in ground-based spectrum monitoring infrastructure to regulate increasingly crowded frequency bands across the continent. The focus on integrating DF capabilities into unified C4ISR systems further solidifies market growth.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is propelled by significant national security investment in China, India, and Japan, fueled by ongoing territorial disputes and naval expansion efforts that necessitate advanced SIGINT and EW assets. Concurrently, the explosion of commercial air travel requires substantial upgrades to Air Traffic Management (ATM) infrastructure, leading to major procurement cycles for ATC DF equipment across regional airports. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily focused on external border protection, coastal surveillance for protecting critical infrastructure (oil and gas), and countering illicit activities, driving demand for portable and naval DF solutions.

- North America: Dominant market share due to high defense budgets, stringent FAA/Coast Guard regulations, and strong industry presence in EW and SIGINT modernization programs.

- Europe: High demand driven by NATO defense spending, emphasis on maritime and aviation safety standards, and adoption of sophisticated spectrum management technologies.

- Asia Pacific (APAC): Fastest growing region, fueled by extensive military modernization (naval and air force assets) and massive investment in commercial air traffic infrastructure upgrades across major economies.

- Middle East & Africa (MEA): Growing demand in border security, coastal surveillance (maritime domain awareness), and investment in C-UAS technologies to protect critical national assets.

- Latin America: Moderate growth focused on modernizing naval fleets, improving Search and Rescue capabilities, and addressing internal security challenges through passive surveillance systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Direction Finder Market.- Rohde & Schwarz GmbH & Co. KG

- L3Harris Technologies, Inc.

- Thales Group

- TCI International, Inc.

- SAAB Group

- BAE Systems plc

- Leonardo S.p.A.

- General Dynamics Corporation

- Elbit Systems Ltd.

- Alaris Antennas (Alaris Holdings)

- DRT (Digital Receiver Technology)

- Thinkom Solutions, Inc.

- GEW Technologies (a subsidiary of SAAB)

- Procom A/S

- Roke Manor Research Ltd.

- Elettronica Group

- Argon ST (a subsidiary of Boeing)

- Southwest Research Institute (SwRI)

- Cobham Advanced Electronic Solutions (CAES)

- EADS Defence and Security (now Airbus Defence and Space)

Frequently Asked Questions

Analyze common user questions about the Direction Finder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between TDOA and Interferometry DF systems?

TDOA (Time Difference of Arrival) uses geographically dispersed receivers synchronized by GPS to calculate a signal source's location across large areas, prioritizing coverage. Interferometry uses a compact antenna array to measure phase differences for rapid, high-accuracy bearing calculation, best suited for localized, tactical applications.

How is the Direction Finder Market affected by the proliferation of drones and UAVs?

The increasing use of UAVs necessitates sophisticated C-UAS (Counter-UAS) direction finding systems. DF technology is crucial for passively locating the unauthorized drone’s command and control signal, enabling precise geo-location and mitigation without reliance on active radar.

Which end-user sector drives the highest demand for advanced DF technology?

The Government and Defense sector drives the highest demand for advanced Direction Finder technology, particularly for high-specification Electronic Warfare (EW) and Signal Intelligence (SIGINT) missions requiring wideband frequency coverage and advanced AI-enhanced signal classification capabilities.

What role does Software-Defined Radio (SDR) play in modern direction finding?

SDR fundamentally transforms DF capabilities by replacing fixed analog hardware with reconfigurable software. This allows systems to rapidly adapt to new signal types, protocols, and frequency bands through simple software updates, enhancing future-proofing and operational flexibility.

Are direction finder systems mandatory for commercial aviation and maritime vessels?

Yes, direction finding capabilities are often mandatory, especially for Search and Rescue (SAR) applications. Aviation (via ELTs) and maritime (via EPIRBs and PLBs) industries must comply with international regulations (e.g., ICAO/GMDSS) requiring systems capable of rapidly locating emergency distress beacons.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automatic Radio Direction Finder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Direction Finder Market Size Report By Type (Portable Direction Finder, Base-station Direction Finder, Vehicle-mounted Direction Finder), By Application (Air Traffic Control, Vessel Traffic Service, Mobile Land), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Automatic Radio Direction Finder Market Statistics 2025 Analysis By Application (Air Traffic Control, Vessel Traffic Service, Search and Rescue, Others), By Type (Maritime, Mobile Land, Airborne), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Direction Finder Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Maritime, Mobile Land, Airborne), By Application (Search and Rescue, Vessel Traffic Service, Air Traffic, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager